Académique Documents

Professionnel Documents

Culture Documents

Manila Standard Today - Business Daily Stocks Review (March 21, 2013)

Transféré par

Manila Standard TodayCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Manila Standard Today - Business Daily Stocks Review (March 21, 2013)

Transféré par

Manila Standard TodayDroits d'auteur :

Formats disponibles

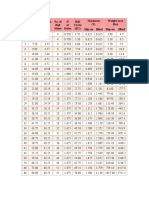

MST Business Daily Stocks Review

M

S

T

Thursday, March 21, 2013

52 Weeks

High Low STOCKS

77.10

57.30

100.00

56.60

1.82

0.68

595.00

48.00

28.50

27.80

23.90

17.90

32.95

18.50

22.00

7.95

3.25

2.00

590.00

420.00

39.20

3.00

0.90

0.18

104.90

71.75

3.06

1.69

96.20

59.00

109.00

71.80

500.00

239.00

60.00

29.75

169.10

100.00

140.00

69.00

2.70

1.71

38.00

28.70

13.58

6.22

2.26

1.24

48.00

25.00

1.62

1.20

61.00

17.10

138.00

45.00

4.99

2.12

3.12

2.41

27.75

7.60

4.55

4.32

7.16

4.83

10.40

3.60

24.00

12.80

95.50

58.50

0.027

0.0110

14.00

10.00

5.49

3.80

2.35

0.61

120.00

89.00

11.70

5.70

91.25

25.00

8.40

1.44

14.66

3.70

1.90

1.11

33.50

20.55

7.50

2.00

18.80

8.76

291.20

218.80

6.82

2.09

13.60

9.70

14.94

8.03

5.09

1.33

3.90

2.30

122.50

100.00

3000.00 240.00

0.220

0.121

2.77

1.66

1.41

1.08

88.00

50.00

5.50

1.05

2.08

0.450

18.00

2.65

2.20

0.90

1.03

59.90

0.169

17.50

2.70

5.95

6.98

3.52

552.50

64.80

4.19

5.20

0.98

693.00

6.80

40.70

6.78

1.54

0.85

3.82

5.03

6.63

9.66

0.0680

2.20

0.66

923.00

2.71

1.57

0.420

0.620

0.850

0.65

40.50

0.014

10.24

1.88

3.30

3.700

0.90

332.00

42.80

1.96

3.36

0.10

455.40

3.07

24.50

4.90

0.81

0.320

1.710

3.48

4.38

1.33

0.044

1.20

0.42

557.00

1.13

1.04

0.205

0.255

0.330

48.00

3.89

0.87

0.195

27.35

5.62

9.00

2.47

0.092

1.11

1.13

0.435

2.48

1.66

2.14

4.50

3.33

0.31

0.990

0.67

38.10

22.30

7.71

3.15

7.57

18.20

0.84

4.55

0.64

5.20

15.00

2.37

0.43

0.162

15.82

4.00

2.51

1.35

0.060

0.76

0.60

0.152

1.63

1.06

0.72

1.60

1.58

0.145

0.240

0.41

12.60

11.86

2.35

1.98

5.72

12.10

0.65

2.31

0.49

2.85

4.72

1.33

42.00

24.10

18.98

1.05

0.88

0.60

10.92

7.60

28.00

17.50

63.90

8.13

0.2420

0.1010

24.00

3.65

77.00

52.40

12.50

9.70

9.70

4.00

1750.00 800.00

1270.00 990.00

11.00

6.63

77.00

54.00

0.98

0.36

10.00

4.65

4.70

1.75

22.00

0.019

0.0850

0.040

3.4400

2.170

9.90

6.28

3.96

2.70

0.84

0.60

4.08

1.34

22.95

13.78

3.47

1.49

12.00

7.15

98.00

21.00

17.88

12.10

2886.00 2096.00

0.39

0.27

34.45

17.90

14.18

3.30

3.30

2.42

0.72

0.35

4.50

1.14

6.20

4.01

6.22

3.00

19.82

16.80

0.345

0.210

29.00

18.60

34.00

17.70

2.12

0.82

1.68

1.02

61.80

12.10

1.21

0.48

1.79

0.8600

2.070

0.9200

0.085

0.047

0.087

0.047

36.50

15.78

12.84

4.70

8.40

3.07

0.032

0.016

0.033

0.017

7.05

5.62

27.85

12.52

48.00

8.50

0.062

0.024

257.80

200.00

0.028

0.014

50.00

22.65

105.50

100.00

11.02

6.52

116.70

104.10

1050.00 1000.00

2.28

2.20

0.68

0.74

11.88

4.21

Previous

Close

High

Low

Close Change Volume

Net Foreign

Trade/Buying

FINANCIAL

85.10

83.50

84.50 (0.18)

