Académique Documents

Professionnel Documents

Culture Documents

Contributions Form - The GMG Lifestyle Plan

Transféré par

jwaldron69Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Contributions Form - The GMG Lifestyle Plan

Transféré par

jwaldron69Droits d'auteur :

Formats disponibles

Contributions Form The GMG Lifestyle Plan

If you are unsure at any stage, please contact the Pensions Department on 020 3353 2000

1.

Please fill in YOUR DETAILS (CAPITAL LETTERS)

SURNAME.. INITIALS DATE OF BIRTH TEL. NO......... HOME ADDRESS .. .

2.

Please set an EFFECTIVE DATE for the change in your contributions

EFFECTIVE DATE

FIRST DAY OF

(MONTH)

(YEAR)

3.

To CHANGE Your Current Rate Of Ordinary Contributions

5%* 2.5%* 0%*

* % of Pensionable Earnings

Please tick one of the boxes The Company will pay between 8% and 12% The Company will pay between 4% and 6% The Company will pay 2.5%

Note that your life cover and Income Protection cover will be lower if you choose to be a non-contributor. If you move from paying 0% to paying 2.5% or 5%, the increase in life cover and Income Protection cover would be subject to medical underwriting.

WARNING: A limit of 50,000, per tax year, total pension contributions (employee plus company) are eligible for tax relief. It is your personal responsibility to monitor future contributions and consider changes as and when you deem appropriate.

4.

To START, STOP or CHANGE Additional Voluntary Contributions (AVCs) or Extra Contributions (ECs)

AVCs as % of pensionable earnings

(MAXIMUM 10%)

OR

Fixed Amount AVCs per month To STOP paying AVCs please tick here

Variable AVCs on any non-pensionable earnings

(MAXIMUM 15%)

If you choose maximum AVCs, you could also consider paying Extra Contributions (ECs). ECs as % of pensionable earnings

(MAXIMUM 85%)

OR

Fixed Amount ECs per month To STOP paying ECs please tick here

5.

Please SIGN, DATE AND RETURN your Contributions Form

I request and authorise the Company to start or stop deductions from my pay (via PaySmart where appropriate) as detailed above. SIGNED.. DATED.

Please return completed form by post to GMG Pensions Department at Centurion House, 129 Deansgate, Manchester M3 3WR or by email to pensions@gmgplc.co.uk or by fax to. 020 3353 3125 no later than the end of the month prior to the Effective Date. It will be acknowledged upon receipt.

L024

The security of your personal information: All the information you provide will be held by the Trustees or by the scheme administrators who act on their behalf to arrange and administer your entitlements (and entitlements in respect of you) from the scheme. The information is kept secure and is only disclosed to third parties to the extent needed to enable the Trustees and their advisers to run the Scheme and comply with any legal or other requirements imposed on the Trustees. It may be necessary from time to time to disclose your personal data to people and organisations outside the European Economic Area and which are not covered by equivalent data protection legislation; in these circumstances the Trustees will take whatever steps they feel are necessary to ensure that your data remains secure.

Vous aimerez peut-être aussi

- Cell Phone BillDocument10 pagesCell Phone BillKimBeem100% (1)

- American Credit Repair: Everything U Need to Know About Raising Your Credit ScoreD'EverandAmerican Credit Repair: Everything U Need to Know About Raising Your Credit ScoreÉvaluation : 3 sur 5 étoiles3/5 (3)

- Sanlam Rsa Benefit StatementDocument8 pagesSanlam Rsa Benefit StatementKim ErasmusPas encore d'évaluation

- Sprint BillDocument42 pagesSprint BillMarshallLongPas encore d'évaluation

- Your Postpay BillDocument4 pagesYour Postpay BillAvneet MaanPas encore d'évaluation

- Https Myaccountportal - SprintDocument15 pagesHttps Myaccountportal - SprintjjPas encore d'évaluation

- Renewal NoticeDocument2 pagesRenewal NoticeJerry LamaPas encore d'évaluation

- Malpractice Proposal-Aijaz-NewDocument2 pagesMalpractice Proposal-Aijaz-NewGalaleldin AliPas encore d'évaluation

- Change of Ownership FormDocument3 pagesChange of Ownership FormOwabong OwabongPas encore d'évaluation

- 1 of 6 Hello!: Total Due $271.76Document21 pages1 of 6 Hello!: Total Due $271.76api-91006865Pas encore d'évaluation

- L190 - TRD FormDocument2 pagesL190 - TRD Formjgreys69Pas encore d'évaluation

- Target Retirement Date Change Form PDFDocument1 pageTarget Retirement Date Change Form PDFjgrey69Pas encore d'évaluation

