Académique Documents

Professionnel Documents

Culture Documents

Full Report1

Transféré par

Arslan RajputDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Full Report1

Transféré par

Arslan RajputDroits d'auteur :

Formats disponibles

1

Chapter No: 01 Introduction to Banking

1.1 What is Bank 1.2 Banking 1.2.1 1.2.2 1.2.3 Origin of Banking Banking in Ancient World Early Banking

1.3 Functions of Commercial Banks 1.4 Role of Banks in the Economic Development of a Country 1.5 Banking in Pakistan

Chapter No: 01 Introduction to Banking

1.1 What is a Bank? There are various views about the origin of the word, bank. The word is derived from an Italian word, banque which means a, bench. The other point of view is that it has originated from the German word bank, which means a joint stock firm. The World Bank is used in the sense of a commercial bank. It is of Germanic origin though some persons trace its origin to the French word, Banqui. Chambers Twentieth Century Dictionary defines a bank as an institution for the keeping lending and exchanging of money. According to Crowther, A bank is a firm which collects the money from those who have spare. It lends money to those who require it. Or The Bankers business is to take the debts of other people to offer his own in exchange, and thereby create money. According to Kent, The bank is an organization whose principal operations are concerned with the accumulation of the temporarily idle money of the general public for the purpose of advancing to others for expenditure.

According to Mr. Parking, A bank is a firm that takes deposits from households and firms and makes loans to other households and firms.

According to Sayers, Ordinary banking business consists of changing cash for bank deposits and bank deposits for cash; transferring bank deposits from one person or corporation to another; giving the secured or unsecured promises of businessmen to repay, etc. Thus bank is a financial institution, which uses funds deposited with it to extend loans to companies or individuals, and also provides financial services to its customers. In other words it is an intermediate party between the borrower and the lender. The difference between the terms on which it borrows and those on which it lends forms the source of its profit.

1.2

BANKING

Banking is the acceptance, transfer, and, most important, creation of deposits. Banking consists of safeguarding and transfer of funds, lending or facilitating loans, guaranteeing creditworthiness, and exchange of money. Such institutions as commercial banks, saving banks, trust companies, finance companies, provide these services and merchant banks or other institutions engaged in investment banking. All countries subject banking to government regulation and supervision normally implemented by central banking authorities. 1.2.1 Origin of Banking Banking was invented before coins and reached a high level of sophistication in the Egypt. Military conquests, such as those of Alexander the Great, spread the use of coins, which became the most convenient means of payment. Banking is the business providing financial services to consumers and businesses. The basic services a bank provides are checking accounts, which can b used like money to make payments and goods and services; saving accounts and time

deposits that can b used to save money for future use; loans that consumers and businesses can use to purchase goods and services; and basic cash management services such as check cashing and foreign currency exchange. Four types of banks specialize in offering these basic banking services: commercial banks, savings and loan associations, savings banks, and credit unions. 1.2.2 Banking in the Ancient World

Many functions of modern banking were participated by ancient civilizations. Usually temples served as banks and priest as bankers. The temples were logical places for enterprise. In a polytheistic era where superstition was rife, few could consider angering the goods by stealing the money from temple. Babylonian cruciform records revel the wide spread use of credit, mortgage, written promises to repay loans and interest charges up to legal maximum rates. History of banking is traced back as 2000 BC Babylonians. Up a code wherein he laid down standard rules, procedure for banking operations by temples and great landowners. He got his code inscribed on a block of 8 feet tall, containing about 150 paragraphs, which deal with nearly all aspects of loans, interest pledges, guarantees, natural accidents, loss theft etc. later on, the Sumerians, Babylonians, hit ties and Assyrians standardized the values of the goods in silver, copper, bronze or electrum. It is not certain as to who invented money; but history records that Gyges, king of Lydia, caste electrum (natural alloy of gold and silver) ingots of identical shape and of uniform weight with a album engraved on it as an official guarantee of value in 687 BC. 1.2.3 Early Banking

Many banking functions such as safeguarding funds, lending, guaranteeing loans, and exchanging money can be traced to the early days of recorded history. In medieval times the Knights Templar, an international military and religious order, not only stored valuables and granted loans but also arranged for the transfer of funds from one country to another. The great banking families of the Renaissance, such as the Medici in Florence, were involved in lending money and financing international trade. The first modern banks were established in the 17th century, notably the Riks bank in Sweden (1656) and the Bank of England (1694). In the 17th century, English goldsmiths provided the model for contemporary banking. Gold was stored with these artisans for safekeeping, and was expected to be returned to the owners on demand. The goldsmiths soon discovered that the amount of gold actually removed by owners was only a fraction of the total stored. Thus, they could temporarily lend out some of this gold to others, obtaining a promissory note for principal and interest. In time, paper certificates redeemable in gold coin were circulated instead of gold. Consequently, the total value of these banknotes in circulation exceeded the value of the gold that was exchangeable for the notes. Two characteristics of this fractional-reserve banking remain the basis for presentday operations. First, the banking systems monetary liabilities exceed its reserves. This feature was responsible in part for Western industrialization, and it still remains important for economic expansion, though a risk of creating too much money is a rise in inflation. Second, liabilities of the banks (deposits and borrowed money) are more liquidthat is, more readily convertible to cash than are the assets (loans and investments) included on the banks balance sheets. This characteristic enables consumers, businesses, and governments to finance

activities that otherwise would be deferred or cancelled; at the same time, it opens banks to the risk of a liquidity crisis. When depositors en masse request payment, the inability of a bank to respond because it lacks sufficient liquidity means that it must either renege on its promises to pay or pay until it fails. A key role of the central bank in most countries is to regulate the commercial banking sector to minimize the likelihood of a run on a bank, which could undermine the entire banking system. The central bank will often stand prepared to act as lender of last resort to the banking system to provide the necessary liquidity in the event of a widespread withdrawal of funds. This does not equal a permanent safety net to save any bank from collapse, as was demonstrated by the Bank of Englands refusal to rescue the failed investment bank Baring in 1995. 1.3 Functions of Commercial Banks Commercial banks perform a variety of functions, which can be divided as; (1) (2) (3) (4) (5) (6) 1. Accepting deposits; Advancing loans; Credit creations; Financing foreign trade; Agency services; and Miscellaneous services to customers. ACCEPTING DEPOSITS

This is the oldest function of a bank and the banker used to charge a commission for keeping the money in its custody when banking was developing as an institution. Now a days bank accepts three kinds of

deposits. The first is saving deposits , on which the bank pays small interest. The depositors are allowed to draw their money by cheques up to a limited amount during a week or year. Businessmen keep their deposits in current accounts . They can withdraw any amount standing to their credit in account deposits by cheques without notice. The bank does not pay interest on such accounts. Current accounts are also known as demand deposits. Deposits are also accepted by a bank in fixed or time deposits. The rate of interest increases with the length of the time period of the fixed deposit. But there is always the maximum limit of the interest rate, which can be paid. For instance, the interest rate on fixed deposits over five years is 8 percent in Pakistan. 2. ADVANCING LOANS One of the primary functions of a commercial bank is to advance loans to its customers. A bank lends a certain percentage of the cash lying in deposits on a higher interest rate than it pays on such deposits. This is how it earns profits and carries on its business. The bank advances loans in the following ways. a) Cash Credit : The bank advances loans to businessmen against certain specified securities. The amount of the loan is credited to the current account of the borrower. In case of a new customer a loan account for the sum is opened. The borrower can withdraw money through cheques according to his requirements but pays interest on the full amount. b) Call Loans : These are very short-term loans advanced to the bill brokers for not more than fifteen days. They are advances against first class bills or securities.

