Académique Documents

Professionnel Documents

Culture Documents

Day 7 Tullow Uganda Limited Vs Heritage Oil

Transféré par

The New VisionTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Day 7 Tullow Uganda Limited Vs Heritage Oil

Transféré par

The New VisionDroits d'auteur :

Formats disponibles

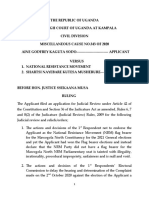

Day 7 Tullow Uganda Limited v (1) Heritage Oil & Gas; (2) Heritage Oil Plc 21 March 2013

Page 1 1 Thursday, 21 March 2013 2 (10.30 am) 3 Housekeeping 4 MR JUSTICE BURTON: I have read Mr Atherton's witness 5 statement and it does seem to me that large chunks of it 6 are, if not the majority of it, either quotations from 7 other documents or arguments. So it may be you won't 8 take the whole day. 9 MR WOLFSON: I don't know whether your Lordship has actually 10 read the first page of my cross-examination notes but 11 that was precisely the point I was going to make. 12 MR JUSTICE BURTON: Yes. 13 MR WOLFSON: My Lord, I do not intend to cross-examine -14 and I say this with all respect to you, Mr Atherton, it 15 is not a criticism, I know how these documents are put 16 together -17 MR JUSTICE BURTON: He was drafting out counsel's skeleton 18 arguments probably. 19 MR WOLFSON: Precisely. I don't propose to cross-examine 20 a witness when the witness is commenting on documents 21 which he was not a party to, which he didn't know about 22 at the time and which my learned friend can make 23 submissions on. 24 MR JUSTICE BURTON: Indeed so. I raise it only because it 25 seems to me that it may reflect upon the amount of

Page 2

1 time -- I hadn't read the witness statement before, 2 because it wasn't part of my pre-trial reading and so I 3 only read it last night preparing myself for your 4 onslaught today and I would have thought it wouldn't be 5 very long. 6 That said, see how long it is, but we may still not 7 start Mr Inch. We'll see how it goes. 8 MR WOLFSON: We will see how it goes. I made the point in 9 my opening submissions that this was not a balanced case 10 in that regard. 11 MR JUSTICE BURTON: No. 12 MR WOLFSON: My learned friend has to prove -13 MR JUSTICE BURTON: You are trying to point out that he is 14 earning his brief fee more than you are, is that it? 15 MR WOLFSON: That is almost invariably the case, my Lord. 16 MR JUSTICE BURTON: Can I ask, one thing, Mr Qureshi, before 17 we seek to put Mr Atherton in the witness box in-chief. 18 It is something that I didn't really understand in 19 opening and still don't understand, and it seems to me 20 I ought to get it in my head before Mr Atherton is 21 called. 22 You are counterclaiming in respect of the money in 23 the escrow and Mr Atherton describes two ways of 24 recovering alleged losses, either interest loss or loss 25 of financial opportunity. But at the moment I don't

Page 3

1 grasp how it is that you have a counterclaim in respect 2 of -- you say, on some basis or other, but you will no 3 doubt tell me, that the money would have come out of 4 escrow in April 2011, but for something -- and I am not 5 sure what the something is -- and had it done so, I 6 quite understand Mr Atherton then describes what you 7 could or would or might have done with the money since, 8 I think it is 9 April 2011. 9 But I don't understand the cause of action. 10 MR QURESHI: My Lord, so far as the cause of action is 11 concerned, if the pleading hasn't articulated it with 12 the clarity that we believed it had, ultimately the 13 issue is essentially that the purpose for which the 14 escrow arrangement had been entered into and those funds 15 were locked in is a purpose that no longer exists. 16 MR JUSTICE BURTON: Help me. The purpose for which your 17 client voluntarily put the money into the escrow 18 account, and you rely on the fact that they paid it in 19 as showing that they were always willing to be sensible 20 about the tax and everyone else around them was not 21 acting so reasonably, and certainly the Government went 22 back, perhaps, on a deal that everyone thought had been 23 done, et cetera, et cetera. 24 But it was put in voluntarily by your clients to 25 await the outcome of the tax liability and that has

Page 4

1 still not been resolved, either the Tax Appeal Tribunal 2 because although you lost first time round you are 3 appealing it, or in the arbitration because the 4 jurisdiction has not yet been resolved, never mind the 5 substance. And so surely the money ought to be staying 6 in the escrow account, subject to any order I may be 7 invited by either of you to make, until the outcome of 8 the tax liability is resolved one way or t'other. At 9 the moment I don't see the case for how it could or 10 should have come out on 9 April 2011. 11 MR QURESHI: My Lord, of course our primary position is that 12 there was no liability to tax. 13 MR JUSTICE BURTON: Of course. 14 MR QURESHI: On the -15 MR JUSTICE BURTON: That is not something they can agree. 16 That is something the Government will have to give in on 17 or you lose on. 18 MR QURESHI: My Lord, it is essentially as follows: Tullow's 19 high point starting -20 MR JUSTICE BURTON: Sorry, to interrupt. It just seemed to 21 me we ought to try to resolve it before you start. 22 MR QURESHI: Tullow's position is that as of the payment 23 made purportedly pursuant to the Memorandum of 24 Understanding and the letters of 15 March, Heritage's 25 tax liability is discharged. That is Tullow's point.

Page 5

1 That is Tullow's case; if that is correct, then the 2 purpose of the escrow arrangement no longer exists. 3 MR JUSTICE BURTON: I am sorry, I have not understood what 4 you have said: "As of the payment made pursuant to the 5 ..." and then the [draft] transcript says -- I don't 6 know what that is -- "to the Memorandum of Understanding 7 and the letters of 15 March your tax liability is 8 discharged. That is Tullow's point." 9 Tullow paid it, rightly or wrongly, on the basis 10 that they were being required by the Government under 11 108 which on their analysis means that they must pay it, 12 whether it is payable or not, if it is due. That is 13 their case: section 108 requires the agent to pay it up 14 if it is due but not if it is payable. 15 Then you fight out whether it was in fact due and 16 payable and if you win, the money comes back and if you 17 lose -- ie, back to you or possibly to them -- we have 18 to see, and if you lose, the Government gets it. And 19 that was done voluntarily by your client. That is what 20 it says. 21 Where is the purpose fail? 22 MR QURESHI: My Lord, so far as the establishment of the 23 escrow arrangement in July 2010, we maintain the 24 position that it was clear to Heritage and clear to 25 Tullow that Heritage were to have sole conduct of the

Page 6

1 tax dispute -2 MR JUSTICE BURTON: Yes. 3 MR QURESHI: -- up until the conclusion of that dispute by 4 final determination -5 MR JUSTICE BURTON: Certainly. 6 MR QURESHI: -- by arbitration or court. 7 MR JUSTICE BURTON: Yes. 8 MR QURESHI: What Tullow sought to do through the exchange 9 of letters, the Memorandum of Understanding with the 10 Ugandan authorities was to put itself in a position 11 where it now says: "Your liability has been discharged." 12 MR JUSTICE BURTON: No, I don't think so. 13 MR QURESHI: My Lord, that is their case. 14 MR JUSTICE BURTON: Is it? 15 MR QURESHI: That is their case. 16 MR JUSTICE BURTON: They paid it as agent for you because 17 they were required to. I mean, this is all to be 18 discussed later. They paid it to you because they were 19 required to do so while you, and despite the fact that 20 you had rendered at any rate the 283 non-payable by 21 paying your one-third or they paid it on your behalf and 22 disputing the balance. Leave aside the extra 30 for the 23 moment. That was bound to take some time and the escrow 24 account would remain in place until then. 25 Mr Atherton seems to say that something happened on

Page 7

1 9 April 2011. I am perhaps -2 MR QURESHI: Perhaps I could turn to the -3 MR JUSTICE BURTON: Had the escrow monies been released 4 in April 2011? I am just looking to see, because 5 I couldn't understand why April was lit upon. 6 MR WOLFSON: That is the date we paid the Government, 7 I understand. 8 MR JUSTICE BURTON: The date you paid the Government, I see. 9 MR QURESHI: My learned friend -10 MR WOLFSON: If I can try to shed some light on it, my Lord, 11 it may tie it up with another point I was going to 12 mention to your Lordship which is that we have put 13 together the note on a constructive way for your 14 Lordship to deal with the Heritage tax point, if I can 15 call it that, and we will hopefully hand that up after 16 the short break this morning. 17 The two points are tied in this respect. As 18 I understand my learned friend's case, it goes something 19 like this -- let us see if I can put it for him: 20 because, Tullow, on your alternative claim in 21 restitution and in fact on the secondary way you put 22 your alternative claim of restitution you, Tullow, are 23 saying that you have discharged our tax liability and, 24 therefore, you have a claim to restitution. Because of 25 that and because the escrow monies -- this is the

Page 8

1 purpose point -- are there in some way as security for 2 our tax bill. Thanks very much you have discharged our 3 tax bill and now we can have the escrow monies out as 4 well. 5 We have a number of answers to that. But as 6 I understand it, it is a fairly brazen point, but that 7 as I understand it is actually the point being made 8 against us. 9 MR JUSTICE BURTON: So it is an answer to your alternative 10 case. Your primary case, which is what we have been 11 listening to for the last few days, is that you are 12 required by the Government to pay it over 13 notwithstanding that the tax position had been secured, 14 as far as the 288 was concerned, by a dispute, a payment 15 of the one-third and an arbitration or a tribunal as to 16 the balance. 17 MR WOLFSON: Yes. 18 MR JUSTICE BURTON: But because you are putting forward an 19 alternative case that you settled their tax liability if 20 all else fails, then they say, "Well, if you settled our 21 tax liability, thank you very much, we should have had 22 the money back". But the trouble is -- I haven't heard 23 Mr Qureshi yet, but the trouble is that on your 24 second -- on that case, if that succeeds, you get it 25 back and you should have had it back on April 7, 2011.

