Académique Documents

Professionnel Documents

Culture Documents

FTP - SanAntonio CaseStudy PDF

Transféré par

Hoàng Trần HữuDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

FTP - SanAntonio CaseStudy PDF

Transféré par

Hoàng Trần HữuDroits d'auteur :

Formats disponibles

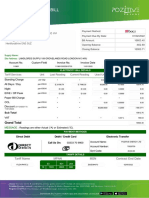

Case Study

San Antonio Federal Credit Union To Help Manage Strategy in a Volatile Interest-Rate Environment, San Antonio Federal Credit Union Successfully Implemented a Funds Transfer Pricing Solution in a Very Short Time Frame When the executives at the San Antonio Federal Credit Union developed a strategy to use matched-term funding to better understand their organizational profitability, they turned to Funds Transfer Pricing from Fiserv.

Funds Transfer Pricing accurately measures net-interest margin by reflecting the economic characteristics of each customer account and instrument. The system avoids the built-in limitations and inaccuracies of a simple pool-based approach and provides a comprehensive set of allocation techniques. We found ourselves in a highly volatile interest-rate environment, said Mark Dwyer, first vice president at SACU. We purchased Funds Transfer Pricing, which was installed, implemented and brought up to speedwith management buy-inall in a very short amount of time. During a period with 11 consecutive drops in the federal funds rate, SACU was able to tie strategy to discipline, using Funds Transfer Pricing analysis instead of gut feelings to move rates. Because of Funds Transfer Pricing, we were better able to understand the various components of our margin and really drill down through the specifics of those components. That knowledge allowed us to maintain a pricing discipline, hold prices, and really trust the Funds Transfer Pricing reports, thereby maximizing our margin. We didnt have to rely on emotions. Funds Transfer Pricing gave us the discipline to stay the course, said Dwyer.

San Antonio Federal Credit Union

Client Profile For nearly 75 years, SACU has grown and prospered with its community. Founded by 12 workers at Duncan Field (later Kelly Air Force Base) in the midst of the Great Depression as a way for the common man to be able to pool resources and to make loans to each other, SACU has blossomed into a multi-billion dollar, full-service financial institution serving nearly 250,000 members worldwide. While SACU is growing larger, just as San Antonio has grown to become the 7th largest city in the U.S., neither has forgotten its heritage.

Fiserv is driving innovation in Payments, Processing Services, Risk & Compliance, Customer & Channel Management, and Insights & Optimization, and leading the transformation of financial services technology to help our clients change the way financial services are delivered. Visit www.fiserv.com for a look at whats next, right now.

That discipline has paid off. Dwyer said that within one year, SACU saved approximately $4 million with Funds Transfer Pricing. We would have taken advantage of the rate cycle regardless, but without Funds Transfer Pricing, we would not have been as stringent with pricing, he continued. We can point to specific savings and link them back to the discipline from having the product in place. Users at SACU were astounded by the quality of data and the precision of highly customizable reports. We were very picky about getting things to tick and tie within reports, said Laurie Thomas, assistant vice president, treasury management. The canned reporting was excellent on its own, but we worked with Risk & Performance Solutions at Fiserv to get specialized reports that ticked and tied to our specifications. We were delighted with the quality of support and amazed at the level of detail right at our fingertips. Small credit unions and banks might not think Funds Transfer Pricing can help their institutions, but it can. Anyone can benefit from Funds Transfer Pricing said Dwyer. Risk & Performance Solutions provides good value, excellent customer support, and products that are flexible and easily accessible. We find theyre designed and priced exactly for what a credit union needs.

Challenge San Antonio Federal Credit Union wanted to better understand and improve organizational profitability through the use of matched term funding. Solution Funds Transfer Pricing Proof Points Supported and validated business strategy with insightful profitability intelligence Benefitted from rich data through extremely customized reporting Realized overall net savings of approximately $4 million dollars in the first year of use

Connect With Us For more information about Funds Transfer Pricing or other corporate performance management solutions from Fiserv, please contact us at 1-800-872-7882 or visit www.fiserv.com.

Fiserv, Inc. 255 Fiserv Drive Brookfield, WI 53045 800-872-7882 262-879-5322 getsolutions@fiserv.com www.fiserv.com

2010 Fiserv, Inc. or its affiliates. All rights reserved. Fiserv is a registered trademark of Fiserv, Inc. Other products referenced in this material may be trademarks or registered trademarks of their respective companies. 629-09-10162 02/10

Vous aimerez peut-être aussi

- Early Warning System For Systemic Banking Crisis in India PDFDocument35 pagesEarly Warning System For Systemic Banking Crisis in India PDFHoàng Trần HữuPas encore d'évaluation

- Early Warning Systems in The Republic of KoreaDocument48 pagesEarly Warning Systems in The Republic of KoreaHoàng Trần HữuPas encore d'évaluation