Such loans can be recalled at a very short notice. In normal times they can also be renewed. c) Overdraft : A bank often permits a businessman to draw cheques for a sum greater than the balance lying in his current account. Providing the overdraft facility up to a specific amount to the businessman. But he is charged interest only on the amount by which his current account is actually overdrawn and not by the full amount of the overdraft sanctioned to him by the bank. d) Discounting Bills of Exchange : If a creditor holding a Bill of Exchange wants money immediately, the bank provides him the money by discounting the bill of exchange. It deposits the amount of the bill in the current account of the bill-holder after deducting its rate of interest for the period of the loan, which is not more than 90 days. When the Bill of Exchange matures, the bank gets its payment from the banker of the debtor who accepted the bill. 3. CREDIT CREATION Credit creation is one of the most important functions of the commercial banks. Like other financial institutions, they aim at earning profits. For this purpose, they accept deposits and advance loans by keeping small cash in reserve for day transactions. When a bank advances a loan, it opens an account in the name of the customer and does not pay him in cash but allows him to draw the money by cheque according to his needs. By granting a loan, the bank creates credit or deposit. 4. FINANCIAL FOREIGN TRADE

A commercial bank finances foreign trade of its customers by accepting foreign bills of exchange and collecting them from foreign banks. It also transacts other foreign exchange business and busy and sells foreign currency. 5. AGENCY SERVICES A bank acts as an agent of its customers in collecting and paying cheques, bills of exchange, drafts, dividends, etc. it also busy and sells shares, securities, debentures, etc. for its customers. Further, it pays subscriptions, insurance Premia, rent, electric and water bills and other similar charges on behalf of its clients. It also acts as a trustee and executor of the property and will its customers. Moreover, the bank acts as an income tax consultant to its clients, for some of these services, the bank charges a nominal fee while it renders others free of charge. 6. MISCELLANCEOUS SERVICES Besides the above services. The commercial bank performs a number of other services. It acts the custodian of the valuables of its customers by providing them lockers where they can keep their jewelry and valuable documents. It issues various from of credit instruments, such as cheques, drafts, travelers cheques, etc., which facilitate transactions. The bank also issues letters of credit and acts as a referee to its clients. It underwrites shares and debentures of companies and helps in the collection of funds from the public. Some commercial banks also publish journals, which provide statistical information about the money market and business trends of the economy. 1.4 ROLE OF BANKS IN ECONOMIC DEVELOPMENT OF A COUNTRY

10

In modern age, monetary by banking system plays a vital role in economic development of a country. To provide financing for the accomplishment of certain economic plans depends upon an organized by sound banking system by a country financial institutions plays an important role in credit provision. So, if the monetary markets by banking system of a country are well organized by sound, it will help in accelerating the process of economic development. To encourage people to save more by then investment of these savings into suitable areas depends upon the policy by strength of banking system. Besides be strong banking system, monetary policy of a county also plays a vital role in development. Although monetary policy of a country is made by the central bank, yet it depends upon the co-operation of commercial banks. As for as a developing country like Pakistan is concerned, it always suffer capital deficiency. Only banks can solve problem by providing credit in required amount. The reasons is, to motivate the people towards savings, collection of the saved amount by then investment of this amount, all this is the duty of banks. By doing so, banks become an example of model investment for people. Hence, the banking system of a country can help i. i) ii) Development of a country. To make the monetary policy successful.

Main features of monetary policy are as following. i) ii) iii) iv) To achieve high level of employment. To stable in prices. To save economy from recession by inflation. To avoid fluctuation of interest rates

11

v)

To improve in standard of living of people.

So the banking system of 3rd world countries is not so stable, so it very difficult to implement monetary policy properly. As far as Pakistan is concerned, when all the scheduled banks were nationalized in 1974, State Bank of Pakistan got a complete grip upon banking network. Owing to this, the role of banks in economic development became more prominent. It can be understand through following facts. i) PICIC by Industrial development bank has played an important role for the development of industrial sector and have issued long by short-term debts for necessary machinery, raw material equipment. ii) For the development of agriculture red sector, NBP was the first one to

be established in this regard. Then ADBP by now other commercial banks are also providing credit for agricultural sector. iii) trade. iv) Have provided credit facility to small business people to promote These banks provide financing for domestic as well as international

cottage industry. v) Have provided financing for house building to overcome the scarcity of

houses. HBFC has played a vital role in this regard. vi) Have played an important role in providing finance to Govt. especially

in agricultural sector. 1.5 Banking in Pakistan Banking is one of the most sensitive businesses all over the world. Efficient banking is the basis of a viable economic structure and growth. Pakistan is no exception.

12

The country started without any worthwhile banking network in 1947 but witnessed phenomenal growth in first two decades. By 1970, it had acquired a flourishing banking sector. The characteristics that distinguished it were that it was indigenous, growth oriented, and well integrated with the local business. Its intermediation cost was reasonable. Its assets were well secured and liabilities well protected. It enjoyed an image of reliability integrity and support to the business community. The first exception to the otherwise good reputation of the banking business was noticed when one of the small banks. Namely the standard bank ltd started securing patronage of army generals for procuring business by using inappropriate methods. This was the beginning of institutional corruption at the highest bureaucratic levels. The state bank of Pakistan was established with a banking control and inspection department but it had a limited role to play in regulating the banking business. The banking business, however, suffered no loss of image or substance because of its limited role. The reason being that the bank management was more proactive to observe as self-imposed business ethics. Nationalization of banks in the seventies changed the whole complexion of the banking industry in the country. With one stroke of pen, the commercial banks were made subservient to the political leadership and the bureaucracy. Specialized banking institutions were already working in the public sector. The new accountability paradigm changed the business ethics in the banking industry, and with this change started the disaster. Nationalization of banking industry was accompanied by violent changes in the external value of rupee. The commercial banks thus lost their equilibrium, initiative and growth momentum. They ceased to be a business concern and

13

became big bureaucracies. This was accompanied by indiscreet loaning under political pressure. They suffered from three terminal diseases none performing loans, higher intermediation cost and loss of initiative and entrepreneurship. In the meanwhile, western banks started entering into the business. They with the support of ruling elite, concentrated on the big business, leaving the routine business to the local banks. This reduced the profitability of the local banks. The government permitted small private sector banks to operate, which indulged in questionable policies to promote business. The public sector banking which constituted the backbone. Thus continued to suffer because of their approach, size and carried over liabilities. The biggest problem for the economic managers of the country was that they had no vision to resolve the structural incompetence of the public sector banking industry. Privatization was considered to be a solution but neither the objectives nor the mechanism of privatization process were clearly spelled out. As a result privatization process could not gain momentums even after unloading of two of the commercial banks. I.e. the Muslim commercial bank and the Allied Bank. The problems accentuated gradually as the issue of non performing loans was politicized by one of the interim governments and soon thereafter some of the newly established private banks and privatized started crumbling and the state bank had to directly intervene to protect the depositors. At this stage the World Bank entered into the game by providing a credit for improving the financial sector the prescription of the World Bank for improving the health of the financial sector was quite simple the bank believed that privatization and globalization of the economic activity was the only solution to the problems of developing countries. It thus prescribed induction of imported leadership, transfer of non-performing loans to a specialized agency, effective

14

regulation, and introduction of banking rationalization of branches and the staff and finally the privatization by allowing international bidders. The World Bank prescription is thus working to the desired ends. The public sector banks have a new leadership that has a background of working with multinationals. They have transferred a part of the non performing loans to the news entity created for the purpose. The SBP is now regulating the commercial banks through what it calls the prudent regulations. The bank branches in major urban business areas are switching over a banking thus minimizing the cultural difference between the domestic and foreign banks. A large number of unprofitable branches have been closed and the staff at the tail has been reduced. All of this has apparently given a new, attractive state of the art look to the public sector banks. World banks funding through the state bank has helped improve their balance sheets and as a result united bank has already been privatized and Habib bank is not for behind the ultimate.

Chapter No: 02

15

INTRODUCTION TO NATIONAL BANK OF PAKISTAN

2.1 Introduction 2.2 History of National Bank of Pakistan 2.3 Functions of National Bank of Pakistan 2.4 Functions of NBP as a Representative of State Bank of Pakistan 2.5 Development of National Bank of Pakistan 2.6 Phases of Banking in Pakistan 2.7 Management System 2.7.1 2.7.2 2.7.3 Structure of the organization Management of NBP Board of Directors

2.8 Branch Network of NBP 2.9 Objectives of Internship

Chapter No: 02

16

INTRODUCTION TO NATIONAL BANK OF PAKISTAN

2.1 INTRODUCTION National Bank of Pakistan maintains its position as Pakistan's premier bank, determined to set higher standards of achievements. It is the major business partner for the Government of Pakistan with special emphasis on fostering Pakistan's economic growth through aggressive and balanced lending policies, technologically oriented products and services offered through its nation wide branches. National Bank of Pakistan, established in 1949 maintains its position as Pakistan's premier bank determined to set higher standards of achievements. It is the major business partner for the Government of Pakistan with special emphasis on fostering Pakistan's economic growth through aggressive and balanced lending policies, technologically oriented products and services offered through its large network of branches locally, internationally and representative offices. National Bank of Pakistan is distinct from other banks in that it has a non-profit and service oriented motive, which has manifested itself in the area of salary deposits of Government employees and payment of utilities bills. These services do not contribute towards the earnings of the bank; rather they put pressure on our resources. Nevertheless, National Bank of Pakistan committed to serving small savers and the general public of the country. National Bank of Pakistan is everyones and does not only serve corporate customers. It would be very complex task to discuss entire functioning of the bank. However, in order to have an in depth analysis, a sound grasps and to produce an effective report on how the bank has been performing in the previous year vis--vis the present day developments.

