Académique Documents

Professionnel Documents

Culture Documents

Mobile Banking in India Final

Transféré par

Megha MittalCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Mobile Banking in India Final

Transféré par

Megha MittalDroits d'auteur :

Formats disponibles

Mobile Banking in India: Present Status and Future Perspectives Prof. (Dr.) S L Gupta & Dr.

Arun Mittal

Prof. (Dr.) S L Gupta Professor, Birla Institute of Technology (Deemed University), Noida Campus A-7, Sector-1, NOIDA E-Mail: slgupta_1965@yahoo.co.in (M) 09811230453

Dr. Arun Mittal Asst. Professor, Birla Institute of Technology (Deemed University), Noida Campus A-7, Sector-1, NOIDA E-Mail: arunmittal1985@gmail.com (M) 09818057205

Mobile banking simply means performing banking transactions through mobile. Presently it is enjoying rapid growth. This has raised certain challenges such as security, reliability and consistency in services to meet customers expectations. Instead of this the future of mobile banks looks bright due to the continuous increase in customers awareness and effectiveness of banking and regulatory system. Introduction: Mobile banking is one of the three major pillars (with ATMs and Internet Banking) of revolutionary improvement in the quality of service delivery of banks. Mobile banking is simply performing banking transactions such as balance checks, account transactions, payments with the help of mobile phone. It can also be understood as availing banking and financial services with the help of mobile telecommunication device. The scope of services offered in mobile banking may include getting account information, transferring funds, sending checkbook request managing deposits, taking quick check of transactions and so on. Mobile banking today is most often performed by SMS (Short Message Service) so that is also known as SMS banking. The welcome of this type of service is very much expected by youth. Indian youth has taken it as a fun of convenience. However mobile banking in India has been used by others also. The very feature of mobile banking Anytime-Anywhere Banking is making it very popular among all the categories. Using mobile phones is a very common practice. Commercial banks are exploring this opportunity to make their services more convenient for their customers. Growing number of mobile subscribers in the country is the most valuable support behind the success of mobile

banking. A wide range of services is provided by banks with the help of mobile banking services. Following table gives a comprehensive list of mobile banking services: Services provided through mobile banking: Account Information Transactions statement Account history Transaction alerts Monitoring of deposits Loan statements Mutual funds statements Check Status/stopping payment Payments & Transfers Micro-payment handling Mobile recharging Commercial payment Bill payment/ Other payments Investments Services Portfolio management Stock quotes and Personalised alerts Supporting Services Request for credit, Checkbook requests Locating ATMs Other Services General information Loyalty-related information Various promotional and other offers and services

Present Status: Mobile banking is enjoying a rapid growth in India. It has successfully crossed the introduction stage. The service is being channelised from metropolitan cities to urban areas and semi urban areas and then to the rural areas. About Indian banks customers a number of studies have revealed the fact that people select the banks whose branches are near to their homes and workplaces. Further in selection of the banks behaviour of employees has also been considered an important aspect. Both the problems can be solved with the help of mobile banking. Now this is the time which supports smart work not hard. The growth of mobile banking in India is primarily forced by convenience and promptness. Indian banking industry has already witnessed two more revolutions in the improvement in the quality of services delivery as Internet banking and ATMs. If we study all three innovations simultaneously we see that mobile banking has it own unique characteristics. Mobile banking is different from internet banking and ATMs in consideration of too many factors. Internet awareness and usage is not as common as the usage of mobile phones. Further (excluding internet on mobile) it requires particular devices such as a desktop or a laptop. Doing internet banking on cyber caf is not safe and is suggested to be prohibited by all banks for security reasons because the cyber caf network may store confidential information of the customers bank account, further customers have to pay something to use internet. Moreover if you dont have the facility with yourself only it is not possible to do anytime banking with internet. These all difficulties have been solved by mobile banking. Huge growth in mobile phones, affordability of handsets and well designed rates and tariffs by telecommunication companies have made mobile phone available for everybody. Indeed the same has become life blood for mobile banking in India. If mobile banking is compared with ATMs, the differences are mixed. Mobile banking cannot become the alternative of cash withdrawal which is done through ATMs but it can facilitate in certain payments and other transactions. This is very much true that ATMs are location specific but mobile banking is not. Further you may face a queue at the peak times in front of the ATMs. Why Mobile Banking?