6,930,560

105.00

102.20

104.40 1.85

2,033,130

1.09

1.00

1.02 (6.42)

747,000

63.30

62.50

63.00 (0.32)

45,770

18.00

18.00

18.00 (34.55)

18,100

20.80

20.00

20.20 1.00

274,600

33.80

33.35

33.70 1.35

416,600

23.00

17.00

22.80 38.18

202,100

2.84

2.80

2.80 1.82

5,000

545.00

540.00

545.00 0.93

180

28.45

28.15

28.45 1.25

50,300

0.35

0.25

0.27 (3.57)

21,640,000

114.40

111.90

112.00 (0.88)

3,879,630

1.90

1.90

1.90 0.00

16,000

34.35

33.50

33.95 (0.15)

595,700

97.00

95.00

97.00 1.25

350,190

140.00

128.00

135.00 3.93

21,570

467.00

453.00

467.00 3.09

2,670

67.00

66.40

66.95 0.68

201,420.00

180.00

177.50

179.30 1.30

434,150

121.50

119.00

119.00 (0.83)

45,280

2.58

2.58

2.58 0.39

64,000

INDUSTRIAL

Aboitiz Power Corp.

36.85

37.25

36.45

36.50 (0.95)

4,857,700

Agrinurture Inc.

6.99

7.00

6.80

6.99 0.00

80,000

Alliance Tuna Intl Inc.

2.00

2.06

1.99

2.05 2.50

1,634,000

Alphaland Corp.

15.00

20.00

17.00

19.50 30.00

20,300

Alsons Cons.

1.37

1.43

1.35

1.40 2.19

3,870,000

Asiabest Group

22.00

22.00

20.95

20.95 (4.77)

26,900

Bogo Medellin

53.00

53.00

53.00

53.00 0.00

760

Calapan Venture

4.53

4.45

4.35

4.44 (1.99)

8,000

Chemrez Technologies Inc.

2.78

2.90

2.90

2.90 4.32

10,000

Cirtek Holdings (Chips)

17.78

18.20

17.80

18.00 1.24

102,700

DNL Industries Inc.

6.93

7.010

6.75

6.85 (1.15)

5,557,200

Energy Devt. Corp. (EDC)

6.39

6.54

6.40

6.50 1.72

19,719,700

EEI

12.40

12.56

12.40

12.50 0.81

372,500

First Gen Corp.

23.80

24.25

23.95

24.20 1.68

985,000

First Holdings A

104.00

106.00

104.20

105.40 1.35

321,920

Greenergy

0.0190

0.0190

0.0180

0.0190 0.00

28,100,000

Holcim Philippines Inc.

13.10

13.20

13.20

13.20 0.76

1,028,500

Integ. Micro-Electronics

3.96

3.95

3.92

3.93 (0.76)

1,185,000

Ionics Inc

0.650

0.730

0.640

0.700 7.69

2,837,000

Jollibee Foods Corp.

116.60

119.00

116.90

117.00 0.34

487,400

Lafarge Rep

10.50

10.50

10.48

10.50 0.00

717,800

Liberty Flour

49.00

50.00

49.00

49.00 0.00

200

LMG Chemicals

2.38

2.49

2.39

2.44 2.52

203,000

LT Group

15.00

16.30

15.06

16.22 8.13

12,066,400

Mabuhay Vinyl Corp.

2.10

2.00

1.97

2.00 (4.76)

12,000

Manila Water Co. Inc.

36.70

36.90

36.60

36.60 (0.27)

2,547,200

Mariwasa MFG. Inc.

7.60

7.60

6.00

6.89 (9.34)

2,704,700

Megawide

17.780

18.000

17.280

18.000 1.24

659,400

Melco Crown

13.46

13.50

14.00

15.10 12.18

234,600

Mla. Elect. Co `A

313.40

315.00

309.00

315.00 0.51

245,450

Pepsi-Cola Products Phil.