Page 9

1 MR WOLFSON: All I would say, my Lord, we are not making 2 closing submissions, it does seem a somewhat 3 counterintuitive result that Tullow has both discharged 4 Heritage's tax liability, because this assumes there was 5 a valid tax liability, and we have paid it. 6 MR JUSTICE BURTON: Yes. 7 MR WOLFSON: And the 283 in the escrow still somehow ends up 8 with them -9 MR JUSTICE BURTON: And not with you. 10 MR WOLFSON: That would seem to be an odd result. 11 MR JUSTICE BURTON: It is only if your alternative case 12 succeeds we have to worry about this. No doubt 13 Mr Qureshi expects your alternative case to fail, but if 14 it succeeds, then you paid their tax liability, you 15 should get the money back with interest since 16 7 April 2011. 17 MR WOLFSON: Well, without wishing to be perhaps overly 18 pedantic at this stage, if the alternative case succeeds 19 we would have a claim against him in restitution so we 20 would get a judgment. Whether we get the escrow monies 21 out goes to the question of the jurisdiction on the 22 escrow and you know our position on that, which is that 23 actually our primary position is that neither party has 24 it because there is no jurisdiction -- you know the 25 sense I am using that word -- there is no jurisdiction

Page 10

1 in this court over that contract. 2 MR JUSTICE BURTON: Yes, I follow that. Yes, there it is. 3 But you are relying on 7 April as being the date when 4 they paid your tax liability. 5 MR QURESHI: Our purported tax liability. They made 6 a payment. 7 MR JUSTICE BURTON: I don't know. I think it has to be your 8 tax liability. I mean, it is all basing on alternative 9 cases. It doesn't arise -- only on one of the various 10 cases does this arise that they paid your tax liability, 11 that, if they have paid your tax liability I entirely 12 follow you should have the money back out of the escrow 13 account but they should have it. The circumstance in 14 which you get the money out of the escrow account and 15 have interest or capital or alternative of vast amounts 16 because you could have invested in Nigeria, at the 17 moment seems to me pie in the sky but at least I now 18 understand the position and Mr Atherton can give his 19 evidence. 20 MR QURESHI: My Lord, if the pleading hasn't expressed the 21 position with sufficient clarity, we can seek to -22 MR JUSTICE BURTON: I hadn't understood it but I now do 23 begin to understand it. Yes? 24 MR QURESHI: My Lord, there are some notes that I am handing 25 up which I believe have been provided to my friend, the

Page 11

1 notes that your Lordship has requested be prepared on 2 clause 3.1 (Handed). 3 MR JUSTICE BURTON: Thank you very much indeed. 4 MR QURESHI: The first -5 MR JUSTICE BURTON: These are the same notes as I have had 6 from Mr Wolfson? 7 MR QURESHI: My Lord, yes. 8 MR JUSTICE BURTON: Thank you very much. 9 MR QURESHI: The first one is on the clause 3.1. The second 10 is on 7.6. The third is 106. The fourth is the 11 payments that continue to be made, and the fifth is the 12 comparison between the December 2010 document that 13 Mr Martin signed off on, the 15 March 2011 Memorandum of 14 Understanding. 15 MR JUSTICE BURTON: Good, that is very helpful. Thank you 16 very much. 17 MR WOLFSON: Can I just raise one further point of 18 housekeeping before we start with the witness. 19 Obviously we are somewhat in the dark on this point 20 but your Lordship was very keen that that letter would 21 go to the Arbitrators. 22 MR JUSTICE BURTON: Yes. 23 MR WOLFSON: Of course we are outside the loop and we are 24 equally keen to know what's going on. 25 MR JUSTICE BURTON: I am very keen to know.

Page 12

1 MR QURESHI: My Lord, I asked about this yesterday. I asked 2 yesterday afternoon and this morning. We have not had 3 an answer from Messrs Curtis. There are two 4 representatives here in court from Messrs Curtis. 5 MR JUSTICE BURTON: I wonder if I could ask them to find out 6 now for me, please. You are sitting at the back. 7 Hello, good morning to you. You sat here yesterday 8 morning, and I know that you reported back but I would 9 like an answer, please, at the short adjournment. There 10 are two of you. Why don't one of you make a phone call 11 and the other stay and listen to the evidence? 12 I would like to know, please, from Messrs Curtis by 13 11.45 whether the letter has gone and if not why not. 14 Do you want to make a phone call now? 15 THE SOLICITOR: Yes, I want to say I will make the phone 16 call but so far we haven't had instructions about the 17 reply. 18 MR JUSTICE BURTON: Perhaps simultaneously there could be 19 contact made by your solicitors, Mr Wolfson, to the 20 relevant person whoever you are in contact with, if 21 anybody, in Uganda reminding them of the obligation of 22 the Government under the Memorandum of Understanding and 23 that this would be part of their obligation. 24 MR WOLFSON: We will certainly make such phone calls as we 25 can.

Page 13

1 MR JUSTICE BURTON: Thank you very much. 2 MR WOLFSON: Of course we are dealing with a Government body 3 but we will certainly do whatever we can. 4 MR JUSTICE BURTON: Thank you very much indeed. Are you 5 going to make the call? Thank you. At least I shall 6 need to know what steps have been taken, thank you. 7 Yes, right. On we go. 8 MR QURESHI: My Lord, it is Mr Atherton's turn. Good 9 morning, Mr Atherton. Mr Atherton, there is somebody 10 helping you with the bundles I believe. 11 MR PAUL RICHARD ATHERTON (sworn) 12 Examination-in-chief by MR QURESHI 13 MR QURESHI: Mr Atherton, in front of you there will be some 14 bundles with pink spines that are numbered E and you 15 should have a bundle which is on the back of it numbered 16 E1 onwards but the bundle I would like you to turn to is 17 bundle C. It has a yellow spine. If I could ask you to 18 turn to tab 9 of bundle C. Do you see that? 19 A. Yes, I do. 20 Q. It is headed "First witness statement of Paul Richard 21 Atherton." If I could ask you to turn to page C/313 of 22 the bundle, page 86 of 86 of the witness statement, do 23 you see that? 24 A. Yes, I do. 25 Q. Mr Atherton, is that your signature?

Page 14

1 A. Yes, it is. 2 Q. This is your statement? 3 A. Correct. 4 MR QURESHI: I believe Mr Wolfson will have some questions 5 for you. 6 MR JUSTICE BURTON: Yes, can I ask just one question before 7 that happens. I understand the position on the 288, 8 that you disputed that and of course you knew that the 9 claimants were paying, you had agreed that they would 10 pay the one-third of the debt on your behalf out of your 11 money that they owed you so that you were fully engaged 12 with a dispute about the 283 million both by having paid 13 your one-third and by having entered into arbitration as 14 to the balance. 15 I am unclear about the 30, the next lot, that is the 16 one-third or so of the extra 100 or the 30 per cent of 17 the extra 100. You plainly disputed the 30 in a letter, 18 or the formal notice that you sent in answer to the 19 assessment. But why didn't you pay up the -- it is 20 chicken feed in the context of what we are talking 21 about. Why didn't you pay up the one-third of the 30 so 22 as to trigger, I think it is section 104, but I can't 23 remember which section it is, as you had done or as they 24 had done on your behalf in relation to the 288? 25 A. We had -- it was 283, my Lord.

Page 15

1 MR JUSTICE BURTON: 283. 2 A. And we had objected to that in August. 3 MR JUSTICE BURTON: You had? 4 A. I believe August the 18th. 5 MR JUSTICE BURTON: Yes. 6 A. We then received an assessment on August the 19th for 7 $30 million being the 30 per cent of the $100 million 8 contractual settlement. 9 MR JUSTICE BURTON: You did. 10 A. We on advice felt that the case was linked with the 11 $1.35 billion, that we had objected -- we had objected 12 in fact the day before -- that it could not be taxed on 13 a standalone basis, that we would therefore object in 14 due course, which we did, that because the two were 15 linked intrinsically, because the contractual settlement 16 was clearly outside of Uganda and was, as I say, linked 17 to the original sale, that there was no need or no 18 requirement to deposit 30 per cent of $30 million. 19 MR JUSTICE BURTON: Has the Government either in 20 correspondence or in the course of the Tax Tribunal or 21 in the course of the arbitration made the point that you 22 aren't entitled to dispute or haven't successfully 23 disputed because you didn't pay the 30 per cent of the 24 30 million? 25 A. My Lord, yes, I believe the Tax Appeals Tribunal has

Page 16

1 accepted our objection and it is being heard and has 2 been heard. 3 MR JUSTICE BURTON: Accepted that you made an objection even 4 though you didn't pay the 30 per cent? 5 A. Correct. 6 MR JUSTICE BURTON: So the Government did take the point but 7 weren't successful in front of the Tribunal, is that 8 correct? 9 A. Correct. 10 MR JUSTICE BURTON: We have, of course, the judgment of the 11 Tribunal. I have skim read it. If it is dealt with 12 somewhere in the judgment, I would be grateful to have 13 it drawn to my attention. Thank you. 14 A. Thank you. 15 Cross-examination by MR WOLFSON 16 MR WOLFSON: Just to clarify that point, Mr Atherton, before 17 we get going properly. I think we can probably agree on 18 this: that Heritage's position, vis vis the Government 19 was, well, since Tullow has actually now put in 313 20 there is enough scope for the other 30 out of that? 21 A. No, my Lord. 22 Q. Okay, we'll come back to it then. 23 A. We are looking at a time of August 19 for the 24 assessment. The period of time whereby we had to object 25 was, I believe, 45 days.

