Académique Documents

Professionnel Documents

Culture Documents

SSRN Id1115392

Transféré par

Stephen HartantoTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

SSRN Id1115392

Transféré par

Stephen HartantoDroits d'auteur :

Formats disponibles

Centralization versus Decentralization:

Risk Pooling, Risk Diversication, and Supply Chain Disruptions

Amanda J. Schmitt

Center for Transportation and Logistics

Massachusetts Institute of Technology

Cambridge, MA, USA

aschmitt@mit.edu

Lawrence V. Snyder

Dept. of Industrial and Systems Engineering

Lehigh University

Bethlehem, PA, USA

larry.snyder@lehigh.edu

Zuo-Jun Max Shen

Dept. of Industrial Engineering and Operations Research

University of California

Berkeley, CA, USA

shen@ieor.berkeley.edu

May 20, 2012

ABSTRACT

We investigate optimal system design in a multi-location system in which supply is subject to

disruptions. We examine the expected costs and cost variances of the system in both a centralized

and a decentralized inventory system. We show that, when demand is deterministic and supply may

be disrupted, using a decentralized inventory design reduces cost variance through the risk diversi-

cation eect, and therefore a decentralized inventory system is optimal. This is in contrast to the

classical result that when supply is deterministic and demand is stochastic, centralization is optimal

due to the risk-pooling eect. When both supply may be disrupted and demand is stochastic, we

demonstrate that a risk-averse rm should typically choose a decentralized inventory system design.

Keywords: Supply chain management; Inventory; Supply chain disruptions; Risk diversication;

Risk pooling

1 Introduction

As supply chains expand globally, supply risk increases. Classical inventory models have generally

focused on demand uncertainty and established best practices to mitigate demand risk. However,

1

supply risk can have very dierent impacts on the optimal inventory management policies and can

even reverse what is known about best practices for system design.

In this paper, we focus on the impact of supply uncertainty on a multi-location system and

compare two policies: centralization (stocking inventory at a central warehouse only) and decen-

tralization (stocking inventory at multiple warehouses). Our analysis is a special case of One-

Warehouse Multiple-Retailer (OWMR) system analysis; while most research on the OWMR model

allows inventory to be held at both echelons, we allow inventory to be held at only one echelon in

order to consider two opposing eects that can occur: risk pooling and risk diversication. The

risk pooling eect occurs when inventory is held at a central location, which allows the demand

variance at each retailer to be combined, resulting in a lower expected cost [Eppen, 1979]. The risk

diversication eect occurs when inventory is held at a decentralized set of locations, which allows

the impact of each disruption to be reduced, resulting in a lower cost variance [Snyder and Shen,

2006]. Whereas the risk-pooling eect reduces the expected cost but (as we prove) not the cost

variance, the risk-diversication eect reduces the variance of cost but not the expected cost.

We prove that the risk diversication eect occurs in systems with supply disruptions. We

also consider systems with both supply and demand uncertainty, in which both risk pooling and

risk diversication have some impact, and numerically examine the tradeo between the two. The

risk mitigated through risk diversication is disruption risk, whereas the risk mitigated through

risk pooling is demand risk. We employ a risk-averse objective to minimize both risk sources and

determine which eect dominates the system and drives the choice for optimal inventory system

design. Specically, comparing centralized and decentralized inventory policies, we contribute the

following:

The exact relationship between optimal costs and inventory levels when demand is determin-

istic and supply may be disrupted

The exact relationship between optimal cost variances when:

demand is deterministic and supply may be disrupted

supply is deterministic and demand is stochastic

Formulations of the expected cost and cost variance when supply is disrupted and demand is

stochastic

Evidence that decentralization is usually optimal under risk-averse objectives

The remainder of the paper is organized as follows. In Section 2 we review the relevant literature.

In Section 3 we analyze the risk-diversication eect in a multi-location system with deterministic

demand and disrupted supply. We consider stochastic demand in Section 4. In Section 5 we

2

consider both demand uncertainty and disrupted supply and again compare inventory strategies,

using a risk-averse objective to choose the optimal inventory design. We summarize our conclusions

in Section 6. Proofs for all propositions and theorems are given in the Appendix.

2 Literature Review

2.1 Single-location Models with Supply Uncertainty

The two most commonly considered forms of supply uncertainty are supply disruptions (in which

supply is halted entirely for a stochastic amount of time) and yield uncertainty (in which the

quantity delivered from the supplier is random). The literature on single-echelon systems with

both of these types of supply uncertainty is extensive, and we omit an exhaustive review here. The

reader is referred to Yano and Lee [1995] for a discussion of the literature on single-echelon systems

with yield uncertainty. Supply disruptions have been considered in several settings, including the

EOQ model [e.g., Berk and Arreola-Risa, 1994, Parlar and Berkin, 1991, Snyder, 2008] and newsboy

settings [e.g., Dada et al., 2007, Tomlin, 2009]. Snyder et al. [2010] provide a through review of

supply disruption literature. Chopra et al. [2007] and Schmitt and Snyder [2012] consider systems

that have both supply disruptions and yield uncertainty.

Multi-period models with stochastic demand have been considered by Schmitt et al. [2010] and

Tomlin [2006], among others, and we rely on several of their results in this paper. Schmitt et

al. develop a closed-form approximate solution for the optimal base-stock level in the face of dis-

ruptions. Tomlin investigates multiple strategies for coping with disruptions, including acceptance

(doing nothing proactively), sourcing (using multiple suppliers), and inventory policies. These pa-

pers provide a foundation for our analysis, but our application to the OWMR model provides new

insights on the impact of supply disruptions in complex systems.

We consider risk-averse objectives for inventory models, a topic which is gaining momentum

in the operations literature. Risk-aversion has been considered in newsboy models to mitigate

demand uncertainty. For example, Eeckhoudt et al. [1995] show that order quantities decrease

with increasing risk-aversion. Van Meighem [2007] considers resource diversication in newsboy

models with risk-averse objectives, advocating diversifying resource availability to protect against

risk. Tomlin and Wang [2005] consider a single-period newsboy setting with supply disruptions;

they model loss-averse and conditional value-at-risk (CVaR) objectives when deciding between

single- and dual-sourcing and between dedicated and exible resource availability. Chen et al.

3

[2007] consider multi-period inventory models with risk-aversion, modeling both replenishment and

pricing decisions. Tomlin [2006] also considers a multi-period setting and employs a meanvariance

approach to consider risk in a two-supplier system in which one supplier is subject to disruptions

and the other is perfectly reliable but more expensive. He uses risk-averse objectives to decide

between single- and dual-sourcing.

2.2 Multi-location Systems with Demand and Supply Uncertainty

In this paper we consider supply and demand uncertainty in a multiple-demand-point system where

inventory may be held at a single warehouse or multiple warehouses, and focus on inventory held at

a single level only in order to draw clear conclusions regarding centralization versus decentralization.

Eppen [1979] considers a system equivalent to this one and shows that under demand uncertainty,

a centralized inventory strategy provides risk-pooling benets and reduces expected costs versus a

decentralized strategy.

Snyder and Shen [2006] use simulation to study multiple complex inventory systems, including

the OWMR system with supply uncertainty with inventory at a single level. Their simulation results

show that, under supply disruptions, expected costs are equal for centralized and decentralized

systems, but the variance of the cost is higher in centralized systems. They call this the risk-

diversication eect and suggest that it occurs because a disruption in a centralized system aects

every retailer and causes more drastic cost variability. They conclude that risk diversication

increases the appeal of inventory decentralization in a system with disruptions. The benets of

supplier diversication have been previously explored, for example in single-period models with yield

uncertainty [e.g., Babich et al., 2007, Dada et al., 2007, Federgruen and Yang, 2008] and multi-

period models with supply disruptions [e.g., Schmitt and Snyder, 2012, Tomlin, 2006]. However,

those models focus on the eect diversication has on lowering the optimal expected costs. In

Snyder and Shens context, and in our analysis in this paper, the benet of diversication of

inventory locations is to lower cost variance.

