Académique Documents

Professionnel Documents

Culture Documents

Synopsis

Transféré par

Jyoti MehtaCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Synopsis

Transféré par

Jyoti MehtaDroits d'auteur :

Formats disponibles

SYNOPSIS

INTRODUCTION TO TREASURY Treasury management is the area which was linked with accounting related activities till some year back. But, now, the focus has been completely shifted from accounting activities to decision making. Treasury management is fast emerging as a specialization in many companies and the accounting function is being delinked from the finance function. Highly focused knowledge of capital markets, instruments and investment avenues, treasury and risk management and related areas, has become essential for managing the treasury profit centre successfully. A bank needs to ensure both efficient implementation of their budgets and good management of their financial resources. Spending agencies must be provided with the funds needed to implement the budget in a timely manner and the cost of borrowing must be minimized. Sound management of financial assets and Liabilities are also required. Treasury dept. helps in the preparation and execution of budget, management of financial operations and also play a role in auditing and evaluation.

TREASURY MANAGEMENT IN UBI

United Bank of India has a strong presence in the Treasury Market in India. The Foreign Exchange treasury at Head office is equipped with state of art technology, highly experienced and motivated staff with professional skills. The Bank deal in all the major international currencies i.e. US$, GBP, Euro, Yen as well as other currencies. The treasury undertakes the following treasury related activities: Foreign Exchange Inter Bank Placements / Borrowings Sale & Purchase of currency on behalf of customers Forward Cover Bookings Cross Currency Swaps Interest Rate Swaps (IRS) Foreign Exchange Money Market Operations

PURPOSE AND SCOPE OF STUDY

Purpose of the project To understand the day to day role and functions of Integrated Treasury, the instruments used by it. Its global dimension and the typical organization of treasury activity in a Bank. Market Risk Valuation. Understand the investment policy of the bank. Study of Liquidity management that is an important function of Treasury i.e. maintaining adequate cash balances to meet day-to-day requirements, deploy surplus funds generated in operation ,sourcing funds to bridge occasional gaps in cash flow, maintaining minimum cash balances required as per cash reserve ratio (CRR) and investing funds in approved securities to the extent required under Statutory Liquidity Ratio (SLR) . Apart from liquidity management, we will also know that treasury is also a profit centre, with its own trading and investing activity in Foreign exchange, Equity, Securities etc, both in primary market as well as secondary market.

Scope of the Project Study of investment procedure of the UBIs Treasury Department. The scope of my project is mostly limited to theoretical & Analytical knowledge only. The project is made on the basis of secondary data.

Executive Summary

The bank recognizes Treasury Activity as an important segment responsible for managing liquidity, managing Statutory Reserve requirement and maximizing the return on its surplus resources by operating in various segments of financial markets.

The another objectives of UBIS Treasury Department is ensuring the risk management. For this it uses the different measurement tools such that Beta, Convexity, Modified Duration, Duration, Value at Risk, Price value of basis points.

The project covers the organization structure, various objectives and the functions of the Treasury. The project gives clear idea about the products in the integrated Treasury and also the important strategies adopted by the dealers and traders in order to maximize their profit which is the main objective in Treasury.

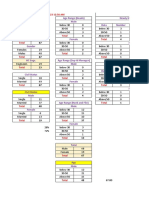

For analysis and finding I made a portfolio of 6 companies of three different sectors i.e IT sector (TCS, INFOSYS), Automobile sector(Tata Motors, Mahindra & Mahindra), FMCG (HUL, Godrej). I collected the 3 months data from BSE and NSE site and calculated each day return for the respective 6 companies and accordingly calculated the mean, S.D and beta. The greater focus is on the investment / foreign exchange and Fund policies of the bank.

The project is also about the Treasury Management Operations in the Indian Banks & also covers the changing role of treasury in the banks with financial market reforms The project covers the Government Securities Market, Foreign Exchange Market, Derivatives Market and Money Market. It also includes the strategic adopted by the dealers to maintain the required Cash Reserve Ratio and Statutory Liquidity Requirement

CONSTRAINTS & LIMITATIONS: 1) The study of the project is that it is basically academic. 2) The information related to the investment is highly confidential. 3) Bank is not interested in providing crucial information about their dealing department, Investment made, hence proper analization could not be made. 4) The little bit differences of the process for managing the treasury in the different banks is not possible individually for each and every individual bank.

