Académique Documents

Professionnel Documents

Culture Documents

CA Memo

Transféré par

OSDocs2012Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

CA Memo

Transféré par

OSDocs2012Droits d'auteur :

Formats disponibles

Case 2:10-md-02179-CJB-SS Document 9069-3 Filed 04/01/13 Page 1 of 20 Portions of this Response have been redacted to protect information

that has been marked as Highly Confidential Subject to Settlement Discussions Confidentiality Agreement IN THE UNITED STATES DISTRICT COURT FOR THE EASTERN DISTRICT OF LOUISIANA In Re: Oil Spill by the Oil Rig Deepwater Horizon in the Gulf of Mexico, on April 20, 2010 This document relates to all actions. * * * * * * * * * * * MDL NO. 2179 SECTION J

HONORABLE CARL J. BARBIER MAGISTRATE JUDGE SHUSHAN

Bon Secour Fisheries, Inc., et al., individually * and on behalf of themselves and all others * similarly situated, * * Plaintiffs, * * v. * * BP Exploration & Production Inc.; BP * America Production Company; BP p.l.c., * * Defendants.

Civil Action No. 12-970 SECTION J

HONORABLE CARL J. BARBIER MAGISTRATE JUDGE SHUSHAN

CLAIMS ADMINISTRATOR PATRICK JUNEAU AND THE SETTLEMENT PROGRAMS RESPONSE TO BPS EMERGENCY MOTION FOR A PRELIMINARY INJUNCTION AGAINST CLAIMS ADMINISTRATOR AND SETTLEMENT PROGRAM TO ENJOIN PAYMENTS AND AWARDS FOR BUSINESS ECONOMIC LOSS CLAIMS BASED ON FICTICIOUS LOSSES Patrick A. Juneau, Claims Administrator of the Deepwater Horizon Economic and Property Damages Settlement Agreement (Claims Administrator), and the Deepwater Horizon Court Supervised Settlement Program (Settlement Program), through their undersigned counsel, respectfully submit their response to the Emergency Motion for a Preliminary Injunction Against Claims Administrator and Settlement Program to Enjoin Payments and

Case 2:10-md-02179-CJB-SS Document 9069-3 Filed 04/01/13 Page 2 of 20

Awards for Business Economic Loss Claims based on Fictitious Losses filed by BP Exploration & Production, Inc., and BP America Production Company (collectively, BP). I. INTRODUCTION BP filed the instant Emergency Motion seeking to enjoin the Claims Administrator and the Settlement Program from misinterpreting the Settlement Agreement and making erroneous awards to claimants based on the Claims Administrators alleged misinterpretation of the terms of that Agreement. In its Motion, BP alleges that in a recent Policy Announcement the Claims Administrator rewrote the express terms of the Agreement and breached his obligation to faithfully implement and administer the Agreement. As will be demonstrated in this response, however, the Claims Administrator has, from the outset of his appointment by the Court, acted in the utmost good faith in the performance of his duties and, as required by his Undertaking, abided by the terms of the Settlement Agreement and the Orders of this Court.1 II. BACKGROUND A. After extensive negotiation, the parties reached a proposed settlement, and the Court appointed Patrick Juneau as Claims Administrator of the Settlement Agreement. On April 20, 2010, a blowout, explosion, and fire occurred aboard the Deepwater Horizon, leading to eleven deaths, dozens of injuries, and a massive discharge of oil into the Gulf of Mexico (the Oil Spill). After all federal actions (excluding securities suits) were centralized in this Court, the Court organized the numerous cases before it by creating pleading bundles for various claims. Relevant hereto, among the pleading bundles was the B1 bundle,

encompassing all private claims for economic loss and property damage. Rec. Doc. 8138, p. 1-2.

1

The Claims Administrator and the Settlement Program are not parties to this litigation; therefore, the motion to enjoin their action is procedurally improper. Nevertheless, the Claims Administrator and the Settlement Program submit this response pursuant to and in compliance with the Courts March 19, 2013 Order.

2

Case 2:10-md-02179-CJB-SS Document 9069-3 Filed 04/01/13 Page 3 of 20

Following the centralization order, the Parties engaged in an extraordinary amount of discovery within a compressed time period to prepare for Phase One of Transoceans Limitation of Liability Trial. In February 2011, settlement negotiations between the Plaintiffs, BP and the Plaintiffs Steering Committee (PSC) began in earnest for a class action settlement of economic and property damages arising out of the Oil Spill. Talks intensified in July 2011, occurring on an almost-daily basis. In late 2012, Magistrate Judge Shushan became involved in the negotiations as neutral mediator. The parties reported that over 145 day-long face-to-face negotiation meetings took place, in addition to numerous phone calls and WebEx conferences. Rec. Doc. 8138, p. 2-3. On March 2, 2012, the Parties informed the Court that they had reached an Agreementin-Principle on the proposed settlement of economic and property damages. Consequently, the Court adjourned Phase I of the trial, which was scheduled to begin on March 5, 2012, and the Parties continued to work on finalizing the details of the settlement. Rec. Doc. 8138, p. 3. On March 8, 2012, at the parties request, the Court entered an Order creating a process to facilitate the transition from the Gulf Coast Claims Facility (GCCF) to the Court Supervised Settlement Program envisioned by the settlement. Rec. Doc. 5995. The Order also appointed Patrick Juneau as Claims Administrator. In furtherance of the Court Order appointing him as Claims Administrator, Mr. Juneau agreed to undertake the responsibilities of Claims Administrator as set forth in: (a) the Transition Order (and any amendments or modifications thereof); (b) the Agreement-in-Principle Regarding Deepwater Horizon Economic Loss and Property Damages Settlement; (c) a final settlement agreement among the parties, should such agreement be finalized and filed and approved by the Court; and (d) as otherwise ordered by the Court. See Exhibit 22 to BPs motion, Undertaking of Patrick Juneau in Furtherance of Court

