Académique Documents

Professionnel Documents

Culture Documents

Yuyutu

Transféré par

Deepak R GoradTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Yuyutu

Transféré par

Deepak R GoradDroits d'auteur :

Formats disponibles

FINAL A/C 1.

From the following information prepare Trading Account: Opening stock 5000 Sales Return 400 Sales a/c 20000 Manufacturing Expenses 100 Purchase return 200 Octroi 500 Wages a/c 4000 Power 700 Carriage inward 300 Purchase a/c 8000 st Closing Stock (31 December 2011) Rs. 2000. 2. Prepare Profit & Loss A/c: Carriage on purchase 2000 Carriage on sales 1000 Duty on Export 2020 Lighting 1050 Water & Electricity 2120 Advertisement 100 Salary of factory manager 2200 Salary of office manager 1500 Gross Profit 15200 Rent received 1500 Rent paid 500 Commission (cr.) 1200 3. Following are the closing balances on 31st march 2012: Outstanding rent 100 Creditors 1800 Bank 3000 Machinery 6300 Capital 20000 Prepaid wages 400 Net loss 4800 Debtors 5400 Drawing 1800 Closing stock 1200

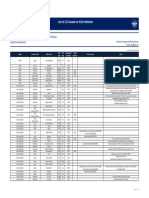

4. From the following Trial- Balance extracted from the books of M/S Rai Bros., prepare Final Accounts for the year ending 31st march 2012. TRIAL-BALANCE Particulars Debtors & Creditors Capital & Drawings Rent & Rates Trade Expenses Purchases & Sales Returns Carriage Inward Wages Salaries Opening Stock Discount Bad Debts Plant & Machinery Furniture Cash in hand Cash at bank Total Closing stock amounted to Rs. 14220. 5. From the following Trial- Balance prepare Final Accounts for the year ending 31st march 2012. TRIAL-BALANCE Particulars Debit Credit Amount Amount Debtors & Creditors 2700 1400 Capital & Drawings 900 10000 Rent & Rates 450 Sundry Expenses 200 Purchases & Sales 9500 14500 Carriage 150 Wages 5000 Opening Stock 2000 Plant & Machinery 3500 Cash at bank 1500 Total 25900 25900 Debit Amount 12000 2900 250 670 8640 190 250 2920 1200 3100 180 200 2510 1800 500 15400 52710 Credit Amount 7900 30000 14290 280

240

52710

6. The following is the trial-balance of Mr. Kapur on 31st march 2012. Particulars Debtors & Creditors Capital & Drawings Carriage outward Purchases & Sales Returns Carriage Inward Wages Opening Stock Building Salaries Patents General expenses Insurance Fuel & Power Plant & Machinery Furniture Cash in hand Cash at bank Total Debit Amount 29000 10490 4080 81350 1360 6400 20960 11520 60000 30000 15000 6000 1200 9460 40000 20000 1080 5260 353160 Credit Amount 12600 142000 197560 1000

353160

Taking into account the following adjustments, prepare Final Accounts. 1. Closing stock amounted to Rs. 13600. 2. Machinery is to be depreciated at the rate of 10% and patents at the rate of 20%. 3. Salaries for the month of March, 2012 amount to Rs. 3000 were unpaid. 4. Insurance include a premium of Rs. 170 for the next year. 5. Outstanding wages Rs. 4000. 6. Provision for bad & doubtful debt is 5% on debtors.

7. The following is the trial-balance of Punjab Jewelers as on 31st march 2012. Particulars Debtors & Creditors Capital Advertisement Purchases & Sales Purchase returns Commission received Opening Stock Repairs & Maintenance Salaries Car General expenses Insurance Building Furniture Cash in hand Cash at bank Total Debit Amount 500000 220000 2250000 720000 130000 300000 350000 160000 70000 4258000 100000 35000 60000 9153000 Credit Amount 398000 5000000 3500000 180000 75000

9153000

Taking into account the following adjustments, prepare Final Accounts. 1. Closing stock amounted to Rs. 800000. 2. Provide depreciation on Building @ 5%, Furniture @ 10% and car @ 20%. 3. Salaries for the month of March, 2012 amount to Rs. 30000 were unpaid. 4. Prepaid advertisement Rs. 20000. 5. Goods used for domestic purpose Rs. 18000. 6. Provision for bad & doubtful debt is 2% on debtors.

