Académique Documents

Professionnel Documents

Culture Documents

Soveriegn Rating & Country Risk

Transféré par

ssimi137Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Soveriegn Rating & Country Risk

Transféré par

ssimi137Droits d'auteur :

Formats disponibles

Sovereign Rating & Country Risk While both sovereign and country risks are potentially important risk

k factors in a corporate risk assessment and are often correlated, the links between them can be quite tenuous. True, nations with a historical record of sovereign default tend also to be nations that exhibit high and persistent country risks. i. Developed countries, such as Switzerland, that tend to attract investment grade ratings for their sovereign debt and have what we consider to be low country risk. ii. Developing countries, such as Kenya, that tend to attract non-investment grade ratings for their sovereign debt but that also tend to suffer from high levels of country risk However, sovereign risk is an increasingly proven to be poor proxy for country risk in many instances. Sovereign debt ratings cannot be used as a proxy for country risk because these two risk sources are conceptually distinct: i. Sovereign ratings capture the risk of a country defaulting on its commercial debt obligations and ii. Country risk covers the downside of a countrys business environment including legal environment, levels of corruption, and socioeconomic variables such as income disparity. There are many examples where levels of sovereign and country risk are diverging for some nations. For example, i. Fast track emerging market economies, such as modern China, where the present sovereign ratings reflect newly robust national finances and a fastgrowing economy alongside continuing degree in nearly all the worlds fastest-growing economies including Brazil, Russia and India. ii. Certain Euro zone countries, where a divergence between sovereign and country risk is happening in reverse. iii. Amalgamation of the fowing indices seemed likely to generate scores that more fully reflected historical observations of country risk than simply using sovereign rating ceilings. i. Corruption Perceptions Index (CPI) Transparency International - The CPI ranks over 170 countries according to the perception of corruption in the public sector. The index is an aggregate based on an underlying collection of assessments and business opinion surveys carried out by various independent institutions. ii. Doing business rankings The World Bank -The Doing Business rankings monitor the environment for with construction permits, registering property, getting credit, protecting investors, paying taxes, trading across borders, enforcing contracts, resolving insolvency and obtaining an electricity supply. iii. Global World Economic Forum (WEF) - The GCI analyses over 100 economic indicators to provide a comprehensive assessment of the competitiveness of an economy, defined as the set of institutions, policies, and factors that determine the level of productivity of a country. The index covers over 140 economies and the underlying indicators encompass areas such as labour market efficiency, institutions, quality of infrastructure, technological readiness, business sophistication and innovation. iv. UN Human Development Index (HDI)- The HDI is a composite index that measures a countrys achievements in terms of health, knowledge, and income. Introduced as an alternative to conventional measures of national development such as the rate of economic growth, the HDI covers over 180 countries

v.

World Bank Political Risk Indicator - The World Bank political risk indicator is used as a stable and predictive measure to assess political risk. This indictor assesses the following risk dimensions: Voice & Accountability, Regulatory Quality, Political Stability, Rule of Law, Government Effectiveness and Control of Corruption.

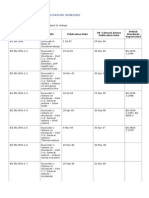

The underlying indices are largely driven by survey information that is somewhat backward looking, so its critical to make sure the final ratings take on a forward looking flavour. For example, in recent years an index-driven approach would have been likely to generate a relatively low country risk score for some Middle Eastern countries, however, the events of the Arab Spring introduced a degree of political instability across the region that needed to be incorporated into the final up-to-date score. World countries by Standard & Poor's Foreign Rating - Aoril 2012

Useful links: http://en.wikipedia.org/wiki/List_of_countries_by_credit_rating file:///C:/Users/Ssimi/Desktop/downloads_fin/New%20folder/New%20folder/151097Country_risk_and_sovereign_risk.pdf

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- MM Chapter 4 Test BankDocument9 pagesMM Chapter 4 Test BankkarimPas encore d'évaluation

- Manual Multibeam SonarDocument23 pagesManual Multibeam SonarAyesha MariyaPas encore d'évaluation

- Statistical Intervals CIDocument28 pagesStatistical Intervals CIMarah Elaine Teves100% (2)

- Asset Conversion CycleDocument12 pagesAsset Conversion Cyclessimi137Pas encore d'évaluation

- Accounting Ratios For ProjectDocument13 pagesAccounting Ratios For ProjectRoyal ProjectsPas encore d'évaluation

- Module-3 RM 5151 Research Methodology and IprDocument39 pagesModule-3 RM 5151 Research Methodology and Iprselvam100% (1)

- LDNA PowerpointDocument83 pagesLDNA PowerpointRita Almira Gutierrez100% (5)

- E2 GRule WriterDocument4 pagesE2 GRule Writermajorj59Pas encore d'évaluation

- Principles of Marketing Module 2 OgongDocument20 pagesPrinciples of Marketing Module 2 OgongHeron KrizPas encore d'évaluation