- Implementing TDABC PDFDocument11 pagesImplementing TDABC PDFHoàng Trần HữuPas encore d'évaluation

- Operational Risk in BankDocument182 pagesOperational Risk in BankSrinivasa HR100% (5)

- Ciml v0 - 8 All Machine LearningDocument189 pagesCiml v0 - 8 All Machine Learningaglobal2100% (2)

- Towards An Early Warning System For The Paraguayan Banking SystemDocument29 pagesTowards An Early Warning System For The Paraguayan Banking SystemHoàng Trần HữuPas encore d'évaluation

- Basel III and BeyondDocument27 pagesBasel III and BeyondDeepak AgrawalPas encore d'évaluation

- Calculation of MLE's For Gamma Distributed Data Using Excel: ECON 4130 HG Nov. 2010Document3 pagesCalculation of MLE's For Gamma Distributed Data Using Excel: ECON 4130 HG Nov. 2010Hoàng Trần HữuPas encore d'évaluation

- 3dprint ManualDocument0 page3dprint ManualHoàng Trần HữuPas encore d'évaluation

- Stereoscopic 3D Display System Using Commercial DIY GoodsDocument6 pagesStereoscopic 3D Display System Using Commercial DIY GoodsHoàng Trần HữuPas encore d'évaluation

- DSP InvertibleDocument6 pagesDSP InvertibleAkshay SharmaPas encore d'évaluation

- Parallax US20120140131A1Document22 pagesParallax US20120140131A1Hoàng Trần HữuPas encore d'évaluation

- Alternative View of Non-MaturityDocument3 pagesAlternative View of Non-MaturityHoàng Trần HữuPas encore d'évaluation

- Oracle High Performance PLSQL Plus 11gDocument151 pagesOracle High Performance PLSQL Plus 11grashad980724Pas encore d'évaluation

- A Multicriteria Methodology For Bank Asset Liability ManagementDocument26 pagesA Multicriteria Methodology For Bank Asset Liability ManagementHoàng Trần HữuPas encore d'évaluation

- Sam Seiden Ota ArticlesDocument28 pagesSam Seiden Ota ArticlesHoàng Trần Hữu33% (9)

- FTP June 2011 Dermine - 2 PDFDocument23 pagesFTP June 2011 Dermine - 2 PDFHoàng Trần HữuPas encore d'évaluation

- CH en May 2009 Understanding Liquidity Premiums PDFDocument21 pagesCH en May 2009 Understanding Liquidity Premiums PDFHoàng Trần HữuPas encore d'évaluation

- Risk Management For Financial InstitutionsDocument42 pagesRisk Management For Financial InstitutionsSyed SohelPas encore d'évaluation

- 2011 01 09 Implementing High Value Fund Transfer Pricing Systems PDFDocument19 pages2011 01 09 Implementing High Value Fund Transfer Pricing Systems PDFHoàng Trần HữuPas encore d'évaluation

- ALMA in Islamic BankingDocument18 pagesALMA in Islamic BankingAgung HaryantoPas encore d'évaluation

- Assets Management Liabilities in Bank PDFDocument61 pagesAssets Management Liabilities in Bank PDFHoàng Trần HữuPas encore d'évaluation

- FTP June 2011 Dermine - 2 PDFDocument23 pagesFTP June 2011 Dermine - 2 PDFHoàng Trần HữuPas encore d'évaluation

- VAR 9604hend PDFDocument32 pagesVAR 9604hend PDFHoàng Trần HữuPas encore d'évaluation

- Improving Risk Management in The Russian Banking Sector: JournalDocument3 pagesImproving Risk Management in The Russian Banking Sector: JournalHoàng Trần HữuPas encore d'évaluation

- Structural Risk Management (Asset Liability Management) PDFDocument41 pagesStructural Risk Management (Asset Liability Management) PDFHoàng Trần HữuPas encore d'évaluation

- Integrated Risk Management System PDFDocument13 pagesIntegrated Risk Management System PDFHoàng Trần HữuPas encore d'évaluation

- FTP Ajantha Madhurapperuma PDFDocument32 pagesFTP Ajantha Madhurapperuma PDFHoàng Trần HữuPas encore d'évaluation

- Managerial Accounting 1 - Cost Behavior and Allocation PDFDocument26 pagesManagerial Accounting 1 - Cost Behavior and Allocation PDFHoàng Trần HữuPas encore d'évaluation

- Basel Risk Banking SSRN-id2060756 PDFDocument17 pagesBasel Risk Banking SSRN-id2060756 PDFHoàng Trần Hữu100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Analisis Kinerja Keuangan PT - Bank Mandiri Syariah, TBK Periode 2016-2020 Menggunakan Metode Du Pont SystemDocument7 pagesAnalisis Kinerja Keuangan PT - Bank Mandiri Syariah, TBK Periode 2016-2020 Menggunakan Metode Du Pont SystemJasika Jurnal Sistem Informasi AkuntansiPas encore d'évaluation