5.95

6.08

5.95

6.02 1.18

7,870,800

Petron Corporation

13.66

13.90

13.60

13.90 1.76

3,232,400

Phoenix Petroleum Phils.

9.30

9.51

9.30

9.30 0.00

4,607,000

RFM Corporation

4.68

4.80

4.66

4.80 2.56

807,000

Roxas Holdings

3.00

3.00

3.00

3.00 0.00

255,000

San Miguel Corp `A

116.10

117.10

116.10

116.10 0.00

393,440

San MiguelPure Foods `B

276.00

275.00

270.00

271.20 (1.74)

29,220

Swift Foods, Inc.

0.134

0.133

0.133

0.133 (0.75)

160,000

TKC Steel Corp.

1.59

1.64

1.60

1.64 3.14

28,000

Trans-Asia Oil

2.28

2.36

2.20

2.20 (3.51)

23,809,000

Universal Robina

102.80

105.50

102.90

104.30 1.46

1,598,540

Victorias Milling

1.44

1.48

1.44

1.44 0.00

2,761,000

Vitarich Corp.

0.92

0.94

0.89

0.92 0.00

1,704,000

Vivant Corp.

9.01

9.01

9.01

9.01 0.00

5,200

Vulcan Indl.

1.52

1.55

1.53

1.53 0.66

120,000

HOLDING FIRMS

Abacus Cons. `A

0.65

0.68

0.65

0.68 4.62

4,299,000

Aboitiz Equity

54.80

56.20

55.00

55.75 1.73

3,183,180

Alcorn Gold Res.

0.1560

0.1580

0.1560

0.1570 0.64

125,150,000

Alliance Global Inc.

19.88

19.90

19.40

19.42 (2.31)

48,370,600

Anglo Holdings A

2.29

2.40

2.30

2.31 0.87

157,000

Anscor `A

6.90

6.95

6.85

6.90 0.00

111,300

Asia Amalgamated A

4.58

4.75

4.36

4.36 (4.80)

26,000

ATN Holdings B

0.95

1.04

1.03

1.03 8.42

7,000

Ayala Corp `A

550.00

560.00

550.00

550.00 0.00

600,650

DMCI Holdings

51.10

51.85

50.90

51.25 0.29

2,464,900

F&J Prince A

2.90

3.10

3.00

3.10 6.90

92,000

Filinvest Dev. Corp.

5.74

5.89

5.70

5.80 1.05

505,100

Forum Pacific

0.235

0.235

0.235

0.235 0.00

10,000

GT Capital

739.00

740.00

738.00

739.00 0.00

49,460

House of Inv.

7.85

7.85

7.85

7.85 0.00

320,000

JG Summit Holdings

40.10

40.10

39.90

39.90 (0.50)

2,034,600

Lopez Holdings Corp.

7.16

7.30

7.15

7.20 0.56

2,455,900

Lodestar Invt. Holdg.Corp.

0.89

0.93

0.90

0.90 1.12

30,000

Mabuhay Holdings `A

0.580

0.630

0.580

0.580 0.00

910,000

Marcventures Hldgs., Inc.

1.75

1.80

1.70

1.80 2.86

1,133,000

Metro Pacific Inv. Corp.

5.18

5.31

5.18

5.19 0.19

22,420,700

Minerales Industrias Corp.

6.40

6.69

6.40

6.40 0.00

32,000

MJCI Investments Inc.

5.98

5.73

5.69

5.69 (4.85)

61,000

Pacifica `A

0.0490

0.0500

0.0500

0.0500 2.04

100,000

Prime Media Hldg

1.810

1.860

1.810

1.860 2.76

67,000

Prime Orion

0.680

0.670

0.670

0.670 (1.47)

333,000

SM Investments Inc.

1022.00

1029.00

1020.00 1025.00 0.29

947,950

Solid Group Inc.

1.98

2.05

1.99

2.05 3.54

186,000

South China Res. Inc.

1.10

1.10

1.09

1.09 (0.91)

65,000

Unioil Res. & Hldgs

0.2500

0.2500

0.2450

0.2460 (1.60)

420,000

Wellex Industries

0.2700

0.2650

0.2600

0.2650 (1.85)

310,000

Zeus Holdings

0.465

0.455

0.450

0.450 (3.23)

290,000

PROPERTY

Anchor Land Holdings Inc.

