Académique Documents

Professionnel Documents

Culture Documents

Value Innovation Insead

Transféré par

macalderonmolinaDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Value Innovation Insead

Transféré par

macalderonmolinaDroits d'auteur :

Formats disponibles

Perspectives NEW

NovemberDecember 2003

Value Innovation: A Balanced Approach to Strategy

By Lauren Keller Johnson, Contributing Writer A summary of remarks by Francis Gouillart, CEO of Emergence Consulting and Chief Research Ofcer for the Value Innovation Network, given at the Balanced Scorecard Collaboratives 2002 North American Summit

If youre struggling to more sharply dene the customer perspective of your Balanced Scorecard, Francis Gouillart youre not alone. A new approach to customer strategy formulation can help you lay out your value proposition in crystal-clear terms and get even more out of your BSC.

What Are We Really Offering? Youve built your Balanced Scorecard and have begun implementing the strategic thinking reected in its four perspectives: nancial, customer, internal business processes, and learning and growth. But you cant shake the feeling that your customer perspective could use a bit more specicity. You nd yourself asking, What do we really mean by top quality, exceptional service, and unbeatable price? Youre not alone. In implementing a Balanced Scorecard, many companies discover that their scorecards customer perspective relies too heavily on vague concepts about what customers want. Such rms realize that they need to retrace their thinking in order to clarify in concrete terms the unique value they believe they can offer customers. That old maxim If you cant say it, you cant do it applies just as much to the realm of business strategy as it does to any other endeavor: if you cant articulate your customer strategy, you cant implement it. Value Innovation a relatively new approach to strategy formulation conceptualized by INSEAD professors W. Chan Kim and Rene Mauborgne enables organizations to articulate their customer strategy in concrete, even graphic terms. With a clear picture of their value proposition in mind, rms can more fully leverage the strategy-execution power of their BSC. Expand the Market and Lower Costs Over the years, many approaches to strategy formulation have emphasized either differentiation or cost leadership. In other words, you carve out a place for yourself in the competitive arena by selling something that no one else sells or by offering your product or service at a price lower than anyone elses. If youre an auto company adhering to the differentiation approach, you might offer a strictly limited edition of a hot new roadster at a price so raried that its sure to capture the exact customer segment you have in mind: wealthy men of a certain age and income who have a penchant for speed and glamour. If youre a chemical, steel, or other commodities rm, you may have little choice but to adopt the cost leadership approach. Many traditional approaches to strategy formulation say you cant excel in both differentiation and cost leadership: you must choose and focus on just one. Worse, if you cant skillfully pull off either approach, youll get mired in a kind of no mans land somewhere between the two extremes. Value Innovation begs to differ. According to Kim and Mauborgne, differentiation (a.k.a. market segmen-

tation) and cost leadership may enable you to score some successes. But those successes wont necessarily translate into large or sustainable businesses. To really hit it big and then stay on top you must create a quantum leap in customer value through differentiation while also pushing for a sharp drop in your industrys cost structure. Otherwise, say Kim and Mauborgne, youll be relegated to the markets margins. How do you replace either/or with both/and strategy formulation? You march straight into that no mans land the markets core and expand it by appealing to a broader range of customers while simultaneously seeking ways to reduce your costs. Value Innovators achieve this delicate balance by rst identifying the key elements of value offered by their own and their competitors product or service, then deciding which of these factors to eliminate, reduce well below the industry standard, or raise well above the industry standard. In addition, they ask themselves what new elements of value they might create that the industry has never offered before. Next they plot the performance of their own offering on each value element relative to their

Continued on next page

The Minds Behind Value Innovation

Professors W. Chan Kim and Rene Mauborgne, both based at INSEAD Business School in Fontainebleau, France, began writing about Value Innovation in 1997. They later cofounded the Value Innovation Network an organization comprising academics, corporate managers, and consulting rms interested in the application of Value Innovation methodologies. (Francis Gouillart is chief research ofcer.) Kim and Mauborgnes extensive writings on Value Innovation have appeared in Harvard Business Review and Sloan Management Review, among other publications.

11

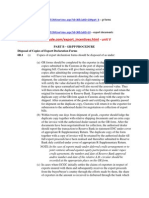

Figure 1. Quickens Value Curve

Source: Kim and Mauborgne

Personal financial software

High

Quicken software The pencils value curve

Relative offering level

Low

Price

Ease of use

Optional features

Speed of handling

Accuracy of handling

Key elements of product, service, and delivery

Intuit looked within its own industry personal nance management software and across complementary products, including the pencil, to understand why customers might choose one product over another.

competitors performance. This graphic depiction becomes what Value Innovators call a value curve. Value Innovation in Action Consider Intuits successful launch of Quicken, the software that enables users to manage their personal nances. Intuit looked at the personal nance management software industry and identied ve key value elements: price, ease of use, optional features, speed of handling, and accuracy of handling. (See Figure 1.) Then, it compared Quickens performance on these ve elements relative to alternative options available to customers, including traditional dual-entry accounting software and even the lowly pencil and calculator. By analyzing the relative performance of the contenders on the ve value elements, Intuit identied potentially fatal weaknesses in traditional personal nance management software (e.g., it was too complicated, expensive, and difcult to use) and in pencils and calculators (e.g., they take too long to use and dont guarantee accurate results). The company decided to dene Quickens unique value proposition to customers by: Eliminating many features included in most traditional personal nance management software.

