Académique Documents

Professionnel Documents

Culture Documents

Salary Income Tax Computation 2012-13

Transféré par

ssasfCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Salary Income Tax Computation 2012-13

Transféré par

ssasfDroits d'auteur :

Formats disponibles

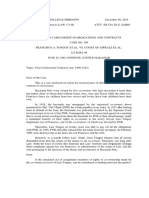

INCOME TAX COMPUTATION FOR INDIVIDUALS (SALARIED PERSONS) FY 2012-2013 (TAX YEAR 2013)

Employee Code Designation

Description Basic Salary House Rent Utility Allowance Medical Allowance Conveyance Alowwance Bonus / Ex-Gratia Leave Fare Assistance (LFA) Leave Encashment P.F. Employer Contribution Payment From WPPF Stay Allowance Overtime Total Particulars A B C D E Amount Paid Eligibile July August September October

Employee Name Department

November December January

CNIC #

NTN Senior Citizen

If Yes

(Aged > 60 years)

Taxable If Yes

February

March

April

May

June

Total -

Exempt -

Actual / Expected Expected Expected Expected Expected Expected Expected Expected Expected Expected Expected Expected Expected

Gross Income Tax Computation

Tax on Tax on

Taxable Income

If Yes

Tax Credits Available at Average Tax Rate Tax Credit Item Name Charitable donation (See Section 61) Investment in Shares & Life Insurance Premium (See Section 62) Contribution to Approved Pension Fund (See Section 63) Profit on Debt on House Loans (purchase/construction) (See Section 64)

Gratuity Opted To Be Taxed at 3 Years Average Rate? Computation of Preceding 3 Years Average Tax Rate See Section 12, Sub Section (6)

Tax Year 2012 2011 2010 Taxable Income

@ 0%

Tax Payable

Total Gross Income Tax (A + B)

Efective Gross Tax Income Tax Rate Taxable Value of Conveyance (See Rule 5) Number of Months Vehicle Usage in Current Year Purpose of Vehicle Usage Official + Personal Value of Motor Vehicle At Cost Amount to be part of taxable Income---------------> Taxable Value of Company Loan (See Section 13 (7)) Average Loan Balance Benchmark Rate Amount to be part of taxable Income--------------->

0.00% Total Amount Eligible for Tax Credit (Under Section 61-64)-------------->

Withholding Adjustment For the Year

12 Tax Deducted by Employer Upto Last Month (See Section 149) 5% On Telephone/Mobile Phone Bills (See Section 236) Along with Motor Vehicle Tax (See Section 234) On Cash Withdrawals from Banks (See Section 231A)

Total -----------> Average Tax Rate of 3 Preceding Years--> 0.00% Computation of Tax on Gratuity (See Clause 13 of Part 1 of 2nd Schedule) Type of Gratuity---> Others (Unapproved Unfunded)

Total Gratuity Exempt Gratuity Taxable Gratuity

If Yes

On Registration of New Car/Jeep (See Section 231B) On Sales/Cancellation of Any Banking Instrument Against Cash (See Section 231AA) 10% On Purchase of Air Tickets (See Section 236B) -

Tax on Gratuity-------------------------------> Computation of Monthly Income Tax Deductions

Eligibile Taxable Amount From Monthly Salary (as Above) Deemed Income (Taxable Value of Employer's Loan / Conveyance) Taxable Gratuity (Opted to be Taxed at Current Year Rate) Zakat (See Section 60) Gross Taxable Income Charitable Donation Admissible For Straight Deduction Taxable Income Gross Tax Chargeable on Taxable Income Senior Citizen Tax Rebate Net Tax Chargeable on Taxable Income Before Tax Credits Tax Credit Allowed At Average Tax Rate (See Section 61-64) Tax on Gratuity Opted to Taxed at 3 Years Average Tax Rate Income Tax Liability Withholding Tax Adjustment (Tax Already Paid) Income Tax Payable / (Refundable) No. of Months Upto June 2013 Monthly Tax Deduction