- Notice of Withdrawal Form From The Pension SchemeDocument1 pageNotice of Withdrawal Form From The Pension SchemeWongani lunguPas encore d'évaluation

- Medical Malpractice Insurance Proposal Form: Personal DetailsDocument2 pagesMedical Malpractice Insurance Proposal Form: Personal DetailsGalaleldin AliPas encore d'évaluation

- Buildings Insurance Claim FormDocument4 pagesBuildings Insurance Claim FormNobertPas encore d'évaluation

- Vets Joining DocumentDocument1 pageVets Joining DocumentdeanmortimorePas encore d'évaluation

- Congratulation! Congratulation!! Congratulation!!!Document2 pagesCongratulation! Congratulation!! Congratulation!!!Yucef Bahian-AbangPas encore d'évaluation

- INFOCOM 2022 Delegate Registration FormDocument2 pagesINFOCOM 2022 Delegate Registration FormSarathya GhoshalPas encore d'évaluation

- INDIVIDUAL APPLICATION FOR MEMBERSHIP August 2022Document4 pagesINDIVIDUAL APPLICATION FOR MEMBERSHIP August 2022macklean lionelPas encore d'évaluation

- Your Reliance Communications BillDocument8 pagesYour Reliance Communications BillSebin MathewsPas encore d'évaluation

- (For All Officers Other Than Group D) : (Through The Head of Office)Document4 pages(For All Officers Other Than Group D) : (Through The Head of Office)Amit GangulyPas encore d'évaluation

- Vantage Loan Application Form: Section A: Particulars of BorrowerDocument9 pagesVantage Loan Application Form: Section A: Particulars of BorrowerOluwaloseyi SekoniPas encore d'évaluation

- 531 Tax Application Cost of Living Rebate Embedded 2023Document1 page531 Tax Application Cost of Living Rebate Embedded 2023micknaylor38Pas encore d'évaluation

- CRS-2806 CD IM Policy BookletDocument36 pagesCRS-2806 CD IM Policy BookletJason FitchPas encore d'évaluation

- Form MDocument1 pageForm Marjunkumar915Pas encore d'évaluation

- Master Data Sheet For Suppliers: Class SRL Via Rovereto 9. 36030 Costabissara (VI) ItalyDocument4 pagesMaster Data Sheet For Suppliers: Class SRL Via Rovereto 9. 36030 Costabissara (VI) Italygiada bagolanPas encore d'évaluation

- Partner Application Form v3.0 - DW PuttyDocument3 pagesPartner Application Form v3.0 - DW PuttyGOPAL TRIVEDIPas encore d'évaluation

- HR Formats 2024Document64 pagesHR Formats 2024Anantha JiwajiPas encore d'évaluation

- Investment ContractDocument5 pagesInvestment ContractJBJBPas encore d'évaluation

- SD502 (V15) 12.2015Document4 pagesSD502 (V15) 12.2015Anonymous gw6lCkTiMWPas encore d'évaluation

- Revised PF Withdrawal Form-19Document3 pagesRevised PF Withdrawal Form-19Sukhveer SinghPas encore d'évaluation

- NU Credit Application Form - AfricaDocument3 pagesNU Credit Application Form - AfricaShina AinaPas encore d'évaluation

- MLAMU Account Opening Form 1Document4 pagesMLAMU Account Opening Form 1Tumwine Kahweza ProsperPas encore d'évaluation

- WITHDRAWAL REQUEST FORMDocument4 pagesWITHDRAWAL REQUEST FORMpedro araujoPas encore d'évaluation

- New Client Registration FormDocument1 pageNew Client Registration Formdetek kPas encore d'évaluation

- KCCI Membership FormDocument2 pagesKCCI Membership FormSuresh AsangiPas encore d'évaluation

- Tanzania Revenue Authority StatementDocument6 pagesTanzania Revenue Authority StatementUrusi TeklaPas encore d'évaluation

- All Accidents Must Be Reported With 24 HoursDocument1 pageAll Accidents Must Be Reported With 24 Hourshharum13Pas encore d'évaluation

- Ghana Syntek Distributor Application FormDocument4 pagesGhana Syntek Distributor Application FormAmbrose OlwaPas encore d'évaluation

- Personal Information Form: Section 1: Your Personal DetailsDocument6 pagesPersonal Information Form: Section 1: Your Personal DetailsRabain NadeemPas encore d'évaluation

