Académique Documents

Professionnel Documents

Culture Documents

Pleading

Transféré par

klg_consultant8688Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Pleading

Transféré par

klg_consultant8688Droits d'auteur :

Formats disponibles

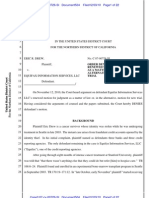

Henry Dale Goltz Evangelina Goltz Aggrieved Parties

Lodgment

UNITED STATES DISTRICT COURT WESTERN DISTRICT OF TEXAS

____________________________________

UNITED STATES OF AMERICA ) Petitioner ) ) -against) ) Henry Dale Goltz ) Evangelina Goltz )

No. SA-06-CA-0503-XR

Judicial Notice and Motion to Abate ___________________________________________________________________

Comes now, Henry Dale Goltz and Evangelina Goltz with this motion to ABATE this numbered action for lack of jurisdiction. The basis for this determination is as follows: 1. Title 26 United States Code Sections 7402 and 7403 state that the district courts of the United States shall have jurisdiction. This court is not a district court of the United States. It is designated as a United States District Court. We assert that there is a difference - the District Court of the United States is a constitutional court of law created under Article III of the Constitution for the United States of America [Ballentines Law Dictionary Supplement 1942]. The United States District Court appears to be a legislative or maritime court. We are not subject to maritime jurisdiction. 2. Plaintiff alleges that Henry Dale Goltz and Evangelina Goltz are taxpayers. As that term is used in Title 26 United States Code, a taxpayer is a person subject to an internal revenue tax. Plaintiff has not offered proof that we are subject to an internal revenue tax. 3. Plaintiff alleges that a delegate of the Secretary of the Treasury assessed and gave notice and demand. No court can have jurisdiction over this matter if the Plaintiff has not met his preconditions. Plaintiff has never identified the delegate of the Secretary, nor produced a valid, legal assessment or a return on which it was based [26 U.S.C. 6201(a) (1)]. Without a valid, legal assessment based on a return, no court can have jurisdiction.

4. Plaintiff is seeking enforcement of its federal tax liens. Plaintiff alleges no federal tax liens. Plaintiff alleges only that it recorded a Notice of Federal Tax Lien in the property records of Bexar County, Texas. Recording a Notice does not a lien make. Absent the alleged liens, no court can claim jurisdiction over a subject matter that does not exist. [Moreover, violation of the Property Code of Texas in the act of recording the Notice as an uncertified alleged Lien vitiates the act and can generate penalties.] 5. This cause is an action in rem in the nature of a claim against the paper titled Notice of Federal Tax Lien, hereafter alleged lien recorded in the Property Records of the Bexar County Clerk by the entity defined thereon as VIC DIETZ, who by filing such in the County records, made a claim of interest in property in Bexar County within the purview of the state district court. State Courts have exclusive jurisdiction in an in rem motion with the res residing in the County. The place for recording and the validity of the documents is a matter totally controlled by state law as there is no federal law that provides a remedy in this state. 6. Alleged lien is in the possession of the Clerk of Bexar County Recorder and was filed under the Property Code Chapter 14: 14.001 through 14.007, Uniform Federal Lien Registration Act, indicating it being filed under state jurisdiction. The state court has exclusive jurisdiction of alleged lien in this action as previously ascertained by law in the Texas Statutes. The intent of the State legislature was crystal clear in their passage of the Statutes concerning the filing of Federal tax Liens and/or Levies in the State of Texas. The legislature had to know that the State had subject matter jurisdiction in this matter, or why would they have bothered to pass such legislation. The Texas Courts are bound by the State Constitution to uphold that legislative intent. 7. Henry Dale Goltz and Evangelina Goltz relies upon the foregoing exclusive original jurisdiction as being the controlling law in relation to the courts, whether local, state, or federal, and neither VIC DIETZ (nor its agents it represented) has given evidence that the state of Texas has ceded the exclusive original jurisdiction. 8. Alleged lien remains in the Bexar County Recorder records and has not been removed therefrom by any lawful means to a records department in the federal courts. 9. State court territorial jurisdiction is determined by the Due Process Clause of the 14th Article of Amendment to the Constitution for the United States of America.. 10. Federal courts have limited jurisdiction in that they can only hear cases that fall both within the scope defined by the Constitution in Article III Section 2 and Congressional statutes. Specifically stated in Clause 1:

The judicial Power shall extend to all Cases, in Law and Equity, arising under this Constitution, the Laws of the United States, and Treaties made, or which shall be made, under their Authority; --to all Cases affecting Ambassadors, other public Ministers and Consuls;--to all Cases of admiralty and maritime Jurisdiction; --to Controversies to which the united States shall be a Party;--to Controversies between two or more States;-between a State and Citizens of another state;--between Citizens of different States,-between Citizens of the same State claiming Lands under Grants of different States, and between a State, or the Citizens thereof, and foreign States, Citizens or Subjects. 11. The judicial power stated in the above Article III has no provision to allow a Federal Court to assume jurisdiction of an in rem motion with the res residing inside the state. 12. Pursuant to Mitchell v. Maurer, 293 U.S. 237 (1934), holding that, federal courts are of limited jurisdiction means that litigants in them must affirmatively establish that jurisdiction exists and may not confer nonexisting jurisdiction by consent or conduct, has not affirmatively established that subject matter jurisdiction exists in this federal court and this court must remand this action back to the state court for this cause alone. 13. If alleged lien filed into the Bexar County Recorder records is not based upon fraud, then entity VIC DIETZ has an opportunity to reveal the truth as to the facts, law and regulations upon which alleged lien is founded and substantiate the matter in the court of competent jurisdiction for a just resolution of the matter. 14. State court authority should not be superseded by federal courts without special authority and this section is to be strictly construed against removal. Garza v. Midland Nat. Ins. Co., D.C. Fla. 1966, 256 F.Supp.12. 15. In order to overcome the interdiction of federal interference in state judicial proceedings, two express preconditions must be shown before relief may be granted to a federal plaintiff; the moving party must demonstrate that he will suffer irreparable injury if the federal court stays its hand, and, second he must demonstrate that he does not have an adequate remedy at law in the state courts. A party may not invoke the aid of a federal court, alleging that his state remedies are inadequate, without having first tested the sufficiency of those remedies and having found them to be wanting. Elizabeth Ann Duke et al. v. The STATE OF TEXAS et al., 477 F.2d 244 (1973) 16. Further concerning Jurisdiction In Rem: In Arndt v. Griggs, 134 U.S. 316, at p. 320, 10 Sup Ct. 557, the court was very clear who held exclusive jurisdiction in rem as it concerns property rights. There is a well recognized class of cases in which a court may render decisions in accordance with due process of law without having jurisdiction of the

person whose rights are to be affected. The court exercises the sovereign power of the state which; has control over property within its limits; and the condition of ownership of real estate therein... They go on to say; The well-being of every community requires that the title of real estate therein shall be secure, and that there be convenient and certain methods of determining any unsettled question respecting it. They were very explicit in relationship to which court holds exclusive jurisdiction in these matters; The duty of accomplishing this is local in its nature; it is not a matter of national concern or vested in the general government; it remains with the state, and as this duty is one of the state, the manner of discharging it must be determined by the state... (Emphasis added) 17. Further, concerning judicial decision on hearing motion: There are essential elements to any case or controversy, whether administrative or judicial, and/or arising under the constitution and laws of the United States Article III 2, U.S. Constitution. (See Federal Maritime Comnission v. South Carolina Ports Authority 535 U.S. (2002) Decided March 28, 2002.) The following elements are essential: 8.1 When challenged, Standing, Venue and all elements of Subject Matter

Jurisdiction, including compliance with substantive and procedural due process requirements, must be established in the record; 8.2 8.3 Facts of the case must be established in record; Unless stipulated by agreement, facts must be verified by competent

witnesses via testimony (affidavit, deposition or direct oral examination); 8.4 The law of the case must affirmatively appear in the record, which, in the

case of a tax controversy, includes taxing statutes with attending regulations; 8.5 The advocate of a position must prove application of law to stipulated or

otherwise provable facts; 8.6 The trial court, whether administrative or judicial, must render a. written

decision that includes findings of fact and conclusions of law. (Emphasis Added) 18. MAXIMS OF LAW with regard to Jurisdiction: A judicial act by a judge without jurisdiction is void (Lofft. 458). Statutes are confined to their own territory, and have no extraterritorial effect (Woodworth v. Spring, 4 Allen (Mass.) 324). Jurisdiction is a power introduced for the public good, on account of the necessity of dispensing justice (10 Coke, 73a).