17

The purpose of writing this report is to express my understanding, knowledge & learning that I got during my internship period in National Bank of Pakistan. Mission Statement To be recognized in the market place by Institutionalizing a merit & performance culture, Creating a powerful & distinctive brand identity, Achieving top-tier financial performance, and Adopting & living out our core values. Core Values We aim to be an organization that is founded on Growth through creation of sustainable relationships with our customers. Prudence to guide our business conduct. A national presence with a history of contribution to our communities. We shall work to Meet expectations through Market-based solutions and products.

Reward entrepreneurial efforts. Create value for all stakeholders. We aim to be peopling who Care about relationships. Lead through the strength of our commitment and willingness to excel. Practice integrity, honesty and hard work. We believe that these are measures of true success. We have confidence that tomorrow we will be Leaders in our industry An organization maintaining the trust of stakeholders.

18

An innovative, creative and dynamic institution responding to the changing needs of the internal and external environment. Mission To provide reliable banking services to Government, financial institutions, public and to act as an operation alarm of State Bank of Pakistan. Vision To be the pre-eminent financial institution in Pakistan and achieve market recognition both in the quality and delivery of service as well as the range of product offering. 2.2 History of National Bank of Pakistan The story of National Bank of Pakistan is part of our struggle for economic independence. When we won political independence, mostly Hindus controlled our economy. East Pakistan was spared from massive migration but its economy was also, being dependent on Calcutta badly hurt. Most bankers and business experts left Pakistan and the economic life was brought to a standstill. The mostly branches of Imperial Bank of India were only in partial operation with skeleton staff. It was very difficult for Pakistan to build up its own Banking system immediately after independence without sufficient resources as at that time most of the commercial banks in Pakistan were the branches of foreign banks, Indian and others was staffed mainly by non-Muslims. Those banks, which stayed, were considering the winding up of their business. By 30th June 1948, the number of scheduled banks in Pakistan declined from 487 to only 195.

19

There was a controversy on establishment of our Central Bank because we had no experience but it was resolved and SBP was established, 3 month a head of schedule, on July 01, 1948. On October 03, 1949, 2 central banks were to announce the new par value of both currencies but India denied a day earlier. India also froze out trade balance surplus that is still an unsettled dispute. India had also withdrawn the merchants who were employed annually for movement of jute crop by financing it. There being no jute industry, prices fell sharply, foreign banks and foreign merchants stood aside and an agrarian unrest was threatening. Two Ordinances were therefore issued. Jute Board Establishment Ordinance NBP Ordinance dated 08.11.1949 2.3 Functions of National Bank of Pakistan The NBP performs two types of functions. It acts as an ordinary commercial bank and places where there is no branch of State Bank of Pakistan it represents it. As a commercial bank it performs the following: Accepting of deposits of money on current a/c, saving a/c, term deposit and other profit and loss sharing accounts. Borrowing money and arranging finance from other banks. Advancing and lending money to its clients. Financing of projects including technical assistance, project appraisal through long term & short term loans Buying, selling, dealing & discounting of bills of exchange, promissory notes, drafts, bill of lading, and other instruments of securities. Foreign exchange business. Financing of seasonal crops like cotton, wheat & rice.

20

Receiving of bonds, valuables etc for save custody. Carrying on agency business of any description other then managing agent on behalf of client, including govt. and local authorities. Generating, undertaking and promoting etc of issue of shares, bonds. Transacting guarantees and indemnity business. Undertaking and executing trusts. Making investments in other banking companies. Joint ventures with foreign dealers, agents and companies for its representation abroad. Participating World Bank and Asian development banks lines of credit. Utility services Providing Hajj services to intending Hajjis Agent to State Bank of Pakistan for collecting. Gold finances. 2.4 Functions of NBP as a Representative of State Bank of Pakistan: Collection of cheques and bill of exchange for its customers. Paying insurance premium, rent or other obligations of the customers. Transferring of money from one place to another. Collecting interest dues, dividend, pensions and other sums due to customers. Acting an executor, trustees for the customers. Providing safe custody and jewelry documents and securities. Issuing of travelers cheques and letter of credit to give credit facilities. Purchasing shares for the customers.

21

Accepting bills of exchange on behalf of customers. Undertaking foreign exchange business. Furnishing trade information and tendering advice to the customers. Formulating operation policy guidelines for the banks. Laying down performance criteria for banks and taking steps for ensuring their observance. Evaluating the performance of the banks in the context of operational guidelines issued to the banks. Determining the areas of coordination of the banks. Making recommendations to the federal govt. for the appointment of auditors of the bank. Conducting such surveys, inquiries and appraisals may be necessary for the purpose of this act. Exercising and performing such powers and functions of the federal govt. under the act and such other functions as the federal govt. may assign to it. 2.5 Development of National Bank of Pakistan NBP was established on 20.11.1949 to provide finance to suitable parties under the National Bank of Pakistan Ordinance No. 21of 1949. It is a semipublic bank and functions like other commercial banks. NBP stood behind jute trade, SBP stood behind NBP and the Government stood behind SBP. Speedy it was such that 6 branches came in to being at once and the doubts on our ability to handle the situation was dispelled forever. Now the Jute Board and NBP were in this field, the foreign merchants and bankers also rushed into get their share in the business and consequently NBP had to lay out much les finance that it could. Until June 1950,

22

NBP remained exclusively in Jute operation; therefore other commodities were also taken up. In 1952, NBP replaced Imperial Bank of India. In 1962, the number of branches increased from 6 to 239 and deposits from Rs. 5 crore to Rs. 106 crore, profit from 3 million to 21 million, and the staff increased from 380 to 7091, as compared to 1949-50. in December 1966, its 600th branch was opened raising the deposit to 2.31 billion and staff to 14963. Up to 1965, the shareholders had received 225% of their original investment. Now it has 13272 employees, 1199 branches and Rs. 395.6 billion deposits. 2.6 PHASES OF BANKING IN PAKISTAN The development of commercial banking is divided into 4 phases. Establishment of Commercial Banking System (1947-74) Nationalization of Banks (1974-79) Deregulation Process (1991-98) NATIONALIZATION ERA On 1st January, 1974 all Pakistani banks were nationalized through nationalization Act 1974. Under this law all Pakistani banks became a public property. All small banks were merged in bigger banks to create 5 major Pakistani banks. These banks were to control by Pakistani banking council. The major changes after nationalization were as follows: Working of banks were extended to underdeveloped areas Market expansion for credit and deposits POST NATIONALIZATION ERA

23

In 1990 the government of Pakistan decided to denationalize all the nationalization institutes. For this purpose amendments were made to nationalization act 1974 and 2 nationalized banks were privatized along with this a permission to open banks in private sector was also granted. After these changes a large no. of private and foreign banks started their operations in Pakistan and the present status can be seen by the following figures. 2.7 Management An Executive Board composed of six Senior Executives of the Bank and the President who is also the Chief Executive supervises the affairs and business of the Bank. 2.7.1 Structure of the organization Head office Karachi PRESIDENT

DIRECTORS

GROUP CHIEFS

Business chief group

Operational group chief

Risk management group chief

Compliance group chief

24

Branch Level MANAGER

OPERATION MANAGER

COMPLIANC E MANAGER

2.7.2 Management of NBP Head Office of the Bank The head office of the National Bank of Pakistan is in Karachi. Central Board The general superintendent and direction of the affairs and business of the bank shall be encrusted to the Central board which may exercise all powers and things as may be exercised or done by the bank and or not by this ordinance expressly directed or required to be done by the bank in general meeting. The central Board shall consist of the following directors namely. The Managing Directors appointed by the central Government under section 16.Nine Directors are elected in local or special meetings by the shareholders in the following manners. The share holders registered in a branch, register maintained for an area mentioned in sub-section (5) of section 8, shall elect