Case 2:10-md-02179-CJB-SS Document 9069-3 Filed 04/01/13 Page 4 of 20

Order Appointing Him Claims Administrator, 1. Mr. Juneau further agreed to comply with all legal and ethical obligations related to his Court appointed role as the Claims Administrator. Id. On April 18, 2012, the PSC and BP filed a Proposed Settlement. Rec. Doc. 6276. The Court issued Preliminary Approval Order on May 2, 2012 granting preliminary approval of the Settlement Agreement and appointing Patrick Juneau as Claims Administrator to oversee the Claims Administration Vendors. Rec. Doc. 6418. The Preliminary Approval Order further

appointed the following entities as Claims Administration Vendors to process the claims in accordance with the terms of the Settlement Agreement: Garden City Group, Inc., BrownGreer, PLC, PricewaterhouseCoopers LLP (PwC), and Postlethwaite & Netterville, APAC (P&N). Id. at 35. The Court ordered the Settlement Program to commence operation on June 4, 2012. The Court retained ongoing and exclusive jurisdiction over the Claims Administrator and Claims Administration Vendors. Id. The Preliminary Approval Order also approved the creation of the Settlement Trust and confirmed Mr. Juneaus appointment as Trustee. Id. On May 4, 2012, a Settlement Trust was created to serve as a funding mechanism to administer the terms of the Settlement Agreement. B. The Settlement Agreement provides objective criteria to evaluate Business Economic Loss claims. The Settlement Agreement resolves certain claims for economic loss and property damage resulting from the Oil Spill. The class is made up of individuals living, working, or owning/leasing property in, and businesses conducting activities in, Louisiana, Mississippi, Alabama, and certain coastal counties in eastern Texas and western Florida, between April 20, 2010, and April 16, 2012. Rec. Doc. 8138, p. 7. The Settlement Agreement provides for twelve different claim types. One of those twelve is a Business Economic Loss (BEL) claim. Both Parties have endorsed the BEL

4

Case 2:10-md-02179-CJB-SS Document 9069-3 Filed 04/01/13 Page 5 of 20

compensation framework as an objective, data-based means to fairly and efficiently compensate claimants. The frameworks negotiated and agreed to by the Parties for BEL claims are set out in Exhibits 4A-4E of the Settlement Agreement. Ex. A, Affidavit of Patrick A. Juneau (hereinafter PAJ Affidavit), 15. Section 4B sets forth the objective causation requirements for BEL claims. Once objective causation is met, the actual profit of a business during a defined postspill period in 2010 is compared to the profit that the claimant might have expected to earn in the comparable post-spill period of 2010. See Rec. Doc. 6430, Settlement Agreement, Ex. 4C at 1. The first step of the compensation calculation is determined as the difference in Variable Profit between the 2010 Compensation Period selected by the claimant and the Variable Profit over the comparable months of the Benchmark Period. Id. at 3. The Compensation Period is selected by the Claimant to include three or more consecutive months between May and December 2010. Id. at 1. The Benchmark Period is the pre-Spill time period which the claimant chooses as the baseline for measuring its historical financial performance. Id. at 1-2. The claimant is required to provide its profit and loss statements and federal tax returns for both periods. Ex. 4A of Agreement at 1. The Settlement Agreement calculates the Variable Profit by sum[ming] the monthly revenue over the period and subtract[ing] the corresponding variable expenses from revenue over the same time period. Ex. 4C of Agreement at 2. Prior to preliminary approval of the Agreement, Claims Counsel requested feedback from the Program accountants on the proposed framework for BEL claims. Ex. B, Affidavit of Mark Staley, 2; Ex. C, Affidavit of Charles R. Hacker, Jr. 3. PwC and PN jointly provided framework recommendations in a memorandum dated April 4, 2012. Id. In the memorandum, the accountants made the following recommendation regarding the calculation of Variable Profit in the BEL framework:

Case 2:10-md-02179-CJB-SS Document 9069-3 Filed 04/01/13 Page 6 of 20

We recommend applying the Variable Margin percent calculated in Step 2 (see page 2) to revenue in order to calculate Variable Profit in Step 1 (see page 1), as opposed to deducting variable costs from revenue. This will: 1. Minimize the potential impact of non-representative variable expenses derived from using only a limited number of months; 2. Have the potential of more accurately matching revenue with expenses by consistently using a longer base period; Exhibit B(1) and C(1), p. 1-2. That memorandum was sent to counsel of both Parties on April 4, 2012. Id; Ex. C, Hacker Affidavit, 3; Ex. C(1). The recommended change did not appear in the Settlement Agreement submitted to the Court for approval. C. The Claims Administrator oversaw the establishment of a transparent program to implement the Settlement Agreement. The Settlement Agreement is implemented by the Settlement Program, which is overseen by the Claims Administrator. Under the terms of the Settlement Agreement, the Claims

Administrator is charged with the duty to faithfully implement and administer the S ettlement, according to its terms and procedures, for the benefit of the Economic Class, consistent with this Agreement, and/or as agreed to by the Parties and/or approved by the Court. Agreement, Section 4.3.1. Further, the Claims Administrator must work with class members to facilitate the assembly and submission of claim forms and supporting documentation, and provide appropriate notice and information to class members so that the class members have the best opportunity to be determined eligible for and receive [] Settlement Payments(s) to which they are entitled under the terms of the Agreement. Agreement, Section 4.3.7. As part of the implementation process, the Parties (both BP and Class Counsel) made a joint presentation and provided an all-day tutorial to the Claims Administrator, his staff and the Claims Administration Vendors on May 8, 2012. Ex. A, PAJ Affidavit, 12. At the tutorial, the Parties explained various aspects of the Settlement Agreement. The Parties emphasized that it

