Académique Documents

Professionnel Documents

Culture Documents

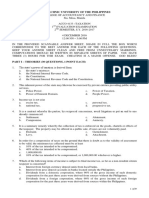

University of Eastern Philippines

Transféré par

Lynlyn Oprenario PajamutanDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

University of Eastern Philippines

Transféré par

Lynlyn Oprenario PajamutanDroits d'auteur :

Formats disponibles

UNIVERSITY OF EASTERN PHILIPPINES University Town, Northern Samar

Final Examination in ECONOMIC EDUCATION Name Student Number TEST I. MULTIPLE CHOICE: Choose the letter of the correct answer and write it down on the space provided in each item. 1. It is process of redistributing land from land lords to tenant-farmers in order that they will be given a chance to own a piece of land to improve their plight. a. Agrarian reform b. Both a & b c. Land reform Date

2. It is concerned with the total development of the farmers economic, social and political transformation. a. Agrarian Reform b. Land Reform c. Both a & b

3. This social classes could own a land and free from tribute payment. a. Elite b. Serfs c. Nobles

4. The system of giving lands to those people who are loyal civilians and military servants as rewards by the crown prince of spain. a. Encomienda System b. Kasama System c. cacique class

5. After the independence on July 4, 1946, a certain rebel group agitated to wage a continuing peasant struggle for Agrarian Reform. a. Sakdalista b. NPA c. Hukbalahap

6. This President enacted RA No. 34 of 1946 providing for a 70-30 crops sharing arrangement and regulating share tenancy contracts to solve land tenure problem. a. Pres. Osmea b. Pres. Roxas c. Pres. Quezon

7. He is the President that signed into law RA No. 3844 otherwise known as the Agricultural Land Reform Code. a. Pres. Macapagal b. Pres. Querino c. Pres. Ramos

8. On September 21, 1972, he issued Presidential Decree No. 2 declaring the entire Philippines as land reform area. a. Pres. Aquino b. Pres. Estrada c. Pres. Marcos

9. A decree granting landholders one year to secure legal titles to their lands and failure of the landowners to secure land title will mean forfeiture of their land. a. Spanish Decree of 1894 b. Spanish Decree1880 c. Spanish Decree 1872

10. One aspect of agrarian reform is to help improve agricultural productivity, increase efficiency in food production and better food for the growing populace. a. Moral aspects b. Economic aspect c. religious aspect

11. This is considered the very foundation of Agrarian Reform in which the farmers are given the chance to become owners of the land they are tilling. a. Support services b. Land distribution c . Both a & b

12. Is is a part of the governments moral obligation to formulate laws that will affect agrarian reform. a. Legal aspect b. Political aspect c. Both a & b

13. An act creating the court of industrial relation which will settle disputes between land owners and agricultural workers. a. Commonwealth Act No.213 b. Commonwealth Act No.178 c. Commonwealth Act No.103 c. PD No.30

14.Declaring the entire Philippines as land reform area. a. PD No.27 b. PD No.2 15. Instituting a Comprehensive Agrarian Reform Program. a. Proclamation No.131 TEST II. IDENTIFICATION: b. Proclamation No.30

c. Proclamation No.40

1.It is a grant of Immunity or freedom from financial charges, burdens or fees extended by the state to the taxpayer. 2. It is the use by the taxpayer of legally permissible methods in order to avoid reduces tax liability. 3. It is the use by the taxpayer of illegal or fraudulent means to defeat or lessen the amount of tax. 4. It refers to income such as interest on bank deposits, royalties, price and other winning. 5. It means pertinent items of the gross income less the deduction and or the personal and additional exemptions. 6.It is the gross income minus allowable deduction. 7. It means all income derived from whatever source. 8.It means all the wealth which flows into the taxpayer other than a mere return of capital. 9. A tax levied directly on personal income in one taxable period. 10. Is the amount which the owner, agent operator or master of the vessel has to pay for each entrance into or departure from port of entry in the Philippines. 11. Is the amount assessed an articles for storage in customs premises , cargo shed and warehouse of the government. 12. Is the amount which the owner, consignee or agent of either , of article of baggage has to pay for the handling , receiving and custody of the imported or exported article of the passenger. 13. it is a tax on the manufacture sale or use of goods and services in which most of the tax revenues comes from the sale of tobacco, alcohol and gasoline. 14. This is a tax levied on the sale of goods and services which is also collected from a certain percentage of the sale. 15. A kind of tax imposes on income from the sale of capital assets, which includes stocks, bonds, real estate and partnership. 16. This means that the source of revenue should be sufficient to address the demand of public expenditures. 17. This means that the tax should be capable of convenience, just an effective administration. 18. These are taxes imposed by the local government to meet particular needs under local government code, such as real property tax and community tax. 19. It is the supreme power of a sovereign state to impose burdens or charges upon persons, property or property rights for public purpose.