Page 17

1 MR JUSTICE BURTON: And you did object. 2 A. Which we did. 3 MR JUSTICE BURTON: So strictly speaking you should have 4 paid the 30 per cent in that 45 days. 5 A. But I believe it was considered by the Tribunal well 6 before the payment date of around mid April, so it's 7 unrelated, my Lord, to my knowledge. 8 MR WOLFSON: As I said, Heritage has never taken the 9 position that that 30 million is to be found if 10 necessary in the monies paid by Tullow. 11 A. Heritage's position has always been maintained that the 12 $30 million tax assessment will be -- is being contested 13 and is not payable as we have taken advice. That is -14 Q. That is not the question I asked. 15 MR JUSTICE BURTON: What you are being asked is whether you 16 ever argued in the alternative, that if you were 17 required to pay one-third of the 30, which would only be 18 10 million, the Government had had the 313 out of Tullow 19 and they should look to that. 20 A. I believe we have never considered it, my Lord. 21 MR WOLFSON: If need be, we'll come back to this point. 22 MR JUSTICE BURTON: Thank you. 23 MR WOLFSON: Let me say now good morning, Mr Atherton. As 24 you were sitting in court when we had the exchange 25 earlier, let me just make clear, so we both know where

Page 18

1 we are going, that I am not going to ask you questions 2 about documents where you are providing a running 3 commentary in your witness statement on documents which 4 you are not involved in, which you didn't see at the 5 time and where you are saying: it can be shown from X or 6 Y that such-and-such. For the avoidance of doubt and 7 for the record we don't accept your comments but I am 8 not going to cross-examine you on it because my 9 submission will be that that is not helpful evidence for 10 my Lord. 11 Before we look at any documents can we just clear up 12 what documents we have. Do you ever make notes of 13 meetings? 14 A. I periodically do make notes of meetings, my Lord. 15 Q. The more important the meeting, the more likely you 16 would be to take a note of it; is that fair? 17 A. In the main, yes. 18 Q. And I think we can accept that Heritage's disposal of 19 its Ugandan assets was at the very least one of the 20 biggest transactions Heritage has ever entered into? 21 A. The sale of the Ugandan assets was a substantial sale 22 and one of the largest, if not the largest, we have 23 entered into, that's correct. 24 Q. I think we can also agree that you haven't disclosed 25 a single handwritten note in these proceedings?

Page 19

1 A. I haven't seen all of the information that has been 2 disclosed, been handled by our lawyers. I'm aware that 3 certain meeting minutes were taken, correct. 4 MR JUSTICE BURTON: Any handwritten notes by you? 5 A. Yes, I did -- I see the key meeting where I did take 6 notes, jottings rather than notes potentially, was the 7 key meet I saw was the meetings with Government with the 8 URA which took place at the beginning of June 2010. 9 MR JUSTICE BURTON: Have you disclosed those? 10 A. I believe that's a question for the lawyers. As I say, 11 I have not seen everything. 12 MR JUSTICE BURTON: Have you handed them to the lawyers? 13 A. Yes, I have. But I believe that those meeting minutes 14 and all of the meetings were without prejudice and, 15 therefore, may not have been disclosed. 16 MR QURESHI: My Lord, your Lordship will recall that there 17 is an email from Mr Kiiza passing on the without 18 prejudice, strictly private and confidential letter of 19 McCarthy Tetrault and the minutes of the meeting that 20 Mr Atherton I believe is referring to where the without 21 prejudice offer was made which found its way into 22 Mr Martin's witness statement, the objection had been 23 made and sustained that that was always a without 24 prejudice discussion and it was always meant to be 25 confidential. So what I had said to your Lordship was

Page 20

1 whilst those documents had found their way into the 2 bundle, in the face of our objection, we maintained the 3 fact that they were with reference to a without 4 prejudice discussion. 5 MR WOLFSON: My question is on a much broader basis, 6 Mr Atherton. It may be -- is your evidence to 7 my Lord that that was the only meeting relevant to the 8 matters we are discussing where you took a note? 9 A. In connection with the sale? 10 Q. No, in connection with the matters we are discussing, 11 together with the sale, your tax liability, discussions 12 with the Government, discussions with Heritage, any 13 briefings to the press, any internal meetings at 14 Heritage, is your evidence that the only meeting at 15 which you took a note was that meeting with the 16 Government for which privilege is being claimed, without 17 prejudice privilege? 18 A. I believe yes. 19 Q. That is the only meeting you took a note, yes, that is 20 your evidence? 21 A. I believe that to be the case, yes. 22 Q. Did Mr Buckingham ever take notes? 23 A. It is a question for Mr Buckingham, but I -24 MR JUSTICE BURTON: We can't put it to Mr Buckingham, can 25 we?

Page 21

1 A. -- don't believe he does. 2 MR JUSTICE BURTON: You don't believe he's a notetaker? 3 A. No. 4 MR WOLFSON: What about the other individuals whom Heritage 5 has apparently searched for documents as part of its 6 disclosure individuals? Let me just read out the names. 7 There are only six of them, and you tell me whether 8 these individuals are in the habit of taking notes of 9 meetings. 10 Brian Smith, Brian Westwood, Mitzi Westwood, Dmitri 11 Tsvetkov, Gordon Wittard and Patrick -- and you are 12 going to have to help me with the surname here, Mr 13 Atherton. I am not going to even try, if you can 14 pronounce it for me? 15 A. I think we'll keep it with Patrick. 16 Q. Very wise. 17 A. We do in-house. 18 Q. We can agree on some things, Mr Atherton. So those five 19 individuals and Patrick, are they in the habit of taking 20 notes of meetings? 21 A. I can confirm Mr Smith doesn't take notes. As to Mr and 22 Mrs Westwood, Patrick and Dmitri, I don't believe Dmitri 23 takes notes, Patrick and Mr and Mrs Westwood I can't 24 say. I don't know. I have not seen any notes from 25 those individuals.

Page 22

1 Q. The reason why I am asking is that we have not had 2 a single handwritten note disclosed by Heritage in these 3 proceedings. There might be a jotting on an occasional 4 document but there is no note of any meeting, no note of 5 internal discussions, nothing of the sort. I am asking 6 whether there were any taken and they have been lost or 7 whether your evidence is that none were ever taken. 8 A. My evidence I have provided is: for certain individuals 9 I don't know. I know people requested. I know that we 10 were sent information from our lawyers about destruction 11 of documents. I'm not aware of any document being 12 destroyed, destructed or withheld. 13 Q. Maybe the notes got lost when you moved ship from the 14 Bahamas to Mauritius? 15 A. None of those individuals were based in the Bahamas or 16 Mauritius. 17 MR JUSTICE BURTON: Where were they based? 18 A. The Westwoods and Patrick, the Westwoods were based in 19 Uganda and then they retired and live in South Africa. 20 Patrick is based in Uganda. Gordon Wittard is based in 21 Scotland. Dmitri Tsevetkov was based -- he is no longer 22 with Heritage -- he was based in the London office. 23 Mr Smith was based in Europe. 24 MR JUSTICE BURTON: So there was a Uganda office and when 25 did that close?

Page 23

1 A. Following the sale we had. 2 MR JUSTICE BURTON: Then you had the ongoing runoff, didn't 3 you, for quite some time? 4 A. Which is still carrying on. Patrick -5 MR JUSTICE BURTON: So you still have an office in Uganda? 6 A. Yes. Patrick is still based in Uganda. 7 MR JUSTICE BURTON: So those offices have been searched for 8 relevant handwritten documents? 9 A. I believe he's been requested to provide the 10 information, that's correct, and I believe in terms of 11 all the documentation that was in the Heritage office 12 together with the employees will have transferred 13 across. I believe everything was moved across by 14 Tullow. 15 MR JUSTICE BURTON: What has moved across? 16 A. All of the documentation, all the archives, all the 17 information. The computers were transferred and handed 18 across. 19 MR JUSTICE BURTON: To? 20 A. To Tullow. 21 MR JUSTICE BURTON: To Tullow? 22 A. In accordance with the SPA. 23 MR JUSTICE BURTON: But you wouldn't hand over handwritten 24 notes, would you? 25 A. I was not involved in the process but I don't believe

Page 24

1 there was ever an edict that we would not hand over 2 handwritten notes. 3 MR WOLFSON: A handwritten note, for example, discussing 4 internally whether you should move the registration of 5 the companies from the Bahamas to Mauritius, you are not 6 suggesting that those sort of notes would have been 7 handed over to Tullow? 8 A. I don't believe those discussions took place with Mr and 9 Mrs Westwood or with Patrick or with people in the 10 office in Kampala. 11 Q. I am only asking because we haven't had any notes about 12 that either, just to pick an example. 13 A. That was based on discussions over the phone. 14 Q. I see. So you get a couple of chaps on the phone, you 15 have decided to move from the Bahamas to Mauritius, is 16 that basically where we are going? 17 MR QURESHI: My Lord, I am not sure why this particular 18 issue is relevant for the pleaded case. 19 MR WOLFSON: We will see where we are going. Anyway, 20 I think we have your evidence that there were no 21 documents. 22 Let us look at a document, therefore, which we do 23 have, your witness statement. It should be in front of 24 you, bundle C, tab 9. Can we start with paragraph 36, 25 please. I think we can hopefully do this fairly quickly