Mobile banking has lot of advantages for both, service providers and those who avail services. It has really become multi beneficial. Banks do not require much investment and they need not to modify their existing infrastructure. Banks can send the message in fewer efforts to huge number of people. Mobile banking also helps banks to make good relations with their customers. In mobile banking the banks get valuable database of the customers which helps them in effective customer relationship management practices. It facilitates in quick feedback and help in customer retention and customer loyalty. Mobile phone provides a way to reach out to people in isolated areas. When banks have database of their customers they can use SMS advertising to give information about their services to their existing customers. This also solves the purpose of promotion and may also help in communicating new services. Customers enjoy anytime anywhere banking with the help of their mobiles. They need not to stand in the queues or to face the employees whom they dont want to face or need not be worried if the branch is not at convenient location. As mobile banking is cost effective for bankers it is cost effective for customers also. The information can also be stored automatically in mobile as a proof in the form of SMS whether sent or received. Supporting Factors: The popularity and effectiveness of mobile banking mainly depends on the banking system in the country and their connection with regulatory and supporting system. There are lots of factors which support mobile banking in India. First of all being so much beneficial, banks are taking initiative and encouraging people to register and use mobile banking services. Customers are also adopting the same because they are also getting lots of benefits. Regulatory system of the country is also serious about the success of this concept. RBI is going to frame formal guidelines for mobile banking very soon so that it can also be streamlined like all other services. Speedy growth in mobile customers and strong IT services are also big supports behind the success of mobile banking in India. Issues and Challenges: The biggest challenge for mobile banking services is security. In the past surveys the same has been generalized as the biggest challenges for internet banking also. Security here simply means that the no body else can know the confidential information of customers bank account. All mandatory alerts are to be sent to the customers in time and the complete system should be very much disciplined and robust. There should not be any chance for the information leakage. This is a matter of fact that users have fewer chances to make mistakes while using mobile banking. If a wrong transaction is done by mistake the options should be there to revert it back. Anyhow lot of things concerned with security will take time to be recognized. In the services which are of financial nature if people once loose confidence it is very difficult to convince them again for the same. India lives in villages and semi urban areas they require more attention towards the concept. Mobile banking education should become a part of the promotional campaigns. The awareness of all the aspects concerned will not only help the customers to use this service but they will significantly reduce number of complaints and will increase the registered users. Another challenge is the consistency in the standards of service quality. The banks have to maintain their

services and the quality thereof. It has been seen that when things are not implemented in a regular form with same standards they fail forever. Future perspective: Success is the sweetest thing in this world. It has a simple formula Do your best and people must like it. In mobile bank ing the service providers must think that they have to give their best services and per customers requirements and convenience. The future of mobile banking depends on efforts of all concerned parties the service providers, service facilitators, regulatory system and customers. The awareness of people, security guidelines by RBI and efforts of banks will surely shape the robust framework for mobile banking in India. The prime concern of banks and RBI must be on the awareness of people, practical training and required security of the transactions made through mobile banking. Banks must organise conferences and a series of interactive seminars on Mobile Banking issues such as security, reliability and regulations. The RBI and banks must publish relevant material related to the issues of mobile banking. These all efforts will certainly make the path for successful mobile banking in the country. Conclusion: The banking business has always been different than others businesses because it comes in the services industry and financial services category. Every body making transactions in finance is more conscious about the security of his money. Many times it has been seen that when a customer once cheated in the case of financial matters he looses his belief forever in that particular system and never does the same again. The banks, regulatory authorities and other organizations must try their level best to make mobile banking system as much secure as they can. It should be mistake less and provide maximum security and reliability to the users. The connectivity with innovative modes of transaction in banking like ATMs, Internet Banking and mobile banking always requires lot of attentions from the side of service providers because a small interruption in the system may spread a very bad word of mouth and fear to the customers. The time has come that banks must scale-up the mobile banking infrastructure to handle exponential growth of the customer base. Mobile banking is anytime and anywhere, so that banks need to ensure that their systems remain ready for the same. As customers will find mobile banking more and more useful, their expectations will increase. If the banks will be unable to meet the performance and they may lose customer confidence.