Important Notes

1. Medical Allowance upto 10% of basic salary is exempt if free medical treatment or hospitalization or re-imbursement of medical or hospitalization charges is not provided (see Clause 139, Sub Clause (b) of Part I of 2nd Schedule). 2. Provident Fund Contributions made by employer in excess of one tenth of salary (10%) or Rs. 100000/= whichever is lower are deemed to be income received by employee (See Clause 3, Sub Clause (a) of Part I of 6th Schedule) . 3. Any income of worker received from WPPF established under Companies Profits (Workers Participation) Act 1968 is totally exempt (see Clause 26 of Part I of 2nd Schedule).

Total Amount of Withholding Tax to be Adjusted--------------> Zakat / Charitable Donations Admissible For Straight Deductions

Items Eligible For Straight Deduction Charitable Donation (See Clause 61 of Part 1 of 2nd Schedule) Zakat Paid (See Section 60) Paid

Total Amount Eligible From Staight Deduction From Income---->

With Compliments From Muhammad Ijaz Khan FCMA Comments / Suggestions to Improve This Sheet are Welcomed Email: mijazkhan@hotmail.com

4. Accumulated balance payment received by an employee participating in a recognized provident fund is totally exempt (see Clause 23 of Part I of 2nd Schedule).

5. Income tax liability of tax payer aged 60 years or more on first day of tax year is reduced by 50% provided his/her taxable income (other than from FTR) does not exceed one million rupees (see Clause (1A) of Part III of 2nd Schedule).

12 -

Vous aimerez peut-être aussi

- Companies House DocumentDocument59 pagesCompanies House DocumentssasfPas encore d'évaluation

- Taxability of Return On Ijarah SukukDocument1 pageTaxability of Return On Ijarah SukukssasfPas encore d'évaluation

- REIT Regulations 2015Document57 pagesREIT Regulations 2015ssasfPas encore d'évaluation

- NBF ReformCommitteeReportDocument116 pagesNBF ReformCommitteeReportssasfPas encore d'évaluation

- Sro 1125Document7 pagesSro 1125msadhanani3922Pas encore d'évaluation

- PQ Magazine Pages - ACCA Exam Tips June 2013Document4 pagesPQ Magazine Pages - ACCA Exam Tips June 2013ssasfPas encore d'évaluation

- Regulations For Monitoring & Compliance of Brokers of The Karachi Stock Exchange Comparative of Existing (System Audit Regulations) & Proposed New RegulationsDocument31 pagesRegulations For Monitoring & Compliance of Brokers of The Karachi Stock Exchange Comparative of Existing (System Audit Regulations) & Proposed New RegulationsssasfPas encore d'évaluation

- NBF ReformCommitteeReportDocument116 pagesNBF ReformCommitteeReportssasfPas encore d'évaluation

- Valuation TableDocument9 pagesValuation Tablessasf0% (1)

- Valuation TableDocument9 pagesValuation Tablessasf0% (1)

- CCP Judgement On ICAP LetterDocument42 pagesCCP Judgement On ICAP LetterNoumAn ShafiquePas encore d'évaluation

- Ibn Arbi Foundation PakistanDocument8 pagesIbn Arbi Foundation PakistanssasfPas encore d'évaluation

- JD-Director Finance & Ad Mini Start IonDocument3 pagesJD-Director Finance & Ad Mini Start IonssasfPas encore d'évaluation

- CAPiCON BrochureDocument6 pagesCAPiCON BrochuressasfPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Misrepresentation Information SheetDocument2 pagesMisrepresentation Information SheetkevinjohnPas encore d'évaluation

- Final Testbank For Tax 4001Document74 pagesFinal Testbank For Tax 4001ceimeen50% (2)

- Investor Presentation Island Offshore FebruaDocument42 pagesInvestor Presentation Island Offshore Februacacalot93100% (1)

