Académique Documents

Professionnel Documents

Culture Documents

DRAFT - Epsom Ewell Islamic Society - Ye 30-09-12

Transféré par

EEISDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

DRAFT - Epsom Ewell Islamic Society - Ye 30-09-12

Transféré par

EEISDroits d'auteur :

Formats disponibles

Registered Charity Number 1085706

Epsom & Ewell Islamic Society Reports and Accounts For The Year Ended 30 September 2012

Epsom & Ewell Islamic Society Reports and accounts Contents

Page Trustees report Independent examiners report on the accounts Statement of Financial Activities Balance sheet Notes to the accounts 2 5 6 7 8

Epsom & Ewell Islamic Society Reports and accounts Trustees report for the year ended 30 September 2012

Reference and administration details Charity name Registered charity number Principal address Epsom & Ewell Islamic Society 1085706 Epsom Islamic Centre Hook Road Epsom Surrey KT19 8TU

Managing charity trustees Dr S U Rahman M M Abdul I Kaidoo A Dossani F Ahmed J Ahmed Dr A Raja R Uddin M Rasool I Kaidoo Chairman Vice Chairman Treasurer (resigned 27 March 2011) Treasurer (appointed 28 March 2011) Assistant Treasurer (appointed 28 March 2011) General Secretary Assistant Secretary (appointed 28 March 2011) General Co-optee (co-opted 27 August 2011) Co-optee (co-opted 28 March 2011)

Custodian charity trustees S Ali S Malik A Malek T Chowdhury M S Simreekheea M S Uddin Structure, governance and management Type of governing document How the charity is constituted Trustee selection method Constitution adopted 12 January 2001 and amended 17 March 2001 Association Seven members of the Executive Committee are elected at the Annual General Meeting. Two members of the Executive Committee are coopted by the Executive Committee.

Epsom & Ewell Islamic Society Reports and accounts Trustees report for the year ended 30 September 2012

Objects and activities Summary of the objects of the charity set out in its governing document To advance religion in accordance with the tenets and doctrines of Islam To provide and assist in the provision of education in the field of Islamic culture, history and practice To foster goodwill and harmonious relations with other ethnic groups

Summary of the main activities undertaken for the public benefit in relation to these objects In carrying out their review of our objectives, the trustees have considered the Charity Commissions general guidance on public benefit and in particular its supplementary public guidance on the advancement of religion for the public benefit. The trustees consider that the following activities provide benefit to those who worship at our mosque.

Prayers: The mosque is open for daily and Friday prayers Festivals: The mosque prepares food during holy month of fasting called Ramadan for those attending our Mosque who wish to break their fast together. Tajweed and Hifdh classes: Recitation and memorisation of the Quran are important elements of religious

education and training. We continue to provide this facility in the mosque

Zakaat: It is part of our faith that all who are able should pay Zakaat which is collected in proportion to a persons

means according to Islam for a number of specific charitable purposes. We provide the opportunity for those attending our mosque to give zakaat which we distribute on their behalf. The mosque makes no charge for the collection and distribution of zakaat.

Special appeals: It is also part of our faith that all who wish to may supplement their zakaat with sadaqah, which

is optional giving for a wider range of charitable purposes. Again we provide the opportunity for those attending our mosque to give sadaqah, in the form of special appeals, which we distribute on their behalf. The mosque makes no charge for the collection and distribution of sadaqah. Achievements and performance The main achievements of the charity during the year were:

Prayers: During the week we had over 25 to 50 people regularly attend daily prayers and over 500 who regularly

attend Friday prayers

Tajweed and Hifdh classes: We are pleased this programme continues to run successfully with over 10 people

regularly attending these classes.

Zakaat: We collected and distributed zakaat of 2,650 on behalf of those attending our mosque Special appeals: We distributed 2,035 to designated causes such as 1,600 for Pakistani flood victims and 435

for the Bangladeshi flood victims.

Loan repayment: We continued to make good progress in repaying 15,000 interest-free loans lent by generous

individuals to purchase the freehold property at a cost of 866,176, leaving 67,000 loans outstanding at year end.

