Académique Documents

Professionnel Documents

Culture Documents

F6 2000 Jun Q

Transféré par

Dylan Ngu Tung HongTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

F6 2000 Jun Q

Transféré par

Dylan Ngu Tung HongDroits d'auteur :

Formats disponibles

Malaysian Institute of Accountants

The Association of Chartered Certified Accountants

Module D Certificate Stage

MIA examinations in collaboration with ACCA

Tax Framework (Malaysia)

June 2000

Question Paper Time allowed This paper is divided into two sections Section A Section B ALL THREE questions are compulsory and MUST be answered THREE questions ONLY to be answered 3 hours

Tax rates and tables are on page 3

paper 7(M)

THIS IS A BLANK PAGE

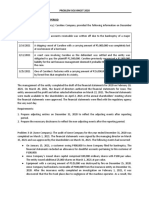

The following tax rates and allowances are to be used when answering the questions. Rate of Income Tax (a) Company (b) Resident individual Chargeable income RM 0 2,500 2,501 5,000 5,001 10,000 10,001 20,000 20,001 35,000 35,001 50,000 50,001 70,000 70,001 100,000 100,001 150,000 Remainder 28%

Rate 0% 2% 4% 6% 10% 16% 21% 26% 29% 30%

Cumulative Tax RM 0 50 250 850 2,350 4,750 8,950 16,750 31,250

Personal Allowances Self Fees for education Medical costs for serious diseases (self, wife or child) Medical expenses for parents Basic support equipment Wife Children basic Life insurance premium, contributions to Employees Provident Fund and other obligatory contributions to other approved schemes Education/medical insurance premiums Tax rebate RM 5,000 2,000 5,000 5,000 5,000 3,000 800

maximum maximum maximum maximum each

5,000 maximum 2,000 maximum 110 + 60 for wife

[P.T.O.

Section A ALL THREE questions are compulsory and MUST be attempted 1 Playhouse Sdn Bhd is engaged in the manufacture of toys for domestic and overseas markets. Its profits and loss account for the year ended 31 March 2000 is as follows: Note Rm000 Rm000 Turnover 53,090 Add: Gain from disposal of shares 1 122 Dividend (net) 2 118 Less: Cost of sales Less: Remuneration Repairs & maintenance Interest on hire purchase Motor vehicles expenses Entertainment Donation Training & consultancy Miscellaneous expenses Foreign exchange gain (realised) Freight & insurance Bad & doubtful debts Depreciation Advertising 3 4 5 1,300 511 7 378 200 37 274 40 (38) 980 1,833 1,090 592 7,204 Net profit before taxation Taxation Net profit after taxation Notes: (1) Shares held in a listed company for the past ten years were disposed of during the year. (2) All dividend income is net of tax except for a tax exempt dividend of Rm46,000 from a pioneer company. (3) Cost of sales includes: (i) An amount of Rm6,000 written-off in respect of 100 units of a product which were destroyed as they were found to contain materials harmful to health. 8,126 2,340 5,786 53,330 38,000 15,330

6 7 8 9 10 11 12

(ii) A provision of Rm4,000 for the foreign exchange loss which the company expects to incur when paying for raw materials purchased. (iii) On a festive day the company gave away toys costing Rm10,000 (market value Rm12,000) as prizes to children at a nearby orphanage. (4) Remuneration This includes the remuneration of Rm108,000 paid to three physically disabled employees and a sum of Rm43,000 embezzled by a director of the company. (5) Included in this figure is an estimated cost of Rm8,000 quoted by the contractor for the repair of the roof over the car porch. It was agreed that the repair work would commence in April 2000. (6) This item is in respect of a sponsorship of television programmes. (7) Donation A cash donation of Rm37,000 was made to a healthcare centre approved by the Ministry of Health. 4

(8) Miscellaneous expenses comprise: Printing of annual reports Leave passages for directors Legal fees incurred on embezzlement Rm000 15 20 5 40 (9) The foreign exchange gain is in respect of toys exported to Europe. (10) Insurance premiums amount to Rm452,000 insured with foreign companies for the export of cargo. (11) Bad & doubtful debts comprise: Bad debts written off of which Rm9,000 is in respect of debts taken over from the vendor when the business was acquired years ago Recovery of debts written off by the vendor Increase in specific provision of which Rm60,000 is non-trade Decrease in general provision of which Rm24,000 is non-trade Rm000

