Académique Documents

Professionnel Documents

Culture Documents

Agriculture

Transféré par

Saksham KaushikDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Agriculture

Transféré par

Saksham KaushikDroits d'auteur :

Formats disponibles

Rural insurance is specifically designed to cater to the needs of agriculturally based businesses.

If you live in rural areas and want to get protection for your properties, then you might want to consider getting a rural insurance policy which will provide you with adequate coverage. There are many insurance companies offering rural insurance packages for homes, farms, businesses, and nearly every other concern you may have.The coverage provided by your rural insurance will depend upon the terms and conditions stated in the policy.There are many types of rural insurance, you must first determine which ones you need to get. A rural insurance policy will shield you from financial ruin in case accidents happen. Getting rural insurance will also give you added security.The key here is to determine which you need to get coverage for. You may even get coverage for theft of vehicles and farm contents so that your rural insurance provider will compensate you if these get stolen.It's always best to be prepared for unfortunate circumstances and this is why you should consider getting a rural insurance policy.

Rural India is often faced with risks linked to lifestyle of people living there. There is a growing need for the Rural mass to be educated on insurance solutions that will help them take care of the risks be it their automobiles, health, property or livestock. Tata AIG offers a variety of Rural Insurance products covering risks of this nature.

Failure

Rural insurance: Need and potential' (Business Line, June 23) has highlighted that the Government should pay serious attention to the rural areas. In fact, Life Insurance Corporation of India (LIC) stipulates that a considerable percentage of its busine ss should be from rural areas. And it has some social security schemes covering the rural and urban poor, landless labour, and so on. Yet it was not possible for it to penetrate into the interiors to tap the rural business. Two main reasons were the cost involved in servicing, and the policies not meeting the credit requirements of the farmers. They were accustomed to old methods of bo rrowing, chitties, etc. Crop insurance was also a failure because of misuse and false claims. And agents as well as insurers are not interested in policies of small sums assured and premiums. So, the Insurance Regulating Authority should insist that the business of every insure r should have a particular percentage of rural business and of small policies. The insurers -- LIC as well as the new entrants -- could introduce cost-effective collection methods by involving post offices. They should introduce innovative schemes such as `Crop linked life insurance', with proper credit facilities, easy claim settl ement methods.

Chola mandlam

Protect your agriculture business in the best manner possible by opting for Rural Insurance from Chola MS. India's heart beats in the rural segment where over 70% of our population lives and toils to enrich our country. We at Chola MS look at rural insurance as more than a mere social responsibility, and have worked to offer protection covers customdesigned to suit the needs of rural India.

Some of our products for the rural segment are hereunder. Health Insurance - We offer affordable and customized family floater health insurance cover to rural population of the country through various channels like MFIs, NGOs and also organizations involved in Financial Inclusions We are also actively involved in Rashtriya Swasthya Bima Yojana (RSBY) scheme, Central-State Govt's joint social healthcare scheme for providing Health Insurance for BPL families across the country, wherein more than 32 Lakh families which are below poverty line (BPL) across various states like Gujarat, Maharashtra, Jharkhand, Bihar and West Bengal have been covered and benefited.

Personal Accident Insurance - Personal Accident Insurance covering Death, Permanent and Partial Total Disability along with hospitalization cash benefits to cover the rural populace Critical illness Insurance - To cater to the treatment cost/financial sustainability in case of listed critical illness is contracted Tractor / Commercial Vehicle / Motor / Farm Inputs Insurance - A product specifically designed for catering to rural requirement Micro Insurance - We work with various Micro Finance organizations working in the hinterland collaborating with SHGs (Self Help Groups) who provide insurance advisory services to the rural customers at their doorstep Combined / Composite Product Insurance - A package policy offering a one stop solution for various protections needs of rural families which includes Health Insurance, Accidental Insurance, Dwelling Insurance etc. is offered under a single policy

Weather / Input Based Crop against Act Of God perils - We are empanelled by the Government of India for WBCIS Scheme for Non Loanee farmers being implemented in various states Cattle Insurance - An insurance policy to provide insurance to cattle-breeding community of rural India to cover their milch-Cows / Buffaloes, Calves / Heifers, Stud Bulls & Bullocks etc; thus providing their prime livelihood source a financial protection in case of death or disability caused to cattle due to accident or disease. We work with the following institutions to offer rural insurance products.

