Académique Documents

Professionnel Documents

Culture Documents

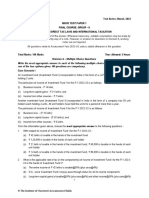

Penalty U/s Nature of Default Amount of Penalty Power To Levy Note

Transféré par

rajeshutkurTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Penalty U/s Nature of Default Amount of Penalty Power To Levy Note

Transféré par

rajeshutkurDroits d'auteur :

Formats disponibles

Penalty u/s

Nature of default

Amount of penalty

Power to levy

Note

221(1)

Failure to pay the whole or part of tax or interest Min. As determined by AO or both in accordance with the provisions of Max. Tax in arrears sec.140A Failure to keep, maintain or retain books of accounts, documents required u/s 44AA Failure to keep and maintain information & documents u/s 92D(1) & (2) Rs.25000 2% of the value of Intl.Transaction for each such failure

271A

271AA

271AAA

Failure to admit substantiated undisclosed source of income in the course of Search u/s 132(4)*

10% of undisclosed income

271B

Failure to get accounts audited or to furnish a report of such audit as required u/s 44AB Failure to furnish report from an accountant required u/s 92E

0.5% of Gross Receipts or Rs.1.5 lakhs Rs.1 lakh

271BA

271C

Failure to deduct/pay whole or any part of tax u/s Amount equal to tax which has 115-O or 194B not been decuted/ paid Failure to collect whole or part of tax Any loan or deposit takne or accepted in contravention of sec.269SS Any loan or deposit which is repaid in contravention of sec.269T Failure to furnish a return of income u/s 139(1) or by its proviso, befor the end of the relevant AY Amount equal to amount of tax not collected Amount equal to the loan or deposit taken or accepted Amount equal to the loan or deposit which is repaid Rs.5000

271CA

271D

10 271E

11 271F

If the assessee proves to the satisfaction of the AO that he was prevented by reasonable cause, no penalty shall be levied. (Sec.273B) If the assessee proves to the satisfaction of the AO that he AO / CIT(A) was prevented by reasonable cause, no penalty shall be levied. (Sec.273B) If the assessee proves to the satisfaction of the AO that he AO / CIT(A) was prevented by reasonable cause, no penalty shall be levied. (Sec.273B) * A statement admitting undisclosed income and specifying manner in which such income is derived is obtained from the assessee; when assessee substantiates the manner in which AO the undislosed income was derived; and when assessee pays the tax together with interest if any in respect of the undisclosed income. If the assessee proves to the satisfaction of the AO that he AO was prevented by reasonable cause, no penalty shall be levied. (Sec.273B) If the assessee proves to the satisfaction of the AO that he AO was prevented by reasonable cause, no penalty shall be levied. (Sec.273B) If the assessee proves to the satisfaction of the AO that he JCIT was prevented by reasonable cause, no penalty shall be levied. (Sec.273B) If the assessee proves to the satisfaction of the AO that he JCIT was prevented by reasonable cause, no penalty shall be levied. (Sec.273B) If the assessee proves to the satisfaction of the AO that he JCIT was prevented by reasonable cause, no penalty shall be levied. (Sec.273B) If the assessee proves to the satisfaction of the AO that he JCIT was prevented by reasonable cause, no penalty shall be levied. (Sec.273B) If the assessee proves to the satisfaction of the AO that he AO was prevented by reasonable cause, no penalty shall be levied. (Sec.273B) AO

12 271FA

13 271FB

14 271G

15 271(1)(b) 16 271(1)(c) 17 271(1)(d)

18

272A(1)(a) & (b)

19 272A(1)(c)

20 272A(2)(a)

21 272A(2)(b)

22 272A(2)(c)

23 272A(2)(d)

24 272A(2)(e)