Jurisdiction is the power to declare the law; and when it ceases to exist, the only function remaining to the court is that of announcing the fact and dismissing the cause (Bullington v. Angel, 220 N.C. 18)

The order of things is confounded if every one preserves not his jurisdiction (4 Inst. Proem).

Notice of Non-acceptance of Removal The Petitioner hereby gives notice of non-acceptance of the alleged removal action for the following causes: 1. Henry Dale Goltz and Evangelina Goltz do not give consent for this action to be removed

from the exclusive original jurisdiction in the state circuit court to the federal legislative court that is without injunctive powers for such removal or for the remedy hereto. 2. This case is an action in rem and operates on paper that is in the possession of the

Clerk of Court in Bexar County of the state of Texas. 3. The said paper involves the right of possession of real property within the County over

which the state circuit court has exclusive original jurisdiction. 4. The adjudication of this case specifically requires an order from a state court which is

beyond the jurisdiction and power of the federal court to provide.

Dismissal of Removal Action Pursuant to the foregoing causes for nonacceptance and additional causes set forth in this Affidavit, this action must be dismissed with prejudice. We declare under penalty of perjury that state court holds exclusive jurisdiction and is the only court that has jurisdiction to be able to rule in relief. Sufficient cause exists for this action to be dismissed with prejudice for lack of subject matter jurisdiction in the federal court. This federal court is without subject matter jurisdiction of the res and/or the issues of this action and we hereby petitions for this action to be dismissed with prejudice as a matter of law and subject matter jurisdiction.

Henry Dale Goltz and Evangelina Goltz move this honorable court to take JUDICIAL NOTICE of the foregoing, and FOR THE REASONS STATED, move this court to ABATE the Plaintiffs action pending its presentation of verifiable proof of its and the courts jurisdiction in this matter.

SPECIAL NOTICE to the court We are in receipt of the courts ORDER AND ADVISORY dated August 21, 2006. It appears to assume jurisdiction based on the allegation that it has received Defendant(s) Answer. Henry Dale Goltz and Evangelina Goltz have not yet submitted an ANSWER to the court. This is in accordance with the July 28th ORDER extending the date for an ANSWER to no later than September 7, 2006. (See Attachment) We do not concede jurisdiction to the court based on having received a copy of the August 21st ORDER.

On this Twenty-Fifth day of August anno Domini Two Thousand and Six All Rights Reserved Without Recourse.

Affirmed by: ____________________ Henry Dale Goltz Aggrieved Party

Affirmed by: ____________________ Evangelina Goltz Aggrieved Party

CERTIFICATE OF SERVICE I am the Aggrieved Party in this matter; I am a Texian American, over the age of twenty-one years. On August 25, 2006 I served a copy of attached Lodgment of Judicial Notice and Motion To Abate, by securely enclosing them in an envelope with prepaid first class postage, and addressed as follows:

Michelle C. Johns Attorney, Tax Division Dept of Justice 717 North Harwood, Suite 400 Dallas, TX 75201

I certify the foregoing to be true and correct and that I believe the service was made in accordance with the Federal Rules of Civil Procedure.

____________________

Henry Dale Goltz, pro per

US PO Box 690126 San Antonio, Texas [78269]

Vous aimerez peut-être aussi

- An Inexplicable Deception: A State Corruption of JusticeD'EverandAn Inexplicable Deception: A State Corruption of JusticePas encore d'évaluation

- Petition for Certiorari: Denied Without Opinion Patent Case 93-1413D'EverandPetition for Certiorari: Denied Without Opinion Patent Case 93-1413Pas encore d'évaluation

- The Book of Writs - With Sample Writs of Quo Warranto, Habeas Corpus, Mandamus, Certiorari, and ProhibitionD'EverandThe Book of Writs - With Sample Writs of Quo Warranto, Habeas Corpus, Mandamus, Certiorari, and ProhibitionÉvaluation : 5 sur 5 étoiles5/5 (9)