Page 25

1 because this is somewhat of a piece of advocacy on your 2 matter. 3 The point, as I understand it, you make in 4 paragraph 36 is that three previous deals had not been 5 taxed by the Ugandan Government and therefore the idea 6 that your sale to ENI, which turned out to be the sale 7 to Tullow, might be taxed came as a shock. I hope that 8 is a fair summary of your position. 9 Let us go in reverse order and look at the 10 transactions which you are talking about. First of all, 11 the transaction in which Tullow acquired Hardman. This 12 was, I think we can agree, a corporate deal, an 13 acquisition of shares in an Australian company and not 14 a Ugandan asset. That is right, isn't it? 15 A. It was the acquisition of an Australian listed company 16 I believe. I'm assuming an Australian company. 17 MR JUSTICE BURTON: Of the shares? 18 A. Of the shares which had a significant portion of its 19 business within Uganda. 20 MR JUSTICE BURTON: Yes. 21 MR WOLFSON: So your point is that, as I understand it, the 22 Ugandan Government should have levied tax 23 extraterritorially on the sellers of those shares 24 wherever in the world they were. Is that the point you 25 are making.

Page 26

1 A. The point I'm making is that no tax was levied by the 2 Ugandan Government. 3 Q. Are you inviting the court to infer from that that the 4 Ugandan Government's failure to levy tax 5 extraterritorially meant that it knew that no 6 substantive tax was due? Is that the point you are 7 making? 8 A. I'm not a Uganda tax expert and I'm certainly not an 9 Australian tax expert. All I'm aware of is that Tullow 10 has allocated a significant portion of the 11 consideration, I believe in excess of $400 million, on 12 that transaction to the assets within Uganda and that 13 they were not taxed in Uganda. 14 Q. I don't need to trouble you about that any more. Let us 15 look at the next one, Tullow's acquisition of Energy 16 Africa. This is even more extreme, isn't it, given that 17 the licence holder in Uganda was not actually Energy 18 Africa but a subsidiary of Energy Africa? 19 A. That's correct, an Isle of Man company. 20 Q. So are you making a point here that the Government 21 should have levied tax extraterritorially on the sellers 22 of shares in a company which itself owned shares in 23 a company which held licences in Uganda? 24 A. Again, I'm aware it was a corporate transaction and I'm 25 aware that was no tax was levied or charged by the

Page 27

1 Ugandan Government, my Lord. 2 Q. Let us look at the last one then, the Government's 3 failure to tax Heritage's disposal to Energy Africa in 4 2001. 5 Now, to get the background facts on this, at 6 paragraph 32 of your statement on the previous page you 7 note that the first drilling successes occurred between 8 2006 and 2009 and, as I understand it from your witness 9 statement, by 2001, which is the date of the 10 transaction, you had just done a seismic survey and you 11 were bringing in Energy Africa to do another survey, is 12 that fair? 13 A. Correct. The consideration for the acquisition of the 14 assets was to fund further monies into the licence by 15 way of a seismic programme. 16 Q. Yes. So when you sold to Energy Africa in 2001 you had 17 forked out a lot of money in costs but the licence 18 hadn't yet increased substantially in value, had it? 19 A. At the time I haven't got a valuation of the licence but 20 we are talking of a few million dollars. We are not 21 talking of billions of dollars, clearly. 22 Q. So we can probably cut this short. I think we are 23 agreeing, Mr Atherton, that in commercial terms, that 24 sale, we are not comparing like with like when we are 25 looking at that sale to looking at the sale from

Page 28

1 Heritage to ENI which became Heritage to Tullow in 2010? 2 A. My Lord, I would say we are to the extent that it was 3 a disposal of a 50 per cent interest in a licence in 4 Uganda. The consideration was different but the asset 5 was a 50 per cent interest which was sold or 6 transferred. 7 Q. What was Heritage's gain on the sale to Energy Africa in 8 2001? 9 A. I don't know. 10 MR JUSTICE BURTON: Did you make any gain at all? 11 A. Possibly, I would imagine we made a small gain but not 12 a significant gain but I don't have the figure to hand, 13 my Lord. 14 MR WOLFSON: It wasn't in the order of $1.35 billion. 15 MR JUSTICE BURTON: He has agreed that. At the moment he 16 isn't able to recollect whether there was any gain at 17 all. 18 A. It was 11 years ago, my Lord. If there was it would be 19 -20 MR JUSTICE BURTON: It would be very small, if it was 21 anything at all. 22 A. Absolutely correct. 23 MR WOLFSON: I think we can move on to the next topic, 24 my Lord. 25 Mr Atherton, I am going to give you the references

Page 29

1 in bundle E. I will also try to give my Lord the core 2 bundle references. The first document is E1/122 which 3 hopefully now should be core 1 and I have it marked as 4 (xi).01. 5 MR JUSTICE BURTON: Yes. 6 MR WOLFSON: It should be a document, Mr Atherton, headed 7 "Statement of the Parliament of the Republic of Uganda", 8 and you will see it is a statement delivered to the 9 Ugandan Parliament by Minister Onek. If you turn to the 10 last page, so to put it in context for you, you will see 11 that the statement is dated 26 November 2009. That is 12 at point 07. This statement is about Heritage's 13 proposed sale to ENI. Have you looked at this before? 14 A. Yes, I have. 15 Q. I will take you to some paragraphs but if I am going too 16 quickly please tell me and I'll slow down. If you look 17 at paragraph 11, you will see the Minister says that: 18 "ENI was first introduced to the Government as 19 a potential buyer of Heritage's 50 per cent interest in 20 area 1 and 3A during August 2009." 21 Is the Minister correct about that? 22 A. ENI approached us in July 2009. I believe ENI then 23 approached the Government. This document refers 24 to August 2009. There is no reason why I would question 25 that. But not a formal introduction by Heritage -- we

Page 30

1 were not involved in any meetings with Government with 2 ENI. 3 Q. I don't think the Minister is saying in paragraph 11 4 that you were, the way I read it. 5 MR JUSTICE BURTON: Yes. 6 MR WOLFSON: You are just saying that to make that clear, 7 are you? 8 A. Correct. It is the way it says "first introduced to 9 Government", it is as though Heritage had introduced I 10 had inferred but we didn't. 11 MR JUSTICE BURTON: It doesn't say that. 12 MR WOLFSON: Paragraph 13, just to put this in context for 13 you, the Government welcomed ENI. Paragraph 14, the 14 proposed price is $1.5 billion to purchase your 15 50 per cent interest, and at paragraph 16 the Minister 16 says in unambiguous terms: 17 "There will be taxation for the sale by Government 18 of Uganda." 19 At paragraph 20 the Minister calls the sale a normal 20 business transaction. You can see that in the third 21 line, Mr Atherton, in paragraph 20, and says that: 22 "The existing legislative framework in the country 23 is sufficient to ensure that this and any similar 24 transaction and undertaking without causing loss to the 25 country."

Page 31

1 Would you agree that when he refers to avoiding 2 a loss to the country, one of the things he must be 3 talking about is a loss of tax revenues? 4 A. My Lord, I would infer any loss to the country by 5 Heritage selling the assets as we did and, based on our 6 advice, no tax being paid, there is no loss to the 7 country. There is no loss to the extent that on this 8 question -- and I think people infer it as Capital Gains 9 Tax -- the purchase consideration does not become 10 a factor in the ongoing tax computation of the 11 purchaser, so the base costs of what they are acquiring 12 is essentially what have we spent and been agreed in the 13 licence, which is between 100 -- later on we talked of 14 US$182 million. 15 The base cost for Capital Gains Tax in accordance 16 with the Ugandan legislation is not uplifted to the 17 $1.35 billion. It remains at the $180 million which is 18 what we have spent on the licence and there is no loss 19 of revenue to the Ugandan Government if they did not 20 tax -- as I said, there is no precedent of tax -- they 21 did not tax this transaction. 22 Conversely, if they were to impose a Capital Gains 23 Tax, there would be a super profit made. 24 MR JUSTICE BURTON: That is your analysis of paragraph 20. 25 Paragraph 16 is clear, isn't it?