20.00

20.00

18.00

20.00 0.00

1,600

A. Brown Co., Inc.

2.90

3.00

2.90

2.97 2.41

1,058,000

Araneta Prop `A

1.770

1.850

1.760

1.790 1.13

1,305,000

Arthaland Corp.

0.205

0.215

0.215

0.215 4.88

10,000

Ayala Land `B

29.60

30.05

29.00

29.40 (0.68)

14,293,700

Belle Corp. `A

5.22

5.45

5.28

5.43 4.02

16,307,600

Cebu Holdings

4.50

4.65

4.50

4.60 2.22

345,000

Century Property

1.98

2.02

1.98

2.00 1.01

8,466,000

Crown Equities Inc.

0.068

0.067

0.067

0.067 (1.47)

2,000,000

Cyber Bay Corp.

0.75

0.77

0.75

0.76 1.33

1,834,000

Empire East Land

1.050

1.070

1.060

1.060 0.95

27,972,000

Ever Gotesco

0.290

0.300

0.290

0.290 0.00

770,000

Global-Estate

2.14

2.27

2.12

2.24 4.67

34,537,000

Filinvest Land,Inc.

1.82

1.85

1.80

1.81 (0.55)

27,269,000

Interport `A

1.28

1.28

1.20

1.28 0.00

114,000

Keppel Properties

3.00

3.00

3.00

3.00 0.00

1,000

Megaworld Corp.

3.61

3.75

3.67

3.69 2.22

64,812,000

MRC Allied Ind.

0.1140

0.1140

0.1120

0.1130 (0.88)

7,080,000

Phil. Estates Corp.

0.5900

0.5900

0.5700

0.5900 0.00

46,000

Phil. Realty `A

0.520

0.550

0.530

0.540 3.85

332,000

Phil. Tob. Flue Cur & Redry

25.00

25.00

25.00

25.00 0.00

1,000

Robinsons Land `B

24.05

24.50

23.90

23.95 (0.42)

6,860,800

Rockwell

2.88

2.92

2.88

2.92 1.39

1,230,000

Shang Properties Inc.

3.40

3.42

3.40

3.42 0.59

7,000

SM Development `A

7.99

8.48

8.01

8.40 5.13

6,857,200

SM Prime Holdings

18.40

18.78

18.30

18.40 0.00

41,660,900

Sta. Lucia Land Inc.

1.00

1.06

0.98

1.00 0.00

9,591,000

Starmalls

4.06

4.06

4.05

4.06 0.00

11,000

Suntrust Home Dev. Inc.

0.580

0.580

0.570

0.570 (1.72)

122,000

Vista Land & Lifescapes

5.230

5.310

5.230

5.270 0.76

11,646,600

SERVICES

2GO Group

1.68

1.80

1.69

1.70 1.19

30,000

ABS-CBN

37.90

37.60

37.20

37.50 (1.06)

180,500

Acesite Hotel

1.31

1.32

1.24

1.29 (1.53)

53,000

APC Group, Inc.

0.740

0.760

0.740

0.760 2.70

1,358,000

Asian Terminals Inc.

13.10

13.10

13.10

13.10 0.00

84,800

Berjaya Phils. Inc.

24.90

24.90

24.90

24.90 0.00

1,100

Bloomberry

13.00

13.20

13.02

13.10 0.77

10,435,600

Boulevard Holdings

0.1220

0.1270

0.1220

0.1230 0.82

27,060,000

Calata Corp.

3.19

3.15

3.10

3.12 (2.19)

529,000

Cebu Air Inc. (5J)

66.00

67.25

66.70

67.25 1.89

112,190

Centro Esc. Univ.

10.98

10.78

10.10

10.78 (1.82)

1,500

DFNN Inc.

4.20

4.35

4.20

4.30 2.38

342,000

FEUI

1180.00

1215.00

1180.00 1215.00

2.97

Globe Telecom

1170.00

1185.00

1175.00 1185.00 1.28

38,215

GMA Network Inc.

9.90

9.90

9.70

9.90 0.00

173,400

I.C.T.S.I.

85.00

88.00

85.00

87.30 2.71

458,970

Information Capital Tech.

