Académique Documents

Professionnel Documents

Culture Documents

Buy Back

Transféré par

sudhir.kochhar3530Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Buy Back

Transféré par

sudhir.kochhar3530Droits d'auteur :

Formats disponibles

STUDY IX FINANCIAL RESTRUCTURING

1. What do you mean by Financial Restructuring? Why there is a

need for Financial Restructuring? Ans: Financial restructuring of a company involves a rearrangement of its financial structure so as to make the company finances more balanced. Both, an undercapitalized and overcapitalized company may restructure their capital by taking corrective steps. Financial restructuring is the process of reshuffling or reorganizing the financial structure, which primarily comprises of equity capital and debt capital. Financial restructuring can be done because of either compulsion or as part of the financial strategy of the company. This financial restructuring can be either from the assets side or the liabilities side of the balance sheet. If one is changed, accordingly the other will be adjusted. The two components of financial restructuring are; Debt Restructuring Equity Restructuring Need for financial restructuring A company should always try to seek a balance between its debt and equity in its capital structure and the funding of the resulting deficit. The targets a company sets in striking this balance are influenced by business conditions, which seldom remain constant. When, during the life time of a company, any of the following situations arise, the Board of Directors of a company is compelled to think and decide on the companys restructuring: necessity for injecting more working capital to meet the market demand for the companys products or services; when the company is unable to meet its current commitments; when the company is unable to obtain further credit from suppliers of raw materials, consumable stores, bought-out components etc. and from other parties like those doing job work for the company. when the company is unable to utilise its full production capacity for lack of liquid funds. Financial restructuring of a company involves a rearrangement of its financial structure to make the companys finances more balanced. Restructuring of under-capitalized Company An under-capitalized company may consider restructuring its capital by taking one or more of the following corrective steps: injecting more capital whenever required either by resorting to rights issue or additional public issue. resorting to additional borrowings from financial institutions, banks, other companies etc. issuing debentures, bonds, etc. or

STUDY IX FINANCIAL RESTRUCTURING

inviting and accepting fixed deposits from directors, their relatives, business associates and public.

Restructuring of over-capitalized company If a company is over-capitalized, its capital also requires restructuring by taking following corrective measures: Buy-back of own shares. Paying back surplus share capital to shareholders. Repaying loans to financial institutions, banks, etc. Repaying fixed deposits to public etc. Redeeming its debentures, bonds, etc.

2. What do you mean by Reduction of share Capital? What is the

mode of Reduction Ans: Reduction of capital means reduction of issued, subscribed and paid-up capital of the company. Section 100 provides for the reduction of share capital, if the articles of the company so authorize. If there is no such clause in the articles, these must be altered by a special resolution giving the company the power to reduce its capital. The need for reduction of capital may arise in various circumstances for example trading losses, heavy capital expenses and assets of reduced or doubtful value. As a result, the original capital may either have become lost or a company may find that it has more resources than it can profitably employ. In either case, the need may arise to adjust the relation between capital and assets [Indian National Press (Indore) Ltd., In re. (1989) 66 Com Cases 387, 392 (MP)]. The mode of reduction, as laid down in Section 100 of the Companies Act, is as follows: A company limited by shares or a company limited by guarantee and having a share capital may, if authorised by its articles, by special resolution, and subject to its confirmation by the Court on petition, reduce its share capital in any way and in particular: (a) by reducing or extinguishing the liability of members in respect of uncalled or unpaid capital e.g., where the shares are of Rs. 100 each with Rs. 75 paid-up, reduce them to Rs. 75 fully paid-up shares and thus relieve the shareholders from liability on the uncalled capital of Rs. 25 per share; (b) by paying off or returning paid-up capital not wanted for the purposes of the company, e.g., where the shares are fully paid-up, reduce them to Rs. 75 each and pay back, Rs. 25 per share; (c) by paying off the paid-up capital on the conditions that it may be called up again so that the liability is not extinguished; (d) by following a combination of any of the preceding methods; (e) by writing off or canceling the capital which has been lost or is under represented by the available assets e.g. a share of Rs. 100 fully paid-up is represented by Rs. 75 worth of assets. In such a situation reality can be reintroduced by writing off Rs. 25 per share. This is the most common method of reduction of capital. The assets side of the balance sheet may include

STUDY IX FINANCIAL RESTRUCTURING

useless assets which are cancelled. On the other side i.e. on the liability side share capital is reduced. There is no limitation on the power of the Court to confirm the reduction except that it must first be satisfied that all the creditors entitled to object to the reduction have either consented or been paid or secured [British and American Trustee and Finance Corpn. v. Couper, (1894) AC 399, 403: (19914) All ER Rep 667]. When exercising its discretion, the Court must ensure that the reduction is fair and equitable. In short, the Court shall consider the following, while sanctioning the reduction: (i) The interests of creditors are safeguarded; (ii) The interests of shareholders are considered; and (iii) Lastly, the public interest is taken care of. 3. Diminution of capital does not constitute reduction of capital within the provisions of the Companies Act, 1956, Comment. (PE-II, May 2004) or Distinguish between Reduction of Share Capital and Diminution of Share Capital. (PE-II, Nov. 2006) Answer: Diminution/Reduction of Capital Section 94(3) of the Companies Act, 1956 specifically states that diminution does not constitute a reduction of capital within the meaning of the Companies Act. Distinction can be made between the two on the following grounds: (i) Reduction of capital may be a reduction in nominal capital, subscribed capital or paid up capital whereas diminution denotes a cancellation of that portion of the issued capital which has not been subscribed [Section 94(1) (e)] (ii) Both require authorization by Articles but reduction of capital can be effected only by a special resolution whereas diminution can be effected by an ordinary resolution. (iii) Reduction of capital needs confirmation by the court [Section 101] whereas diminution needs no such confirmation [Section 94(2)] (iv) In case of reduction, Court (now Tribunal) may order the company to add the words and reduce after its name [Section 102(3)] but no such order can be passed in case of diminution [Section 94] (v) In case of diminution notice is to be given to the Registrar within 30 days from the date of cancellation, whereas in the case of reduction more detailed procedure regarding notice to the Registrar has been prescribed by section 103, though there is no such time limit as aforesaid.

Reduction of share capital without sanction of the Court The following are cases which amount to reduction of share capital but where no confirmation by the Court is necessary: (a) Surrender of shares - Surrender of shares means the surrender of shares already issued to the company by the registered holder of shares.