If the assessee proves to the satisfaction of the AO that he was prevented by reasonable cause, no penalty shall be levied. (Sec.273B) If the assessee proves to the satisfaction of the AO that he Failure to furnish the return of FB u/s 115WD(1) Rs.100 per day AO was prevented by reasonable cause, no penalty shall be levied. (Sec.273B) 2% of the value of If the assessee proves to the satisfaction of the AO that he Failure to furnish information or document u/s Intl.Transaction for each such AO / CIT(A) was prevented by reasonable cause, no penalty shall be 92D(3) failure levied. (Sec.273B) Failure to comply with a notice u/s If the assessee proves to the satisfaction of the AO that he AO / CIT(A) 142(1)/143(2)/ 115WD(2)/115WE(2) or failure to Rs.10,000 for each such default was prevented by reasonable cause, no penalty shall be / CIT comply with 142(2A) levied. (Sec.273B) Concealing particulars of or furnishing Min.100% of tax evaded AO / CIT(A) Sec. 273B is not applicable inaccurate particulars of such income Max.300% of tax evaded / CIT If the assessee proves to the satisfaction of the AO that he Concealing particulars of or furnishing Min.100% of tax evaded AO / CIT(A) was prevented by reasonable cause, no penalty shall be inaccurate particulars of such fringe benefits Max.300% of tax evaded / CIT levied. (Sec.273B) Failure to state tha truth of any matter touching JCIT, JDIT If the assessee proves to the satisfaction of the AO that he the subject of assessment or to answer any Rs.10000 for each such failure or or Higher was prevented by reasonable cause, no penalty shall be question or sign any statement demanded by IT default authority levied. (Sec.273B) authority Failure to comply with summons issued JCIT, JDIT If the assessee proves to the satisfaction of the AO that he Rs.10000 for each such failure or u/s131(1) as to attend or produce books or or Higher was prevented by reasonable cause, no penalty shall be default documents at a certain place and time. authority levied. (Sec.273B) JCIT, JDIT If the assessee proves to the satisfaction of the AO that he Failure to comply with notice issued u/s 94(6) Rs.100 per day or Higher was prevented by reasonable cause, no penalty shall be reg furnishing of infn of securities, etc. authority levied. (Sec.273B) JCIT, JDIT If the assessee proves to the satisfaction of the AO that he Failure to give notice of discontinuance of Rs.100 per day or Higher was prevented by reasonable cause, no penalty shall be business or profession u/s 176(3) authority levied. (Sec.273B) Rs.100 per day. For default u/s Failure to furnish in due time any of the returns, JCIT, JDIT If the assessee proves to the satisfaction of the AO that he 206 & 206C penalty cannot statements or particulars mentioned in secs.133, or Higher was prevented by reasonable cause, no penalty shall be exceed the amount of tax 206, 206C or 285B authority levied. (Sec.273B) deductible or collectible JCIT, JDIT If the assessee proves to the satisfaction of the AO that he Failure to allow inspection of any register as per Rs.100 per day or Higher was prevented by reasonable cause, no penalty shall be sec.134 to allow copies of such register authority levied. (Sec.273B) JCIT, JDIT If the assessee proves to the satisfaction of the AO that he Non filing of ROI u/s 139(4A) & 139(4C) or delay Rs.100 per day or Higher was prevented by reasonable cause, no penalty shall be in filing authority levied. (Sec.273B) Failure to furnish Annual Return u/s 285BA Rs.100 per day Approved authority

25 272A(2)(f)

Failure to deliver or cause to be delivered in due Rs.100 per day subject to a max CIT / CCIT time a copy of declaration in Form 15G/15H of tax deductible/collectible Failure to furnish a certificate of TDS/TCS u/s 203 /206C Failure to deduct and pay tax as required by sec.226(2) JCIT, JDIT Rs.100 per day subject to a max or Higher of tax deductible/collectible authority JCIT, JDIT Rs.100 per day or Higher authority JCIT, JDIT Rs.100 per day or Higher authority JCIT, JDIT Rs.100 per day or Higher authority JCIT, JDIT Rs.100 per day subject to a max or Higher of tax deductible/collectible authority JCIT, JDIT Rs.100 per day or Higher authority JCIT, JDIT Rs.100 per day or Higher authority Rs.10000 for each such failure or AO default Rs.10000 AO

26 272A(2)(g)

27 272A(2)(h)

28 272A(2)(i) Failure to furnish a statement u/s 192(2C)

29 272A(2)(j) Failure to deliver copy of declration Failure to deliver quarterly statement of TDS & TCS Failure to furnish quarterly return of interest payment without TDS u/s194A Failure to comply with provisions of sec.133B Failure to comply with Sec.139A or quoting or intimating wrong PAN Failure to get or to quote TAN in challans, certificates, returns, etc. Failure to comply with provisions of sec 206CA

30 272A(2)(k)

31 272A(2)(l)

