Académique Documents

Professionnel Documents

Culture Documents

Spanish Tax Facts

Transféré par

bpspainholdingsDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Spanish Tax Facts

Transféré par

bpspainholdingsDroits d'auteur :

Formats disponibles

Spanish Tax Facts

http://www.bpspainholdings.com/2013/04/spanish-tax-facts/

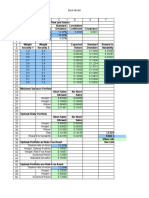

Taxation in Spain occurs at a national level and at a regional (Autonomous Community) or municipal level. The Spanish taxation system was subject to a significant review in 2007 that resulted in the introduction of a new Personal Income Tax Act. The tax regime in Spain is controlled by the Ministry of the Treasury.Tax Year 1st January to 31st December. Assessment Basis Spanish residents are taxed on their worldwide income (earned and unearned), capital gains from all sources and on their worldwide assets. Spain operates a self-assessment regime.For personal income tax purposes, married couples may choose to file tax returns jointly or separately.Income Tax Spanish residents are subject to Spanish Personal Income Tax (IRPF). Individuals and couples benefit from personal allowances which reduce their liability to tax and which increase in line with the number of dependent children.A new structure has been created for the taxation of income, which now falls into two categories: the general base and the savings base of income.The general base includes salary and other benefits from employment, income from economic activities, and property rental income (either actual or deemed). Such income is reduced by applicable deductions and allowances. It is subject to a progressive scale which is applied to successive portions of taxable income with rates ranging from 24% to 43%*. In the autumn of 2011 a new tax bracket was introduced for higher income earners as an austerity measure, with income over 175,000 now subject to a 45% rate.The savings base is subject to a 19% tax rate on savings income up to 6000 and to 21% on the excess and includes interest, dividends, and capital gains/losses paid to residents in Spain, together with life and disability insurance proceeds paid to Spanish residents by a Spanish entity (or an EU insurer operating on a Freedom of Services passport into Spain) where any investment element is limited to Spanish tax compliant funds.*Some Autonomous Communities have considered increasing the local personal income tax rates to help combat the economic crisis in Spain. The following maximum rates for personal income tax have been agreed for the 2011 tax year e.g. Andalucia: 48%; Asturias: 48.5%; Cataluna: 49%. Taxation of Investment Income Any investment income received will form part of the taxpayers income tax calculation and any withholding tax deducted will be held as a credit against the final calculation of income tax due. Spanish insurers and EU insurers with a Spanish branch or operating on a Freedom of Services passport in Spain are required to withhold 19% tax on gains on payments from tax compliant insurance policies held by Spanish residents. Foreign insurance policies will be subject to income tax, and can offset losses, on an annual basis.Generally an annual exemption limited to 1,500 is granted to resident individuals in respect of all dividends. Premium Taxes Life insurance in Spain is exempt from premium taxes. Tax on Property Rental Income Property income (provided it is not used for economic activity) is taxed as general base income. The amounts received are the gross income and may be reduced by deducting all expenses necessary to service and repair the property. These can include interest on loans used to acquire the property, depreciation expenses of up to 3% of the purchase price or its cadastral value, excluding the value of the land. There are further reductions that can be made where the property is destined to become the individuals personal residence.

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Intoduction To WeldingDocument334 pagesIntoduction To WeldingAsad Bin Ala QatariPas encore d'évaluation

- Online Games and Academic AchievementDocument25 pagesOnline Games and Academic AchievementJasmine GamoraPas encore d'évaluation

- Chapter FourDocument9 pagesChapter FourSayp dPas encore d'évaluation

- Free Higher Education Application Form 1st Semester, SY 2021-2022Document1 pageFree Higher Education Application Form 1st Semester, SY 2021-2022Wheng NaragPas encore d'évaluation

- SA 8000 Audit Check List VeeraDocument6 pagesSA 8000 Audit Check List Veeranallasivam v92% (12)