20. It is considered as the life blood of the government that without which a government may not be able to perform and expenditures or financed by tax revenues.

TEST III. ENUMERATION 1. 2. 3. 4. Five importance of taxation Five importance of land reform program Examples of direct tax Basic principles of sound tax system

*****Good Luck*****

Prepared by:

DR. NESTOR P. GALAROZA Professor

Vous aimerez peut-être aussi

- The Present State of the British Interest in India: With a Plan for Establishing a Regular System of Government in That CountryD'EverandThe Present State of the British Interest in India: With a Plan for Establishing a Regular System of Government in That CountryPas encore d'évaluation

- Eco102 IntroductionDocument7 pagesEco102 IntroductionJess JasminPas encore d'évaluation

- Reviewer Mga BoplaxDocument10 pagesReviewer Mga BoplaxJay-R Delos SantosPas encore d'évaluation

- Southern Baptist College Mlang, Cotabato ECON 1011-EDocument8 pagesSouthern Baptist College Mlang, Cotabato ECON 1011-EAsnaira Eman YunosPas encore d'évaluation

- Name: Girlie A. Obungen: Land Reform Under Aquino Administration (1986-1992)Document5 pagesName: Girlie A. Obungen: Land Reform Under Aquino Administration (1986-1992)Kenneth AlegrePas encore d'évaluation

- Rebap 2023 MockDocument15 pagesRebap 2023 MockVernon Raagas100% (3)

- Tax1 Prelim Summer 17Document5 pagesTax1 Prelim Summer 17Sheena CalderonPas encore d'évaluation

- Land Reform and Taxation - Docx Filename UTF-8''Land Reform and TaxationDocument4 pagesLand Reform and Taxation - Docx Filename UTF-8''Land Reform and Taxationramil quilasPas encore d'évaluation

- Phil. History Module 14Document10 pagesPhil. History Module 14Janice Florece ZantuaPas encore d'évaluation

- Lesson 13, Taxation, READINGS IN THE PHILIPPINE HISTORYDocument6 pagesLesson 13, Taxation, READINGS IN THE PHILIPPINE HISTORYMa Bernadeth C RodoyPas encore d'évaluation

- General Education Basic Economics With Agrarian Reform: Part Ii Analyzing Test Items (Economics)Document4 pagesGeneral Education Basic Economics With Agrarian Reform: Part Ii Analyzing Test Items (Economics)mae santosPas encore d'évaluation

- TaxationDocument67 pagesTaxationStyvhen DealdayPas encore d'évaluation

- Local Government TaxationDocument16 pagesLocal Government TaxationReychelle Marie BernartePas encore d'évaluation

- Agrarian Reform Constitutional BasisDocument5 pagesAgrarian Reform Constitutional BasisSohayle Boriongan MacaunaPas encore d'évaluation

- Finman 6Document1 pageFinman 6john paul pradoPas encore d'évaluation

- Critical Analysis of Agrarian ReformDocument20 pagesCritical Analysis of Agrarian ReformJerome Nuguid25% (4)

- Tax 100 Questions FINALDocument17 pagesTax 100 Questions FINALQuendrick SurbanPas encore d'évaluation

