Académique Documents

Professionnel Documents

Culture Documents

Revalidation Test Paper Question-GR I

Transféré par

Velayudham ThiyagarajanCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Revalidation Test Paper Question-GR I

Transféré par

Velayudham ThiyagarajanDroits d'auteur :

Formats disponibles

REVISED SYLLABUS 2008

REVALIDATION TEST PAPERS

INTERMEDIATE Group I

THE INSTITUTE OF COST ACCOUNTANTS OF INDIA DIRECTORATE OF STUDIES

Copyright Reserved by the Institute of Cost Accountants of India

Questions to the Revalidation Test Paper Intermediate-Group-I

PAPER - 5 FINANCIAL ACCOUNTING

QUESTIONS TO REVALIDATION TEST PAPER-RV/05/FAC/2010

Time Allowed : 3 Hours Answer Question No. 1 which is compulsory and five from the rest. 1. (a) Distinguish between Liability and Provision. (3 marks) Full Marks : 100

(b) A & B are two partners of a firm sharing the profits & losses in the ratio of 7/12 and 5/12 respectively. On Ist April 2009,they take C as a partner giving him 1/6 share. A & B agreed further to share the C future profits in the ratio of 13/12 & 7/24 resp.C,in addition to his capital, brings in Rs96000 as his goodwill for 1/6 share. The goodwill is amount to be shred between A & B. The share of goodwill amount of A & B respectively will be A : Rs. 24000 & Rs. 72000 B : Rs. 72000 & Rs. 24000 C : Rs. 56000 & Rs. 40000 D : Rs. 52000 & Rs. 44000 Choose the correct answer. (c) Match the following : (i) AS-4 (ii) AS-10 (iii) As-26 (iv) AS-1 (d) Match the following : (i) Cash Reserve (ii) Clear Profit (iii) Escalation Clause (1) Electricity Supply Co (2) Construction Co (3) Banking Co (3 marks) (3 marks) (1) Disclosure of Accounting Policies (2) Contingencies & Events occurring after the Balance Sheet Date (3) Accounting for Fixed Assets (4) Intangible Assets (4 marks) (3 marks)

(e) Can a company change the method of providing Depreciation? (f) State whether each of the following statement is true or false (i) Dividend can be declared out of revaluation of fixed assets (ii) Calls in arrears is shown in the B/S under the heading current assets (g) Mention the funds out of which a company can purchase its own share? (h) Choose the correct answer : Under the Hire Purchase System the last installment paid comprises (i) Cash Price only (ii) Interest only (iii) Cash Price and Interest

(4 marks) (3 marks)

(2 marks)

Questions to the Revalidation Test Paper Intermediate-Group-I

2. (a) M/s Rama and Rina commenced business on 1st January 2005, when they purchased plant and equipment for Rs. 7,00,000. They adopted a policy of (i) charging depreciation at 15% p.a. on diminishing balance method and (ii) charging full years depreciation on additions. Over the years, their purchases of plant have been : Date August 1, 2006 September 30, 2009 Amount 1,50,000 2,00,000

On January 1,2009 it was decided to change the method and rate of depreciation to 10% p.a. on straight line method with retrospective effect from January 1, 2005, the adjustment being made in the accounts for the year ending 31st December, 2009. Kolkata the difference in depreciation to be adjusted in the Plant and Equipment Account on January 1, 2009 and show the ledger account for the year 2009. (10 marks) (b) Classify the following items as capital or revenue expenditure : (i) An extension of railway tracks in the factory area; (ii) Wages paid to machine operators; (iii) Installation costs of new production machine; (iv) Materials for extensions to foremens offices in the factory; (v) Rent paid for the factory. (5 marks) 3. (a) The Bihar Coal Co. Ltd. holds a lease of coal mines for a period of twelve years, commencing from 1st April 2002. According to the lease, the company is to pay Rs 7.50 as royalty per ton with a minimum rent of Rs 150,000 per year. Short workings can, however, be recovered out of the royalty in excess of the minimum rent of the next two years only. For the year of a strike the minimum rent is to be reduced to 60%. The output in tons for the 6 years ending 31st March,2008 is as under: 2002-03 : 10,000; 2003-04 : 12,000; 2004-05:25,000; 2005-06: 20,000; 2006-07: 50,000; and 2007-08:15,000 (strike). Write up the necessary Ledger Accounts in the books of Bihar Coal Co. Ltd. (10 marks) (b) Distinguish between Hire Purchase System and Instalment System. (5 marks)

