Académique Documents

Professionnel Documents

Culture Documents

093 M 1 Solutions

Transféré par

Jackie Zhangwen ChenDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

093 M 1 Solutions

Transféré par

Jackie Zhangwen ChenDroits d'auteur :

Formats disponibles

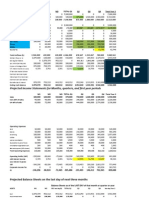

--- VERSION A --Balance Sheet

ASSETS

Cash Ppd Equipment Rental Supplies Ppd Office Rent Total Assets 2,424,800 3,400 2,200 9,000 2,439,400

Income Statement

Sales Salaries Expense Office Rent Expense Supplies Expense Interest Expense Equipment Rent Expense Net Income 22,000 5,000 250,000 350,000 1,634,400 150,000 15,000 13,000 2,439,400 1,500,000 522,000 104,000 12,700 6,200 2,400 852,700

LIABILITIES/OE

Salaries Payable Interest Payable Notes Payable Contributed Capital Retained Earnings Unearned Revenue Dividends Payable Accounts Payable Total L + OE

--- VERSION A --CFO, Indirect Method

Net Income:

Accounts Receivable Supplies Prepaid Rent Accounts Payable Interest Payable Unearned Revenue Salaries Payable Gain Loss Depreciation 840 -200 -300 -100 -200 -250 -100 500 -600 400 1,900 1,890

CFO, Direct Method

Revenue Accounts Receivable Unearned Revenue Cash from Customers Salaries Expense Salaries Payable Cash paid for Salaries Income Tax Expense Cash paid for Taxes Rent Expense Prepaid Rent Cash paid for Rent Interest Expense Interest Payable Cash paid for Interest Supplies Expense 14,000 -200 -100 13,700 6,300 -500 5,800 400 400 4,500 100 4,600 160 250 410 100

Cash Flow from Investing

Sale of PPE: Purchase of PPE: Sale of Investment: CFI: 550 -50 200 700

Cash Flow from Financing

Pay Note Payable: Dividends Paid: Contributed Capital CFF: -2,000 -370 580 -1,790

CFO:

--- VERSION B --Balance Sheet

ASSETS

Cash Ppd Equipment Rental Supplies Ppd Office Rent Total Assets 2,755,800 3,400 2,600 10,000 2,771,800

Income Statement

Sales Salaries Expense Office Rent Expense Supplies Expense Interest Expense Equipment Rent Expense Net Income 21,500 6,667 300,000 360,000 1,744,633 320,000 5,000 14,000 2,771,800 1,600,000 511,500 112,000 13,300 7,867 2,400 952,933

LIABILITIES/OE

Salaries Payable Interest Payable Notes Payable Contributed Capital Retained Earnings Unearned Revenue Dividends Payable Accounts Payable Total L + OE

--- VERSION B --CFO, Indirect Method

Net Income:

Accounts Receivable Supplies Prepaid Rent Accounts Payable Interest Payable Unearned Revenue Salaries Payable Gain Loss Depreciation 1,240 -300 -100 -200 -100 -350 -200 400 -600 400 1,900 2,090

CFO, Direct Method

Revenue Accounts Receivable Unearned Revenue Cash from Customers Salaries Expense Salaries Payable Cash paid for Salaries Income Tax Expense Cash paid for Taxes Rent Expense Prepaid Rent Cash paid for Rent Interest Expense Interest Payable Cash paid for Interest Supplies Expense 14,200 -300 -200 13,700 6,100 -400 5,700 400 400 4,400 200 4,600 260 350 610 100

Cash Flow from Investing

Sale of PPE: Purchase of PPE: Sale of Investment: CFI: 650 -100 100 650

Cash Flow from Financing

Pay Note Payable: Dividends Paid: Contributed Capital CFF: -1,950 -570 480 -2,040

CFO:

--- VERSION C --Balance Sheet

ASSETS

Cash Ppd Equipment Rental Supplies Ppd Office Rent Total Assets 3,115,800 3,400 2,700 11,000 3,132,900

Income Statement

Sales Salaries Expense Office Rent Expense Supplies Expense Interest Expense Equipment Rent Expense Net Income 24,800 8,333 350,000 450,000 1,750,767 510,000 25,000 14,000 3,132,900 1,700,000 580,800 120,000 13,200 9,533 2,400 974,067