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Literature ReviewDocument12 pagesLiterature ReviewJyoti MehtaPas encore d'évaluation

- 1.2 Objectives of The Study 1.3 Period of Study 1.4 Scope of The Study 1.5 Research MethodologyDocument48 pages1.2 Objectives of The Study 1.3 Period of Study 1.4 Scope of The Study 1.5 Research MethodologyJyoti MehtaPas encore d'évaluation

- A Project Report ON Summer TrainingDocument1 pageA Project Report ON Summer TrainingJyoti MehtaPas encore d'évaluation

- To Whom It May Concern: Trainee-Client Servicing' With Whatthehell? in The ClientDocument3 pagesTo Whom It May Concern: Trainee-Client Servicing' With Whatthehell? in The ClientJyoti MehtaPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Sagar Suresh Gupta: Career ObjectiveDocument3 pagesSagar Suresh Gupta: Career ObjectiveakashniranjanePas encore d'évaluation

- Bank Exam Question Papers - Bank of IndiaDocument34 pagesBank Exam Question Papers - Bank of IndiaGomathi NayagamPas encore d'évaluation

- The Evolution of Professional SellingDocument4 pagesThe Evolution of Professional SellingSabaPas encore d'évaluation

- Importance of Sales PromotionDocument3 pagesImportance of Sales PromotionHajra KhanPas encore d'évaluation

- Ba 223 IntaxDocument3 pagesBa 223 IntaxElrose Saballero KimPas encore d'évaluation

- Digital India in Agriculture SiddhanthMurdeshwar NMIMS MumbaiDocument4 pagesDigital India in Agriculture SiddhanthMurdeshwar NMIMS MumbaisiddhanthPas encore d'évaluation

- Crafting Business ModelsDocument22 pagesCrafting Business Modelsfernandonef100% (1)

- FF Mugalpur Urf Aghwanpur Mustahk Near Norani Maszid Tatarpur Moradabad (Part) MORADABAD 244504 Dist. - Moradabad 99XXXX9686Document2 pagesFF Mugalpur Urf Aghwanpur Mustahk Near Norani Maszid Tatarpur Moradabad (Part) MORADABAD 244504 Dist. - Moradabad 99XXXX9686arshadnsdl8Pas encore d'évaluation

- D4Document6 pagesD4crap talkPas encore d'évaluation

- Ssab 2022Document187 pagesSsab 2022Megha SenPas encore d'évaluation

- Q - 1 (MTP 2, A - 2021, N S) : Z Score AreaDocument2 pagesQ - 1 (MTP 2, A - 2021, N S) : Z Score AreaSiva Kumar ReddyPas encore d'évaluation

- G11 ABM Org and MGT Lesson 1 Handouts (Part 3)Document4 pagesG11 ABM Org and MGT Lesson 1 Handouts (Part 3)Leo SuingPas encore d'évaluation

- Forms of Business Organization in NepalDocument10 pagesForms of Business Organization in Nepalsuraj banPas encore d'évaluation

- Employee Data Sheet As of June 21, 2023Document90 pagesEmployee Data Sheet As of June 21, 2023Marie Anne RemolonaPas encore d'évaluation

- Verification of InvestmentsDocument3 pagesVerification of InvestmentsAshab HashmiPas encore d'évaluation

- Consumer QuestionnaireDocument3 pagesConsumer QuestionnairepriyankaPas encore d'évaluation

- Microeconomics 4th Edition Krugman Test BankDocument35 pagesMicroeconomics 4th Edition Krugman Test Banksintochenge62100% (27)

- O&M Module PDF File-1Document177 pagesO&M Module PDF File-1Strewbary BarquioPas encore d'évaluation

- 4.2 Accounting For Depreciation and Disposal of Non-Current AssetsDocument10 pages4.2 Accounting For Depreciation and Disposal of Non-Current Assetsnoahsilva374Pas encore d'évaluation

- Entrepreneur: Warren BuffetDocument12 pagesEntrepreneur: Warren BuffetAnadi GuptaPas encore d'évaluation

- Barringer E4 PPT 03GEfeasibility AnalysisDocument28 pagesBarringer E4 PPT 03GEfeasibility AnalysisraktimbeastPas encore d'évaluation

- Private Company ValuationDocument35 pagesPrivate Company ValuationShibly0% (1)

- Activity Chapter 4: Ans. 2,320 SolutionDocument2 pagesActivity Chapter 4: Ans. 2,320 SolutionRandelle James Fiesta0% (1)

- The IMC PlanDocument76 pagesThe IMC PlanNoha KandilPas encore d'évaluation

- CemDocument6 pagesCemSamaresh ChhotrayPas encore d'évaluation

- ACCA P5 - Advanced Performance Management Passcards 2013-1Document177 pagesACCA P5 - Advanced Performance Management Passcards 2013-1allenchi100% (3)

- Jeffrey HealthcareServicesDocument77 pagesJeffrey HealthcareServicesPiyush JainPas encore d'évaluation

- SDPL Co. ProfileDocument48 pagesSDPL Co. ProfileShyam SutharPas encore d'évaluation

- Coca Cola Company PresentationDocument29 pagesCoca Cola Company PresentationVibhuti GoelPas encore d'évaluation

- George Oakes LTD: GOL Online StoreDocument3 pagesGeorge Oakes LTD: GOL Online StoreSatishElReyPas encore d'évaluation