4. (a) From the following information, calculate the value of goodwill by super profit method and CapitaIisation method (i) Average Capital employed in the business Rs. 7,00,000. (ii) Net trading profit of the firm for the past three years Rs. 1,47,600; Rs. 1,48,100 and Rs.1,52,500. (iii) Rate of Interest expected from capital having regard to the risk involved 18%. (iv) Fair remuneration to the partners for their services 12,000 per annum. (v) Sundry Assets (excluding goodwill) of the firm Rs. 7,54,762. (vi) Sundry Liabilities Rs. 31,329. (vii) Goodwill valued at 2 years purchase (b) Write a short Note on Segmental Reporting. (10 marks) (5 marks)

5. (a) Swapna Ltd. has two branches, at Mumbai and at Delhi. Goods are invoiced to Branches at cost plus 50%. Goods are transferred by/to anther branch at its cost. Following information is available of the transactions of Mumbai for the year ended on 31st March 2008. Rs. (a) Opening Stock at its cost (b) Goods sent to Branch (including goods invoiced at to Branch on 31st March but not received by Branch before closing) (c) Goods received from Delhi Branch (d) Goods transferred to Delhi Branch (e) Goods returned by Branch to H.O. (f) Goods returned by Credit Customers to Branch (g) Goods returned by Credit Costomers directly to H.O. 26,700 1,500 78,300 600 5,100 1,170 570 120

Questions to the Revalidation Test Paper Intermediate-Group-I (h) Agreed allowance to Customers off the selling price (already taken into account while invoicing) (i) Normal loss due to wastage and deterioration of stock (at cost) (j) Loss-in transit (at invoice price) Rs. 660 against which a sum of Rs. 400 was recovered from the Insurance Company in full settlement of the claim. (k) Cash Sales Rs. 3,200 and Credit Sales (l) Branch Expenses (including Insurance charges) (m) Bad Debts Rs. 100 and Discount allowed to Customers 100 150 72940 5,000 50

Prepare Branch Stock Account, Branch Adjustment Account and Branch Profit and Loss Account in the following case. If the Closing Stock at Branch at its cost as per physical verification amounted to Rs. 20,000 (10 marks) (b) Write short notes on treatment of abnormal losses in Branch Account. (5 marks)

6. (a) Alpha Ltd issued a prospectus inviting applications for 2,000 shares of Rs.10 each at a premium of Rs. 2 per share, payable as follows : On Application Rs.2 On Allotment Rs. 5 (including premium) On First Call Rs.3 On Second & Final Call Rs. 2 Applications were received for 3,000 shares and pro rata allotment was made on the applications for 2,400 shares. It was decided to utilise excess application money towards the amount due on allotment. Mohit, to whom 40 shares allotted, failed to pay the allotment money and on his subsequent failure to pay the first call, his shares were forfeited. Jagat, the holder of 60 shares failed to pay the two calls and on his such failure, his shares were forfeited. Of the shares forfeited, 80 shares were sold to Rishav credited as fully paid for Rs. 9 per share, the whole of Mohits shares being included. Give Journal Entries to record the above trasactions (including cash transactions) (b) Discuss the conditions of Companies Act with regard to buy back of shares. (10 marks) (5 marks)