In this paper, we explore the implications of the risk diversication eect by developing a

theoretical model for the expected cost and cost variance of multi-location system subject to supply

uncertainty. We analytically prove the presence of risk diversication in this system, discuss its

impact, and examine the system under uncertainty in both supply and demand. When demand is

deterministic and supply is subject to disruptions, we determine the optimal inventory levels and

costs. For that case and the case in which demand is stochastic and supply is deterministic, we

4

quantify the cost variance. We combine supply disruptions and stochastic demand in a subsequent

model and formulate the expected costs and cost variances. We show that under a risk-averse

objective function, the benets of risk diversication typically surpass those of risk pooling.

3 Multi-location System with Supply Disruptions

3.1 Assumptions and Notation

In this section we examine the impact of supply disruptions on the multi-location system. We

consider a base-stock inventory system where demand occurs according to the same distribution

across multiple locations and compare policies for stocking inventory at the central warehouse only

(centralized system) or at multiple warehouses (decentralized system). We assume orders are placed

every period regardless of any xed-order costs, which is not unreasonable in internal distribution

settings, so we set order costs equal to zero in our model (we discuss what impact this might have

in our conclusions). We assume zero lead times since deterministic lead times would not impact

optimal base-stock levels or order quantities, but would simply require that orders be placed exactly

the lead time quantity in advance. We also assume deterministic demand, but will relax the latter

assumption in Section 4.

We assume that in both the centralized and decentralized settings, disruptions occur randomly

at the inventory location(s); that is, disruptions occur at the central warehouse in the centralized

system or at any of the multiple warehouses in the decentralized system. Disruptions occur in-

dependently at all locations in the system. Relevant examples of disruptions of this nature could

include disruption of an upstream supplier, failure of inbound transportation capabilities (e.g. a

snowstorm or ood that shuts down rail or major roadways), transportation labor issues (e.g. a

port strike), shipment quality issues (e.g. a bacterial contamination), or other major issues that

interrupt material ow to a single location. In our model, when a disruption occurs at a facility,

we assume there is no back-up source of material available (i.e. no cross-shipments or alternate

sources). If a disruption occurs at the central warehouse, then all downstream locations feel any

resulting shortage equally.

We assume disruptions follow a random process governed by the pmf

i

and cdf F(i), where i

is the number of consecutive periods during which a given stage has been disrupted, as is typical in

supply disruption literature [e.g., Hopp and Liu, 2006, Tomlin, 2006]. Therefore

i

is the probability

that a given stage has been disrupted for precisely i periods (i 0) and F(i) is the probability

5

Table 1: Notation

Notation Denition

n number of demand sets or locations; number of decentralized warehouses

d deterministic demand per period at each demand location

p penalty cost per period at each facility

h holding cost per period at each facility

i index representing being in a state with i disrupted periods in a row

i

probability of being in state i

F(i) cumulative distribution function for the failure states

S

optimal base-stock level for an individual facility

S

D

optimal base-stock level for each warehouse in the decentralized system

S

C

optimal base-stock level for the warehouse in the centralized system

E[C] expected cost for an individual facility

E[C

D

] expected cost for the decentralized system

E[C

C

] expected cost for the centralized system

V [C] variance of the cost for an individual facility

V [C

D

] variance of the cost for the decentralized system

V [C

C

] variance of the cost for the centralized system

that it has been disrupted for i periods or fewer. Disruptions may be governed by a Markov

chain or a more general process. They follow the same process at every location and they are

independent over time and, in the decentralized system, across locations (each location can be

disrupted independently). In both systems, disruptions pause the ow of supply to the disrupted

stage, but any inventory at that stage may still be used during the disruption; therefore, disruptions

aect a stages supply-receiving function but not its demand-receiving function.

A holding cost of h per unit per period is incurred at the warehouse in the centralized system

or at each of the warehouses in the decentralized system. During non-disrupted period, this cost

is simply h times the base-stock level, less one periods worth of demand, d, observed that period.

However, during disruptions, the inventory continues to deplete by d each period until inventory is

exhausted and demand cannot be met. Unmet demands are backordered, and a stockout penalty

of p is incurred in both systems.

The parameters, decision variables (base-stock levels at each location), and performance mea-

sures for the system are summarized in Table 1. We use an additional subscript s to denote the

disrupted-supply model discussed in this section. Note that since S

D

is dened as the optimal

base-stock level for an individual warehouse in the decentralized system, the total inventory for

that system is nS

D

.

6

3.2 Mean and Variance of Optimal Cost

For a base-stock inventory policy at a single warehouse, the costs in a given period depend on the

state of the system, dened as the number of consecutive periods for which it has been disrupted.

Tomlin [2006] derives the expected cost for such a system, given in (1), and shows that the optimal

base-stock level is as given in (2):

E

s

[C] =

i=0

i

[h(S

s

(i + 1)d)

+

+p((i + 1)d S

s

)

+

] (1)

S

s

= jd, where j is the smallest integer such that F(j 1)

p

p +h

(2)

Schmitt et al. [2010] discuss these results, demonstrating that the optimal base-stock level is an

increasing step function of the newsboy fractile and the disruption probability. As the cost of

disruptions increases, the optimal solution increases by discrete jumps to the next whole periods

worth of demand.

We make use of these results in our analysis of the system. The relationships between the

inventory levels, expected costs, and cost variances for the centralized and decentralized systems

are given in the following theorem.

Theorem 1 In the multi-location system subject to supply disruptions, the decentralized, central-

ized, and single-facility optimal base-stock levels and performance measures are related as follows:

1. S

Cs

= nS

Ds

= nS

s

2. E

s

[C

C

] = E

s

[C

D

] = nE

s

[C

]

3. V

s

[C

C

] = nV

s

[C

D

] = n

2

V

s

[C

]

Proof : See Appendix, Section A.2.

Thus the total system inventory and expected costs are equal in the centralized and decentralized

systems, but the variance is n times greater for the centralized system, suggesting that, at least for

a risk-averse decision maker, the decentralized system is the better design for this system.

The intuition behind Theorem 1 is as follows. Because the total inventory is the same in both

systems, the total inventory devoted to each of the n sets of customers is the same in both systems.

Therefore each customer set feels the eects of disruptions for the same percentage of periods, on

average, in both systems. That is, a given disruption in either system causes a customer set to

experience the same number of stock-out periods. We state this formally in the following Corollary.

7

Corollary 2 In the multi-location system subject to supply disruptions, if base-stock levels are set

optimally, the distribution of consecutive periods for which a given warehouse is stocked out is

identical for the centralized and decentralized systems.

This causes the expected holding and stock-out costs to be the same. However, disruptions are

less frequent but more severe in the centralized system, and therefore that system has a greater

cost variance.

The relationships presented in Theorem 1 demonstrate the risk-diversication eect in the

multi-location system. If demand is deterministic, there is no risk-pooling benet from centraliza-

tion (since there is no risk from uncertain demand), thus expected costs for the centralized and

decentralized systems are equal. However, the risk from uncertain supply is better mitigated in the

decentralized system, as the lower variance for that system demonstrates. Snyder and Shen [2006]

demonstrate a similar result using simulation, though their model diers slightly from ours in that

they assume that inventory at a given stage may not be used when that stage is disrupted.