Ministry of Labour, Govt of India Confederation of National Rural NGO's of India CIL's Manogromor Centers in A.P, Maharashtra, T.N. EID Parry to provide insurance to growers and workers Cholamandalam Investment & Finance Company Limited IndusInd Bank Limited - Vehicle Finance Division Mahindra Insurance Brokers Limited Dharmapuri District Central Co-operative Bank Salem District Central Co-operative Bank Rural Co-operative Banks Department of Agriculture, Govt. of Tamil Nadu Department of Agriculture, Govt. of Karnataka Department of Health & Family Welfare, Govt. of Gujarat Department of Labour, Employment & Training, Govt. of Jharkhand Department of Labour Resources, Govt. of Bihar Department of Labour , Govt. of Maharashtra Department of Labour, Govt. of West Bengal Central Bank of India

New segment

Insurance companies, which used to service these segments just to comply with IRDA norms, seem to have realised the potential of rural India. According to a Max New York Life-NCAER survey, only 19% of the country's rural households have life insurance cover, compared with the figure of 38% for ubran families. The challenge for the service providers is to find delivery channels to cater to these markets. IRDA guidelines stipulate that an insurance company starting operations need to have at least 7% of its clients from rural areas in the first year. The share of rural policies needs to grow to 20% in the 10th year. In the case of non-life insurers, they need to ensure that at least 7% of their gross premium income is from rural areas in the first year. The share will need to grow to at least 25% within the first 10 years.

The service providers which depend on banks have an advantage in terms of distribution infrastructure. "In-depth local market knowledge and formidable network of bank branches in rural and semi-urban areas comes handy for us," said Harpal Karlkut, chief executive officer at Canara HSBC Oriental Bank of Commerce Life Insurance. Some players such as Aviva are banking on the network of cooperative banks in rural areas for distributing their products. Some others are exploring more innovative channels. While the Life Insurance Corporation and ICICI Prudential Life Insurance are tieups with retailers such as Suvidhaa Infoserve, which runs close to 13,000 kirana stores across 400 locations. DLF Pramerica Life Insurance is partnering with Srei Sahaj EVillage to reach some 27,000 villages. Tie-ups with post offices is another delivery channel that is under exploration. ICICI Prudential has tied up with India Post last week to reach out to rural markets through 16,159 post offices across Andhra Pradesh. Max New York Life Insurance is banking on delivery channels such as microfinance institutions and non-gazatted organisations. In terms of product innovation, the micro-insurance segment remains lucrative for the companies. Micro insurance, which qualifies as part of the obligations of insurers towards social and rural sector, is generating interest among the insurers. With the rural economy getting more and more independent from the agriculture income, growth is expected to remain robust for the country's insurers.

New segment

are: Is the Indian rural market for insurancea great promise or a great challenge? A potential miracle or a mirage? A mere regulatory obligation or a great opportunity? How is the rural market defined? Are rural operations cost-effective? Is it commercially wise to make huge investments to create a rural distribution and delivery system? We at the Foundation of Research, Training & Education in Insurance (FORTE) thought it would be a great help to the industry if these issues were addressed. So we decided to commission a research study to Marketing and Research Team (MART). The study, titled Rural Insurance: Issues, Challenges & Opportunities had the following objectives: • Understand rural customers current knowledge, attitude and practice regarding finance, specifically savings, loans, bank deposits as well as insurance itself. • Determine the potential rural customers perceived need for acceptance of and willingness to purchase insurance policies. • Gather inputs for the development of a broad marketing approach for each potential customer segment in terms of products/pricing of insurance policies, promotion and development of communications relevant to the rural markets. • Gather inputs for the development of a broad distribution strategy for each potential customer segment and identification of delivery systems relevant to rural markets. Interesting findings The study brought forth revealing data. The rural folks have a strong saving habitthey save about one-third of their income annually across the three income segments studied. What was stunning was that the respondents, even those residing in backward areas, were quite conversant with insurance. The Indian rural market for insurance is not entirely an uninformed market. Almost 93% of the respondents were aware of life insurance; while 61% were aware of motor and accident insurance. Around 36% of them had bought some insurance or the other and another 38% of these policyholders had intention to buy more. A little over half (51%) of all the respondents had intentions of buying insurance products. Out of the non-policy holder respondents 62% intended to buy. If these numbers are extrapolated over the macro level, rural population being 742 million, the potential market could be of mind-boggling proportions.