- Demand For Loan Restructure - BTBDocument5 pagesDemand For Loan Restructure - BTBwrmarleyPas encore d'évaluation

- Tax liability of co-owners in real estate transactionsDocument115 pagesTax liability of co-owners in real estate transactionsfullpizzaPas encore d'évaluation

- FCA Arrears Information SheetDocument2 pagesFCA Arrears Information SheetLee RamshawPas encore d'évaluation

- Disputed Partnership Between BrothersDocument2 pagesDisputed Partnership Between BrothersIsha SorianoPas encore d'évaluation

- Thanks For Downloading This Sample Business: Your Business Is Unique. Your Business Plan Should Be TooDocument33 pagesThanks For Downloading This Sample Business: Your Business Is Unique. Your Business Plan Should Be TooEva LopenaPas encore d'évaluation

- Prakash Kumar Gounder: Permanent AddressDocument3 pagesPrakash Kumar Gounder: Permanent AddressirfanPas encore d'évaluation

- Kuratko 8 e CH 08Document35 pagesKuratko 8 e CH 08waqasPas encore d'évaluation

- Jawahar ThakurDocument1 pageJawahar ThakurAbin VarghesePas encore d'évaluation

- 349 Tongoy Vs CA 123 SCRA 99Document2 pages349 Tongoy Vs CA 123 SCRA 99Joseff Anthony FernandezPas encore d'évaluation

- Roodman & Morduch 2009Document50 pagesRoodman & Morduch 2009droodman100% (2)

- Merchantville Downtown Redevelopment Area ProposalDocument24 pagesMerchantville Downtown Redevelopment Area Proposaljalt61Pas encore d'évaluation

- Luna v. EncarnacionDocument2 pagesLuna v. Encarnacionrichelle_orpilla5942Pas encore d'évaluation

- Credit Appraisal ProcessDocument12 pagesCredit Appraisal ProcessmithilPas encore d'évaluation

- Special & Technical Knowledge for Real EstateDocument6 pagesSpecial & Technical Knowledge for Real EstateJuan Carlos NocedalPas encore d'évaluation

- D'Angelo Lee SuitDocument4 pagesD'Angelo Lee SuitRobert WilonskyPas encore d'évaluation

- Investment BankingDocument32 pagesInvestment Bankingajeetsingh_ims100% (1)

- Financial Services: Finance Companies: True / False QuestionsDocument16 pagesFinancial Services: Finance Companies: True / False Questionslatifa hnPas encore d'évaluation

- Book Freehold Plot in Sector 89 FaridabadDocument2 pagesBook Freehold Plot in Sector 89 FaridabadAtul LalitPas encore d'évaluation

- Kamlesh Dissertation PDFDocument154 pagesKamlesh Dissertation PDFSeema rojPas encore d'évaluation

- IMF and World Bank: Objectives, Functions and StructureDocument23 pagesIMF and World Bank: Objectives, Functions and Structuresanthosh kumaranPas encore d'évaluation

- Faizal Ikram & Co: Jardine Lloyd Thompson SDN BHD (16674-K)Document5 pagesFaizal Ikram & Co: Jardine Lloyd Thompson SDN BHD (16674-K)ikramPas encore d'évaluation

- Rashmi Wadekar - PROFILEDocument6 pagesRashmi Wadekar - PROFILEkkundan52Pas encore d'évaluation

- Guinggona v. City FiscalDocument3 pagesGuinggona v. City Fiscal001noonePas encore d'évaluation

- Investor+Agreement Final+07+17Document5 pagesInvestor+Agreement Final+07+17Carl Jayvhan RitoPas encore d'évaluation

- Exhibit 1 CNAM China Armco Metals Securites Fraud LawsuitDocument19 pagesExhibit 1 CNAM China Armco Metals Securites Fraud LawsuitAdam LemboPas encore d'évaluation

- Term LoanDocument39 pagesTerm Loanashok_gupta077Pas encore d'évaluation

- BankingDocument14 pagesBankingj531823Pas encore d'évaluation