STUDY IX FINANCIAL RESTRUCTURING

Where shares are surrendered to the company, whether by way of settlement of a dispute or for any other reason, it will have the same effect as a transfer in favour of the company and amount to a reduction of capital. But if, under any arrangement, such shares, instead of being surrendered to the company, are transferred to a nominee of the company then there will be no reduction of capital [Collector of Moradabad v. Equity Insurance Co. Ltd., (1948) 18 Com Cases 309: AIR 1948 Oudh 197]. Surrender may be accepted by the company under the same circumstances where forfeiture is justified. It has the effect of releasing the shareholder whose surrender is accepted for further liability on shares. The Companies Act contains no provision for surrender of shares. Thus surrender of shares is valid only when Articles of Association provide for the same and: (i) where forfeiture of such shares is justified; or (ii) when shares are surrendered in exchange for new shares of same nominal value. Both forfeiture and surrender lead to termination of membership. However, in the case of forfeiture, it is at the initiative of company and in the case of surrender it is at the initiative of member or shareholder. (b) Forfeiture of shares - A company may if authorised by its articles, forfeit shares for non-payment of calls and the same will not require confirmation of the Court. Where power is given in the articles, it must be exercised strictly in accordance with the regulations regarding notice, procedure and manner stated therein, otherwise the forfeiture will be void. Forfeiture will be effected by means of Board resolution. The power of forfeiture must be exercised bona fide and in the interest of the company. (c) Diminution of capital - Where the company cancels shares which have not been taken or agreed to be taken by any person [Section 94(1)(3)]. (d) Redemption of redeemable preference shares. (e) Purchase of shares of a member by the company under Section 402. (f) Buy-back of its own shares under Section 77A. Reduction of capital when company is defunct The Registrar of Companies has been empowered under Section 560 to strike off the name of a company from its register on the ground of non-working company. Therefore, where the company has ceased to trade, and Registrar exercises his power under Section 560 a reduction of capital cannot be prevented. [Great Universal Stores Ltd., Re. (1960) 1 All ER 252: (1960)]. Reduction of capital of unlimited company An unlimited company to which Section 100 does not apply, can reduce its capital in any manner that its Memorandum and Articles of Association allow. It is not governed by Sections 94 and 100 of the Act. Equal Reduction of Shares of One Class Where there is only one class of shares, prima facie, the same percentage should be paid off or cancelled or reduced in respect of each share, but where different amounts are paid-up on shares of the same class, the reduction can be effected by equalizing the amount so paid-up. [Marwari

STUDY IX FINANCIAL RESTRUCTURING

Stores Ltd. v. Gouri Shanker Goenka (1936) 6 Com Cases 285]. The same principle is to be followed where there are different classes of shares. It is, however, not necessary that extinguishment of shares in all cases should necessarily result in reduction of share capital. Accordingly, where reduction is not involved, Section 100 would not be attracted. [Asian Investment Ltd. Re. (1992) 73 Com Cases 517, 523 (Mad)]. Qualification shares of directors [Section 270] Where the directors are required to hold qualification shares, care must be taken to ensure that the effect of a reduction does not disqualify any director. Conclusiveness of certificate for reduction of capital Where the Registrar had issued his certificate confirming the reduction, the same was held to be conclusive although it was discovered later that the company had no authority under its articles to reduce capital [Re Walkar & Smith Ltd., (1903) 88 LT 792 (Ch D)]. Similarly, in a case where the special resolution for reduction was an invalid one, but the company had gone through with the reduction, the reduction was not allowed to be upset [Ladiess Dress Assn. v. Pulbrook, (1900) 2 QB 376]. Diminution of share capital is not a reduction of capital In the following cases, the diminution of share capital is not to be treated as reduction of the capital: (i) Where the company cancels shares which have not been taken or agreed to be taken by any person [Section 94(1)(e)]; (ii) Where redeemable preference shares are redeemed in accordance with the provisions of Section 80; (iii) Where any shares are forfeited for non-payment of calls and such forfeiture amounts to reduction of capital; (iv) Where the company buys-back its own shares under Section 77A of the Act. In all these cases, the procedure for reduction of capital as laid down in Section 100 is not attracted. Liability of Members in respect of Reduced Share Capital On the reduction of share capital, the extent of the liability of any past or present member or any call or contribution shall not exceed the difference between the amount already paid on the share, or the reduced amount, if any, which is deemed to have been paid thereon by the member, and the amount of the shares fixed by the scheme of the reduction. 4. What do you mean by Buy Back of shares? ANSWER: Concept of Buy-Back of Shares The concept of buy-back is a recent one so far as India is concerned. The Companies Amendment Act, 1999 introduced the concept of buy-back of shares. Buy-back of shares means the purchase by the company of its own shares. Buy-back of equity shares is an important mode of capital restructuring. It is a corporate financial strategy which involves capital restructuring and is prevalent globally with the underlying objectives of increasing earnings per share, averting hostile takeovers, improving returns to the stakeholders and realigning the capital structure. In India, while buy-back of securities is not permitted as a treasury option under which the securities may be reissued later, a company can resort to

STUDY IX FINANCIAL RESTRUCTURING

buy-back to reduce the number of shares issued and return surplus cash to the shareholders. Buyback is a method of cancellation of share capital. It leads to reduction in share capital of a company as opposed to issue of shares which results in an increase in the share capital. Not only statute, but also common law, has upheld the sanctity of a companys capital. In 1887, in Trevor v. Whitworth (1887) 12 App Cas 409, it was held that a company limited by shares may not purchase its own shares as this would amount to an unauthorized reduction of capital. The rationale for this decision is plain, namely, that the creditors of the company make decisions on its credit-worthiness on several grounds and the share capital is important ground. Prior to the amendment of the Companies Act, 1956, buyback of shares in India was prohibited. Section 77 of the Act, imposed a blanket ban on companies from buying their own shares. Section 77A,77AA and 77B have been introduced in 1999 in the Companies Act, 1956 to enable companies to purchase their own shares or other specified securities. However, Section 77A of the Companies Act, 1956 which was inserted in the Companies Act, 1956 by the Companies (Amendment) Act, 1999 with retrospective effect from 31.10.1998 is an exception to the prohibition under Section 77 and Section 100. Section 77A allows companies to buy-back their own shares as well as other specified securities.