32 272AA

33 272B

34 272BB

35 272BBB

Rs.10000

AO

If the assessee proves to the satisfaction of the AO that he was prevented by reasonable cause, no penalty shall be levied. (Sec.273B) If the assessee proves to the satisfaction of the AO that he was prevented by reasonable cause, no penalty shall be levied. (Sec.273B) If the assessee proves to the satisfaction of the AO that he was prevented by reasonable cause, no penalty shall be levied. (Sec.273B) If the assessee proves to the satisfaction of the AO that he was prevented by reasonable cause, no penalty shall be levied. (Sec.273B) If the assessee proves to the satisfaction of the AO that he was prevented by reasonable cause, no penalty shall be levied. (Sec.273B) If the assessee proves to the satisfaction of the AO that he was prevented by reasonable cause, no penalty shall be levied. (Sec.273B) If the assessee proves to the satisfaction of the AO that he was prevented by reasonable cause, no penalty shall be levied. (Sec.273B) If the assessee proves to the satisfaction of the AO that he was prevented by reasonable cause, no penalty shall be levied. (Sec.273B) If the assessee proves to the satisfaction of the AO that he was prevented by reasonable cause, no penalty shall be levied. (Sec.273B) If the assessee proves to the satisfaction of the AO that he was prevented by reasonable cause, no penalty shall be levied. (Sec.273B) If the assessee proves to the satisfaction of the AO that he was prevented by reasonable cause, no penalty shall be levied. (Sec.273B)

Vous aimerez peut-être aussi

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionD'EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionPas encore d'évaluation

- PenaltiesDocument33 pagesPenaltiesAshok HirparaPas encore d'évaluation

- Penalties Chart Under Income TaxDocument6 pagesPenalties Chart Under Income TaxFathima SulaimanPas encore d'évaluation

- Direct Tax Laws Detail Test 1 May 2024 Test Paper 1702105507Document9 pagesDirect Tax Laws Detail Test 1 May 2024 Test Paper 1702105507shauryagupta20013007Pas encore d'évaluation

- Rajesh Kumar Sharma - Submission Before ITAT - Penalty - 201617Document6 pagesRajesh Kumar Sharma - Submission Before ITAT - Penalty - 201617sssadangiPas encore d'évaluation

- Ganaesmurthy Form16Document4 pagesGanaesmurthy Form16sundar1111Pas encore d'évaluation

- Thirumoorthy Form16Document4 pagesThirumoorthy Form16sundar1111Pas encore d'évaluation

- Ashokkumar Form 16Document4 pagesAshokkumar Form 16sundar1111Pas encore d'évaluation

- Penalty and ProsecutionsDocument50 pagesPenalty and ProsecutionsSatish BhadaniPas encore d'évaluation

- Babu Form 16Document4 pagesBabu Form 16sundar1111Pas encore d'évaluation

- 78728bos63016 p3Document34 pages78728bos63016 p3dileepkarumuri93Pas encore d'évaluation

- Form 3CD NewDocument16 pagesForm 3CD NewRikta KariaPas encore d'évaluation

- MTP 12 17 Questions 1696512917Document11 pagesMTP 12 17 Questions 1696512917harshallahotPas encore d'évaluation

- CA Final DT Q MTP 1 May 23Document10 pagesCA Final DT Q MTP 1 May 23Mayur JoshiPas encore d'évaluation

- Test Series: March, 2023 Mock Test Paper 1 Final Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument10 pagesTest Series: March, 2023 Mock Test Paper 1 Final Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionSagar ShahPas encore d'évaluation

- CSDocument26 pagesCSAnjuElsaPas encore d'évaluation

- Anil Kumar Bhatia and Ors Vs Asstt Commissioner ofID100010COM554512Document10 pagesAnil Kumar Bhatia and Ors Vs Asstt Commissioner ofID100010COM554512Jung AleehsusPas encore d'évaluation

- Irc XiDocument301 pagesIrc XihenrydpsinagaPas encore d'évaluation

- Penalties & ProsecutionDocument9 pagesPenalties & Prosecutions4sahith100% (1)

- Income Tax FormatDocument2 pagesIncome Tax FormatmanmohanibcsPas encore d'évaluation

- Income Tax Savings Declaration Form EngDocument2 pagesIncome Tax Savings Declaration Form EngDedyTo'tedongPas encore d'évaluation

- 21 4 2018 Ca Devendra Jain Penalty 270aDocument31 pages21 4 2018 Ca Devendra Jain Penalty 270adhanishta906Pas encore d'évaluation

- Backup Withholding - What Is It and How Can I Obtain A RefundDocument35 pagesBackup Withholding - What Is It and How Can I Obtain A RefundAyodeji Badaki100% (1)

- Instructions ITR7 AY2020 21Document80 pagesInstructions ITR7 AY2020 21Ipsita DasPas encore d'évaluation

