Académique Documents

Professionnel Documents

Culture Documents

Ccil 1

Transféré par

Vikash KumarTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Ccil 1

Transféré par

Vikash KumarDroits d'auteur :

Formats disponibles

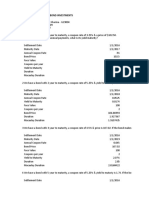

Fixed Income Markets (Basic) Syllabus & References

Chapter 1 Indian Bond Market Overview Introduction Instruments Players Markets Money Market Instruments The Government Bond Market (Primary and Secondary Market) Market Conventions Regulations Interface with Banking system and other financial markets Trading, Clearing and Settlement Systems Chapter 2 Time Value of Money Present Value Discounting Discount Factors Bootstrapping Interpolation Chapter 3 Introduction to Bonds Bond Features Types of Bonds Interface with Economy Chapter 4 Bond Characteristics Bond pricing and Yield Accrued Interest Day Count Conventions Clean and Dirty Bond Prices Bond / Yield Relationship Bond price in continuous time Treasury Bills Chapter 5 Fixed Income Risk Measurements Bond Instruments and Interest Rates Risk Duration, Modified Duration and Convexity Macaulay duration Relationship between duration, yield, coupon and maturity Basis Point Value (BPV) Convexity Measure

Chapter 6 Yield Curve Analysis Yield Curve Different types of yield curve o YTM curve o Par yield curve o Zero coupon (spot) yield curve o Forward curve Yield curve and yield curve theories Econometric forecasting of the yield curve Benchmark curve Interpreting the Yield Curve/ZCYC Chapter 7 Portfolio Management and Trading Strategies Constructing the bond portfolio Passive and active bond portfolio management Market timing strategies Timing bets on interest rate level Timing bets on specific changes in the yield curve Bullet, barbell, ladder and Butterfly strategies Chapter 9 Measuring Volatility Concept of Value at Risk VAR Calculation VAR Conversion VAR Methods o Historical Simulation o Normal (Variance/Covariance method) o Monte Carlo Chapter 10 Structured Products Structured Products Securitized Debt Mortgage Backed Securities Reference Books: 1. Duration, Convexity, and other Bond Risk Measures, Frank J. Fabozzi, John Wiley and Sons 2. Hand Book of Fixed Income Securities, Frank J. Fabozzi, McGraw-Hill Professionals 3. Fixed Income Analysis - Second Edition, Frank J. Fabozzi, John Wiley and Sons

4. Bond & Money Market Strategy, Moorad Chowdhary, Butterworth Heinemann 5. The Money Markets Handbook: A Practioners Guide, Moorad Chowdhary, John Wiley and Sons 6. Analysing & Interpreting the Yield Curve, Moorad Chowdhary, John Wiley and Sons 7. Fixed Income Markets (Instruments, Applications, Mathematics), Moorad Chowdhary, John Wiley and Sons 8. Introduction to Bond Markets, Moorad Chowdhary, John Wiley and Sons 9. An Introduction to Repo Markets, Moorad Chowdhary, John Wiley and Sons 10. Fixed Income Markets and their Derivatives, Suresh Sundaresan, South Western College Publications 11. Value at Risk, Philippe Jorion, McGraw-Hill 12. Bond Pricing & Portfolio Analysis, Olivier De La Grandville, MIT Press 13. Handbook of Debt Securities and Interest Rate Derivatives, A V Rajwade, TATA McGraw Hill 14. Fixed Income Securities - Tools for Today's Markets, Bruce Tuckman, John Wiley and Sons

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- UK Gilts CalculationsDocument10 pagesUK Gilts CalculationsAditee100% (1)

- Week07 - Ch09 - Interest Rate Risk - The Duration Model (Part II)Document22 pagesWeek07 - Ch09 - Interest Rate Risk - The Duration Model (Part II)Kaison LauPas encore d'évaluation

- Chapter 8 Part TwoDocument19 pagesChapter 8 Part TwoAbdelnasir HaiderPas encore d'évaluation