5. What is the objective of Buy Back of shares?

ANSWER: Good corporate governance calls for maximizing the shareholder value. When a company has surplus funds for which it does not have good avenues for deployment assuring an average return on capital employed and earnings per share, the companys financial structure requires balancing. The reasons for buy-back may be one or more of the following: (i) to improve earnings per share; (ii) to improve return on capital, return on net worth and to enhance the longterm shareholder value; (iii) to provide an additional exit route to shareholders when shares are under valued or are thinly traded; iv) To enhance consolidation of stake in the company; (v) To prevent unwelcome takeover bids; (vi) To return surplus cash to shareholders; (vii) To achieve optimum capital structure; (viii) To support share price during periods of sluggish market conditions; (ix) To service the equity more efficiently. The decision to buy-back is also influenced by various other factors relating to the company, such as growth opportunities, capital structure, sourcing of funds, cost of capital and optimum allocation of funds generated.

6. What are the criteria of Buy Back of shares?

ANSWER: Criteria of Buyback of shares

STUDY IX FINANCIAL RESTRUCTURING

In order to make buyback beneficial, the company may undertake buyback after meeting the following criteria: i. The company has exhausted all avenues of fresh investments/outlay in the near future ii. Buyback can be undertaken without jeopardizing the lenders risk iii. The company enjoys a return on capital employed which is significantly higher than the normal cost of borrowing. iv. The market price of the companys share is far lower than its intrinsic value

7. What are the sources of Buy Back of shares?

ANSWER: AVAILABLE SOURCES FOR BUY-BACK OF SECURITIES Sources of buy-back: According to Section 77A(1) of the Companies Act, 1956 a company may purchase its own shares or other specified securities (hereinafter referred to as buy-back) out of: (i) its free reserves; or (ii) the securities premium account; or (iii) the proceeds of any shares or other specified securities. However, no buy-back of any kind of shares or other specified securities can be made out of the proceeds of an earlier issue of the same kind of shares or same kind of other specified securities. Thus, the company must have at the time of buy-back, sufficient balance in any one or more of these accounts to accommodate the total value of the buy-back. Free reserves and securities premium account While the surplus in the profit and loss account can be used for buy-back of securities, in case the profit and loss account shows a debit balance, such debit balance should first be deducted from free reserves. Capital redemption reserve, revaluation reserve, investment allowance reserve, profit on re-issue of forfeited shares, profits earned prior to incorporation of the company and any other specific reserve are not available for distribution as dividend and hence do not form part of free reserves for the purpose of buy-back. Even though Section 77A(1) provides that a company may buy-back its securities out of securities premium account, Sub-section (2) of Section 78 does not mention buy-back of securities as one of the purposes for which the balance in the securities premium account may be utilised. However, by virtue of the non obstante clause in Section 77A, namely Notwithstanding anything contained in this Act., Section 77A prevails over Section 78. Therefore, the securities premium account can be utilized for buyback of securities.

Illustration E:

The following reserves appear in the balance sheet of XYZ Limited.

STUDY IX FINANCIAL RESTRUCTURING

(a) Capital Redemption Reserve. (b) Debenture Redemption Reserve. (c) Dividend Equalization Reserve. (d) Foreign Currency Fluctuation Reserve. (e) General Reserve. (f) Securities Premium Account. (g) Statutory Reserve. (h) Investment Fluctuation Reserve. Of the above, for the purpose of buy-back of securities, only the following are considered as free reserves: (i) Dividend Equalization Reserve. (ii) Foreign Currency Fluctuation Reserve (if not in the nature of provision). (iii) General Reserve. (iv) Securities Premium Account. (v) Investment Fluctuation Reserve.

***************************************************************************************************** ***********************

Proceeds of issue Buy-back may be made out of the proceeds of an issue of securities other than the same kind of securities as are proposed to be bought back. The proceeds of an earlier issue of one kind of securities may be used for the purpose of buy-back of any other kind of securities. The proceeds of an issue of preference shares may be used to buy-back equity shares and the proceeds of an issue of equity shares may be used to buy-back preference shares. However, the proceeds of issue of preference shares carrying differential rights as to dividend, voting etc. cannot be utilized inter se for the purpose of buy-back. For instance, the proceeds of issue of 10% preference shares cannot be utilized for buy-back of 8% preference shares, as these are of the same kind, though of different classes of shares. There should be no direct nexus between the proceeds of an issue and buyback of securities of a company. Borrowings from banks/financial institutions Where a company has borrowed any money from banks/ financial institutions for any purpose, it should not utilize such money for buy-back of securities. [Rule 8(e)]. Further, if any approval is required to be obtained from banks/financial institutions, such approval should be obtained before passing the Board resolution for buy-back of securities.

***************************************************************************************************** *****************************

8. What are the Conditions to be fulfilled and obligations of Buy

Back of shares? ANSWER:

STUDY IX FINANCIAL RESTRUCTURING

CONDITIONS TO BE FULFILLED AND OBLIGATIONS FOR BUY-BACK OF SECURITIES: Only fully paid-up securities qualify for buy-back. [Section 77A (2)(e)]. If some securityholders have not made the payment of calls or any sums due on the securities, it would not disentitle the company from buy-back. However, the securities on which the call money remains in arrears cannot be bought back. Fully paid-up securities, even if quoted below par on the stock exchanges, qualify for buy-back. If a security has been issued at a discount, the payment of the total amount due thereon should be considered as a sufficient qualification for its buy-back. After buy-back, the company should have a debt-equity ratio not exceeding 2:1, i.e. all secured and unsecured debts of the company should not be more than twice the aggregate of its capital and free reserves. However, the Central Government has the power to prescribe a higher debt-equity ratio for a class or classes of companies. [Section 77A(2)(d)].

Where buy-back of shares is made out of free reserves, the company should transfer to the capital redemption reserve account referred to in clause (d) of the proviso to Sub-section (1) of Section 80, a sum equal to the nominal value of the shares so bought back and the details of such transfer should be disclosed in the balance sheet. [Section 77AA]. Such transfer to capital redemption reserve account will also not be required when buy-back is of securities other than shares.