4 Multi-location System with Stochastic Demand

We now consider the classical model discussed by Eppen [1979]: the multi-location system with

deterministic supply and stochastic demand. Following Eppen, we assume that demand is normally

distributed with the same mean and variance

2

at each of the decentralized warehouses. There-

fore, the demand at the central warehouse in the centralized system has mean n and variance

2

C

= n

2

. We employ a subscript d to denote this model.

In Section 4.1, we review the results concerning the optimal base-stock levels and expected cost

presented by Eppen [1979]. We then evaluate the cost variance at optimality in Section 4.2. To

the best of our knowledge, ours is the rst study to consider the cost variance at optimality in this

system.

4.1 The Risk-Pooling Eect

The expected cost and optimal base-stock level for a single warehouse subject to stochastic demand

are well known:

E

d

[C] = h(S

d

) +(p +h)

1

_

S

d

_

(3)

S

d

= +

1

_

p

p +h

_

(4)

8

where

1

(x) =

_

x

(vx)(v)dv is the standard normal loss function. Therefore, for the centralized

system,

E

d

[C

C

] = h(S

Cd

n) +

C

(p +h)

1

_

S

Cd

n

C

_

(5)

S

Cd

= n +

C

1

_

p

p +h

_

(6)

Since the decentralized system functions as n single-wasehouse systems, E[C

Dd

] = nE

d

[C] and

S

Dd

= S

d

. We have the following Theorem:

Theorem 3 (Eppen, 1979) The optimal expected costs and inventory levels for the centralized

and decentralized multi-location systems subject to stochastic demand are as follows:

E

d

[C

D

] =

nE

d

[C

C

] (7)

nS

Dd

S

Cd

= (n

n)

1

_

p

p +h

_

(8)

Proof: Given by Eppen [1979].

This is the classical risk-pooling eect: by serving the warehouses demand from a centralized

inventory site, we pool the risk from demand uncertainty. As a result, the optimal expected cost

is

n times smaller for the decentralized system, and less inventory is required.

4.2 Cost Variance

The following theorem presents the relationship of cost variance for this system.

Theorem 4 At optimality, the cost variance for the centralized and decentralized multi-location

systems subject to stochastic demand are equal:

V

d

[C

C

] = V

d

[C

D

] (9)

Proof: See Appendix, Section A.3.

The theorem suggests that, under stochastic demand and deterministic supply, centralization

is optimal due to the risk-pooling eect, which aects the expected cost only and has no impact on

cost variance. In contrast, under supply disruptions and deterministic supply, decentralization is

optimal due to the risk-diversication eect, which aects the cost variance only and has no impact

on the expected cost. A natural question is, when both demand uncertainty and disruptions are

present, which system is optimal, i.e., which prevails: risk pooling or risk diversication? We

address this question in the next section.

9

5 Multi-location System with Supply Disruptions and Stochastic

Demand

In this section we compare the cost means and variances for centralized and decentralized multi-

location systems in which each warehouse is subject to random demand and the whole system is

subject to disrupted supply. We assume that when supply is not disrupted, the yield is deterministic.

We use a subscript b to denote this model since both supply and demand are stochastic. We

formulate the expected costs and cost variances in Sections 5.1 and 5.2, respectively. We perform

numerical analysis to compare the performance of the two systems in Section 5.3. Finally, in Section

5.4, we introduce a meanvariance objective that allows us to choose optimally between the two

systems when risk aversion is accounted for. We summarize our ndings in Section 5.5.

5.1 Expected Costs

At a single warehouse, a single periods demand is denoted D and is distributed as N(,

2

), while

the total demand in i periods is distributed as N(i, i

2

). The cost for a single warehouse subject

to normally distributed demand and disrupted supply is given by Schmitt et al. [2010] as:

E

b

[C] =

i=1

i1

_

h

_

S

b

(S

b

id)f

i

(id)dd +p

_

S

b

(id S

b

)f

i

(id)dd

_

=

i=1

i1

_

h(S

b

i) +

i(p +h)

1

_

S

b

i

i

__

(10)

Schmitt et al. [2010] prove that E

b

[C] is convex and argue that the optimal base-stock level cannot

be found in closed form because

_

Si

i

_

appears in the rst-order condition for i = 0, 1, . . . , .

Using (10), we derive the expected costs for the two systems in the following Proposition.

Proposition 5 When demand is normally distributed at the warehouses and supply is subject to

disruptions, the expected costs for the centralized and decentralized multi-location systems are:

E

b

[C

D

] = n

i=1

i1

_

h(S

Db

i) +

i(p +h)

1

_

S

Db

i

i

__

(11)

E

b

[C

C

] =

i=1

i1

_

h(S

Cb

in) +

in(p +h)

1

_

S

Cb

in

in

__

(12)

Proof: See Appendix, Section A.4.

Clearly, for the decentralized system, S

Db

= S

b

. For the centralized system, we have conrmed

numerically that S

Cb

= nS

b

in general, as in the deterministic-demand model in Section 3. However,

10

unlike that model, S

Cb

is neither consistently greater than nor consistently less than nS

b

when

demand is stochastic.

5.2 Cost Variance

We present the cost variance for arbitrary (not necessarily optimal) base-stock levels in the following

Proposition.

Proposition 6 When demand is normally distributed at the warehouses and supply is subject to

disruptions, the cost variances for the decentralized and centralized multi-location systems are:

V

b

[C

D

] = n

_

i=1

i1

_

h

2

(S

2

Db

2S

Db

i +i

2

+i

2

2

) + 2i

2

(p

2

h

2

)

2

_

S

Db

i

i

_

_

i=1

i1

_

h(S

Db

i) +

i(p +h)

1

_

S

Db

i

i

__

_

2

_

_

(13)

V

b

[C

C

] =

i=1

i1

_

h

2

(S

2

Cb

2S

Cb

ni +ni

2

+n

2

i

2

2

) + 2ni

2

(p

2

h

2

)

2

_

S

Cb

ni

ni

_

_

i=1

i1

_

h(S

Cb

ni) +

ni(p +h)

1

_

S

Cb

ni

ni

__

_

2

, (14)

where

1

() is the standard normal loss function and

2

() is the standard normal second-order loss

function.

Proof: See Appendix, Section A.5.

We have been unable to prove analytically that V

b

[C

C

] V

b

[C

D

]. However, we demonstrate

numerically in Section 5.3 that this inequality holds for every instance we tested. Thus, the risk-

diversication eect appears to prevail under supply disruptions, even when demand is stochastic.

5.3 Numerical Study

In this section, we perform a numerical study to compare the performance of the two systems

when supply disruptions and stochastic demand are present simultaneously. We consider n = 4

decentralized warehouses. We model disruptions as a two-state, discrete-time Markov process with

disruption probability and independent recovery probability . (That is, the probability of being

disrupted [not disrupted] next period given that the system is not disrupted [disrupted] in the

current period is given by [].)

11

Table 2: Parameter Levels

Variable Values

(failure probability) 0.05, 0.1, 0.2, 0.3, 0.4

(recovery probability) 0.25, 0.5, 0.75

(demand st. dev.) 5, 15, 25

p (penalty cost) 2, 5, 10, 15, 20

The steady-state probabilities for the disruption process are given by [Schmitt et al., 2010]:

0

=

+

;

i

=

+

(1 )

i1

, i 1 (15)

In Section 5.3.1, we vary the input parameters one by one to determine the impact of each

on the performance of the two systems. In Section 5.3.2 we examine the impact of the disruption

characteristics on the systems.