8. From the following trial-balance of Mr. Ram prepare Manufacturing, Trading and Profit & Loss Account for the year ended 31st December 2011 and Balance-Sheet on that date: Particulars Debtors & Creditors Capital & Drawings Carriage outward Purchases & Sales Returns Carriage Inward Wages Opening Stock Loan @ 9% (1st may 11) Coal, Gas & Water Duty & Clearing Charges Office Rent Printing & Stationery Bad Debts Reserve Bills Receivable & Payble Salaries Bank Charges General expenses Insurance Factory Rent Plant & Machinery Furniture Cash in hand Cash at bank Total Debit Amount 60000 5000 4200 100000 2500 7500 10000 30000 1200 1500 2500 500 45000 18000 25 800 350 1900 65000 3500 1250 4525 365250 750 10000 Credit Amount 28000 100000 200000 1500

25000

365250

Taking into account the following adjustments, prepare Final Accounts. 1. Closing stock amounted to Rs. 40000. 2. Machinery is to be depreciated at the rate of 10%. 3. Outstanding expenses are: Salaries Rs. 2400, factory rent Rs. 1500, Office Rent Rs. 550. 4. Interest on capital at 5% per annum. 5. Goods withdrawn for personal use Rs. 2525. 6. Provision for bad & doubtful debt is 2.5% on debtors after elimination of bad debts amounting to Rs. 2000. 7. The manager is allowed a commission of 5% of net profit before charging the commission.

9. From the following trial-balance prepare Trading and Profit & Loss Account for the year ended 31st December 2011 and Balance-Sheet on that date: Particulars Debit Credit Amount Amount Debtors & Creditors 29260 44000 Capital & Drawings 13200 228800 Freehold Property 66000 Purchases & Sales 110000 231440 Returns 1100 Wages 35200 Opening Stock 38500 Loan to Krishna @ 10% (Balance on 1-1-11) 44000 Gas & Fuel 2970 Office expenses 2750 Freight 9900 Loose Tools 2200 Bad Debts Reserve 880 Interest on loan to Krishna 1100 Bills Receivable & Payble 5500 Salaries 13200 Discount 1320 Postage 1540 Bad Debts 660 Insurance 1760 Factory Lighting 1100 Office Rent 2860 Plant & Machinery 99000 Furniture 5500 Cash in hand 2640 Cash at bank 29260 Total 512820 512820 Taking into account the following adjustments, prepare Final Accounts. 1. Closing stock amounted to Rs. 72600. 2. A Machinery was installed during the year costing Rs. 15400, but it was not recorded in the books as no payment was made for it. Wages Rs. 1100 paid for its erection has been debited to wages account. 3. Depreciate: Plant & Machinery by 33.33% Furniture by 10% Freehold Property by 5% 4. Loose tools were valued at Rs. 1760 on 31st December 2011. 5. Of the sundry debtors Rs. 600 are bad and should be written off. 6. Provision for bad & doubtful debt is 5% on debtors. 7. The manager is allowed a commission of 10% of net profit after charging the commission.

10. Mr. Krishna Kumar carries on the business as a retailer. He extracted the following balances from his books of accounts as on 31st March 2012. Particulars Debit Credit Amount Amount Capital account 750000 Drawings 18000 Buildings 500000 Furniture & Fixtures 20000 Opening stock 225000 Sales 1800000 Purchases 1337000 Creditors 200000 Debtors 500000 Office expenses 24000 Salaries 18000 Rent 6000 Traveling & conveyance 4000 Insurance 1000 Motorcar expenses 15000 Postage & Telephones 3600 Electricity charges 2400 Fixed deposits with bank@ 10% interest 50000 Cash in hand 1000 Cash at bank 10000 Loan from H.C. @ 12% interest 25000 Motor Car 40000 Printing & Stationery 5000 Provision for Bad & Doubtful Debts 5000 Total 2780000 2780000 You are required to prepare a Trading. Profit & Loss account and BalanceSheet for the year ending 31st March 2012 taking into consideration the following adjustments: (i) Closing Stock amounts to be Rs.300000. (ii) A customer returned goods on 31st March 2012 amounting to Rs.4000, which was not accounted for , but already included in the closing stock at selling price. The cost price of said goods was Rs.3200. (iii) Annual insurance premium of Rs.1000 is valid upto 30th June 2012. (iv) Provision for bad and doubtful debts is to be kept at % on debtors. (v) interest on fixed deposit and payable on loan from H.C. is to be provided. (vi) Provide depreciation on Buildings at 2.5%, on furniture 10% and on motorcar 20%. (vii) Mr. Krishna Kumar withdraw goods for personal use costing Rs.2000. (viii) Make a provision for discount on debtors at 2% and discount on creditors at 1%.