6

Case 2:10-md-02179-CJB-SS Document 9069-3 Filed 04/01/13 Page 7 of 20

was their joint intent to create an objective causation test discernible by merely reading the terms of the Settlement Agreement, as well as objective compensation formulae based upon a businesss profit and loss statements. Id. at 21. The Parties explained that the role of the Claims Administrator was to simply apply the objective formulae set forth in the Settlement Agreement, avoiding any additional subjective analysis. At that presentation, the Parties reiterated that one of the core principles of the Settlement Agreement was to avoid the type of case-by-case subjective analysis that was being utilized under the previous GCCF process. Id. The Claims Administration staff and vendors devoted a large part of the summer of 2012 to creating computer programs and damage calculators to enable the Program to have the appropriate frameworks in place to properly implement the Settlement Agreement on a practical level. Ex. A, PAJ Affidavit, 13. The Program also established a claimant-friendly and

transparent claim-filing system. After a claimant submits a claim online, in person, or via mail, the Program creates an electronic claims file through which the claimant can access and monitor the progress of his/her claim. Id. at 16. BrownGreer, PLC makes an initial assessment of eligibility, including whether the claim passes the objective causation test outlined in Exhibit 4B of the Settlement Agreement. Once a claim is determined to have satisfied the causation criteria, it is routed to the Programs accounting team (PwC and P&N) for further evaluation. The Programs accounting team analyzes the financial records submitted by the claimant and calculates the compensation due as per the formulae set out in Exhibit 4C of the Settlement Agreement. Id. If the claimant is determined to be eligible for an award, an Eligibility Notice is issued. Upon the issuance of an Eligibility Notice, the Program accountants worksheets are then made available online to the claimant, BP and Class Counsel. These worksheets detail all figures

Case 2:10-md-02179-CJB-SS Document 9069-3 Filed 04/01/13 Page 8 of 20

used in Programs calculations, including revenues and expenses assigned for each month during both the Benchmark Period and the Compensation Period. Id. The Settlement Agreement also contains an internal appellate review process. To the extent that either party disagrees with the Programs decisions or calculations, a Party may appeal to an independent panel of Court-appointed appellate neutrals. The Court also retains the discretionary right to review any decisions of the panel. Id. Further, the Settlement Agreement sets forth a procedure for resolving any disagreements regarding the Claims Administrators oversight and administration of the Settlement Agreement. First, the Claims Administrator and other members of the three-person Claims Administration Panel consisting of the Claims Administrator, a representative of BP and a representative of Class Counsel, shall attempt to resolve the disagreement unanimously. See Agreement, at 4.3.4. If they are unable to do so, the issue or disagreement will be referred to the Court for resolution. Id. D. The Programs implementation frameworks were tested by both Parties in the summer of 2012. In preparation for the implementation of the Program, as it relates to BEL claims, the Claims Administrator oversaw a blind variance analysis testing program, which gave both Parties and the Claims Administrator the opportunity to test the computer programs and calculators to ensure that the Programs frameworks were properly devised and would yield results that were in compliance with the Parties understanding of the Settlement Agreement. Ex. A, PAJ Affidavit, 17; Ex. D, Affidavit of Howard K. Fisher, 7, 10. On or about June 19, 2012, BP, the PSC, and a team of Claims Administrator-appointed accountants were each provided 62 actual BEL claims previously filed with the GCCF. Ex. D, Fisher Affidavit, 8, 12. Those claims were then blinded and run through the algorithms that had been established by the Program. Simultaneously, both BP and the Program accountants independently calculated

8

Case 2:10-md-02179-CJB-SS Document 9069-3 Filed 04/01/13 Page 9 of 20

and interpreted the compensation to be paid based upon the profit and loss statements of each of the 62 blind datasets. Ex. A, PAJ Affidavit, 18. Upon completion of the testing, BP and the Claims Administration accountants shared and compared compensation results to identify continuity and compensation variance issues. Ex. D, Fisher Affidavit, 16. Across the 62 claims tested, the net difference between the total compensation calculations of BP and the Claims Administration was less than 0.5 percent. Id. at 24. There were reportedly only two variances in the way in which BP and the Claims Administration accountants were interpreting the Agreement: one regarding the calculation of variable payroll and one regarding the application of payroll expenses. Ex. A, PAJ Affidavit, 18; Ex. D, Fisher Affidavit, 21. It is important to note that, within the 62 claim sample, there were claimants whose profit and loss statements contained noticeably variable monthly revenues (i.e, their profit and loss statements contained what appear to be revenue spikes). Ex. D, Fisher Affidavit, 27. Yet, during and after the testing, neither party raised a concern regarding such revenue abnormalities or suggested that the Program accountants address such issues. Id. at 27-28. Once the two interpretative issues regarding payroll were addressed, both BP and the PSC were in agreement that the Programs systems were properly designed and were reaching correct award amounts, and that the actual processing of claims could commence. The first Notice of Eligibility for a BEL claim was issued on July 26, 2012. Ex. A, PAJ Affidavit, 1819. E. The issue of Alternative Causation was raised by the Claims Administrator in the fall of 2012 and dismissed by BP as an inevitable concomitant of an objective quantitative, data-based test. As the Programs accounting team started to review and evaluate actual claims, they encountered situations in which the Settlement Agreements formulae provided for recovery for