Page 32

1 A. We had taken advice. 2 MR WOLFSON: Mr Atherton, we are not going to get very far 3 if you don't answer the questions which I am putting to 4 you. The only question I was putting to you was whether 5 paragraph 20, when it talks about loss to the country, 6 did you read that as tax revenues? As I understand it 7 you are saying: no, you didn't. Is that right? 8 A. Correct. 9 Q. I mean, I am grateful for the lecture on Ugandan Capital 10 Gains Tax and we may come to that if we need to. 11 What I am putting to you, Mr Atherton, is a very 12 simple proposition, that the position of the Ugandan 13 Government is that companies which make a large amount 14 of money in Uganda should be paying tax in Uganda; is 15 that your understanding of their position too? 16 A. I think we can make it even a simpler process. We will 17 pay any tax that's legally and lawfully due. We -- the 18 structure, we know we are disputing the tax with the 19 Ugandan Government. Everyone does. It is a fact, and 20 there are two elements. There is a tax element and at 21 this time we were looking at consent. But with the tax, 22 we provided for the tax. It is reserved. It has either 23 been deposited in country or it has been deposited into 24 an escrow account such that we can go through the due 25 processes, the legal processes within country, in

Page 33

1 accordance with their rules and regulations and we can 2 determine whether tax is payable or not. 3 MR JUSTICE BURTON: That is your general position in this 4 case and you have now stated it and it is very well 5 understood by me and by the court. But let us try at 6 the moment to stick to what you are being asked about, 7 and at the moment the implication of the first part of 8 your statement is, because tax had never been levied 9 before on transactions which you say were similar, you 10 didn't expect to pay tax and that is what you are being 11 asked about; not whether you are liable to pay tax, not 12 whether you are rightly or wrongly disputing tax. That 13 will come later. 14 Try and concentrate on the questions being asked. 15 At the moment all that is being put to you is that when 16 you read this press release you knew that the Ugandan 17 Government would be expecting tax. They might have had 18 a wrong expectation but they were expecting tax to be 19 paid. 20 A. That would be correct, my Lord. 21 MR JUSTICE BURTON: Right. 22 MR WOLFSON: So just to be clear, I think we are now, 23 although your internal position may have been that no 24 tax was payable you understood that the Minister's 25 position, honestly held, was that tax would be payable;

Page 34

1 is that fair? 2 A. As at the November 26, the Minister had stated that he 3 considered that tax would be payable and our view was: 4 you have not seen any documents, not considered this, 5 we'd only announced the sale with an MOU three days 6 before this. We hadn't provided any documentation to 7 them and so we felt this premature, but clearly this 8 refers to taxation. 9 Q. I am asking because in your witness statement in 10 paragraph 60 you characterise this as political 11 posturing by the Minister. What I'm trying to get at is 12 whether you are saying that the Minister was saying 13 something which he didn't believe or something with 14 which you disagreed. You will appreciate that there is 15 a distinction between those two. Which is it? 16 A. We believed that he was incorrect or poorly advised. 17 Q. Would you like to reconsider the phrase "political 18 posturing by the Minister" or are you happy to stick 19 with that in your paragraph 60? 20 A. I'm happy. 21 Q. Having made the clear and unambiguous statement in 22 paragraph 16 of the statement to Parliament that there 23 will be taxation for the sale by the Government of 24 Uganda, you would have appreciated that it would be 25 politically difficult, if not political suicide, for the

Page 35

1 Minister later to say, "There's a company which has just 2 made $1.35 billion profit in Uganda but it turns out we 3 can't tax it at all"? You must have appreciated that, 4 didn't you? 5 A. No. 6 Q. Mr Atherton, what I am putting to you, so there is no 7 misunderstanding, is that it was perfectly apparent to 8 you from November 2009 at the latest that your sale was 9 going to be assessed to tax in Uganda? 10 MR JUSTICE BURTON: Rightly or wrongly. 11 MR WOLFSON: Yes, rightly or wrongly. I am not saying that 12 the Government's position was correct. That is for 13 another -- we'll come back to that but you understood 14 that the Government's position was that the sale was 15 going to be taxed in Uganda, and you understood that at 16 the latest from November 2009? 17 A. No, that is not correct. 18 Q. Since we are on -- I think your Lordship may have 19 paragraph 60 of the witness statement open? 20 MR JUSTICE BURTON: Yes. 21 MR WOLFSON: While we are on here, let us just pick up 22 paragraph 61, Mr Atherton, where you describe how -- it 23 reads a bit like a movie -- Heritage received a leaked 24 briefing purporting to be from Minister Onek to the 25 President. I am looking at the last part of your

Page 36

1 witness statement where you say this: 2 "This briefing was passed to Heritage in rather odd 3 circumstances by two gentlemen who visited HOGL's 4 offices in Uganda on 6 January 2012 claiming to be from 5 the office of the President. They offered the 6 possibility of being able to provide more leaked 7 documents in exchange for payment." 8 Then you say that was unacceptable, so you didn't 9 engage in further communications. 10 Can you shed any further light on this rather 11 tantalising extract as to what actually happened or is 12 that all you are prepared to say about it? 13 A. I think the witness statement summarises it. Two people 14 arrived into our local office in Kampala. 15 MR JUSTICE BURTON: Were you there? 16 A. No, I was not. 17 MR JUSTICE BURTON: So this is hearsay? 18 A. This is based on a discussion with the country manager 19 who was there. 20 MR WOLFSON: I see. 21 A. And they provided the document. They would not leave 22 their names. We tried to trace them to understand who 23 they were. We never saw them again. They never came 24 back to our offices to our knowledge. 25 MR WOLFSON: To --

Page 37

1 A. It was very strange. Any of our offices. We do not 2 believe they made contact with any Heritage personnel to 3 our knowledge. 4 MR JUSTICE BURTON: At any rate, they gave you some 5 documents which emanated from the Government. 6 A. That's correct. 7 MR JUSTICE BURTON: And they made this statement that you 8 record in paragraph 61. 9 MR WOLFSON: Yes, it is not clear from your witness 10 statement that this was information passed on to you 11 from your chap in Uganda. 12 A. It was passed on by our Ugandan office. 13 Q. But you are certain that Heritage wouldn't have actively 14 sought out this briefing and they came to you 15 unannounced? 16 A. Absolutely. It was very strange. I would point out 17 that through the disclosure documents it has become 18 apparent that Tullow also received the same documents 19 which were considered to be confidential and sensitive 20 according to an email in the core bundle. 21 Q. Mr Atherton, are you the CFO of Heritage? 22 A. Yes, I am. 23 Q. You will know that you are shedding out large sums of 24 dosh to my learned friend who can put your case so your 25 knowledge of what Tullow received, as I understand it,

Page 38

1 is knowledge which you have got from looking at the 2 documents. If you continue to try to make points like 3 this, it is absolutely fine but I will still ask the 4 questions I am going to ask, okay? 5 Bundle E3/743, core 1/80.001. I hope that that will 6 be an email from Mr Kaplanis to you. Core 80.001, an 7 email from Mr Kaplanis to you on 12 February. He is 8 forwarding a new story from the Dow Jones and if you 9 look through, you will see that they have been told by 10 a Mr Kaujju of the URA that the URA will levy CGT at 30 11 per cent once the deal is finalised. 12 So before we saw the Minister saying it and on 13 12 February 2010 we have the URA itself saying that. So 14 I put to you the same point, that by February 2010 it 15 was obvious that, come what may, Heritage was going to 16 be served with a tax assessment in Uganda. 17 A. My Lord, if I can backtrack one second in terms of 18 the November -- is it the 27th, which was the 19 parliamentary notes which we looked at? I think it 20 was November. 21 MR WOLFSON: Yes, it was, I think it was the 29th but I'm 22 not sure anything turns on that. 23 A. Where they said there would be taxation on this. We 24 hadn't signed the agreement with ENI at that time. If 25 you go to the sale and purchase agreement which is

Page 39

1 included in the documents, it is clear that one 2 mechanism, one way that the contingent consideration of 3 $150 million would be payable was by the purchaser 4 obtaining very large tax breaks in country for up to or 5 more than 10 years. That is what ENI at the time was in 6 discussion with, and believed they would receive. 7 So back in the day of November it was thought that 8 the purchaser would receive significant tax breaks. We 9 then move forward to February with the URA statement by 10 Peter Kaujju, who is a public and corporate affairs 11 officer. He was often in the press and this is on the 12 12th. If you go to the February 17th, he is in the 13 press again, this time saying: "We're thinking of taxing 14 the transaction", and I am paraphrasing here but it is 15 in the bundle. Shall we go to it? It makes sense 16 rather than me getting it incorrect. 17 Q. Actually can you just answer the question I put to you? 18 It was a very short question and if the answer is "no" 19 we can move on. The question was simply this: was it 20 obvious to you by February 2010 that Heritage was going 21 to be served with a tax assessment in Uganda? 22 A. No. 23 Q. Good. We can move on. As I understand your case, you 24 allege that Tullow assisted, advised and encouraged the 25 Government to tax Heritage. Are you saying, just so I

Page 40

1 understand where you are coming from, that but for acts 2 of Tullow the Government wouldn't have served the 3 6 July 2010 assessment on Heritage? 4 A. I believe if the ENI transaction had completed and 5 Tullow had not pre-empted the transaction, that we would 6 not have received the 6 July 2010 assessment. 7 Q. Is there anything else which you are relying on in that 8 regard other than the fact that the transaction ended up 9 with Tullow and not ENI as a result of Tullow's exercise 10 of its contractual pre-emption right? 11 A. I think two things. One is that is correct that it was 12 Tullow rather than ENI, and secondly I think the date, 13 if they were to tax or issue an assessment, it would 14 have been significantly earlier than July. 15 MR JUSTICE BURTON: I have been looking for the 17 February 16 and the only thing I can find is at 744 where Mr Kaujju 17 says if it is to do with the transfer of shares there is 18 no tax applied but if it is a sale of assets then they 19 will be taxed. Is that what you had in mind? It 20 doesn't seem to accord with how you remembered it? 21 A. He says on 744, my Lord, in the third paragraph, towards 22 the end: 23 "Mr Kaujju told the Daily Monitor that the full 24 details of the transaction were not yet to be completed. 25 We are still trying to pick up the details, we got