- CH 09Document45 pagesCH 09Monir AheenPas encore d'évaluation

- MAS 2 Report (Autosaved) (Autosaved)Document18 pagesMAS 2 Report (Autosaved) (Autosaved)Hazel Jane EsclamadaPas encore d'évaluation

- V1 20171229 阶段测试测试(产品&估值)题目 PDFDocument24 pagesV1 20171229 阶段测试测试(产品&估值)题目 PDFIsabelle ChouPas encore d'évaluation

- Fabozzi Ch04 BMAS 7thedDocument51 pagesFabozzi Ch04 BMAS 7thedBilalTariqPas encore d'évaluation

- Agency Callable Primer 07mar07Document18 pagesAgency Callable Primer 07mar07Neil SchofieldPas encore d'évaluation

- Chapter 4 NotesDocument3 pagesChapter 4 NotesMatt CourchainePas encore d'évaluation

- 2023 L3 Section3Document122 pages2023 L3 Section3PrarthanaRavikumarPas encore d'évaluation

- Bond Return Valuatio DurationDocument63 pagesBond Return Valuatio DurationSambi Reddy Gari NeelimaPas encore d'évaluation

- Convexity and ImmunizationDocument8 pagesConvexity and Immunizationarjun guptaPas encore d'évaluation

- Tutorial 6- Bonds, duration and convexityDocument3 pagesTutorial 6- Bonds, duration and convexityEmna NegrichiPas encore d'évaluation

- Matlab Bond Pricing Examples PDFDocument5 pagesMatlab Bond Pricing Examples PDFromanticos2014Pas encore d'évaluation

- Bond Risk - Duration and ConvexityDocument26 pagesBond Risk - Duration and ConvexityamcucPas encore d'évaluation

- 10 InclassDocument50 pages10 InclassTPas encore d'évaluation

- Topic 2 To 10 Answer PDFDocument24 pagesTopic 2 To 10 Answer PDFNaveen SaiPas encore d'évaluation

- Summer Internship Report: at Edelweiss Financial ServicesDocument7 pagesSummer Internship Report: at Edelweiss Financial ServicesJatin GuptaPas encore d'évaluation

- CEFA Examination Syllabus 2021Document30 pagesCEFA Examination Syllabus 2021Erico Cortez Fioravante AgnelloPas encore d'évaluation

- Question Paper Security Analysis (MB331F) : July 2008: Section A: Basic Concepts (30 Marks)Document16 pagesQuestion Paper Security Analysis (MB331F) : July 2008: Section A: Basic Concepts (30 Marks)Jatin GoyalPas encore d'évaluation

- Reasury Rash Ourse: by Jawwad Ahmed FaridDocument13 pagesReasury Rash Ourse: by Jawwad Ahmed FaridmohamedPas encore d'évaluation

- Fixed Income SecuritiesDocument21 pagesFixed Income SecuritiesSarah Al ZubaidiPas encore d'évaluation

- Ch05-Interest Rate Risk ManagementDocument35 pagesCh05-Interest Rate Risk ManagementVisal ChinPas encore d'évaluation

- IIM-UDR-FIS-2020-Outline - Will Be ModifiedDocument6 pagesIIM-UDR-FIS-2020-Outline - Will Be Modifiedim masterPas encore d'évaluation

- Teaching Notes FMI 342Document162 pagesTeaching Notes FMI 342Hemanth KumarPas encore d'évaluation

- UK Gilts - Analysis of Bond InvestmentDocument7 pagesUK Gilts - Analysis of Bond InvestmentKshitishPas encore d'évaluation

- Risk Management at Pim CoDocument12 pagesRisk Management at Pim CorpcampbellPas encore d'évaluation

- Chapter 3 - Interest Rates and Security ValuationDocument26 pagesChapter 3 - Interest Rates and Security ValuationNazmul Hasan Bhuyan100% (2)

- (Goldman Sachs) A Mortgage Product PrimerDocument141 pages(Goldman Sachs) A Mortgage Product Primer00aaPas encore d'évaluation

- Birla Institute of Technology and Science, PilaniDocument3 pagesBirla Institute of Technology and Science, PilaniLakshya AgarwalPas encore d'évaluation