Académique Documents

Professionnel Documents

Culture Documents

Agency & Partnership 3 February 1998: Agency I. Nature of The Agency Relationship

Transféré par

Noel RemolacioTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Agency & Partnership 3 February 1998: Agency I. Nature of The Agency Relationship

Transféré par

Noel RemolacioDroits d'auteur :

Formats disponibles

AGENCY & PARTNERSHIP 3 February 1998 Partnership is Essentially an Agency Relation (ergo, they go together) Agency issues, WONT

NT Show up alone on the Exam. They will be buried in a contract or tort fact pattern Agency: 1 Person, the Agent, voluntarily UNDERTAKING to Act for Another Party, the Principal, with the CONSENT of Both Parties AGENCY I. NATURE OF THE AGENCY RELATIONSHIP A. NATURE OF THE RELATIONSHIP: AGENT & PRINCIPAL 1. Consensual - A Completely Consensual Relationship - May not be entered into Unilaterally. 2. Contractual - Not Quite a Normal Contract, since there is NO Consideration required; that is an agent may act gratuitously - As far As CONTRACTUAL CAPACITY: an Agent does not need Capacity, however, the PRINCIPAL requires Capacity. The Agent, though, at a minimum requires minimal mental Capacity - An Agent May be DISQUALIFIED if he purports to represent 2 directly adverse principals in the same transaction UNLESS he FULLY DISCLOSES and gets CONSENT from Both Sides - No Contractual FORMALITIES are required to establish an agency relationship - No Writing Is Required (Except for the EQUAL DIGNITIES Rule which Does NOT apply in Massachusetts); rule: if the underlying transaction requires a writing, the agreement appointing the agent must be in writing B. DUTIES OF AGENT TO PRINCIPAL 1. Reasonable Care - The Agent must use reasonable care in acting for the Principal - Reasonable Care is the Care that is Expected according to the community standard, unless Special Skill (then held to the higher standard) - This Standard includes the duty to notify the principal if the agent receives material information relating to the transaction (since ANY notice given to the Agent is IMPUTED to the Principal) 2. Loyalty - An Agent has a Duty of Loyalty to the Principal: therefore, the Agent may not act in a conflict of interest fashion - Conflicts of Interest usually arise in Opportunity Fact Patterns - If there is an Opportunity that should go to the Principal, the Agent may not take it for himself - The Agent may not make a SECRET Profit on the transaction - Before the AGENT may act for himself, he must fully disclose all material facts of the deal to the Principal, and the Principal must turn down the deal. Only then may the Agent take the deal himself

Massachusetts Bar Exam Review: AGENCY & PARTNERSHIP: February 1998

Page 1 of 10

3. Obedience - The Agent must obey all reasonable instructions given to him by the Principal - The Agent need not obey ALL instructions, just the Reasonable ones C. DUTIES OF PRINCIPAL TO AGENT 1. Indemnification - The Principal owes a Duty to the Agent to indemnify him for reasonable expenses & liabilities pursuant to the Agents relationship to the principal. 2. Compensation - Although the relation may be completely gratuitous, compensation may be paid (for gratuitous, require an express agreement) - Absent an Agreement, the Principle owes the Agent a Duty to pay reasonable compensation 3. Co-operation - The Principle may NOT hinder or interfere with the Agents duties - Also, the Principal may not refuse to do something that he is required to do - MA: Real Estate Agent: not entitled to a Commission UNTIL the Deal Actually Closes. If a Deal Fails owing to the Principles Failure to co-operate, then the Real Estate Agent may still be entitled to some Compensation. For a close call on the exam, try to find a breach of duty so may continue the analysis and earn points elsewhere. D. REMEDIES FOR BREACH OF DUTY 1. Damages - For a breach of duty, the remedy is usually the Standard Contractual Remedy of Damages - However, if the breach is egregious there is the Possibility of Punitive Damages - If the Agent breaches the Duty of Loyalty, the Agent is NOT entitled to ANY COMPENSATION - Also, in an opportunity fact pattern, the Principles Alternate Remedy to Damages is to create a constructive trust over the property at issue in the opportunity transaction, and then eventually get it for himself.

Massachusetts Bar Exam Review: AGENCY & PARTNERSHIP: February 1998

Page 2 of 10

II.