Page 41

1 a copy of the sales agreement between Tullow and 2 Heritage and it is being studied by a team in URA." 3 MR WOLFSON: Do you want to carry on. Read the next 4 paragraph. 5 A. "Explaining when Capital Gains Tax would apply to 6 a sale, he said: if it's to do with the transfer of 7 shares there is no tax applied, but if a sale of assets 8 then there will be tax." 9 MR JUSTICE BURTON: That is what I quoted to you and that 10 doesn't appear to be the way you remembered it. 11 A. No, I was looking at the paragraph before, my Lord. 12 MR WOLFSON: It is always difficult when you read a bit of 13 a document, Mr Atherton, because the fact is the 14 Heritage/Tullow transaction was an asset sale, not 15 a share sale, wasn't it? 16 A. Pardon? Can you repeat the question, I was reading the 17 document. 18 Q. Yes, the Heritage/Tullow transaction was an asset sale 19 not a share sale, correct? 20 A. Yes, it was an asset sale. 21 Q. When it exercised the right of pre-emption, Tullow was 22 presented, as per the contract, with the same contract 23 that you were otherwise going to enter into with ENI, 24 correct? 25 A. The basis of pre-emption is it is the same but

Page 42

1 essentially you change the names of the purchaser, 2 my Lord. 3 MR JUSTICE BURTON: Yes. I am not going to stop you, at 4 least I am going to try not to stop you, Mr Atherton, 5 but this is simply indicative of the fact that -6 Mr Wolfson put it much more colloquially but you have 7 got counsel who will pick up anything that is overlooked 8 and it does seem to me that this is example is one in 9 which you said he said the contrary five days later and 10 in fact when one looks at the document he didn't say the 11 contrary five days later. So in fact it has not got you 12 out of the answer that you were going to make. 13 A. If we can carry on to further paragraphs on this 14 document 744, my Lord? 15 MR JUSTICE BURTON: Yes. 16 A. Under the one, the penultimate paragraph on initial 17 revenue and if we go to the last sentence: 18 "Miss Sarah Banago, [apologies for my pronunciation] 19 the Assistant Commissioner for Public and Corporate 20 Affairs at URA said she could not comment on the 21 statements but confirmed nothing had yet been finalised. 22 At this point it would be speculation for us to state 23 which taxes qualified ..." 24 MR JUSTICE BURTON: That is in the context of them not 25 knowing whether it was the transfer of shares, in which

Page 43

1 case there would be no tax, or the sale of assets in 2 which case there would. All I think I am asking is 3 there is nothing in here which would entitle you to say 4 that the Government didn't expect to charge tax if the 5 transaction was a sale of assets? 6 A. We felt at the time that there was some mixed messaging 7 in the press, that it was confusing but clearly there 8 was considerable more weight towards the Government was 9 looking to tax the transaction, correct. Our advice at 10 that time, and still has been -11 MR JUSTICE BURTON: You see, the reason why Mr Wolfson is 12 asking you these questions is because it seems to be 13 suggested that it was really the claimants who had 14 caused the Government to get you charged tax, and that 15 is part of your pleaded case, as I understand it. At 16 the moment he is exploring the question as to whether, 17 even before the claimants were involved, the Government 18 were saying they were going to be charging for tax so it 19 wasn't the claimants' idea, it was the Government's 20 idea. That I think is what he is on about at the 21 moment. 22 A. Understood. 23 MR JUSTICE BURTON: And that does appear to be the case, 24 doesn't it? 25 A. Sorry to interrupt, my Lord, but there was certainly

Page 44

1 information in the press to that extent and through 2 press releases, correct. 3 MR WOLFSON: I think you said earlier -- I will try and find 4 it on the transcript, Mr Atherton, so I don't misquote 5 you -- you said: 6 "If the ENI transaction had completed and Tullow had 7 not pre-empted the transaction, we would not have 8 received the 6 July 2010 assessment." 9 You later made the point that the date may have been 10 different. Are you suggesting that if the transaction 11 had gone through with ENI, rather than Tullow, you 12 wouldn't have been assessed by the Government to tax at 13 all? 14 A. I don't know. It is a hypothetical question where 15 something that did not take place. I do not know. 16 Q. Because I think we can agree that the deal, so far as 17 Heritage is concerned, is exactly the same deal. All 18 you are doing is you are selling to X instead of to Y, 19 you change the name on the document, as you say? 20 MR JUSTICE BURTON: He has agreed that. 21 MR WOLFSON: My Lord, I was going to move to another topic. 22 MR JUSTICE BURTON: I have put that in as 80.001A. 23 MR WOLFSON: Yes, my Lord. Would this be a convenient 24 moment, my Lord? 25 MR JUSTICE BURTON: No, we'll carry on.

Page 45

1 MR WOLFSON: I am sorry. Of course. I am sorry. 2 Can we turn to B1/3, Mr Atherton. B1 should be the 3 SPA and at page 3 -- sorry, when I say page 3, I'm using 4 the B numbers not the document numbers -- you will see 5 that Heritage Oil & Gas Limited is described there as 6 being registered in the Bahamas. You provided a copy of 7 this SPA to the Government shortly after it was 8 executed, didn't you? 9 A. Yes. 10 Q. And you knew in mid February 2010, because that is 11 apparent from the press release we were looking at 12 a moment ago, that this was the document which the 13 Government was looking at, the URA was looking at, to 14 decide whether you were liable to pay tax in Uganda; is 15 that correct? 16 A. I would assume that to be correct. 17 Q. In the document we were just looking at a moment ago -18 you may still have it in front of you -- do you still 19 have E3, that press release, or has it gone back? You 20 see what Mr Kaujju said, just to remind you, is "We are 21 still studying the agreement". That agreement is the 22 SPA, isn't it? 23 A. I would assume that, yes. I have no reason to dispute 24 that. 25 Q. If you can just keep that open then, let us go back to

Page 46

1 B1 for a moment then, page 21, clause 4.1. These are 2 warranties and indemnities which are provided. In your 3 own time, would you have a look, please, at subparagraph 4 (a)(i) of clause 4.1. (Pause). Have you read that? 5 A. Yes. 6 Q. The seller is Heritage, isn't it? 7 A. Heritage Oil & Gas, correct. 8 Q. And you warrant that that is a company duly organised 9 and validly existing under the laws of the jurisdiction 10 of the Bahamas. 11 Could you now turn to page 39 of the bundle, 12 clause 5.1. 13 "Until closing each party shall notify the other 14 party promptly after such party becomes actually aware 15 [interesting use of "actually"] there is any warranty 16 given by it in this agreement is untrue, inaccurate or 17 misleading in any respect or will be untrue, inaccurate 18 or misleading in any respect as of the closing date." 19 When was the closing date? 20 A. 26 July, 2010. 21 Q. So you accept, I think, that you had an express 22 contractual obligation to inform Tullow if Heritage 23 is -- I am using "Heritage" for HOGL -- if HOGL's 24 domicile changed, correct? 25 A. There is a requirement here based on 5.1 to provide

Page 47

1 information to them, yes. 2 Q. Is that a "yes"? 3 A. Yes. 4 Q. We know that Heritage had re-domiciled itself from the 5 Bahamas to Mauritius on 15 March 2010, correct? 6 A. By continuation, correct. 7 Q. Mauritius has a double taxation treaty with Uganda, does 8 it not? 9 A. Yes, it does. 10 Q. Would you turn to bundle E4/934. The core bundle is 11 core 1/104.002. I am sorry the writing is small. But 12 there are emails in even smaller writing. You will see 13 the bottom email is from Daniel O'Neill. You will see, 14 Mr Atherton, he is a senior legal adviser at Tullow and 15 he is sending this email to Robert Brant. He is at 16 McCarthy Tetrault, isn't he? 17 A. Correct. 18 Q. They are your lawyers? 19 A. Correct. 20 Q. When I say "your lawyers", I don't just mean in this 21 litigation but they generally act for Heritage, is that 22 fair? 23 A. That's correct. 24 Q. Geoff Peters, who is he? 25 A. Again, he was at the time working with McCarthy's so he

Page 48

1 was our lawyer. 2 Q. Graham Martin my Lord has seen over some days and Peter 3 Sloan is another Tullow man. 4 Just read it to yourself, Mr Atherton, if you would. 5 So you will see that he says that the escrow bank, which 6 is Standard Chartered, is carrying out KYC -- Know Your 7 Customer -- checks and in the course of those 8 investigations it has been discovered that Heritage has 9 just been re-domiciled to Mauritius and basically he 10 asks you to explain what's going on and whether the 11 Government has been told. 12 Mr Brant replies at the top of the page: 13 "Dan, that change has been in the works for a while 14 for internal Heritage group purposes but has only just 15 now become effective. The warranty at article 4.1(a)(i) 16 is no longer correct because the company is now 17 registered in Mauritius but the change should have no 18 bearing on the sale. Heritage will be corresponding 19 with the Ugandan Government in due course." 20 There is then an email which is copied to you at 21 bundle E3/804. I am afraid there is no core bundle 22 reference for this one. Bundle E3/804. I am afraid you 23 now have gone down a notch in the print size. 24 MR JUSTICE BURTON: Yes. 25 MR WOLFSON: And you see it attaches a revised draft of the