600 (13) 1,420 (174) 1,833

(12) Included in this amount is the medical costs amounting to Rm30,000 under a court order awarded against the company for health injury suffered by a consumer. (13) Capital allowances on factory machinery are as follows: Brought forward from previous years Year of assessment 2000 (current year basis) (14) Information on motor vehicles: (i) On 10 December 1999 the company sold a station wagon for Rm28,000. The vehicle was purchased on 12 May 1998 for Rm40,000. Capital allowances were deemed to be claimed. Rm000 29 800

(ii) On 5 May 1999 the company purchased a van under a hire purchase agreement as follows: Deposit of Rm15,000 paid on 5 May 1999 Loan amount Rm40,000 repayable at Rm1,700 for 40 months commencing on 5 June 1999. Included in the monthly installment is interest of Rm700. (iii) A car for the managing director which cost Rm190,000 was purchased on 9 October 1999. Use the rate of 20% for initial allowance and annual allowance. Required: (a) Compute the tax payable by Playhouse Sdn Bhd for the year of assessment 2000. Every item mentioned in the notes to the accounts must be listed in your computation, indicating it with Nil where no adjustment is necessary. (17 marks) (b) Explain your treatment of the items mentioned in each of the notes EXCEPT notes 13 and 14. (11 marks) (28 marks)

[P.T.O.

(a) The following will apply to Mr Too and his wife Amy in the year 2000. Mr Too Mr Too whose wife Joan died on 2 January 2000 married Amy, a divorcee, on 6 May 2000. They submitted the following tax return for the year of assessment 2000. Mr Toos deceased wife had no sources of income. Mr Too was a partner of a legal firm. The allocation from the partnership applicable to him for the year ended 31 March 2000 was as follows: Rm 120,000 10,000 (15,000) 1,000 400 16,000 1,440

Salary Interest on capital Divisible loss (his share) Capital allowance (his share) Approved donation by the partnership (his share) Income from non-partnership sources: Rental income (adjusted) Dividend (net of tax) Mr Too claimed the appropriate reliefs in respect of the following: Relief in respect of his deceased wife Life insurance premium on his life Life insurance premium on the life of Amy (policy commenced on 1 June 2000) Necessary support equipment for his mother Maintaining his children: The first child aged 22, unmarried, studied at Universiti Malaya (cost of maintenance Rm6,000) The second child, aged nineteen, unmarried, who was disabled

4,800 300 5,500

Amy Amy was employed as a marketing executive with HiStyle Sdn Bhd from 1 July 1990 to 31 May 2000. During the period of her employment she made contributions to the HiStyle provident scheme which was not approved by the Inland Revenue Board. Upon cessation of her employment she received a lump sum payment of Rm93,000 from the scheme made up as follows: Rm Companys contributions 62,000 Amys contributions 28,000 Interest 3,000 Amy obtained a car loan from a financial institution. Interest for the period 1 January 2000 to 31 May 2000 amounted to Rm4,000 of which Rm2,500 was subsidised by HiStyle. HiStyle provided her with corporate membership of a golf club. The subscription for the period 1 January 2000 to 31 May 2000 was Rm800. HiStyle provided a house for Amy. The annual value of the house was Rm48,000 and the value of the furnishings was Rm140 per month as per the Inland Revenue Board guidelines. Amy was provided with the house until the last day of her employment. Amys remuneration for the period 1 January 2000 to 31 May 2000 was as follows: Rm Salary 7,000 per month Travelling allowance 1,000 per month Bonus 17,500

Rm Other receipts were: Alimony payment from her ex-husband from January to April 2000. Lottery win Interest on a fixed deposit of Rm80,000 for three months from 10 January 2000 with Bank Simpanan Nasional

22,500 10,000 1,000

Amy claimed the appropriate reliefs in respect of the following expenses: Travelling expenses of Rm4,300 incurred for business trips and Rm1,500 in respect of travelling from home to office. Employees Provident Fund contributions 6,325

Child relief for her son, Jim from her previous marriage. He was twenty years old, unmarried, and studied full time at a university in Australia. Amy incurred Rm2,000 which covered 20% of the expenses on his education and maintenance. Her ex-husband contributed Rm8,000 of the expenses and claimed child relief. Medical expenses of Rm4,200 incurred in respect of her father. Amy did not elect for joint assessment. Required: Compute the tax payable for the year of assessment 2000 by: (i) Mr Too; (ii) Amy (State the reason for not including any item in your computation.) (10 marks) (13 marks)

(b) After their divorce Amys ex-husband, Mr Tan married Dolly during the year 2000. Dolly will not elect for joint asessment in respect of her income for the year 2000. Mr Tan will make a claim for the following in his tax return: The alimony payment of Rm22,500; Child relief in respect of the expenses of Rm8,000 incurred by him as mentioned earlier. Required: State, with reasons, whether or not and to what extent, you would allow Mr Tans claims (3 marks) (26 marks)

[P.T.O.