- Milton Form16Document4 pagesMilton Form16sundar1111Pas encore d'évaluation

- Accounts & Financial Returns Inspection ChecklistDocument2 pagesAccounts & Financial Returns Inspection ChecklistGilbert Bera - PatjolePas encore d'évaluation

- Offences and Prosecution Under Income Tax ActDocument8 pagesOffences and Prosecution Under Income Tax Actnahar_sv1366Pas encore d'évaluation

- Income Tax Appeal Vaish AssociatesDocument35 pagesIncome Tax Appeal Vaish AssociatesvineetPas encore d'évaluation

- CGB Supplement 2014 - RemediesDocument4 pagesCGB Supplement 2014 - RemediesrodgermatthewPas encore d'évaluation

- Notice PDFDocument7 pagesNotice PDFsachme1998Pas encore d'évaluation

- Itr-7 FaqDocument14 pagesItr-7 FaqAshwin KumarPas encore d'évaluation

- Instructions To Form ITR-7 (A.Y. 2020-21) : Page 1 of 79Document79 pagesInstructions To Form ITR-7 (A.Y. 2020-21) : Page 1 of 79Ravindra PoojaryPas encore d'évaluation

- Central Board of Direct Taxes, E-Filing Project: ITR 1 - Validation Rules For AY 2017-18Document7 pagesCentral Board of Direct Taxes, E-Filing Project: ITR 1 - Validation Rules For AY 2017-18Vijaykumar ChalwadiPas encore d'évaluation

- Central Board of Direct Taxes, E-Filing Project: ITR 1 - Validation Rules For AY 2017-18Document7 pagesCentral Board of Direct Taxes, E-Filing Project: ITR 1 - Validation Rules For AY 2017-18Priya mishraPas encore d'évaluation

- Q 10 Edtea 23-24Document53 pagesQ 10 Edtea 23-24hadj menPas encore d'évaluation

- P15Document17 pagesP15sogoja2705Pas encore d'évaluation

- INCOME TAX: CIT (A) Cannot Summarily Dismiss Appeal in Case of The Non-Appearance of Assessee-AppellantDocument9 pagesINCOME TAX: CIT (A) Cannot Summarily Dismiss Appeal in Case of The Non-Appearance of Assessee-Appellant911 SupportPas encore d'évaluation

- Levy of Penalties, Heads of Income & Aggregation of Income Under Income Tax ActDocument45 pagesLevy of Penalties, Heads of Income & Aggregation of Income Under Income Tax ActJitendra VernekarPas encore d'évaluation

- Chelladurai Form16Document4 pagesChelladurai Form16sundar1111Pas encore d'évaluation

- Chinnaduran Form16Document4 pagesChinnaduran Form16sundar1111Pas encore d'évaluation

- 2022-10-19 CorrigendumDocument3 pages2022-10-19 CorrigendumSukalyan BasuPas encore d'évaluation

- Consequences of Tds FailureDocument2 pagesConsequences of Tds FailureMahaveer DhelariyaPas encore d'évaluation

- MTP 15 28 Answers 1703566022Document11 pagesMTP 15 28 Answers 1703566022nilesh.nkj1325Pas encore d'évaluation

- Adjudication Order Against Consolidated Securities Ltd. in The Matter of Asian Oilfield Services Ltd.Document13 pagesAdjudication Order Against Consolidated Securities Ltd. in The Matter of Asian Oilfield Services Ltd.Shyam SunderPas encore d'évaluation

- Issues Related To Taxation of NPOsDocument17 pagesIssues Related To Taxation of NPOsCA Poonam GuptaPas encore d'évaluation

- Penalty For Concealment of IncomeDocument18 pagesPenalty For Concealment of IncomeRaj_Kumar_FCAPas encore d'évaluation

- CBDT - E-Filing - ITR 1 - Validation RulesDocument15 pagesCBDT - E-Filing - ITR 1 - Validation Rulesshadab qureshiPas encore d'évaluation

- Best Judgment AssessmentDocument9 pagesBest Judgment AssessmentkagalwalaaPas encore d'évaluation

- Sanjay Kumar Agarwal PDFDocument68 pagesSanjay Kumar Agarwal PDFvaabscaPas encore d'évaluation

- Form-12BB 2019-20Document1 pageForm-12BB 2019-20sabir aliPas encore d'évaluation

- Delhi ITAT (Bar) Reports - December 2020Document23 pagesDelhi ITAT (Bar) Reports - December 2020PARVATI KUMARIPas encore d'évaluation