Case 2:10-md-02179-CJB-SS Document 9069-3 Filed 04/01/13 Page 10 of 20

claimants for losses that a reasonable observer might conclude were not in any way related to the Oil Spill. Ex. A, PAJ Affidavit, 22. Accordingly, on September 25, 2012, Michael Juneau, special counsel of the Claims Administrator, approached both Parties to clarify whether the Parties intended, as they had explained at the May 8, 2012 tutorial, that the Program was to apply the objective formulae to determine whether and how much a claimant could recover, even when a subjective analysis might logically conclude that such losses were not Spill-related. Id. 2223. In a September 25, 2012 email, the Claims Administrator set forth the following query in an email sent to both Parties: As to BEL claims, once a claimants financial records satisfy the causation standards set out in Exhibit 4B, does the Settlement Agreement mandate and/or allow the Claims Administrator to separate out losses attributable to the oil spill vs. those that are not? Stated another way, once a claimant passes the causation threshold, is the claimant entitled to recovery of all losses as per the formula set out in Exhibit 4C, or is some consideration to be given so as to exclude those losses clearly unrelated to the spill? I will give a hypothetical situation to try to illustrate the question we are asking: Hypo: A small accounting corporation / firm is located in Zone B. They meet the V-shaped curve causation test. The explanation for the drop in revenue is that one of the three partners went out on medical leave right around the time of the spill. Their work output, and corresponding income, thus went down by about a third. The income went back up 6 months later when the missing partner returned from medical leave. Applying the compensation formula under Exhibit 4C of the Settlement Agreement, the accounting firm can calculate a fairly substantial loss. Is that full loss recoverable?

Ex. A(2), 9/25/12 email from Michael Juneau. BP responded to this query via two separate communications from two of its attorneys, both of which made clear that BPs position was that the claimant in the posed hypothetical would be entitled to full recovery. BP stated:

10

Case 2:10-md-02179-CJB-SS Document 9069-3 Filed 04/01/13 Page 11 of 20

If the accurate financial data establish that the claimant satisfies the BEL causation requirement, then all losses calculated in accord with Exhibit 4C are presumed to be attributable to the Oil Spill. Nothing in the BEL Causation Framework (Ex. 4B) or Compensation Framework (Ex. 4C) provides for an offset where the claimants firms revenue decline (and recovery, if applicable) satisfies the causation test but extraneous non-financial data indicates that the decline was attributable to a factor wholly unrelated to the Oil Spill. Such false positives are an inevitable concomitant of an objective quantitative, data-based test. Exhibit A(3), 09/28/12 email from Keith Moskowitz; Exhibit A(4), 09/28/12 letter from Mark Holstein at 3. Based on what was the confirmed agreement of the Parties on this issue, the Claims Administrator issued a Policy Announcement on October 10, 2012, which stated in part: 2. No Analysis of Alternative Causes of Economic Losses. The Settlement Agreement represents the Parties negotiated agreement on the criteria to be used in establishing causation. The Settlement Agreement sets out specific criteria that must be satisfied in order for a claimant to establish causation. Once causation is established, the Settlement Agreement further provides specific formulae by which compensation is to be measured. All such matters are negotiated terms that are an integral part of the Settlement Agreement. The Settlement Agreement does not contemplate that the Claims Administrator will undertake additional analysis of causation issues beyond those criteria that are specifically set out in the Settlement Agreement. Both Class Counsel and BP have in response to the Claims Administrators inquiry confirmed that this is in fact a correct statement of their intent and of the terms of the Settlement Agreement. The Claims Administrator will thus compensate eligible Business Economic Loss and Individual Economic Loss claimants for all losses payable under the terms of the Economic Loss frameworks in the Settlement Agreement, without regard to whether such losses resulted or may have resulted from a cause other than the Deepwater Horizon oil spill provided such claimants have satisfied the specific causation requirements set out in the Settlement Agreement. Further, the Claims Administrator will not evaluate potential alternative causes of the claimants economic injury, other than the analysis required by Exhibit 8A of whether an Individual Economic Loss claimant was terminated from a Claiming Job for cause.

11

Case 2:10-md-02179-CJB-SS Document 9069-3 Filed 04/01/13 Page 12 of 20

Ex. A, PAJ Affidavit, 25; Ex. A(5), Policy Announcement of 10/10/12, at pages 2-3. Neither Party objected to this Policy Announcement, nor did either Party request a Claims Administration Panel meeting to address this issue any further. Ex. A, PAJ Affidavit, 26. The issue of objective causation was again addressed in a conference before the Court on December 12, 2012. At that time, both Parties again confirmed that the Policy Statement of October 10, 2012 was an accurate statement of their agreement on this issue. This agreement was confirmed in Judge Barbiers email of December 12, 2012 following the conclusion of that conference. Ex. A, PAJ Affidavit, 28; Ex. A(6). F. The issue of revenue matching or revenue smoothing was raised by BP in the fall of 2012 and addressed by the Claims Administrator. On September 28, 2012, BP contacted the Claims Administrator to request a conference regarding the following questions: 1. For industries with specialized accounting or irregularly received revenue, such as construction businesses which receive progress or milestone payments, how does the Settlement Program determine for purposes of applying the BEL methodology when given revenue and expenses are incurred. 2. How does the Settlement Program determine the accounting methodology used in a claimants financial statements (e.g., cash, accrual, etc.) and whether it has been applied on a consistent basis in the Benchmark Period and Compensation Period? 3. Where a claimant has unusually large expense or negative revenue in year-end months (November or December), what does the Settlement Program do to determine whether those amounts relate solely to the period in which they are recorded or are a true up of amounts recorded in prior periods? If the latter, what if any adjustments to financial statements does the Program make for purposes of evaluating causation and/or compensation? 4. Where a claimant has unusually large revenue or expense in a particular month, particularly where this month appears out of the ordinary compared to the claimants typical seasonal pattern, what does the Settlement Program do to understand the cause of the spike and ensure the spike is not a function of improper or inconsistent accounting?

