Académique Documents

Professionnel Documents

Culture Documents

HW19

Transféré par

kayteeminiCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

HW19

Transféré par

kayteeminiDroits d'auteur :

Formats disponibles

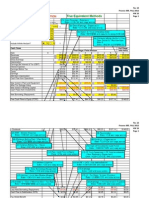

PROJECT NPV

Basics

(in thousands of $)

Year 0

Year 1

Year 2

Year 3

Year 4

Year 5

Year 6

Year 7

Key Assumptions

Unit Sales

Inflation Rate

Real Cost of Capital

Tax Rate

5700

1.5%

9.3%

42.0%

11400

1.8%

9.5%

42.0%

19000

2.1%

9.7%

42.0%

21500

2.5%

9.9%

42.0%

24100

2.8%

10.1%

42.0%

12050

2.8%

10.3%

42.0%

8200

2.8%

10.6%

42.0%

10.9%

10.9%

11.5%

23.7%

12.0%

38.6%

12.6%

56.1%

13.2%

76.6%

13.4%

100.3%

13.7%

127.7%

Discounting

Discount Rate = Cost of Capital

Cumulative Discount Factor

0.0%

Price or Cost / Unit

Sales Revenue / Unit

Variable Cost / Unit

Cash Fixed Costs

$15.30

$15.58

$15.91

$16.30

$16.76

$17.23

$17.71

$9.20

$9.37

$9.57

$9.80

$10.08

$10.36

$10.65

$7,940 $8,084.51 $8,257.52 $8,460.65 $8,697.55 $8,941.08 $9,191.43

Cash Flow Forecasts

Sales Revenue

Variable Costs

Gross Margin

$87,210

$52,440

$34,770

$177,594

$106,789

$70,806

$302,325

$181,790

$120,535

$350,520

$210,770

$139,750

$403,910

$242,874

$161,036

$207,610

$124,837

$82,773

$145,234

$87,330

$57,904

Cash Fixed Costs

Depreciation

Total Fixed Costs

$7,940

$4,557

$12,497

$8,085

$4,557

$12,642

$8,258

$4,557

$12,815

$8,461

$4,557

$13,018

$8,698

$4,557

$13,255

$8,941

$4,557

$13,498

$9,191

$4,557

$13,749

Operating Profit

Taxes

Net Profit

$22,273

$9,355

$12,918

$58,164

$24,429

$33,735

$107,720

$45,242

$62,478

$126,732

$53,227

$73,505

$147,781

$62,068

$85,713

$69,274

$29,095

$40,179

$44,155

$18,545

$25,610

Add Back Depreciation

Operating Cash Flow

$4,557

$17,475

$4,557

$38,292

$4,557

$67,035

$4,557

$78,062

$4,557

$90,270

$4,557

$44,736

$4,557

$30,167

$17,475

$15,752

$38,292

$30,958

$67,035

$48,369

$78,062

$50,021

$90,270

$51,107

$44,736

$22,337

$5,600

$35,767

$15,707

Investment in Plant & Equip

Cash Flows

Present Value of Each Cash Flow

Net Present Value

($37,500)

($37,500)

($37,500)

$196,751

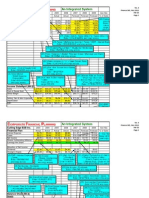

PROJECT NPV

Sensitivity Analysis

(in thousands of $)

Year 0

Year 1

Year 2

Year 3

Year 4

Year 5

Year 6

Year 7

Key Assumptions

Base Case Unit Sales

Unit Sales Scale Factor

Unit Sales

Inflation Rate

Real Cost of Capital Increment

Real Cost of Capital

Tax Rate

5700

100.0%

5700

1.5%

11400

19000

21500

24100

12050

8200

9.3%

42.0%

11400

1.8%

0.2%

9.5%

42.0%

19000

2.1%

0.4%

9.7%

42.0%

21500

2.5%

0.6%

9.9%

42.0%

24100

2.8%

0.8%

10.1%

42.0%

12050

2.8%

1.0%

10.3%

42.0%

8200

2.8%

1.2%

10.6%

42.0%

10.9%

10.9%

11.5%

23.7%

12.0%

38.6%

12.6%

56.1%

13.2%

76.6%

13.4%

100.3%

13.7%

127.7%

$9.70

$9.88

$10.09

$10.34

$10.63

$10.92

$11.23

Variable Costs / Unit:

Direct Labor

Materials

Selling Expenses

Other

Total Variable Cost / Unit

$5.20

$3.70

$2.30

$0.80

$12.00

$5.29

$3.77

$2.34

$0.81

$12.22

$5.41

$3.85

$2.39

$0.83

$12.48

$5.54

$3.94

$2.45

$0.85

$12.79

$5.70

$4.05

$2.52

$0.88

$13.14

$5.86

$4.17

$2.59

$0.90

$13.51

$6.02

$4.28

$2.66

$0.93

$13.89

Cash Fixed Costs:

Lease Payment

Property Taxes

Administration

Advertising

Other

Total Cash Fixed Costs

$4,100

$730

$680

$1,120

$730

$7,360

$4,175

$743

$692

$1,122

$743

$7,476

$4,264

$759

$707

$1,127

$759

$7,616

$4,369

$778

$725

$1,133

$778

$7,783

$4,491

$800

$745

$1,143

$800

$7,978

$4,617

$822

$766

$1,154

$822

$8,181

$4,746

$845

$787

$1,168

$845

$8,391

Discounting

Discount Rate = Cost of Capital

Cumulative Discount Factor

0.0%

Price or Cost / Unit

Sales Revenue / Unit

Working Capital

No. 12

Finance 305, FALL 2012

HW 19

Page 2

Work Cap / Next Yr Unit Sales

Working Capital

$1.23

$7,011

$1.25

$14,232

$1.27

$24,152

$1.30

$27,915

$1.33

$32,061

$1.37

$16,479

$1.41

$11,528

$1.45

$0

Cash Flow Forecasts

Sales Revenue

Variable Costs

Gross Margin

$55,290 $112,593 $191,670 $222,225 $256,074 $131,622

$92,076

$68,400 $139,290 $237,118 $274,918 $316,792 $162,831 $113,909

($13,110) ($26,697) ($45,448) ($52,693) ($60,719) ($31,209) ($21,833)

Cash Fixed Costs

Depreciation

Total Fixed Costs

Operating Profit

Taxes

Net Profit

Add Back Depreciation

Operating Cash Flow

$7,360

$4,557

$11,917

$7,476

$4,557

$12,033

$7,616

$4,557

$12,173

$7,783

$4,557

$12,340

$7,978

$4,557

$12,535

$8,181

$4,557

$12,738

$8,391

$4,557

$12,948

($25,027)

($10,511)

($14,516)

($38,730)

($16,267)

($22,463)

($57,621)

($24,201)

($33,420)

($65,032)

($27,314)

($37,719)

($73,254)

($30,767)

($42,487)

($43,947)

($18,458)

($25,489)

($34,781)

($14,608)

($20,173)

$4,557

($9,959)

$4,557

($17,906)

$4,557

($28,863)

$4,557

($33,162)

$4,557

($37,930)

$4,557

($20,932)

$4,557

($15,616)

Investment in Working Capital

Investment in Plant & Equip

Investment Cash Flow

$7,011

($37,500)

($30,489)

($7,221)

($9,920)

($3,763)

($4,146)

$15,581

$4,951

($7,221)

($9,920)

($3,763)

($4,146)

$15,581

$4,951

$11,528

$5,600

$17,128

Cash Flows

Present Value of Each Cash Flow

Net Present Value

($30,489)

($30,489)

########

($17,180)

($15,486)

($27,826)

($22,497)

($32,626)

($23,541)

($37,307)

($23,906)

($22,348)

($12,653)

($15,981)

($7,979)

$1,512

$664

Data Table: Sensitivity of the Net Present Value to Unit Sales and Date 0 Real Cost of Capital

Input Values for Unit Sales Scale Factor

Out Formula: Net Present Value

########

80%

90%

100%

110%

120%

9.0% ($118,314) ($127,246) ($136,177) ($145,108) ($154,039)