25

from amongst themselves, such number of directors for that area as may be decided before election by the Central Government having regard to the proportion which that share capital subscribed by the shareholders of that area bears to the whole. Provided that the shareholders registered in branch register maintained at Dacca shall elect from amongst themselves at least two Directors. Three directors appointed by the Central Government, provided that the total number of the elected and appointed Directors representing the area for which the Decca register is maintained shall be not be less than three. The President of the Central Board shall be appointed by the Government from amongst the Directors. 2.7.3 Board of Directors Syed Ali Raza Chairman Board, National Bank of Pakistan Mr. S. Ali Raza is the Chairman, NBP Board of Directors. Mr. Raza is a graduate of the London School of Economics and M.Sc. in Admn. Science from the London Graduate Business Centre, City University, London. Before joining the National Bank of Pakistan in July 2000 as the Banks President, he held a key management position as Managing Director and Regional Head, Pakistan, Middle East and North Africa at the Bank of America (BOA). Qamar Hussain President , NBP Mr. Qamar Hussain is the President of National Bank of Pakistan (NBP), the largest Commercial Bank of the country. He holds an MBA degree in International Business & Finance from Mcgill University, Montreal, Canada and has undergone

26

extensive training in business leadership abroad. Mr. Hussain started his banking career from Bank of America N.T. & S.A., Pakistan in the year 1981. Prior to joining NBP in 2009, he has worked with American Express Bank Limited as Senior Director Global Credit, New York and earlier as Senior Director Country Manager, Bangladesh. He had also been associated with the CHASE MANHATTAN BANK in Pakistan and USA. Mr. Tariq Kirmani Director Soon after completing his Masters in Business Administration (MBA) Mr. Kirmani embarked upon a rewarding career, starting with a multi-national Oil Company (Caltex later Chevron Pakistan) in 1969 and worked for seven years in the United States of America, United Arab Emirates and Australia in different senior management positions in Marketing Operations and Finance. Mrs. Haniya Shahid Naseem Director Mrs. Haniya Shahid Naseem is an MBA with more than fifteen years experience of working in the education, social, industrial textile and agriculture sectors of Pakistan. She has served for 5 years on the Board of a textile company, having a turnover of more than one Billion Rupees. Presently she is actively involved in the administration of Pakistan Public School Multan. Ms. Nazrat Bashir Director Ms. Nazrat Bashir belongs to District Management Group of Civil Services of Pakistan. She is Masters in Economics from New York University, New York, USA and Master in Psychology from Peshawar University; Peshawar.She has extensively traveled abroad and has attended various international Seminars and Conferences such as on Micro Finance.

27

Mr. Ekhlaq Ahmed Secretary Board of Directors Mr. Ekhlaq Ahmed, EVP is the Company Secretary of the Bank and also the Secretary of Credit & Operations Committees. He is M.A. (Economics) from Rajshahi University, Bangladesh (former East Pakistan). He is a Diplomaed Associate Institute of Bankers, Pakistan (DAIBP) and secured overall 1st position in order of merit and won Muslim Commercial Bank Prize in the subject of Foreign Trade & Foreign Exchange. Senior management Qamar Hussain President Dr. Asif A. Brohi SEVP & Group Chief, Commercial & Retail Banking Group Shahid Anwar Khan SEVP & Group Chief, Credit Management Group Ziaullah Khan SEVP & Group Chief Assets Recovery Group and Divisional Head, Islamic Banking Division Dr. Mirza Abrar Baig SEVP & Group Chief, Human Resources Management & Administration Group Nausherwan Adil SEVP & Group Chief, Operations Group Tariq Jamali SEVP & Group Chief, Compliance Group Nadeem A. Ilyas SEVP & Group Chief, Corporate & Investment Banking Group & PSO to President

28

Syed Iqbal Ashraf SEVP Group Chief, Overseas Banking Group Muhammad Nusrat Vohra SEVP & Group Chief, Treasury Management Group Khalid Bin Shaheen SEVP & Group Chief, Global Home Remittance Management Group Imam Bakhsh Baloch SEVP & Group Chief, Audit & Inspection Group Asif Hassan SEVP & Group Chief, Small and Medium Assets Recovery Group Tahira Raza EVP & Head Risk Management Division, Credit Management Group Sheharyar Qaisrani EVP/Divisional Head Agriculture Business Division, C&RB Group Muhammad Hassan Khaskheli EVP & Divisional Head, Personnel & Industrial Relations Division, HRM&A Group Qamar Hussain EVP & Divisional Head, Human Resources Division, HRM&A Group Moizuddin Khan EVP & Divisional Head, Training & Organizational Development Division, HRM&A Group Ekhlaq Ahmed EVP & Secretary Board of Directors Aamir Sattar EVP & Financial Controller, Financial Control Division Raza Mohsin Qizilbash

29

EVP & Head, Legal Division Mahmood Siddique EVP & CIO, IT Division Javaid Haider SVP & Divisional Head, Logistic Support & Engineering Division, CM Group Aamir Abbasi SVP & Divisional Head, Corporate Communication Division Muhammad Rafique SVP, Head PMO S.M. Ali Zamin SVP & Secretary Operations Committee Local Board The local board shall be established for the areas mentioned in sub section (5) of section B, one each at Karachi and the Lahore, and shall without prejudice to the powers conferred by the section 12, have power, within the prescribe limits generally to transact all usual business of the bank. A local Board shall consist of the following members namely.

The Managing Director One member appointed by the central board from amongst the Directors elected by the shareholders registers in the branch register of the area. Two members appointed by the Central Government from the area in which the Local Board is established. Three members elected in a local or special local meeting from the amongst themselves by the shareholders register in the branch register of the area.

Managing Director The Managing director shall be appointed by the Central Government for o period

30

3.2 Cash Department not exceeding five years and on such salary and terms and conditions of the service Cash department of NBP is given the complete responsibility of handling all as the central Government may determine. receipts cash, as a result of transaction in both local & foreign New disbursement Managementof Structure currencies & near cash items was suchremoved as traveler etc (when theyordinance are issued 1974. The previous management bycheques the bank nationalized against cash).As a conseand quence is also responsible for the bookkeeping of these The general direction the it superintendent of the affairs and the business of the transactions the safe custody Board of cashconsisting & near cash Following are the banks vests& in the Executive of securities. the President (Chief Executive) major functions department of NBP and five seniordealing executive of the bank. The Federal Government in 1980 constituted Cash receive deposits) members one representing the ministry of a Board of receipts the bank(or and two additional Finance and the other, Pakistan Banking Council. Encashment of cheque Cash receipts The depositor uses Networks cheque deposit slip (or cash deposit slip) for depositing the Domestic Branch amount. types of deposit slip: National There Bankare of two Pakistan is cash the only Pakistani bank to have representative in One current account-holders offices allfor over the Pakistan as well as in Azad Jammu & Kashmir. Other for saving account holders. Both are in different colors for clear identification. 3.6 Branch Network Encashment of cheque Encashment of cheque cash department of NBP is a separate close part covered with glasses. No one other than cash departments employee is allowed to enter into that area. 3.3 Clearing Department This department deals with the transactions related to the other bank. The State Bank of Pakistan acts as a clearing agent for the commercial banks. It deals with the cheques of any other branch of other bank. If more than one Cheque is attached with slip then the entry is to be done one by one. The Cheque number,

31

date on the Cheque and the name of the branch of the bank on which the Cheque is drawn is entered. When the clearing has been prepared then the next step is to stamp the cheques and slips with clearing stamp on front of the Cheque and slip and NBP General Account on the back. After this clearing is to be passed to the in charge officer who signs on it. Amount is transferred to the customer account after 3-4 days. Cheques and slips are to be stamped carefully because sometimes clearing has been returned due to the reason of not properly stamped or any other. 3.4 Remittance Department Remittance is the monitory transfer from one place to another place or from one country to another country to fulfill the requirements of the customers by the order of the customer. Remittance Department at NBP Main Branch, Kotli can be divided into two sections due to its activities. Domestic Remittance Foreign Remittance 3.4.1 Domestic Remittance Domestic remittance section deals with remittance incoming and outgoing but only in domestic i.e. Pakistan rupee and within Pakistan. Domestic remittance includes the following eight functions in NBP: a) Transfer through Pay Order Pay order is also called as cashier order, managers cheque, bankers cheque, and cheque on services. Pay order is an instrument through which payment can be made from one bank to another bank within city. In case of NBP, pay orders are also used, instead of demand drafts; outside the city where NBP does not