Epsom & Ewell Islamic Society Reports and accounts Trustees report for the year ended 30 September 2012 Charities policy on reserves The trustees have reviewed the reserves of the charity. Their policy is to hold enough funds to meet 2 months operating costs of the mosque. Declaration The trustees declare that they have approved the trustees report above. Signed on behalf of the charitys trustees

Signature(s)

....

Full name(s)

....

Position

....

Date

....

Signature(s)

....

Full name(s)

....

Position

....

Date

....

Signature(s)

....

Full name(s)

....

Position

....

Date

....

Signature(s)

....

Full name(s)

....

Position

....

Date

.

4

....

Epsom & Ewell Islamic Society Reports and accounts Independent examiners report on the accounts for the year ended 30 September 2012

I report to the trustees of The Epsom & Ewell Islamic Society on the financial statements for the year ended 30 September 2012 set out on pages 6 to 13. Respective responsibilities of trustees and examiner The charity's trustees are responsible for the preparation of the accounts. The charitys trustees consider that an audit is not required for this year under section 144 of the Charities Act 2011 (the Charities Act) and that an independent examination is needed. It is my responsibility to: examine the accounts under section 145 of the Charities Act, to follow the procedures laid down in the general Directions given by the Charity Commission (under section 145(5)(b) of the Charities Act), and to state whether particular matters have come to my attention.

Basis of independent examiners statement My examination was carried out in accordance with general Directions given by the Charity Commission. An examination includes a review of the accounting records kept by the charity and a comparison of the accounts presented with those records. It also includes consideration of any unusual items or disclosures in the accounts, and seeking explanations from the trustees concerning any such matters. The procedures undertaken do not provide all the evidence that would be required in an audit, and consequently no opinion is given as to whether the accounts present a true and fair view and the report is limited to those matters set out in the statement below. Independent examiner's statement In connection with my examination, no matter has come to my attention 1. which gives me reasonable cause to believe that in, any material respect, the requirements: 2. to keep accounting records in accordance with section 130 of the Charities Act; and to prepare accounts which accord with the accounting records and comply with the accounting requirements of the Charities Act have not been met; or

to which, in my opinion, attention should be drawn in order to enable a proper understanding of the accounts to be reached.

Signed: S A Rahman

Date:

Member of Institute of Chartered Accountants in England and Wales and Chartered Institute of Taxation 133 Nork Way Banstead Surrey SM7 1HR

Epsom & Ewell Islamic Society Reports and accounts Statement of Financial Activities for the year ended 30 September 2012

Incoming resources (Note 3)

Unrestricted funds

Restricted income funds 2,650 2,650

Endowment funds -

Total this year 3 64,444 240 20,653 85,340

Total last year 11 110,031 720 1,463 16,953 129,178

Interest income Donations legacies and grants Fundraising events Calendar sales Fees for charitable services Total incoming resources Resources expended (Notes 4-7) Wages, salaries, pensions and NI Cost of fundraising events Rent, rates and Insurance Repairs and maintenance Light and heat Telephone postage and stationery Donations and grants Legal and professional fees Bank charges and interest Depreciation Total resources expended Net movement in funds Total funds brought forward Total funds carried forward

3 61,794 240 20,653 82,690

21,198 4,203 3,028 (2,376) 4,252

21,198 4,203 3,028 (2,376) 4,252

47,233 4,245 2,460 4,522 4,501

1,574 2,962 30,776 639 3,577 69,833 12,857 890,823

2,655 2,655 (5) -

1,574 5,617 30,776 639 3,577 72,488 12,852 890,823

1,878 9,569 20,848 303 1,198 96,757 32,421 858,402

903,680

(5)

903,675

890,823

Epsom & Ewell Islamic Society Reports and accounts Balance Sheet for the year ended 30 September 2012