No further issue of the same kind of securities should be made within a period of 6 months from the date of completion of buyback of securities. [Section 77A(8)]. Hence, an issue of preference shares may be made by a company within a period of 6 months from the date of completion of buy-back of equity shares and vice versa. An issue of shares in pursuance of a scheme of amalgamation, being by virtue of a court order, is permissible. However, no buy-back of securities should be undertaken while a petition for amalgamation is pending. No issue of any security including bonus shares should be made till the closure of offer of buy-back. [Regulation 19(1)(b) & Rule 8(1)(b)]. Convertible debentures can be bought back before the date of their conversion but such a purchase would amount to the company purchasing its own shares and all the provisions relating to buy-back shall become applicable. The buyback is authorized by its articles

A special resolution has been passed in general meeting of the company authorizing the buyback

STUDY IX FINANCIAL RESTRUCTURING

The buyback is less than twenty-five per cent of the total paid capital and free reserves of the company The buyback is in accordance with the regulations made by the SEBI in this behalf. Buyback within 1 year U/S 77A (4): Every Buyback shall be completed within 12 months from the date of passing the special regulation.

Physical destruction of securities U/S 77 A(7): A company should extinguish and physically destroy the securities so bought back with in 7 days of the last date of completion of buyback No fresh issue with in 24 months U/S 77A(8): A company cannot make fresh issue of the same kind of securities within period of 24 months except :a) by way of bonus issue b) conversion of warrants c) stock option scheme d) sweat equity e) conversion of preference shares or debentures into equity shares

No Buyback allowed U/S 77B a)through any subsidiary co including its own subsidiary companies b)through any investment company c)if default is made in repayment of interest or dividend or loan or deposit etc.

Declaration of solvency U/S 77A(6) Company has passed a special regulation to Buyback its own shares or other securities, it shall, before making such Buyback, a. File a declaration of solvency : With Registrar The SEBI in the prescribed form b. Submit an affidavit (signed by at least 2 directors) to the effect that the board has made a full enquiry into the affairs of the company Note: No declaration of solvency shall be filed with SEBI by a company whose shares are not listed on any recognized stock exchange. 9. What are the methods of Buy Back of shares? ANSWER: Methods of Buyback U/S 77A (5) The Buyback may be made : a) From the existing share holders on a proportionate basis b) From the open market c) From odd lots

10

STUDY IX FINANCIAL RESTRUCTURING

d) By purchasing the securities issued to the employees of the company under ESOS According to Regulation 4 of the Regulations, a company may buy back its own securities by any one of the following methods: from the existing security-holders on a proportionate basis through the tender offer; from the open market through: book-building process, stock exchange from odd-lot holders.

Powers of CLB/Court Prior to the enactment of the Companies (Amendment) Act, 1999, no company limited by shares and no company limited by guarantee and having a share capital could buy its own securities unless the consequent reduction of capital was effected and sanctioned pursuant to the provisions of Sections 100 to 104 or of Section 402 of the Act. The Company Law Board (CLB), pursuant to the provisions of Section 402 of the Act, may order a company to purchase the shares or any interest of its members in the company on an application made by members under Section 397 or 398 of the Act to remedy oppression and mismanagement. The reduction of share capital as a consequence of such an order is not affected by nor will it be governed by the provisions of the Act relating to buy-back of securities. The provisions of the Act relating to buy-back of securities are also not applicable to the extent of the sanction of a High Court to any scheme of compromise or arrangement pursuant to Sections 391 to 394 of the Act. In the case of Union of India v. Sterlite Industries (India) Ltd. (2003)(113)-Comp Cas 0273, (Bom), the Court observed that the non obstante clause in Section 77A, namely Notwithstanding anything contained in this Act means that notwithstanding the provisions of Section 77 and Sections 100 to 104, the company can buy-back its shares subject to compliance with the conditions mentioned in Section 77A without approaching the Court under Sections 100 to 104 or Section 391.Therefore, Section 77A is an enabling provision and the Courts powers under Sections 100 to 104 and Sections 391 are not in any way curtailed or affected. The provisions of Section 77A are applicable only to buy-back of securities under Section 77A and the conditions applicable to Sections 100 to 104 and Section 391 cannot be imported into or made applicable to buy-back of securities under Section 77A. Similarly, the conditions for buy-back of securities under Section 77A cannot be applied to a scheme under Sections 100 to 104 and Section 391, as the two operate in independent fields. In the case of Himachal Telematics Ltd. v. Himachal Futuristic Communications Ltd. (1996) 86 Comp Cas 325 (Del) a scheme of amalgamation was to be undertaken. However, the transferee company had

11

STUDY IX FINANCIAL RESTRUCTURING

a subsidiary which was holding shares of the transferor company. An objection was raised that the sanction of the scheme of amalgamation would result in the buying back by the transferee company of shares of its subsidiary and would thereby violate the provisions of Sections 42 and 77 of the Act. Dealing with the argument regarding violation of Section 77, it was held that no violation would result as a consequence of sanctioning the scheme of amalgamation as the transferee company was not buying any of its own shares.

10. What is the Authority and Quantum of Buy Back of shares? ANSWER: AUTHORITY AND QUANTUM OF BUY-BACK OF SECURITIES

Authority in the Articles Buy-back of securities should be authorised by the Articles of Association of the company. [Section 77A(2)(a)]. In case the Articles do not contain such a provision, they should be amended appropriately authorizing the buy-back of securities. Such an amendment should be made either at a meeting preceding the meeting wherein the resolution for buy-back is to be passed or at the same meeting wherein the resolution for buy-back is to be passed but the resolution for amendment of Articles should precede the resolution for buy-back of securities.

Board resolution and quantum of buy-back

By passing a resolution, the Board can authorize the buy-back of securities not exceeding 10% of the total paid-up equity capital and free reserves of the company.

10% OF ( TOTAL PAID UP EQUITY CAPITAL + FREE RESERVES )

[Proviso to Section 77A(2)]. The aforesaid limit is to be applied not to the number of securities to be bought back but to the amount required for buyback of such securities. The resolution authorizing buy-back should be passed at a meeting of the Board [Section 292(1)(aa)]. Such a resolution should not be passed by circulation or at a meeting of a committee of the Board. However, the methodology, mode of buy-back and other procedural requirements for buyback may be delegated by the Board.

Shareholders resolution and quantum of buy-back

By passing a special resolution, the shareholders can authorize the buy-back of securities not exceeding 25% of the total paid-up capital

12

STUDY IX FINANCIAL RESTRUCTURING

and free reserves of the company in that financial year . [Section 77A(2)(b) and (c)].