Reducing the array of optional features offered, as well as lowering Quickens price. Raising the products ease of use. By implementing these changes, Intuit created a new, highly successful value curve for Quicken and went on to capture the personal nance software market. Pursuing Value Innovation: The Six Paths To gure out which value elements to eliminate, reduce, raise, or create in other words, to generate a new value curve Value Innovators use whats called the Six Paths Framework. (See Figure 2.) With this framework, you look across the following factors to identify ways to redene your value curve: Industries Strategic groups within the industry (such as one- and two-star hotels in the hospitality industry) The array of potential customers Complementary offerings Competing products functional or emotional appeal (e.g., Starbuckss hip look and cultural appeal) Time (e.g., identifying opportunities offered by impending industry trends)

To see what the Six Paths framework offers, lets take a look at a particularly spectacular Value Innovator: Cirque du Soleil. This Canada-based company, founded by former street performers, created a whole new value proposition and industry cost structure by focusing on two of the six Value Innovation paths: looking across industries and looking across the array of potential customers. Cirque du Soleil built on classic features of the big-league circus industry (such as acrobatics and clown performances) by adding elements from entirely separate industries (including opera, theater, rock music, and ballet). It also decided to target adult audiences more than children. By selecting these two paths, it realized it could expand its market and lower costs by: Eliminating animal acts (which typically account for 45 % of the circus industrys costs) as well as star performers (who often command fees of $5 to $10 million). Using those savings to raise the artistic, adult quality of the Cirque du Soleil experience (e.g., original music, a performance theme, elements of ballet, rened concessions such as champagne and chocolate-covered strawberries).

12

NovemberDecember 2003

Creating new value elements by designing an entirely different show every year. By using Value Innovation, Cirque du Soleil has come to dominate an industry that many analysts had dismissed as a dying breed. The company boasts among the highest repeat-business numbers in the circus industry and rakes in almost $600 million every year. Not bad for a a band of clowns and contortionists! Southwest Airlines has enjoyed similar success in this case, by looking across time to see how the impending deregulation of its industry might offer new opportunities. After considering the potential ramications of deregulation, Southwest cut out stops in pricey airports such as LaGuardia in New York City and avoided routes situated in highly congested airtravel corridors (such as the U.S. Northeast). It also trimmed in-ight food service providing passengers with small snack packs rather than full meal service. It has used the resulting savings to boost the quality and reliability of luggage handling, offer passengers affordable airfares,

and ensure on-time arrivals value elements prized by its customers. Thanks to Southwests Value Innovation, customers have become so enamored of the company that they go out of their way to y Southwest. Indeed, entire new ecosystems have cropped up around the airlines major hubs including generous parking and fast-food joints that let passengers pack whatever they want to eat on the plane. Moreover, the company appeals to multiple customer segments everyone from business travelers to budget-minded families traveling with their kids. In a time of great turmoil for most of the airline industry, Southwest has been able to maintain a dominant position and secure the loyalty of its customers. The Future of Strategy Formulation Strategy formulation and implementation continue to be works in progress constantly evolving as the business world changes form. With its focus on the precise formulation of strategy from the customers perspective, Value Innovation enables companies to lay a solid foundation for their

Value Innovators

Any company can be a Value Innovator. In addition to Intuit, Cirque du Soleil, and Southwest Airlines, the following rms have used Value Innovation to formulate a potent customer strategy: Bloomberg Financial News The Home Depot Ralph Lauren Starbucks Borders General Electric Swatch Formula One hotels Ryanair IKEA

strategy implementation making tools such as the Balanced Scorecard even more powerful. To Learn More Want to know more about Value Innovation? See the following articles by Kim and Mauborgne, published in Harvard Business Review (available at www.harvardbusinessonline.org): Tipping Point Leadership (April 2003) Charting Your Companys Future (June 2002)

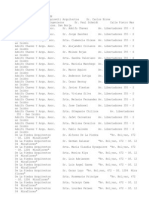

Figure 2. The Six Paths Framework

1. Across industries

Reduce What factors should be reduced well below the industry standard?

6. Across time/trends

Eliminate What factors should be eliminated that the industry has taken for granted?

2. Across strategic groups

Create What factors should be created that the industry never offered?