7. (a) Hansa Ltd. was incorporated on 1st July, 2008 to acquire a running business with effect 1st April, 2008. The accounts for the year ended 31st March, 2009 disclosed the following : (i) There was a gross profit of Rs. 30,00,000. (ii) The sales for the year amounted to Rs. 1,20,00,000 of which Rs. 24,00,000 were for the first six months. (iii) The expenses debited to the Profit and Loss Account includeddirectors fees : Rs. 1,50,000; bad debts : Rs. 36,000; advertising : Rs. 1,20,000 (under a contract amounting to Rs. 10,000 per month); salaries and general expenses : Rs. 6,40,000; preliminary expenses written off Rs. 50,000; and donation to a political party given by the company Rs. 50,000. Prepare a statement showing the amount of profit made before and after incorporation. (b) Distinguish between Statutory Reserve and Cash Reserve in respect of Banking Companies 8. Write note on : (a) Double Accounting System (b) Reinsurance (c) Materiality Concept (d) Minimum Rent (e) Bonus Share (15 marks) (10 marks) (5 marks)

Questions to the Revalidation Test Paper Intermediate-Group-I

PAPER - 6 COMMERCIAL AND INDUSTRIAL LAWS AND AUDITING

QUESTIONS TO REVALIDATION TEST PAPER-RV/06/CIA/2010

Time Allowed : 3 Hours Full Marks : 100

SECTION I : COMMERCIAL AND INDUSTRIAL LAWS

Q. No. 1 is compulsory and any two questions from rest. 1. (a) Comment on following statement. (1) Passing of risk is dependent on delivery of goods. (2) Every trade practice in restraint of trade is not necessarily a restrictive trade practice. (3) Lay off and retrenchment cans not the same meaning. (4) Gratuity can be attached by an order of court. (5) Eligibility of bonus depends on the period of actual service. (6) Minor under Contract Act is always a beneficiary. (7) An apprentice is a workman under Industrial Dispute Act. (8) Acceptance for honour can be made only when the instruments becomes Dishonored by non acceptance or by non payment. (9) Matters provided in first schedule, second schedule and third schedule of pay ment of Bonus Act. (b) Difference between bill of exchange and cheque. 2. (a) Discuss the essentials of a valid contract. (b) Who cannot enter into a contract? (c) Distinguish between void and illegal contracts. (4 marks) (8 marks) (3 marks) (3 marks) (18 marks)

3. (a) What are the remedies available to a worker who has paid less than the minimum rates of wages? State the procedure for determination of dispute. (4 marks) (b) Who is occupier of a factory under Factories act? When can he be exempted from liability. (c) Discuss rights of consumer under consumer protection act. (d) Discuss rights of unpaid seller. 4. (a) Can a minor be liable for payment of supplies of necessaries to him? (b) Explain remedies available under consumer protection act. (c) Write about Partnership by holding out. (d) When an offer lapses. 5. Write short notes (any Two) : (a) Exceptions to the rule no. consideration no contract (b) Anti Competitive Agreements (c) Objectives of Right to Information Act. (d) Monitoring and Reporting under Right to Information Act. (4 marks) (3 marks) (3 marks) (4 marks) (4 marks) (3 marks) (3 marks) (14 marks)

Questions to the Revalidation Test Paper Intermediate-Group-I

SECTION II : AUDITING

Q. No. 1 is compulsory and any two questions from rest. 1. State with reasons whether the following statement are TRUE or FALSE. (i) Internal Audit is entrusted to the employees of the organization. (ii) When there is a Statutory Audit, introduction of Internal Audit is not necessary at all. (iii) Auditing is generally associated with only accounting and financial records. (iv) Only the vouching to ascertain the arithmetical accuracy is not enough. (v) Internal Audit is similar to that of internal control. (vi) Detection of frauds is the duty of the Statutory Auditor and not necessarily that of an internal auditor. 2. What is audit evidence? Explain the different types of audit evidence and different methods of obtaining them. (16 marks) 3. What do you mean by CARO? Explain what is expected under the CARO regarding : (a) Inventory (b) Internal Audit (c) Internal Control (d) Deposit of Statutory Dues. (e) Frauds 4. Answer in brief : (a) What is the professional qualification of Company Auditor? (b) Who can become a Cost Auditor of a company? (c) A person disqualified for any reason to be a Co. Auditor is also disqualified to be an auditor of which companies? (d) When Central Govt. appoints a Company Auditor? (e) Who can remove the Co. Auditor? (f) Give any two important rights of Co. Auditor. (g) What is an important duty of Co. Auditor to shareholders of the Co.? (h) To whom the auditor performs his duty of signing an Audit Report? 6. Write short notes on : (a) Efficiency Audit. (b) Qualified Report (c) Auditing in EDI environment (d) Audit checks in case of Depreciation. (16 marks) (16 marks) (16 marks) (18 marks)