Note

Unrestricted funds

Fixed assets Tangible assets Total fixed assets 8

Restricted income funds -

Endowment funds -

Total this year 952,250 952,250

Total last year 939,968 939,968

952,250 952,250

Current assets Debtors Cash at bank and in hand Total current assets Creditors: amounts falling due within 1 year Net current assets/(liabilities) Total assets less current liabilities Creditors: amounts falling due after 1 year Net assets Funds of the charity Unrestricted funds Total funds

500 25,338 25,838

500 25,338 25,838 7,413

500 36,856 37,356 4,501

10

7,413

18,425

18,425

32,855

970,675 10

970,675

972,823

67,000 903,675

67,000 903,675

82,000 890,823

903,680 903,680

(5) (5)

903,675 903,675

890,823 890,823

Signed by 1 or 2 trustees on behalf of all the trustees

Signature(s)

....

Full name(s)

....

Position

....

Date

....

Epsom & Ewell Islamic Society Reports and accounts Notes to the accounts for the year ended 30 September 2012 1. 1.1 Basis of preparation Basis of accounting

These accounts have been prepared on the basis of historic cost (except that investments are shown at market value) in accordance with Accounting and Reporting by Charities Statement of Recommended Practice (SORP 2005); and with Accounting Standards; and with the Charities Act. 1.2 Change in basis of accounting

There has been no change to the accounting policies (valuation rules and methods of accounting) since last year. 1.3 Changes to previous accounts

No changes have been made to accounts for previous years. 2. Basis of preparation

Incoming resources Recognition of incoming resources These are included in the Statement of Financial Activities (SoFA) when: the charity becomes entitled to the resources; the trustees are virtually certain they will receive the resources; and the monetary value can be measured with sufficient reliability. Incoming resources with related expenditure Where incoming resources have related expenditure (as with fundraising or contract income) the incoming resources and related expenditure are reported gross in the SoFA. Grants and donations Grants and donations are only included in the SoFA when received. Tax reclaims on donations and gifts Incoming resources from tax reclaims are included in the SoFA at the same time as the gift to which they relate. Contractual income and performance related grants This is only included in the SoFA once the related goods or services have been delivered. Gifts in kind Gifts in kind are accounted for at a reasonable estimate of their value to the charity or the amount actually realised. Gifts in kind for sale or distribution are included in the accounts as gifts only when sold or distributed by the charity. Gifts in kind for use by the charity are included in the SoFA as incoming resources when receivable. Donated services and facilities These are only included in incoming resources (with an equivalent amount in resources expended) where the benefit to the charity is reasonably quantifiable, measurable and material. The value placed on these resources is the estimated value to the charity of the service or facility received. Volunteer help The value of any voluntary help received is not included in the accounts but is described in the trustees annual report. Investment income This is included in the accounts when received.

Epsom & Ewell Islamic Society Reports and accounts Notes to the accounts for the year ended 30 September 2012 2. Basis of preparation

Expenditure and liabilities Liability recognition Liabilities are recognised as soon as there is a legal or constructive obligation committing the charity to pay out resources. Grants payable without performance conditions These are only recognised in the accounts when a commitment has been made and there are no conditions to be met relating to the grant which remain in the control of the charity. Assets Tangible fixed assets for use by charity These are capitalised if they can be used for more than one year, and cost at least 500. They are valued at cost or a reasonable value on receipt.

3.

Analysis of incoming resources This year 3 3 20,241 23,581 870 17,102 2,650 64,444 240 240 20,603 50 20,653 Last year 11 11 45,659 30,465 3,420 1,079 20,782 3,110 5,516 110,031 720 720 1,463 1,463 16,953 16,953

Bank interest Interest income Islamic appeal fund Jumuah collection Membership fees Miscellaneous donations Monthly donations Special appeal fund Zakaat & fitra collection Gift Aid Donations, legacies and grants Ramadan expenses' collection Eid salat collection Fundraising events Calendar sales Calendar sales Madrassa tuition fees Nikah fees Fees for charitable services