LIABILITIES/OE

Salaries Payable Interest Payable Notes Payable Contributed Capital Retained Earnings Unearned Revenue Dividends Payable Accounts Payable Total L + OE

--- VERSION C --CFO, Indirect Method

Net Income:

Accounts Receivable Supplies Prepaid Rent Accounts Payable Interest Payable Unearned Revenue Salaries Payable Gain Loss Depreciation 940 -100 -400 -100 -300 -150 200 300 -600 300 1,800 1,890

CFO, Direct Method

Revenue Accounts Receivable Unearned Revenue Cash from Customers Salaries Expense Salaries Payable Cash paid for Salaries Income Tax Expense Cash paid for Taxes Rent Expense Prepaid Rent Cash paid for Rent Interest Expense Interest Payable Cash paid for Interest Supplies Expense Accounts Payable Incr. in Supplies Cash paid for Supplies 14,300 -100 200 14,400 6,600 -300 6,300 500 500 4,400 100 4,500 260 150 410 100 300 400 800 1,890

Cash Flow from Investing

Sale of PPE: Purchase of PPE: Sale of Investment: CFI: 650 -200 400 850

Cash Flow from Financing

Pay Note Payable: Dividends Paid: Contributed Capital CFF: -2,150 -70 380 -1,840

CFO:

CFO:

--- VERSION D --Balance Sheet

ASSETS

Cash Ppd Equipment Rental Supplies Ppd Office Rent Total Assets 3,317,800 3,400 3,300 12,000 3,336,500

Income Statement

Sales Salaries Expense Office Rent Expense Supplies Expense Interest Expense Equipment Rent Expense Net Income 21,000 10,000 400,000 390,000 1,805,500 680,000 15,000 15,000 3,336,500 1,700,000 501,000 128,000 13,600 11,200 2,400 1,043,800

LIABILITIES/OE

Salaries Payable Interest Payable Notes Payable Contributed Capital Retained Earnings Unearned Revenue Dividends Payable Accounts Payable Total L + OE

--- VERSION D --CFO, Indirect Method

Net Income:

Accounts Receivable Supplies Prepaid Rent Accounts Payable Interest Payable Unearned Revenue Salaries Payable Gain Loss Depreciation 1,240 -300 -100 -200 -100 -350 -200 400 -600 400 1,900 2,090

CFO, Direct Method

Revenue Accounts Receivable Unearned Revenue Cash from Customers Salaries Expense Salaries Payable Cash paid for Salaries Income Tax Expense Cash paid for Taxes Rent Expense Prepaid Rent Cash paid for Rent Interest Expense Interest Payable Cash paid for Interest Supplies Expense Accounts Payable Incr. in Supplies Cash paid for Supplies 14,200 -300 -200 13,700 6,100 -400 5,700 400 400 4,400 200 4,600 260 350 610 100 100 100 300 2,090

Cash Flow from Investing

Sale of PPE: Purchase of PPE: Sale of Investment: CFI: 650 -100 100 650

Cash Flow from Financing

Pay Note Payable: Dividends Paid: Contributed Capital CFF: -1,950 -570 480 -2,040

CFO:

CFO:

FINANCIAL STATEMENT ANALYSIS

--- ALL VERSIONS --Current Ratio = Asset Turnover = Profit Margin = Return on Equity = EBITDA =

1.0625 0.3269 0.1471 0.2632 3400

or

or or

1.3750 0.2982

0.1724

Vous aimerez peut-être aussi

- Equity ValuationDocument2 424 pagesEquity ValuationMuteeb Raina0% (1)

- 11 Accountancy Notes Ch08 Financial Statements of Sole Proprietorship 02Document9 pages11 Accountancy Notes Ch08 Financial Statements of Sole Proprietorship 02Anonymous NSNpGa3T93100% (1)

- 1 2 3 4 5 6 7 8 9 File Name: C:/Courses/Course Materials/3 Templates and Exercises M&A Models/LBO Shell - Xls Colour CodesDocument46 pages1 2 3 4 5 6 7 8 9 File Name: C:/Courses/Course Materials/3 Templates and Exercises M&A Models/LBO Shell - Xls Colour CodesfdallacasaPas encore d'évaluation

- Statement of Cash FlowsDocument16 pagesStatement of Cash FlowsWeng Torres AllonPas encore d'évaluation