Questions to the Revalidation Test Paper Intermediate-Group-I

PAPER - 7 APPLIED DIRECT TAXATION

QUESTIONS TO REVALIDATION TEST PAPER-RV/07/ADT/2010

Time Allowed : 3 Hours Answer Question No. 1 which is compulsory and five from the rest. 1. (a) What is the tax incidence of contribution made by an employer to the pension scheme of Central Government? (2 marks) (b) What is the cost of acquisition of sweat equity shares in the hands of the employee? (2 marks) (c) Gratuity of Rs. 1,20,000 is received in August, 2007 by Mr. M, a legal heir of Mr. R aged 45 years who died on June 28, 2007. Is it taxable? (2 marks) (d) Cash gifts received under section 56(2)(vi) from non-relatives are not taxable upto (1) Rs. 1,00,000; (2) Rs. 75,000; (3) Rs. 50,000; (4) Rs. 25,000. (2 marks) (e) Mr. A has three minor children deriving interest from bank deposits to the tune of Rs. 2,000, Rs. 1,300 and Rs. 1,600 respectively. Exemption available under section 10(32) of the Income-tax Act, 1961 is (1) Rs. 4,900; (2) Rs. 4,300; (3) Rs. 4,500; (4) None of the above. (2 marks) (f) Miss Femina, aged 17, is married to Mr. Masculine. Her mother alone is alive. Income by way of interest on loans, of Miss Femina will be (1) Assessed to tax in the hands of Mr. Masculine; (2) Assessed to tax in the hands of her mother; (3) Taxable in her own hands; (4) None of the above. (g) Mr. X gifts Rs. 60,000 to the HUF of which he is member; said amount will be treated as income of (1) Mr. X; (2) The HUF; (3) None, as it is exempt; (4) None of the above (2 marks) (h) Short-term capital gains arising from sale of listed shares through a recognized stock exchange, for which security transaction tax has been paid, will be charged to tax at a concessional rate of 10%. (2 marks) (i) The following is not a venture capital undertaking for the purposes of section 10(23F), if engaged in business of : (1) Generation of power; (2) Telecommunications; (3) Providing infrastructural facility; (4) Dairy farming whose shares are not listed in a recognised stock exchange. (2 marks) (2 marks) Full Marks : 100

Questions to the Revalidation Test Paper Intermediate-Group-I

(j) In valuation of immovable property in Bangalore, the specified area means ............ of the aggregate area, for wealthtax purposes. (1) (2) (3) (4) 60 65 70 75 per per per per cent; cent; cent; cent.

(2 marks)

(k) The urban lands of Mr. A were required by the State Government 10 years back and compensation of Rs. 10 lakhs was awarded by the Court in February, 2008 and the same was received in May, 2008. State the consequences under the Income-tax Act, 1961, showing clearly the year of taxability. What will happen if Mr. A dies and Mr. L, his legal heir receives the enhanced compensation? (5 marks) 2. (a) Mr a has joined K ltd on July 2006inthe scale of Rs15000-1500-21000-2500-31000. Compute the Gross salary for the relevant Previous year. (4 marks) (b) Elaborate on what are to be taxed as profits in lieu of salary. (6 marks) (c) Mr B TAKES A INTEREST FREELOAN OF Rs250000 on IST November of the relevant Previous year to construct his house.The loan is repayable in 50 monthly instalments from January of the relevant previous year.Compute the value of perquisite.(SBI lending rate-8.5% p.a) (5 marks) 3. (a) Is it possible for the net annual value of a house property to be negative? What will be the tax treatment if income under the head income from house property is negative? (6 marks) (b) What do you mean by composite rent? What is the tax treatment of Composite rent under the Income TAX Act-1961. (9 marks) 4. (a) Write a short note on Special provisions for computing the profits and gains of civil construction u/s 44AD of The Income Tax Act 1961. (7 marks) (b) What are intangible assets? Give four examples.What is the rate of depreciation on a block of intangible assets? (8 marks) 5. (a) P commenced a business on 10/05/1992. The said business is sold by J ON 25TH August of the relevant previous year and he received Rs. 10 lacs towards goodwill.Compute Capital gain of the relevant previous year. What will be your answer in the above case, if P had acquired the goodwill for this business for a consideration of Rs. 300000. (8 marks) (b) What is slump sale? How is capital gain computed in case of a slump sale? 6. (a) Discuss the taxability of gifts received by an assessee. (b) F received the following gifts during the relevant previous year (i) (ii) (iii) (iv) Rs 40,000 from the elder sister Rs. 60,000 from the daughter of her elder sister Rs. 125,000 from various on the occasion of her marriage. Wrist watch valued at Rs. 40,000 from his friend. (7 marks) (7 marks)