25% OF ( TOTAL PAID UP CAPITAL + FREE RESERVES )

Paid-up capital includes both equity and preference share capital. Whereas unlisted companies should obtain shareholders approval by passing the special resolution only at a duly convened general meeting, listed companies should obtain such approval by postal ballot. The notice containing the special resolution proposed to be passed should be accompanied by an explanatory statement stating: (a) all material facts, fully and completely disclosed; (b) the necessity for buy-back; (c) the class of security intended to be purchased under the buy-back; (d) the amount to be invested under buy-back; and (e) the time limit for completion of buy-back [Section 77A(3)]. The detailed requirements in this regard, as laid down in the Regulations and Rules respectively for listed and unlisted companies, are explained later.

Maximum quantum of buy-back

A company cannot buy-back more than 25% of its total paid-up capital and free reserves. [Section 77A(2)(c)].

25% OF ( TOTAL PAID UP CAPITAL + FREE RESERVES )

The aforesaid limit is to be applied not to the number of securities to be bought back but to the amount required for buy-back of such securities.

Buy-back of equity shares in any financial year should not exceed 25% of the total paid-up equity capital of the company. [Proviso to Section 77A(2)(c)]. 25% OF ( TOTAL PAID UP EQUITY CAPITAL )

A company may buy-back its entire (i.e. 100%) securities other than equity shares, viz. preference shares and any other securities as may be notified by the Central Government from time to time, in a financial year, subject to the overall limit of 25% of the total paid-up capital and free reserves of the company. Given below are illustrations of the quantum that Board/shareholders can buy-back in certain situations: Illustration A: The capital structure of a company consists of: (a) 10,00,000 equity shares of Rs. 10 each fully paid-up. (b) Free reserves Rs. 7,50,00,000. the

13

STUDY IX FINANCIAL RESTRUCTURING

The Board can authorise buy-back upto 10% of the total paid-up equity share capital and free reserves, i.e.10% of Rs. [1,00,00,000 + 7,50,00,000] = Rs. 85,00,000 However, buy-back of equity shares in a financial year cannot exceed 25% of the paid-up equity capital in that year and hence the Board cannot authorize buy-back of equity shares in excess of 25% of Rs.1, 00,00,000 = Rs. 25,00,000. Shareholders can approve buy-back upto 25% of paid-up capital and free reserves, i.e. 25% of Rs. [1,00,00,000 + 7,50,00,000] = Rs. 2,12,50,000, but this is subject to the overall limit of 25% of Rs. 1,00,00,000 = Rs. 25,00,000. Illustration B: The capital structure of a company consists of: (a) 10,00,000 equity shares of Rs. 10 each fully paid-up. (b) 10,00,000 equity shares of Rs. 10 each on which Rs. 5 is paidup. (c) Free reserves Rs. 7,50,00,000. ANS: The total paid-up equity share capital of the company is Rs. [1,00,00,000 + 50,00,000] = Rs.1,50,00,000. The Board can, within the overall limits, buy-back upto 10% of the total paidup equity share capital and free reserves, i.e. 10% of Rs. [1,50,00,000 + 7,50,00,000]= Rs. 90,00,000. The shareholders can approve buy-back upto 25% of paid-up capital and free reserves, i.e.25% of Rs. [1,50,00,000 + 7,50,00,000] = Rs. 2,25,00,000. However, the buy-back in the present case cannot exceed 25% of paid-up equity capital i.e. 25% of Rs. [1,00,00,000 + 50,00,000] = Rs. 37,50,000. Illustration C: The capital structure of a company consists of: (a) 10,00,000 equity shares of Rs. 10 each fully paid-up. (b) 10,00,000 equity shares of Rs. 10 each on which Rs. 5 is paid-up. (c) 10,00,000 equity shares of Rs.10 each fully paid-up with differential rights as to voting. (d) 1,00,000 preference shares of Rs. 100 each fully paid-up. (e) Free reserves Rs. 7,50,00,000. ANS: The total paid-up equity share capital of the company is Rs. [1,00,00,000 + 50,00,000 + 1,00,00,000] = Rs. 2,50,00,000. The Board can draw upto 10% of the total paid-up equity share capital and free reserves, i.e. 10% of Rs. [2,50,00,000 + 7,50,00,000] = Rs. 1,00,00,000. The shareholders can approve buy-back upto 25% of paid-up capital and free reserves, i.e. 25% of Rs.[2,50,00,000 +1,00,00,000 + 7,50,00,000] = Rs.2,75,00,000. However, the buy-back of equity shares should be limited to 25% of the total paid-up equity capital of Rs.2,50,00,000 = Rs. 62,50,000. In both the cases of approval by the Board or the shareholders, the buy-back of preference shares can be done upto 100% i.e. 1,00,000 preference shares

14

STUDY IX FINANCIAL RESTRUCTURING

of Rs. 100 each as it is within the overall limit of Rs. 1,00,00,000 or Rs. 2,75,00,000 respectively. Further offer of buy-back Once the buy-back has been made with the authorization of the Board and not that of the shareholders, no further offer for buy-back of any securities can be made without the consent of shareholders accorded by a special resolution within 365 days reckoned from the date of the offer. [Second Proviso to Section 77A(2)]. However, the shareholders can make further offer within a period of 365 days, provided the aggregate of authorisation does not exceed the quantum specified. Illustration D: Where an earlier offer up to 8% of the total paid-up equity capital and free reserves was made with the approval of the Board, no further offer can be made without the approval of shareholders within a period of 365 days reckoned from the date of offer, inspite of the fact that the Board is entitled to buy-back upto 10% of paid-up equity capital and free reserves but had drawn upon only 8% thereof.

11. Why there is need for Buy Back of shares? ANSWER: NECESSITY FOR BUY-BACK

Good corporate governance requires proper utilisation of shareholders money. When a company has surplus funds, which it can not, in the given circumstances and in the given state of money market, deploy in a growth process from which it would be able to maintain an average return on capital employed and earning per share, the companys finances need to be restructured by balancing the same. The Board of Directors of the company has to make a thorough study into the financial structure of the company, the precise reasons for its restructuring and the mode of restructuring which would be suitable to the requirements of the company in the given circumstances. One of the methods of financial restructuring open to a company is buy-back of its own securities. Buy-back results in the return of the shareholders money and a reduction of the floating stock of the companys securities in the market while at the same time creating value for the remaining equity. Funding buy-back Limits upto which securities can be bought back A buy-back must be equal to or less than twenty-five per cent of the total paid-up capital and free reserves of the company. However, the buy-back of equity shares in any financial year should not exceed twenty-five per cent of its total paid-up equity capital in that financial year [Section 77A(2)(c)]. Time limit for completion of buy-back Every buy-back must be completed within twelve months from the date of passing of the special resolution [Section 77A(4)].