Page 49

1 escrow agreement. There are a number of changes. If 2 you just turn through 806, 807 and thereafter, a number 3 of changes are made but there is no change to the point 4 on page 806 setting out Heritage Oil & Gas' registered 5 office at the Bahamas. You see that, do you, yes? 6 A. I am just reading it. 7 MR JUSTICE BURTON: It is at the top of the page. 8 A. Yes. 9 MR WOLFSON: So is the position this: despite the fact that 10 you were under a contractual obligation to tell Tullow 11 when any warranty became untrue, you did not do so, 12 correct? 13 A. I believe just at 1 April there were still some various 14 corporate matters required in Mauritius. The date of 15 the continuation was 15 March, so a couple of weeks 16 before, and I believe there was a licence we had to 17 obtain which we obtained at the beginning of April. 18 MR JUSTICE BURTON: Beginning of February. 19 A. No, April. 20 MR JUSTICE BURTON: I see. 12 April says the company is now 21 registered in Mauritius, so by 12 April it was all in 22 place? 23 A. That's correct, my Lord. 24 MR JUSTICE BURTON: So you are being asked about why you 25 didn't notify the --

Page 50

1 A. And that was because there was various documents and 2 licences we had to obtain which we hadn't obtained at 3 this date. I think we obtained them right at the 4 beginning of April, my Lord. 5 MR WOLFSON: Are you suggesting that you looked at this 6 warranty and thought: "Well, because we haven't obtained 7 the licences we don't have to tell them about the change 8 of domicile"? Is that what you are saying? 9 A. I'm saying there is various documentation which was 10 going through and in due course would have been provided 11 by the warranty. 12 Q. And you hadn't told the Government either, had you? 13 A. No, we hadn't. 14 Q. Despite the fact that you knew that the URA was 15 considering your tax liability on the basis of the old 16 Bahamas domicile rather than the new Mauritian domicile? 17 A. We were aware of the URA were looking at the documents 18 based on the February press report. I believe the 19 Government was aware in -- I don't know the date the 20 Government was made aware. I believe it was May. 21 MR JUSTICE BURTON: May. 22 A. May. I don't have a specific date. We didn't -23 MR JUSTICE BURTON: Was there a document to say that? 24 A. I'm not aware of a document, but I'm sure counsel will 25 provide it.

Page 51

1 MR WOLFSON: We may come to this, my Lord. Mr Atherton, 2 what I am putting to you is that looking at these 3 documents, the conclusion would appear to be, but tell 4 me if I am wrong, that Heritage must have told its 5 lawyers to conceal the fact of Heritage's re-domicile 6 from the Government? 7 A. No. 8 Q. Do you have any other explanation for why your lawyers 9 would not have made the amendment to the domicile point? 10 Is that just an error on their part? 11 A. As I said, there was various documentation still going 12 through. It may have been an error. There was never 13 any discussion about withholding the information from 14 Tullow. In terms of Government, we didn't tell 15 Government until later. With hindsight we should have 16 told them earlier, absolutely we should have done. We 17 didn't. They were aware of it in May and we should have 18 informed Government much earlier. 19 Q. The fact is, Mr Atherton, what was going on was you were 20 moving from the Bahamas to Mauritius, I assume not for 21 the weather but because Mauritius is one of the few 22 countries which has a double tax treaty with Uganda; 23 that is the truth, isn't it? 24 A. We went to Mauritius for a number of reasons. 25 MR JUSTICE BURTON: Was that reason included in them?

Page 52

1 A. We say it is corporate planning which would include 2 fiscal reasons, yes. Heritage Oil & Gas has other 3 licences, has other interests in other countries and we 4 were looking at planning for those other countries as 5 well, not specifically Uganda. 6 MR JUSTICE BURTON: You said that this was one of the 7 largest -- I think you actually accepted the largest 8 transaction -9 A. That's correct. It is public record. 10 MR JUSTICE BURTON: -- Heritage had done and moving to 11 Mauritius was part of the tax planning and you are being 12 asked whether -- just let us get this straight what the 13 question is -- Mauritius was one of the few countries 14 which had a double tax treaty with Uganda and that was 15 why you went there? 16 A. It was a factor. It was one of the reasons in our 17 planning. 18 MR JUSTICE BURTON: What were the other factors? 19 A. It was better regulated. The time zone was working 20 better in terms of our jurisdictions in terms of where 21 we were based. They are much more efficient and banking 22 is better and we felt overall that the level of service 23 we were provided in Mauritius was much better than we 24 were being provided in the Bahamas. 25 MR WOLFSON: When you say "being provided", these are by

Page 53

1 service companies, effectively? 2 A. By financial -- by third party agents and professional 3 bodies. 4 Q. How many Heritage employees work in Mauritius? 5 A. Directly employed by Heritage? 6 Q. Yes. 7 A. Zero. 8 Q. Right. 9 A. That would be the same in terms of jurisdictions 10 throughout the world. Many, many companies -11 Q. Absolutely. 12 A. -- will use directors' positions. Isle of Man, many 13 other places. Many, many international companies have 14 a similar tax status as we do. 15 Q. Mr Atherton, I am only asking these questions because, 16 first, the re-domicile is not mentioned anywhere in your 17 witness statement, correct? We can read it. 18 A. I think it is. 19 Q. Okay. You haven't given any disclosure in these 20 proceedings evidencing the reasoning or rationale for 21 moving to Mauritius, correct? 22 A. That's correct, but I do refer to it in my witness 23 statement. I am sure I do. 24 Q. If you want, we'll go through what you say but I think 25 we can probably move on after a couple more questions.

Page 54

1 MR JUSTICE BURTON: Over the short adjournment, the five 2 minute break, you can have a quick flip through and see 3 if you can find it. 4 MR WOLFSON: Mr Atherton, I think we actually can agree on 5 this. 6 MR QURESHI: It is paragraph 6, my Lord, right at the 7 outset. 8 MR JUSTICE BURTON: You have found it already. 9 MR QURESHI: It is paragraph 6, right at the outset. 10 MR WOLFSON: I am very happy to go to paragraph 6 because 11 there all is revealed. Let us see what we are told in 12 paragraph 6. 13 MR QURESHI: I am not promising all will be revealed. I'm 14 not sure what my friend has in mind. 15 MR WOLFSON: What we are told in paragraph 6 is: 16 "On 15 March HOGL was registered by continuation as 17 a private company limited by shares in the Republic of 18 Mauritius." 19 The point I was trying to explore with you, 20 Mr Atherton, and I think we can probably end here before 21 the break because I think we now agree, is that when we 22 read in documents that the move was made for internal 23 Heritage group purposes, I think you are accepting that 24 one of those purposes was the perceived tax advantages 25 relating to your potential tax liability to the URA from

Page 55

1 this deal, correct? 2 A. One of the reasons for going, as I explained, was there 3 was a double taxation agreement but there were other 4 reasons as well. 5 MR WOLFSON: My Lord, I am going to go to a slightly 6 different topic. That may be a convenient moment, 7 my Lord. 8 MR JUSTICE BURTON: Yes. I hope we are going to have 9 a report when we come back, which will be before five to 10 12, from Curtis & Co. Thank you. 11 (11.45 am) 12 (A short break) 13 (11.55 am) 14 MR WOLFSON: My Lord, we will provide a new folder. 15 MR JUSTICE BURTON: We are doing well at the moment, 16 thank you very much. Any news from Curtis & Co? 17 THE SOLICITOR: My Lord, I telephoned the partner in charge 18 of his clients here in London and he explained to me, 19 my Lord, he has been in touch with the Government of 20 Uganda but they have not had any instructions as to what 21 (inaudible) and he was involved in the GOU and they 22 might get some correspondence by next week but they 23 haven't yet, but they have been in touch with them. 24 MR JUSTICE BURTON: They have been in touch with their 25 client?

Page 56

1 THE SOLICITOR: Yes. 2 MR WOLFSON: My Lord, we will chivvy the Government as well 3 so far as we can. We are obviously not a party. 4 MR JUSTICE BURTON: Thank you very much. You are going to 5 tell me at some stage your constructive suggestion. 6 I don't know whether it is one you have discussed yet 7 with Mr Qureshi. 8 MR WOLFSON: No, it isn't yet but we thought we would put it 9 in a note so there is no ambiguity as to what we are 10 proposing. We hope it will be agreeable because it is 11 really trying to find a way forward and hold the fort. 12 I think it is being printed so I'm sorry it is running 13 a little bit late. That is the substantive Ugandan tax 14 point. 15 MR JUSTICE BURTON: Yes. 16 MR WOLFSON: Mr Atherton, before the short break we were 17 talking about Mauritius. In addition to many other 18 delights of Mauritius, I think we can agree that one of 19 the advantages of Mauritius is in fact it has no Capital 20 Gains Tax at all, is that right? 21 A. I believe it's similar to the Bahamas in that respect, 22 that depending on your business licence it can have no 23 Capital Gains Tax. 24 MR JUSTICE BURTON: The Bahamas doesn't have a double tax 25 treaty with Uganda.

Page 57

1 A. I don't believe it does, my Lord. 2 MR JUSTICE BURTON: So if the double tax treaty operates and 3 Uganda has Capital Gains Tax but Mauritius doesn't, that 4 means that you don't have to pay Capital Gains Tax; is 5 that right? 6 A. My Lord, I'm not an expert in Ugandan tax, I am afraid. 7 MR JUSTICE BURTON: There we are, thank you. 8 MR WOLFSON: And I think you agreed, Mr Atherton, that one 9 of the purposes -- and I say one -- one of the purposes 10 of the move to Mauritius was to take advantage of the 11 fiscal rules applicable in Mauritius. 12 A. Correct, in terms of we went to Mauritius. 13 Q. Mr Atherton, could you look, please, at bundle E24/6503. 14 My Lord, it is now in the core. It is in core 3. It is 15 a document which is now noted as 984.020.004. 16 Just to show you what it is, Mr Atherton, while you 17 are turning it up, if you look at 6500, this is the tax 18 bill Tribunal ruling in Uganda. Do you have that, 6500? 19 A. Yes, I have. 20 Q. Good. You were a witness for Heritage in those 21 proceedings, weren't you? 22 A. That's correct. 23 Q. I think you were the only witness for Heritage in those 24 proceedings, as you are here, correct? 25 A. That is correct.