(a) Encik Yusof who is engaged in cosmetics trading, has made up his accounts to 30 June for many years. Required: (i) State the basis period of Encik Yusof in respect of his business income for the year of assessment 2000; (1 mark) (ii) When, and in what amounts would Encik Yusof be required to pay tax by instalments on his business income for the year of assessment 2000? (2 marks)

(b) Image Sdn Bhd has a nine-month fixed deposit of Rm30,000 with a licensed bank at 4% interest per annum. The deposit will mature on 28 February 2001. Required: Compute the interest income of Image Sdn Bhd for the relevant year(s) of assessment and state the earliest date on which assessment(s) can be made. (4 marks)

(c) Encik Jackson Ho commenced employment on 1 May 2000 at a net salary of Rm5,000 per month after deduction of tax under the Schedular Tax Deduction (STD). Required: Explain whether or not Encik Ho is required to notify the Inland Revenue Board of his chargeability to tax in respect of his income for the year 2000. If so, by what date must he notify the IRB? (2 marks)

(d) Mr Yen, a Hong Kong national, left Malaysia on 1 January 2000. His periods of stay in Malaysia were as follows: Year 1997 1998 In Malaysia 16.11.97 to 31.12.97 1.1.98 to 9.2.98 22.2.98 to 30.4.98 4.5.98 to 1.7.98 21.9.98 to 30.11.98 Days 46 40 68 59 71

He was in Hong Kong twice for social visits from 10.2.98 to 21.2.98 (12 days) and again from 1.5.98 to 3.5.98 (3 days). 1999 2000 Required: Determine the residence status of Mr Yen for each of the years and support your answer with reasons or the relevant sub-section number. (4 marks) (13 marks) 1.6.99 to 31.12.99 214

On 1 January he departed Malaysia at 1350 hours.

Section B THREE questions ONLY to be attempted 4 (a) Lanno Sdn Bhd, a manufacturing company, purchased a factory on 10 March 1995 and incurred expenditure as follows: Purchase price (including land cost Rm445,000) Stamp duties Legal fees Total Rm000 2,000 45 10 2,055

The vendor company, a manufacturer, had used the factory for the purpose of their business up to 20 February 1995. The vendors residual expenditure as at 31 December 1994 was Rm1,020,000. The factory was constructed in 1984 at a cost of Rm15 million. It was brought into use in November 1984 and capital allowances were claimed for each year. On 1 July 1998 Lanno transferred the factory to its wholly owned subsidiary, Soonlee Sdn Bhd, for Rm12million (excluding land cost). The market value at the time of transfer has been Rm11 million for the building and Rm05 million for the land. Soonlee was engaged in the business of hiring storage space to the public and the building was used as a warehouse for the purposes of its business. The financial year end of each company is 31 December. Required: Using preceding year basis in each case: (i) Compute the qualifying building expenditure and industrial building allowances of Lanno Sdn Bhd for the relevant years of assessment; (6 marks) (ii) Determine the qualifying building expenditure and the industrial building allowance(s) of Soonlee Sdn Bhd for the year of assessment 1999. (1 mark) (b) Miss Goh is considering buying a shop lot advertised in the newspaper. She has heard that sometimes the acquirer could be assessed to real property gains tax and be required to pay the tax. She seeks your clarification on this matter. Required: (i) In what circumstances may the Director General make an assessment on the acquirer of a chargeable asset under the Real Property Gains Tax Act, 1976? (3 marks) (ii) For the purposes of the Real Property Gains Tax Act how would an assessment made on the acquirer differ from that made on the disposer? (1 mark) (11 marks)

[P.T.O.

(a) Eng Lee owns a shop house which is used as a sundry shop. He has an arrangement with Kiat Ho and Lian Soon as follows: Eng Lee is entitled to Rm2,000 per month plus a further sum of Rm6,000 at the close of the accounting year if the gross revenue exceeds Rm100,000. Kiat Ho provided a loan of Rm50,000 for working capital and is entitled to interest on this at the rate of 3% per annum and also to 10% of the shop takings. Lian Soon manages the business and receives a fixed salary and the entire net profit.