12

Case 2:10-md-02179-CJB-SS Document 9069-3 Filed 04/01/13 Page 13 of 20

Ex. E, Affidavit of Michael J. Juneau (hereinafter MJJ Affidavit), 8-10, Ex. E(1), 9/28/12 email from Dan Cantor. Representatives of both Parties, the Claims Administrator and

Settlement Program accountants participated in an October 2, 2012 conference call scheduled by the Claims Administrator to address these questions. Ex. E, MJJ Affidavit, 11; Ex. C, Hacker Affidavit, 6. During that call, the Settlement Program addressed the questions posed by BP and explained that (1) the accountants were not auditing claimants financial information, (2) the Settlement Agreement did not specify a prescribed accounting methodology (i.e., cash vs. accrual basis), and (3) the accountants had generally been considering revenues and expenses as they were booked by the claimant, and would propose adjustments to the claimant only if errors were discovered in the claimants information. Ex. C, Hacker Affidavit, 6; Ex. E, MJJ Affidavit, 13. The conference call ended only after BP and their accountants indicated that they had no more questions; at that time, neither party requested a Claims Administration Panel meeting to contest any of those issues following that conference. Ex. E, MJJ Affidavit, 14; Ex. A, PAJ Affidavit, 29. G. The issue of Alternative Causation or Revenue Matching was not raised at the Final Fairness hearing held November 8, 2012 as a basis to withhold approval of the Settlement. The Final Fairness Hearing was held before this Court on November 8, 2012. At that hearing, both Parties voiced approval of the ongoing claims process and the manner in which the Program was being administered. Ex. A, PAJ Affidavit, 30. To the Claims Administrators knowledge, neither party voiced any objection to the Programs handling of claims with respect to either the (i) objective or alternative causation issue or (ii) the smoothing of revenue / matching of revenue and expenses issue, or urged such issues to the Court as a reason not to approve the Settlement Agreement. Id. The Court took the issue of final approval of the

13

Case 2:10-md-02179-CJB-SS Document 9069-3 Filed 04/01/13 Page 14 of 20

Settlement under advisement and issued its written ruling granting final approval of the Settlement on December 21, 2012. Rec. Doc. 8138. H. After the Final Fairness Hearing, BP again raised the issues of revenue matching or revenue smoothing which was then addressed formally by the Claims Administrator in a January 15, 2013 Policy Announcement. Following the October 2, 2012 conference call, BP did not express to the Program or the Claims Administrator any additional concerns regarding the issue of matching of revenue and expenses until December 5, 2012, when counsel for BP requested a meeting with Program accountants regarding the issue of the assignment of revenue to the proper months for purposes of the BEL causation framework and the proper matching of revenue and corresponding expenses for purposes of the BEL compensation framework. Ex. E, MJJ Affidavit, 15, 16; Exhibit E(2) (emphasis added). Michael Juneau undertook efforts to schedule the meeting with the Program accountants as requested by BP. Ex. A, PAJ Affidavit, 34. That meeting was scheduled for December 19, 2012, but BP subsequently advised that it wished to postpone that meeting. Id. On December 16, 2012, Class Counsel requested that a formal Policy Announcement be issued to address the issue that had been again raised by BP. Ex. A, PAJ Affidavit, 35. The Claims Administrator requested that BP submit its written position on the issue by December 28, 2012. At BPs request, the Claims Administrator extended that deadline an additional ten (10) days to January 8, 2013. Id. at 36. After review of the submissions of both Parties, the Claims Administrator issued a formal Policy Announcement on January 15, 2013. Id. at 38; Exhibit A(8), 1/15/13 Announcement of Policy Decisions. The Programs announced policy was that the Claims Administrator will typically consider both revenues and expenses in the periods in which those revenues and expenses were recorded at the time, will not typically re -allocate

14

Case 2:10-md-02179-CJB-SS Document 9069-3 Filed 04/01/13 Page 15 of 20

such revenues or expenses to different periods,but does, however, reserve the right to adjust the financial statements in certain circumstances, including but not limited to, inconsistent basis of accounting between benchmark and compensation periods, errors in previously recorded transactions and flawed or inconsistent treatment of accounting estimates. Id. A Claims Administration Panel meeting was held the following day on January 16, 2013, but the Panel was unable to resolve the dispute unanimously. Pursuant to the appeals process, the issue was referred to the Court for resolution. Ex. A, PAJ Affidavit, 40. I. The Court affirmed the Claims Administrators January 15, 2013 interpretation of the Settlement Agreement, after which BP moved for an injunction. The Court held a conference on January 24, 2013. At that time, the Court affirmed the January 15, 2013 Policy Announcement of the Claims Administrator. Ex. A, PAJ, 41; Exhibit A(9), 1/30/13 email from Judge Barbier. BP subsequently filed a Motion for Reconsideration. The Court set a briefing schedule and subsequently issued a written ruling on March 5, 2013, again affirming the interpretation of the Settlement Agreement as articulated in the Claims Administrators Policy Announcement of January 15, 2013, particularly holding that the BEL Framework (1) does not require a matching of expenses to revenue, the smoothing of revenues, or a reallocation of revenues to periods other than those during which the revenues were recorded, and (2) provides that a claimants Variable Profit is to be determined based on the revenue and expenses recorded during the relevant periods selected by the claimant. Rec. Doc. 8812. BP filed the instant Emergency Motion for Preliminary Injunction on March 15, 2013, requesting that the Court enjoin the Claims Administrator and the Settlement Program from rewriting the Settlement Agreement and making erroneous awards to claimants based on their alleged misinterpretations. In its Motion, BP alleges that the Claims Administrators January 15,