- Constitution of the State of Minnesota — Republican VersionD'EverandConstitution of the State of Minnesota — Republican VersionPas encore d'évaluation

- Sample Motion to Vacate, Motion to Dismiss, Affidavits, Notice of Objection, and Notice of Intent to File ClaimD'EverandSample Motion to Vacate, Motion to Dismiss, Affidavits, Notice of Objection, and Notice of Intent to File ClaimÉvaluation : 5 sur 5 étoiles5/5 (21)

- California Supreme Court Petition: S173448 – Denied Without OpinionD'EverandCalifornia Supreme Court Petition: S173448 – Denied Without OpinionÉvaluation : 4 sur 5 étoiles4/5 (1)

- Petition for Certiorari – Patent Case 99-396 - Federal Rule of Civil Procedure 12(h)(3) Patent Assignment Statute 35 USC 261D'EverandPetition for Certiorari – Patent Case 99-396 - Federal Rule of Civil Procedure 12(h)(3) Patent Assignment Statute 35 USC 261Pas encore d'évaluation

- Petition for Certiorari Denied Without Opinion: Patent Case 98-1151D'EverandPetition for Certiorari Denied Without Opinion: Patent Case 98-1151Pas encore d'évaluation

- Federal Tort Claims Act: Volume 1: Volume 1: Contemporary DecisionsD'EverandFederal Tort Claims Act: Volume 1: Volume 1: Contemporary DecisionsÉvaluation : 5 sur 5 étoiles5/5 (1)

- Petition for Extraordinary Writ Denied Without Opinion– Patent Case 94-1257D'EverandPetition for Extraordinary Writ Denied Without Opinion– Patent Case 94-1257Pas encore d'évaluation

- Petition for Certiorari – Patent Case 01-438 - Federal Rule of Civil Procedure 52(a)D'EverandPetition for Certiorari – Patent Case 01-438 - Federal Rule of Civil Procedure 52(a)Pas encore d'évaluation

- The Declaration of Independence: A Play for Many ReadersD'EverandThe Declaration of Independence: A Play for Many ReadersPas encore d'évaluation

- Lighting the Way: Federal Courts, Civil Rights, and Public PolicyD'EverandLighting the Way: Federal Courts, Civil Rights, and Public PolicyPas encore d'évaluation

- How one of my Pro-se cases got destroyed by federal rogue judgesD'EverandHow one of my Pro-se cases got destroyed by federal rogue judgesPas encore d'évaluation

- Anti-SLAPP Law Modernized: The Uniform Public Expression Protection ActD'EverandAnti-SLAPP Law Modernized: The Uniform Public Expression Protection ActPas encore d'évaluation

- Petition for Certiorari Denied Without Opinion: Patent Case 96-1178D'EverandPetition for Certiorari Denied Without Opinion: Patent Case 96-1178Pas encore d'évaluation

- Legal ResearchDocument5 pagesLegal ResearchJanileahJudetteInfante100% (1)

- APPENDIX H, Petition For Writ of Mandamus FSC 2016-2031Document27 pagesAPPENDIX H, Petition For Writ of Mandamus FSC 2016-2031Neil GillespiePas encore d'évaluation

- American Court Structure and Jurisdiction OverviewDocument67 pagesAmerican Court Structure and Jurisdiction Overviewmjwyatt01Pas encore d'évaluation

- Drew v. Equifax, C07-00726 SI (N.D. Cal. Dec. 3, 2010)Document22 pagesDrew v. Equifax, C07-00726 SI (N.D. Cal. Dec. 3, 2010)Venkat BalasubramaniPas encore d'évaluation

- Khadr - D - 068 Motion To Dismiss Speedy TrialDocument46 pagesKhadr - D - 068 Motion To Dismiss Speedy TrialfasttrackenergydrinkPas encore d'évaluation

- The Four Mistakes: Avoiding the Legal Landmines that Lead to Business DisasterD'EverandThe Four Mistakes: Avoiding the Legal Landmines that Lead to Business DisasterÉvaluation : 1 sur 5 étoiles1/5 (1)