Required: Does a partnership exist in the above scenario? Give reasons to support your answer. (7 marks)

(b) At what point is sales tax levied on a licensed manufacturer in respect of goods manufactured by him? (4 marks) (11 marks)

(a) Mr Lee, the owner of a chain of hotels in Korea, has a proposal to open hotels in Penang (50 rooms), Langkawi (60 rooms) and Sarawak (20 rooms). He seeks your clarification regarding the Service Tax Act, 1975. Required: Explain whether or not Mr Lees proposed operations are liable to service tax. (4 marks)

(b) State whether the following items provided by a licensed hotel are taxable under the Service Tax Act: (i) (ii) room charges for sleeping accommodation; ballroom charges for staging cultural shows;

(iii) charges for conference rooms; (iv) (v) (vi) handicrafts; tobacco; drinks;

(vii) foods; (viii) cover charge; (ix) parking fees; (x) souvenirs. (5 marks)

(c) On its 10th anniversary a licensed hotel provided free foods and drinks in its coffee house to handicapped children. The cost of the foods and drinks was Rm800; the market value was Rm1,100. Required: Determine whether service tax is payable, and if so, why and how much. (2 marks) (11 marks)

10

(a) State briefly the principles derived from case law in regard to the taxability or otherwise of money received under an agreement to communicate know-how. (8 marks)

(b) Hill Bhd, a foreign company whose control and management is exercised in Malaysia, has an agreement with a company in Japan whereby Hill Bhd is required to pay a royalty at the rate of 8% of annual turnover for the use of a design used in the manufacture of rice cookers. In 2000 Hill Bhd made a royalty payment of Rm700,000, of which Rm200,000 is in respect of the annual turnover of its branch in Thailand. This was debited to the branch account and only Rm500,000 was charged as an expense against the income generated in Malaysia. Required: State, with reason(s) and to what extent, the Japanese company is subject to Malaysian tax. (Ignore the terms of any Double Taxation Agreement) (3 marks) (11 marks)

(a) (i) A company resident in Malaysia carried on a consultancy business in Malaysia and reported a revenue of Rm2 million. This included consultancy fees of Rm100,000 earned by the company in Africa and remitted back to Malaysia. Required: Explain how the company is chargeable to tax under the Income Tax Act, 1967 in regard to the income mentioned in the scenario. (Ignore any double taxation agreement) (2 marks) (ii) Mr Koo, a Hong Kong citizen and resident in Malaysia has the following sources of income: Rm200,000 earned from designing a logo for a Malaysian company; Rental income of Rm10,000 from a property in Hong Kong remitted to Malaysia; A dividend of Rm5,000 from a Hong Kong company credited to his bank account in Hong Kong.

Required: State with reasons whether or not these sources of income are chargeable to Malaysian tax. (3 marks) (b) Linefo Sdn Bhd, a company resident in Malaysia, paid a dividend of Rm360,000 to its holding company on 15 April 2000 without deduction of tax at source. Linefos tax chargeable for the year of assessment 2000 (current year basis) is Rm120,000 and its Section 108 account as at 1.1.2000 is Rm5,000. The financial year end of the two companies is 31 March. Required: (i) Show how the failure to deduct tax at source has affected the tax computation of the holding company; (2 marks) (ii) Compute the Section 108 balance of Linefo Sdn Bhd as at 1.1.2001. (4 marks) (11 marks) End of Question Paper

11

[P.T.O.

Vous aimerez peut-être aussi

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionD'EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionPas encore d'évaluation

- F6 2001 Jun QDocument11 pagesF6 2001 Jun QDylan Ngu Tung HongPas encore d'évaluation

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionD'EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionPas encore d'évaluation

- F6 Pilot PaperDocument19 pagesF6 Pilot PaperSoon SiongPas encore d'évaluation

- Uog Year 2 Taxation Paper Uog March 2013Document9 pagesUog Year 2 Taxation Paper Uog March 2013helenxiaochingPas encore d'évaluation

- 2009 June QuestionsDocument10 pages2009 June QuestionsFatuma Coco BuddaflyPas encore d'évaluation

- New Employment Inc QnsDocument13 pagesNew Employment Inc QnsLoveness JoseehPas encore d'évaluation

- Case Study - Chapter 1 2 3 4 - 2Document5 pagesCase Study - Chapter 1 2 3 4 - 2Lê Ngọc Vân NhiPas encore d'évaluation

- Public Finance & TaxationDocument4 pagesPublic Finance & Taxationfikremaryam hiwiPas encore d'évaluation

- Chapter 49-Pfrs For SmesDocument6 pagesChapter 49-Pfrs For SmesEmma Mariz Garcia40% (5)

- Taxation - Questions Sepr 2012Document17 pagesTaxation - Questions Sepr 2012kannadhassPas encore d'évaluation

- Assignment MBA III: Business Taxation: TH THDocument4 pagesAssignment MBA III: Business Taxation: TH THShubham NamdevPas encore d'évaluation

- Mock Exam Qs en June2017Document17 pagesMock Exam Qs en June2017Vannak2015Pas encore d'évaluation