32

have its branch. So, we can say except Karachi for all other cities pay orders are issued by NBP. b) Transfer through Demand Draft It has been defined as an unconditional order in writing addressed by one person to another, signed by the person giving it (the drawer), and requiring the person to whom it is addressed (the drawee) to pay on demand or at a fixed or determinable future time a certain sum of money to or to the order of, a specified person (the payee) or to the bearer. Demand draft is an instrument which is payable on demand, and through which funds are transferred outside the city or country, where NBP has its branch. The main and important purpose of issuing the demand draft from the bank is that environment of our country is not too good to carry cash from one place to another. So, demand draft helps us to overcome this situation to some extent because it avoids carrying cash amount with us. c) Telegraphic Transfer (TT) Generally a mail transfer takes 3-4 days to reach its destination. T.T. is the fastest mode of transferring funds from one bank to another bank not in days but in hour or minutes. In such cases transfer of funds message is passed on through a telegram, to the drawee branch of the same bank. When the urgency of situation demands that the payment is to be made immediately then the message is conveyed to the drawee branch by telephone. Payment to the beneficiary is effected directly by the drawee office upon identification or through credit into beneficiarys bank account. d) Mail Transfer (MT) This is an order to pay money, drawn by one branch of a bank upon another branch of the same bank or Mail Transfer is the transfer of funds from one branch

33

to another branch of the same bank within Pakistan. If such balance is transferred by means of mail, it is described as mail transfer remittance. e) Local / Internal Transfer (LT) Local / Internal transfer is the transfer of funds from one account to another account within the same branch i.e. Main Branch, Lahore. 3.4.2 Foreign Remittance

Foreign Remittance section deals with remittance (incoming and outgoing) but in foreign currency and outside Pakistan. Funds are transferred into four types of currencies by Remittance department. USD GBP JPY DEM To facilitate its customers in the area of Home Remittances, National Bank of Pakistan has taken a number of measures to: Increase home remittances through the banking system Meet the SBP directives/instructions for timely and prompt delivery of remittances to the beneficiaries New Features The existing system of home remittances has been revised/significantly improved and well-trained field functionaries are posted to provide efficient and reliable home remittance services to nonresident Pakistanis at 15 overseas branches of the Bank besides Pakistan International Bank (UK) Ltd., and Bank Al-Jazira, Saudi Arabia.

34

Zero Tariffs: NBP is providing home remittance services without any charges. Strict monitoring of the system is done to ensure the highest possible security. Special courier services are hired for expeditious delivery of home remittances to the beneficiaries. 3.5 Credit Department In NBP the credit activities are played under a separate department. So the main activities of this department are: To give credit to customers. Closely monitor the development in different accounts. Reporting to SBP and head office. 3.6 Advances Department Advances are the major source of earning income for commercial banks, it is interest charged on the money lend to the customer. Bank advances to customers are made either by way of loan or by overdraft on current account. At present NBP provides both long term as well as short-term loans. Loans Cash credit Overdraft 3.6.1 Loans Loan against Gold facility of Rs.5000 against 10 grams of gold

35

Mark-up 9% per annum Repayable after 1 year Under this type of loan, which is granted to the borrower, the head cashier estimates the value of gold or gold ornaments through an agent {gold smith} and keeps a margin of 40 to 50%. After the opening of the gold loan a/c a token is given to the borrower, which is a bank receipt. On repayment of loan, the gold or ornaments held as security for it, together with the demand promissory note duly discharged is return to the borrower and his receipt for the gold ornament taken in the demand loan ledger. This receipts states that the ornaments returned are complete and are in order. Part delivery of ornaments is given against part payment of a loan but care is taken that the ornaments still in the banks possession fully covers the balance for the loan outstanding. The interest on gold loan is to be applied with quarterly rest. 3.6.2 Cash credit Here, cash credit a/c is opened in the name of customer to borrow from the bank. Customer is granted a loan up to a certain limit which is sanctioned by the head office, which he draw when he requires interest is charged on the amount actually utilized by the customer. In order to avoid the danger of idle funds, the bank charges a certain rate if interest, even if the customer does not withdraw any amount. The credit is usually given against the securities of goods or merchandise as follows: Advances against pledge stock in trade or products When a cash is granted against the pledge of stick or product, cash credit form is taken, from the certain products or stock, but the actual pledge is created when the

36

stock or finish product are placed under the banks lock and key or the document of title are duly endorsed to the bank by the borrower. Hypothecation of stock on finish products The difference between pledge and hypothecation is that under the pledge the borrowers goods are placed in the banks possession under own lock whereas, under hypothecation, they remain in the possession of the borrower or guarantor and are merely charged to the bank under documents signed by them. Even though the documents empower the bank to take the possession of the goods hypothecated, but it is possible that the borrower may actually resist any attempt. Mortgage of property Title deeds immovable property is accepted by the bank only as collateral security or alternatively as unauthorized security. 3.6.3Overdrafts When the bankers permit his customer to overdraft upon his current a/c up to a certain limit, it is called overdraft facility provided by the bank. The customer is charged with the interest for the amount he has actually overdrawn from the bank. The customer is free to take the overdraft facility up to the limit whenever he needs and he can at any time return back the advance to the bank by deposited the amount with the bank. There are two types of drafts: Unsecured overdraft Under such type of overdraft the bank rely upon the personal security of the customer or customers mentioned on the customers a/c. Secured overdraft Under this type of overdraft the bank allows his customer to withdraw more than his deposits after giving security against the amount overdrawn.

37

3.7 Accounts Department The main function of the accounts department of National Bank of Pakistan is to maintain general ledger accounts and after the business hours the function of the accounts officer is to close books. General ledger It is the prime record of the branch reflecting its assets and liabilities and serves as the master control of accounting system of the branch. It consists of only those accounts, which are authorized by the head office. Voucher System Voucher is a written authorization used in approving a transaction for recording and payment. It is a system, which is generally designed to provide strong internal control over the transaction, which takes place in any department of the bank. One debit and one credit voucher is prepared. At the end of the day, these vouchers are collected and recorded. Debit voucher is used in two cases Whenever any expense is incurred When a depositor withdraws some amount form his/her account Debit voucher contains Name of Branch Date Branch Code Account No Transaction Code Amount and other details (Narration) Credit voucher is used in two cases

38

When a depositor deposit any amount in his account Any income received by the bank e.g. bank draft Expense voucher It includes: Salaries given to all employees of the bank Wages Rent Lease Installments Insurance -Vehicle Insurance - Cash Utility Bills Medical Allowances Salary Structure Bonuses are credited after every 6 months i.e. June and December. These are 1st and 2nd profit bonuses and are equal to one months basic salary. Allowances includes house allowance, transport allowance and utility allowance Provident Fund is provided to each employee on his/her retirement. Contribution by employer and employee is 8.3%. Preparation of Statements Weekly Statements are sent at first to National Bank of Pakistan head office Karachi

39

Monthly Statements are sent at first to National Bank of Pakistan head office Karachi and then these are sent to head office affairs in consolidation form. All vouchers and statements are signed and approved by manager accounts or who has authority to sign on behalf of the bank and whose signatures appears in one of the banks book of specimen signature or a person who has authority to sign internal vouchers and records extent of its authority will be made by the country manager. Daily Activity Report includes the details of the following: Loan Transactions General Ledger Transactions Fixed Deposits Transactions

40

Chapter No: 04 Services and Products of NBP

4.1 International Banking 4.2 NBP Offers 4.2.1 4.2.2 4.2.3 4.2.4 4.2.5 4.3.1 4.3.2 4.4.1 4.4.2 4.5.1 4.5.2 Demand drafts Mail transfers Pay order Traveler's cheques Letter of credit New features Swift system NIDA Equity investments Corporate finance Agricultural finance services

4.3 International Banking

4.4 Short Term Investments

4.5 Trade Finance Other Business Loans

4.6 NBP Retail Products

41

Chapter No: 04 Services and Products of NBP

4.1 International Banking National Bank of Pakistan is at the forefront of international banking in Pakistan which is proven by the fact that NBP has its branches in all of the major financial capitals of the world. Additionally, we have recently set up the Financial Institution Wing, which is placed under the Risk Management Group. The role of the Financial Institution Wing is: To effectively manage NBPs exposure to foreign and domestic correspondence Manage the monetary aspect of NBPs relationship with the correspondents to support trade, treasury and other key business areas, thereby contributing to the banks profitability Generation of incremental trade-finance business and revenues 4.2 NBP Offers:

42

The lowest rates on exports and other international banking products Access to different local commercial banks in international banking. 4.2.1 Demand drafts If you are looking for a safe, speedy and reliable way to transfer money, you can now purchase NBPs Demand Drafts at very reasonable rates. Any person whether an account holder of the bank or not, can purchase a Demand Draft from a bank branch 4.2.2 Mail transfers Move your money safely and quickly using NBP Mail Transfer service. And we also offer the most competitive rates in the market. 4.2.3 Pay order * NBP provides another reason to transfer your money using our facilities. Our pay orders are a secure and easy way to move your money from one place to another. And, as usual, our charges for this service are extremely competitive. 4.2.4 Traveler's cheques Negotiability: Validity: Availability: Encashment: Limitation: Safety: Pak Rupees Travelers Cheques are a negotiable instrument There is no restriction on the period of validity At 700 branches of NBP all over the country At all 400 branches of NBP No limit on purchase NBP Travelers Cheques are the safest way to carry our money

4.2.5 Letter of credit NBP is committed to offering its business customers the widest range of options in the area of money transfer. If you are a commercial enterprise then our Letter

43

of Credit service is just what you are looking for. With competitive rates, security, and ease of transaction, NBP Letters of Credit are the best way to do your business transactions.