- Health Index CalculationDocument7 pagesHealth Index CalculationManinder ChoudharyPas encore d'évaluation

- Aries ChildDocument3 pagesAries Childssimi137Pas encore d'évaluation

- Accounting FraudDocument3 pagesAccounting Fraudssimi137Pas encore d'évaluation

- Working Capital MGTDocument12 pagesWorking Capital MGTssimi137Pas encore d'évaluation

- Analysis 8 IndustriesDocument20 pagesAnalysis 8 Industriesssimi137Pas encore d'évaluation

- Financial Statement ManipulationDocument10 pagesFinancial Statement Manipulationssimi137Pas encore d'évaluation

- Analysis 8 IndustriesDocument20 pagesAnalysis 8 Industriesssimi137Pas encore d'évaluation

- Case Study - Financial Statement AnaysisDocument8 pagesCase Study - Financial Statement Anaysisssimi137Pas encore d'évaluation

- Accounting and Financial ManagementDocument16 pagesAccounting and Financial Managementssimi137Pas encore d'évaluation

- SAMBA2Document14 pagesSAMBA2anon-478730100% (3)

- Implementation Challenges of Training PolicyDocument35 pagesImplementation Challenges of Training PolicySergeyPas encore d'évaluation

- Enhancing Reading Fluency of Grade 3 Students Amidst Covid-19 Pandemic: Parent-Teacher Reading InterventionDocument10 pagesEnhancing Reading Fluency of Grade 3 Students Amidst Covid-19 Pandemic: Parent-Teacher Reading InterventionAlthea Mae P. SlnPas encore d'évaluation

- 54 PDFDocument24 pages54 PDFyaprak dönerPas encore d'évaluation

- Factor Analysis with PASW: Exploring Common and Unique FactorsDocument40 pagesFactor Analysis with PASW: Exploring Common and Unique FactorsSaad MotawéaPas encore d'évaluation

- Blooms Taxonomy Verb List PDFDocument2 pagesBlooms Taxonomy Verb List PDFSUGANTHIPas encore d'évaluation

- Summer Training Report on Airtel Performance Appraisal (38 charactersDocument71 pagesSummer Training Report on Airtel Performance Appraisal (38 charactersgeetainderhanda4430100% (1)

- AST-503 Nonparametric Test PDFDocument85 pagesAST-503 Nonparametric Test PDFMd. Danial RafiPas encore d'évaluation

- Technology Affecting Student'S Academic Performance in Online Learning RationaleDocument4 pagesTechnology Affecting Student'S Academic Performance in Online Learning RationaleLabLab ChattoPas encore d'évaluation

- Factors Choosing Sample SizeDocument9 pagesFactors Choosing Sample SizeGish KK.GPas encore d'évaluation

- Benchmarking For Analytical Methods: The Horwitz Curve: GadgetsDocument2 pagesBenchmarking For Analytical Methods: The Horwitz Curve: GadgetsRachel HillPas encore d'évaluation

- An Investigation On The Interrelation Between Teachers' Viewpoint On Mathematics and Learners' Mathematics Accomplishment in High and Higher Secondary Schools in Hilly District of AssamDocument275 pagesAn Investigation On The Interrelation Between Teachers' Viewpoint On Mathematics and Learners' Mathematics Accomplishment in High and Higher Secondary Schools in Hilly District of AssamDrAshim BoraPas encore d'évaluation

- BS To ENDocument7 pagesBS To ENdownloadkaroPas encore d'évaluation

- Perception of Teacher Towards The Proposed Bill: No Homework PolicyDocument10 pagesPerception of Teacher Towards The Proposed Bill: No Homework PolicyNinna Denise Derpo BasquiñaPas encore d'évaluation

- Verb List For Writing Educational Objectives: Cognitive DomainDocument3 pagesVerb List For Writing Educational Objectives: Cognitive DomainElla Cagadas PuzonPas encore d'évaluation

- Comprehensive Evaluation of Salud Escolar A Health School Program in MexicoDocument9 pagesComprehensive Evaluation of Salud Escolar A Health School Program in MexicoSebastian GPPas encore d'évaluation

- Introduction To English AssessmentDocument13 pagesIntroduction To English AssessmentFadhlur RahmanPas encore d'évaluation

- Measurement uncertainty estimation non-homogeneous populationsDocument5 pagesMeasurement uncertainty estimation non-homogeneous populationsPaaahMullerPas encore d'évaluation

- Topic 9: Panel Data ModelsDocument46 pagesTopic 9: Panel Data ModelsMah DoPas encore d'évaluation

- Building Effective CommitteesDocument18 pagesBuilding Effective CommitteesStevePas encore d'évaluation

- REGRESSION ANALYSIS TITLEDocument2 pagesREGRESSION ANALYSIS TITLEHitesh Sharma100% (1)

- Group 5 Road To Success!Document19 pagesGroup 5 Road To Success!Nicole EspinoPas encore d'évaluation

- Home Insurance-1Document12 pagesHome Insurance-1ashu0% (1)