- Dabur Vs PatanjaliDocument4 pagesDabur Vs PatanjalirangarajanPas encore d'évaluation

- DR K.M.NAIR - GEOSCIENTIST EXEMPLARDocument4 pagesDR K.M.NAIR - GEOSCIENTIST EXEMPLARDrThrivikramji KythPas encore d'évaluation

- Amul Amul AmulDocument7 pagesAmul Amul Amulravikumarverma28Pas encore d'évaluation

- Aplikasi Metode Geomagnet Dalam Eksplorasi Panas BumiDocument10 pagesAplikasi Metode Geomagnet Dalam Eksplorasi Panas Bumijalu sri nugrahaPas encore d'évaluation

- Cannabis Effects On Driving SkillsDocument15 pagesCannabis Effects On Driving SkillsCharles PetersPas encore d'évaluation

- Notice of Privacy Practices (Generic)Document3 pagesNotice of Privacy Practices (Generic)cecilled_08Pas encore d'évaluation

- Cyber Safety PP Presentation For Class 11Document16 pagesCyber Safety PP Presentation For Class 11WAZ CHANNEL100% (1)

- FennelDocument2 pagesFennelAlesam44bPas encore d'évaluation

- The Problem of Units and The Circumstance For POMPDocument33 pagesThe Problem of Units and The Circumstance For POMPamarendra123Pas encore d'évaluation

- Beckhoff Service Tool - USB StickDocument7 pagesBeckhoff Service Tool - USB StickGustavo VélizPas encore d'évaluation

- Key ScientificDocument4 pagesKey ScientificGarrettPas encore d'évaluation

- Assignment On Inservice Education Sub: Community Health NursingDocument17 pagesAssignment On Inservice Education Sub: Community Health NursingPrity DeviPas encore d'évaluation

- A Conceptual Framework For Characterizing M - 2019 - International Journal of MiDocument7 pagesA Conceptual Framework For Characterizing M - 2019 - International Journal of MiKENNY BRANDON MAWODZWAPas encore d'évaluation

- Shizhong Liang, Xueming Liu, Feng Chen, Zijian Chan, (2004) .Document4 pagesShizhong Liang, Xueming Liu, Feng Chen, Zijian Chan, (2004) .Kiệt LêPas encore d'évaluation

- BKM 10e Ch07 Two Security ModelDocument2 pagesBKM 10e Ch07 Two Security ModelJoe IammarinoPas encore d'évaluation

- Iso 9227Document13 pagesIso 9227Raj Kumar100% (6)

- L A R G e - S C A L e M e T H A M P H e T A M I N e M A N U F A C T U R eDocument21 pagesL A R G e - S C A L e M e T H A M P H e T A M I N e M A N U F A C T U R eDaria Schka100% (1)

- Removing Eyelid LesionsDocument4 pagesRemoving Eyelid LesionsMohammad Abdullah BawtagPas encore d'évaluation

- Reverse Osmosis Desalination: Our Global Expertise To Address Water ScarcityDocument16 pagesReverse Osmosis Desalination: Our Global Expertise To Address Water Scarcitynice guyPas encore d'évaluation

- Fundamental Molecular Biology: GenomesDocument45 pagesFundamental Molecular Biology: GenomesMoonHoLeePas encore d'évaluation

- Prof. Madhavan - Ancient Wisdom of HealthDocument25 pagesProf. Madhavan - Ancient Wisdom of HealthProf. Madhavan100% (2)

- Astm B633Document5 pagesAstm B633nisha_khan100% (1)

- MCQ Homework: PeriodonticsDocument4 pagesMCQ Homework: Periodonticsفراس الموسويPas encore d'évaluation

- Earth Loop ImpedanceDocument5 pagesEarth Loop ImpedanceKaranjaPas encore d'évaluation

- Cemco T80Document140 pagesCemco T80Eduardo Ariel Bernal100% (3)