0.400

0.400

0.400

0.400 0.00

600,000

IPeople Inc. `A

11.00

10.50

10.50

10.50 (4.55)

1,500

IP Converge

4.40

4.47

4.30

4.47 1.59

3,000

IP E-Game Ventures Inc.

0.023

0.024

0.023

0.024 4.35

20,300,000

Island Info

0.0510

0.0520

0.0510

0.0520 1.96

400,000

ISM Communications

2.0100

2.0900

2.0000

2.0900 3.98

115,000

Leisure & Resorts

8.08

8.18

8.09

8.12 0.50

592,200

Macroasia Corp.

2.40

2.50

2.40

2.50 4.17

7,000

Manila Bulletin

0.80

0.80

0.80

0.80 0.00

13,000

Manila Jockey

2.39

2.39

2.39

2.39 0.00

14,000

MG Holdings

0.65

0.66

0.60

0.66 1.54

293,000

Pacific Online Sys. Corp.

14.78

16.00

15.00

15.44 4.47

198,600

Paxys Inc.

2.79

2.85

2.64

2.85 2.15

551,000

Phil. Racing Club

10.46

9.95

9.95

9.95 (4.88)

800

Phil. Seven Corp.

92.00

92.00

92.00

92.00 0.00

500

Philweb.Com Inc.

14.50

14.50

14.12

14.48 (0.14)

948,700

PLDT Common

2722.00

2824.00

2780.00 2810.00 3.23

204,225

PremiereHorizon

0.330

0.330

0.325

0.330 0.00

1,680,000

Puregold

39.20

40.00

38.75

38.90 (0.77)

3,045,000

STI Holdings

0.97

0.98

0.97

0.98 1.03

4,456,000

Touch Solutions

17.50

17.92

17.50

17.88 2.17

78,400

Transpacific Broadcast

2.17

2.19

2.19

2.19 0.92

1,000

Waterfront Phils.

0.400

0.400

0.390

0.400 0.00

310,000

Yehey

1.300

1.290

1.290

1.290 (0.77)

86,000

MINING & OIL

Apex `A

4.49

4.50

4.30

4.49 0.00

16,000

Apex `B

4.32

4.50

4.50

4.50 4.17

10,000

Atlas Cons. `A

21.50

22.00

21.00

21.90 1.86

2,849,400

Basic Energy Corp.

0.275

0.280

0.280

0.280 1.82

1,080,000

Benguet Corp `A

17.70

17.70

17.70

17.70 0.00

3,900

Benguet Corp `B

17.00

17.50

17.00

17.50 2.94

92,900

Century Peak Metals Hldgs

0.94

0.94

0.94

0.94 0.00

24,000

Coal Asia

0.99

0.99

0.98

0.99 0.00

1,491,000

Dizon

10.50

10.88

10.20

10.20 (2.86)

131,500

Geograce Res. Phil. Inc.

0.51

0.52

0.51

0.51 0.00

939,000

Lepanto `A

1.090

1.090

1.080

1.080 (0.92)

4,894,000

Lepanto `B

1.200

1.180

1.140

1.180 (1.67)

4,837,000

Manila Mining `A

0.0580

0.0590

0.0570

0.0580 0.00

74,730,000

Manila Mining `B

0.0580

0.0590

0.0580

0.0590 1.72

15,500,000

Nickelasia

24.50

25.20

24.00

24.80 1.22

1,679,300

Nihao Mineral Resources

3.33

3.60

3.50

3.38 1.50

1,436,000

Oriental Peninsula Res.

3.300

3.400

3.300

3.350 1.52

408,000

Oriental Pet. `A

0.0200

0.0210

0.0200

0.0210 5.00

2,200,000

Oriental Pet. `B

0.0210

0.0210

0.0210

0.0210 0.00

600,000

Petroenergy Res. Corp.

6.90

6.90

6.90

6.90 0.00

11,500

Philex `A

16.80

17.400

16.840

17.30 2.98

1,770,500

PhilexPetroleum

29.35

30.35

28.70

30.35 3.41

180,600

Philodrill Corp. `A

0.042

0.042

0.041

0.042 0.00

81,900,000

Semirara Corp.

237.00

256.00

237.00

253.80 7.09

648,870

United Paragon

0.0170

0.0170

0.0160

0.0170 0.00

12,000,000

PREFERRED

ABS-CBN Holdings Corp.