- Hull OFOD10e MultipleChoice Questions and Answers Ch17Document7 pagesHull OFOD10e MultipleChoice Questions and Answers Ch17Kevin Molly KamrathPas encore d'évaluation

- Notes To Interim Finacial StatementsDocument7 pagesNotes To Interim Finacial StatementsJhoanna Marie Manuel-AbelPas encore d'évaluation

- Najir SangrahaDocument411 pagesNajir SangrahaBhava Nath DahalPas encore d'évaluation

- Model Question For Account409792809472943360Document8 pagesModel Question For Account409792809472943360yugeshPas encore d'évaluation

- Financial LiteracyDocument22 pagesFinancial LiteracyRio Albarico100% (1)

- The Land System in Malabar in TheDocument31 pagesThe Land System in Malabar in TheBalakrishna GopinathPas encore d'évaluation

- Bounding BermudansDocument6 pagesBounding Bermudans楊約翰Pas encore d'évaluation

- Takeover and AcquisitionsDocument42 pagesTakeover and Acquisitionsparasjain100% (1)

- RRL Matrix - ToPIC 1 Effect of The New IFRS 15 Adoption - Revenue Recognition To Earnings Quality of FirmsDocument12 pagesRRL Matrix - ToPIC 1 Effect of The New IFRS 15 Adoption - Revenue Recognition To Earnings Quality of FirmsEuniceChungPas encore d'évaluation

- Non Taxable Income, Income From Salary and Income From HPDocument35 pagesNon Taxable Income, Income From Salary and Income From HPAnonymous ckTjn7RCq8Pas encore d'évaluation

- BFM Sem - Vi Corporate RestructuringDocument48 pagesBFM Sem - Vi Corporate RestructuringJeffPas encore d'évaluation

- Monthly Budget Worksheet Exp 03-31-17Document1 pageMonthly Budget Worksheet Exp 03-31-17api-32901810850% (2)

- 1601-FQ Final Jan 2018 Rev DPADocument2 pages1601-FQ Final Jan 2018 Rev DPAMarvin AmparadoPas encore d'évaluation

- Bar Review Material No. 3 PDFDocument2 pagesBar Review Material No. 3 PDFScri Bid100% (1)

- Introduction of Bajaj Allianz Life Insurance CompanyDocument13 pagesIntroduction of Bajaj Allianz Life Insurance CompanyGirish Lundwani60% (5)

- Proposal Stock MarketDocument62 pagesProposal Stock MarketMugea Mga100% (1)

- AFAR 3 AnswersDocument5 pagesAFAR 3 AnswersTyrelle Dela CruzPas encore d'évaluation

- Tata AIA Life Insurance Smart Sampoorna Raksha TandCDocument31 pagesTata AIA Life Insurance Smart Sampoorna Raksha TandCAnkit Maheshwari /WealthMitra/Delhi/Dwarka/Pas encore d'évaluation

- Corporate FinancesDocument4 pagesCorporate FinancesAinil MardiahPas encore d'évaluation

- TempBillDocument1 pageTempBillNilesh UmaretiyaPas encore d'évaluation

- CGTMSEDocument4 pagesCGTMSEPrasath KumarPas encore d'évaluation

- 7 Bank Marketing Strategies To Increase DepositsDocument10 pages7 Bank Marketing Strategies To Increase DepositsBalwinder SinghPas encore d'évaluation

- Tax SssssssDocument3 pagesTax SssssssJames Francis VillanuevaPas encore d'évaluation

- Declaration For Lost Gold Loan Token: Description of Ornaments Weight Approx. Market Value SI. No. 2278-MDS-134Document1 pageDeclaration For Lost Gold Loan Token: Description of Ornaments Weight Approx. Market Value SI. No. 2278-MDS-134Muthoot Finance100% (3)

- ASJ #1 September 2011Document72 pagesASJ #1 September 2011Alex SellPas encore d'évaluation

- TAX-CREBA VS Executive Secretary RomuloDocument2 pagesTAX-CREBA VS Executive Secretary RomuloJoesil Dianne100% (2)

- 2023 - Q1 Press Release BAM - FDocument9 pages2023 - Q1 Press Release BAM - FJ Pierre RicherPas encore d'évaluation

- UTOPIA Key Terms and Definitions PDFDocument8 pagesUTOPIA Key Terms and Definitions PDFSherilyn Gautama100% (2)

- Bafm6102 - Prelim Exam - Attempt ReviewDocument13 pagesBafm6102 - Prelim Exam - Attempt ReviewKinglaw PilandePas encore d'évaluation