5.3.1 Impact of Parameters

We conducted a full-factorial experiment to determine the eect of the input parameters on the

optimal base-stock levels and the cost mean and variance at optimality in the two multi-location

systems. We varied , keeping xed to 100, and varied p, keeping h xed to 1. (This can be

done with nearly no loss of generality since the model is most sensitive to changes in the ratios

/ and p/(p + h) rather than to changes in the individual parameters.) In addition, we varied

the disruption parameters and . Table 2 lists the values tested for each parameter. The total

number of parameter combinations is 5 3 3 5 = 225.

For each combination of parameters, we optimized the expected cost functions (11) and (12)

numerically to solve for the optimal base-stock levels in both systems. Table 3 lists the mean,

median, minimum, and maximum, over the 225 instances, of several performance measures: dif-

ference in total inventory (column 2), dierence in expected cost (column 3), percent dierence in

expected cost (column 4), coecient of variation (CV) of the cost for the centralized and decen-

tralized systems (columns 5 and 6, resp.), and dierence in CV (column 7). The CV is given by

(C

) =

V [C

]

E[C

]

.

From Table 3 it is evident that, as suggested in Section 5.1, the decentralized system does

not always stock more than the centralized one, despite the risk-pooling eect; in 80 out of 225

cases (36%), the centralized system has a higher total base-stock level. This occurs because of

the discrete nature of disruptions. If demand is deterministic, then the optimal base-stock level is

always an integer multiple of the demand (see Section 3.2), and demand stochasticity perturbs these

12

Table 3: Comparison of Performance Measures

Inv. Di. E[Cost] Di. % E[Cost] Di. CV

C

CV

D

CV Di.

nS

Db

S

Cb

E

b

[C

D

] E

b

[C

C

]

E

b

[C

D

]E

b

[C

C

]

E

b

[C

C

]

(C

Cb

) (C

Db

) (C

Cb

) (C

Db

)

Mean 12 13.27 2.5% 2.12 1.03 1.09

Med. 14 9.10 0.9% 1.95 0.97 1.01

Min. -78 0.00 0.0% 0.89 0.44 0.38

Max. 89 53.64 41.9% 4.14 1.97 2.17

$-

$2,000

$4,000

$6,000

$8,000

$10,000

0.980 0.985 0.990 0.995 1.000

p/(p+h)

Eb[Cc]

SDb[Cc]

Eb[Cd]

SDb[Cd]

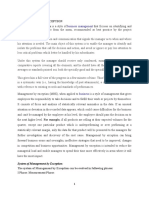

Figure 1: Centralized and Decentralized Expected Cost and Cost Standard Deviation vs.

p

p+h

discrete base-stock levels only slightly. Since the total standard deviation of demand is smaller in

the centralized system, the jumps are less smooth (closer to the deterministic-demand solution) and

may jump slightly above the optimal decentralized system levels. However, the optimal expected

cost of the centralized system is always less than or equal to that of the decentralized system.

Therefore, the expected-cost benet of the risk-pooling eect still exists when supply disruptions

are present, even though the ordering of the magnitude of base-stock levels does not.

We found that the dierence in expected cost is most sensitive to changes in and : it increases

as increases (disruptions become shorter) or as increases (demand is more uncertain). In these

cases, the impact of disruptions is smaller compared to that of the demand uncertainty, and so the

benets from risk pooling become more pronounced.

The cost variance is always greater for the centralized system, conrming the risk-diversication

eect. We found that the dierence in cost variance between the two systems generally increases as

p, , and the percent down-time (1

0

) increase, or as decreases. As the impact of disruptions

increases (either because they last longer increases or decreasesor because stockouts cost

more), the variance increases more for the centralized system than it does for the decentralized sys-

tem, because the risk-diversication eect mitigates the impact of disruptions in the decentralized

system.

13

Figure 1 plots the mean and standard deviation (SD) of cost for both systems as a function

of the newsboy fractile, p/(p + h). In this plot, we xed = 0.05, = 0.8, and = 15. The

mean and SD for both systems generally increase with the newsboy fractile. However, there is a

sharp decrease in the SD for the centralized system at p/(p +h) = 0.99. At this value, the optimal

base-stock level increases sharply from S

Cb

= 891 to S

Cb

= 1154. This large increase in inventory

results in a signicantly greater protection against disruptions and, as a result, in a reduction in

cost SD. The decentralized system has a similar, but less pronounced, decrease at the same point.

Note also from Figure 1 that the expected costs for the two systems are extremely close, while the

SD is substantially larger for the centralized system. We revisit this issue in Section 5.4.

5.3.2 Impact of Disruption Prole

Two pairs of (, ) values may result in the same fraction of periods disrupted, dened as

1

0

= /( +), (16)

but still have very dierent characteristics. For example, if and are both close to 0, then

disruptions are rare but long, while if they are both close to 1, then disruptions are frequent but

short. Snyder and Tomlin [2008] refer to the frequency/duration characteristics of a disruption as

the disruption prole. In this section, we study the eect of the disruption prole on the optimal

base-stock levels and performance measures of the two systems.

We generated ve groups of three (, ) pairs each. Within each group, the (, ) pairs have

the same percentage down-time (16) but a dierent disruption prole. The 15 instances are listed

in Table 4. The percent down-time increases with the group number (I, II, ...), while the disruption

length decreases with the letter within a group (a, b, c). In all instances, we set = 15 and p = 10

(the middle value from Table 2) and, as before, set h = 1 and = 100. Table 5 presents the optimal

base-stock levels and the mean and CV of cost for both systems.

The disruption prole has a signicant impact on the optimal base-stock levels and performance

measures. As the percent down-time increases, expected costs and optimal base-stock levels gen-

erally increase for both systems. Moreover, within a group (xed percent down-time), the optimal

base-stock levels and cost mean and variance are signicantly greater for rare/long disruptions than

for frequent/short ones. For example, instance I(a), which has a recovery probability () of less than

0.1, has particularly large CVs: 5.1 for the decentralized system and 11.4 for the centralized system.

Disruptions are rare in instance I(a), so the expected cost is small, but when disruptions occur, the

cost spikes, increasing the variance signicantly. Note also that in groups I and II, disruptions are

14

Table 4: Disruption Proles

Group % Down-Time

a 0.001 0.099

I b 1% 0.005 0.495

c 0.01 0.99

a 0.01 0.19

II b 5% 0.025 0.475

c 0.05 0.95

a 0.01 0.09

III b 10% 0.05 0.45

c 0.1 0.9

a 0.01 0.057

IV b 15% 0.05 0.283

c 0.1 0.567

a 0.01 0.04

V b 20% 0.05 0.2

c 0.1 0.4

Table 5: Base-Stock Levels and Performance Measures vs. Disruption Prole

Group S

Cb

E

b

[C

C

] (C

C

) nS

Db

E

b

[C

D

] (C

D

)

a 441.8 402.57 11.4 483.6 452.05 5.1

I b 441.8 130.17 7.3 483.6 179.53 2.6

c 441.8 89.76 4.0 483.6 139.12 1.2

a 451.5 1,075.26 5.7 502.8 1,103.96 2.7

II b 451.5 449.73 4.9 502.8 478.41 2.2

c 451.5 239.21 3.5 502.8 267.89 1.4

a 810.9 3,691.54 3.8 821.7 3,693.17 1.9

III b 764.6 854.80 3.0 729.2 860.72 1.5

c 745.9 411.87 1.2 691.7 419.30 0.8

a 2774.6 5,782.11 2.5 2751.4 5,784.26 1.3

IV b 1205.8 1,791.29 2.7 1211.5 1,798.20 1.4

c 821.7 812.71 2.4 843.3 826.61 1.2

a 4374.9 6,844.85 1.9 4357.5 6,847.41 1.0

V b 2009.5 2,994.01 2.4 2017.9 3,000.02 1.2

c 1214.0 1,402.56 2.2 1227.8 1,413.12 1.1

15

Table 6: Comparison of Performance Measures vs. Disruption Prole

Inv. Di. E[Cost] Di. % E[Cost] Di. CV Di.