11. The following is the trial-balance of Mr. Kapur on 31st march 2012 Particulars Debit Credit Amount Amount Debtors & Creditors 20,000 25,000 Capital & Drawings 4,000 9,30,000 Carriage outward 2,000 Purchases & Sales 5,00,000 12,00,000 Returns 15,000 25,000 Carriage Inward 7,000 Wages 50,000 Opening Stock 35,000 Building 5,50,000 Salaries 1,00,000 Patents 40,000 General expenses 20,000 Insurance 5,000 Fuel & Power 2,000 Plant & Machinery 7,00,000 Furniture 75,000 Cash in hand 10,000 Cash at bank 45,000 Total 2,18,00,000 2,18,00,000 Taking into account the following adjustments, prepare Final Accounts. Closing stock amounted to Rs. 45,000. Machinery is to be depreciated at the rate of 10% and patents at the rate of 20%. Salaries for the month of March, 2012 amount to Rs. 10,000 were unpaid. Insurance include a premium of Rs. 500 for the next year. Outstanding wages Rs. 4000. Provision for bad & doubtful debt is 5% on debtors.

12. The following is the trial-balance of Punjab Jewelers as on 31st march 2012. Particulars Debit Credit Amount Amount Debtors & Creditors 1,00,000 75,000 Capital 3,500 2,10,000 Advertisement 2,500 Purchases & Sales 2,10,000 5,00,000 Purchase returns 2,000 Commission received 5,000 Opening Stock 39,000 Repairs & Maintenance 2,100 Salaries 6,000 Car 2,400 General expenses 1,50,000 Insurance 500 Building 2,00,000 Furniture 50,000 Cash in hand 10,000 Cash at bank 12,000 Total 7,90,000 7,90,000 Taking into account the following adjustments, prepare Final Accounts. 1. Closing stock amounted to Rs. 45,000. 2. Provide depreciation on Building @ 5%, Furniture @ 10% and car @ 20%. 3. Salaries for the month of March, 2012 amount to Rs. 300 were unpaid. 4. Prepaid advertisement Rs. 200. 5. Goods used for domestic purpose Rs. 18000. 7. Provision for bad & doubtful debt is 2% on debtors.

13. The following is the trial-balance prepare final accounts on 31st December 2012. Particulars Debit Credit Amount Amount Debtors & Creditors 54000 21400 Capital 180000 Carriage 8200 Sales 240000 Returns 5000 Material consumed 150000 Wages 36100 Loan from Kapil @ 12% (balance on 1-4-12) 10000 Closing Stock 46500 Power & Fuel 5400 Coal, gas & water 2200 Trade expenses 14500 Rates & taxes 5200 Loose tools 16000 Bad debts reserve 7600 Interest on Kapils loan 600 Bills Receivable & Bills payable 4000 3700 Salaries 20000 Discount 600 Outstanding trade expenses 2000 Insurance premium 4500 Bad debts 1800 Fire insurance 3000 Outstanding wages 3400 Bank charges 300 Plant & Machinery 80000 Furniture 18000 Cash in hand 1600 Bank 8200 Total 476900 476900 Taking into account the following adjustments, prepare Final Accounts. 1. Provision for bad & doubtful debt is Rs.4000. 2. Carry forward the following unexpired amounts: (a) Fire insurance Rs.500 (b) Rates & taxes Rs.1200 (c) Insurance premium Rs.1500 3. Wages include Rs.5000 spent on installation of a new machine on 1st January 2012. 4. Depreciate plant & machinery by 10% and furniture by 20%. 5. Loose tools were valued at Rs.12000 on 31st December 2012. 6. accrued income Rs.2300.