Vibrant market Our research clearly indicates that the rural market is a vibrant market and holds tremendous potential for growth of insurance business, particularly because of the strong saving habit. While the industry would certainly be much heartened by the promising prospects in the rural sector, the real challenge for them would still be the distribution and delivery systems. Here again research has come up with valuable data about the extensive network built by the rural development agencies, the banks, the cooperative institutions, the NGOs and some industrial houses in the rural sector. Insurance companies would therefore be well advised to work out collaborative arrangements with these institutions to mutual advantage. Building infrastructure These institutions, having spent huge amounts for creating the infrastructure, will be happy to collaborate and recover some of the costs. Insurance companies would

The rural market in India, constituting 742 million people, is by far the largest potential market in the world. The annual rural household income of Rs 56,630 (as per NCAER, IMDR 2002) coupled with changing rural aspirations in consumption patterns and lifestyles unfolds tremendous opportunities for rural marketing. However, some of the issues that seem to be hindering large-scale advent in the rural markets are lack of understanding of rural customer, inadequate data on rural markets, poor infrastructure, low levels of literacy and poor reach of mass media. The insurance sector, per se, also did not make much headway in the rural sector. The insurance market in India, liberalised in 2000 with the advent of private insurance companies in November 2000 has not expanded in real terms beyond the urban domain. The penetration of insurance in India is pitifully low and if we aim for the modest target of insurance premium becoming 5% of GDP, insurance companies need to look at newer market segments rather than fight for a share in the same pie. There exists a vast potential in the rural areas where more than 70% of our population lives. But it is common perception and belief amongst the insurance companies that it is expensive to do business in rural areas. Most companies are focusing only on meeting regulatory requirements from rural areas and dont see them as commercially viable rural business opportunities, waiting to be exploited. Some of the questions tormenting the insurance marketers particularly the ones in the private sector are: Is the Indian rural market for insurancea great promise or a great challenge? A potential miracle or a mirage? A mere regulatory obligation or a great opportunity? How is the rural market defined? Are rural operations cost-effective? Is it commercially wise to make huge investments to create a rural distribution and delivery system? We at the Foundation of Research, Training & Education in Insurance (FORTE) thought it would be a great help to the industry if these issues were addressed. So we decided to commission a research study to Marketing and Research Team (MART). The study, titled Rural Insurance: Issues, Challenges & Opportunities had the following objectives: • Understand rural customers current knowledge, attitude and practice regarding finance, specifically savings, loans, bank deposits as well as insurance itself. • Determine the potential rural customers perceived need for acceptance of and willingness to purchase insurance policies. • Gather inputs for the development of a broad marketing approach for each potential customer segment in terms of products/pricing of insurance policies, promotion and development of communications relevant to the rural markets. • Gather inputs for the development of a broad distribution strategy for each potential customer segment and identification of delivery systems relevant to rural markets