- Polytechnic University of The Philippines: ST NDDocument10 pagesPolytechnic University of The Philippines: ST NDShania BuenaventuraPas encore d'évaluation

- Agrarian Reform PoliciesDocument22 pagesAgrarian Reform PoliciesBJ AmbatPas encore d'évaluation

- Land Law SeminarDocument4 pagesLand Law Seminararshithgowda01Pas encore d'évaluation

- Primary Objective Comprehensive Agrarian Reform LawDocument12 pagesPrimary Objective Comprehensive Agrarian Reform LawVillar John Ezra100% (1)

- Pertinent Laws On Agrarian ReformDocument5 pagesPertinent Laws On Agrarian ReformJahzeel SoriaPas encore d'évaluation

- The Code of Agrarian Reform (R.A. NO. 3844, AS Amended)Document28 pagesThe Code of Agrarian Reform (R.A. NO. 3844, AS Amended)Karl KiwisPas encore d'évaluation

- Gec 2 - CH 4, Lesson 3. TaxationDocument62 pagesGec 2 - CH 4, Lesson 3. TaxationAquila Lynx Fornax FørsÿthêPas encore d'évaluation

- Agra MCQDocument4 pagesAgra MCQDiane UyPas encore d'évaluation

- Tax1 Q1 Summer 17Document3 pagesTax1 Q1 Summer 17Sheena CalderonPas encore d'évaluation

- History, Concepts, & Principles of TaxationDocument52 pagesHistory, Concepts, & Principles of TaxationBianca GalindoPas encore d'évaluation

- Taxn 1000 First Term Exam Sy 2021-2022 QuestionsDocument8 pagesTaxn 1000 First Term Exam Sy 2021-2022 QuestionsLAIJANIE CLAIRE ALVAREZPas encore d'évaluation

- Local Government Taxation in The Philippines: A Report PaperDocument11 pagesLocal Government Taxation in The Philippines: A Report PaperNaruse JunPas encore d'évaluation

- The National Teachers College: Preliminary ExaminationDocument12 pagesThe National Teachers College: Preliminary ExaminationRed YuPas encore d'évaluation

- Rizal Memorial Colleges - School of Law: 1 Semester SY 2020 - 2021Document15 pagesRizal Memorial Colleges - School of Law: 1 Semester SY 2020 - 2021CrisDBPas encore d'évaluation

- Social Science: Test I-ADocument12 pagesSocial Science: Test I-AFrancess Mae AlonzoPas encore d'évaluation

- Module 1 TaxationDocument5 pagesModule 1 TaxationQueenel MabbayadPas encore d'évaluation

- Local Government Taxation in The Philippines 1220413948637399 9Document38 pagesLocal Government Taxation in The Philippines 1220413948637399 9Jojo PalerPas encore d'évaluation

- Agra NotesDocument67 pagesAgra NotesmayaPas encore d'évaluation

- TAX - Quiz 1Document14 pagesTAX - Quiz 1Mojan VianaPas encore d'évaluation

- The Evolution of Taxation What Is Taxation?Document4 pagesThe Evolution of Taxation What Is Taxation?Sophia Ivy E. ServidadPas encore d'évaluation

- Agrarian Reform in The PhilippinesPresentation TranscriptDocument8 pagesAgrarian Reform in The PhilippinesPresentation TranscriptMinerva Vallejo AlvarezPas encore d'évaluation

- SBN 1112Document8 pagesSBN 1112Shanelle T. NapolesPas encore d'évaluation

- Land Acquisition: Professional PracticeDocument8 pagesLand Acquisition: Professional PracticedrashtiPas encore d'évaluation

- Primer Part Two On Comprehensive Agrariann Reform La1Document72 pagesPrimer Part Two On Comprehensive Agrariann Reform La1MoonPas encore d'évaluation

- Prelim Quiz No. 1 I. Multiple Choice. Each Choice Has An Equal Chance of Being Correct, Choose The Corresponding Letter You Think Is TheDocument42 pagesPrelim Quiz No. 1 I. Multiple Choice. Each Choice Has An Equal Chance of Being Correct, Choose The Corresponding Letter You Think Is TheJaquelyn JacquesPas encore d'évaluation