- Proposal of Chart of Account For Execpro ResourcesDocument4 pagesProposal of Chart of Account For Execpro ResourcesinfoexecproPas encore d'évaluation

- Apple Inc. - Dupont Analysis For Class-1 - Group - 11Document24 pagesApple Inc. - Dupont Analysis For Class-1 - Group - 11Anurag SharmaPas encore d'évaluation

- Kapoor Case StudyDocument13 pagesKapoor Case StudyBristi ChoudhuryPas encore d'évaluation

- The Seven Centers of Management Attention HTTH e Hese en ...Document3 pagesThe Seven Centers of Management Attention HTTH e Hese en ...Marquise GinesPas encore d'évaluation

- Chapter 23 - Worksheet and SolutionsDocument21 pagesChapter 23 - Worksheet and Solutionsangelbear2577Pas encore d'évaluation

- Case Analysis - Dr. Pepper Snapple Group, Inc.Document18 pagesCase Analysis - Dr. Pepper Snapple Group, Inc.greddyteg100% (1)

- Uniform Auditing and Accounting Guide - AASHTODocument236 pagesUniform Auditing and Accounting Guide - AASHTOscimpean1913100% (1)

- Prep Trading - Profit-And-Loss-Ac Balance SheetDocument25 pagesPrep Trading - Profit-And-Loss-Ac Balance Sheetfaltumail379100% (1)

- Channel Strategy and PlanDocument13 pagesChannel Strategy and Planapi-3831256100% (1)

- Lecture 3 Week 3 PPT 3Document39 pagesLecture 3 Week 3 PPT 3Li Lin100% (1)

- Ultimate Binary Options e BookDocument45 pagesUltimate Binary Options e BookJayPas encore d'évaluation

- CBSE Class 12 Accountancy - Cash Flow StatementDocument14 pagesCBSE Class 12 Accountancy - Cash Flow StatementVandna Bhaskar38% (8)

- Cash Flow StatementDocument28 pagesCash Flow StatementJaan Sonu100% (2)

- Use of TemplateDocument13 pagesUse of Templatesachin2727Pas encore d'évaluation

- Book 1Document14 pagesBook 1Jap Ibe100% (2)

- Financial Analysis & Reporting Part II Course I - Oral VersionDocument53 pagesFinancial Analysis & Reporting Part II Course I - Oral VersionantoinePas encore d'évaluation

- Dyeing CalculationDocument6 pagesDyeing CalculationRihan Ahmed RubelPas encore d'évaluation

- Umer Solution 2Document21 pagesUmer Solution 2shoaiba1Pas encore d'évaluation

- Sales 204,490: Opening Inventory PurchasesDocument15 pagesSales 204,490: Opening Inventory PurchasesvickylePas encore d'évaluation

- Sanchez Daisy A1Document12 pagesSanchez Daisy A1api-300102702Pas encore d'évaluation

- Accy 517 HW PB Set 1Document30 pagesAccy 517 HW PB Set 1YonghoChoPas encore d'évaluation

- Annex HDocument45 pagesAnnex HImelda BugasPas encore d'évaluation

- Sheet1: Indirect Method - Operating Cash Direct Method - Operating CashDocument7 pagesSheet1: Indirect Method - Operating Cash Direct Method - Operating CashJayesh MahajanPas encore d'évaluation

- BDP Financial Final PartDocument14 pagesBDP Financial Final PartDeepak G.C.Pas encore d'évaluation

- PC DepotDocument94 pagesPC DepotShani Dev0% (1)

- Pretty Me Financial Statements: Assets Liabilities and EquityDocument3 pagesPretty Me Financial Statements: Assets Liabilities and EquityThien NguyenPas encore d'évaluation

- HorngrenIMA14eSM ch16Document53 pagesHorngrenIMA14eSM ch16Piyal HossainPas encore d'évaluation

- Cash Flow - Fund Flow - Cash ForecastsDocument22 pagesCash Flow - Fund Flow - Cash ForecastsAkhil Vashishtha100% (1)

- Statement of Cash FlowsDocument36 pagesStatement of Cash FlowsLoida Yare Laurito100% (1)

- Projected Income Statements For Months, Quarters, and First Year PeriodsDocument5 pagesProjected Income Statements For Months, Quarters, and First Year Periodssarakhan0622Pas encore d'évaluation