Epsom & Ewell Islamic Society Reports and accounts Notes to the accounts for the year ended 30 September 2012 4. Analysis of resources expended This year 16,083 3,900 1,215 21,198 4,203 4,203 853 1,971 204 3,028 744 830 1,574 927 2,035 2,655 5,617 600 2,981 1,380 24,243 1,572 30,776 Last year 36,730 4,225 6,278 47,233 3,295 150 200 600 4,245 1,120 1,250 90 2,460 648 1,230 1,878 1,385 2,668 5,516 9,569 750 2,654 673 14,356 2,415 20,848

Maulana services Caretaker Employer's NICs Wages, salaries, pensions and NI Ramadan expenses Advertising and subscriptions Travelling Sundry expenses Cost of fundraising events Rates Insurance Hiring of halls Rent, rates and insurance Telephone Printing postage and stationery Telephone postage and stationery Madrassa books Special appeal Zaka'at & fitrah Donations and grants Accountancy Caretaker and admin staff Legal and professional Madrassah teacher Maulana services Legal and professional

5. 5.1

Details of certain items of expenditure Trustee expenses

No payments or reimbursement of outof-pocket expenses were made to trustees or third parties for expenses incurred by trustees.

10

Epsom & Ewell Islamic Society Reports and accounts Notes to the accounts for the year ended 30 September 2011 5. 5.2 Details of certain items of expenditure Fees for examination or audit of accounts This year 500 100 600 Last year 500 250 750

Independent examiners fees for reporting on the accounts Other fees paid to the independent examiner

6. 6.1

Paid employees Staff costs This year 19,983 1,215 21,198 Last year 40,955 6,278 47,233

Gross wages, salaries and benefits in kind Employers National Insurance costs

6.2

Average number of full-time equivalent employees in the year This year Number 1 1 Last year Number 1 1

Charitable activities (Mosque)

7.

Grant making

Grants made to institutions Total amount of grants paid 1,600 435 528 2,563

Names of institutions Pakistan Recovery Fund Zam Zam Charitable Trust Zam Zam Charitable Trust

Purpose Pakistan Flood Appeal Bangladesh Flood Appeal Zakaat & Fitrah

11

Epsom & Ewell Islamic Society Reports and accounts Notes to the accounts for the year ended 30 September 2011 8. 8.1 Tangible fixed assets Cost or valuation Freehold land & buildings Balance brought forward Additions Balance carried forward 8.2 932,214 Other land & buildings Plant, machinery & motor vehicles Fixtures, fittings & equipment 8,952 15,859 932,214 24,811 Payment on account and assets under construction Total

941,166 15,859 957,025

Accumulated depreciation and impairment provisions Freehold land & buildings Other land & buildings Plant, machinery & motor vehicles Fixtures, fittings & equipment 1,198 3,577 4,775 Payment on account and assets under construction Total

1,198 3,577 4,775

Balance brought forward Depreciation charge for the year Balance carried forward

8.3

Net book value Freehold land & buildings Other land & buildings Plant, machinery & motor vehicles Fixtures, fittings & equipment 7,754 20,036 Payment on account and assets under construction Total

939,968 952,250

Balance brought forward Balance carried forward

932,214 932,214

Debtors and prepayments Amounts falling due within one year This year Last year 500 500 Amounts falling due after more than one year This year Last year -

Analysis of debtors

Other debtors Total

12

Epsom & Ewell Islamic Society Reports and accounts Notes to the accounts for the year ended 30 September 2011 10 Creditors and accruals Amounts falling due within one year This year Last year 4,631 1,248 2,782 3,253 7,413 4,501 Amounts falling due after more than one year This year Last year 67,000 82,000 67,000 82,000

Analysis of creditors

Loans and overdrafts Trade creditors Other creditors Total

11

Endowment and restricted income funds

11.1 Funds held Zakaat and fitrah collection fund is a restricted income fund established to collect obligatory charitable donations from individuals for distribution for specified purposes. 11.2 Movement of major funds Fund names Fund balances brought forward Incoming resources Resources expended Transfers Gains and losses Fund balances carried forward (5) (5)

Zaka'at & fitrah Total

2,650 2,650

(2,655) (2,655)

