Académique Documents

Professionnel Documents

Culture Documents

Netting and Offsetting

Transféré par

MilyAries26Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Netting and Offsetting

Transféré par

MilyAries26Droits d'auteur :

Formats disponibles

Netting and Offsetting: reporting derivatives under US GAAP and under IFRS

1. Reporting net vs gross For netting/ offsetting of assets and liabilities also result in significant differences in banks total assets, posing problems for framing an international leverage ratio.

2. Fundamental concepts: netting, offsetting an set-off 2.1. Set -off: 2.1.1.Derecho legal: 2.1.1.1. regulacin 2.1.1.2. contractualmente 2.1.2.por medida de fuerza de: 2.1.2.1. fuerza de las condiciones del contrato 2.1.2.2. por bancarrota 2.2. Netting: 2.2.1.Acuerdos de neteo: contrato simple entre dos partes bajo el cual todas las transacciones puede ser neteadas o compensadas entre ambos. 2.2.2.Se aplica con sistema de confirmacin 2.2.3.Concepto fundamental que distingue a los derivados de cualquier otro tipo de garanta deuda u otro instrumento financiero 2.2.4.Es la terminacin o cancelacin reciproca de las obligaciones, la valuacin o terminacin de las obligaciones y su reemplazo por una nica obligacin de pago. 2.2.5.Principales casos que toma el netting: 2.2.5.1. Proceso de neteo o pago de neteo (settlement netting) : ocurre en el transcurso normal del negocio en marcha en una empresa solvente e incluye la combinacin de la compensacin del flujo de caja de las obligaciones entre dos partes en un dia acordado en una moneda pactada en un nico proceso de pago o de cobro. En este caso es lo mismo que el set-pff. El pago es opcional puede ser solo a nivel de presentacin o provision. 2.2.5.2. Compensacin anticipada: es la cancelacin de contratos no cumplidos siendo sustituidas por la obligacin de una parte de pagar a la otra una suma neta nica, que representa la diferencia entre el clculo actual del valor de las obligaciones de las dos partes.Aplicable en casos de default. 2.2.5.2.1. Close-out-netting tres pasos: 2.2.5.2.1.1. Terminacion: la parte afectada por el default pone trmino a la obligacion del acuerdo 2.2.5.2.1.2. Valuacion: proceso de determinar el reemplazo del costo de cada transaccion 2.2.5.2.1.3. Determinacion del balance neto: neteo de los valores positivos (que se adeudan a la empresa afectada) +/- valores negativos (adeudados por la empresa afectada) para concluir en una nica suma

3. Offsetting: 3.1. Concepto utilizado por contabilidad y para efectos de reporte nicamente, presentacin neta en los registros financieros de activos y pasivos con la intencin de mostrar la posicin legal de la empresa (set-off) 3.2. A risk managment tool 3.3. Existing offseting models

4. Why are derivatives different? 5. How derivatives are managed 5.1. Main charateristics 5.1.1.Obligor risk 5.1.2.Counterparty credit risk 5.1.2.1. The buyer takes the risk that the seller (usually a bank) may default 5.1.2.2. The seller takes the risk that the buyer may default on the contract 5.1.3.Collateral posting (garantia) 5.2. Potfolio management 5.3. Cash flows 6. The efficacy of netting and collateral as risk mitigation techniques 6.1. Systematic risk 6.2. Volatility 6.3. Liquidity and collateral 7. Two different accounting models 7.1. Scope: (ambito de aplicacion) 7.1.1.Offsetting primarily affects financial instruments that are subject to a master netting agreement and include:

8. OTC derivatives 9. Repurchase and reverse repurchase agreements 10. Exchange-traded derivatives, wich are those derivatives that are traded on or novated into an exchange 10.1. The IFRS offsetting model.2 principios : 10.1.1. A currently enforceable legal right to offset 10.1.1.1. Must not be contingent on a future event 10.1.1.2. Must be legally enforceable oin all of the following circunstances: 10.1.1.2.1. The normal course of business 10.1.1.2.2. The event of default 10.1.1.2.3. The event of insolvency or bankruptcy, of the entity and all of the counterparties 10.1.2. An intent either to settle net or simultaneously 10.1.2.1. Financial assets and financial liabilities eligible for set-off are submitted at the same point in time for processing 10.1.2.2. Once the financial assets and financial liabilities are submitted for processing, the parties are committed to fulfil the settlement obligation 10.1.2.3. There is no potential for the cash flows arising from the assets and liabilities to change once the have been submitted for processing (unless the processing fails ) 10.1.2.4. Assets and liabilities that are collateralized With securities will be settled on a securities transfer or similar system (delivery vs payment) so that if the transfer of securities fails, the processing of the realted receivable or payable for which the securities are collateral will also fail (and viceversa) 10.1.2.5. Any transactions that fail, as outlined in the previous, will be re-entered for processing until they are settled 10.1.2.6. Settlement is carried out through the same settlement institution (bank , a central bank or a central securities depository)

10.1.2.7. An intraday credit facility is in place that will provide sufficient overdraft amounts to enable the processing of payments at the settlement date for each of the parties, and it is virtually 5 ertain that the intraday credit facility will be honoured if called up. 10.1.3. The US Gaap offsetting modelconditions 10.1.4. Differences between IFRS and US Gaap: (pp 27) 10.1.4.1. The existing exception for derivatives in relation to the intent criterion 10.1.4.2. The conditional right to set-off (under a master netting agreement) criterion under US Gaap

10.1.5. Specific application guidance (pp28)

10.1.6. Advantages and disadvantages (pp34) 10.1.6.1. Generation of future cash flows 10.1.6.2. Credit risk 10.1.6.3. Liquidity risk

11. Common offsetting disclosures 11.1. Scope: facilitate comparison between those entities that prepair their financial statements 12. Disclosures (pp31)

13. Un-weighted leverage ratio: total tier 1 capital to total un-weighted asset of a least 3 per cent. 13.1.1. The ratio is computed using the existing Basel II netting requeriments largely because accounting offsetting rule currently differ significantly between jurisdiction

Vous aimerez peut-être aussi

- Nic 32 Instrumentos Financieros - PresentaciónDocument21 pagesNic 32 Instrumentos Financieros - PresentaciónCARLOS100% (6)

- Análisis de productos y servicios de inversión. ADGN0108D'EverandAnálisis de productos y servicios de inversión. ADGN0108Pas encore d'évaluation

- Cuenta Corriente MercantilDocument8 pagesCuenta Corriente MercantilFranciscoPas encore d'évaluation

- Manejo de Las Cuentas BancariasDocument13 pagesManejo de Las Cuentas BancariasAna PerezPas encore d'évaluation

- Contratos ForwardDocument5 pagesContratos ForwardXIOM98Pas encore d'évaluation

- Gestión Estratégica BCP (Año 2014)Document30 pagesGestión Estratégica BCP (Año 2014)Pamela A.Pas encore d'évaluation

- Practica Final CON Superior 1 2 - 4 - 2021Document7 pagesPractica Final CON Superior 1 2 - 4 - 2021Betsy Arlene Lluberes Baez100% (4)

- Convenio MultilateraDocument35 pagesConvenio MultilateraSebastián RossaPas encore d'évaluation

- Sesion 2 Banca y Mercados Financieros PDFDocument19 pagesSesion 2 Banca y Mercados Financieros PDFdiazaigPas encore d'évaluation

- Acuerdo SUGEF 1-05Document38 pagesAcuerdo SUGEF 1-05scribdcmvPas encore d'évaluation

- 2 Cuadro Comparativo 3022 2649Document14 pages2 Cuadro Comparativo 3022 2649Zonia Rocio BonillaPas encore d'évaluation

- Definiciones de Instrumentos FinancierosDocument5 pagesDefiniciones de Instrumentos FinancierosMARIA MERCEDES MOLINA GUERRAPas encore d'évaluation

- 21 VÁSQUEZ REBAZA, Walter - Cláusulas de AceleraciónDocument76 pages21 VÁSQUEZ REBAZA, Walter - Cláusulas de AceleraciónKatherine RománPas encore d'évaluation