(8 marks)

7. (a) What is the due date of filling of return of income in case of a nonworking partner of a firm whose accounts are not liable to be audited? (b) Is e-filling of return mandatory? State the assessees for whom e-filling of returns is mandatory? (c) Can a belated return of income filed u/s 139(4) be revised? (d) Can a revised return be further revised? (e) Who can sign the return of HUF, if HUF does not have a major member? 8. (a) State briefly the exemptions available u/s 5 of Wealth Tax Act,1957. (b) Write a brief note on deduction available under section 80DD OF THE Income Tax Act,1961 (35 marks) (7 marks) (8 marks)

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Aptitude Tests For EmploymentDocument29 pagesAptitude Tests For EmploymentVelayudham ThiyagarajanPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Icai Differences Between Ifrss and Ind AsDocument21 pagesIcai Differences Between Ifrss and Ind AsdhuvadpratikPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Psychometric Tests PDFDocument7 pagesPsychometric Tests PDFMarshall MahachiPas encore d'évaluation

- Project ReportDocument9 pagesProject ReportVelayudham ThiyagarajanPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Custom Duty CalculetorDocument2 pagesCustom Duty CalculetorVelayudham ThiyagarajanPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Balance Sheet As Per New Schedule ViDocument11 pagesBalance Sheet As Per New Schedule ViVelayudham ThiyagarajanPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Academics: o o o o o o oDocument4 pagesAcademics: o o o o o o oVelayudham ThiyagarajanPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- MM+T+Codes SAPDocument4 pagesMM+T+Codes SAPVelayudham ThiyagarajanPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Keys Combination Functions Control CombinationsDocument8 pagesKeys Combination Functions Control CombinationsVelayudham ThiyagarajanPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Tax Touch Up: Which Is That Amt DepositedDocument5 pagesTax Touch Up: Which Is That Amt DepositedVelayudham ThiyagarajanPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- ATC Enrolment Fee Structure ICAIDocument4 pagesATC Enrolment Fee Structure ICAIVelayudham ThiyagarajanPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- End User Guide To Accounts Receivable in Sap FiDocument82 pagesEnd User Guide To Accounts Receivable in Sap FiVelayudham ThiyagarajanPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Rippling Metrics RedactedDocument17 pagesRippling Metrics RedactedScott GalvinPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Info 620 Exam 2 Study Guide PDFDocument4 pagesInfo 620 Exam 2 Study Guide PDFюрий локтионовPas encore d'évaluation

- Mobile Detailer Business PlanDocument16 pagesMobile Detailer Business PlanTaisa StocksPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- AssignmentDocument5 pagesAssignmentpeter chadaPas encore d'évaluation

- Merchandising Calender: By: Harsha Siddham Sanghamitra Kalita Sayantani SahaDocument29 pagesMerchandising Calender: By: Harsha Siddham Sanghamitra Kalita Sayantani SahaSanghamitra KalitaPas encore d'évaluation