41.00

41.00

40.00

40.50 (1.22)

3,091,000

First Gen G

110.00

110.70

110.00

110.70 0.64

10,860

GMA Holdings Inc.

9.90

9.90

9.90

9.90 0.00

270,000

PCOR-Preferred

109.00

109.00

108.60

108.60 (0.37)

19,300

SMC Preferred A

75.00

75.00

74.95

75.00 0.00

1,582,370

SMC Preferred C

78.50

78.10

78.00

78.00 (0.64)

72,300

SMPFC Preferred

1039.00

1040.00

1039.00 1039.00

0.00

WARRANTS & BONDS

Megaworld Corp. Warrants

2.55

2.60

2.58

2.60 1.96

178,000

Megaworld Corp. Warrants2

2.50

2.50

2.50

2.50 0.00

1,000

SME

Ripple E-Business Intl

9.88

8.90

8.88

8.88 (10.12)

13,200

Banco de Oro Unibank Inc.

Bank of PI

Bankard, Inc.

China Bank

Citystate Savings

COL Financial

Eastwest Bank

Filipino Fund Inc.

I-Remit Inc.

Manulife Fin. Corp.

Maybank ATR KE

MEDCO Holdings

Metrobank

Natl Reinsurance Corp.

PB Bank

Phil. National Bank

Phil. Savings Bank

PSE Inc.

RCBC `A

Security Bank

Union Bank

Vantage Equities

84.65

102.50

1.09

63.20

27.50

20.00

33.25

16.50

2.75

540.00

28.10

0.28

113.00

1.90

34.00

95.80

129.90

453.00

66.50

177.00

120.00

2.57

(198,622,977.50)

(78,279,248.00)

4,301,990.00

5,146,355.00

(2,800.00)

166,400.00

(203,555,078.00)

1,258,000.00

3,253,886.00

3,087,602.50

3,610,802.00

3,618,324.00

20,217,075.00

(102,000.00)

(103,500.00)

99,400.00

29,000.00

(53,410.00)

120,384.00

31,216,436.00

(886,852.00)

2,305,080.00

13,631,661.00

1,800.00

376,200.00

(4,641,190.00)

(4,666,115.00)

21,000.00

2,400.00

22,272,314.00

(51,861,730.00)

8,677,487.00

1,894,992.00

(54,686.00)

36,752,384.00

(19,239,275.00)

(4,665,034.00)

(18,122,540.00)

531,270.00

(387,232.00)

3,254,400.00

2,733,860.00

13,935,513.00

7,350.00

18,873,317.50

(10,767,880.00)

(406,476,406.00)

648,600.00

18,195,820.00

(440,577.00)

875,320.00

(480,830.00)

(18,850,470.00)

(9,175,973.00)

(5,697,424.00)

271,972,040.00

(41,790.00)

(14,700.00)

(115,321,865.00)

69,122,487.00

(331,200.00)

(5,795,150.00)

(134,000.00)

16,809,480.00

18,506,300.00

(24,767,170.00)

58,289,220.00

(9,219,960.00)

145,600.00

(237,943.00)

(53,491,434.00)

(22,780.00)

(40,500.00)

(15,693,924.00)

7,500.00

76,000.00

6,254,500.00

(62,000.00)

(589,745.00)

190

7,630,720.00

(2,652,629.50)

(547,140.00)

46,000.00

28,960.00

225,115,920.00

(9,699,990.00)

(6,080,135.00)

(935,000.00)

990.00

(51,000.00)

(3,413,570.00)

(2,073,190.00)

84,400.00

10,350.00

(4,288,700.00)

(73,015.00)

982,300.00

(15,712,796.00)

(36,618,605.00)

1,980,000.00

(111,951,750.00)