- ACC 4041 Tutorial - Investment IncentivesDocument4 pagesACC 4041 Tutorial - Investment IncentivesAyekurikPas encore d'évaluation

- Dec 2007 PDFDocument9 pagesDec 2007 PDFeric_mdisPas encore d'évaluation

- Question Analysis: Taxation IDocument9 pagesQuestion Analysis: Taxation IIQBALPas encore d'évaluation

- Ftxmys 2012 Jun QDocument13 pagesFtxmys 2012 Jun Qaqmal16Pas encore d'évaluation

- Ac5007 QuestionsDocument8 pagesAc5007 QuestionsyinlengPas encore d'évaluation

- Tax Laws in Tanzania: Taxation Questions & AnswersDocument11 pagesTax Laws in Tanzania: Taxation Questions & AnswersKessy Juma90% (119)

- Tax IllustrationsDocument7 pagesTax IllustrationsMsema KweliPas encore d'évaluation

- Acca Tx-Mys 2019 JuneDocument14 pagesAcca Tx-Mys 2019 JuneChoo LeePas encore d'évaluation

- Deloitte Tax Challenge 2012Document4 pagesDeloitte Tax Challenge 2012伟龙Pas encore d'évaluation

- Certified Accounting Technician Examination Advanced Level Paper T9 (SGP)Document14 pagesCertified Accounting Technician Examination Advanced Level Paper T9 (SGP)springnet2011Pas encore d'évaluation

- Acc 3013 - Fwa Revision QuestionsDocument12 pagesAcc 3013 - Fwa Revision Questionsfalnuaimi001Pas encore d'évaluation

- Mock Exam Paper: Time AllowedDocument9 pagesMock Exam Paper: Time AllowedVannak2015Pas encore d'évaluation

- Cat/fia (FTX)Document21 pagesCat/fia (FTX)theizzatirosliPas encore d'évaluation

- Advanced Taxation: Certified Finance and Accounting Professional Stage ExaminationDocument6 pagesAdvanced Taxation: Certified Finance and Accounting Professional Stage ExaminationSuman UroojPas encore d'évaluation

- F6MYS 2014 Jun QDocument12 pagesF6MYS 2014 Jun QBeeJuPas encore d'évaluation

- Tax ReviewerDocument22 pagesTax ReviewercrestagPas encore d'évaluation

- Assignment (20%) TRIMESTER 1, 2019/2020 BAC2674 Taxation I: % of Similarity % of Marks DeductionDocument5 pagesAssignment (20%) TRIMESTER 1, 2019/2020 BAC2674 Taxation I: % of Similarity % of Marks DeductionArjun DonPas encore d'évaluation

- Taxation Attempt All Questions (10 10 100)Document6 pagesTaxation Attempt All Questions (10 10 100)Mff DeadsparkPas encore d'évaluation

- ACC4182010 BDocument10 pagesACC4182010 Bashra16605Pas encore d'évaluation

- SVKM'S Nmims Anil Surendra Modi School of Commerce Sybcom Sem Iii (2019-22) Subject Name: Direct Taxation No. of Hours: 2 Hours InstructionsDocument20 pagesSVKM'S Nmims Anil Surendra Modi School of Commerce Sybcom Sem Iii (2019-22) Subject Name: Direct Taxation No. of Hours: 2 Hours InstructionsMadhuram SharmaPas encore d'évaluation

- Practice Questions - 08-06-2023Document2 pagesPractice Questions - 08-06-2023MUHAMMAD AHMEDPas encore d'évaluation

- Model Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFDocument5 pagesModel Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFShah SujitPas encore d'évaluation

- T 5 Business Expenses PT 2 2015Document15 pagesT 5 Business Expenses PT 2 2015DarshiniPas encore d'évaluation

- Taxation Management and PlanningDocument10 pagesTaxation Management and PlanningJoel EdauPas encore d'évaluation

- Advanced Taxation (Malaysia) : Professional Pilot Paper - Options ModuleDocument20 pagesAdvanced Taxation (Malaysia) : Professional Pilot Paper - Options ModuleTang Swee ChanPas encore d'évaluation

- Dec 06Document13 pagesDec 06Kelly Tan Xue LingPas encore d'évaluation

- Tax ComputationDocument13 pagesTax ComputationEcha Sya0% (1)

- T4Q RCA2 2020 Personal Tax Comp FocusDocument3 pagesT4Q RCA2 2020 Personal Tax Comp FocusHaananth SubramaniamPas encore d'évaluation

- F6uk 2012 Dec QDocument13 pagesF6uk 2012 Dec QSaad HassanPas encore d'évaluation