4.3 International Banking

To facilitate its customers in the area of Home Remittances, National Bank of Pakistan has taken a number of measures to: Increase home remittances through the banking system Meet the SBP directives/instructions for timely and prompt delivery of remittances to the beneficiaries 4.3.1 New features: The existing system of home remittances has been revised/significantly improved and well-trained field functionaries are posted to provide efficient and reliable home remittance services to nonresident Pakistanis at 15 overseas branches of the Bank besides United National Bank (the joint venture between NBP and UBL in UK)., and Bank Al-Jazira, Saudi Arabia. Zero Tariff: NBP is providing home remittance services without any charges. Strict monitoring of the system is done to ensure the highest possible security. Special courier services are hired for expeditious delivery of home remittances to the beneficiaries. 4.3.2 Swift system The SWIFT system (Society for Worldwide Inter bank Financial Telecommunication) has been introduced for speedy services in the area of home remittances. The system has built-in features of computerized test keys, which

44

eliminates the manual application of tests that often cause delay in the payment of home remittances. The SWIFT Center is operational at National Bank of Pakistan with a universal access number NBP-PKKA. All NBP overseas branches and overseas correspondents (over 450) are drawing remittances through SWIFT. Using the NBP network of branches, you can safely and speedily transfer money for our business and personal needs.

4.4 Short Term Investments

NBP now offers excellent rates of profit on all its short term investment accounts. Whether you are looking to invest for 3 months or 1 year, NBPs rates of profit are extremely attractive, along with the security and service only NBP can provide. 4.4.1 NIDA National Income Daily Account The scheme was launched in December 1995 to attract corporate customers. It is a current account scheme and is part of the profit and loss system of accounts in operation throughout the country. 4.4.2 Equity investments NBP has accelerated its activities in the stock market to improve its economic base and restore investor confidence. The bank is now regarded as the most active and dominant player in the development of the stock market. NBP is involved in the following: Investment into the capital market Introduction of capital market accounts (under process) NBPs involvement in capital markets is expected to increase its earnings, which would result in better returns offered to account holders

45

4.5 Trade Finance Other Business Loans

4.5.1 Corporate finance Working Capital and Short Term Loans: NBP specializes in providing Project Finance Export Refinance to exporters Pre-shipment and Post-shipment financing to exporters Running finance Cash Finance Small Finance Discounting & Bills Purchased Export Bills Purchased / Pre-shipment / Post Shipment Agricultural Production Loans Medium term loans and Capital Expenditure Financing: NBP provides financing for its clients capital expenditure and other long-term investment needs. By sharing the risk associated with such long-term investments, NBP expedites clients attempt to upgrade and expand their operation thereby making possible the fulfillment of our clients vision. This type of long term financing proves the banks belief in its client's capabilities, and its commitment to the country. Loan Structuring and Syndication: National Banks leadership in loan syndicating stems from ability to forge strong relationships not only with borrowers but also with bank investors. Because we understand our syndicate partners asset criteria, we help borrowers meet substantial financing needs by enabling them to reach the banks most interested in lending to their particular industry, geographic location and structure through syndicated debt offerings. Our syndication capabilities are complemented by our own capital strength and by industry teams, who bring specialized knowledge to the structure of a transaction. Cash Management Services: With National Banks Cash Management Services (in process of being set up), the customers sales collection will be channeled through vast network of NBP

46

branched spread across the country. This will enable the customer to manage their companys total financial position right from your desktop computer. They will also be able to take advantage of our outstanding range of payment, ejection, liquidity and investment services. In fact, with NBP, youll be provided everything, which takes to manage your cash flow more accurately. 4.5.2 Agricultural finance services: I Feed the World program, a new product, is introduced by NBP with the aim to help farmers maximize the per acre production with minimum of required input. Select farms will be made role models for other farms and farmers to follow, thus helping farmers across Pakistan to increase production. Agricultural Credit: The agricultural financing strategy of NBP is aimed at three main objectives: Providing reliable infrastructure for agricultural customers Help farmers utilize funds efficiently to further develop and achieve better production Provide farmers an integrated package of credit with supplies of essential inputs, technical knowledge, and supervision of farming. Agricultural Credit (Medium Term): Production and development Watercourse improvement Wells Farm power Development loans for tea plantation Fencing Solar energy

47

Equipment for sprinklers Farm Credit: NBP also provides the following subsidized with ranges of 3 months to 1 year on a renewal basis. Operating loans Land improvement loans Equipment loans for purchase of tractors, farm implements or any other equipment Livestock loans for the purchase, care, and feeding of livestock

4.6 NBP Retail Products

Unprecedented Safety - Unprecedented Return Premium Aamdani Home Page Unprecedented Safety - Unprecedented Return Premium Saver Home Page

President's Rozgar Scheme - Easy financing for self employment Karobar Home Page

48

Affordable, Flexible & Convenient home financing for all Saibaan Home Page Take upto 20 Advance Salaries - Affordable Installations from 1 - 60 months Advance Salary Home Page One Card does it all - ATM plus Debit Card in one Cash Card Home Page Invest with Confidence - Marginal Finance Facility Investor Advantage Home Page Meet your need for ready cash against your idle gold jewelry with no minimum limits Cash n Gold Home Page

NBP KISAN Taqat Kisan Taqat Home Page

NBP's affordable agricultural program offers you a wide range of financing Kisan Dost Home Page

49

Knitting Links - AASAN Banking Online Home Page

NBP Helpline 0800-80080 from 8:30 am to 10:00 pm

NBP's Internet Based Home Remittence Service Pak Remit Home Page Personal Accident Insurance Protection Shield Home Page

CHAPTER NO: 05 FINANCIAL STATEMENTS OF NATIONAL BANK OF PAKISTAN

5.1 Balance Sheet

50

5.2 Profit and Loss Statement 5.3 Cash Flow Statement 5.4 Statement of comprehensive Income 5.5 Statement of Changes in Equity 5.6 Ratio Analysis 5.6.1 5.6.2 5.6.3 5.6.4 5.6.5 5.6.6 5.6.7 5.6.8 5.6.9 5.6.10 5.6.11 Return on Total Assets Return on Equity Ratio Earnings Per share Current Ratio Networking Capital Equity Ratio Net Profit Ratio Gross Profit Ratio Cost Ratio Operating Profit Ratio Operating Ratio

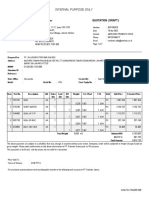

CHAPTER NO: 05 FINANCIAL STATEMENTS OF NATIONAL BANK OF PAKISTAN 5.1 Balance Sheet As at December 31, 2010

2008 2009 2010 .US Dollars in '000. ASSETS 1,240,0 81 1,348,64 7 1,344,15 8 Cash and balances with treasury banks 115,442,36 0 115,827,8 68 106,503,7 56 2010 2009 2008 ...Rupees in '000...