15

STUDY IX FINANCIAL RESTRUCTURING

Public announcement-Filing of offer documents specified Sub-regulation (1) of Regulation 8 of the Regulations, provides that the company which has been authorised by a special resolution, should before the buy-back of securities make a public announcement in at least one English national daily, one Hindi national daily and a regional language daily all with wide circulation at the place where the registered office of the company is situated, containing all the material information as specified in Schedule II to the Regulations. Sub-regulation (2) of Regulation 8 provides that the public announcement should specify a date, which would be the specified date for the purpose of determining the names of the security-holders to whom the letter of offer is required to be sent. The specified date should not be earlier than thirty days and not later than forty-two days from the date of the public announcement [Sub-regulation (3) of Regulation 8]. Filing of offer documents with SEBI Sub-regulation (4) of Regulation 8 provides that the company shall, within seven working days of the public announcement, file with SEBI, a draft letter of offer containing disclosures as specified in Schedule-III to the Regulations, through a merchant banker who is not associated with the company. The draft letter of offer should be accompanied by the fees specified in Schedule IV to the Regulations [Sub-regulation (5) of Regulation 8]. Despatch of letter of offer to shareholders The letter of offer should be despatched to the shareholders not earlier than twenty-one days from its submission to SEBI under Sub-regulation (4) [Subregulation (6) of Regulation 8]; If within twenty-one days from the date of submission of the draft letter of offer, SEBI specifies any modification in the draft letter of offer, the merchant banker and the company are required to carry out such modifications before the letter of offer is despatched to the shareholders. Offer procedure Regulation 9 of the SEBI Regulations lays down the following procedure for making of the offer for buy-back of shares: The offer for buy-back must remain open to the members for a period of not less than fifteen days and not exceeding thirty days. The date of the opening of the offer must not be earlier than seven days or later than thirty days after the specified date. The letter of offer must be sent to the security-holders so as to reach there before the opening of the offer. If the number of securities offered by the security-holders is more than the total number of securities to be bought back by the company, the acceptances per security holder should be equal to the acceptances tendered by the security-holders divided by the total acceptances received and multiplied by the total number of securities to be bought back.

16

STUDY IX FINANCIAL RESTRUCTURING

The acceptance per security holder can be decided by applying the following formula: AS= ATS/TA x NSB where AS = Acceptance per security holder ATS = Acceptance tendered by the security-holders TA = Total acceptances received NSB = Number of securities to be bought back The company is required to complete the verification of the offers received, within fifteen days of the closure of the offer and the securities lodged will be deemed to be accepted unless a communication of rejection is made within fifteen days from the closure of the offer. Escrow account Regulation 10 of the SEBI Regulations provides thatthe company should as and by way of security for performance of its obligations under the Regulations, on or before the opening of the offer, deposit in an escrow account the sum as specified in Sub-regulation (2). the escrow amount is payable in the following manner: if the consideration payable does not exceed Rs.100 crores-25 per cent of the consideration payable; if the consideration payable exceeds Rs.100 crores-25 per cent upto Rs.100 crores and 10 per cent thereafter; the escrow account referred to above shall consist of: cash deposited with a scheduled commercial bank, or bank guarantee in favour of the merchant banker, or deposit of acceptable securities with appropriate margin, with the merchant banker, or a combination of (a), (b) and (c) above; where the escrow account consists of deposit with a scheduled commercial bank, the company while operating the account, should empower the merchant banker to instruct the bank to issue a bankers cheque or demand draft for the amount lying to the credit of the escrow account, as provided in the Regulations; . Extinguishing of bought-back securities Sub-section (7) of Section 77A of the Companies Act lays down that where a company buys back its own securities, it should, within seven days of the last date of completion of the buy-back, extinguish and physically destroy the securities so bought back. Regulation 12 of the SEBI Regulations provides thatThe company should extinguish and physically destroy the security certificates so bought back, in the presence of a Registrar or the Merchant Banker, and the Statutory Auditor within seven days from the date of acceptance of the securities. If the securities offered for buy-back are already dematerialized, then they should be extinguished and destroyed in the manner specified under the Securities and Exchange Board of India (Depositories and Participants) Regulations, 1996 and the bye-laws made thereunder. The company is required to furnish a certificate to SEBI fully verified by:

17

STUDY IX FINANCIAL RESTRUCTURING

the registrar and whenever there is no registrar through the merchant banker; two whole-time directors including the managing director and the statutory auditor of the company, and certifying compliance as specified in Sub-regulation (I), within seven days of the extinguishment and destruction of the certificates. The particulars of the security certificates extinguished and destroyed under Sub-regulation (1) should be furnished to the stock exchanges where the securities of the company are listed, within seven days of extinguishment and destruction of the certificates. Register of bought-back securities (5) The company is required to maintain a record of security certificates which have been cancelled and destroyed, as prescribed in Sub-section (9) of Section 77A of the Companies Act. According to the said Section, where a company buys-back its securities, it shall maintain a register of securities so bought, the consideration paid for the securities bought back, the date of cancellation of securities, the date of extinguishment and physically destroying of securities and such other particulars, as may be prescribed under Rule 5C and Form No. 4B of General Rules and Forms. . Buy-back from open market Regulation 14 of the Regulations lays down that a buy-back of shares from the open market may be in any one of the following methods: Through stock exchange. Book-building process. Buy-back through the stock exchange Regulation 15 of the Regulations provides that a company should buy-back its specified securities through the stock exchange as provided hereunder: the special resolution as under Regulation 5 and 5A should specify the maximum price at which the buy-back will be made; the buy-back of securities should not be from the promoters or persons in control of the company; the company should appoint a merchant banker and make a public announcement as referred to in Regulation 8 at least seven days prior to the commencement of buy back; a copy of the public announcement which should contain disclosures regarding details of the brokers and stock exchanges through which the buyback would be made must be filed with SEBI within two days of the announcement along with the fees as specified in Schedule IV to the Regulations; the buy-back should be made only on stock exchanges with electronic trading facility and only through the order matching mechanism except all or none order matching system; the company and the merchant banker should give information to the stock exchange on a daily basis regarding the securities bought-back and the same should be published in a national daily; the identity of the company as a purchaser would appear on the electronic screen when the order is placed. Extinguishment of Certificates

