Académique Documents

Professionnel Documents

Culture Documents

In IFarm

Transféré par

Rushabh NanavatiTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

In IFarm

Transféré par

Rushabh NanavatiDroits d'auteur :

Formats disponibles

START-UP CORNER

InI Farms: Reaping a harvest of organised play

Mumbai-based pomegranate exporter has attracted early investors but increasing scale & securing large land leases are challenges, writes Raghavendra Kamath

crop from existing growers, while orty-year-old Mahipal Singh that region. These include 25 per cent comes from contract and his fellow farmers in Netherlands-based Levarht, a supfarming and 50 per cent from its Narmada district, Gujarat, plier of fresh produce to supermarown farms. Depending on the three didnt know much about growing kets in that country. InI is among modes, it records margins of 10-30 pomegranates. Till 2011, they most- the most reliable and consistent per cent. ly grew bananas and other fruit. suppliers of good quality pomeThe company packs, sorts and Today, Singh and others are granates from India. The product is grades the fruit according to the involved in contract farming across packaged and supplied according requirements of various markets to the standards required by 200 acres for a horticulture firm. such as West Asia, Europe and the Singh said he expects a harvest European customers, Gerbert Van domestic market. About 80 per of good-quality pomegranates this Egmond of Levarht says in an cent of the volumes are accounted June-July and this could open the emailed reply. by Europe, 15 per cent by domestic Not only will InI have an doors to foreign markets for him. markets and West Asia for the rest. This could also boost the busi- opportunity to scale up production, The company expects 2014 to ness of Mumbai-based start-up InI it would also have access to adebe an important year. Khandelwal Farms, a horticulture firm focused quate volumes of exportable prohopes to cross the ~100-crore mileon pomegranates and involved in duce to meet contracts, says stone in the next three-and-a-half Vikram Puri, chief executive of contract farming with Singh. to four years. Considering the area With just a few organised play- Mahindra ShubhLabh, Mahindra under management, as well as our ers such as KB Exports, Freshtrop & Mahindras agri-business complans, we have a visibility of ~80-90 and Maha Anar in the segment and pany and Indias largest exporter crore and we expect the project to the vast export potential in western of table grapes to the European break even next year, he says. Europe and central Asia and the Union. Puri adds InI has a major advanincreasing demand in domestic What next? markets, InI Farms is already a tage scale. Since pomegranates Pankaj Khandelwal, chairman and managing director of InI, one of the Khandelwal says the company is focus area for investors such as are mostly grown in central south- few organised horticulture firms that deal in pomegranates working on a second commodiRonnie Screwvalas Unilazer ern Maharashtra, where high Another key task was to put ty/fruit, which he plans to softVentures and venture capital fund humidity during the monsoon pendent consultant. As part of his affects the crop and the problem assignment, he helped a European together a team to manage opera- launch in October. He doesnt disAavishkaar. It has a lot of scope for scaling of bacterial wilt is yet to be tackled, company acquire horticulture firm tions, as getting people with agri- close what the commodity would up and backward and forward inte- InI has shifted to new locations Desai Fruits and Vegetables, end- cultural know-how and corporate be. InI is also gration, as most of its cultivation where the weather is better suited ing up running the company for management keen to extend and harvest happens in the unor- for the fruit. Since they are the three years as chief executive. In skills was diffiits operations ganised sector, says Amit Banka, exclusive owners of the farms, if September 2009, he set up InI cult. From its to South-east managing director, InI Farms. For the entire area has to be sprayed in Farms, with his wife as a partner. launch as a sixAsia and the a spe- He secured seed funding from member team, one, makFar East in the Ashish Gupta, information tech- InI has 85 fulling ready- Since pomegranates require three years to cific show results, selling the 10-year story to coming years. nology entrepreneur and co- time and about to-drink Here, its relafounder of Helion Ventures, and 120 part-time juices or investors who look for exits in five-seven tionship with Pawan Vaish, co-founder of IBM employees. pulp on a years was a big task Levarht would Why Daksh. large scale PANKAJ KHANDELWAL come in handy. Since I had a stint of three to choose pomeis yet to be Chairman & Managing Director, InI Farms The company four years with Desai Fruits, I had a granates? tapped, is already helphe adds. Started with a sequencethey can get the spray- kind of soft landing, he says. His Because 44 acre farm in Ahmednagar in ing done effectively, he says, term at Desai Fruits not only pomegranates Pomegranate has a lot of scope ing InI to build supply relaMaharashtra, InI has plantations adding, Because of bacterial prob- helped him sign contract farming have a long for scaling up, and backward tions in West spread across 800 acres in lems, farm gate prices of the fruit agreements with farmers such as shelf life, are and forward integration, as Asia. In the Maharashtra, Madhya Pradesh and remain high, as it impacts crop Singh (who dealt with Desai), it also produced most of its cultivation and future, we helped him secure customers such round the year harvest happens in the Gujarat. Its business is about ~1.6-1.7 yields. believe well be and see unorganised sector Farm gate prices range from ~60 as Levarht. crore a month or about ~20 crore a able to extend Khandelwal says the biggest demand from AMIT BANKA to ~80 a kg and these are sold for year. our relationthe Managing Director, InI Farms In the next five years, InI aims to ~100-200 a kg, depending on the challenge was to draw investors to across ship by have plantations of 2,000 acres and quality and source of the harvest. the start-up. Since pomegranates world, he says, increasing volrequire three years to come up, to If you have to add an additional fruit to its busisell the 10-year story to investors run cold storages, supply chains umes of pomegranates, as well as ness. It also hopes to record rev- Early years enue of ~150 crore by then, says After securing degrees from Indian who look for exits in five to seven and warehouses through the year, adding new products, says Pankaj Khandelwal, chairman and Institute of Technology-Kanpur years was a big task, he says. you should have commodities Levarhts Egmond. Currently, InI is focused on the and Indian Institute of However, investment companies through the year. managing director. export markets, considering it is Even as InI aims to tap the Management-Kolkata, Khandelwal Unilazer Ventures and Aavishkaar difficult to secure domestic bulk lucrative European market, it had a stint with McKinsey & Co, showed faith (both declined to dis- Business model already has a few loyal customers in after which he became an inde- close the sums they have invested). InI Farms buys 25 per cent of the orders through the year. However,