14. On 31st March 2012 the following Trial Balance has been extracted from the books of a merchant: Debit Balances Amount Credit balances Amount Drawings A/c 3,000 Capital Account 30,000 Debtors 19,100 Creditors 8,401 5% loan on mortgage Interest on Loan 200 (1.4.2011) 8,500 Cash in hand Opening Stock Motor Vehicles Cash at bank Land & Building Bad Debts Purchases Sales Return Carriage Outward Advertisement General Expenses Bills Receivables Carriage Inward Establishment Rates, Taxes & Insurance 3,050 5,839 9,000 4,555 12,000 625 67,458 7,821 1,404 2,264 4,489 6,882 3,929 8,097 Bad Debts Provision Purchas Return Discount Bills Payable Rent Received Sales 710 1,346 440 2,714 250 1,11,243

3,891 163604 163604 Prepare Trading and Profit & Loss Account for the year ending on 31st March 2012 and a Balance Sheet as on that date after considering the following matters: Depreciate Land & Building at 5% p.a. and motor vehicles at 15% p.a. Goods costing Rs. 600 were sent to a customer on sale or return basis for Rs. 700 on 30th March 2012 and has been recorded in the books as actual sales. Salaries amounting to Rs. 700 and rates amounting to Rs. 400 due. A fire broke out on 1st April 2012 destroying goods worth Rs. 200. The provision for doubtful debts is to be brought up to 5% on sundry debtors. Stock in hand on 31st March 2012was valued at Rs. 6,250. Goods costing Rs. 500 were taken away by the proprietor for his personal use; no entry has been made in the books of accounts. Prepaid insurance amounted to Rs. 175.

Provide for managers commission at 5% on net profit after charging such commission.

15. From the following trial balance and information, prepare Trading and Profit & Loss a/c of Mr. Rishabh for the year ended 31st March 2012 and a Balance-Sheet as on that date: Particulars Capital/Drawing Land & Building Plant & Machinery Furniture Sales/Purchase Returns Debtors/Creditors Loan from Gajanand on 1.7.2011 @6%p.a. Carriage Sundry Expenses Printing & Stationery Insurance Expenses Provision for doubtful debts Provision for discount on Debtors Bad Debts Profit of Textile Dept. Stock of General Goods on 1.4.2011 Salaries & Wages Trade Expense Stock of Textile Goods on 31.3.2012 Cash at Bank Cash in Hand Debit Amount 12,000 90,000 20,000 5,000 80,000 5,000 18,400 Credit Amount 1,00,000

1,40,000 4,000 12,000 30,000

10,000 600 500 1,000 1,000 380 400 10,000 21,300 18,500 800 8,000 4,600 1,280 297,380

297,380

Additional Information: Stock of general goods on 31.3.2012 valued at Rs. 27,300. Fire occurred on 23rd March 2012 and Rs.10,000 worth of general goods were destroyed. The insurance company accepted claim for Rs. 6,00o only and paid the claim money on 10th April 2012. Bad Debts amounting to Rs. 400 are to be written off. Provision for doubtful debts is to be made at 5% and for discount at 2% on debtors. Make a provision of 2% on creditors for discount. Received Rs. 6,000 worth of goods on 27th March 2012 but the invoice of purchase was not recorded in purchase book. Rishabh took away goods worth Rs. 2,000 for personal use but no record was made thereof. Charged depreciation at 2% on Land & Buildings, 20% on Plant & Machinery, and 5% on furniture. Insurance prepaid amounts to Rs. 200.

Manufacturing Account 1. From the following particulars of Mr. Ganesh, Prepare, Manufacturing, Trading & Profit & Loss Accounts for the year ended 31st March 2012 and Balance-Sheet as on that date after adjustment entries: Particulars Debit Credit Amount Amount Debtors & Creditors 11,000 80,000 Capital & Drawings 70,000 2,50,000 Building 1,50,000 Purchases & Sales 1,20,000 6,75,000 Returns 860 5,300 Manufacturing Wages 60,000 Manufacturing Expenses 50,000 Opening Stock Raw Materials 40,000 Work In Progress 30,000 Finished Goods 20,000 Discount 1,500 5,720 Carriage Inward 4,000 Carriage Outward 4,200 Interest & Bank Charges 1,260 Insurance 3,000 Bad Debts 1,500 Bad Debts Reserve 6,000 Bank Overdraft 40,000 Furniture 15,000 Plant & Machinery 4,50,000 Salaries 28,000 Cash in hand 1,400 Cash at bank 300 Total 10,62,020 10,62,020 Additional Information: Outstanding Manufacturing Expenses are Rs. 500. Closing Stock of Raw Material Rs. 25,000, W.I.P. Rs. 20000 and Finished Goods Rs. 20,000. Depreciate Machinery @ 10%.