Vous aimerez peut-être aussi

- Questionnaire On AdvertainmentDocument4 pagesQuestionnaire On AdvertainmentMegha MittalPas encore d'évaluation

- Synthesis Matrix PDFDocument2 pagesSynthesis Matrix PDFMegha MittalPas encore d'évaluation

- Spiritual Advertising: Conceptual Framework and Indian ExperienceDocument8 pagesSpiritual Advertising: Conceptual Framework and Indian ExperienceMegha MittalPas encore d'évaluation

- Balance of PaymentsDocument9 pagesBalance of PaymentsKapil DixitPas encore d'évaluation

- Definition of MSME and State Financial InstitutionsDocument1 pageDefinition of MSME and State Financial InstitutionsMegha Mittal100% (1)

- Spiritual Advertising: Conceptual Framework and Indian ExperienceDocument8 pagesSpiritual Advertising: Conceptual Framework and Indian ExperienceMegha MittalPas encore d'évaluation

- Six Factors Model of Success Dr. Arun MittalDocument9 pagesSix Factors Model of Success Dr. Arun MittalMegha MittalPas encore d'évaluation

- ARVIND Joshi Hindi PoemDocument2 pagesARVIND Joshi Hindi PoemMegha MittalPas encore d'évaluation

- MsmeDocument42 pagesMsmeRajesh KumarPas encore d'évaluation

- A Comparative Study of Promotional Strategies Adopted by Public and Private Sector Banking in India.Document13 pagesA Comparative Study of Promotional Strategies Adopted by Public and Private Sector Banking in India.Megha MittalPas encore d'évaluation

- MsmeDocument42 pagesMsmeRajesh KumarPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- IRC5 Programming and Operation - 2007Document102 pagesIRC5 Programming and Operation - 2007Siska Andriana Gusti100% (2)

- Data Overview - ICT GENERAL TECHNICIAN (Offshore)Document2 pagesData Overview - ICT GENERAL TECHNICIAN (Offshore)balj balhPas encore d'évaluation

- Release Notes COMPRION LTE CMW500 Network Simulation Controller R4.10.3Document4 pagesRelease Notes COMPRION LTE CMW500 Network Simulation Controller R4.10.3Saidul IslamPas encore d'évaluation

- CSharp For Sharp Kids - Part 1 Getting StartedDocument10 pagesCSharp For Sharp Kids - Part 1 Getting StartedBrothyam Huaman CasafrancaPas encore d'évaluation

- Passenger Services Conference Resolutions Manual: Resolution 792Document9 pagesPassenger Services Conference Resolutions Manual: Resolution 792Mike WillysPas encore d'évaluation

- UsabqtrDocument4 pagesUsabqtrVian ZiroPas encore d'évaluation

- SJ-20120802162214-007-ZXA10 C300 (V1.2.3) Optical Access Convergence Equipment Configuration Manual (CLI)Document209 pagesSJ-20120802162214-007-ZXA10 C300 (V1.2.3) Optical Access Convergence Equipment Configuration Manual (CLI)sethzinho0% (1)

- 664 Publist 2014 DecemberDocument15 pages664 Publist 2014 DecemberJ Salvador Calderón BarrancosPas encore d'évaluation