Khandelwal expects the domestic markets to pick up in the next three years. The company is already in talks with domestic retail chains for long-term contracts. Challenges Horticulture experts say InIs business model is viable, provided it manages labour and cultivation and secures good land-leasing agreements. Their model works well if land leasing is permitted or land ceiling exemptions are extended to horticulture. Only then can you reap the benefits or efficiencies of scale, says Mahindras Puri. Currently, only Madhya Pradesh allows lease arrangements and ceiling exemptions. Asitava Sen, senior director and head (food & agribusiness research and advisory), Rabo India Finance, says, Average yields in India are about four tonnes/acre, which is lower than global standards. Given the fragmentation of land, aggregating farmers and formation of producer organisations may help not only to secure adequate farm income, but also to facilitate growth in productivity, quality and farm investments. He adds since fertilisers and agro-chemicals account for about half the cultivation costs, partnerships with farm input companies are important to enhance quality and yields and manage costs. The price competitiveness of Indian pomegranates is another issue for companies such as InI. The price competitiveness of Indian pomegranates compared to those from other countries is a significant challengeit is difficult for any Indian company to supply fruits round-the-year in Europe. Also, the size of the fruit supplied from India needs to increase, says Levarhts Egmond. He adds in the DecemberFebruary period, the crop shipped from Iran, Israel and Turkey score because of cheaper transport and freshness resulting from the shorter transit period. In April-May, the Peruvian crop scores because of better colouration and fewer pesticides. In May-June, the crop from Chile fares well because of better sizes and wide varieties, he says.