- Territory Revenue Office Life Insurance Return: Stamp Duty ActDocument20 pagesTerritory Revenue Office Life Insurance Return: Stamp Duty ActPandurang UpparamaniPas encore d'évaluation

- Job Search LogDocument2 pagesJob Search LogSherri Lynn EvangelistoPas encore d'évaluation

- Loan Application Hekima Loan 2022Document2 pagesLoan Application Hekima Loan 2022JAMES MUANGEPas encore d'évaluation

- Uganda Boda Boda Employment ContractDocument6 pagesUganda Boda Boda Employment ContractwasswaPas encore d'évaluation

- Absa Consultants and Actuaries Afrimat Pension Fund (Withdrawal) - 101456903 PDFDocument3 pagesAbsa Consultants and Actuaries Afrimat Pension Fund (Withdrawal) - 101456903 PDFAlvin JantjiesPas encore d'évaluation

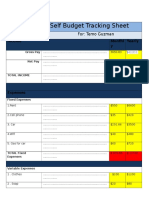

- My Future Self Budget Tracking Sheet: For: Temo GuzmanDocument2 pagesMy Future Self Budget Tracking Sheet: For: Temo Guzmanapi-321434791Pas encore d'évaluation

- Apprenticeship-Application-Form (2) 240412 143743Document2 pagesApprenticeship-Application-Form (2) 240412 143743loresankolobaPas encore d'évaluation

- Form - 1 Application For Opening An Account: Paste Photograph of Applicant/sDocument9 pagesForm - 1 Application For Opening An Account: Paste Photograph of Applicant/sSundar RajanPas encore d'évaluation

- IT-GO No.979Document117 pagesIT-GO No.979Kathiravan GopalanPas encore d'évaluation

- Membership Form: Payment Method Credit /debit CardDocument1 pageMembership Form: Payment Method Credit /debit CardCalum HallPas encore d'évaluation

- Sila Masukkan Semua Maklumat Yang Berkenaan Dengan BetulDocument8 pagesSila Masukkan Semua Maklumat Yang Berkenaan Dengan Betulmadir7712Pas encore d'évaluation

- Employee Pension Scheme Form 10 C - Sample Form With Guidelines PDFDocument2 pagesEmployee Pension Scheme Form 10 C - Sample Form With Guidelines PDFSuraj BaugPas encore d'évaluation

- Greenlight Planet 1-2Document2 pagesGreenlight Planet 1-2Angela Mia AyakoPas encore d'évaluation

- Squeeze Page - Business ProposalDocument8 pagesSqueeze Page - Business ProposalandrewmoshiPas encore d'évaluation

- Claim-Application-Form-E-payoutDocument1 pageClaim-Application-Form-E-payoutdarkoboadu9Pas encore d'évaluation

- Tarif For PVT ITIsDocument1 pageTarif For PVT ITIsashmiPas encore d'évaluation

- Application for Membership to include AML Requirements 2020Document2 pagesApplication for Membership to include AML Requirements 2020raphaelmohara04Pas encore d'évaluation

- Marketing ResearchDocument1 pageMarketing ResearchrkgunjanPas encore d'évaluation

- Contributions Form - The GMG Lifestyle PlanDocument1 pageContributions Form - The GMG Lifestyle Planjgrey69Pas encore d'évaluation

- Members Guide - Sept 2013Document28 pagesMembers Guide - Sept 2013jgrey69Pas encore d'évaluation

- Flexible Benefits Member Guide - Casuals&Hotdesk Sept 2013Document11 pagesFlexible Benefits Member Guide - Casuals&Hotdesk Sept 2013jgrey69Pas encore d'évaluation

- Investment Guide - Sept 2013Document16 pagesInvestment Guide - Sept 2013jgrey69Pas encore d'évaluation

- Casuals Contribution Change FormDocument1 pageCasuals Contribution Change Formjgrey69Pas encore d'évaluation

- Investment Choices Form PDFDocument2 pagesInvestment Choices Form PDFjgrey69Pas encore d'évaluation

- The GMG Lifestyle Plan (Casual Workers Including Hotdesk) Opt-Out FormDocument1 pageThe GMG Lifestyle Plan (Casual Workers Including Hotdesk) Opt-Out Formjgrey69Pas encore d'évaluation

- Non-Participation in PaySmart FormDocument2 pagesNon-Participation in PaySmart Formjgrey69Pas encore d'évaluation

- Investment Policy Document - GMG - Feb 2013Document10 pagesInvestment Policy Document - GMG - Feb 2013jgrey69Pas encore d'évaluation