- Taxation MalawiDocument15 pagesTaxation MalawiCean Mhango100% (1)

- ACCA CAT Paper T9 Preparing Taxation Computations Solved Past PapersDocument190 pagesACCA CAT Paper T9 Preparing Taxation Computations Solved Past PapersJennifer Edwards0% (1)

- Term Test 2Document5 pagesTerm Test 2lalshahbaz57Pas encore d'évaluation

- AE 221 Unit 3 Problems PDFDocument5 pagesAE 221 Unit 3 Problems PDFMae-shane SagayoPas encore d'évaluation

- Quick Quiz 1 SS 2021 B (Que)Document3 pagesQuick Quiz 1 SS 2021 B (Que)Tiana Ling Jiunn LiPas encore d'évaluation

- Mauritian Taxation - Ba Acctg and FinanceDocument8 pagesMauritian Taxation - Ba Acctg and Financemissyemylia27novPas encore d'évaluation

- F6 InterimDocument7 pagesF6 InterimSad AnwarPas encore d'évaluation

- Tutorial 3 WHT DiscussDocument6 pagesTutorial 3 WHT DiscussAqila Syakirah IVPas encore d'évaluation

- Acca TX Mys DEC 2019 Sample QuestionsDocument24 pagesAcca TX Mys DEC 2019 Sample QuestionsShazwanieSazaliPas encore d'évaluation

- TAX320Document14 pagesTAX320Faiz MohamadPas encore d'évaluation

- TradesDocument3 pagesTradesAlber Howell MagadiaPas encore d'évaluation

- QuestionsDocument7 pagesQuestionsMyra RidPas encore d'évaluation

- Intacc3 Other Problems On ProvisionsDocument8 pagesIntacc3 Other Problems On ProvisionsMa. Nica Del RosarioPas encore d'évaluation

- Tutorial 1: 1. Included in The Cost of Sales AreDocument3 pagesTutorial 1: 1. Included in The Cost of Sales AreOrangeeeePas encore d'évaluation

- Taxation (United Kingdom) : Tuesday 12 June 2012Document12 pagesTaxation (United Kingdom) : Tuesday 12 June 2012Iftekhar IftePas encore d'évaluation

- Fundamental of Taxation and Auditing (Mgt.218) - BBS Third Year - 4 Years Program - Model Question - With SOLUTIONDocument21 pagesFundamental of Taxation and Auditing (Mgt.218) - BBS Third Year - 4 Years Program - Model Question - With SOLUTIONRiyaz RangrezPas encore d'évaluation

- Mock Sep 2023 - Question PaperDocument8 pagesMock Sep 2023 - Question Paperfahadkhn871Pas encore d'évaluation

- Kenya Methodist University: Endof1 Trimester 2022 (PT) ExaminationDocument5 pagesKenya Methodist University: Endof1 Trimester 2022 (PT) ExaminationJoe 254Pas encore d'évaluation

- Heat Pump Dryer: User ManualDocument56 pagesHeat Pump Dryer: User ManualDylan Ngu Tung HongPas encore d'évaluation

- Hess513 Wastewater Enginering - Problem Statement: P01: How Clean or Dirty Water Is?Document5 pagesHess513 Wastewater Enginering - Problem Statement: P01: How Clean or Dirty Water Is?Dylan Ngu Tung HongPas encore d'évaluation

- Horizontal DistanceDocument33 pagesHorizontal DistanceDylan Ngu Tung HongPas encore d'évaluation

- Tut 1Document1 pageTut 1Dylan Ngu Tung HongPas encore d'évaluation

- Penyata Akaun / Statement of Account: Layak Untuk Dilindungi Oleh PIDMDocument2 pagesPenyata Akaun / Statement of Account: Layak Untuk Dilindungi Oleh PIDMDylan Ngu Tung HongPas encore d'évaluation

- MTH10007 Notes s1-2015Document208 pagesMTH10007 Notes s1-2015Dylan Ngu Tung Hong0% (1)

- Parents Are The Best TeacherDocument7 pagesParents Are The Best TeacherDylan Ngu Tung HongPas encore d'évaluation

- F6 1999 Jun ADocument7 pagesF6 1999 Jun ADylan Ngu Tung HongPas encore d'évaluation

- Chapter 7 StatisticsDocument15 pagesChapter 7 StatisticsDylan Ngu Tung HongPas encore d'évaluation

- Case Study - Chapter 1 2 3 4 - 2Document5 pagesCase Study - Chapter 1 2 3 4 - 2Lê Ngọc Vân NhiPas encore d'évaluation