- Cta 12 ClientesDocument21 pagesCta 12 ClientesVanessa CarriónPas encore d'évaluation

- Instrumentos Financieros DerivadosDocument43 pagesInstrumentos Financieros Derivadosjaime ePas encore d'évaluation

- Superintendencia Financiera de Colombia: Capítulo Xviii Instrumentos Financieros Derivados Y Productos EstructuradosDocument52 pagesSuperintendencia Financiera de Colombia: Capítulo Xviii Instrumentos Financieros Derivados Y Productos Estructuradosjoffred alexander mendez rodriguezPas encore d'évaluation

- Unidad 3Document2 pagesUnidad 3Fiorella MorlinePas encore d'évaluation

- Cuenta Corriente MercantilDocument17 pagesCuenta Corriente MercantilLinda Escalante Frisancho0% (1)

- Preguntas Cap 6 y 7 GMDocument10 pagesPreguntas Cap 6 y 7 GMGerald FFAPas encore d'évaluation

- Contratación Mercantil (JB)Document15 pagesContratación Mercantil (JB)Natalia TorrubiaPas encore d'évaluation

- T 17 Esquema Ejecucion DinerariaDocument60 pagesT 17 Esquema Ejecucion Dinerariamaria luisaPas encore d'évaluation

- Clase No.14Document3 pagesClase No.14jose contrerasPas encore d'évaluation

- Preguntas Del Capítulo 6 - Roberto VasquezDocument7 pagesPreguntas Del Capítulo 6 - Roberto Vasquezalexander rafael guzmanPas encore d'évaluation

- Pasivos Ciertos e InciertosDocument13 pagesPasivos Ciertos e InciertosCamila BurgerPas encore d'évaluation

- De Los Contratos de CreditoDocument5 pagesDe Los Contratos de CreditoMort De SangPas encore d'évaluation

- Costos Por PrestamosDocument20 pagesCostos Por PrestamosGiovanni LeivaPas encore d'évaluation

- FactorajeDocument15 pagesFactorajemeifPas encore d'évaluation

- Clase 6Document15 pagesClase 6Alfred MacadamPas encore d'évaluation

- Efectivo MinimoDocument47 pagesEfectivo Minimosantiago coenPas encore d'évaluation

- M9 U3 S7 DezbDocument20 pagesM9 U3 S7 DezbDevadip Gabriel Zavala BaezaPas encore d'évaluation

- T EfeminDocument49 pagesT EfeminJuzgado de Faltas Santa Lucía, Ctes.Pas encore d'évaluation

- Clausulas Contractuales. Obligaciones y Contratos ICADEDocument9 pagesClausulas Contractuales. Obligaciones y Contratos ICADEjaime.iglesias.delbarrioPas encore d'évaluation

- Contrato SwapDocument6 pagesContrato SwapPabel LlantoyPas encore d'évaluation

- IFRS 9 Enero 21-NegroDocument110 pagesIFRS 9 Enero 21-NegroKandy PérezPas encore d'évaluation

- VÁSQUEZ, Walter - Cláusulas de AceleraciónDocument90 pagesVÁSQUEZ, Walter - Cláusulas de AceleraciónIrene Zegarra LlanosPas encore d'évaluation

- Operaciones de Reporte (REPO)Document4 pagesOperaciones de Reporte (REPO)Diego AndréePas encore d'évaluation

- Concepto de Contrato de Cuenta Corriente MercantilDocument4 pagesConcepto de Contrato de Cuenta Corriente MercantilGabriel SanchezPas encore d'évaluation

- Nic 23 PDFDocument20 pagesNic 23 PDFAndresPas encore d'évaluation

- Factoring 1Document6 pagesFactoring 1walterchuPas encore d'évaluation

- Diccionario 1Document11 pagesDiccionario 1Bart FrienderPas encore d'évaluation

- Remesa, Cuenta Corriente MercantilDocument5 pagesRemesa, Cuenta Corriente MercantilFedra CaronPas encore d'évaluation

- Niif y Nics e Interpretaciones ReferidasDocument11 pagesNiif y Nics e Interpretaciones ReferidasLisbeth López Cerna100% (1)