> EXPERT

TAKE

What intrigued me about InI was its innovative business model and the fact that chief executive Pankaj Khandelwal had impeccable credentials (IIT, IIM, McKinsey and Desai Fruits) and an amazing passion for the business. It has a unique model, through which it manages and controls the process from growing to supplying the fruit to large importers and retailers across the world. The focus on improving quality and productivity, together with branding, differentiates it from any other company in this largely unorganised sector. I also liked its laser-sharp focus. The company is focused on a single commodity, the pomegranate, a fruit with growing demand the world over. From the companys perspective, a mere one per cent share of global production is a significant volume. Managing scale in a perishable commodity in India is a challenge, especially for one aspiring to be a world-class horticulture company. The risks associated with weather, diseases and infrastructure have to be managed well to ensure consistency in supply, both in quality and time. InI aims to address this through a distributed and round-the-year production. I think the success of the venture would be driven by the teams ability to meet the management complexities associated with handling multiple-production centres and building extensive supplychain capabilities.

Pavan Vaish, global COO, Unitedlex, a legal outsourcing company and a seed investor in InI

Vous aimerez peut-être aussi

- Helen Hodgson - Couple's Massage Handbook Deepen Your Relationship With The Healing Power of TouchDocument268 pagesHelen Hodgson - Couple's Massage Handbook Deepen Your Relationship With The Healing Power of TouchLuca DatoPas encore d'évaluation

- Global Supplier Quality Manual SummaryDocument23 pagesGlobal Supplier Quality Manual SummarydywonPas encore d'évaluation

- American Wire & Cable Daily Rated Employees Union v. American Wire & Cable Co and Court of AppealsDocument2 pagesAmerican Wire & Cable Daily Rated Employees Union v. American Wire & Cable Co and Court of AppealsFoxtrot Alpha100% (1)

- Project Report On Inventory MGMTDocument76 pagesProject Report On Inventory MGMTajay135100% (3)

- Midsal Poultry Feed Mill Businees PlanDocument25 pagesMidsal Poultry Feed Mill Businees Planibrahim koroma90% (10)

- Project On Dairy IndustryDocument57 pagesProject On Dairy IndustryMeet Vajaria53% (19)

- Understanding Rice Milling OperationsDocument68 pagesUnderstanding Rice Milling OperationsChannu Arjun100% (1)

- BVOP-Ultimate Guide Business Value Oriented Portfolio Management - Project Manager (BVOPM) PDFDocument58 pagesBVOP-Ultimate Guide Business Value Oriented Portfolio Management - Project Manager (BVOPM) PDFAlexandre Ayeh0% (1)

- Reliance Value ChainDocument19 pagesReliance Value ChainRukshana Praveen0% (1)

- Rite Rice Farm Business PlanDocument12 pagesRite Rice Farm Business PlanMuhammed Ahmed100% (1)

- Cookery-10 LAS-Q3 Week5Document7 pagesCookery-10 LAS-Q3 Week5Angeline Cortez100% (1)

- Office of The Court Administrator v. de GuzmanDocument7 pagesOffice of The Court Administrator v. de GuzmanJon Joshua FalconePas encore d'évaluation

- SEED INUDSTRY SWOT AnalysisDocument107 pagesSEED INUDSTRY SWOT AnalysisPrashanth PB82% (11)

- KMF ProjectDocument85 pagesKMF ProjectUmesh Allannavar67% (3)

- Rite Rice Farm Business PlanDocument12 pagesRite Rice Farm Business PlanAndrew A Abraham100% (1)

- Micro or Small Goat Entrepreneurship Development in IndiaD'EverandMicro or Small Goat Entrepreneurship Development in IndiaPas encore d'évaluation

- Sahyadri ReportDocument34 pagesSahyadri ReportVikas Mahale Patil100% (1)

- Industrial Visit: Sahyadri Famers Producer CompanyDocument24 pagesIndustrial Visit: Sahyadri Famers Producer CompanyLofojay75% (4)

- Agriculrure Ventures-: in Spotlight!!!Document4 pagesAgriculrure Ventures-: in Spotlight!!!Priyanka RawatPas encore d'évaluation

- 890 Corporate Reports Champion Agro 1Document3 pages890 Corporate Reports Champion Agro 1Sanjay ShingalaPas encore d'évaluation

- "Marketing & Sales of Agricultural Seeds": Project Report OnDocument29 pages"Marketing & Sales of Agricultural Seeds": Project Report OnJAIMINPas encore d'évaluation

- Garden Silk MillsDocument32 pagesGarden Silk MillsKrishna KediaPas encore d'évaluation