Creating New Market Space (January 1999) Knowing a Winning Business Idea When You See One (September 2000) Value Innovation: The Strategic Logic of High Growth (January 1997)

New value curve

5. Across functional or emotional appeal

Raise What factors should be raised well beyond the industry standard?

3. Across the chain of buyers

Source: Kim and Mauborgne

4. Across complementary offerings

Fair Process: Managing in the Knowledge Economy (JulyAugust 1997), named by HBRs editors in 2003 as one of the ve best classic articles on people and organizational motivation

Reprint #B0311D

The Six Paths framework provides a structured process for nding new value curves. 13 Excerpted from Balanced Scorecard Report Volume 5, Number 6 2003 by Harvard Business School Publishing and Palladium Group, Inc., and reprinted with permission.

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Monday To Friday: - Solihull To Coventry Via Catherine-de-Barnes, Hampton-in-Arden & MeridenDocument2 pagesMonday To Friday: - Solihull To Coventry Via Catherine-de-Barnes, Hampton-in-Arden & MeridenanuragrathorePas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Prepared by Iordanis Petsas To Accompany by Paul R. Krugman and Maurice ObstfeldDocument39 pagesPrepared by Iordanis Petsas To Accompany by Paul R. Krugman and Maurice ObstfeldNazish GulzarPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Table of ContensDocument17 pagesTable of ContensEcha SkeskeneweiiPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Basic Documents and Transactions Related To Bank DepositsDocument15 pagesBasic Documents and Transactions Related To Bank DepositsJessica80% (5)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- New Interchange: Student's Book IntroDocument7 pagesNew Interchange: Student's Book Introsaciaaa100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Part B - GR/PP Procedure Disposal of Copies of Export Declaration Forms 6B.1Document3 pagesPart B - GR/PP Procedure Disposal of Copies of Export Declaration Forms 6B.1Vimala Selvaraj VimalaPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- IRR and NPV Conflict - IllustartionDocument27 pagesIRR and NPV Conflict - IllustartionVaidyanathan RavichandranPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Insurance Company Final AccountsDocument17 pagesInsurance Company Final AccountsKirti_Bhatia_5739Pas encore d'évaluation

- 8294 PDFDocument174 pages8294 PDFManjeet Pandey100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Casino Regulatory Manual For Entertainment City Licensees Version 4Document366 pagesCasino Regulatory Manual For Entertainment City Licensees Version 4Paige Lim100% (2)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Exam2 Solutions 40610 2008Document8 pagesExam2 Solutions 40610 2008blackghostPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Kiat Penulisan Proposal PKM Unand - CahyadiDocument43 pagesKiat Penulisan Proposal PKM Unand - CahyadinugrahaPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Advantages and Disadvantages of CFSDocument4 pagesAdvantages and Disadvantages of CFSZeebaPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- CIFDocument2 pagesCIFSaikumar SelaPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Terex LiftaceDocument2 pagesTerex LiftaceEduardo SaaPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Delhi To Mumbai PDFDocument2 pagesDelhi To Mumbai PDFAshutosh YadavPas encore d'évaluation

- Business London's 20 Under 40 - London's New Economic TrailblazersDocument2 pagesBusiness London's 20 Under 40 - London's New Economic TrailblazersrtractionPas encore d'évaluation

- Partnership SBCDocument10 pagesPartnership SBChyosunglover100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Duke Energy Coal AllocationDocument4 pagesDuke Energy Coal AllocationSatish Kumar100% (1)

- IE CH 05-AnsDocument4 pagesIE CH 05-AnsHuo ZenPas encore d'évaluation

- New Ra April 2023Document279 pagesNew Ra April 2023Jagdamba OverseasPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Econ Practice Exam 2Document15 pagesEcon Practice Exam 2MKPas encore d'évaluation

- Dental Practice Training With Tracy StuartDocument2 pagesDental Practice Training With Tracy StuartChris BarrowPas encore d'évaluation

- List of Guest HousesDocument5 pagesList of Guest Housesramineedi6Pas encore d'évaluation

- PIT HomeworkDocument2 pagesPIT HomeworkNhi Nguyen0% (1)

- Lucian A 1Document17 pagesLucian A 1keylaelizabehtPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Brochure FT TBR Final 2018Document13 pagesBrochure FT TBR Final 2018Cico LisadonPas encore d'évaluation

- Elements of SCMDocument6 pagesElements of SCMPraveen ShuklaPas encore d'évaluation

- The Shift Towards Umbrella Branding Is Inescapable': Anandakuttan B UnnithanDocument1 pageThe Shift Towards Umbrella Branding Is Inescapable': Anandakuttan B UnnithanSandeep SinghPas encore d'évaluation

- Roller CoasterDocument3 pagesRoller CoasterDiego Chavez GomezPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)