51

446,46 7 199,43 1 1,988,9 79 4,808,6 31 281,97 9 37,313 5,187,7 24 9,521,6 05

330,741 228,064 2,534,13 4 5,533,51 8 292,802 35,656 694,729 10,998,2 91

353,843 268,094 3,508,47 7 5,559,86 9 313,074 80,954 622,887 12,051,3 56

Balances with other banks Lending for financial institutions-net Investments-net Advances-net Operating fixed assets Deferred tax assets-net Other assets-net

330,389,66 4 23,025,156 301,323,80 4 477,506,56 4 26,888,226 6,952,666 53,496,240 1,035,024,6 80

28,405,56 4 19,587,17 6 217,642,8 22 475,243,4 31 25,147,19 2 3,062,271 59,666,43 8 944,582,76 2

38,344,6 08 17,128,0 32 170,822,4 91 412,986,8 65 24,217,6 55 3,204,57 2 44,550,3 47 817,758,3 26

LIABILITIES 118,98 6 471,08 5 7,276,5 05 10,621,16 9 45,278,13 8 727,464,82 5 10,219,0 61 40,458,9 26 624,939,0 16

123,668 527,198 8,470,26 9

93,226 234,077 9,689,19 8

Bills Payable Borrowings Deposits and other accounts Sub-ordinated loans Liabilities against assets subject to finance lease Deferred tax liabilities Other liabilities

8,006,631 20,103,591 832,151,88 8

294 461,74 7 8,328,6 17 1,192,9 88

496

1,242

106,704

42,629 42,269,62 3 825,676,3 84 118,906,3 78

25,274 39,656,8 31 715,299,1 08 102,459,2 18

492,168 9,613,79 9 1,384,49 2

537,466 10,555,20 9 1,496,14 7

NET ASSETS REPRESENTED BY

4,616,038 906,528,85 2 128,495,82 8

104,44 0 232,18 4 610,77 6 947,40 0 245,58 8 1,192,9

125,328 264,095 706,723 1,096,14 6 288,346 1,384,49

156,660 284,688 766,813 1,208,16 1 287,986 1,496,14

Share Capital Reserves Unappropriated profit Surplus on revaluation of assets-net

13,454,628 24,450,244 65,857,438 103,762,31 0 24,733,518 128,495,82

10,763,70 2 22,681,70 7 60,696,51 0 94,141,91 9 24,764,45 9 118,906,3

8,969,75 1 19,941,0 47 52,456,2 04 81,367,0 02 21,092,2 16 102,459,2

52

88

78

18

5.2 PROFIT AND LOSS ACCOUNT For the year ended December 31, 2010

2009 2010 US Dollars in '000 907,58 7 471,44 3 436,11 4 128,58 5 1,030,1 29 526,876 503,253 81,633 2010 2009 Rupees in '000 884721 34 452504 76 432216 58 701104 6 295467 8 3965 996968 9 332519 69 7794769 7 4048964 9 3745804 8 1104346 9

Mark-up/ return/interest earned Mark-up/ return/interest expensed Net mark-up/ interest income Provision against non-performing advances-net Provision for diminution in the value of investment Provision against off balance sheet obligation Bad debts written off directly Net markup/ interest income after provisions NON MARK-UP/ INTEREST INCOME Fee, Commission and Brokerage income Dividend income Income from dealing in foreign currencies Gain on sale and redemption of securities-net Unrealized gain on revaluation of investments classified as held-for-trading Other income Total non-markup/ interest expenses NON MARK-UP INTEREST EXPENSES

7,052 236 135,87 3 300,27 1

34,403 46

605629 20237 1166933 5 2578871 3

116,082 387,171

103,98 1 22,360 35,259 53,446

112,146 12,802 25,745 29,253

963157 9 109949 3 221113 9 251236 3

8930391 1820336 3028165 4591894

27 6,430 221,52 3 521,79 4

79 25,282 205,307 592,478

6730 217133 6 176326 40 508846 09

2355 552216 1902535 7 4481407 0

53

262,81 2 7,228 3,745 273,78 5 248,00 9 103,29 6 48,126 11,643 43,527 204,48 2 610,77 6

305,091 1,724 1,384 308,199 284,279 114,515 -10,936 -23,798 79,781 204,498 706,723

Administrative expenses Other provisions/ write offs Other charges Total non markup /interest expenses PROFIT BEFORE TAXATION Taxation Taxation - current - Prior year

262025 77 148026 118887 264694 90 244151 19 983504 8 -939256 204388 7 685190 5 175632 14 606965 10

2257147 0 620780 321647 2351389 7 2130017 3 8871513 4133282 -999904 3738327 1756184 6 5245620 4

Taxation - Deferred

PROFIT AFTER TAXATION Inappropriate profit brought forward Transfer from surplus on revaluation of fixed assets on account of incremental Depreciation Profit available for appropriation

1,443 816,70 1

1,371 912,592

117738 783774 62

123934 7014198 4

In Dollars 0.15 0.15 0.15 0.15

Basic earnings per share Diluted earnings per share

In Rupees 13.05 13.05 13.05 13.05

5.3 CASH FLOW STATEMENT For the year ended December 31, 2010

2009 2010 US Dollars in '000 CASH FLOWS FROM OPERATING ACTIVITIES 248,010 -22,360 225,650 284,279 -12,802 271,477 Profit before taxation less: dividend income 24,415,1 19 1,099,49 3 23,315,6 26 21,300,17 3 1,920,336 19,379,83 7 2010 2009 ..Rupees..

54

Adjustment s: 10,097 54 128,585 7,052 236 12,500 108 81,633 34,403 46 Depreciation Amortization Provision against non-performing advances-net Provision for diminution in the value of investments-net Provision against off balance sheet obligation Unrealized gain on revaluation of investment classified as held-for-trading Capital gain on redemption of NI(U)T LoC Units Gain on sale of fixed assets Financial charges on leased assets Bad debts written off directly Other provisions /write offs 1,073,54 5 9,300 7,011,04 6 2,954,67 8 3,965 86,214 4,600 11,043,46 9 605,629 20,237

-27 -45,122 -88 117 7,227 108,131 333,781

-78 -3,428 -385 230 1,724 126,753 398,230

-6,730 -294,424 -33,081 19,829 148,026 10,886,1 54 34,201,7 80 3,475,48 0 4,163,33 8 9,274,17 9 4,815,37 7 12,097,6 20 2,614,53 8 25,647,3 84 104,687, 063

-2,355 3,875,309 -7,587 10,072 620,780 9,286,750 28,666,58 7

(increase)/Decrease of operating assets -29,192 -15,941 853,472 121,613 1,020,2 18 -40,467 -48,476 107,984 56,068 140,859 Increase in operating liabilities 4,682 57,367 1,193,7 64 -30,442 298,626 1,218,9 28 bills payable Borrowin gs Deposits and other accounts 402,108 4,926,951 102,525,8 09 Lending to financial institutions-gross Held-for-trading securities Advances-net Other assets (excluding advance tax) 2,507,144 1,369,079 73,300,03 5 10,444,60 3 87,620,86 1

55

30,306 1,286,1 19 115,469 -117 115,586 484,096

45,109 934,969 107,352 -231 107,583 1,084,7 57 1,061,6 14 106,345 12,802 -31,782 -3,806 685 977,370

Other liabilities (excluding current taxation)

Income tax paid Financial charges paid

Net cash generated from operating activities CASH FLOWS FROM INVESTING ACTIVITIES Net investments in available-for-sale securities Net proceeds from Held-to-maturity securities Dividend income received Investment in operating fixed assets Investment in subsidiary and associates Sale proceeds of property and equipment disposed off Net cash (used) in investing activities CASH FLOWS FROM FINANCING ACTIVITIES Payments of lease obligations Dividend paid Net cash (used) in financing activities Effects of exchange differences on translation of the net assets of foreign branches Increase /Decrease in cash and cash equivalents Cash and cash equivalents at beginning of the year Cash and cash equivalents at end of the year

3,874,18 3 80,299,3 24 9,219,87 1 -19,829 9,239,70 0 93,163,7 84

2,602,792 110,457,6 60 9,916,950 -10,072 9,927,022 41,576,36 4 47,744,53 3 11,038,01 4 1,920,336 1,771,649 -617,495 13,657 37,161,67 0

555,916 128,522 22,360 -20,628 -7,190 158 432,694

91,176,1 68 9,133,42 9 1,099,49 3 2,729,58 6 -326,853 58,852 83,940,8 33

-245 -67,769 -68,014

-569 -93,853 -94,422

-48,902 8,060,51 0 8,109,41 2

-21,024 5,820,338 5,841,362

10,706 -5,906 1,684,5 46 1,678,6 40

142 13,107 1,678,6 40 1,691,7 47

12,216 1,125,75 5 144,169, 195 145,294, 950

919,475 -507,193 144,676,3 88 144,169,1 95

56

5.4 STATEMENT OF COMPREHENSIVE INCOME For the year ended December 31, 2010

2009 2010 2010 2009 US Dollars in '000 Profit after taxation for the year ..Rupees in '000.. 17,563,21 4 17,561,84 6

204,482

204,498

Other comprehensive income:

10,706

142

Exchange adjustments on translation of net assets of foreign branches

12,216

919,475

215,188

204,640

Total comprehensive income for the year

17,575,43 0

18,481,32 1

57

Surplus arising on revaluation of assets has been reported in accordance with the requirement of the companies ordinance, 1984 and the directives of the Stat Bank of Pakistan in a separate account below equity.