Vous aimerez peut-être aussi

- Final AccountsDocument12 pagesFinal Accountsanandm1986100% (1)

- Final AccountsDocument12 pagesFinal AccountsHarish SinghPas encore d'évaluation

- Final AcctsDocument7 pagesFinal AcctsSyed ShabirPas encore d'évaluation

- FA - Excercises & Answers PDFDocument17 pagesFA - Excercises & Answers PDFRasanjaliGunasekeraPas encore d'évaluation

- Final AccDocument13 pagesFinal Accmdr32000Pas encore d'évaluation

- 01 Company Final Accounts QuestionsDocument10 pages01 Company Final Accounts QuestionsMd. Iqbal Hasan0% (1)

- Accounting ProblemsDocument9 pagesAccounting ProblemsMukta MattaPas encore d'évaluation

- Management Accounting Assignment 8 QDocument7 pagesManagement Accounting Assignment 8 Qdharamraj22Pas encore d'évaluation

- Final Accounts Revision ProblemsDocument4 pagesFinal Accounts Revision Problemsblazingsun_11Pas encore d'évaluation

- Venu SirDocument32 pagesVenu SirvenuvenugopalPas encore d'évaluation

- Extra AfaDocument5 pagesExtra AfaJesmon RajPas encore d'évaluation

- P5 Syl2012 InterDocument12 pagesP5 Syl2012 InterVimal ShuklaPas encore d'évaluation

- Final Account HWDocument5 pagesFinal Account HWniks4585Pas encore d'évaluation

- Final AccountsDocument5 pagesFinal AccountsGopal KrishnanPas encore d'évaluation

- 438Document6 pages438Rehan AshrafPas encore d'évaluation

- Accounting 1 FinalDocument2 pagesAccounting 1 FinalchiknaaaPas encore d'évaluation

- Accounting and Finance Numericals Problems and AnsDocument11 pagesAccounting and Finance Numericals Problems and AnsPramodh Kanulla0% (1)

- Final AccountsDocument27 pagesFinal AccountsNafis Siddiqui100% (1)

- Accounting I.com 2Document4 pagesAccounting I.com 2Saqlain KazmiPas encore d'évaluation

- Cash Flow StatementDocument2 pagesCash Flow StatementAmolsKordePas encore d'évaluation

- Far100 110Document12 pagesFar100 110itssfatinPas encore d'évaluation

- Loyola College (Autonomous), Chennai - 600 034.: First Semester - Nov 2005Document4 pagesLoyola College (Autonomous), Chennai - 600 034.: First Semester - Nov 2005Charles VinothPas encore d'évaluation

- Accountancy - Paper-I - 2012Document3 pagesAccountancy - Paper-I - 2012MaryamQaaziPas encore d'évaluation

- DU B.com (H) First Year (Financial Acc.) - Q Paper 2010Document7 pagesDU B.com (H) First Year (Financial Acc.) - Q Paper 2010mouryastudypointPas encore d'évaluation

- Assignment Accounting FundamentalsDocument2 pagesAssignment Accounting FundamentalsRajshree DewooPas encore d'évaluation

- Problem 1:: Company Final Accounts: Problems and Solutions - AccountingDocument28 pagesProblem 1:: Company Final Accounts: Problems and Solutions - AccountingRafidul Islam100% (1)

- Appropriation Accounts AndyDocument26 pagesAppropriation Accounts AndyAndrew MwingaPas encore d'évaluation

- Exercise (Final Accounts)Document14 pagesExercise (Final Accounts)Abhishek Bansal100% (1)

- Bengal Institute of Business Studies: Assignment On Accounting For Managers (50 Marks)Document3 pagesBengal Institute of Business Studies: Assignment On Accounting For Managers (50 Marks)mohitarya011Pas encore d'évaluation