- A Legal Lynching...: From Which the Legacies of Three Black Houston Lawyers BlossomedD'EverandA Legal Lynching...: From Which the Legacies of Three Black Houston Lawyers BlossomedPas encore d'évaluation

- PA Rules of Judicial Notice 201Document2 pagesPA Rules of Judicial Notice 2014EqltyMomPas encore d'évaluation

- 30 Harold ST Void Judgment Motion - Current or Past CaseDocument8 pages30 Harold ST Void Judgment Motion - Current or Past Casedonna coxPas encore d'évaluation

- g-639 Freedom of Information ActDocument4 pagesg-639 Freedom of Information Actapi-385285522100% (2)

- The Louisiana Mayor’S Court: An Overview and Its Constitutional ProblemsD'EverandThe Louisiana Mayor’S Court: An Overview and Its Constitutional ProblemsPas encore d'évaluation

- 60CV-13-2662 Notice of AppealDocument3 pages60CV-13-2662 Notice of AppealEquality Case FilesPas encore d'évaluation

- Motion To Strike-Dismiss Complaint - MCDocument12 pagesMotion To Strike-Dismiss Complaint - MCJames ForsPas encore d'évaluation

- The Effect of Lack of JurisdictionDocument16 pagesThe Effect of Lack of JurisdictioncamyllPas encore d'évaluation

- UNITED STATES OF AMERICA'S MOTION TO DISMISS APPEAL AND STAY BRIEFING SCHEDULEdd.242731.5.0Document12 pagesUNITED STATES OF AMERICA'S MOTION TO DISMISS APPEAL AND STAY BRIEFING SCHEDULEdd.242731.5.0D B Karron, PhDPas encore d'évaluation

- Staci Williams Federal ComplaintDocument18 pagesStaci Williams Federal ComplaintThe Dallas Morning NewsPas encore d'évaluation

- Motion To Abate Weiss PDFDocument4 pagesMotion To Abate Weiss PDFpalmbeachtimPas encore d'évaluation

- Summary Judgement (Final) Summary Judgement (Final)Document17 pagesSummary Judgement (Final) Summary Judgement (Final)Yi YingPas encore d'évaluation

- Civil Pro I Outline 1st SemesterDocument46 pagesCivil Pro I Outline 1st SemestermanutdfcPas encore d'évaluation

- Poverty: Its Illegal Causes and Legal Cure: Lysander SpoonerD'EverandPoverty: Its Illegal Causes and Legal Cure: Lysander SpoonerPas encore d'évaluation

- Intent To SueDocument5 pagesIntent To SueMindy WadleyPas encore d'évaluation

- Petition for Certiorari – Patent Case 94-782 - Federal Rule of Civil Procedure 12(h)(3) - Patent Statute 35 USC 261 – Judgment lien Statute 12 USC 1963D'EverandPetition for Certiorari – Patent Case 94-782 - Federal Rule of Civil Procedure 12(h)(3) - Patent Statute 35 USC 261 – Judgment lien Statute 12 USC 1963Évaluation : 5 sur 5 étoiles5/5 (2)

- Courts and Procedure in England and in New JerseyD'EverandCourts and Procedure in England and in New JerseyPas encore d'évaluation

- 1st Amended ComplaintDocument51 pages1st Amended ComplaintRod SatrePas encore d'évaluation

- A Guide to District Court Civil Forms in the State of HawaiiD'EverandA Guide to District Court Civil Forms in the State of HawaiiPas encore d'évaluation

- The Law (in Plain English) for Small Business (Sixth Edition)D'EverandThe Law (in Plain English) for Small Business (Sixth Edition)Pas encore d'évaluation

- The Constitution of the United States of America: The Declaration of Independence, The Bill of RightsD'EverandThe Constitution of the United States of America: The Declaration of Independence, The Bill of RightsPas encore d'évaluation

- Deters Divorce Answer and CounterclaimDocument3 pagesDeters Divorce Answer and CounterclaimNathaniel Livingston, Jr.Pas encore d'évaluation