THIRD PARTY ISSUES A. CONTRACT RELATED 3RD PARTY ISSUES - The Agent enters a Contract on behalf of the Principal. The issue is whether the contract created between the Principle-Agent & the 3rd Party is valid enough to bind somebody - Whether a Contract was created depends on whether the Agent had authority - If the Agent had authority, the Principle will be bound. If not, the principle will not be bound. - There are 3 types of Authority; Actual, Apparent, & Ratified (sequential analysis) 1. Actual Authority - Self-explanatory: What transpired between the Principle & the Agent. Did the Principle Actually give the Agent authority to enter into a contract. Focus on what happened between the two of them. - Actual Express Authority: - Either written, spoken, or some other manifestation of the Principle to grant the Agent authority to enter into contracts. - Actual Authority is NARROWLY construed. The Agent must act within the scope of his authority in order to bind the Principal - Actual Authority may not be revoked due to mistake or fraud - Actual Implied Authority: - Test is the REASONABLE Agents Belief - Basis of the Reasonable Belief is Industry Custom, Prior Dealings, Emergency Situation - Delegation by Agent - Generally NOT permitted. Exception: Industry custom, Prior Dealing, Emergency, PURELY MINISIRIAL ACT (like typing) - Termination of Actual Authority - 1st Question: Does the Agent Have Authority? If Actual (expressimplied) If so, was it ever terminated? - Actual Authority MAY be Terminated by the terms of the grant of Agency Authority (typically Time or an Event) - Actual Authority MAY be Terminated by a Unilateral Act of Termination by Either the Principle or the Agent (since this is a Consensual Relationship)(note there is a difference between the Power to Terminate and the Right to terminate. Although one has the Power to terminate, he may breach his agreement) - Actual Authority MAY be Terminated by the Agents Breach of Loyalty - Actual Authority MAY be Terminated by a material change in circumstances - Actual Authority MAY be Terminated by DEATH or Incapacity of Either the Principal or the Agent. (note; dont get suckered with a Sympathetic plaintiff. Like when an Agency terminated after the Principal dies NO MATTER how hard the Agent Worked. Exception: An Agency COUPLED with an INTEREST (like a Security interest)

Massachusetts Bar Exam Review: AGENCY & PARTNERSHIP: February 1998

Page 3 of 10

will not terminate via death). Durable Power of Attorney: If give written power of attorney to an Agent & proved that incapacity will not terminate the relationship, it will be honored (this is a STATUTORY exception). DEATH however will still terminate, even a Durable Power of Attorney 2. Apparent Authority - Relates to the Way an Agent presents himself to a 3rd Party - Focus on the Perception of the 3rd Party - It is a 2 Part Test: a.) Was the Agent held out by the Principle with Authority (Did the Principle do something or say something to give the 3rd party a reason to believe that the Agent had Actual Authority?) b.) Did the 3rd Party reasonably rely on the apparent authority? - An Agent Can NEVER create his OWN apparent authority; the Apparent authority derives from the actions of the Principal - Typical Apparent Authority Fact Patterns - Secret Instructions - Agent has some Actual authority, but the Agent exceeds that actual authority. Say the Principal secretly tells the Agent NOT to pay more than $1 Million for a piece of property. Agent then does the deal for $1.05 Million. In that case, the Principal will be bound because the Agent had Apparent Authority to bind the Principle. However, the Principal may have a Cause of Action Against the Agent for Breach of Obedience. - Lingering Authority - The Agent had Actual Authority at one point, but it has since been terminated. However, the Agent may have lingering apparent authority. To CUT OFF the Apparent Authority (to avoid any lingering authority) the Principle must give timely & proper NOTICE of Termination to the 3rd party. Timely is Dependent upon the facts & circumstances. PROPER = personal notice to all those 3rd parties that the principal knows the agent has dealt with + publication to the rest of the world. - If the Agent has Written Authority or Possession of Goods, to terminate that Apparent Authority, the PRINCIPAL must take the WRITING AWAY or REMOVE THE GOODS. If the Agent still has the Writing or Goods, the Agent will Still have Lingering Apparent Authority. - General Agents - Unlike Special Agents, General Agents will have more probability of Finding Apparent Authority (such as corporate officers).

Massachusetts Bar Exam Review: AGENCY & PARTNERSHIP: February 1998

Page 4 of 10

3. Ratified Authority - After the Fact blessing by the Principal as to the Agents Actions - Pre-requisites - Principal must KNOW all MATERIAL Facts of the transaction - Principal must Expressly or Impliedly Accept the Benefit of the Deal - Ratification may NOT Alter or Change the Deal Entered into by the Agent (its all or nothing) - Ratification is INEFFECTIVE unless the Principal is Disclosed - Timing: if the 3rd Party Dies, becomes incapacitated, or withdraws, the Transaction MAY NOT be ratified. Ergo, REQUIRE 3rd Party capacity at the time of Ratification - If no Authority, No Contract and the Principal Cannot be bound 4. Liability - 3rd Party v Principal - Principal will be Liable to the 3rd Party if there is VALID AUTHORITY (any of the types). As soon as there is a breach, 3rd party may sue the principal rd - 3 Party v Agent - Agents Liability Depends on whether the Principal was Disclosed: - Disclosed Principal (Existence + Identity Known to 3rd Party) is ALWAYS liable on the Contract, yet the Agent is generally not liable. - Exceptions where Agent Liable for Disclosed Principal: Agreement said so, Implied warranty to 3rd Party that Principal had contractual authority, etc. - Undisclosed or Partially Disclosed Principal: Liability IMPOSED on BOTH the Principal AND the Agent. rd - 3 Party Liability to Principal and Agent - An AGENT can never sue the 3rd party - The Principal may sue the 3rd Party as long as his agent had valid authority; in such a case, he may sue as if he himself had entered into the contract. HOWEVER, for fraudulent concealment if the Principal KNEW the 3rd Party would never enter into a contract with him, and he had the Agent enter into a contract with the 3rd Party while keeping the identity of the Principal Secret, then the Principal May NOT sue (although he is still bound to that contract). However for a non-fraudulent concealment, the Principal may still sue the 3rd party as long as there was a Valid Business Purpose for the Concealment.