- Sales: Proforma Income StatementDocument2 pagesSales: Proforma Income StatementIshpal SinghPas encore d'évaluation

- Principles of Accounting Simulation - Student's Answer - Excel FileDocument55 pagesPrinciples of Accounting Simulation - Student's Answer - Excel FilekoopamonsterPas encore d'évaluation

- Chapter 07 - Accounting Information SystemsDocument21 pagesChapter 07 - Accounting Information SystemsflowerkmPas encore d'évaluation

- IAS 7 Statement of Cash FlowsDocument28 pagesIAS 7 Statement of Cash FlowsEynar MahmudovPas encore d'évaluation

- Cash Flow STMTDocument2 pagesCash Flow STMTpadmanabha1979Pas encore d'évaluation

- Results: Simulation: Co. Name: C: YearDocument5 pagesResults: Simulation: Co. Name: C: Yeargarima_kukreja_dcePas encore d'évaluation

- Financial Statements: BAO6504 Accounting For ManagementDocument20 pagesFinancial Statements: BAO6504 Accounting For ManagementDaud SulaimanPas encore d'évaluation

- Cash Flow Statemen IndirectDocument2 pagesCash Flow Statemen IndirectSakshi GuptaPas encore d'évaluation

- Cash Flow Analysis: 15.511 Corporate AccountingDocument31 pagesCash Flow Analysis: 15.511 Corporate AccountingAnanda RamanPas encore d'évaluation

- Cash FlowDocument4 pagesCash FlowGlenn Aquino ÜPas encore d'évaluation

- Cash Flow: Dadasaheb Narale Roll No.10 Sinhgad Institute of Business ManagementDocument20 pagesCash Flow: Dadasaheb Narale Roll No.10 Sinhgad Institute of Business Managementaftabkhan21Pas encore d'évaluation

- Preparing The Statement of Cash Flows-Indirect MethodDocument11 pagesPreparing The Statement of Cash Flows-Indirect MethodMelvin ZefanyaPas encore d'évaluation

- Bplan FinancialsDocument8 pagesBplan FinancialsInder KeswaniPas encore d'évaluation

- AMDM Ch.3 SolDocument5 pagesAMDM Ch.3 SolrssnathanPas encore d'évaluation

- Cash Flow Statements (FRS 1) : A2 Level Accounting - Resources, Past Papers, Notes, Exercises & QuizesDocument6 pagesCash Flow Statements (FRS 1) : A2 Level Accounting - Resources, Past Papers, Notes, Exercises & QuizesCross MatricPas encore d'évaluation

- Fd2dbTraditional & Mordern Formats of Finanancial StatementsDocument6 pagesFd2dbTraditional & Mordern Formats of Finanancial StatementsAmitesh PandeyPas encore d'évaluation

- Solutions To Problem Set ADocument5 pagesSolutions To Problem Set AGalih Eka PutraPas encore d'évaluation

- NumberDocument2 pagesNumberHelplinePas encore d'évaluation

- Laundry - System Analysis and Design - (Excel Linking)Document10 pagesLaundry - System Analysis and Design - (Excel Linking)JO SAPas encore d'évaluation

- Balane SheetDocument33 pagesBalane SheetOswinda GomesPas encore d'évaluation

- D/S Cover Computation: Trading Profit & Loss A/CDocument4 pagesD/S Cover Computation: Trading Profit & Loss A/CRajeev NiroshanPas encore d'évaluation

- FUNDAMENTALS OF ACCOUNTANCY BUSINESS AND MANAGEMENT PPP 1Document185 pagesFUNDAMENTALS OF ACCOUNTANCY BUSINESS AND MANAGEMENT PPP 1Janelle Dela Cruz100% (1)

- BuwisDocument23 pagesBuwisshineneigh00Pas encore d'évaluation

- Cashflowstatement IMPDocument30 pagesCashflowstatement IMPAshish SinghalPas encore d'évaluation

- CummingmDocument259 pagesCummingmfasanoj5211Pas encore d'évaluation

- Asset: Exercise 1. Project Cost and Disbursement Schedule (In Thousand)Document12 pagesAsset: Exercise 1. Project Cost and Disbursement Schedule (In Thousand)kjmarts08Pas encore d'évaluation