- Annexure To Income Tax CircularDocument6 pagesAnnexure To Income Tax CircularDipti BhanjaPas encore d'évaluation

- Solution CA Inter TaxationDocument17 pagesSolution CA Inter TaxationBhola Shankar PrasadPas encore d'évaluation

- ViewPDF AspxDocument3 pagesViewPDF AspxAllan DerickPas encore d'évaluation

- Income Tax Calculator F.Y.12-13Document4 pagesIncome Tax Calculator F.Y.12-13reamer27Pas encore d'évaluation

- 2008 Jun - Question Paper F8 Audit PDFDocument5 pages2008 Jun - Question Paper F8 Audit PDFCool RapperPas encore d'évaluation

- 1.gnutti Carlo - Tax Audit - 2023 - 27.10.2023Document30 pages1.gnutti Carlo - Tax Audit - 2023 - 27.10.2023ssb.corporateteamPas encore d'évaluation

- Annex VII E3h8 Expendverif enDocument22 pagesAnnex VII E3h8 Expendverif ensdiamanPas encore d'évaluation

- Wiley Practitioner's Guide to GAAS 2016: Covering all SASs, SSAEs, SSARSs, PCAOB Auditing Standards, and InterpretationsD'EverandWiley Practitioner's Guide to GAAS 2016: Covering all SASs, SSAEs, SSARSs, PCAOB Auditing Standards, and InterpretationsPas encore d'évaluation

- RegularRetAnx2 RemDocument1 pageRegularRetAnx2 RemrajeshutkurPas encore d'évaluation

- RBI Guidelines For NPADocument46 pagesRBI Guidelines For NPADowlathAhmedPas encore d'évaluation

- E DiaryDocument14 pagesE DiaryrajeshutkurPas encore d'évaluation

- Audit Commands For FinacleDocument3 pagesAudit Commands For FinacleDavinder Kaur Oberoi100% (1)

- Audit Commands For FinacleDocument3 pagesAudit Commands For FinacleDavinder Kaur Oberoi100% (1)

- Audit Commands For FinacleDocument3 pagesAudit Commands For FinacleDavinder Kaur Oberoi100% (1)

- Audit Commands For FinacleDocument3 pagesAudit Commands For FinacleDavinder Kaur Oberoi100% (1)

- Datewise Vat 2007 033Document6 pagesDatewise Vat 2007 033rajeshutkurPas encore d'évaluation

- Form 105Document2 pagesForm 105rajeshutkurPas encore d'évaluation

- Mvat f709Document1 pageMvat f709pavanthapaPas encore d'évaluation

- Form 105Document2 pagesForm 105rajeshutkurPas encore d'évaluation

- Additional Check List For Indian Citizen Residing Abroad, Foreign Citizen and Other Than Individual (Like Company or Trust or Firm Etc.) PAN ApplicantsDocument7 pagesAdditional Check List For Indian Citizen Residing Abroad, Foreign Citizen and Other Than Individual (Like Company or Trust or Firm Etc.) PAN ApplicantsMiheer JesraniPas encore d'évaluation

- Form 708Document1 pageForm 708rajeshutkurPas encore d'évaluation

- Form 708Document1 pageForm 708rajeshutkurPas encore d'évaluation

- SafeScrypt Subscription Form PDFDocument1 pageSafeScrypt Subscription Form PDFManu SolomonPas encore d'évaluation

- Afakjsj AdfslfDocument1 pageAfakjsj AdfslfrajeshutkurPas encore d'évaluation

- E I TransactionDocument15 pagesE I TransactionmbhuvPas encore d'évaluation

- Afakjsj AdfslfDocument1 pageAfakjsj AdfslfrajeshutkurPas encore d'évaluation

- Afakjsj AdfslfDocument1 pageAfakjsj AdfslfrajeshutkurPas encore d'évaluation

- VAT ChallanDocument2 pagesVAT Challanrajeshutkur0% (1)

- VAT Rate ScheduleDocument34 pagesVAT Rate Schedulecasantosh8Pas encore d'évaluation

- VAT ChallanDocument2 pagesVAT Challanrajeshutkur0% (1)

- VAT ChallanDocument2 pagesVAT Challanrajeshutkur0% (1)

- AmzonDocument18 pagesAmzonrajeshutkurPas encore d'évaluation

- Sa Aug11 Ifrs9Document7 pagesSa Aug11 Ifrs9jiteshrohraPas encore d'évaluation

- Sa Aug11 Ifrs9Document7 pagesSa Aug11 Ifrs9jiteshrohraPas encore d'évaluation

- Degree 21-22 INTERNSHIPDocument4 pagesDegree 21-22 INTERNSHIPkoushik royalPas encore d'évaluation