- Private Sector Intervention in Indian Fruit & Vegetable Sector For Increasing Rural Wealth: A Case StudyDocument12 pagesPrivate Sector Intervention in Indian Fruit & Vegetable Sector For Increasing Rural Wealth: A Case StudyAsian Development BankPas encore d'évaluation

- Case Study - Group 3Document9 pagesCase Study - Group 3ERTUGRALPas encore d'évaluation

- Industrial Report On Saras DairyDocument88 pagesIndustrial Report On Saras DairyDeepak ChelaniPas encore d'évaluation

- MODULE 1 - Inam Nqumse 990305 5161 083 Farming ManagementDocument56 pagesMODULE 1 - Inam Nqumse 990305 5161 083 Farming ManagementInam AfrikaPas encore d'évaluation

- New Microsoft Office Word DocumentDocument3 pagesNew Microsoft Office Word DocumentDharmik MalaviyaPas encore d'évaluation

- Mother Dairy Summer Training ReportDocument47 pagesMother Dairy Summer Training ReportMithlesh SinghPas encore d'évaluation

- Amul Ice CreamDocument32 pagesAmul Ice CreamSumit DodaniPas encore d'évaluation

- Dudh Pandhari 1Document9 pagesDudh Pandhari 1rohini100% (2)

- Food and Inns ProjectDocument83 pagesFood and Inns ProjectGopi Nath100% (1)

- Untitled DocumentDocument16 pagesUntitled DocumentBharath MahendrakarPas encore d'évaluation

- Research Methodology of Sri Bhuvaneshwari Agro IndustriesDocument16 pagesResearch Methodology of Sri Bhuvaneshwari Agro IndustriesBharath MahendrakarPas encore d'évaluation

- Types of IndustriesDocument4 pagesTypes of IndustriesAsjad AliPas encore d'évaluation

- Patidar CottonDocument57 pagesPatidar CottonFarhanPas encore d'évaluation

- Scaling A Start-UpDocument7 pagesScaling A Start-UpSurojit PattanayakPas encore d'évaluation

- Summer Internship Report - IFFCODocument41 pagesSummer Internship Report - IFFCORiyaz Ansari100% (2)

- Active Crop Business PlanDocument15 pagesActive Crop Business PlanbrihadPas encore d'évaluation

- Agriculture Sector of IndiaDocument23 pagesAgriculture Sector of IndiaDnyaneshwar JadhavPas encore d'évaluation

- Kaveri SeedDocument39 pagesKaveri SeedAnirudhPas encore d'évaluation

- Organizational Study: Presidency CollegeDocument73 pagesOrganizational Study: Presidency CollegeAjmel Azad EliasPas encore d'évaluation

- Amul (Milk and Tru) : 1. Macro-Environmental AnalysisDocument2 pagesAmul (Milk and Tru) : 1. Macro-Environmental AnalysisGandhi Jenny Rakeshkumar BD20029Pas encore d'évaluation

- Inventory Management in Iffco VDocument89 pagesInventory Management in Iffco VShrinivas NagarappaPas encore d'évaluation

- PR Draft - DeHaat Freshtrop BTA 13 11 23Document2 pagesPR Draft - DeHaat Freshtrop BTA 13 11 23digvijay.deoPas encore d'évaluation

- Finance ReportDocument77 pagesFinance ReportDipak DiyoraPas encore d'évaluation

- Word ProjectDocument35 pagesWord ProjectVivek SinghPas encore d'évaluation

- SUMMER PRO - Dairyy.productssDocument63 pagesSUMMER PRO - Dairyy.productssManpreetsandher Sandher50% (2)

- Iffco ProjectDocument132 pagesIffco ProjectSangram PandaPas encore d'évaluation

- Anoop Project SynopsisDocument28 pagesAnoop Project Synopsispandey_hariom12Pas encore d'évaluation

- Ginni International Limited-1Document17 pagesGinni International Limited-1Charanpreet SinghPas encore d'évaluation

- Marketing Management On Bio Diesel For New Product DevelopmentDocument19 pagesMarketing Management On Bio Diesel For New Product DevelopmentMuhammad Asad AttariPas encore d'évaluation