12

Transactions with related parties

12.1 Loans due to trustees and related parties Amount owing This year Last year 2,000 2,000 7,500 12,500 9,500 14,500

Name of Trustee or related party Dr Shakil Rahman Mannan Abdul

Legal authority Trustee Trustee

13

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Ealities of Ufism And: Adariyah AwiyahDocument42 pagesEalities of Ufism And: Adariyah AwiyahYusufAliBahrPas encore d'évaluation

- Rubayiat of Hamza BabaDocument195 pagesRubayiat of Hamza Babazeb3450% (1)

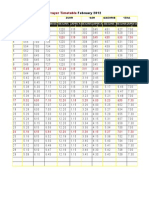

- Prayer Timetable February 2012Document1 pagePrayer Timetable February 2012EEISPas encore d'évaluation

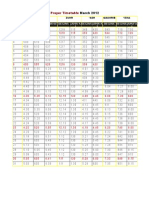

- Prayer Timetable March 2012Document1 pagePrayer Timetable March 2012EEISPas encore d'évaluation

- Prayer Timetable April 2012Document1 pagePrayer Timetable April 2012EEISPas encore d'évaluation

- EEIS Secretary Report 2010Document7 pagesEEIS Secretary Report 2010EEISPas encore d'évaluation

- Prayer Timetable June 2011Document1 pagePrayer Timetable June 2011EEISPas encore d'évaluation

- Prayer Timetable December 2011Document1 pagePrayer Timetable December 2011EEISPas encore d'évaluation

- January 2012 Salah TimetableDocument1 pageJanuary 2012 Salah TimetableEEISPas encore d'évaluation

- Ramadan Timetable 2010Document2 pagesRamadan Timetable 2010EEISPas encore d'évaluation

- Prayer Time September 2011Document1 pagePrayer Time September 2011EEISPas encore d'évaluation

- Salah Timetable Sep 2010Document1 pageSalah Timetable Sep 2010EEISPas encore d'évaluation

- Salah Timetable July 2010Document1 pageSalah Timetable July 2010EEISPas encore d'évaluation

- Salah Timetable Dec 2010Document1 pageSalah Timetable Dec 2010EEISPas encore d'évaluation

- BBT and The QuranDocument19 pagesBBT and The QuranEEIS100% (1)

- Salah Timetable August 2010Document1 pageSalah Timetable August 2010EEISPas encore d'évaluation

- Salah Timetable April 2010Document1 pageSalah Timetable April 2010EEISPas encore d'évaluation

- Big Bang Theory and QuranDocument18 pagesBig Bang Theory and QuranEEISPas encore d'évaluation

- Newsletter Issue 1 March Final)Document2 pagesNewsletter Issue 1 March Final)EEISPas encore d'évaluation

- July 2010 Prayer TimetableDocument1 pageJuly 2010 Prayer TimetableEEISPas encore d'évaluation

- Ramadhan 09Document1 pageRamadhan 09EEISPas encore d'évaluation

- Salah Timetable June 2010Document1 pageSalah Timetable June 2010EEISPas encore d'évaluation

- Zakat Self-Assessment: Section 1 - Do You Have To Pay Zakat This Year ?Document4 pagesZakat Self-Assessment: Section 1 - Do You Have To Pay Zakat This Year ?EEIS100% (2)

- Salah Timetable March 2010Document2 pagesSalah Timetable March 2010EEISPas encore d'évaluation

- May 09Document1 pageMay 09EEISPas encore d'évaluation

- June 09Document1 pageJune 09EEISPas encore d'évaluation

- August 09Document1 pageAugust 09EEISPas encore d'évaluation

- Babynamesboysv 2Document46 pagesBabynamesboysv 2Bhupendra SinghPas encore d'évaluation

- Fatemeh Keshavarz On SadiDocument12 pagesFatemeh Keshavarz On SadiashfaqamarPas encore d'évaluation

- ScriptDocument12 pagesScriptSachin KumarPas encore d'évaluation

- Mass Media in Pakistan PDFDocument43 pagesMass Media in Pakistan PDFFaiza KhalidPas encore d'évaluation