Massachusetts Bar Exam Review: AGENCY & PARTNERSHIP: February 1998

Page 5 of 10

B. TORT RELATED 3RD PARTY ISSUES - Issues are when may the Principal be liable for the Acts of the Agent? Essentially, it is VICARIOUS LIABILITY - The Agent, however, is ALWAYS liable for his Own Tortious Acts - The Principal, however, is generally liable only if meet the burdens of Respondeat Superior for Negligence 1. Negligence - Negligence Liability for the Principal is Grounded in the Concept of Respondeat Superior; It has a 2 part Test a.) Was there a proper agency relationship between the principal & the agent to find liability in the principal (usually employer-employee) b.) Was the Agent acting within the scope of employment? A.) Proper Agency Relationship - Principal = Employer, Agent = Employee - Fact Dependant Analysis. Certain Factors include: Salary, Tools, RIGHT TO CONTROL (the more control, the more an employment situation exists rather than an independent contractor) - Will the Principal be liable for the Torts of a Sub-Agent? If the Employee has a RIGHT to Delegate, the Principal will be liable whether or not that Sub-Agent was an employee of the employer - Borrowed Servant Fact Pattern: Usually Occurs in an Equipment Rental Situation. Rent a crane, and it comes with an operator. Usually the Employer will be liable for any negligence committed by that operator, however, sometimes the Borrower may be liable depending on whether the Borrower Exercised any control. - Exception: An Employer WILL be liable for an Independent Contract engaged in an Ultra Hazardous Activity B.) Within the Scope of Employment - Fact Sensitive; Ask Is the Employee doing the type of work hes expected to do; at the time hes expected to do it, at the place where the job should be, for the benefit of the employer? - Test of Frolic & Detour: If the deviation from the employment was SLIGHT, it was a detour and still within the Scope of Employment (i.e., salesman on way home from the sales call, goes to the cleaners to pick up his shirts, still acting within the scope, just on a slight DETOUR). However if it is a MAJOR deviation, it is frolic and NOT within the Scope of Employment (same salesman has an 8 Martini Lunch) 2. Intentional Torts - Intentional Torts are NOT within the Scope of Employment, and there can be NO employer liability - Exception: If work Requires FORCE, such as a Bar Bouncer, House Detective or Security Guard, (Force Authorized, Friction Generated), then Intentional torts will be within the scope of employment as long as done for the BENEFIT of the Employer. - Note: A Principal-Employer can Still be DIRECTLY liable for Own Negligence in SUPERVISING or SELECTING Employees

Massachusetts Bar Exam Review: AGENCY & PARTNERSHIP: February 1998

Page 6 of 10

PARTNERSHIPS I. OVERVIEW - Partnerships are generally agency relationships - Most Partnership Issues are Resolved through Agency Principals - Each Partner is both a Principal and an Agent - MA has the UNIFORM PARTNERSHIP ACT: Absent an Agreement to the contrary, the UPA provisions will govern - Thus, the 1st part of the Analysis is to LOOK to the AGREEMENT; if the agreement contains a certain clause, that clause governs. The UPA is only in default of an agreement (UNLIKE Corporations where the Corp. Act Governs) - 5 Major Areas: - Partnership Formation - Partnership Property - Relations Between Partners - Relations between Partners, the Partnership, & 3rd Parties - Dissolution & Termination of the Partnership PARTNERSHIP FORMATION - Assume that any PARTNERSHIP is A General Partnership (absent specific instructions to the Contrary) - A Joint Venture is a General Partnership (just a specific deal where a partnership is broader) - NO FORMALITIES are required in the Formation of a Partnership: All that is Required is INTENT: No writing required, if ORAL, no need of express words to form the partnership - UPA defines a Partnership: as 2 or more persons doing BUSINESS as co-owners FOR PROFIT - Factors in Determining INTENT to form a partnership via doing business as coowners for Profit: Name designating a partnership, bank accounts, leases, et. al. are helpful to show an intent to form a partnership to do business for profit - UPA states that the Receipt of Profits (In Lieu of or In Addition to Wages, Rent, Interest ) Are NOT NECESSARILY Evidence of Partnership, HOWEVER, receipt of profits is prima facie evidence of an INTENT to form a Partnership - Limited Partnership: Only Formed by following the Strict Formalities outlined in the Statute (like a corporation). Must file a Certificate and have at least 1 fully liable general partner, but additional partners will have limited liability so long as they stay out of the day to day management of the business.

II.

Massachusetts Bar Exam Review: AGENCY & PARTNERSHIP: February 1998

Page 7 of 10

III.

