Académique Documents

Professionnel Documents

Culture Documents

Imt 115

Transféré par

Pinky MattaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Imt 115

Transféré par

Pinky MattaDroits d'auteur :

Formats disponibles

Subject Code: IMT-115

Subject Name : SERVICE

Notes:

a. b. c. d. Write answers in your own words as far as possible and refrain from copying from the text books/handouts. st nd rd Answers of I Set (Part-A), II Set (Part-B), III Set (Part C) and Set-IV (Case Study) must be sent together. Mail the answer sheets alongwith the copy of assignments for evaluation & return. Only hand written assignments shall be accepted. 5 Questions, each question carries 1 marks. 5 Questions, each question carries 1 marks. 5 Questions, each question carries 1 marks. Confine your answers to 150 to 200 Words. Two Case Studies : 5 Marks. Each case study carries 2.5 marks.

TAX - I

A. First Set of Assignments: B. Second Set of Assignments: C. Third Set of Assignments: D. Forth Set of Assignments:

ASSIGNMENTS

FIRST SET OF ASSIGNMENTS Marks Assignment-I = 5

PART A

1. Name the committee which committee recommended the introduction of service tax in India. Also name the Act under which Service Tax is levied? 2. Which service were the first on which service tax was levied and what was the rate of service tax then? What is the current rate of Service tax? 3. A company having registered office in Jammu provides taxable service in Haryana. Is the company liable to pay service tax? 4. Why is service sector taxed? 5. Give Constitutional background for levy of Service Tax. SECOND SET OF ASSIGNMENTS Assignment-II = 5 Marks

PART B

1. What are the due dates of filling return of service tax? When should the return be filed if the due date happens to be a public holiday? 2. Give the essential characteristics of service. Who is to pay service tax? 3. X an individual has not provided any services in the half year period of April to September should he file any return for this period? 4. Who is the controlling authority for administration of service tax? 5. What are the penalties for delay in filling of service tax return?

Service Tax - I. ....................................................... Page 1 of 2 .......................................................................... IMT-115

THIRD SET OF ASSIGNMENTS

Assignment-III = 5 Marks

PART C

1. What do you mean by value of taxable services? 2. When is service tax payable? Is service tax payable on the advances received by the service provider? 3. A service was made taxable w.e.f. 1/07/2007. Contract for providing services was entered into prior to the effective date i.e. 1/07/2007. Bill has been raised and the value in full received from the customer prior to 1/07/2007. However, services were made rendered after 1/07/2007. Are the services taxable? 4. A service provider has not shown the service tax amount in my invoice. What is the amount on which I will have to pay service tax? 5. Discuss the provisions relating to self adjustment of excess tax paid in earlier period. FOURTH SET OF ASSIGNMENTS Assignment-IV = 2.5 Each Case Study

CASE STUDY - I

Mr. Ajar a Chartered accountant raised an Invoice for Rs.28060 (25000+3060 service tax) to a client on 20/01/2007. The client however has paid a lump-sum of Rs.26000 on 28/04/2007 for full and final settlement: 1. 2. How much service tax Mr. Ajar has to pay and when does this tax become due for payment? What will be his liability if client refuses to pay service tax and pays only Rs.25000 in total?

CASE STUDY-II

For providing beauty treatment services, a parlour uses materials such as cosmetics and toilet preparations. Whether the cost of such materials will be included in the value of taxable services? Whether any abetment is admissible on account of the value of materials consumed in providing the service?

Service Tax - I. ....................................................... Page 2 of 2 .......................................................................... IMT-115

Vous aimerez peut-être aussi

- Imt 72Document6 pagesImt 72Pinky MattaPas encore d'évaluation

- Imt 71Document4 pagesImt 71Pinky MattaPas encore d'évaluation

- Nlu 02Document2 pagesNlu 02Pinky MattaPas encore d'évaluation

- Imt 23 PDFDocument6 pagesImt 23 PDFarun1974Pas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Enerparc - India - Company Profile - September 23Document15 pagesEnerparc - India - Company Profile - September 23AlokPas encore d'évaluation

- 004-PA-16 Technosheet ICP2 LRDocument2 pages004-PA-16 Technosheet ICP2 LRHossam Mostafa100% (1)