- Sacramento Family Court News: Investigative Reporting, News, Analysis, Opinion & SatireDocument40 pagesSacramento Family Court News: Investigative Reporting, News, Analysis, Opinion & SatireCalifornia Judicial Branch News Service - Investigative Reporting Source Material & Story IdeasPas encore d'évaluation

- Demand Letter Qualified Written Request2Document7 pagesDemand Letter Qualified Written Request2klg_consultant8688Pas encore d'évaluation

- Shyster Financial's ownership of promissory noteDocument2 pagesShyster Financial's ownership of promissory notevaltec100% (1)

- The Constructs of HumanityDocument1 pageThe Constructs of Humanityklg_consultant8688Pas encore d'évaluation

- Prove The NegativeDocument1 pageProve The Negativeklg_consultant8688Pas encore d'évaluation

- Chain of TitleDocument2 pagesChain of Titleklg_consultant8688Pas encore d'évaluation

- Update Will CodicilDocument2 pagesUpdate Will Codicilklg_consultant8688Pas encore d'évaluation

- Revolutionary Guide to Healing and Longevity Through NutritionDocument4 pagesRevolutionary Guide to Healing and Longevity Through Nutritionklg_consultant8688Pas encore d'évaluation

- Interview With A Banker About A ForeclosureDocument4 pagesInterview With A Banker About A Foreclosureklg_consultant8688Pas encore d'évaluation

- Generic Suit at Common LawDocument9 pagesGeneric Suit at Common LawVen Geancia100% (3)

- 2011-Ny-Slip-Op-32828-U-0judge: Joan A. MaddenDocument15 pages2011-Ny-Slip-Op-32828-U-0judge: Joan A. Maddenklg_consultant8688Pas encore d'évaluation

- TestimonyDocument1 pageTestimonyklg_consultant8688Pas encore d'évaluation

- TILA Mortgage RescissionDocument3 pagesTILA Mortgage Rescissionklg_consultant868850% (2)

- Wamu - JP Morgan Chase - Fdic NotesDocument2 pagesWamu - JP Morgan Chase - Fdic Notesklg_consultant8688Pas encore d'évaluation

- 2009 32740Document8 pages2009 32740klg_consultant8688Pas encore d'évaluation

- Revolutionary Guide to Healing and Longevity Through NutritionDocument4 pagesRevolutionary Guide to Healing and Longevity Through Nutritionklg_consultant8688Pas encore d'évaluation

- Sample Payoff Request LetterDocument1 pageSample Payoff Request Letterklg_consultant868860% (5)

- contractsII UccDocument4 pagescontractsII Uccklg_consultant8688Pas encore d'évaluation

- The Positive LawDocument5 pagesThe Positive Lawklg_consultant8688Pas encore d'évaluation

- Bar Exam Study Plan BreakdownDocument5 pagesBar Exam Study Plan Breakdownklg_consultant86880% (1)

- Sales and Sales Financing Breitowitz1Document20 pagesSales and Sales Financing Breitowitz1klg_consultant8688Pas encore d'évaluation

- TestimonyDocument1 pageTestimonyklg_consultant8688Pas encore d'évaluation

- First Stage Is To Provide ADocument2 pagesFirst Stage Is To Provide Aklg_consultant8688Pas encore d'évaluation

- Model Notary Act of 2010Document160 pagesModel Notary Act of 2010klg_consultant8688100% (2)

- Unlawful NotaryDocument5 pagesUnlawful Notaryklg_consultant8688100% (1)

- Chain of TitleDocument2 pagesChain of Titleklg_consultant8688Pas encore d'évaluation

- Restraining OrderDocument5 pagesRestraining OrderBelthuzar0Pas encore d'évaluation

- Ss Alvarez Vs CiDocument13 pagesSs Alvarez Vs CiKat PinedaPas encore d'évaluation

- LLDA Vs CADocument12 pagesLLDA Vs CAKitkat AyalaPas encore d'évaluation

- Monroy vs. Court of Appeals, 20 SCRA 620, No. L-23258 July 1, 1967Document9 pagesMonroy vs. Court of Appeals, 20 SCRA 620, No. L-23258 July 1, 1967Ej CalaorPas encore d'évaluation

- Theft Affidavit ComplaintDocument3 pagesTheft Affidavit ComplaintNingClaudio86% (14)