PARTNERSHIP PROPERTY - Who Owns? The Partner or the Partnership? - Depends on the Factual Intent - Factors to Consider include: Whether the Property was Kept on Partnership premises, who holds the title, AND if PURCHASED with PARTNERSHIP Funds, it BELONGS to the PARTNERSHIP, and not any individual Partner - Does the Partner have a Right to Specific Property - No Individual Partner has a Right to Specific Partnership Property - The Partnership Interest - Each Partner has a Right to his Own Partnership Interest (sort of like a share of stock) - A Partner May sell or transfer his INCOME interest to anyone at anytime - If the Partner transfers his interest, he can only transfer his ECONOMIC (Income) interest. The Person who buys the interest will have only an income right, and no other rights (like voting or management) - Nobody may become a Partner without the Consent of all the other partners (due to Agency Principals) RELATIONS BETWEEN PARTNERS - A dispute among Partners is Called an accounting - Partners have High Duties of loyalty to the Partnership and other Partners - Watch for Opportunity Fact Patterns. BEFORE a Partner may Act on an opportunity, he must: - Fully Disclose the Opportunity to the Partnership - Offer the Opportunity to the Partnership - Have the Partnership Reject the Opportunity - Only then may the Partner Act on the Opportunity for himself (like Agency Principals) - Sharing of Profits & Losses: In the Absence of an Agreement, the UPA provides that Profits are to Be SHARED EQUALLY and Losses are to be allocated in the Same Percentage as the Profits. (Regardless of the Contributions, Actual Work, et. al: Again, Watch for the Sympathetic Plaintiff) - Note; Agreement Can Always Provide otherwise - If the Agreement is ABOUT Losses & Not Profits, the Agreement will control the losses, but the profits should be shared equally (Losses Always Follow Profit Allocation but NOT Vice Versa) - Partners Have NO Right to Compensation; only time a partner has a right to compensation is during the Wind Down of the Partnership - Of course, the agreement may provide for compensation - Management: Absent an Agreement, the UPA says that all partners have an Equal Voice in the management of the partnership - 1 partner, 1 Vote. In ordinary matters, a Majority controls; for extra-ordinary matters, require unanymity UNLESS the agreements is to the contrary

IV.

Massachusetts Bar Exam Review: AGENCY & PARTNERSHIP: February 1998

Page 8 of 10

V.

RELATIONS BETWEEN PARTNERS, THE PARTNERSHIP, & 3RD PARTIES - Similar to Agency Principals - Contract - For a partnership to be bound for the Acts of a Partner: Require Authority: - Actual; in the partnership agreement - Apparent: in the ordinary course of business - Ratification - Tort - There is NO Respondeat Superior for Partnerships - However, if a Tort is Committed in the Scope of the Partnership Business, the Partnership is liable - Liability - If the Partnership has Liability, then each Partner has FULL PERSONAL individual Liability - Knowledge & Notice - Knowledge: If a Partner has knowledge, it will be IMPUTED to the Partnership or other Partners ONLY if the other partners are Close enough to the transaction to reasonably know about it - Notice: when a 3rd Party places a Partner on notice, that NOTICE is IMPUTED to the entire partnership - Liability to 3rd Parties : joint & several - In-coming Partners: - Will NOT be personally liable for the pre-existing debts or obligations of the partnership (except for any capital contributions) - Out-going Partners: - Will be Liable for the debts & obligations that the Partnership incurred while he was a partner. However, the out-going partner I NOT liable for Subsequent debts & obligations of the partnership IF there was proper & timely notice (same as for Agency); Personal notice to those with whom do business, & published notice to the rest of the world. Similar Lingering Authority Problems as in Agency - Limited Partnerships: - There is NO liability for the Debts & Obligations of the Limited Partnership so long as the Limited Partner DOES NOT Take an ACTIVE ROLE in the Management of the Business of the Limited Partnership. Also, as long as NO 3rd Party relied on the Limited Partner Acting as a General Partner due to the active role in the management of the business. However, if a Limited Partner lends his NAME for use in the partnership, he may incur personal liability - Partnership by Estoppel - If 1 Misrepresents his status as a PARTNER & a 3rd Party relies on it, he MAY be liable as if he were a Partner. (he is not actually a partner, but treated as a partner for liability to 3rd parties)

Massachusetts Bar Exam Review: AGENCY & PARTNERSHIP: February 1998

Page 9 of 10

VI.