- Building Program Template AY02Document14 pagesBuilding Program Template AY02Amy JanePas encore d'évaluation

- Guide To Growing MangoDocument8 pagesGuide To Growing MangoRhenn Las100% (2)

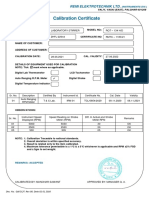

- Calibration CertificateDocument1 pageCalibration CertificateSales GoldClassPas encore d'évaluation

- Oracle FND User APIsDocument4 pagesOracle FND User APIsBick KyyPas encore d'évaluation

- Abu Hamza Al Masri Wolf Notice of Compliance With SAMs AffirmationDocument27 pagesAbu Hamza Al Masri Wolf Notice of Compliance With SAMs AffirmationPaulWolfPas encore d'évaluation

- CLAT 2014 Previous Year Question Paper Answer KeyDocument41 pagesCLAT 2014 Previous Year Question Paper Answer Keyakhil SrinadhuPas encore d'évaluation

- Assignment - 2: Fundamentals of Management Science For Built EnvironmentDocument23 pagesAssignment - 2: Fundamentals of Management Science For Built EnvironmentVarma LakkamrajuPas encore d'évaluation

- Year 9 - Justrice System Civil LawDocument12 pagesYear 9 - Justrice System Civil Lawapi-301001591Pas encore d'évaluation

- Aluminum 3003-H112: Metal Nonferrous Metal Aluminum Alloy 3000 Series Aluminum AlloyDocument2 pagesAluminum 3003-H112: Metal Nonferrous Metal Aluminum Alloy 3000 Series Aluminum AlloyJoachim MausolfPas encore d'évaluation

- Supergrowth PDFDocument9 pagesSupergrowth PDFXavier Alexen AseronPas encore d'évaluation

- Capital Expenditure DecisionDocument10 pagesCapital Expenditure DecisionRakesh GuptaPas encore d'évaluation

- Ishares Core S&P/TSX Capped Composite Index Etf: Key FactsDocument2 pagesIshares Core S&P/TSX Capped Composite Index Etf: Key FactsChrisPas encore d'évaluation

- Google App EngineDocument5 pagesGoogle App EngineDinesh MudirajPas encore d'évaluation

- ST JohnDocument20 pagesST JohnNa PeacePas encore d'évaluation

- A. The Machine's Final Recorded Value Was P1,558,000Document7 pagesA. The Machine's Final Recorded Value Was P1,558,000Tawan VihokratanaPas encore d'évaluation

- Research Article: Finite Element Simulation of Medium-Range Blast Loading Using LS-DYNADocument10 pagesResearch Article: Finite Element Simulation of Medium-Range Blast Loading Using LS-DYNAAnonymous cgcKzFtXPas encore d'évaluation

- Guide For Overseas Applicants IRELAND PDFDocument29 pagesGuide For Overseas Applicants IRELAND PDFJasonLeePas encore d'évaluation

- 90FF1DC58987 PDFDocument9 pages90FF1DC58987 PDFfanta tasfayePas encore d'évaluation

- Engineering Notation 1. 2. 3. 4. 5.: T Solution:fDocument2 pagesEngineering Notation 1. 2. 3. 4. 5.: T Solution:fJeannie ReguyaPas encore d'évaluation

- CIR Vs PAL - ConstructionDocument8 pagesCIR Vs PAL - ConstructionEvan NervezaPas encore d'évaluation

- Astm E53 98Document1 pageAstm E53 98park991018Pas encore d'évaluation

- HandloomDocument4 pagesHandloomRahulPas encore d'évaluation

- Cryo EnginesDocument6 pagesCryo EnginesgdoninaPas encore d'évaluation

- Shubham RBSEDocument13 pagesShubham RBSEShubham Singh RathorePas encore d'évaluation

- Internship ReportDocument46 pagesInternship ReportBilal Ahmad100% (1)

- IdM11gR2 Sizing WP LatestDocument31 pagesIdM11gR2 Sizing WP Latesttranhieu5959Pas encore d'évaluation

- A320 TakeoffDocument17 pagesA320 Takeoffpp100% (1)

- POST TEST 3 and POST 4, in ModuleDocument12 pagesPOST TEST 3 and POST 4, in ModuleReggie Alis100% (1)