- South India Spinning Mills PVT LTD Swot Analysis: StrengthsDocument5 pagesSouth India Spinning Mills PVT LTD Swot Analysis: StrengthsananthakumarPas encore d'évaluation

- Capricorn Food Products India Ltd. MBA Internship ReportDocument41 pagesCapricorn Food Products India Ltd. MBA Internship ReportArjunPas encore d'évaluation

- ASSIGNMENT 1 Anmol FeedsDocument4 pagesASSIGNMENT 1 Anmol FeedsPratik Kumar GhoshPas encore d'évaluation

- Organisational Study 2012 at Iffco Aonla Bareilly UpDocument68 pagesOrganisational Study 2012 at Iffco Aonla Bareilly UpSatya KurmiPas encore d'évaluation

- Saras Report AADISHDocument78 pagesSaras Report AADISHHari KrishanPas encore d'évaluation

- Nithya Silk Cotton Spinning Mills PVT LTD Swot Analysis: StrengthsDocument5 pagesNithya Silk Cotton Spinning Mills PVT LTD Swot Analysis: StrengthsananthakumarPas encore d'évaluation

- New Report On Organisation Study in KMFDocument75 pagesNew Report On Organisation Study in KMFk yasaswini100% (3)

- ChamDocument35 pagesChamvasavadapradipPas encore d'évaluation

- Saras Project ReportDocument89 pagesSaras Project ReportVikas Choudhary0% (2)

- Augmentation of Productivity of Micro or Small Goat Entrepreneurship through Adaptation of Sustainable Practices and Advanced Marketing Management Strategies to Double the Farmer’s IncomeD'EverandAugmentation of Productivity of Micro or Small Goat Entrepreneurship through Adaptation of Sustainable Practices and Advanced Marketing Management Strategies to Double the Farmer’s IncomePas encore d'évaluation

- Contract Farming for Better Farmer-Enterprise Partnerships: ADB's Experience in the People's Republic of ChinaD'EverandContract Farming for Better Farmer-Enterprise Partnerships: ADB's Experience in the People's Republic of ChinaPas encore d'évaluation

- A SUCCESSFUL POULTRY PROJECT: MAKE MONEY OUT OF CHICKENSD'EverandA SUCCESSFUL POULTRY PROJECT: MAKE MONEY OUT OF CHICKENSPas encore d'évaluation

- Leveraging on India: Best Practices Related to Manufacturing, Engineering, and ItD'EverandLeveraging on India: Best Practices Related to Manufacturing, Engineering, and ItPas encore d'évaluation

- Structure of IIP ReportDocument2 pagesStructure of IIP ReportTejas GohelPas encore d'évaluation

- GhioeaghieavkdslboiesDocument1 pageGhioeaghieavkdslboiesRushabh NanavatiPas encore d'évaluation

- Yubyuf Uifiuf Fyilliyu Yuib R OoDocument2 pagesYubyuf Uifiuf Fyilliyu Yuib R OoRushabh NanavatiPas encore d'évaluation

- ACF Assignment 1Document1 pageACF Assignment 1Rushabh NanavatiPas encore d'évaluation

- Ancient text discoveryDocument1 pageAncient text discoveryRushabh NanavatiPas encore d'évaluation

- Domain and RangeDocument6 pagesDomain and RangeHailstorm1Pas encore d'évaluation

- IiftDocument43 pagesIiftEswar Kiran ReddyPas encore d'évaluation

- For It PrecticeDocument5 pagesFor It PrecticeRushabh NanavatiPas encore d'évaluation

- Canada's Experience with Income TrustsDocument19 pagesCanada's Experience with Income TrustsRushabh NanavatiPas encore d'évaluation

- Domain and RangeDocument6 pagesDomain and RangeHailstorm1Pas encore d'évaluation

- Domain and RangeDocument6 pagesDomain and RangeHailstorm1Pas encore d'évaluation

- Ti Cycles FinalDocument20 pagesTi Cycles FinalAbhishek Jaiswal0% (1)

- Nextdoor Thrives On Connecting Neighbourhood CommunitiesDocument1 pageNextdoor Thrives On Connecting Neighbourhood CommunitiesRushabh NanavatiPas encore d'évaluation