- Comprehensive Agrarian Reform LawDocument23 pagesComprehensive Agrarian Reform LawDom Muya BaccayPas encore d'évaluation

- National Economy and PatrimonyDocument7 pagesNational Economy and Patrimonydhanty20Pas encore d'évaluation

- Preliminary Examination in INCOME TAXATION: Accountancy DepartmentDocument6 pagesPreliminary Examination in INCOME TAXATION: Accountancy DepartmentKenneth Bryan Tegerero TegioPas encore d'évaluation

- Investments Law ReviewerDocument17 pagesInvestments Law ReviewerTalitha Reneé Lopez TanPas encore d'évaluation

- Legal Case Monitoring System (LCMS) : Activity No. 01: Find Me!Document4 pagesLegal Case Monitoring System (LCMS) : Activity No. 01: Find Me!Cyril Cauilan0% (1)

- BUENSUCESO, Veronica E. 3ce - B CARLOS, Ma. Christine D. 13C: Agrarian Reform ESTRABINIO, Arniesa Mari GONZAGA, Marge Rea Erma CDocument6 pagesBUENSUCESO, Veronica E. 3ce - B CARLOS, Ma. Christine D. 13C: Agrarian Reform ESTRABINIO, Arniesa Mari GONZAGA, Marge Rea Erma CNica BuensucesoPas encore d'évaluation

- Taxation 2 (Part 2 Cases)Document131 pagesTaxation 2 (Part 2 Cases)Lemuel Angelo M. EleccionPas encore d'évaluation

- Activity 3 Income TaxDocument4 pagesActivity 3 Income Taxkaji cruzPas encore d'évaluation

- TAX Major Quiz 1 Answer KeyDocument9 pagesTAX Major Quiz 1 Answer KeyTeresaPas encore d'évaluation

- Taxation ExamDocument7 pagesTaxation ExamJean PaladaPas encore d'évaluation

- Article Xii - National Economy and PatrimonyDocument9 pagesArticle Xii - National Economy and PatrimonyrosePas encore d'évaluation

- The Evolution of Philippine TaxationDocument54 pagesThe Evolution of Philippine TaxationIson, Marc Ervin A.Pas encore d'évaluation

- Philippine Constitution Agrarian Reform AND TaxationDocument26 pagesPhilippine Constitution Agrarian Reform AND TaxationAriell Emradura100% (1)

- Post-War Interventions Toward Agrarian ReformDocument3 pagesPost-War Interventions Toward Agrarian Reformkimboy bolañosPas encore d'évaluation

- Readings in Philippine HistoryDocument32 pagesReadings in Philippine HistoryAileen MalanaPas encore d'évaluation

- A. Majority of The Members of The CongressDocument8 pagesA. Majority of The Members of The CongressShenPas encore d'évaluation

- Bayag 1Document41 pagesBayag 1Jan Angelo MagnoPas encore d'évaluation

- Dance With MeDocument1 pageDance With MeLynlyn Oprenario PajamutanPas encore d'évaluation

- University of Eastern PhilippinesDocument1 pageUniversity of Eastern PhilippinesLynlyn Oprenario PajamutanPas encore d'évaluation

- Authorize LetterDocument1 pageAuthorize LetterLynlyn Oprenario PajamutanPas encore d'évaluation

- Application For LeaveDocument2 pagesApplication For LeaveLynlyn Oprenario PajamutanPas encore d'évaluation

- Orly GDocument2 pagesOrly GLynlyn Oprenario PajamutanPas encore d'évaluation

- Theories of Development (Management)Document4 pagesTheories of Development (Management)Lynlyn Oprenario PajamutanPas encore d'évaluation

- Community Immersion For CWTSDocument2 pagesCommunity Immersion For CWTSLynlyn Oprenario Pajamutan100% (7)