- Factoring. BordaDocument4 pagesFactoring. BordaSeba MariscottiPas encore d'évaluation

- Unidad 4 - Actividad 5Document9 pagesUnidad 4 - Actividad 5davidPas encore d'évaluation

- Pasivos y Activos ContingDocument6 pagesPasivos y Activos ContingYinna ParutaPas encore d'évaluation

- Norma Internacional de Información Financiera 9. Instrumentos FinancierosDocument104 pagesNorma Internacional de Información Financiera 9. Instrumentos FinancierosBruno FernándezPas encore d'évaluation

- La Cesión de Créditos en El FactoringDocument7 pagesLa Cesión de Créditos en El FactoringRode100% (1)

- Articulo Comentando Fallo Sobre Factoring PDFDocument11 pagesArticulo Comentando Fallo Sobre Factoring PDFEstebanGarciaCalvoPas encore d'évaluation

- Nicsp15 (1) 22122Document2 pagesNicsp15 (1) 22122Jorge Luis Marroquin GonzalezPas encore d'évaluation

- Tema 3: Institutos Preconcursales: Los Acuerdos de RefinanciaciónDocument15 pagesTema 3: Institutos Preconcursales: Los Acuerdos de RefinanciaciónkarimaPas encore d'évaluation

- Proyecto Seminario Niif 9Document9 pagesProyecto Seminario Niif 9lorenaPas encore d'évaluation

- CaracterizaciónDocument123 pagesCaracterizaciónmisericordiapereiraomarPas encore d'évaluation

- NIC 23 - Costos Por PréstamosDocument12 pagesNIC 23 - Costos Por PréstamosAdelso ChechoPas encore d'évaluation

- R.S. Prácticas Pre IIDocument32 pagesR.S. Prácticas Pre IIGOMERO DE LA CRUZ CINDY MASSIELPas encore d'évaluation

- Biondi U4 PDFDocument32 pagesBiondi U4 PDFErica Lopez - Estudio ArataPas encore d'évaluation

- NIIF 9 - Instrumentos Financieros PDFDocument159 pagesNIIF 9 - Instrumentos Financieros PDFDavid Sánchez AranzaPas encore d'évaluation

- Niif9 GrandeDocument119 pagesNiif9 GrandeHilary Sandoval SanchezPas encore d'évaluation

- Efectivo y Equivalentes A EfectivoDocument6 pagesEfectivo y Equivalentes A EfectivoLuz Alexandra Leon LozanoPas encore d'évaluation

- TEMA 7 Pymes 2014Document20 pagesTEMA 7 Pymes 2014Irene B. AbesoPas encore d'évaluation

- Rest PatDocument14 pagesRest Patluis nieto suerosPas encore d'évaluation

- Ciniif 21 GravamenesDocument10 pagesCiniif 21 GravamenesRebeca ReinosoPas encore d'évaluation

- Resumen PFDocument4 pagesResumen PFMilyAries26Pas encore d'évaluation

- Netting and OffsettingDocument10 pagesNetting and OffsettingMilyAries26Pas encore d'évaluation

- Resumen Tercera Sesion PFDocument4 pagesResumen Tercera Sesion PFMilyAries26Pas encore d'évaluation

- Resumen Tercera Sesion PFDocument4 pagesResumen Tercera Sesion PFMilyAries26Pas encore d'évaluation

- UntitledDocument1 pageUntitledMilyAries26Pas encore d'évaluation

- UntitledDocument1 pageUntitledMilyAries26Pas encore d'évaluation

- Examen Extraordinario Contabilidad 2017Document2 pagesExamen Extraordinario Contabilidad 2017cadoce197Pas encore d'évaluation

- Directiva #001-2016-UndacDocument10 pagesDirectiva #001-2016-UndacJosé Antonio Cardenas Sinche0% (1)

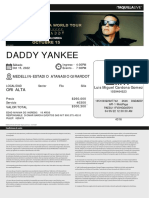

- OrderTickets 2Document1 pageOrderTickets 2PpppPas encore d'évaluation

- Análisis Financiero Act 3Document12 pagesAnálisis Financiero Act 3Jonathan Stiven Español JimenezPas encore d'évaluation