Input Values for

11.0% ($116,757) ($125,515) ($134,272) ($143,030) ($151,787)

Date 0 Real Cost of Capital

13.0% ($115,255) ($123,845) ($132,435) ($141,026) ($149,616)

No. 12

Finance 305, FALL 2012

HW 19

Page 3

15.0% ($113,805) ($122,234) ($130,662) ($139,091) ($147,520)

17.0% ($112,405) ($120,678) ($128,950) ($137,223) ($145,495)

Sensitivity of Project NPV to Unit Sales and Cost of Capital

$15,000

$10,000

Project NPV

$5,000

9.0%

11.0%

13.0%

15.0%

17.0%

80%

90%

100%

Unit Sales Scale Factor

110%

120%

$10,000 -$15,000

$0

$5,000 -$10,000

($5,000)

$0 -$5,000

($5,000)-$0

Real Cost of Capital

No. 12

Finance 305, FALL 2012

HW 19

Page 4

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Top Firms For Internships & Jobs in Corporate LawDocument2 pagesTop Firms For Internships & Jobs in Corporate LawYashaswini BohraPas encore d'évaluation

- PEarl and Dean Vs ShoemartDocument3 pagesPEarl and Dean Vs Shoemartjdg jdgPas encore d'évaluation

- Cost Behavior-Analysis and UseDocument74 pagesCost Behavior-Analysis and UseGraciously EllePas encore d'évaluation

- Kanban Fishbone JidokaDocument20 pagesKanban Fishbone JidokasentaprilepPas encore d'évaluation

- Chapter 1 and 2 MC and TFDocument17 pagesChapter 1 and 2 MC and TFAngela de MesaPas encore d'évaluation

- Final Project India BullsDocument61 pagesFinal Project India BullsRanadip PaulPas encore d'évaluation

- Objection HandlingDocument3 pagesObjection HandlingNabin GaraiPas encore d'évaluation

- Nqesh Reviewer For Deped PampangaDocument3 pagesNqesh Reviewer For Deped PampangaRonald Esquillo100% (1)

- Material Master Data CleansingDocument11 pagesMaterial Master Data CleansingmsukuPas encore d'évaluation

- DFS AnalysisDocument8 pagesDFS AnalysiskayteeminiPas encore d'évaluation

- F A P V: IRM ND Roject AluationDocument4 pagesF A P V: IRM ND Roject AluationkayteeminiPas encore d'évaluation

- Two Methods: Ebt and Quity AluationDocument2 pagesTwo Methods: Ebt and Quity AluationkayteeminiPas encore d'évaluation

- Capsim NotesDocument1 pageCapsim NoteskayteeminiPas encore d'évaluation

- HW16 Fig 9.11Document4 pagesHW16 Fig 9.11kayteeminiPas encore d'évaluation

- HW14 15Document13 pagesHW14 15kayteeminiPas encore d'évaluation

- Dividend Discount Model: Tock AluationDocument1 pageDividend Discount Model: Tock AluationkayteeminiPas encore d'évaluation

- F A P V: IRM ND Roject AluationDocument12 pagesF A P V: IRM ND Roject AluationkayteeminiPas encore d'évaluation

- HW18Document3 pagesHW18kayteeminiPas encore d'évaluation

- HW16 Fig 9.6Document13 pagesHW16 Fig 9.6kayteeminiPas encore d'évaluation

- F A P V: Five Equivalent MethodsDocument6 pagesF A P V: Five Equivalent MethodskayteeminiPas encore d'évaluation

- HW20Document18 pagesHW20kayteeminiPas encore d'évaluation

- Two Methods: Ebt and Quity AluationDocument2 pagesTwo Methods: Ebt and Quity AluationkayteeminiPas encore d'évaluation

- Loan Amortization: OAN MortizationDocument1 pageLoan Amortization: OAN MortizationkayteeminiPas encore d'évaluation

- NPV Using Contstant DiscountingDocument2 pagesNPV Using Contstant DiscountingkayteeminiPas encore d'évaluation

- NPV Using Contstant DiscountingDocument2 pagesNPV Using Contstant DiscountingkayteeminiPas encore d'évaluation