- Cost-Based POC MethodDocument5 pagesCost-Based POC Methodkkka TtPas encore d'évaluation

- Financial Statement Analysis Ticker: Periodicity: Annuals Filing: Filing: For The Period Ending 2009-12-30 2010-12-30Document19 pagesFinancial Statement Analysis Ticker: Periodicity: Annuals Filing: Filing: For The Period Ending 2009-12-30 2010-12-30Mohammad ShahraeeniPas encore d'évaluation

- ACC206 Guidance Report Week OneDocument25 pagesACC206 Guidance Report Week OneAssignment writers140% (1)

- The Balance Sheet Example: Current AssetsDocument4 pagesThe Balance Sheet Example: Current AssetsLegogie Moses AnoghenaPas encore d'évaluation

- Bharath.H.S Mrinalini Nirmal Dev Shradha Shetty V Shetty DurgaprasadDocument14 pagesBharath.H.S Mrinalini Nirmal Dev Shradha Shetty V Shetty DurgaprasadMrinalini RavindranathPas encore d'évaluation

- Nomer 8 Ujian MKDocument5 pagesNomer 8 Ujian MKnoortiaPas encore d'évaluation

- Control Obj For Non-Current AssetsDocument6 pagesControl Obj For Non-Current AssetsTrần TùngPas encore d'évaluation

- Supplier PartnershipDocument19 pagesSupplier PartnershipMian Roshaan WasimPas encore d'évaluation

- Advantage SolutionsDocument4 pagesAdvantage SolutionsRadhika YadavPas encore d'évaluation

- ISC Economics XI XIIDocument8 pagesISC Economics XI XIIDev KhariPas encore d'évaluation

- Channel Design & ImplementationDocument19 pagesChannel Design & ImplementationSiddharth SrivastavaPas encore d'évaluation

- KPMG GSDocument4 pagesKPMG GSAswath ChandrasekarPas encore d'évaluation

- Class 12 CBSE ISC Accountancy Assignment 10Document15 pagesClass 12 CBSE ISC Accountancy Assignment 10studentPas encore d'évaluation

- Marketing (Pob)Document7 pagesMarketing (Pob)Joshua BrownPas encore d'évaluation

- The Cost of Capital Lecture (Revised)Document50 pagesThe Cost of Capital Lecture (Revised)Ranin, Manilac Melissa S50% (4)

- Journal or Day BookDocument42 pagesJournal or Day BookRaviSankar100% (1)

- MKTG201 Fundamentals of MarketingDocument10 pagesMKTG201 Fundamentals of MarketingG JhaPas encore d'évaluation

- Chapter 1Document19 pagesChapter 1Cresselle Ann GarciaPas encore d'évaluation

- Amul Sip ProposalDocument15 pagesAmul Sip ProposalRakesh MishraPas encore d'évaluation

- Quizlet Econ 303Document29 pagesQuizlet Econ 303Kim TaehyungPas encore d'évaluation

- Pr1 Chapter 1Document18 pagesPr1 Chapter 1アポロニオ モナPas encore d'évaluation

- Break-Even Analysis - LinearDocument2 pagesBreak-Even Analysis - LinearJoshua MarianoPas encore d'évaluation

- Topic 1.1 Cost BehaviorDocument51 pagesTopic 1.1 Cost BehaviorGaleli PascualPas encore d'évaluation

- Chapter 3 - TheoriesDocument10 pagesChapter 3 - TheoriesXynith Nicole RamosPas encore d'évaluation

- AnalysisDocument34 pagesAnalysisIndraneel MahantiPas encore d'évaluation

- Christa Clothing InternationalDocument15 pagesChrista Clothing Internationalaquib ansariPas encore d'évaluation

- Ratio Analysis and Comparison of Two CompaniesDocument28 pagesRatio Analysis and Comparison of Two Companiesmadhu hotwaniPas encore d'évaluation

- Chap 7 - Cost-Volume-Profit AnalysisDocument9 pagesChap 7 - Cost-Volume-Profit Analysislalith4uPas encore d'évaluation

- Eje 2 E-Commerce Exploracion de Estrategias de Marketing DigitalDocument12 pagesEje 2 E-Commerce Exploracion de Estrategias de Marketing DigitalAlonso Mera SabalzaPas encore d'évaluation