Page 58

1 Q. And to be fair to you, the Tribunal found you to be 2 "composed" and said that your evidence was "reliable". 3 That is not a question. That is a compliment. The 4 question is: if you would look at 6503, the penultimate 5 paragraph, where you tell the TAT, who accept this 6 evidence: 7 "The change in registration was based on corporate 8 planning. It was not purposely done to take advantage 9 of the benefit Mauritius could offer in light of the 10 transaction with Tullow." 11 I am afraid what I have to put to you, Mr Atherton, 12 is that evidence which you gave to the TAT, and which 13 the TAT accepted because it found you to be a composed 14 witness, was in fact untrue? 15 A. This is I think the findings from the TAT? I have only 16 looked at one page just now. 17 Q. No, it isn't, Mr Atherton. 18 A. It is the ruling, sorry. 19 Q. Sorry, it is the ruling but here what we are doing is 20 they are repeating your evidence and, as I said, they 21 found you to be a reliable witness. If you just go 22 back, for example, let us turn the pages through. 6500 23 is the start. At 6501, they set out the issues and then 24 halfway down: 25 "The applicant called one witness, Mr Paul Richard

Page 59

1 Atherton." 2 That is you, isn't it? 3 A. That's correct. 4 Q. And you gave your evidence by way of a video conference, 5 correct? 6 A. Yes. 7 Q. So there is no dispute that you were talking about it? 8 A. No, that's me. 9 Q. Then throughout the rest of that page and the next 10 page 6502 -11 MR JUSTICE BURTON: We don't need to go back that far. The 12 paragraph in question says that: "Mr Atherton told the 13 Tribunal ..." 14 MR WOLFSON: Absolutely. The point I am making, my Lord, is 15 that it is in a whole section which is setting out your 16 evidence, and what you told the TAT was untrue, wasn't 17 it? 18 A. No, my Lord. What I told the TAT that it was in 19 connection with corporate planning and that there were 20 better time zones is what I told the TAT. 21 MR JUSTICE BURTON: That is also not what you told me. What 22 is being put to me is that this evidence, without 23 characterising adjectives, is different from what you 24 have told me today. 25 A. Based on the ruling I accept that, my Lord, but I did

Page 60

1 not tell the TAT and I did not specifically say it was 2 not purposely done to take advantage of the benefits 3 Mauritius could offer. That's correct. 4 MR JUSTICE BURTON: So they have inaccurately recorded your 5 evidence. 6 A. That's correct, my Lord. 7 MR WOLFSON: Where were you when the video conference was 8 given? 9 A. I was in London. 10 Q. Was it recorded? 11 A. I don't know, my Lord. I don't know. 12 Q. To your knowledge, does Heritage have a recording of 13 your evidence? 14 A. I don't know, my Lord. No, I'm not aware of a recording 15 but I don't know. I'm not sure what facilities there 16 were. It was a video conference. Whether it was -17 MR JUSTICE BURTON: There will probably be a transcript of 18 it, won't there? 19 A. I don't know, my Lord. 20 MR JUSTICE BURTON: So this statement is not what you said, 21 that is right? You did not say the change in 22 registration was based on corporate planning? You did 23 say that? 24 A. I did say that. 25 MR JUSTICE BURTON: You did not say:

Page 61

1 "It was not purposely done to take advantage of the 2 benefit Mauritius could offer in light of the 3 transaction with Tullow." 4 You did not say that? 5 A. I didn't say it. 6 MR JUSTICE BURTON: Because it is a very important sentence, 7 isn't it, and they obviously thought you said that and 8 relied on it. 9 MR WOLFSON: You did say the rest of the previous bit of the 10 paragraph so you did say it was registered by 11 continuation? 12 A. That's correct. 13 Q. I'm not asking whether it is correct as a fact but you 14 did say it to the Tribunal. They have recorded your 15 evidence correctly in that first sentence? 16 A. Yes. 17 Q. Right, and the second sentence. You told them? 18 A. Yes. 19 Q. And the third sentence? 20 A. No. 21 Q. The third sentence is a change in registration? 22 MR JUSTICE BURTON: That is right, isn't it, the change in 23 registration? 24 A. Sorry, I read that as the second. Yes, that's correct. 25 MR JUSTICE BURTON: The first three sentences accurately

Page 62

1 record what you said. The fourth sentence does not 2 accurately what you said. You did not say anything of 3 the kind. 4 A. Correct. 5 MR WOLFSON: I am not going to go through the whole thing 6 but let us just look at the next sentence. 7 You did testify that during the time the applicant 8 was in Uganda the respondents -- that is the URA -- had 9 never requested it to file any tax returns; you told 10 them that? 11 A. Yes, I presume that's the case. 12 Q. And the next sentence? 13 A. I presume so. We did not submit any tax returns. I 14 can't remember whether I said they were aware of it 15 because they had nothing on their record. I can't say. 16 Q. My Lord, I am not going to go through the whole of that 17 document. 18 MR JUSTICE BURTON: No. 19 MR WOLFSON: Mr Atherton, the parent. 20 MR JUSTICE BURTON: Was it on oath this statement to the Tax 21 Tribunal? 22 A. Pardon? 23 MR JUSTICE BURTON: Was it on oath the statement to the Tax 24 Tribunal? 25 A. I think it was, my Lord. I think it was but I can't

Page 63

1 remember for sure. 2 MR WOLFSON: My Lord, I think that is actually recorded. If 3 your Lordship looks at 6501, Mr Mott reminds me, that it 4 does say right at the outset. 5 A. Yes, it does say oath. 6 MR WOLFSON: So it does look like you swore to tell the 7 truth: "Mr Atherton gave his testimony on oath." Bottom 8 on 6501, my Lord. 9 MR JUSTICE BURTON: Yes, "testimony on oath". Thank you. 10 MR WOLFSON: Then just so your Lordship has a reference: 11 "The witness was composed and the Tribunal finds his 12 evidence reliable". 13 MR JUSTICE BURTON: Yes, I have that. 14 MR WOLFSON: My Lord, I was going to move on to a slightly 15 different point. Mr Atherton, I think we can agree that 16 the parent of HOGL Heritage Oil Plc, that is not 17 domiciled in Mauritius, that is domiciled in Jersey, 18 that is right? 19 A. The ultimate parent company is Heritage Oil PL and it is 20 domiciled in Jersey, correct. 21 Q. And that is where Mr Buckingham lives as well? 22 A. Mr Buckingham lives in Jersey, correct. 23 Q. I think actually at one point the Daily Telegraph called 24 him the richest man in Jersey but I'm not going to put 25 that to you. The Daily Telegraph called Lord Sumption

Page 64

1 the cleverest man in Britain but I don't know whether 2 that gives the paper any more probative value on any 3 other statement. All this is way above my pay grade. 4 Mr Atherton, can I just try and put this into some 5 sort of context. We are talking here of $400 million of 6 potential tax liability, aren't we? 7 A. The assessment was for $404 million, correct. 8 Q. Today's market cap of Heritage Oil Plc is about, 9 allowing for pound/dollar, about $700 million, is that 10 about right? 11 A. I would say closer to $800 million. 12 Q. My understanding is that it is 548 million. I am not 13 quite sure where the pound/dollar is at the moment. 14 Shall we say 750? 15 A. Actually I would probably say it is probably closer to 16 above 800, but between $750 million and $850 million, 17 my Lord . 18 Q. So in the context of Heritage the potential tax 19 liability of $400 million is a huge amount of money, is 20 it not? 21 A. $400 million is a considerable sum but it has been 22 reserved. It has been parked to one side with 23 a question mark subject to assessment and determination 24 of the dispute, so it is not a factor in our share 25 price.

Page 65

1 Q. Mr Atherton, I am now going to turn to a different topic 2 which is your engagement with the Government with regard 3 to your potential tax liability. The first document 4 I would like you to look at is in bundle E4/927. This 5 is core 1/102. I am afraid it is not a great copy, 6 Mr Atherton. I hope you can read it. 7 Let us start from the top. It is from URA. It is 8 addressed to Heritage in Jersey care of Heritage in 9 Kampala. 10 "Taxes on disposal of licence in trusts in 11 exploration areas 1 and 3A. We refer to the sale and 12 purchase agreement (SPA) between Heritage Oil & Gas and 13 Tullow". It gives the date. "Tullow has exercised its 14 pre-emptive rights and purchase Heritage licence 15 interest". Refers to section 17.2 of the Income Tax 16 Act. Then says it gives rise to income sourced in 17 Uganda under 79G and 79S of the Income Tax Act and sets 18 out the taxes which applied. 19 Where you get to, the nub of it is on the second 20 page: they are asking you to pay $404,925,000 in tax, 21 yes? 22 A. That's correct. 23 Q. And the assessment is on the next page at 99. Your 24 response to this demand and this assessment at this 25 stage was to say that no tax was due because the

Page 66