- Upload 5Document10 pagesUpload 5BencePalacPas encore d'évaluation

- Sample ProblemsDocument7 pagesSample ProblemsArvin Kim AriatePas encore d'évaluation

- Bar Q and ADocument20 pagesBar Q and AshakiraPas encore d'évaluation

- Cases On TaxationDocument13 pagesCases On TaxationPeanutButter 'n JellyPas encore d'évaluation

- Tax Invoice - TMFYVDDocument1 pageTax Invoice - TMFYVDTauriq SafodienPas encore d'évaluation

- Invoice 458608Document1 pageInvoice 458608mi fokkoPas encore d'évaluation

- Project Report On: Tax Avoidence and Tax EvasionDocument3 pagesProject Report On: Tax Avoidence and Tax EvasionAnupam BeoharPas encore d'évaluation

- Acknowledgment Receipt-Doas Land-2018Document1 pageAcknowledgment Receipt-Doas Land-2018Athena SalasPas encore d'évaluation

- Cor Clearing LLC The Landmark Center 1299 Farnam Street SUITE 800 OMAHA, NE 68102Document10 pagesCor Clearing LLC The Landmark Center 1299 Farnam Street SUITE 800 OMAHA, NE 68102luisPas encore d'évaluation

- Form of NBR IT Return For IndividualsDocument10 pagesForm of NBR IT Return For IndividualsSumit GPas encore d'évaluation

- Invoice Woodland Shoes FlipcartDocument4 pagesInvoice Woodland Shoes FlipcartPrashant AdhikariPas encore d'évaluation

- Metropolis Town Villa Cost SheetDocument1 pageMetropolis Town Villa Cost SheetpreanandPas encore d'évaluation

- CV Nadia ManoppoDocument2 pagesCV Nadia ManoppoJoni HaryonoPas encore d'évaluation

- Boat Airdopes 141 PDFDocument1 pageBoat Airdopes 141 PDFSantosh SharmaPas encore d'évaluation

- Case Digest in Taxation Law ReviewDocument11 pagesCase Digest in Taxation Law ReviewJanine Kae UrsulumPas encore d'évaluation

- Atlantic Fish Company Is A Wholesale Distributor of Cod TheDocument1 pageAtlantic Fish Company Is A Wholesale Distributor of Cod TheAmit PandeyPas encore d'évaluation

- Salary Slip (70015365 June, 2018)Document1 pageSalary Slip (70015365 June, 2018)Mesum Rashee ShakarPas encore d'évaluation

- Epayslip 2024-01-26 11319801Document1 pageEpayslip 2024-01-26 11319801Anthony Balaba MabaoPas encore d'évaluation

- Lifelong LLIC20 Induction Cooktop: Grand Total 1249.00Document4 pagesLifelong LLIC20 Induction Cooktop: Grand Total 1249.00P SinghPas encore d'évaluation

- GST Issues Real Estate Sector Yashwant KasarDocument49 pagesGST Issues Real Estate Sector Yashwant KasarSaikrishna AlluPas encore d'évaluation

- Certificate of Update of Exemption and of Employer's and Employee's InformationDocument5 pagesCertificate of Update of Exemption and of Employer's and Employee's InformationRollyPas encore d'évaluation

- ITR2015Document1 pageITR2015Drizza FerrerPas encore d'évaluation

- OM No. 2018-04-03Document2 pagesOM No. 2018-04-03Christian Albert HerreraPas encore d'évaluation

- Questionnaire 30% Ruling - 2020Document5 pagesQuestionnaire 30% Ruling - 2020nitish dikshitPas encore d'évaluation

- Income Tax Lessons July 2019 0 PDFDocument124 pagesIncome Tax Lessons July 2019 0 PDFHannah YnciertoPas encore d'évaluation

- Flipkart Clothes - 27823Document1 pageFlipkart Clothes - 27823raghuveer9303Pas encore d'évaluation

- Tax Calculator AY 09-10Document4 pagesTax Calculator AY 09-10madhuamsPas encore d'évaluation

- Book1 PsDocument2 pagesBook1 PsVincent IgnacioPas encore d'évaluation

- BLESS 20121209 00003 941541 financial5ROC CREDocument2 pagesBLESS 20121209 00003 941541 financial5ROC CREEcho WackoPas encore d'évaluation

- Rice, Noodle, Fish: Deep Travels Through Japan's Food CultureD'EverandRice, Noodle, Fish: Deep Travels Through Japan's Food CultureÉvaluation : 4 sur 5 étoiles4/5 (20)

- Lands of Lost Borders: A Journey on the Silk RoadD'EverandLands of Lost Borders: A Journey on the Silk RoadÉvaluation : 3.5 sur 5 étoiles3.5/5 (53)