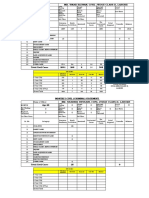

DISSOLUTION & TERMINATION OF THE PARTNERSHIP - Dissolution Termination - Dissolution: Change in the Legal Relationship of the Partners - Termination: Post-dissolution, winding up of the business - Dissolution: Ways to Have a Dissolution - by AGREEMENT (if express term dissolves after a time or an act) - by DEATH (automatic dissolution) - by BANKRUPTCY (automatic dissolution) - by EXIT of PARTNER (by express will, he chooses to leave) Termination: the Winding up of the affairs of the business after the dissolution UNLESS ALL partners agree to continue the business as a partnership - If the Partners do not Agree to continue the business after the dissolution, then move on to Termination - Winding Up: Finish all of the unsettled business, but CANNOT take on new business - Partners who wind up the business are ENTITLED to Compensation - Sell off the assets of the partnership - Distribute the Proceeds (sequentially) 1. Creditors who are NOT partners 2. Creditors who ARE partners 3. Repay the Capital Contribution of the Partners 4. Share the Profits as per agreement or UPA If No profits, but only Losses, other concept of contribution: If any Partner PAYS more than his proportional share (absent an agreement) the other partners MUST CONTRIBUTION so that the 1st Partner DOES NOT PAY more than equal share. - For Example: 3 Partners (A, B, C) start a partnership. - A contributes $10,000 - B contributes $ 5,000 - C Contributes $ 2,000 - Total $17,000 - The Partnership eventually DISSOLVES, and there is NO Continuation. Begin the Termination Process. After PAYING off the Creditors, there is $5,000 Left (have $12,000 in accumulated Losses). How to Distribute the Remaining $5,000 (no agreement, UPA governs). - $12,000 Total Loss 3 Partners = $4,000 proportional loss - Cap. Act. Contribution Share of Loss Cap Act. Contrib Cap Act A; $10,000 $4,000 $6,000 (6,000) 0 B: $ 5,000 $4,000 $1,000 (1,000) 0 C: $ 2,000 $4,000 (2,000) 2,000 0

C MUST CONTRUBUTE 2,000 to balance his Capital Account B will receive 1,000 to balance his capital account A will receive 6,000 to balance his capital account LLC; not much; MA recognize; hybrid Pship (tax) & Corp (ltd. Liab)

Massachusetts Bar Exam Review: AGENCY & PARTNERSHIP: February 1998

Page 10 of 10

Vous aimerez peut-être aussi

- Life, Accident and Health Insurance in the United StatesD'EverandLife, Accident and Health Insurance in the United StatesÉvaluation : 5 sur 5 étoiles5/5 (1)

- AgencyDocument13 pagesAgencyCeleste DuriasPas encore d'évaluation

- Business Associations Outline + ChecklistDocument44 pagesBusiness Associations Outline + ChecklistCAlawoutlines100% (27)

- Corporations Attack OutlineDocument7 pagesCorporations Attack OutlineJoe100% (5)

- RD RD RD RDDocument11 pagesRD RD RD RDJanePas encore d'évaluation

- Acing Business Organizations (Book Outline)Document62 pagesAcing Business Organizations (Book Outline)anenefred100% (9)

- 2017 11 15 Weinstein ComplaintDocument81 pages2017 11 15 Weinstein ComplaintSharon WaxmanPas encore d'évaluation

- Reid v. INS, 420 U.S. 619 (1975)Document13 pagesReid v. INS, 420 U.S. 619 (1975)Scribd Government DocsPas encore d'évaluation

- Law of Agency - Summary NotesDocument8 pagesLaw of Agency - Summary NotesWycliffe Ogetii91% (32)

- Principal Third Party: AgencyDocument3 pagesPrincipal Third Party: AgencyKersy Mere Fajardo0% (1)

- Philippines Court Appeal Collection Money DamagesDocument8 pagesPhilippines Court Appeal Collection Money DamagesPrncssbblgmPas encore d'évaluation

- FORECLOSUREDocument3 pagesFORECLOSURENoel RemolacioPas encore d'évaluation

- Notes Chapter 7 REGDocument9 pagesNotes Chapter 7 REGcpacfa100% (6)

- Zonal Values of Real Properties in Legazpi City and Albay MunicipalitiesDocument984 pagesZonal Values of Real Properties in Legazpi City and Albay MunicipalitiesNoel Remolacio64% (14)

- Agency OutlineDocument6 pagesAgency OutlinerjsPas encore d'évaluation

- Agency NotesDocument6 pagesAgency NotesFrancis Njihia KaburuPas encore d'évaluation

- Agencyandpartnership 12712275603502 Phpapp01Document48 pagesAgencyandpartnership 12712275603502 Phpapp01Atif AshrafPas encore d'évaluation

- Stat Con Case Digests 2Document7 pagesStat Con Case Digests 2Nix Yu100% (1)

- Earnest Money Receipt AgreementDocument1 pageEarnest Money Receipt AgreementNowhere Man100% (2)

- Corporations Agency PartnershipDocument61 pagesCorporations Agency PartnershipDan StewartPas encore d'évaluation

- Business Associations OutlineDocument50 pagesBusiness Associations OutlinemasskonfuzionPas encore d'évaluation

- Business Associations OutlineDocument37 pagesBusiness Associations OutlineSyCrush100% (3)

- FranchiseeDocument43 pagesFranchiseeMAHENDERPas encore d'évaluation

- Basic Accounting for Non-Accountants Part 1Document2 pagesBasic Accounting for Non-Accountants Part 1Noel RemolacioPas encore d'évaluation