- Aida Eugenio Vs CSC DigestDocument3 pagesAida Eugenio Vs CSC DigestLynlyn Oprenario PajamutanPas encore d'évaluation

- Villanueva V CA DigestDocument1 pageVillanueva V CA DigestLynlyn Oprenario PajamutanPas encore d'évaluation

- General Services Unit: University of Eastern PhilippinesDocument2 pagesGeneral Services Unit: University of Eastern PhilippinesLynlyn Oprenario PajamutanPas encore d'évaluation

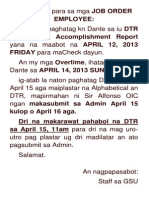

- Anunsyo para Sa Mga Job Order EmployeeDocument2 pagesAnunsyo para Sa Mga Job Order EmployeeLynlyn Oprenario PajamutanPas encore d'évaluation

- Birthday SongDocument3 pagesBirthday SongLynlyn Oprenario Pajamutan100% (3)

- University of Eastern PhilippinesDocument1 pageUniversity of Eastern PhilippinesLynlyn Oprenario PajamutanPas encore d'évaluation

- Birthday SongDocument3 pagesBirthday SongLynlyn Oprenario Pajamutan100% (3)

- Comp InspectionDocument1 pageComp InspectionLynlyn Oprenario PajamutanPas encore d'évaluation

- Certificate of AppreciationDocument3 pagesCertificate of AppreciationLynlyn Oprenario PajamutanPas encore d'évaluation

- Certificate of Accomplishment: University of Eastern PhilippinesDocument1 pageCertificate of Accomplishment: University of Eastern PhilippinesLynlyn Oprenario PajamutanPas encore d'évaluation

- University of Eastern Philippines University Town, Northern SamarDocument1 pageUniversity of Eastern Philippines University Town, Northern SamarLynlyn Oprenario PajamutanPas encore d'évaluation

- University of Eastern PhilippinesDocument1 pageUniversity of Eastern PhilippinesLynlyn Oprenario PajamutanPas encore d'évaluation

- Peraturan Skim Pemeriksaan Khas BIDocument56 pagesPeraturan Skim Pemeriksaan Khas BIahmad exsanPas encore d'évaluation

- Pestano V Sumayang, SandovalDocument2 pagesPestano V Sumayang, SandovalTricia SandovalPas encore d'évaluation

- Critical Analysis of Anti-Competitive AgreementDocument13 pagesCritical Analysis of Anti-Competitive AgreementAddyAdityaLadha100% (1)

- Life in Australia BookletDocument46 pagesLife in Australia BookletAmber Patterson100% (1)

- 24.02.27 - Section 14 - SuperFormDocument4 pages24.02.27 - Section 14 - SuperFormMichael NettoPas encore d'évaluation

- Czech Republic: Jump To Navigation Jump To SearchDocument5 pagesCzech Republic: Jump To Navigation Jump To SearchRadhika PrasadPas encore d'évaluation

- Property Law Exam NotesDocument30 pagesProperty Law Exam NotesRitesh AroraPas encore d'évaluation

- 17025-2017..1Document109 pages17025-2017..1حسام رسمي100% (2)

- Arts. 2132-2139 Concept (2132) : Chapter 4: ANTICHRESISDocument5 pagesArts. 2132-2139 Concept (2132) : Chapter 4: ANTICHRESISSherri BonquinPas encore d'évaluation

- Abragan Vs ROdriguezDocument2 pagesAbragan Vs ROdriguezAndrei Da JosePas encore d'évaluation

- 016 Magtajas v. Pryce Properties - 234 SCRA 255Document13 pages016 Magtajas v. Pryce Properties - 234 SCRA 255JPas encore d'évaluation

- Intolerance and Cultures of Reception in Imtiaz Dharker Ist DraftDocument13 pagesIntolerance and Cultures of Reception in Imtiaz Dharker Ist Draftveera malleswariPas encore d'évaluation

- Freedom of SpeechDocument5 pagesFreedom of SpeechDheeresh Kumar DwivediPas encore d'évaluation