- NPV Using General Discounting Nominal RateDocument3 pagesNPV Using General Discounting Nominal RatekayteeminiPas encore d'évaluation

- NPV Using General DiscountingDocument1 pageNPV Using General DiscountingkayteeminiPas encore d'évaluation

- NPV Using General DiscountingDocument1 pageNPV Using General DiscountingkayteeminiPas encore d'évaluation

- HW2Document8 pagesHW2kayteeminiPas encore d'évaluation

- 305 Final ReviewDocument3 pages305 Final ReviewkayteeminiPas encore d'évaluation

- Single Cash Flow - Present ValueDocument4 pagesSingle Cash Flow - Present ValuekayteeminiPas encore d'évaluation

- Dynamic - Financial Statements!Document20 pagesDynamic - Financial Statements!kayteeminiPas encore d'évaluation

- Arun Sharma CAT (DI and LR) PDFDocument18 pagesArun Sharma CAT (DI and LR) PDFRupasinghPas encore d'évaluation

- How To Read A Balance SheetDocument17 pagesHow To Read A Balance Sheetismun nadhifahPas encore d'évaluation

- Revaluation UUCMS - Unified University College Management SystemDocument2 pagesRevaluation UUCMS - Unified University College Management SystemMateen PathanPas encore d'évaluation

- Iec WorkDocument1 pageIec WorkETERNAL CONSULTANCY AND SERVICESPas encore d'évaluation

- LMGE A January 2024 A2 BriefDocument2 pagesLMGE A January 2024 A2 Briefsabapahty chettiyarPas encore d'évaluation

- Digest Topic 6Document17 pagesDigest Topic 6Elise Rozel DimaunahanPas encore d'évaluation

- Ms8-Set C Midterm - With AnswersDocument5 pagesMs8-Set C Midterm - With AnswersOscar Bocayes Jr.Pas encore d'évaluation

- Latihan Ukk Lembar Jawaban +++Document12 pagesLatihan Ukk Lembar Jawaban +++graciaPas encore d'évaluation

- Tybms Sem5 CRM Apr19Document2 pagesTybms Sem5 CRM Apr19chirag guptaPas encore d'évaluation

- Vikas Dairy Project 2022 ChangenewDocument32 pagesVikas Dairy Project 2022 ChangenewAnchitJaiswalPas encore d'évaluation

- Real Estate PortfolioDocument17 pagesReal Estate Portfolioapi-283375993Pas encore d'évaluation

- MAS-Learning Assessment 2-For PostingDocument7 pagesMAS-Learning Assessment 2-For PostingDarlene JacaPas encore d'évaluation

- Md. Sahabuddin Lecturer School of Business Canadian University of BangladeshDocument3 pagesMd. Sahabuddin Lecturer School of Business Canadian University of BangladeshLabib RaisulPas encore d'évaluation

- Mira Lestari: Marketing Assistant ManagerDocument1 pageMira Lestari: Marketing Assistant ManagerBonaga RitongaPas encore d'évaluation

- Developing SMART Goals For Your OrganizationDocument2 pagesDeveloping SMART Goals For Your OrganizationtrangPas encore d'évaluation

- Intermediate Accounting Vol 2 Canadian 3rd Edition Lo Test BankDocument25 pagesIntermediate Accounting Vol 2 Canadian 3rd Edition Lo Test BankGregoryVasqueztkbn100% (56)

- Mckinsey 7S Model:: The Seven S Are Divided in Two Categories Which Are: Strategy StyleDocument5 pagesMckinsey 7S Model:: The Seven S Are Divided in Two Categories Which Are: Strategy StyleSuvankarPas encore d'évaluation

- Product and Operation Management PDFDocument3 pagesProduct and Operation Management PDFPoh Za ShahPas encore d'évaluation

- Corporate Finance-Lecture 10Document11 pagesCorporate Finance-Lecture 10Sadia AbidPas encore d'évaluation

- Business EthicsDocument6 pagesBusiness EthicsSupah LookiePas encore d'évaluation

- Answer Sheet (Sagutang Papel) : ActivityDocument2 pagesAnswer Sheet (Sagutang Papel) : ActivityAngelica ParasPas encore d'évaluation