15

Case 2:10-md-02179-CJB-SS Document 9069-3 Filed 04/01/13 Page 16 of 20

2013 Policy Announcement rewrite[s] the Agreements express terms, and contradicts its purpose, plain text, and underlying principles by authorizing compensation awards for claimants seeking to recover for non-existent losses. BPs motion, p. 2. BP also contends that, through his January 15, 2013 Policy Announcement, the Claims Administrator has breached his obligation to faithfully implement and administer the Agreement according to its terms and consistent with its stated purpose. Id. III. LAW AND ARGUMENT The underlying issues BP raises in its Motion were raised by BP in September 2012 and discussed by the Claims Administrator with BP and Class Counsel in an October 2, 2012 telephone conference prior to the Final Fairness Hearing on the Settlement Agreement. At the time of that hearing in November, there appeared to be unanimous consent that the BEL Framework was being interpreted and implemented properly. Nevertheless, after the Fairness Hearing and after the Court approved the Settlement Agreement, BP submitted a position paper asking the Claims Administrator to revisit the questions regarding how the BEL Framework operated specifically with respect to the analysis and calculation of a claimants Variable Profit. BPs January 8, 2013 position paper was the first time that BP proposed a multi-step process to further evaluate claims within the construction, agriculture, and professional services industries for purposes of measuring revenue and matching corresponding variable expenses, which process was contrary to the way that the Program accountants understood the Agreement and had been treating the calculation of Variable Profit. Ex. B, Staley Affidavit, 7, 8. After reviewing both Parties submissions, the Claims Administrator issued a Policy Announcement based upon his understanding of the formulae set forth in the Settlement Agreement, as applied by the Settlement Program accountants. The Claims Administrator then

16

Case 2:10-md-02179-CJB-SS Document 9069-3 Filed 04/01/13 Page 17 of 20

followed the appropriate dispute resolution procedure when BP disagreed with his interpretation. When the Claims Administration Panel was unable to agree unanimously on a resolution, the matter was presented to the Court. The Court has now ruled, and the Parties, the Claims Administrator, and the Settlement Program are bound by that ruling. Accordingly, the Claims Administrator has instructed the Program to continue to implement the Settlement Agreement in accordance with the Courts ruling of March 5, 2013. The ruling is the law of the case, see Coliseum Square Ass'n, Inc. v. Jackson, 465 F.3d 215, 246 (5th Cir. 2006), and supplants the Claims Administrators Policy Announcement of January 15, 2013. From the outset of his appointment, the Claims Administrator has performed and continues to perform his official functions exactly as outlined in the Settlement Agreement, the Undertaking, and the Trust Agreement. The Claims Administrator was not the author of the Settlement Agreement, did not devise the criteria to be used in deciding whether a claimant does or does not have losses attributable to the Oil Spill, and did not devise the compensation formulae used to determine the award amounts. All of those determinations were negotiated by the Parties and are recorded in the terms of the Settlement Agreement. The Claims

Administrator does not have the authority to revise the terms of the agreement or devise different methods of compensation. Instead, the role of the Claims Administrator is simply to implement the terms of the Settlement Agreement as agreed to by the Parties and as set forth in the written Settlement Agreement. Ex. A, PAJ Affidavit, 14. Indeed, if the Claims Administrator and the Program now adopted BPs proposed framework for analyzing a claimants Variable Profit and began awarding and distributing claims based on that alternative formula, they would be in contempt of the Courts March 5, 2013.

17

Case 2:10-md-02179-CJB-SS Document 9069-3 Filed 04/01/13 Page 18 of 20

Moreover, the methodology used by the Settlement Program accountants to calculate the Variable Profit amount under Exhibit 4C, and which the Claims Administrator reaffirmed in his January 15, 2013 Policy Announcement, represented a reasonable construction of the language of the Agreement. The Agreement as written does not call for a conversion of any claimants financial data from cash basis to accrual, but rather simply states that the accountant only must subtract the corresponding variable expenses from revenue over the same time period. And, because a claimant has the option of designating only a limited number of months for inclusion in the Compensation Period, it was apparent very early in the process that the resulting calculation would be impacted if there were non-representative variable expenses within that limited time period, and that a more accurate matching of revenue with expense would occur if a longer time period could be used. See Ex. B(1) and C(1) at 1-2. Those observations, made by the accountants before the Settlement Program was implemented, were sent to counsel for both Parties and demonstrated that the language of the Agreement, when given a straightforward reading, could result in the types of anomalies that BP identifies in its motion. The position of the Claims Administrator, therefore, was neither novel nor unreasonable, but rather reflected the consistent application of an interpretation of this language dating back to observations that predate the Settlement Program itself. Nevertheless, the Claims Administrator fully acknowledges that the Court has final authority over the proper interpretation of the Settlement Agreement. Should the Court now determine that an interpretation other than the one set forth in its March 5, 2013 ruling is appropriate, the Claims Administrator and the Program will faithfully implement the Agreement according to the ruling issued by this Court.

18

Case 2:10-md-02179-CJB-SS Document 9069-3 Filed 04/01/13 Page 19 of 20

IV.

CONCLUSION The Claims Administrator and the Settlement Program have in the past and will continue

in the future to follow the Orders of the Court as to interpretation and implementation of the Settlement Agreement.

Respectfully submitted, /s/ Gina M. Palermo Richard C. Stanley, 8487 Jennifer L. Thornton, 27019 Gina M. Palermo, 33307 Patrick H. Fourroux, 34550 Of STANLEY, REUTER, ROSS, THORNTON & ALFORD, L.L.C. 909 Poydras Street, Suite 2500 New Orleans, Louisiana 70112 Telephone: (504) 523-1580 Facsimile: (504) 524-0069

Attorneys for Deepwater Horizon Court Supervised Settlement Program and Patrick A. Juneau, in his official capacity as Claims Administrator of the Deepwater Horizon Court Supervised Settlement Program administering the Deepwater Horizon Economic and Property Damages Settlement Agreement, and in his official capacity as Trustee of the Deepwater Horizon Economic and Property Damages Settlement Trust

19

Case 2:10-md-02179-CJB-SS Document 9069-3 Filed 04/01/13 Page 20 of 20

CERTIFICATE OF SERVICE I hereby certify that on this 1st day of April, 2012, I electronically filed the foregoing Response with the Clerk of Court by using the CM/ECF system, which will send a notice of electronic filing to all counsel of record.