- Autonomous Region: AR MMDocument32 pagesAutonomous Region: AR MMBea Dacillo BautistaPas encore d'évaluation

- Madagascar Comoros Islands v1 m56577569830503995Document15 pagesMadagascar Comoros Islands v1 m56577569830503995Pablo SulicPas encore d'évaluation

- Dr. Zakaria Hegazy CV السيرة الذاتية -زكريا حجازىDocument9 pagesDr. Zakaria Hegazy CV السيرة الذاتية -زكريا حجازىZakaria HegazyPas encore d'évaluation

- Kurds SuppresionDocument19 pagesKurds SuppresionHabilian AssociationPas encore d'évaluation

- Thunder and Lighthing Polka-Clarinete BajoDocument2 pagesThunder and Lighthing Polka-Clarinete BajojorgePas encore d'évaluation

- Commentary of Imam Al AskariDocument64 pagesCommentary of Imam Al AskariscparcoPas encore d'évaluation

- Contoh Soal Discussion TextDocument6 pagesContoh Soal Discussion TextKomang MadavaPas encore d'évaluation

- Shirdi Sai CommandmentsDocument8 pagesShirdi Sai CommandmentsHappy MountainsPas encore d'évaluation

- When Indonesia Meets The Middle East: Thoughts On Center-Periphery RelationsDocument24 pagesWhen Indonesia Meets The Middle East: Thoughts On Center-Periphery RelationsHoover Institution100% (1)

- Position of Islam Islamic LawDocument34 pagesPosition of Islam Islamic LawWahida Ani100% (2)

- Essential Principles of IslamDocument78 pagesEssential Principles of IslamCuneyt Tari DJ-CosmicPas encore d'évaluation

- Punjabi Culture & HeritageDocument34 pagesPunjabi Culture & Heritageervin_buddyPas encore d'évaluation

- Etiquettes of Disagreement - Shaykh Hamza YusufDocument6 pagesEtiquettes of Disagreement - Shaykh Hamza YusufChhotto SufiPas encore d'évaluation

- Prophetic Leadership PDocument8 pagesProphetic Leadership PIshaq Bin SadiqPas encore d'évaluation

- Arabic Grammar - ExercisesDocument167 pagesArabic Grammar - ExercisesRaza Bin MuhammadPas encore d'évaluation

- Puisi-Puisi Arifin Arif: Satu Analisis Takmilah: January 2014Document29 pagesPuisi-Puisi Arifin Arif: Satu Analisis Takmilah: January 2014Batrisyia SandihPas encore d'évaluation

- Airlines - Saudia An Airline and Its AircraftDocument66 pagesAirlines - Saudia An Airline and Its AircraftAlex BearcatPas encore d'évaluation

- Sarf in ShortDocument21 pagesSarf in Shortعبد الرحمن زيكاPas encore d'évaluation

- Year 2 - Foundational Islamic Sciences - The Qalam SeminaryDocument4 pagesYear 2 - Foundational Islamic Sciences - The Qalam SeminarySaqib MohammedPas encore d'évaluation

- Islamism and Social Movement Theory Asef BayatDocument19 pagesIslamism and Social Movement Theory Asef BayatSalim UllahPas encore d'évaluation

- Dynamic Model of Ibn Khaldun Theory On PovertyDocument26 pagesDynamic Model of Ibn Khaldun Theory On PovertyReza FetrianPas encore d'évaluation

- The 14th Degree and Beyond MagazineDocument54 pagesThe 14th Degree and Beyond MagazineOriginal Author100% (9)

- Sultan Abdul Mubin of Brunei - Two Literary Depictions of His Reign - Annabel Teh GallopDocument34 pagesSultan Abdul Mubin of Brunei - Two Literary Depictions of His Reign - Annabel Teh GallopKamran Asat IrsyadyPas encore d'évaluation

- Karnataka State Board Book Class 10Document152 pagesKarnataka State Board Book Class 10the back benchers showPas encore d'évaluation