Group nS

Db

S

Cb

E

b

[C

D

] E

b

[C

C

]

E

b

[C

D

]E

b

[C

C

]

E

b

[C

C

]

(C

C

) (C

D

)

a 41.8 49.48 12.29 % 6.4

I b 41.8 49.36 37.92 % 4.7

c 41.8 49.36 54.99 % 2.8

a 51.5 28.70 2.67 % 2.9

II b 51.5 28.68 6.38 % 2.7

c 51.5 28.68 11.99 % 2.1

a 10.8 1.62 0.04 % 1.9

III b -35.4 5.92 0.69 % 1.5

c -54.1 7.43 1.80 % 0.5

a -23.3 2.15 0.04 % 1.3

IV b 5.7 6.91 0.39 % 1.4

c 21.6 13.89 1.71 % 1.3

a -17.4 2.56 0.04 % 1.0

V b 8.4 6.01 0.20 % 1.2

c 13.8 10.57 0.75 % 1.1

rare enough that it is optimal to barely protect against them at allthe optimal base-stock levels

are almost the same as in the no-disruption case (in which S

C

= 440.1 and S

D

= 480.1). Therefore,

disruptions are quite costly when they occur. These results conrm results by Snyder and Tomlin

[2008], Tomlin [2006], and others that suggest that rare/long disruptions are more dicult to plan

for than frequent/short ones.

Table 6 compares the performance of the centralized and decentralized systems for these in-

stances. Either system may have a greater total base-stock level (as in Table 3), and there is no

clear relationship between the dierence in base-stock levels and the disruption prole. However, as

the mean disruption duration increases (within a group), the dierence in expected cost decreases

and the dierence in cost variance increases. In other words, when disruptions are longer, the

risk-pooling eect is less pronounced and the risk-diversication eect is more pronounced.

5.4 Optimal Risk-Averse Design

We have shown that for the OWMR system with both supply disruptions and stochastic demand,

inventory decentralization reduces the cost variance via the risk-diversication eect while central-

ization reduces the expected cost via the risk-pooling eect. It is natural to ask which eect is

more pronounced, and therefore which system a risk-averse decision maker should prefer.

16

5.4.1 MeanVariance Objective

We employ the classical meanvariance approach, minimizing the following objective function:

(1 )E[C] +V [C] (17)

where [0, 1]. The larger is, the more risk-averse the decision maker is. Many other objectives

for risk-averse decision making have been proposed in the nance and operations literature. We

chose to focus on the meanvariance objective primarily for analytical tractability. Numerical

studies using the Conditional Value-at-Risk (CVaR) objective produced similar insights, but a more

formal theoretical analysis was precluded by the increased complexity of the objective function.

We optimized (17) numerically using a line-search procedure. This function is neither convex

nor concave for all values of . There are values of and S

b

such that (17) is convex and values for

which it is not convex. By testing the function numerically, we found that for 0.05, the range

we used in our tests below, (17) is convex at nearly every value of S

b

, with the exception of S

b

0.

We also found that the function is convex for all S , in the instances we tested, and this range

typically includes the optimal base-stock level. Moreover, the second derivative of (17) is positive

at the solution found by our optimization procedure for every instance we tested. Therefore, we

are condent that our results represent the globally optimal solutions for each instance.

5.4.2 Numerical Study

Our numerical study shows that even for very small values of , the decentralized system is almost

always optimal under the meanvariance objective. We set = 100, = 15, = 0.025, and

= 0.5, resulting in a percent down-time of 4.76%. Figure 2 plots the regions in which each

system is optimal for [0, 0.05] and p/(p + h) [0.5, 1) (keeping h xed to 1, i.e., p [1, )).

The region in which the centralized system is optimal is barely visible. Figure 3 zooms in on the

range [0, 0.001] so that this region is more visible. Clearly, the centralized system is optimal

only for very risk-neutral decision makers operating under low service levels: for 0.0008 and

p/(p +h) 0.5, the decentralized system is always optimal.

The centralized system can also be optimal for systems with very low disruption risk. For

example, Figure 4 plots the optimal systems for 0.12% down-time ( = 0.001 and = 0.8).

However, even in this case, the decentralized system is optimal for all 0.02 and p/(p+h) 0.75.

We next examined the impact of and on the optimal design. In Figure 5, we set p/(p+h) =

0.9 and = 0.001. The graph shows that the decentralized system is always optimal when the

17

0.5

0.6

0.7

0.8

0.9

1

0.00 0.01 0.02 0.03 0.04 0.05

kappa

n

e

w

s

b

o

y

f

r

a

c

t

i

l

e

Decentralized

Optimal

Centralized

Optimal

Figure 2: Optimal Inventory System for 4.76% Down-Time

0.5

0.6

0.7

0.8

0.9

1

0.0000 0.0002 0.0004 0.0006 0.0008 0.0010

kappa

n

e

w

s

b

o

y

f

r

a

c

t

i

l

e

Centralized

Optimal

Decentralized

Optimal

Figure 3: Optimal Inventory System for 4.76% Down-Time: Narrower Range

0.5

0.6

0.7

0.8

0.9

1

0.00 0.01 0.02 0.03 0.04 0.05

kappa

n

e

w

s

b

o

y

f

r

a

c

t

i

l

e

Centralized

Optimal

Decentralized

Optimal

Figure 4: Optimal Inventory System for 0.12% Down-Time

18

0

0.2

0.4

0.6

0.8

1

0.000 0.002 0.004 0.006 0.008 0.010

alpha

b

e

t

a

Centralized

Optimal

Decentralized

Optimal

Figure 5: Optimal Inventory System for Varying and Values

failure probability exceeds 0.7%, regardless of the recovery probability.

These gures all employ small values of and the newsboy fractile and reasonably small dis-

ruption probabilities. They demonstrate that the decentralized system is far more likely to be the

optimal inventory design for a risk-averse rm.

Since the variance is typically several orders of magnitude greater than the expected cost for

our model, one could argue that the mean-variance objective is naturally biased toward the lower-

risk strategy, i.e., the decentralized system. Therefore, we also performed similar tests using the

standard deviation of the cost in place of the variance, and with values roughly equal to the

square root of the original values. The results were very similar. For the same parameter values

discussed above, we found that when the disruption probability is 4.76%, the decentralized system

is optimal for all 0.0075 and p/(p + h) 0.5, and when the disruption probability is 0.12%,

the decentralized system is optimal for all 0.1 and p/(p + h) 0.75. We also varied and

as above and found that when = 0.001 and p/(p + h) = 0.9, the decentralized system is always

optimal when the failure probability exceeds 1.8%, regardless of the recovery probability. A more

detailed description of these results is omitted due to space considerations.

5.5 Summary of Numerical Comparisons

For the multi-location system subject to both demand uncertainty and supply disruptions:

The risk-diversication eect exists, resulting in lower cost variance in the decentralized

system

The risk-diversication eect is more pronounced when disruptions are longer and more

costly

The risk-pooling eect exists, resulting in lower expected cost in the centralized system

The risk-pooling eect does not always result in lower total base-stock levels

19

The risk-pooling eect is more pronounced when disruptions are less frequent and

shorter, or when demand is more variable

Disruption proles aect the optimal solutions

For the same percent down-time, longer disruptions result in higher optimal base-stock

levels, higher expected costs, and higher cost variances

The dierence in cost variances between the centralized and decentralized systems is

greater for longer disruptions, but the dierence in expected cost is greater for shorter

disruptions.