18

STUDY IX FINANCIAL RESTRUCTURING

Regulation 16 lays down that the provisions of Regulation 12 pertaining to extinguishment of certificates will be applicable mutatis mutandis and the company shall complete the verification of acceptances within fifteen days of the pay-out. Buy-back through book-building A company can buy-back its securities through the book-building process as provided hereunder: a The special regulation as in Regulation 5 or 5A, should specify the maximum price at which the buy-back will be made. The company should appoint a merchant banker. A public announcement as referred to in Regulation 8 shall be made at least seven days prior to the commencement of the buy-back. Subject to the provisions of Sub-clauses (i) and (ii), the provisions of Regulation 10 regarding escrow account are applicable: The deposit in the escrow account should be made before the date of the public announcement. The amount to be deposited in the escrow account should be determined with reference to the maximum price as specified in the public announcement containing detailed methodology of the book-building process, manner of acceptance, format of acceptance to be sent by the security-holders pursuant to public announcement and details of bidding centres. A copy of the public announcement must be filed with SEBI within two days of the announcement along with the fees as specified in Schedule IV to the Regulations. The Public announcement shall also contain the detailed methodology of the book building process, the manner of acceptance, the format of acceptance to be sent by the security holders pursuant to the public announcement and the details of bidding centres. The book-building process should be made through an electronically linked transparent facility. The number of bidding centres should not be less than thirty and there should be at least one electronically linked computer terminal at all the bidding centres. The offer for buy-back should be kept open to the security-holders for a period of not less than fifteen days and not exceeding thirty days. The merchant banker and the company should determine the buy-back price based on the acceptances received and the final buy-back price, which should be the highest price accepted should be paid to all holders whose securities have been accepted for the buy-back. The provisions of Regulation 9(5) pertaining to verification of acceptances and the provisions of Regulation 11 pertaining to opening of special account and payment of consideration are applicable mutatis mutandis. Extinguishment of certificates The provisions of Regulation 12 pertaining to extinguishment of certificates are applicable mutatis mutandis.

19

STUDY IX FINANCIAL RESTRUCTURING

ANNEXURE 2 Specimen of Special Resolution for alteration of Articles of Association for including an Article Authorising buy-back of securities Special resolution RESOLVED THAT pursuant to Section 31 of the Companies Act, 1956, the articles of association of the company be and are hereby altered in the following manner: After article No. 15, the following be inserted as article 15A: Article 15A. Buy-back of securities. The company may any time, in accordance with the provisions of Sections 77A, 77AA and 77B and other applicable provisions, if any, of the Companies Act, 1956 or the corresponding provisions of the Rules, Regulations and Guidelines prescribed by the Government of India, the Securities and Exchange Board of India or any other authority, for the time being in force, buy back its own securities. [

20

Vous aimerez peut-être aussi

- CBLR Adt 2023 Eng Notice 30082022Document2 pagesCBLR Adt 2023 Eng Notice 30082022Sandeep BhandariPas encore d'évaluation

- Notice To General Manager .Electricity Co. LTD., For Illegal Disconnecting of Electric Connection and For Refund of Bill Amount Paid AgainDocument2 pagesNotice To General Manager .Electricity Co. LTD., For Illegal Disconnecting of Electric Connection and For Refund of Bill Amount Paid Againsudhir.kochhar3530Pas encore d'évaluation

- Project On Telephone Billing SysDocument33 pagesProject On Telephone Billing SysStunnerBest50% (8)

- Insurance LawDocument131 pagesInsurance Lawchethan chetuPas encore d'évaluation

- Share Consumer Protection Act 2019Dr KOCHHARDocument29 pagesShare Consumer Protection Act 2019Dr KOCHHARsudhir.kochhar3530Pas encore d'évaluation

- Model Form of ComplaintDocument2 pagesModel Form of Complaintsudhir.kochhar3530Pas encore d'évaluation

- DGFT FAQs - Steel Import Management System (SIMS) v1.0Document4 pagesDGFT FAQs - Steel Import Management System (SIMS) v1.0sudhir.kochhar3530Pas encore d'évaluation

- Essential Commodities Act 1955Document9 pagesEssential Commodities Act 1955sudhir.kochhar3530Pas encore d'évaluation

- Chapter 5 GATT and Its OriginDocument18 pagesChapter 5 GATT and Its Originsudhir.kochhar3530Pas encore d'évaluation

- 41 BALLB21, Rhea Chawla, Legal Methods ProjectDocument17 pages41 BALLB21, Rhea Chawla, Legal Methods Projectsudhir.kochhar3530Pas encore d'évaluation

- Documentary Letter of CreditDocument1 pageDocumentary Letter of Creditsudhir.kochhar3530Pas encore d'évaluation

- Factoring AgreementDocument4 pagesFactoring Agreementsudhir.kochhar3530Pas encore d'évaluation

- Section 10 (4) of The Patents Act, 1970Document6 pagesSection 10 (4) of The Patents Act, 1970sudhir.kochhar3530Pas encore d'évaluation

- Bill of Exchange Case StudyDocument5 pagesBill of Exchange Case StudySudhir Kochhar Fema Author100% (2)

- Legal Language and Legal Writing Including General English Ebook & Lecture Notes PDF Download (Studynama - Com - India's Biggest Website For Law Study Material Downloads)Document159 pagesLegal Language and Legal Writing Including General English Ebook & Lecture Notes PDF Download (Studynama - Com - India's Biggest Website For Law Study Material Downloads)Vinnie Singh75% (16)

- Circular No.8 - 15359546696391039365422Document2 pagesCircular No.8 - 15359546696391039365422sudhir.kochhar3530Pas encore d'évaluation

- SILC Working DraftDocument21 pagesSILC Working DraftBar & BenchPas encore d'évaluation

- Letter of CreditDocument37 pagesLetter of CreditMohammad A Yousef100% (1)

- Ujjam Bai v. State of UP Case Analysis PDFDocument24 pagesUjjam Bai v. State of UP Case Analysis PDFsudhir.kochhar3530Pas encore d'évaluation

- Legal Language and Legal Writing Including General EnglishDocument3 pagesLegal Language and Legal Writing Including General Englishsudhir.kochhar3530Pas encore d'évaluation

- Exam ScheduleDocument13 pagesExam Schedulesudhir.kochhar3530Pas encore d'évaluation