- Contract of AgencyDocument30 pagesContract of AgencyRiyaPas encore d'évaluation

- Key ANS. Book4.4 Valuation and Appraisal RDL 55q 10p 2014Document11 pagesKey ANS. Book4.4 Valuation and Appraisal RDL 55q 10p 2014Noel RemolacioPas encore d'évaluation

- GR No. 149145 Roman Catholic Bishop of Kalibo, Aklan v. Municipality of Buruanga, Aklan FactsDocument1 pageGR No. 149145 Roman Catholic Bishop of Kalibo, Aklan v. Municipality of Buruanga, Aklan FactsJoni Prudentino Cruz100% (1)

- Counter AffidavitDocument6 pagesCounter AffidavitFelip Mat100% (3)

- Civil Law Summer Reviewer 2008: A C B O Law On AgencyDocument17 pagesCivil Law Summer Reviewer 2008: A C B O Law On AgencyAgnes Anne GarridoPas encore d'évaluation

- DIAG - Test Book 2.6 Real Estate Taxation RDL40q 8p 2014Document8 pagesDIAG - Test Book 2.6 Real Estate Taxation RDL40q 8p 2014Noel Remolacio100% (1)

- New Contractor's License Application FormDocument25 pagesNew Contractor's License Application FormAlexander Madayag80% (30)

- C14 Department of Foreign Affairs Vs National Labor Relations Commission (NLRC) and Jose MagnayiDocument2 pagesC14 Department of Foreign Affairs Vs National Labor Relations Commission (NLRC) and Jose MagnayiJireh RaramaPas encore d'évaluation

- BPI v. CA Digest 2007Document2 pagesBPI v. CA Digest 2007Daniel Fordan88% (8)

- Korea Exchange Bank Vs FilkorDocument2 pagesKorea Exchange Bank Vs FilkorKirsten Denise B. Habawel-VegaPas encore d'évaluation

- LAW ON SALES, AGENCY AND CREDITDocument11 pagesLAW ON SALES, AGENCY AND CREDITSteffany Roque100% (1)

- Law On Sale - Contract of Sale - Q&ADocument6 pagesLaw On Sale - Contract of Sale - Q&AlchieSPas encore d'évaluation

- Rafael Suntay VS CA, Federico SuntayDocument2 pagesRafael Suntay VS CA, Federico SuntayJustinePas encore d'évaluation

- Consent Act On His Behalf: Relationship: Results FromDocument41 pagesConsent Act On His Behalf: Relationship: Results FromJustin WilsonPas encore d'évaluation

- LC Agency'07supV3Document2 pagesLC Agency'07supV3Kat-Jean FisherPas encore d'évaluation

- Company Law Week 12Document10 pagesCompany Law Week 12Yaseen HassimPas encore d'évaluation

- Agency LawDocument2 pagesAgency LawampriestPas encore d'évaluation

- Mercy 2 ReportDocument6 pagesMercy 2 Reportmercy babaPas encore d'évaluation

- Business Associations Outline I. Entity Forms 1. S P O ODocument29 pagesBusiness Associations Outline I. Entity Forms 1. S P O OMattie ParkerPas encore d'évaluation

- Agency Chapter 1Document5 pagesAgency Chapter 1Jayne CabuhalPas encore d'évaluation

- Law of Agency in Malaysia ExplainedDocument25 pagesLaw of Agency in Malaysia ExplainedKenneth Wen Xuan TiongPas encore d'évaluation

- Contract Agency-Employee: LAB PresentationDocument24 pagesContract Agency-Employee: LAB PresentationMohan Singh SikarwarPas encore d'évaluation

- Topic 5Document8 pagesTopic 5WANYAMA EMMANUELPas encore d'évaluation

- THC 107 - Finals 3Document2 pagesTHC 107 - Finals 3KIAN ANGELA LACSONPas encore d'évaluation

- CONTRACT OF AGENCYDocument16 pagesCONTRACT OF AGENCYShawn VillaPas encore d'évaluation

- Agency LawDocument9 pagesAgency LawJorge ParkerPas encore d'évaluation

- Unit 2: Law Relating To Special ContractsDocument23 pagesUnit 2: Law Relating To Special ContractsAyesha AzharPas encore d'évaluation

- Unit 1 - Part 2Document29 pagesUnit 1 - Part 2sourabhdangarhPas encore d'évaluation

- The Law of Agency & Elements of The Law of E-CommerceDocument76 pagesThe Law of Agency & Elements of The Law of E-CommerceKatrina EustacePas encore d'évaluation

- LAW AssignmentDocument5 pagesLAW AssignmentPrasanna KumarPas encore d'évaluation

- 40N Rosin.S2012 Agency OverviewDocument107 pages40N Rosin.S2012 Agency Overviewmason_lanham8143Pas encore d'évaluation

- The Law of Agency and Elements of The Law of Electronic CommerceDocument76 pagesThe Law of Agency and Elements of The Law of Electronic CommerceShirdah AgistePas encore d'évaluation