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Chicks Kids and Couples The Nation in Calendar ArtDocument15 pagesChicks Kids and Couples The Nation in Calendar ArtSonia KumariPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- 1651036440434-List of Trains With Unreserved CoachesDocument6 pages1651036440434-List of Trains With Unreserved CoachesHemantPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- History of Ancient IndiaDocument5 pagesHistory of Ancient IndiaJoana Oyardo LlanaPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- So Many Hungers! - Still An Existing Reality in The Country (In Reference To Bhabani Bhattacharya's Novel, 'So Many Hungers')Document5 pagesSo Many Hungers! - Still An Existing Reality in The Country (In Reference To Bhabani Bhattacharya's Novel, 'So Many Hungers')Editor IJTSRDPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- 2nd Pak Studies Notes Faizi Online Academy PPSC FPSC Preparation Point 03093311603Document5 pages2nd Pak Studies Notes Faizi Online Academy PPSC FPSC Preparation Point 03093311603RIZWAN RIZZIPas encore d'évaluation

- Branches With Corporate Banking ServicesDocument9 pagesBranches With Corporate Banking ServicesGaurav ShahPas encore d'évaluation

- Std11 MalayalamDocument122 pagesStd11 MalayalamSuresh RajuPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Centre List 19Document7 pagesCentre List 19om vermaPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Sem I Sec BDocument6 pagesSem I Sec BRam Kumar YadavPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- TN Vision 2023 PDFDocument68 pagesTN Vision 2023 PDFRajanbabu100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Paint IndustryDocument18 pagesPaint IndustryJA SujithPas encore d'évaluation

- 8 TH GTSODocument4 pages8 TH GTSOKesanam Sp100% (1)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Awards and Honours 2023 - BankExamsTodayDocument3 pagesAwards and Honours 2023 - BankExamsTodayabhishek pathakPas encore d'évaluation

- India Heritage Note and PPT and Invitation Letter PDFDocument48 pagesIndia Heritage Note and PPT and Invitation Letter PDFShekar ReddyPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- B.p.no Contractor Name Mobile No. Meet Y/n: Dealer Code DealerDocument7 pagesB.p.no Contractor Name Mobile No. Meet Y/n: Dealer Code DealerAnkit SenPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Class 6-7-8-9-10-11 - 12 Political ScienceDocument109 pagesClass 6-7-8-9-10-11 - 12 Political Sciencegoyalrohit924Pas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- P P Grama DevateyaruDocument8 pagesP P Grama DevateyaruYogeshRajamargaPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Current Affairs PDF January 1 15 2019 PDFDocument133 pagesCurrent Affairs PDF January 1 15 2019 PDFKanak ChaudharyPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Welcome To Jobs in Nokia For FresherDocument2 pagesWelcome To Jobs in Nokia For FresherLibin RajPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- 625238Document319 pages625238Mahin MondalPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Committee Lists BISDocument158 pagesCommittee Lists BISBarjinder Singh GhaiPas encore d'évaluation

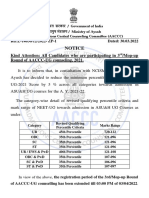

- NEET-UG Percentile Reduction & ExtensionDocument2 pagesNEET-UG Percentile Reduction & ExtensionNaazPas encore d'évaluation

- Sonal Singh - Grant of DiwaniDocument12 pagesSonal Singh - Grant of DiwaniZoya NawshadPas encore d'évaluation

- Political Science-II 1 PDFDocument24 pagesPolitical Science-II 1 PDFKhushi SinghPas encore d'évaluation

- 1536039998103-Hindi BooksDocument59 pages1536039998103-Hindi Bookstheentertainmentexpress7Pas encore d'évaluation

- WR Nda I 2016 Engl FDocument20 pagesWR Nda I 2016 Engl FAnonymous lDGCe7EPas encore d'évaluation

- Time Line Between 1857 To 1947Document8 pagesTime Line Between 1857 To 1947Safdar Hayat KhaksarPas encore d'évaluation

- Vivekananda's Travels in IndiaDocument5 pagesVivekananda's Travels in IndiaDeepSan100% (1)

- M SC (Micro) - IDocument2 pagesM SC (Micro) - Ikuldip.biotechPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Madan Mohan Malaviya (Document65 pagesMadan Mohan Malaviya (Amit UpadhyayPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)