- I CreateDocument1 pageI CreateRushabh NanavatiPas encore d'évaluation

- PAASCU Lesson PlanDocument2 pagesPAASCU Lesson PlanAnonymous On831wJKlsPas encore d'évaluation

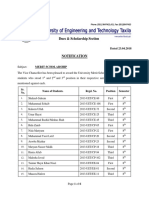

- Dues & Scholarship Section: NotificationDocument6 pagesDues & Scholarship Section: NotificationMUNEEB WAHEEDPas encore d'évaluation

- Unit 9Document3 pagesUnit 9Janna Rick100% (1)

- 2-Library - IJLSR - Information - SumanDocument10 pages2-Library - IJLSR - Information - SumanTJPRC PublicationsPas encore d'évaluation

- Summer 2011 Redwood Coast Land Conservancy NewsletterDocument6 pagesSummer 2011 Redwood Coast Land Conservancy NewsletterRedwood Coast Land ConservancyPas encore d'évaluation

- TOP 50 Puzzles For IBPS Clerk Mains 2018-19 WWW - Ibpsguide.com PDFDocument33 pagesTOP 50 Puzzles For IBPS Clerk Mains 2018-19 WWW - Ibpsguide.com PDFHarika VenuPas encore d'évaluation

- It ThesisDocument59 pagesIt Thesisroneldayo62100% (2)

- Henry VII Student NotesDocument26 pagesHenry VII Student Notesapi-286559228Pas encore d'évaluation

- Com 10003 Assignment 3Document8 pagesCom 10003 Assignment 3AmandaPas encore d'évaluation

- The Forum Gazette Vol. 2 No. 23 December 5-19, 1987Document16 pagesThe Forum Gazette Vol. 2 No. 23 December 5-19, 1987SikhDigitalLibraryPas encore d'évaluation

- Lucid Motors Stock Prediction 2022, 2023, 2024, 2025, 2030Document8 pagesLucid Motors Stock Prediction 2022, 2023, 2024, 2025, 2030Sahil DadashovPas encore d'évaluation

- School of Architecture, Building and Design Foundation in Natural Build EnvironmentDocument33 pagesSchool of Architecture, Building and Design Foundation in Natural Build Environmentapi-291031287Pas encore d'évaluation

- Senarai Syarikat Berdaftar MidesDocument6 pagesSenarai Syarikat Berdaftar Midesmohd zulhazreen bin mohd nasirPas encore d'évaluation

- Adorno - Questions On Intellectual EmigrationDocument6 pagesAdorno - Questions On Intellectual EmigrationjimmyrosePas encore d'évaluation

- Financial Accounting and ReportingDocument31 pagesFinancial Accounting and ReportingBer SchoolPas encore d'évaluation

- Common Application FormDocument5 pagesCommon Application FormKiranchand SamantarayPas encore d'évaluation

- Senior Civil Structure Designer S3DDocument7 pagesSenior Civil Structure Designer S3DMohammed ObaidullahPas encore d'évaluation

- The Butterfly Effect movie review and favorite scenesDocument3 pagesThe Butterfly Effect movie review and favorite scenesMax Craiven Rulz LeonPas encore d'évaluation

- Decision Support System for Online ScholarshipDocument3 pagesDecision Support System for Online ScholarshipRONALD RIVERAPas encore d'évaluation

- Portfolio ValuationDocument1 pagePortfolio ValuationAnkit ThakrePas encore d'évaluation

- Present Tense Simple (Exercises) : Do They Phone Their Friends?Document6 pagesPresent Tense Simple (Exercises) : Do They Phone Their Friends?Daniela DandeaPas encore d'évaluation

- Puberty and The Tanner StagesDocument2 pagesPuberty and The Tanner StagesPramedicaPerdanaPutraPas encore d'évaluation

- Kepler's Law 600 Years Before KeplerDocument7 pagesKepler's Law 600 Years Before KeplerJoe NahhasPas encore d'évaluation

- Transpetro V 5 PDFDocument135 pagesTranspetro V 5 PDFadityamduttaPas encore d'évaluation