- Chapter 32Document6 pagesChapter 32softplay12Pas encore d'évaluation

- Agency What Is An Agency?Document7 pagesAgency What Is An Agency?Vasanthi DonthiPas encore d'évaluation

- ASSIGNMENT VI Contracts MehulDocument4 pagesASSIGNMENT VI Contracts MehulRiya SinghPas encore d'évaluation

- Class Notes BADocument20 pagesClass Notes BAStan JenkinsPas encore d'évaluation

- Agency MaterialDocument5 pagesAgency MaterialMonsonedu IkechukwuPas encore d'évaluation

- Question Bank Answer: UNIT 3: Contract of AgencyDocument6 pagesQuestion Bank Answer: UNIT 3: Contract of Agencyameyk89Pas encore d'évaluation

- Differences Between Employees and Independent Contractors, Agency Relationships and DutiesDocument2 pagesDifferences Between Employees and Independent Contractors, Agency Relationships and DutiesSamantha GrozaPas encore d'évaluation

- CH8 Principle AgentDocument2 pagesCH8 Principle Agentmissalali3Pas encore d'évaluation

- AgencyDocument2 pagesAgencyAl Raiyan LopitoPas encore d'évaluation

- BLAW 308 Final Cheat SheetDocument2 pagesBLAW 308 Final Cheat Sheetjack stauberPas encore d'évaluation

- AgencyDocument5 pagesAgencyBrit SunPas encore d'évaluation

- AgencyDocument5 pagesAgencyPepa JuarezPas encore d'évaluation

- Business Law Notes - Agency Law - MBA BoostDocument4 pagesBusiness Law Notes - Agency Law - MBA BoostDan Dan Dan DanPas encore d'évaluation

- Corporations Outline 1Document92 pagesCorporations Outline 1shashankbijapur100% (1)

- Valeriano 2B Pat-Final-ExamDocument24 pagesValeriano 2B Pat-Final-ExamAira Rowena TalactacPas encore d'évaluation

- AgPart 925 - Rev 1Document11 pagesAgPart 925 - Rev 1cezar delailaniPas encore d'évaluation

- Agency Law ExplainedDocument5 pagesAgency Law Explainedkaita BrucePas encore d'évaluation

- LIMITS OF AN AGENT'S AUTHORITYDocument2 pagesLIMITS OF AN AGENT'S AUTHORITYLeo Joselito Estoque BonoPas encore d'évaluation

- Authority of The AgentsDocument27 pagesAuthority of The AgentsLulwa Alsheikh100% (1)

- 32corps LongDocument86 pages32corps LongJenny HaleyPas encore d'évaluation

- Blaw 308 NotesDocument31 pagesBlaw 308 Notesjack stauberPas encore d'évaluation

- Ateneo Central Bar Operations 2007 Civil Law Summer Reviewer AgencyDocument33 pagesAteneo Central Bar Operations 2007 Civil Law Summer Reviewer AgencyJean PangoPas encore d'évaluation

- Waiver of Preference of Assignment PDFDocument1 pageWaiver of Preference of Assignment PDFNoel RemolacioPas encore d'évaluation

- PettycashtemplateDocument1 pagePettycashtemplateNoel RemolacioPas encore d'évaluation

- Petty Cash TemplateDocument1 pagePetty Cash TemplateNoel RemolacioPas encore d'évaluation

- References OnlineDocument2 pagesReferences OnlineNoel RemolacioPas encore d'évaluation

- Application For Employment Form 2015Document2 pagesApplication For Employment Form 2015Noel RemolacioPas encore d'évaluation

- Job Aid For Taxpayers - How To Fill Up 1700 Version 2013Document10 pagesJob Aid For Taxpayers - How To Fill Up 1700 Version 2013MyraAranelPas encore d'évaluation

- Guide to Filing Taxes with eBIRFormsDocument52 pagesGuide to Filing Taxes with eBIRFormsviktoriavillo100% (1)

- Hotel Market Analysis ReportDocument1 pageHotel Market Analysis ReportNoel RemolacioPas encore d'évaluation

- Waiver of Preference of AssignmentDocument1 pageWaiver of Preference of AssignmentNoel RemolacioPas encore d'évaluation

- Yutivo Sons Hardware Company, Petitioner, vs. Court of Tax AppealsDocument12 pagesYutivo Sons Hardware Company, Petitioner, vs. Court of Tax AppealsNoel RemolacioPas encore d'évaluation

- Contract For Services RenderedDocument2 pagesContract For Services RenderedKen MorrisonPas encore d'évaluation

- Hotel Market Analysis ReportDocument1 pageHotel Market Analysis ReportNoel RemolacioPas encore d'évaluation

- Application For Employment Form 2015Document2 pagesApplication For Employment Form 2015Noel RemolacioPas encore d'évaluation

- UCPB BIR EFPS Quick Guide - One Pager - AO2013-0118Document1 pageUCPB BIR EFPS Quick Guide - One Pager - AO2013-0118Noel Remolacio100% (1)