875

Vous aimerez peut-être aussi

- Manila Standard Today - Business Daily Stocks Review (November 27, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (November 27, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (December 4, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (December 4, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (February 5, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (February 5, 2013)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (July 31, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (July 31, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (December 4, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (December 4, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (November 20, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (November 20, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (May 21, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (May 21, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (April 12, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (April 12, 2013)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (December 27, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (December 27, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (March 19, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (March 19, 2013)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (June 14, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (June 14, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (April 18, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (April 18, 2013)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (November 19, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (November 19, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (October 22, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (October 22, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (May 25, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (May 25, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (December 26, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (December 26, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (October 1, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (October 1, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (November 22, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (November 22, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (May 30, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (May 30, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (July 26, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (July 26, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (January 23, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (January 23, 2013)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (May 29, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (May 29, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (March 14, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (March 14, 2013)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (June 22, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (June 22, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stock Review (September 27, 2012)Document1 pageManila Standard Today - Business Daily Stock Review (September 27, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stock Review (September 26, 2012)Document1 pageManila Standard Today - Business Daily Stock Review (September 26, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (June 8, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (June 8, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (June 15, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (June 15, 2012)Manila Standard TodayPas encore d'évaluation

- Stocks Monitoring - Blue Chips: SN Company Code Date 26-Jun-18 2-Dec-18 4-Dec-18 19-Jun-19 25-Mar-20Document3 pagesStocks Monitoring - Blue Chips: SN Company Code Date 26-Jun-18 2-Dec-18 4-Dec-18 19-Jun-19 25-Mar-20Marcus AmabaPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (May 16, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (May 16, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (February 11, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (February 11, 2013)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - August 24, 2012 IssueDocument1 pageManila Standard Today - August 24, 2012 IssueManila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (October 16, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (October 16, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (November 21, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (November 21, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (February 7, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (February 7, 2013)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (May 31, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (May 31, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (May 04, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (May 04, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (December 12, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (December 12, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (April 25, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (April 25, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (January 16, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (January 16, 2013)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (December 19, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (December 19, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (May 10, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (May 10, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (January 30, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (January 30, 2013)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (December 14, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (December 14, 2012)Manila Standard TodayPas encore d'évaluation

- Les Indices BoursierDocument6 pagesLes Indices BoursierkhalifatoPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (April 10, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (April 10, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (April 24, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (April 24, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (January 11, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (January 11, 2012)Manila Standard TodayPas encore d'évaluation

- 01062020Document14 pages01062020Kishore KunduPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (December 6, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (December 6, 2012)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (October 30, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (October 30, 2012)Manila Standard TodayPas encore d'évaluation

- 01042010Document9 pages01042010Kishore KunduPas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (February 22, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (February 22, 2013)Manila Standard TodayPas encore d'évaluation

- Sistema de AguaDocument10 pagesSistema de AguaNANDO 15Pas encore d'évaluation

- Technical Guide: FinancialsDocument9 pagesTechnical Guide: FinancialswindsingerPas encore d'évaluation

- Technical Guide: FinancialsDocument9 pagesTechnical Guide: FinancialswindsingerPas encore d'évaluation

- Manila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Document1 pageManila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Manila Standard TodayPas encore d'évaluation

- Awwacl207c DDocument2 pagesAwwacl207c Dprnsh_kPas encore d'évaluation

- Propuesto / Conocido By+ky 2 B+2y (1+k 2) A / P y N K B Q A P S RDocument27 pagesPropuesto / Conocido By+ky 2 B+2y (1+k 2) A / P y N K B Q A P S RHarolHarolTareasPas encore d'évaluation

- The Standard - Business Daily Stocks Review (June 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 5, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (June 3, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 3, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (June 8, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 8, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (June 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 4, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (May 25, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 25, 2015)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Document1 pageManila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (May 20, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 20, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (May 22, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 22, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (June 2, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 2, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (May 26, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 26, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (May 13, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 13, 2015)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Weekly Stock Review (April 20 - 24, 2015)Document1 pageManila Standard Today - Business Weekly Stock Review (April 20 - 24, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (May 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 5, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (May 11, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 11, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (May 18, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 18, 2015)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Document1 pageManila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (May 6, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 6, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (May 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 4, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (April 30, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 30, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (April 29, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 29, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (April 28, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 28, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (April 16, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 16, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (April 24, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 24, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (April 22, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 22, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (April 23, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 23, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (April 17, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 17, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Weekly Stocks Review (April 19, 2015)Document1 pageThe Standard - Business Weekly Stocks Review (April 19, 2015)Manila Standard TodayPas encore d'évaluation

- Bongbong MarcosDocument35 pagesBongbong MarcosMark DeveraPas encore d'évaluation

- Capital, Coercion, and Crime: Bossism in The Philippines, John T. SidelDocument4 pagesCapital, Coercion, and Crime: Bossism in The Philippines, John T. SidelJoo XanderPas encore d'évaluation