- David MAP 107Document10 pagesDavid MAP 107Ridah SolomonPas encore d'évaluation

- QuestionsDocument7 pagesQuestionsMyra RidPas encore d'évaluation

- ACT 501 - AssignmentDocument6 pagesACT 501 - AssignmentShariful Islam ShaheenPas encore d'évaluation

- 29 9 13 Accounts SumsDocument11 pages29 9 13 Accounts SumssahilgeraPas encore d'évaluation

- ADL 03 Ver2+Document6 pagesADL 03 Ver2+DistPub eLearning SolutionPas encore d'évaluation

- Department of Business AdministrationDocument9 pagesDepartment of Business AdministrationKannan NagaPas encore d'évaluation

- Basic BS1Document1 pageBasic BS1PeeushGoelPas encore d'évaluation

- Final Account With AnswersDocument23 pagesFinal Account With Answerskunjap0% (1)

- Class 11 Accounts Half Yearly SPDocument9 pagesClass 11 Accounts Half Yearly SPRakesh AgarwalPas encore d'évaluation

- 18516BCH201 - Exam Paper-For Trial Exam (2013) - Sec BDocument5 pages18516BCH201 - Exam Paper-For Trial Exam (2013) - Sec Bakki3004Pas encore d'évaluation

- Liquidation of CompanyDocument8 pagesLiquidation of CompanySeban Ks0% (2)

- Trading Account PDFDocument9 pagesTrading Account PDFVijayaraj Jeyabalan100% (1)

- Reg. No.: Sub. Code: DJB 2 CDocument6 pagesReg. No.: Sub. Code: DJB 2 CHARINIVEERAPPANPas encore d'évaluation

- Worksheet 5 NMIMSDocument4 pagesWorksheet 5 NMIMSvipulPas encore d'évaluation

- Hi-Aims College of Commerce and Management Sargodha: ST TH ST ST STDocument6 pagesHi-Aims College of Commerce and Management Sargodha: ST TH ST ST STMozam MushtaqPas encore d'évaluation

- (ACC 2023) Xii Target Paper by Sir Irfan JanDocument36 pages(ACC 2023) Xii Target Paper by Sir Irfan JanmohsinbeforwardPas encore d'évaluation

- Prati AccountancyDocument2 pagesPrati AccountancyMohan NjPas encore d'évaluation

- IMT 57 Financial Accounting M1Document4 pagesIMT 57 Financial Accounting M1solvedcarePas encore d'évaluation

- 7 Adjustments To Final AccountsDocument11 pages7 Adjustments To Final AccountsBhavneet SachdevaPas encore d'évaluation

- CBSE Class 11 Accountancy Question Paper SA 2 2013 PDFDocument6 pagesCBSE Class 11 Accountancy Question Paper SA 2 2013 PDFsivsyadavPas encore d'évaluation

- Final Acc-Numerical 1Document10 pagesFinal Acc-Numerical 1Rajshree BhardwajPas encore d'évaluation

- Accounts of Banking CompaniesDocument9 pagesAccounts of Banking Companieskunjap0% (1)

- Uog Year 2 Taxation Paper Uog March 2013Document9 pagesUog Year 2 Taxation Paper Uog March 2013helenxiaochingPas encore d'évaluation

- Branch AccountsDocument12 pagesBranch AccountsRobert Henson100% (1)

- Sum No.: 3: Debit Balances Rs. Credit Balances RsDocument3 pagesSum No.: 3: Debit Balances Rs. Credit Balances Rsdeepak7393Pas encore d'évaluation

- IPCC - November 2014Document11 pagesIPCC - November 2014suhaib1282Pas encore d'évaluation

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionD'EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionPas encore d'évaluation

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionD'EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionPas encore d'évaluation

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawD'EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawÉvaluation : 3.5 sur 5 étoiles3.5/5 (4)

- 21St Century Computer Solutions: A Manual Accounting SimulationD'Everand21St Century Computer Solutions: A Manual Accounting SimulationPas encore d'évaluation

- Credit Union Revenues World Summary: Market Values & Financials by CountryD'EverandCredit Union Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- 8 Management Lessons: From The Films of Al PacinoDocument10 pages8 Management Lessons: From The Films of Al PacinoDeepak R GoradPas encore d'évaluation