For a risk-averse rm, the decentralized system is typically the optimal inventory design

This holds unless service level (newsboy fractile), value, or failure probabilities are

very low

6 Conclusions

In this paper, we consider a multi-location system with both supply and demand uncertainty. We

investigate the risk-diversication eect, in which the expected cost is the same in the centralized

and decentralized systems but the cost variance is smaller in the decentralized system. The intuition

behind this eect is that by distributing inventory at multiple sites, the impact of any one disruption

is smaller, even though each site is still aected by the same number of disruptions. The rm

benets from not putting all its eggs in one basket; although the same number of eggs may be

destroyed, they are not all destroyed at once. We proved that the risk-diversication eect occurs

in multi-location systems with supply disruptions.

In contrast, the classical risk-pooling eect prevails under demand uncertainty; under this eect,

the expected cost is smaller in the centralized system, and we prove that the variance is equal in

the two systems. We showed numerically that, when disruptions and demand uncertainty are

both present, both eects occur to a certain extent, but that in most cases the risk-diversication

eect strongly dominates the risk-pooling eect. Therefore, a decentralized system is optimal when

disruptions and demand uncertainty are both present, except when the service level (newsboy

fractile) is very low, the rm is very risk neutral, and/or the system is very reliable.

Natural extensions to this research can be made by relaxing the assumptions in our models. For

example, we assumed zero xed-ordering costs. An argument could be made that this ignores an

additional cost benet from centralization; synchronizing orders could reduce the total xed costs.

However, as we have shown, risk diversication would suggest that a risk-averse rm should not

synchronize orders if individual shipments may be disrupted at the supplier.

20

Another extension could relax our assumption of independently distributed disruptions. Eppen

[1979] shows that demand correlation aects the magnitude of the risk pooling eect; positively

correlated demand decreases the risk pooling benets of centralization and negatively correlated

demand increases them. A similar study could be conducted for supply uncertainty. We would

expect that positively correlated supply disruptions would decrease the risk diversication benets

of decentralization, whereas negatively correlated disruptions would increase those benets.

Another obvious extension to our work could address the assumption that inventory can only

be held at one echelon of the supply chain, which we made to simplify our analysis and clarify our

conclusions. Of course, centralized and decentralized systems are not the only choices available to a

rm operating in a multi-location environment; the rm may also choose a hybrid system in which

inventory is held at both echelons. Such a system may well provide a desirable balance between

the risk-diversication and risk-pooling eects. These systems are signicantly harder to analyze

(as the literature on multi-location system attests), but an investigation of these two competing

eects in this context is an important avenue for future research.

7 Acknowledgments

This research was supported in part by National Science Foundation grants DGE-9972780, DMI-

0522725, and DMI-0621433. This support is gratefully acknowledged.

References

S. Axsater. Inventory Control. Kluwer Academic Publishers, Boston, MA, rst edition, 2000.

V. Babich, A.N. Burnetas, and P. H. Ritchken. Competition and diversication eects in supply

chains with supplier default risk. Manufacturing & Service Operations Management, 9(2):123

146, 2007.

E. Berk and A. Arreola-Risa. Note on Future supply uncertainty in EOQmodels. Naval Research

Logistics, 41:129132, 1994.

X. Chen, M. Sim, D. Simchi-Levi, and P. Sun. Risk aversion in inventory management. Operations

Research, 55(5):828842, 2007.

S. Chopra, G. Reinhardt, and U. Mohan. The importance of decoupling recurrent and disruption

risks in a supply chain. Naval Research Logistics, 54(5):544555, 2007.

M. Dada, N. Petruzzi, and L. Schwarz. A newsvendors procurement problem when suppliers are

unreliable. Manufacturing & Service Operations Management, 9(1):932, 2007.

L. Eeckhoudt, C. Gollier, and H. Schlesinger. The risk-averse (and prudent) newsboy. Management

Science, 41(5):786794, 1995.

21

G. D. Eppen. Eects of centralization on expected costs in a multi-location newsboy problem.

Management Science, 25(5):498501, 1979.

A. Federgruen and N. Yang. Selecting a portfolio of suppliers under demand and supply risks.

Operations Research, 56(4):916936, 2008.

W. J. Hopp and Z. Liu. Protecting supply chain networks against catastrophic failures. Work-

ing paper, Dept. of Industrial Engineering and Management Science, Northwestern University,

Evanston, IL, 2006.

M. Parlar and D. Berkin. Future supply uncertainty in EOQ models. Naval Research Logistics,

38:107121, 1991.

A. J. Schmitt and L. V. Snyder. Innite-horizon models for inventory control under yield uncertainty

and disruptions. Computers and Operations Research, 39:850862, 2012.

A. J. Schmitt, L. V. Snyder, and Z. J. M. Shen. Inventory systems with stochastic demand and

supply: Properties and approximations. European Journal of Operational Research, 206(2):313

328, 2010.

L. V. Snyder. A tight approximation for a continuous-review inventory model with supplier dis-

ruptions. Working paper, P.C. Rossin College of Engineering and Applied Sciences, Lehigh

University, Bethlehem, PA, 2008.

L. V. Snyder and Z. J. M. Shen. Supply and demand uncertainty in multi-echelon supply chains.

Working paper, P.C. Rossin College of Engineering and Applied Sciences, Lehigh University,

Bethlehem, PA, 2006.

L. V. Snyder and B. Tomlin. Inventory management with advanced warning of disruptions. Working

paper, P.C. Rossin College of Engineering and Applied Sciences, Lehigh University, Bethlehem,

PA, 2008.

L. V. Snyder, Z. Atan, P. Peng, Y. Rong, A. J. Schmitt, and B. Sinsoysal. Supply chain disruptions:

A review. Working paper, P.C. Rossin College of Engineering and Applied Sciences, Lehigh

University, Bethlehem, PA, 2010.

B. Tomlin. On the value of mitigation and contingency strategies for managing supply chain

disruption risks. Management Science, 52(5):639657, 2006.

B. Tomlin. Disruption-management strategies for short life-cycle products. Naval Research Logis-

tics, 56:318347, 2009.

B. Tomlin and Y. Wang. On the value of mix exibility and dual sourcing in unreliable newsvendor

networks. Manufacturing & Service Operations Management, 7(1):3757, 2005.

J. A. Van Meighem. Risk mitigation in newsvendor networks: Resource diversication, exibility,

sharing and hedging. Management Science, 53(8):12691288, 2007.

C. A. Yano and H. L. Lee. Lot sizing with random yields: A review. Operations Research, 43(2):

311334, 1995.

P. H. Zipkin. Foundations of Inventory Management. McGraw-Hill Higher Education, Boston,

MA, rst edition, 2000.

22

A APPENDIX: PROOFS

A.1 Loss Functions

Let X be a random variable with pdf f(x) and cdf F(x). The loss function for X is given by:

G(x) =

_

x

(t x)f(t)dt =

_

x

(1 F(t))dt (18)

and the second-order loss function is:

H(x) =

1

2

_

x

(t x)

2

f(t)dt =

_

x

G(t)dt. (19)

Let

1

(z) be the standard normal loss function and

2

(z) as the standard normal second-order

loss function.

The following lemma presents properties we use in the proofs below. The proof of the lemma is

omitted; it follows from well known results concerning loss functions [e.g., Axsater, 2000, Zipkin,

2000].