- MTB w3Document7 pagesMTB w3aliahna espinosaPas encore d'évaluation

- Region 4Document11 pagesRegion 4Patricia Estrada BalatbatPas encore d'évaluation

- Quezon City Dpos Traffic 927 - 5914Document4 pagesQuezon City Dpos Traffic 927 - 5914chigZ GamingPas encore d'évaluation

- Performance of Schools ECE, ECT Board ExamDocument13 pagesPerformance of Schools ECE, ECT Board ExamTheSummitExpressPas encore d'évaluation

- AP BalitaDocument2 pagesAP BalitaFiehl Simone M. BijasaPas encore d'évaluation

- BE Form 6 DAILY ACCOMPLISHMENT REPORTDocument7 pagesBE Form 6 DAILY ACCOMPLISHMENT REPORTRene Rulete MapaladPas encore d'évaluation

- Factorsthatledtospanishcolonizationofthe 130106235341 Phpapp02Document32 pagesFactorsthatledtospanishcolonizationofthe 130106235341 Phpapp02LeePas encore d'évaluation

- A Self-Learning Module in English 10 2 Quarter, Languages of Research, Campaigns and AdvocaciesDocument11 pagesA Self-Learning Module in English 10 2 Quarter, Languages of Research, Campaigns and AdvocaciesJustin Lee BeladoPas encore d'évaluation

- Geography and Environment: Geography of The Philippines List of Islands of The PhilippinesDocument4 pagesGeography and Environment: Geography of The Philippines List of Islands of The Philippineskate trishaPas encore d'évaluation

- Pre TestDocument6 pagesPre TestAngie Diño AmuraoPas encore d'évaluation

- Unit I Lesson 1Document20 pagesUnit I Lesson 1zaynfox86Pas encore d'évaluation

- SDR 2018Document26 pagesSDR 2018Cybrewspace Computer SalesPas encore d'évaluation

- Alvin Gwap ADocument2 pagesAlvin Gwap AThreeamgirls ComshopPas encore d'évaluation

- CA Case Law Finder (2008-2012)Document29 pagesCA Case Law Finder (2008-2012)nasenagunPas encore d'évaluation

- National Artist For Literature Part 2Document30 pagesNational Artist For Literature Part 2ruzzel cedrick g zaballeroPas encore d'évaluation

- Nursing History in The PhilippinesDocument47 pagesNursing History in The PhilippinesLj RamosPas encore d'évaluation

- Golangco SyllabusDocument3 pagesGolangco SyllabusMaria Cresielda EcalneaPas encore d'évaluation

- Republic Act No. 7104 "Commission On The Filipino Language Act"Document6 pagesRepublic Act No. 7104 "Commission On The Filipino Language Act"Enrico C. TorralbaPas encore d'évaluation

- Biodiversity in The PhilippinesDocument1 pageBiodiversity in The PhilippinesBhabes Alla CansonPas encore d'évaluation

- Nkml5tjza - Quarter 1 Module 1 (Discussion)Document9 pagesNkml5tjza - Quarter 1 Module 1 (Discussion)Jandy P. JavierPas encore d'évaluation

- Philippine History: Spanish Regime in The PhilippinesDocument44 pagesPhilippine History: Spanish Regime in The PhilippinesEinah EinahPas encore d'évaluation

- Voters ListDocument15 pagesVoters ListJustine Mae RodriguezPas encore d'évaluation

- Rizal Revised9Document64 pagesRizal Revised9Princess ReyshellPas encore d'évaluation

- Trial and Execution of RizalDocument3 pagesTrial and Execution of RizalJuan Emmanuel Ventura67% (9)

- What Is Housing?Document8 pagesWhat Is Housing?Psy Giel Va-ayPas encore d'évaluation

- Module 2 1Document5 pagesModule 2 1regine seldaPas encore d'évaluation

- GE 7 - Lauron Rhoxsan - ACTIVITY 5Document3 pagesGE 7 - Lauron Rhoxsan - ACTIVITY 5Dan Sia DeiPas encore d'évaluation

- Tales From The 7,000 Isles - Filipino Folk Stories (PDFDrive)Document205 pagesTales From The 7,000 Isles - Filipino Folk Stories (PDFDrive)Brian Norton100% (2)