- Mangla Refurbishment Project Salient FeaturesDocument8 pagesMangla Refurbishment Project Salient FeaturesJAZPAKPas encore d'évaluation

- 7 Hive NotesDocument36 pages7 Hive NotesSandeep BoyinaPas encore d'évaluation

- The Effect of Cross-Cultural Management On The Performance of Multinational Companies in NigeriaDocument13 pagesThe Effect of Cross-Cultural Management On The Performance of Multinational Companies in NigeriaPreethu GowdaPas encore d'évaluation

- HIRA For Electrical Hand Tools - 12Document1 pageHIRA For Electrical Hand Tools - 12Devendra BrilltechPas encore d'évaluation

- Encryption LessonDocument2 pagesEncryption LessonKelly LougheedPas encore d'évaluation

- CIVIL1Document213 pagesCIVIL1kokueiPas encore d'évaluation

- Galley Steward Knowledge: Free Screening / Interview GuidelineDocument2 pagesGalley Steward Knowledge: Free Screening / Interview GuidelineAgung Mirah Meyliana100% (2)

- UST G N 2011: Banking Laws # I. The New Central Bank Act (Ra 7653)Document20 pagesUST G N 2011: Banking Laws # I. The New Central Bank Act (Ra 7653)Clauds GadzzPas encore d'évaluation

- Lesson 12: Parallel Transformers and Autotransformers: Learning ObjectivesDocument13 pagesLesson 12: Parallel Transformers and Autotransformers: Learning ObjectivesRookie Thursday OrquiaPas encore d'évaluation

- Incorporation of Industrial Wastes As Raw Materials in Brick's Formulation (Wiemes-Brasil-2016)Document9 pagesIncorporation of Industrial Wastes As Raw Materials in Brick's Formulation (Wiemes-Brasil-2016)juan diazPas encore d'évaluation

- Quote Generator DocumentDocument47 pagesQuote Generator DocumentPrajwal KumbarPas encore d'évaluation

- Tutorial MailchimpDocument334 pagesTutorial MailchimpLeandroSabado100% (1)

- Industrial Training HandbookDocument26 pagesIndustrial Training HandbookChung tong Betty wongPas encore d'évaluation

- Pas 16 - Property Plant and EquipmentDocument4 pagesPas 16 - Property Plant and EquipmentJessie ForpublicusePas encore d'évaluation

- Refill Brand Guidelines 2Document23 pagesRefill Brand Guidelines 2Catalin MihailescuPas encore d'évaluation

- PR Status ReportDocument28 pagesPR Status ReportMascheny ZaPas encore d'évaluation

- MS Word Lecture NotesDocument11 pagesMS Word Lecture NotesMoguriPas encore d'évaluation

- Designing A 3D Jewelry ModelDocument4 pagesDesigning A 3D Jewelry ModelAbdulrahman JradiPas encore d'évaluation

- Oxidation Ponds & LagoonsDocument31 pagesOxidation Ponds & LagoonsDevendra Sharma100% (1)

- Conventional and Computed TomographyDocument29 pagesConventional and Computed TomographyJerome D FlorentinoPas encore d'évaluation

- OIG ReportDocument43 pagesOIG ReportRohan M100% (1)

- Taguig City University: College of Information and Communication TechnologyDocument9 pagesTaguig City University: College of Information and Communication TechnologyRay SenpaiPas encore d'évaluation

- Ticket - Abibus PDFDocument1 pageTicket - Abibus PDFJosephPas encore d'évaluation

- Full Download Test Bank For Managerial Decision Modeling With Spreadsheets 3rd Edition by Balakrishnan PDF Full ChapterDocument36 pagesFull Download Test Bank For Managerial Decision Modeling With Spreadsheets 3rd Edition by Balakrishnan PDF Full Chapterhospital.epical.x6uu100% (20)

- Maneesh Misra CV - 1Document3 pagesManeesh Misra CV - 1Rohit KarhadePas encore d'évaluation

- BOOK2Document201 pagesBOOK2Chetan Satish PadolePas encore d'évaluation

- Material Submission Form Register - STR (20210929)Document1 pageMaterial Submission Form Register - STR (20210929)HoWang LeePas encore d'évaluation

- Sample Resume FinalDocument2 pagesSample Resume FinalSyed Asad HussainPas encore d'évaluation