- As 2359.9-2006 Powered Industrial Trucks Overhead Guards - Specification and Testing (ISO 6055-2004 MOD)Document8 pagesAs 2359.9-2006 Powered Industrial Trucks Overhead Guards - Specification and Testing (ISO 6055-2004 MOD)SAI Global - APACPas encore d'évaluation

- 01 FT43131EN01GLN0 Flexihopper OverviewDocument137 pages01 FT43131EN01GLN0 Flexihopper OverviewSlah MisbahPas encore d'évaluation

- Improvements in Superabsorbent Water Blocking Materials For New Power Cable ApplicationsDocument6 pagesImprovements in Superabsorbent Water Blocking Materials For New Power Cable Applicationsssingaram1965Pas encore d'évaluation

- MSS SP-6 2012Document7 pagesMSS SP-6 2012ISRAEL PORTILLO100% (1)

- Assignment On PROBABILITYDocument2 pagesAssignment On PROBABILITYSushobhit ChoudharyPas encore d'évaluation

- Chapter 20 Additional Assurance Services Other InformationDocument26 pagesChapter 20 Additional Assurance Services Other InformationburzumagnusPas encore d'évaluation

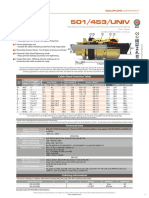

- 501/453/UNIV: Cable Gland Selection TableDocument1 page501/453/UNIV: Cable Gland Selection TableAkmalPas encore d'évaluation

- Asr 1002Document3 pagesAsr 1002Mohamed FayePas encore d'évaluation

- LC1D1210 Telemecanique LC1-D12-10 Contactor Replacement PDFDocument1 pageLC1D1210 Telemecanique LC1-D12-10 Contactor Replacement PDFredaPas encore d'évaluation

- Basic Safety Plan: Aker Powergas PVT LTD Page NoDocument36 pagesBasic Safety Plan: Aker Powergas PVT LTD Page NoAbid AliPas encore d'évaluation

- USAREUR Pam 30-60-1 1975 Identification Guide, Part Three Weapons and Equipment, East European Communist Armies Volume II, Mine Warfare and Demolition EquipmentDocument286 pagesUSAREUR Pam 30-60-1 1975 Identification Guide, Part Three Weapons and Equipment, East European Communist Armies Volume II, Mine Warfare and Demolition EquipmentBob Andrepont100% (3)

- 793D Off Higway Truck FDBDocument28 pages793D Off Higway Truck FDBMelissa TorresPas encore d'évaluation

- ERouting OSPF PT Practice SBADocument4 pagesERouting OSPF PT Practice SBAwilsonmadridPas encore d'évaluation

- Macro ListDocument7 pagesMacro ListavulsoPas encore d'évaluation

- Specifications Infusion Pump TE-135Document2 pagesSpecifications Infusion Pump TE-135Muhammad Iqwan Mustaffa100% (1)

- Tda 9875Document93 pagesTda 9875FxprimePas encore d'évaluation

- SCADADocument45 pagesSCADAalexlakimikapestaPas encore d'évaluation

- Orientation On The Manual For The Evaluation (Autosaved)Document31 pagesOrientation On The Manual For The Evaluation (Autosaved)Em Boquiren CarreonPas encore d'évaluation

- ONTAP 9 NDMP Configuration Express GuideDocument22 pagesONTAP 9 NDMP Configuration Express Guidestreet_carpPas encore d'évaluation

- DC 180kW HPC Product BrochureDocument2 pagesDC 180kW HPC Product BrochureRona AgustinPas encore d'évaluation

- National Step Tablet Vs Step Wedge Comparision FilmDocument4 pagesNational Step Tablet Vs Step Wedge Comparision FilmManivannanMudhaliarPas encore d'évaluation

- Civil Engineer Interview QuestionsDocument7 pagesCivil Engineer Interview QuestionsVirgil Sorcaru100% (1)