- Roy Colby - A Communese-English DictionaryDocument156 pagesRoy Colby - A Communese-English DictionaryTim Brown100% (1)

- Statement of Comprehensive IncomeDocument1 pageStatement of Comprehensive IncomeKent Raysil PamaongPas encore d'évaluation

- Paystub 202102Document1 pagePaystub 202102dsnreddyPas encore d'évaluation

- Belgica vs. Ochoa, G.R. No. 208566Document52 pagesBelgica vs. Ochoa, G.R. No. 208566Daryl CruzPas encore d'évaluation

- Important Tables in Payables ModuleDocument4 pagesImportant Tables in Payables ModuleunnikallikattuPas encore d'évaluation

- DiffusionDocument15 pagesDiffusionRochie DiezPas encore d'évaluation

- AK Opening StatementDocument1 pageAK Opening StatementPaul Nikko DegolladoPas encore d'évaluation

- Second Edition (Re-Print)Document262 pagesSecond Edition (Re-Print)Deepak DubeyPas encore d'évaluation

- Petition To Determine HeirshipDocument4 pagesPetition To Determine Heirshipjnylaw20020% (1)

- Medical Certificate TemplateDocument1 pageMedical Certificate TemplateAnjo Alba100% (1)

- Collado v. Homeland Security Immigration Services - Document No. 10Document2 pagesCollado v. Homeland Security Immigration Services - Document No. 10Justia.comPas encore d'évaluation

- 003 Charge-sheet-for-Australian-parliamentDocument14 pages003 Charge-sheet-for-Australian-parliamentgPas encore d'évaluation

- De Leon Vs EsperonDocument21 pagesDe Leon Vs EsperonelobeniaPas encore d'évaluation

- STHBDocument4 pagesSTHBketanrana2Pas encore d'évaluation

- 5.ilano VS CaDocument2 pages5.ilano VS CaJinalyn GarciaPas encore d'évaluation

- Inc 2Document19 pagesInc 2MathiPas encore d'évaluation

- Rebuttal Evidence - PlainitiffDocument6 pagesRebuttal Evidence - PlainitiffSonali CPas encore d'évaluation

- How to get US Bank Account for Non US ResidentD'EverandHow to get US Bank Account for Non US ResidentÉvaluation : 5 sur 5 étoiles5/5 (1)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesD'EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesPas encore d'évaluation

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyD'EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyPas encore d'évaluation

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProD'EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProÉvaluation : 4.5 sur 5 étoiles4.5/5 (43)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessD'EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessÉvaluation : 5 sur 5 étoiles5/5 (5)

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationD'EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationPas encore d'évaluation

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCD'EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCÉvaluation : 4 sur 5 étoiles4/5 (5)

- Tax Savvy for Small Business: A Complete Tax Strategy GuideD'EverandTax Savvy for Small Business: A Complete Tax Strategy GuideÉvaluation : 5 sur 5 étoiles5/5 (1)

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesD'EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesÉvaluation : 4 sur 5 étoiles4/5 (9)

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipD'EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipPas encore d'évaluation

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyD'EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyÉvaluation : 4 sur 5 étoiles4/5 (52)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingD'EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingÉvaluation : 5 sur 5 étoiles5/5 (3)

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)D'EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Évaluation : 4.5 sur 5 étoiles4.5/5 (43)

- Tax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthD'EverandTax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthPas encore d'évaluation

- Small Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessD'EverandSmall Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessPas encore d'évaluation

- S Corporation ESOP Traps for the UnwaryD'EverandS Corporation ESOP Traps for the UnwaryPas encore d'évaluation

- The Payroll Book: A Guide for Small Businesses and StartupsD'EverandThe Payroll Book: A Guide for Small Businesses and StartupsÉvaluation : 5 sur 5 étoiles5/5 (1)

- Make Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionD'EverandMake Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionPas encore d'évaluation

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsD'EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsPas encore d'évaluation

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsD'EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsÉvaluation : 3.5 sur 5 étoiles3.5/5 (9)

- Lower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderD'EverandLower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderPas encore d'évaluation