Lemma 7 1. Let X have cdf F and loss function G. Then for any function (x),

d

dx

G((x)) =

(x)[1 F((x))]. (20)

2. If X is normally distributed with mean and variance

2

and f(x) is its pdf, then

_

S

(x S)

2

f(x)dx = 2

2

2

_

S

_

. (21)

A.2 Proof of Theorem 1, Section 3.2

A.2.1 Optimal Base-Stock Levels

S

Ds

= S

s

since each warehouse acts as a single-facility system. Moreover, from (2) we know that

S

s

= jd, where j is the smallest integer such that F(j 1)

p

p+h

. Similarly, in the centralized

system, the optimal base-stock level is S

Cs

= jnd for the same j (since the denition of j does not

depend on the demand). Therefore, S

Cs

= nS

s

.

A.2.2 Expected Costs at Optimality

In the decentralized system, the total expected cost is simply the sum of the single-facility costs,

so E

s

[C

D

] = nE

s

[C].

23

In the centralized system, the optimal expected cost at the centralized warehouse, using nS

s

in

place of S

Cs

in (1), is given by:

E

s

[C

C

] =

i=1

i

[h(nS

s

(i + 1)nd)

+

+p((i + 1)nd nS

s

)

+

]

= n

i=1

i

[h(S

s

(i + 1)d)

+

+p((i + 1)d S

s

)

+

]

= nE

s

[C

] = E

s

[C

D

] (22)

A.2.3 Cost Variances at Optimality

For the decentralized system, since each warehouse operates independently, the variance of the cost

is equal to the sum of the single-warehouse variances, or V

s

[C

D

] = nV

s

[C].

Now, for a single warehouse,

E

s

[(C

)

2

] =

i=1

i

_

h

2

_

(S

s

(i + 1)d)

+

_

2

+p

2

_

((i + 1)d S

s

)

+

_

2

_

(23)

In the centralized system, using S

Cs

= nS

s

,

E

s

[(C

C

)

2

] =

i=1

i

_

h

2

_

(nS

s

(i + 1)nd)

+

_

2

+p

2

_

((i + 1)nd nS

s

)

+

_

2

_

= n

2

i=1

i

_

h

2

_

(S

s

(i + 1)d)

+

_

2

+p

2

_

((i + 1)d S

s

)

+

_

2

_

= n

2

E

s

[(C

)

2

] (24)

Thus, using (22) and (24),

V

s

[C

C

] = E

s

[(C

C

)

2

] E

s

[C

C

]

2

= n

2

E

s

[(C

)

2

] (nE

s

[C

])

2

= n

2

(E

s

[(C

)

2

] E

s

[C

]

2

)

= n

2

V

s

[C

] (25)

Thus V

s

[C

C

] = nV

s

[C

D

].

A.3 Proof of Theorem 4, Section 4.2

At optimality, the centralized and decentralized base-stock levels satisfy

S

Dd

=

_

p

p +h

_

=

S

Cd

n

C

. (26)

Let

X

_

p

p +h

_

(27)

24

Using (21) from Lemma 7,

E

d

[C

2

] = h

2

_

S

d

(S

d

d)

2

f(d)dd +p

2

_

S

d

(d S

d

)

2

f(d)dd (28)

= h

2

_

(S

2

d

2S

d

d +d

2

)f(d)dd + (p

2

h

2

)

_

S

d

(d S

d

)

2

f(d)dd (29)

= h

2

(S

2

d

2S

d

+

2

+

2

) + 2

2

(p

2

h

2

)

2

_

S

d

_

(30)

At optimality, we have

E

d

[(C

)

2

] = h

2

((S

d

)

2

2S

d

+

2

+

2

) + 2

2

(p

2

h

2

)

2

(X) (31)

In addition, from (3),

E

d

[C

] = h(S

d

) +(p +h)

1

(X) . (32)

Therefore,

V

d

[C

] = E

d

[(C

)

2

] E

d

[C

]

2

= h

2

((S

d

)

2

2S

d

+

2

+

2

) + 2

2

(p

2

h

2

)

2

(X)

_

h(S

d

) +(p +h)

1

(X)

2

= h

2

((S

d

)

2

2S

d

+

2

+

2

) + 2

2

(p

2

h

2

)

2

(X)

_

h

2

((S

d

)

2

2S

d

+

2

) + 2h(p +h)(S

d

)

1

(X) +

2

(p +h)

2

1

(X)

2

= h

2

2

+ 2

2

(p

2

h

2

)

2

(X) 2h(p +h)(S

d

)

1

(X)

2

(p +h)

2

1

(X)

2

=

2

_

h

2

+ 2(p

2

h

2

)

2

(X) 2h(p +h)X

1

(X) (p +h)

2

1

(X)

2

(33)

Let Y equal the sum of the terms inside the brackets. Note that Y is a function of X, not of or

alone; therefore, Y is the same for an individual warehouse or for the centralized warehouse in

the centralized system.

Since the decentralized system functions as n individual warehouses, we have

V

d

[C

D

] = nV

d

[C

]. (34)

Applying (33),

V

d

[C

C

] =

2

C

Y = n

2

Y = nV

d

[C

] = V

d

[C

D

]. (35)

as desired.

25

A.4 Proof of Proposition 5, Section 5.1

E

b

[C

D

] is simply equal to nE

b

[C]. Similarly, E

b

[C

C

] = nE

b

[C], but with the pooled demand

standard deviation equal to

n and the demand mean equal to n.

A.5 Proof of Proposition 6, Section 5.2

Using (21) from Lemma 7, we get

E

b

[C

2

] =

i=1

i1

_

h

2

_

S

b

(S

b

id)

2

f

i

(id)dd +p

2

_

S

b

(id S

b

)

2

f

i

(id)dd

_

=

i=1

i1

_

h

2

_

(S

2

b

2S

b

id +i

2

d

2

)f

i

(id)dd + (p

2

h

2

)

_

S

b

(id S

b

)

2

f

i

(id)dd

_

=

i=1

i1

_

h

2

(S

2

b

2S

b

i +i

2

+i

2

2

) + 2i

2

(p

2

h

2

)

2

_

S

b

i

i

__

(36)

V

b

[C] = E

b

[C

2

] (E

b

[C])

2

=

i=1

i1

_

h

2

(S

2

b

2S

b

i +i

2

+i

2

2

) + 2i

2

(p

2

h

2

)

2

_

S

b

i

i

__

i=1

i1

_

h(S

b

i) +

i(p +h)

1

_

S

b

i

i

__

_

2

(37)

In the decentralized system, the total variance is just the sum of the individual-warehouse variances

since each retailer operates independently. In the centralized system, the total demand seen by the

centralized warehouse is distributed as N(ni, ni

2

). Therefore,

V

b

[C

C

] =

i=1

i1

_

h

2

(S

2

Cb

2S

Cb

ni +ni

2

+n

2

i

2

2

) +

2ni

2

(p

2

h

2

)

2

_

S

Cb

ni

ni

_

_

i=1

i1

_

h(S

Cb

ni) +

ni(p +h)

1

_

S

Cb

ni

ni

__

_

2

(38)

26

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Sample Management Letter PointsDocument3 pagesSample Management Letter PointsSummerrr33% (3)

- MITx MicroMasters SCM KeyConceptsDocument268 pagesMITx MicroMasters SCM KeyConceptsentra777Pas encore d'évaluation

- ACCM343 Advanced Accounting 2011 by Guerrero PeraltaDocument218 pagesACCM343 Advanced Accounting 2011 by Guerrero PeraltaHujaype Abubakar80% (10)

- Working Capital Cocacola TOTAL PROJECT (1) - 1Document84 pagesWorking Capital Cocacola TOTAL PROJECT (1) - 1Gopi Nath75% (4)