/s/ _Gina M. Palermo____

20

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Crim BarbriDocument53 pagesCrim BarbricoddusPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Torts OutlineDocument70 pagesTorts OutlineBear100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Subject Topic/Subtopic Mnemonic Meaning: Lemon Test: Establishment ClauseDocument3 pagesSubject Topic/Subtopic Mnemonic Meaning: Lemon Test: Establishment ClausehillaryPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Criminal LawDocument114 pagesCriminal Lawyes1nthPas encore d'évaluation

- Criminal Law EXAM Notesp PDFDocument11 pagesCriminal Law EXAM Notesp PDFHemantPrajapati100% (1)

- Pdo AipsDocument22 pagesPdo AipsOswaldo ChiaPas encore d'évaluation

- English Criminal LawDocument8 pagesEnglish Criminal LawCalvin WangPas encore d'évaluation

- Leonila Garcia-Rueda vs. Wilfredo PascasioDocument3 pagesLeonila Garcia-Rueda vs. Wilfredo PascasioAnonymous 5MiN6I78I0Pas encore d'évaluation

- Crim Exam OutlineDocument29 pagesCrim Exam OutlineSunny Reid WarrenPas encore d'évaluation

- PSC Post-Trial Brief (Phase One) (Doc 10458) 6-21-2013Document72 pagesPSC Post-Trial Brief (Phase One) (Doc 10458) 6-21-2013OSDocs2012100% (1)

- Extension of Time Claim Procedures and AssessmentDocument1 pageExtension of Time Claim Procedures and AssessmentSilentArrowPas encore d'évaluation

- Concept of Justice - Is Social Justice Just - PDFDocument257 pagesConcept of Justice - Is Social Justice Just - PDFAndre SilvaPas encore d'évaluation

- To's Post-Trial BriefDocument57 pagesTo's Post-Trial BriefOSDocs2012Pas encore d'évaluation

- DOJ Pre-Trial Statement On QuantificationDocument14 pagesDOJ Pre-Trial Statement On QuantificationwhitremerPas encore d'évaluation

- BP Pre-Trial Statement On QuantificationDocument13 pagesBP Pre-Trial Statement On Quantificationwhitremer100% (1)

- 2013-9-11 BPs Phase II PreTrial Reply Memo For Source Control Doc 11349Document13 pages2013-9-11 BPs Phase II PreTrial Reply Memo For Source Control Doc 11349OSDocs2012Pas encore d'évaluation

- 2013-09-05 BP Phase 2 Pre-Trial Memo - Source ControlDocument13 pages2013-09-05 BP Phase 2 Pre-Trial Memo - Source ControlOSDocs2012Pas encore d'évaluation

- 2013-9-18 Aligned Parties Pre-Trial Statement Doc 11411Document41 pages2013-9-18 Aligned Parties Pre-Trial Statement Doc 11411OSDocs2012Pas encore d'évaluation

- State of LAs Post Trial Brief Phase I (Doc. 10462 - 6.21.2013)Document23 pagesState of LAs Post Trial Brief Phase I (Doc. 10462 - 6.21.2013)OSDocs2012Pas encore d'évaluation

- BP's Post-Trial BriefDocument72 pagesBP's Post-Trial BriefOSDocs2012Pas encore d'évaluation

- To's Proposed FOF and COLDocument326 pagesTo's Proposed FOF and COLOSDocs2012Pas encore d'évaluation

- HESI's Proposed FOF and COLDocument335 pagesHESI's Proposed FOF and COLOSDocs2012Pas encore d'évaluation

- HESI's Post-Trial BriefDocument52 pagesHESI's Post-Trial BriefOSDocs2012Pas encore d'évaluation

- DR Gene: CloggedDocument1 pageDR Gene: CloggedOSDocs2012Pas encore d'évaluation

- BP's Proposed Findings - Combined FileDocument1 303 pagesBP's Proposed Findings - Combined FileOSDocs2012Pas encore d'évaluation

- USAs Proposed Findings Phase I (Doc. 10460 - 6.21.2013)Document121 pagesUSAs Proposed Findings Phase I (Doc. 10460 - 6.21.2013)OSDocs2012Pas encore d'évaluation

- Driller HITEC Display CCTV Camera System: Source: TREX 4248 8153Document1 pageDriller HITEC Display CCTV Camera System: Source: TREX 4248 8153OSDocs2012Pas encore d'évaluation

- State of ALs Post Trial Brief Phase I (Doc. 10451 - 6.21.2013)Document22 pagesState of ALs Post Trial Brief Phase I (Doc. 10451 - 6.21.2013)OSDocs2012Pas encore d'évaluation

- USAs Post Trial Brief Phase I (Doc. 10461 - 6.21.2013)Document49 pagesUSAs Post Trial Brief Phase I (Doc. 10461 - 6.21.2013)OSDocs2012Pas encore d'évaluation

- Foam Stability Testing: Request Date Slurry I.D. Result CommentsDocument1 pageFoam Stability Testing: Request Date Slurry I.D. Result CommentsOSDocs2012Pas encore d'évaluation

- Macondo Bod (Basis of Design)Document23 pagesMacondo Bod (Basis of Design)OSDocs2012Pas encore d'évaluation