- Exam DT CHNG 503 PDFDocument1 pageExam DT CHNG 503 PDFsudhir.kochhar3530Pas encore d'évaluation

- Revised LLB LLM - 20181122Document3 pagesRevised LLB LLM - 20181122sudhir.kochhar3530Pas encore d'évaluation

- 027 - The Polluter Pays Principle and The Supreme Court of India (108-116)Document9 pages027 - The Polluter Pays Principle and The Supreme Court of India (108-116)yogasri gPas encore d'évaluation

- Indian Trust Act Easy To UnderstandDocument14 pagesIndian Trust Act Easy To Understandpradeep kumar patra71% (7)

- Summary of Recent Case Laws of DT Applicable For May., 2018 ExamsDocument5 pagesSummary of Recent Case Laws of DT Applicable For May., 2018 Examssudhir.kochhar3530Pas encore d'évaluation

- Bare Acts: Isbn Product Title Author Pages Price (INR) Price (Usd) Year Edition BindingDocument5 pagesBare Acts: Isbn Product Title Author Pages Price (INR) Price (Usd) Year Edition Bindingsudhir.kochhar3530Pas encore d'évaluation

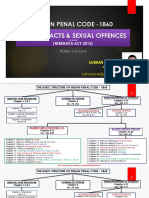

- IPC - Obscene Acts & Sexual OffencesDocument32 pagesIPC - Obscene Acts & Sexual Offencessudhir.kochhar3530100% (2)

- Ugc Net Law Free Solved Paper English Version 0849333308Document52 pagesUgc Net Law Free Solved Paper English Version 0849333308sudhir.kochhar3530Pas encore d'évaluation

- LLBDocument3 pagesLLBsudhir.kochhar3530Pas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- United States v. Robert Catoggio, Roy Ageloff, 326 F.3d 323, 2d Cir. (2003)Document9 pagesUnited States v. Robert Catoggio, Roy Ageloff, 326 F.3d 323, 2d Cir. (2003)Scribd Government DocsPas encore d'évaluation

- The Deed of Settlement (Ahmad)Document19 pagesThe Deed of Settlement (Ahmad)ANZAR AHMEDPas encore d'évaluation

- $1,141,000 Autocallable Barrier Notes With Step-Up Premium: HSBC Usa IncDocument21 pages$1,141,000 Autocallable Barrier Notes With Step-Up Premium: HSBC Usa InccaslusPas encore d'évaluation

- Adbi Routledge Handbook Banking Finance AsiaDocument561 pagesAdbi Routledge Handbook Banking Finance AsiaYoshitaPas encore d'évaluation

- Hard AfDocument9 pagesHard AfVincenzo CassanoPas encore d'évaluation

- Cpa Review - CGTDocument10 pagesCpa Review - CGTKenneth Bryan Tegerero TegioPas encore d'évaluation

- CFS Cbse Question BankDocument8 pagesCFS Cbse Question BankAgastya KarnwalPas encore d'évaluation

- Senate Hearing, 113TH Congress - Financial Services and General Government Appropriations For Fiscal Year 2014Document49 pagesSenate Hearing, 113TH Congress - Financial Services and General Government Appropriations For Fiscal Year 2014Scribd Government DocsPas encore d'évaluation

- Indian Terrain Ltd. - Q2FY17 Result Update: Mixed Show CMP INR: 137 Target Price: 195Document9 pagesIndian Terrain Ltd. - Q2FY17 Result Update: Mixed Show CMP INR: 137 Target Price: 195Arjun Shanker GuptaPas encore d'évaluation

- Tax IIDocument234 pagesTax IIGanesh PatnaikPas encore d'évaluation

- Overview of CSE (Chittagong Stock Exchange)Document20 pagesOverview of CSE (Chittagong Stock Exchange)Mohammad Shibli50% (2)

- ReadingDocument205 pagesReadingHiền ThuPas encore d'évaluation

- Sample Admission Test For MBA Regular (3.5 Year) Degree ProgramDocument5 pagesSample Admission Test For MBA Regular (3.5 Year) Degree ProgramCMA RajaPas encore d'évaluation

- Non-Bank Financial Institutions Activity in The Context of Economic Growth: Cross-Country ComparisonsDocument11 pagesNon-Bank Financial Institutions Activity in The Context of Economic Growth: Cross-Country ComparisonsMd MohiuddinPas encore d'évaluation

- Panera Annual ReportDocument88 pagesPanera Annual Reportbookluvver212Pas encore d'évaluation

- Chapter 1-3Document17 pagesChapter 1-3Kevin James Sedurifa OledanPas encore d'évaluation

- SYNOPSIS HDFC BankDocument4 pagesSYNOPSIS HDFC BanksargunkaurPas encore d'évaluation

- Professional Stock Market Training Course by Shakti Shiromani ShuklaDocument12 pagesProfessional Stock Market Training Course by Shakti Shiromani ShuklaShakti ShuklaPas encore d'évaluation

- Electronic Banking Is An Umbrella Term For The Process by Which A Customer May Perform BankingDocument15 pagesElectronic Banking Is An Umbrella Term For The Process by Which A Customer May Perform BankingDrNeeraj N. RanaPas encore d'évaluation

- SWOT - Company SecretaryDocument8 pagesSWOT - Company Secretaryshubham831968Pas encore d'évaluation

- IFSB-6 (December 2008) - enDocument37 pagesIFSB-6 (December 2008) - enZakkaPas encore d'évaluation

- HBL Asset Management FM LTD - PPTX UpdatedDocument16 pagesHBL Asset Management FM LTD - PPTX UpdatedMisbah Khan100% (1)

- Hedge Fund Management in IndiaDocument11 pagesHedge Fund Management in IndiaIJRASETPublicationsPas encore d'évaluation

- Sanli Environmental IPO ProspectusDocument282 pagesSanli Environmental IPO ProspectusTony LeongPas encore d'évaluation

- Ministop 2017-2019Document210 pagesMinistop 2017-2019Sheila Mae MalesidoPas encore d'évaluation

- PIMIXDocument1 pagePIMIXeric brodersonPas encore d'évaluation

- 1 Financial MarketDocument35 pages1 Financial MarketSachinGoelPas encore d'évaluation

- CbclivDocument92 pagesCbclivRajanPas encore d'évaluation

- HHHJJDocument6 pagesHHHJJNiks MonzantoPas encore d'évaluation