- Cavinkare Project PDFDocument43 pagesCavinkare Project PDFNandini Bharat100% (1)

- DGKC Research ReportDocument34 pagesDGKC Research Reportgbqzsa100% (1)

- INVENTORY MANAGEMENT TechniquesDocument24 pagesINVENTORY MANAGEMENT TechniquesWessal100% (1)

- Inventory Estimation - Gross Profit Method (Lecture and Exercises)Document7 pagesInventory Estimation - Gross Profit Method (Lecture and Exercises)xvii entertainmentPas encore d'évaluation

- Alignment Sample DPRMDocument25 pagesAlignment Sample DPRMCharlene PawidPas encore d'évaluation

- Case Study LogisticsDocument32 pagesCase Study LogisticsjswsucksPas encore d'évaluation

- TCCC Gri Report2013Document91 pagesTCCC Gri Report2013Keisuke YasudaPas encore d'évaluation

- BIGMAN Print Calendar PDFDocument3 pagesBIGMAN Print Calendar PDFStephen HartantoPas encore d'évaluation

- PG Rfid2005Document1 pagePG Rfid2005Stephen HartantoPas encore d'évaluation

- AddingDropping Course FormDocument2 pagesAddingDropping Course FormStephen HartantoPas encore d'évaluation

- Android Beginners GuideDocument84 pagesAndroid Beginners GuideAmelia Nur IswanyPas encore d'évaluation

- Argentina: Key Indicators, 2010Document2 pagesArgentina: Key Indicators, 2010Stephen HartantoPas encore d'évaluation

- Int MKTG The Global Branding of STELLA ARTOIS 2Document13 pagesInt MKTG The Global Branding of STELLA ARTOIS 2Stephen Hartanto100% (1)

- Ab Inbev Ar11 enDocument182 pagesAb Inbev Ar11 enIna LupuşorPas encore d'évaluation

- Aggregation Strategies: Aggregation To Overcome Differences. Aggregation Involves Using Various GroupingDocument7 pagesAggregation Strategies: Aggregation To Overcome Differences. Aggregation Involves Using Various GroupingStephen HartantoPas encore d'évaluation

- Building BrandsDocument14 pagesBuilding BrandsAarti J. KaushalPas encore d'évaluation

- The Multi-Commodity Network Flow ProblemDocument2 pagesThe Multi-Commodity Network Flow ProblemStephen HartantoPas encore d'évaluation

- Leagility in Reverse LogisticsDocument7 pagesLeagility in Reverse LogisticsStephen HartantoPas encore d'évaluation

- 5-5 Tambunan Paper enDocument9 pages5-5 Tambunan Paper enStephen HartantoPas encore d'évaluation

- Nike WU-CaseSeriesDocument20 pagesNike WU-CaseSeriesStephen HartantoPas encore d'évaluation

- Homework 01Document1 pageHomework 01Stephen HartantoPas encore d'évaluation

- Hofstede'S Cultural DimensionsDocument1 pageHofstede'S Cultural DimensionsStephen HartantoPas encore d'évaluation

- Amazon Annual Report 2011Document88 pagesAmazon Annual Report 2011fishsticks92Pas encore d'évaluation

- National Taiwan University of Science and Technology Guidelines For The Appointment of Special Project and Visiting Teaching and Research PersonnelDocument3 pagesNational Taiwan University of Science and Technology Guidelines For The Appointment of Special Project and Visiting Teaching and Research PersonnelStephen HartantoPas encore d'évaluation

- Grading System Per Aug2012Document1 pageGrading System Per Aug2012Stephen HartantoPas encore d'évaluation

- Yasmin ChandaniDocument13 pagesYasmin ChandaniStephen HartantoPas encore d'évaluation

- National Taiwan University of Science and Technology (NTUST)Document3 pagesNational Taiwan University of Science and Technology (NTUST)Stephen HartantoPas encore d'évaluation

- 29 Push Pull StrategyDocument11 pages29 Push Pull StrategyStephen HartantoPas encore d'évaluation

- Homework 02Document1 pageHomework 02Stephen HartantoPas encore d'évaluation

- NIKE, Inc. (NKE)Document2 pagesNIKE, Inc. (NKE)Stephen HartantoPas encore d'évaluation

- KorteDocument22 pagesKorteStephen HartantoPas encore d'évaluation

- Ilinth2 AllDocument243 pagesIlinth2 AllStephen HartantoPas encore d'évaluation

- BaylesDocument12 pagesBaylesTendi MuchenjePas encore d'évaluation

- Beta wp88Document22 pagesBeta wp88Stephen HartantoPas encore d'évaluation

- CH 3 - AnswersDocument3 pagesCH 3 - AnswersStephen HartantoPas encore d'évaluation

- Basic Mas ConceptsDocument7 pagesBasic Mas Conceptsjulia4razoPas encore d'évaluation

- Intermediate Accounting - Property Plant and EquipmentDocument55 pagesIntermediate Accounting - Property Plant and Equipment박은하Pas encore d'évaluation

- Zara PPT - Group9Document16 pagesZara PPT - Group9Snehashis KhanPas encore d'évaluation

- KAIZEN PAPER KALDI Final PaperDocument34 pagesKAIZEN PAPER KALDI Final PaperClaire ZafraPas encore d'évaluation

- Sample Final Exam With SolutionDocument17 pagesSample Final Exam With SolutionYevhenii VdovenkoPas encore d'évaluation

- 2021 - Machine Learning (Theses)Document65 pages2021 - Machine Learning (Theses)Rosnani Ginting TBAPas encore d'évaluation

- SAP Certified Application Associate - SAP S/4HANA Sourcing and Procurement - MiniDocument16 pagesSAP Certified Application Associate - SAP S/4HANA Sourcing and Procurement - Minibharti savarkarPas encore d'évaluation

- Factory OverheadDocument21 pagesFactory OverheadJuvi CruzPas encore d'évaluation

- Bsa 2 - Finman - Group 8 - Lesson 4Document6 pagesBsa 2 - Finman - Group 8 - Lesson 4Allyson Charissa AnsayPas encore d'évaluation

- Distinguish Between Aggregate Production Planning and Material Requirement PanningDocument10 pagesDistinguish Between Aggregate Production Planning and Material Requirement PanningDesu mekonnenPas encore d'évaluation

- Home Depot Lowes CaseDocument36 pagesHome Depot Lowes CaseCathal Andrew Moroney0% (1)

- Solutionsfor LNGBulk Storage BR0915 ENGDocument6 pagesSolutionsfor LNGBulk Storage BR0915 ENGemre.atalay5945Pas encore d'évaluation

- AmazonDocument21 pagesAmazonMuhammad NaumanPas encore d'évaluation

- Preparing For The New Venture Launch: Early Management DecisionsDocument20 pagesPreparing For The New Venture Launch: Early Management Decisionsjawad khalidPas encore d'évaluation

- Final KEC ReportDocument116 pagesFinal KEC Reports2410100% (4)

- Rabobank Rapport enDocument49 pagesRabobank Rapport enMaksudul IslamPas encore d'évaluation

- Mbe & CoordinationDocument6 pagesMbe & CoordinationADITYA PANDEYPas encore d'évaluation

- F5 Exercise PackDocument94 pagesF5 Exercise PackIzhar MumtazPas encore d'évaluation

- Job Description Purchasing ManagerDocument2 pagesJob Description Purchasing Managermira swaniPas encore d'évaluation

- A FMDocument9 pagesA FMshalu_duaPas encore d'évaluation

- Inventory Slots 5e Rule VariantDocument3 pagesInventory Slots 5e Rule VariantTelradaPas encore d'évaluation