- Taller Final Cedinsi Contabilidad BasicaDocument20 pagesTaller Final Cedinsi Contabilidad Basicakaren lizethPas encore d'évaluation

- 2 Revisado Adm. de Recursos Mat. y Financieros II CorregidoDocument9 pages2 Revisado Adm. de Recursos Mat. y Financieros II Corregidonaury esaa100% (1)

- Reporte de FinanzasDocument9 pagesReporte de FinanzasTania Gallegos VillalobosPas encore d'évaluation

- 6ARentabilidad - Analisis de RentabilidadDocument57 pages6ARentabilidad - Analisis de Rentabilidadmanuel-moralesPas encore d'évaluation

- Funciones Del Credito Unidad 3Document10 pagesFunciones Del Credito Unidad 3Abiud DiazPas encore d'évaluation

- Origen de Las Finanzas en La Republica DominicanaDocument3 pagesOrigen de Las Finanzas en La Republica DominicanaMiguel Osmil PerezPas encore d'évaluation

- Capítulo II de Los Medios ElectrónicosDocument4 pagesCapítulo II de Los Medios ElectrónicosEstrella La Mera MeraPas encore d'évaluation

- Examen 1 Isabella Padron FinalDocument8 pagesExamen 1 Isabella Padron FinalIsabella Del Carmen Padrón GrisantiPas encore d'évaluation

- Prueba Excel DatosDocument12 pagesPrueba Excel DatosAnonymous TjeFqv5NsPas encore d'évaluation

- Sesión 03 - TareasCalificada1Document3 pagesSesión 03 - TareasCalificada1luiggi100% (1)

- Guía Pagos Posgrado UNC Mensualidades y Asesoramientos: ¿Qué Pasos Debo Seguir para Realizar Mi Pago?Document4 pagesGuía Pagos Posgrado UNC Mensualidades y Asesoramientos: ¿Qué Pasos Debo Seguir para Realizar Mi Pago?Diana MedinaPas encore d'évaluation

- Planteamiento Del Problema de Un SoftwareDocument3 pagesPlanteamiento Del Problema de Un SoftwareFrancisco Yepez100% (1)

- Cotizacion Mesa de Agua LuluDocument11 pagesCotizacion Mesa de Agua LuluLIshi Guzman RojasPas encore d'évaluation

- Conciliacion Bancaria EjemploDocument4 pagesConciliacion Bancaria EjemploEcos De Ávalon J. Miguel SolaresPas encore d'évaluation

- Timbre Fiscal 3Document1 pageTimbre Fiscal 3Abg Sulennys JimenezPas encore d'évaluation

- FactoringDocument20 pagesFactoringRudolfPas encore d'évaluation

- Evaluacion de Computacion IIDocument9 pagesEvaluacion de Computacion IISusana Guevara0% (2)

- MercadotecniaDocument9 pagesMercadotecniaHenry SuarezPas encore d'évaluation

- Interes SimpleDocument26 pagesInteres Simpleeddy toapanta75% (4)

- FORMULARIO SOBRE HOJA DE CUENTAS S-26 ACTUALIZADO A 09-19 (Lunes 18-11-2019) PDFDocument2 pagesFORMULARIO SOBRE HOJA DE CUENTAS S-26 ACTUALIZADO A 09-19 (Lunes 18-11-2019) PDFElisa Poveda67% (3)

- Carta Compromiso de PagoDocument1 pageCarta Compromiso de PagoJonathan Garcia0% (1)

- City Express CDMX Tlalpan: Comprobante de ReservaciónDocument2 pagesCity Express CDMX Tlalpan: Comprobante de ReservaciónREGISTRO PUBLICO VEHICULARPas encore d'évaluation

- VariableDocument2 pagesVariableyordiPas encore d'évaluation

- Formato Eeff Subcafaes Ejerc 2016Document43 pagesFormato Eeff Subcafaes Ejerc 2016Hernan LagosPas encore d'évaluation