- Korean Picture Dictionary: Learn 1,500 Korean Words and Phrases (Ideal for TOPIK Exam Prep; Includes Online Audio)D'EverandKorean Picture Dictionary: Learn 1,500 Korean Words and Phrases (Ideal for TOPIK Exam Prep; Includes Online Audio)Évaluation : 4.5 sur 5 étoiles4.5/5 (9)

- Learn Mandarin Chinese with Paul Noble for Beginners – Complete Course: Mandarin Chinese Made Easy with Your 1 million-best-selling Personal Language CoachD'EverandLearn Mandarin Chinese with Paul Noble for Beginners – Complete Course: Mandarin Chinese Made Easy with Your 1 million-best-selling Personal Language CoachÉvaluation : 5 sur 5 étoiles5/5 (15)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassD'EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassPas encore d'évaluation

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantD'EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantÉvaluation : 4 sur 5 étoiles4/5 (104)

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsD'EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsPas encore d'évaluation

- Learn Chinese: A Comprehensive Guide to Learning Chinese for Beginners, Including Grammar, Short Stories and Popular PhrasesD'EverandLearn Chinese: A Comprehensive Guide to Learning Chinese for Beginners, Including Grammar, Short Stories and Popular PhrasesPas encore d'évaluation

- We Are Soldiers Still: A Journey Back to the Battlefields of VietnamD'EverandWe Are Soldiers Still: A Journey Back to the Battlefields of VietnamÉvaluation : 4 sur 5 étoiles4/5 (28)

- The Longevity Plan: Seven Life-Transforming Lessons from Ancient ChinaD'EverandThe Longevity Plan: Seven Life-Transforming Lessons from Ancient ChinaPas encore d'évaluation

- Real Japanese, Part 1: An Introductory Guide to the Language and Culture of JapanD'EverandReal Japanese, Part 1: An Introductory Guide to the Language and Culture of JapanÉvaluation : 4.5 sur 5 étoiles4.5/5 (15)

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.D'EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Évaluation : 5 sur 5 étoiles5/5 (89)

- A Short Ride in the Jungle: The Ho Chi Minh Trail by MotorcycleD'EverandA Short Ride in the Jungle: The Ho Chi Minh Trail by MotorcycleÉvaluation : 4.5 sur 5 étoiles4.5/5 (16)

- Black Dragon River: A Journey Down the Amur River at the Borderlands of EmpiresD'EverandBlack Dragon River: A Journey Down the Amur River at the Borderlands of EmpiresÉvaluation : 4 sur 5 étoiles4/5 (25)

- Mastering Chinese Words: Expanding Your Vocabulary with 2500 of the Most Common Chinese WordsD'EverandMastering Chinese Words: Expanding Your Vocabulary with 2500 of the Most Common Chinese WordsÉvaluation : 4.5 sur 5 étoiles4.5/5 (30)

- Survival Chinese: How to Communicate without Fuss or Fear Instantly! (A Mandarin Chinese Language Phrasebook)D'EverandSurvival Chinese: How to Communicate without Fuss or Fear Instantly! (A Mandarin Chinese Language Phrasebook)Évaluation : 3.5 sur 5 étoiles3.5/5 (7)

- Nihongi: Chronicles of Japan from the Earliest of Times to A.D. 697D'EverandNihongi: Chronicles of Japan from the Earliest of Times to A.D. 697Évaluation : 5 sur 5 étoiles5/5 (2)

- The Best Team Wins: The New Science of High PerformanceD'EverandThe Best Team Wins: The New Science of High PerformanceÉvaluation : 4.5 sur 5 étoiles4.5/5 (31)

- Brief History of China: Dynasty, Revolution and Transformation: From the Middle Kingdom to the People's RepublicD'EverandBrief History of China: Dynasty, Revolution and Transformation: From the Middle Kingdom to the People's RepublicÉvaluation : 5 sur 5 étoiles5/5 (6)

- Lonely Planet Malaysia, Singapore & BruneiD'EverandLonely Planet Malaysia, Singapore & BruneiÉvaluation : 3.5 sur 5 étoiles3.5/5 (14)

- Chinese for Beginners: A Comprehensive Guide for Learning the Chinese Language QuicklyD'EverandChinese for Beginners: A Comprehensive Guide for Learning the Chinese Language QuicklyÉvaluation : 5 sur 5 étoiles5/5 (32)

- How To Budget And Manage Your Money In 7 Simple StepsD'EverandHow To Budget And Manage Your Money In 7 Simple StepsÉvaluation : 5 sur 5 étoiles5/5 (4)