- Set up Firefox to view PDFs with AdobeDocument4 pagesSet up Firefox to view PDFs with AdobeNoel RemolacioPas encore d'évaluation

- I Letter Agmt PDFDocument6 pagesI Letter Agmt PDFNoel RemolacioPas encore d'évaluation

- Key ANS - Book 5.5 Mathmatics of Real Estate RDL 19q 3p 2014Document4 pagesKey ANS - Book 5.5 Mathmatics of Real Estate RDL 19q 3p 2014Noel RemolacioPas encore d'évaluation

- Cases NcbaDocument41 pagesCases NcbaNoel RemolacioPas encore d'évaluation

- Birefps User Guide UpdatedDocument20 pagesBirefps User Guide UpdatedIreneMackay GiraoPas encore d'évaluation

- Diag. Test 1 Book 1,2,3 Test No. 1 - 30q 2014Document5 pagesDiag. Test 1 Book 1,2,3 Test No. 1 - 30q 2014Noel RemolacioPas encore d'évaluation

- DIAG. TEST Book 5.5 Mathmatics of Real Estate Rdl19q 3p 2014Document3 pagesDIAG. TEST Book 5.5 Mathmatics of Real Estate Rdl19q 3p 2014Noel RemolacioPas encore d'évaluation

- Six in One Corporation: Peñaranda ST., Legazpi CityDocument1 pageSix in One Corporation: Peñaranda ST., Legazpi CityNoel RemolacioPas encore d'évaluation

- COmmercial Law CasesDocument50 pagesCOmmercial Law CasesNoel RemolacioPas encore d'évaluation

- Aaa v. BBB Gr212448Document7 pagesAaa v. BBB Gr212448Zen JoaquinPas encore d'évaluation

- Manila International Airport Authority Vs CA, 495 SCRA 591Document14 pagesManila International Airport Authority Vs CA, 495 SCRA 591Winnie Ann Daquil LomosadPas encore d'évaluation

- RemediesDocument42 pagesRemediescwangheichanPas encore d'évaluation

- Idaho 1Document17 pagesIdaho 1JamesMurtaghMD.comPas encore d'évaluation

- Corp Law Reviewer FinalsDocument13 pagesCorp Law Reviewer FinalsRen A EleponioPas encore d'évaluation

- Business LawDocument3 pagesBusiness Lawwilliam olandoPas encore d'évaluation

- Class ActionDocument4 pagesClass ActiongeetuaggarwalPas encore d'évaluation

- Alfredo N. Aguila V. Court of Appeals, Et Al. G.R. NO. 127347 Date of Promulgation Ponente FactsDocument3 pagesAlfredo N. Aguila V. Court of Appeals, Et Al. G.R. NO. 127347 Date of Promulgation Ponente FactsRhett Vincent De La rosaPas encore d'évaluation

- Philippine Trust Co. v. Roldan 99 Phil. 392Document6 pagesPhilippine Trust Co. v. Roldan 99 Phil. 392Debbie YrreverrePas encore d'évaluation

- Mr. Umar Rizwan, Civil Judge Class-Ii, Lahore: MonthDocument3 pagesMr. Umar Rizwan, Civil Judge Class-Ii, Lahore: MonthShery SiddiqPas encore d'évaluation

- Arbitration Types & FeaturesDocument4 pagesArbitration Types & FeaturesAnusha V RPas encore d'évaluation

- The Constitution (Sixty-Ninth Amendment) Act, 1991Document4 pagesThe Constitution (Sixty-Ninth Amendment) Act, 1991logiece89Pas encore d'évaluation

- Hernandez v. Hard Rock Cafe International (USA), Inc. Et Al - Document No. 6Document2 pagesHernandez v. Hard Rock Cafe International (USA), Inc. Et Al - Document No. 6Justia.comPas encore d'évaluation

- Lineberry v. State of Arkansas - Document No. 4Document1 pageLineberry v. State of Arkansas - Document No. 4Justia.comPas encore d'évaluation

- Equity Personal NotesDocument65 pagesEquity Personal NoteshouselantaPas encore d'évaluation

- Santana-Diaz v. United States, 86 F.3d 1146, 1st Cir. (1996)Document2 pagesSantana-Diaz v. United States, 86 F.3d 1146, 1st Cir. (1996)Scribd Government DocsPas encore d'évaluation

- In Re Estate of Joseph F. Abely, Deceased. William F. Abeley, Co-Executor v. Commissioner of Internal Revenue, 489 F.2d 1327, 1st Cir. (1974)Document2 pagesIn Re Estate of Joseph F. Abely, Deceased. William F. Abeley, Co-Executor v. Commissioner of Internal Revenue, 489 F.2d 1327, 1st Cir. (1974)Scribd Government DocsPas encore d'évaluation

- Financial Technology Partners LP v. FNX Limited Et Al - Document No. 7Document2 pagesFinancial Technology Partners LP v. FNX Limited Et Al - Document No. 7Justia.comPas encore d'évaluation