- Plaintiffs Proposed Findings and Conclusions (Phase One) (Doc 10459) 6-21-2013Document199 pagesPlaintiffs Proposed Findings and Conclusions (Phase One) (Doc 10459) 6-21-2013OSDocs2012Pas encore d'évaluation

- Circa 2003Document1 pageCirca 2003OSDocs2012Pas encore d'évaluation

- Circa 2003Document1 pageCirca 2003OSDocs2012Pas encore d'évaluation

- Arnaud Bobillier Email: June 17, 2010: "I See Some Similarities With What Happened On The Horizon"Document5 pagesArnaud Bobillier Email: June 17, 2010: "I See Some Similarities With What Happened On The Horizon"OSDocs2012Pas encore d'évaluation

- Exterior: Circa 2003Document1 pageExterior: Circa 2003OSDocs2012Pas encore d'évaluation

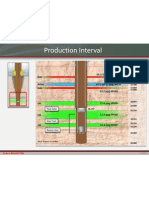

- Production Interval: 14.1-14.2 PPG M57B Gas Brine GasDocument1 pageProduction Interval: 14.1-14.2 PPG M57B Gas Brine GasOSDocs2012Pas encore d'évaluation

- April 20, BLOWOUT: BP Misreads Logs Does Not IdentifyDocument22 pagesApril 20, BLOWOUT: BP Misreads Logs Does Not IdentifyOSDocs2012Pas encore d'évaluation

- Webster:: Trial Transcript at 3975:2-4Document1 pageWebster:: Trial Transcript at 3975:2-4OSDocs2012Pas encore d'évaluation

- Laboratory Results Cement Program Material Transfer TicketDocument13 pagesLaboratory Results Cement Program Material Transfer TicketOSDocs2012Pas encore d'évaluation

- End of Transmission: Transocean Drill Crew Turned The Pumps Off To InvestigateDocument1 pageEnd of Transmission: Transocean Drill Crew Turned The Pumps Off To InvestigateOSDocs2012Pas encore d'évaluation

- Torts Twerski F2008aDocument22 pagesTorts Twerski F2008ajlfr111Pas encore d'évaluation

- Reeves V Commissioner of PoliceDocument37 pagesReeves V Commissioner of PoliceBernice Purugganan AresPas encore d'évaluation

- Emergent Capital Investment Management, LLC v. Stonepath Group, Inc., Previously Known As Net Value Holdings, Inc., Andrew Panzo and Lee Hansen, 343 F.3d 189, 2d Cir. (2003)Document12 pagesEmergent Capital Investment Management, LLC v. Stonepath Group, Inc., Previously Known As Net Value Holdings, Inc., Andrew Panzo and Lee Hansen, 343 F.3d 189, 2d Cir. (2003)Scribd Government DocsPas encore d'évaluation

- F4-02 Tort LawDocument24 pagesF4-02 Tort Lawsusandavid0022Pas encore d'évaluation

- Ralph M. Nowak, Administrator of The Estate of Sally Ann Nowak v. Tak How Investments, LTD., D/B/A Holiday Inn Crowne Plaza Harbour View, 94 F.3d 708, 1st Cir. (1996)Document17 pagesRalph M. Nowak, Administrator of The Estate of Sally Ann Nowak v. Tak How Investments, LTD., D/B/A Holiday Inn Crowne Plaza Harbour View, 94 F.3d 708, 1st Cir. (1996)Scribd Government DocsPas encore d'évaluation

- Laws 1113 Study Notes Law of Torts A Lecture Summary and Case StudiesDocument9 pagesLaws 1113 Study Notes Law of Torts A Lecture Summary and Case StudiesHanh Trang NguyenPas encore d'évaluation

- Elements of A Negligence Claim: Car Accidents Slip and FallDocument19 pagesElements of A Negligence Claim: Car Accidents Slip and FallOlu FemiPas encore d'évaluation

- Major Cases of Criminal LawDocument7 pagesMajor Cases of Criminal LawHiba ShahidPas encore d'évaluation

- DRA. LEILA A. DELA LLANA, Petitioner, vs. REBECCA BIONG, Doing Business Under The Name and Style of Pongkay Trading, RespondentDocument3 pagesDRA. LEILA A. DELA LLANA, Petitioner, vs. REBECCA BIONG, Doing Business Under The Name and Style of Pongkay Trading, Respondentj guevarraPas encore d'évaluation

- Klesch & Company v. Liberty Media, 10th Cir. (2007)Document20 pagesKlesch & Company v. Liberty Media, 10th Cir. (2007)Scribd Government DocsPas encore d'évaluation

- Law of NegligenceDocument16 pagesLaw of NegligenceSufyan SallehPas encore d'évaluation

- Law School Torts NotesDocument5 pagesLaw School Torts NotesKJ100% (1)

- CAUSATION - NotesDocument6 pagesCAUSATION - NotesIkram khanPas encore d'évaluation

- Paroline's Petition For A Writ of CertiorariDocument24 pagesParoline's Petition For A Writ of CertiorariMarsh Law Firm PLLCPas encore d'évaluation

- Mens and Actus ReusDocument3 pagesMens and Actus ReusBrian Okuku OwinohPas encore d'évaluation

- Estela and CrisostomoDocument4 pagesEstela and CrisostomoJo DevisPas encore d'évaluation

- Compiled Torts DigestDocument15 pagesCompiled Torts Digestbeth_afanPas encore d'évaluation

- Reply Memorandum of Defendant Salesforce - Com, Inc. in Support of Demurrer To Second Amended ComplaintDocument16 pagesReply Memorandum of Defendant Salesforce - Com, Inc. in Support of Demurrer To Second Amended ComplaintElizabeth Nolan BrownPas encore d'évaluation

- Legal Lang Sem2 AssignmentDocument7 pagesLegal Lang Sem2 AssignmentHelik SoniPas encore d'évaluation