5.5 STATEMENT OF CHANGES IN EQUITY For the year ended December 31, 2010

Reserves Capital Revenu Share Unappropri Exchang Total e Capital ated profit e Statutor Genera Translati y l on ...Rupees... 8,969,75 1 13,432,3 33 81,367,00 2

Balance as at January 1, 2009 Comprehensive Income Profit after tax for the year ended December 31, 2009 Other comprehensive incomenet of tax

5,987,376

521,338

52,456,204

17,561,846

17,561,84 6

919,475 919,475

17,561,846

919,475 18,481,32 1

Transferred from surplus on

58

revaluation of fixed assets to unappropriate profit-net of tax Transfer to statutory reserve Transactions with owners Issue of bonus shares (20%) Cash dividend (Rs.6.5 per share) Balance as at December 31, 2009 1,793,95 1 1,821,18 5

123,934 -1,821,185

123,934

-1,793,951 -5,830,338 -5,830,338 94,141,91 9 94,141,91 9

10,763,7 02 10,763,7 02

6,906,851

15,253,5 18 15,253,5 18

521,338

60,696,510

Balance as at January 1, 2010 Comprehensive Income Profit after tax for the year ended December 31, 2010 Other comprehensive incomenet of tax

6,906,851

521,338

60,696,510

17,563,214 12,216 12,216 17,563,214

17,563,21 4 12,216 17,575,43 0

Transferred from surplus on revaluation of fixed assets to unappropriate profit-net of tax Transfer to statutory reserve Transactions with owners Issue of bonus shares (20%) Cash dividend (Rs.6.5 per share) Balance as at December 31, 2010 13,454,6 28 17,009,8 39 2,690,92 6 1,756,32 1

117,738 -1,756,321

117,738

-2,690,926

-8,072,777

-8,072,777 103,762,3 10

6,919,067

521,338

65,857,438

5.6 Ratio Analysis 5.6.1 Return on Total Assets

59

This ratio shows the yield earned by the use of assets in financial year. Return on asset measures the overall effectiveness of management in generating profits with its available assets. Formula Return on Total Assets = Net Profit after tax /total assets * 100 For 2009 =17561846 / 944232762 * 100 =1.86% For 2010 =17563214 / 1035024680 * 100 =1.70% Comments This ratio shows the high profitability in 2009 where it was 1.86% but in 2010 it is 1.70%, the rate of profitability decreases to 0.16% in 2010. 5.6.2 Return on Equity Ratio Dividing the earning after tax by shareholders funds carries out this ratio the purpose of calculating the ratio to find out the yield after utilizing the shareholder fund for one year. The way of calculating this ratio is given below:

60

Formula Return on Equity=Net profit after tax / shareholders equity * 100 For 2009 = 17561846 / 118906378 * 100 =14.77% For 2010 = 17563214 / 128495828 * 100 =13.67% Comments In 2010 it decrease to 13.67% as compared to 2009 in which it was 14.77% it means the return on each share decrease with the rate of 1.1% in 2010 5.6.3 Earnings Per share This is very important ratio for the shareholders and investors. The shareholders and investors give the main emphasis to the earning per share while making the decision to invest or to become a member of the company. This ratio is calculated as follows: Formula

61

Earning Per Share=Earning available to common stock / No. of shares outstanding For 2009 =17561846 / 1345463 =13.05 For 2010 =17563214 / 1345463 =13.05 Comments The bank earning per share remain unchanged it means that the rupee amount earned on behalf of each outstanding share of common stock has not changed in 2010. 5.6.4 Current Ratio The current ratio measures the firms ability to meet its short term obligations Formula Current Ratio = Current assets / Current liabilities For 2009 =856706861 / 588632541

62

=1.45 For 2010 =1247687548 / 641703009 =1.94 Comments Here the current ratio increased from 1.45 to 1.94 which is a good sign for firm as its ability to repay its debt is increased. 5.6.5 Networking Capital Formula Networking capital = Current assets Current liabilities For 2009 =856706861-588632541 =268074320 For 2010 =1247687548-641703009 =605984539

63

5.6.6 Equity Ratio Formula Equity ratio = Shareholders funds / Total assets * 100 For 2009 =118906378 / 944582762 * 100 =12.59% For 2010 =128495828 / 1035024680 * 100 =12.41% 5.6.7 Net Profit Ratio This ratio measures the firms success with respect to earning on sales. The net profit ratio measures the percentage of each sale remaining after all costs & expenses, including interest, taxes, & preferred stock dividends, have been decided. Formula Net Profit Ratio = Net profit / Sales * 100 For 2009

64

=17561846 / 77947697 * 100 =22.53% For 2010 =17563214 / 88472134 * 100 =19.85% Comments The net profit ratio decreased from 22.53% to 19.85% it means net profit ratio decreased in 2010 with the rate of 2.68% 5.6.8 Gross Profit Ratio The gross profit ratio measures the percentage of each sales rupees remaining after the firm has paid for its goods. Formula Gross Profit Ratio = Gross profit / Sales * 100 For 2009 =37458048 / 77947697 * 100 =48.05% For 2010

65

=43221658 / 88472134 * 100 =48.85% Comments The gross profit increased from 48.05% that was in 2009, to 48.85% which is in 2010.it means this ratio increased with the rate of 0.8% which is favorable sign. 5.6.9 Cost Ratio Formula Cost Ratio = Cost of Services Offered / Net Sales * 100 For 2009 =40489649 / 77947697 * 100 =51.94% For 2010 =45250476 / 88472134 * 100 =51.14% 5.6.10 Operating Profit Ratio Formula

66

Operating Profit Ratio = Operating profit / Net Sales * 100 For 2009 =21300173 / 77947697 * 100 =27.33% For 2010 =24415119 / 88472134 * 100 =27.60% 5.6.11 Operating Ratio Operating profit measures the each sales rupee remaining after all costs &expenses other than interests, taxes& preferred stock dividends are deducted. Formula Operating Ratio = C.G.S + Operating Expense / Net Sales * 100 For 2009 = (40489649+23513897) / 77947697 * 100 =82.11% For 2010 = (45250476+26469490) / 88472134 * 100

67

=81.06% Comments In 2009 operating profit ratio was 27.33% which increased in 2010,in which it is 27.60% it means in 2010 this ratio increased with the rate of 0.27% which is favorable.

Chapter No: 06 WORK EXPERIENCE

6.1 Internship Activities 6.1.1 6.1.2 6.1.3 Accounts Department Computer Section Western Money

68

6.1.4 6.1.5 6.1.6

Govt Section Accounts Department Deposit Department

6.2 What I learnt during my internship at National Bank of Pakistan (Positive & Negative) 6.3 Internship has influenced my future career plan

Chapter No: 06 WORK EXPERIENCE

6.1 INTERNSHIP ACTIVITIES I completed my internship at National Bank of Pakistan, Main Branch KOTLI. In the period of 6 weeks, I tried my best to gain a practical exposure and an experience to plan, develop, present and report and to seek a challenging career oriented position in the field of general banking by using the potential of

69

handwork and professional skills. I worked almost in all departments. I discussed some detail of departments related to my practical experience. I worked in these sections of the bank. 6.1.1 ACCOUNTS DEPARTMENT Preparation of Debit Vouchers Preparation of Credit Vouchers Expense Vouchers Account Opening Issuance of Cheque Preparation of Pension Bills Preparation of Benevolent Fund 6.1.2 COMPUTER SECTION Entry of Vouchers Remittance Entry of Debit Voucher Entry of Credit Voucher Entry of Cheques those presented for withdrawal NBP General Account Reports of different transaction Day End Reports 6.1.3 WESTERN MONEY Receive Money Send Money 6.1.4 GOVT SECTION Clearing of Government Cheques

70