- G.R. No. 212731: Factual AntecedentsDocument5 pagesG.R. No. 212731: Factual AntecedentsGennard Michael Angelo AngelesPas encore d'évaluation

- IPL Assignment No. 6Document92 pagesIPL Assignment No. 6Krisia OrensePas encore d'évaluation

- People v. Flowers Case BriefDocument2 pagesPeople v. Flowers Case Briefsamijiries100% (1)

- Information (Sample)Document2 pagesInformation (Sample)Marie Charlotte Olondriz67% (6)

- In Re - Juan Publico - SalvadorDocument5 pagesIn Re - Juan Publico - SalvadorAntonio Dominic SalvadorPas encore d'évaluation

- Villanueva Vs PeopleDocument14 pagesVillanueva Vs PeopleMarianne Hope VillasPas encore d'évaluation

- 'Mohd. Shafi Naikoo vs. D.M., Anantnag & Ors. (J&K&L High Court Accepts Unconditional Apology From SR AAG, DM Anantnag)Document18 pages'Mohd. Shafi Naikoo vs. D.M., Anantnag & Ors. (J&K&L High Court Accepts Unconditional Apology From SR AAG, DM Anantnag)BIRENDER SINGHPas encore d'évaluation

- Santos Ventura Hocorma Foundation vs. SantosDocument5 pagesSantos Ventura Hocorma Foundation vs. SantosVeraNataaPas encore d'évaluation

- Legal Ethics - Cases 3Document133 pagesLegal Ethics - Cases 3Rian Lee TiangcoPas encore d'évaluation

- Non Disclosure AgreementDocument1 pageNon Disclosure AgreementMuhammad BilalPas encore d'évaluation

- Jimma Reat Case: Second Amended ComplaintDocument49 pagesJimma Reat Case: Second Amended ComplaintMichael_Lee_RobertsPas encore d'évaluation

- Lea Reporting PDFDocument13 pagesLea Reporting PDFDes MoralesPas encore d'évaluation

- Before The Court of Sessions at Jagatpura, State of KingsthanDocument18 pagesBefore The Court of Sessions at Jagatpura, State of KingsthanHarshit Singh Rawat100% (1)

- Lasalle Bank V Patrick PuentesDocument10 pagesLasalle Bank V Patrick PuentesRicharnellia-RichieRichBattiest-CollinsPas encore d'évaluation

- Rights and Freedoms Under the Philippine ConstitutionDocument85 pagesRights and Freedoms Under the Philippine Constitutionmary anne sisonPas encore d'évaluation

- EvidenceDocument3 pagesEvidenceAdv Nikita SahaPas encore d'évaluation

- CPD - RDC: Condamnation de Bosco Ntaganda À 30 Ans de Prsion Par La CPIDocument117 pagesCPD - RDC: Condamnation de Bosco Ntaganda À 30 Ans de Prsion Par La CPIjeuneafriquePas encore d'évaluation

- LOCAL REVENUE GENERATION IN UGANDADocument64 pagesLOCAL REVENUE GENERATION IN UGANDAMwesigwa DaniPas encore d'évaluation

- Robert Kenneth Decker Plea AgreementDocument7 pagesRobert Kenneth Decker Plea AgreementCalebPas encore d'évaluation

- 003 Cantos vs. PeopleDocument7 pages003 Cantos vs. Peoplest3ll4_my8Pas encore d'évaluation

- H.W On Doctrine of Primary JurisdictionDocument1 pageH.W On Doctrine of Primary JurisdictionJoanna Stephanie RodriguezPas encore d'évaluation

- Commonwealth v. Edward Archer Sentencing MemoDocument9 pagesCommonwealth v. Edward Archer Sentencing MemoPhiladelphia District Attorney's OfficePas encore d'évaluation

- Constitutional Right to Privacy of CommunicationDocument2 pagesConstitutional Right to Privacy of CommunicationJustine UyPas encore d'évaluation

- Constitutional Powers & Position of President of IndiaDocument23 pagesConstitutional Powers & Position of President of IndiaNominee PareekPas encore d'évaluation

- Answerscriminal ProcedureDocument1 pageAnswerscriminal Procedurexeileen08Pas encore d'évaluation