- Branch Accounts Theory and Problems PDFDocument18 pagesBranch Accounts Theory and Problems PDFketanPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Cereal Partners WorldwideDocument13 pagesCereal Partners WorldwideBeamlakPas encore d'évaluation

- E. Patrick Assignment 4.1Document3 pagesE. Patrick Assignment 4.1Alex100% (2)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Partnership Questions Problems With Answers PDF FreeDocument11 pagesPartnership Questions Problems With Answers PDF FreeJoseph AsisPas encore d'évaluation

- Group 6 - Transforming Luxury Distribution in AsiaDocument5 pagesGroup 6 - Transforming Luxury Distribution in AsiaAnsh LakhmaniPas encore d'évaluation

- Lesson 2 - Branches of AccountingDocument15 pagesLesson 2 - Branches of AccountingLeizzamar BayadogPas encore d'évaluation

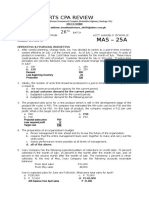

- MAS 25A 27TH BATCH With AnswersDocument12 pagesMAS 25A 27TH BATCH With AnswersSarah Jane GanigaPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Chapter 5Document36 pagesChapter 5Baby KhorPas encore d'évaluation

- Definition of GaapDocument2 pagesDefinition of GaapAshwini PrabhakaranPas encore d'évaluation

- Activity Based Costing and Lean AccountingDocument91 pagesActivity Based Costing and Lean AccountingAira Nharie MecatePas encore d'évaluation

- CH4 - Job Order Costing and Overheads ApplicationDocument51 pagesCH4 - Job Order Costing and Overheads ApplicationYMPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Lean Chapter 2Document14 pagesLean Chapter 2WinterMist11Pas encore d'évaluation

- Quiz Quiz 2 Single Entry and Cash Accrual Accounting PDFDocument28 pagesQuiz Quiz 2 Single Entry and Cash Accrual Accounting PDFluismorentePas encore d'évaluation

- Chapter - 32: Corporate Restructuring, Mergers and AcquisitionsDocument26 pagesChapter - 32: Corporate Restructuring, Mergers and AcquisitionsHardeep sagarPas encore d'évaluation

- Introduction To Marketing Management MNM1503Document27 pagesIntroduction To Marketing Management MNM1503Melissa0% (1)

- 59 IpcccostingDocument5 pages59 Ipcccostingapi-206947225Pas encore d'évaluation

- TB 14Document67 pagesTB 14Dang ThanhPas encore d'évaluation

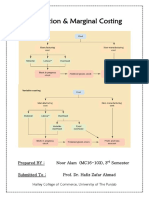

- Absorption & Marginal Costing - Noor Alam (MC16-103)Document24 pagesAbsorption & Marginal Costing - Noor Alam (MC16-103)Ahmed Ali Khan100% (2)

- Brand Positioning Refers To "Target Consumer's" Reason To Buy Your Brand in Preference To Others. It IsDocument11 pagesBrand Positioning Refers To "Target Consumer's" Reason To Buy Your Brand in Preference To Others. It IsAndrew BrownPas encore d'évaluation

- DocDocument45 pagesDocYogesh KatnaPas encore d'évaluation

- Lembar KerjaDocument29 pagesLembar Kerjakholisatunnisa530Pas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Profit and Loss - 21TDY 659Document47 pagesProfit and Loss - 21TDY 659aakash rayPas encore d'évaluation

- Business Strategy of The E-Type Company PDFDocument2 pagesBusiness Strategy of The E-Type Company PDFHadeer KamelPas encore d'évaluation

- Instant Download Ebook PDF Fundamental Accounting Principles Volume 1 16th Canadian Edition PDF ScribdDocument42 pagesInstant Download Ebook PDF Fundamental Accounting Principles Volume 1 16th Canadian Edition PDF Scribdjudi.hawkins744100% (40)

- Financial Statement Analysis and Security Valuation 5th Edition by Penman ISBN Test BankDocument16 pagesFinancial Statement Analysis and Security Valuation 5th Edition by Penman ISBN Test Bankcindy100% (24)