- Drgorad SM ProjectDocument10 pagesDrgorad SM ProjectDeepak R GoradPas encore d'évaluation

- Size in FY 11 (US $ BN) Size in FY 17 (US $ BN) Size in FY 22 (US $ BN) Generation EquipmentDocument2 pagesSize in FY 11 (US $ BN) Size in FY 17 (US $ BN) Size in FY 22 (US $ BN) Generation EquipmentDeepak R GoradPas encore d'évaluation

- Sterling: Master of Management Studies (MMS)Document4 pagesSterling: Master of Management Studies (MMS)Deepak R GoradPas encore d'évaluation

- Master of Management Studies (MMS) : SterlingDocument3 pagesMaster of Management Studies (MMS) : SterlingDeepak R GoradPas encore d'évaluation

- Brand Quiz: - Who Is The Brand Ambassador For Fiama DI Wills Range of ProductsDocument27 pagesBrand Quiz: - Who Is The Brand Ambassador For Fiama DI Wills Range of ProductsDeepak R GoradPas encore d'évaluation

- Big Days Student AllocationDocument3 pagesBig Days Student AllocationDeepak R GoradPas encore d'évaluation

- Finance HR Management Administration: Mr. Sunil Jha MR - Thoresh MarianaDocument1 pageFinance HR Management Administration: Mr. Sunil Jha MR - Thoresh MarianaDeepak R GoradPas encore d'évaluation

- In The Context of Mutual Fund, SIP Stands For?Document11 pagesIn The Context of Mutual Fund, SIP Stands For?Deepak R GoradPas encore d'évaluation

- Acknowledgement: I Am Very Thankful To Mr. Tejas Doshi (Area Manager), Hager Group Who HasDocument2 pagesAcknowledgement: I Am Very Thankful To Mr. Tejas Doshi (Area Manager), Hager Group Who HasDeepak R GoradPas encore d'évaluation

- Each of 3500 To 9500 SQDocument2 pagesEach of 3500 To 9500 SQDeepak R GoradPas encore d'évaluation

- ModelDocument1 pageModelDeepak R GoradPas encore d'évaluation

- Graphics: This Text Can Be Replaced With Your Own TextDocument6 pagesGraphics: This Text Can Be Replaced With Your Own TextDeepak R GoradPas encore d'évaluation

- Drops: WaterDocument4 pagesDrops: WaterDeepak R GoradPas encore d'évaluation

- Diagram 2: This Is A Placeholder TextDocument4 pagesDiagram 2: This Is A Placeholder TextDeepak R GoradPas encore d'évaluation

- Chart: RadarDocument4 pagesChart: RadarDeepak R GoradPas encore d'évaluation

- Triangle: ChartDocument4 pagesTriangle: ChartDeepak R GoradPas encore d'évaluation

- Chart: All Phrases Can Be Replaced With Your Own Text. All Phrases Can Be Replaced With Your Own TextDocument4 pagesChart: All Phrases Can Be Replaced With Your Own Text. All Phrases Can Be Replaced With Your Own TextDeepak R GoradPas encore d'évaluation

- Graphics: This Text Can Be Replaced With Your Own TextDocument5 pagesGraphics: This Text Can Be Replaced With Your Own TextDeepak R GoradPas encore d'évaluation

- Quiz On Obligations and ContractsDocument9 pagesQuiz On Obligations and ContractsTracy Miranda BognotPas encore d'évaluation

- Complaint To Determine Student Loans Undue HardshipDocument3 pagesComplaint To Determine Student Loans Undue Hardshipntshadow100% (1)

- 9706 - May June 2010 - All Mark Scheme PDFDocument46 pages9706 - May June 2010 - All Mark Scheme PDFRobert Nunez100% (1)

- Bankruptcy Prediction ModelDocument13 pagesBankruptcy Prediction ModelShubham GuptaPas encore d'évaluation

- Case Study JalDocument14 pagesCase Study JalAVANTIKA BISHTPas encore d'évaluation

- 83 Republic V de Los AngelesDocument1 page83 Republic V de Los AngelesluigimanzanaresPas encore d'évaluation

- Labor Case 251 Scra 354Document7 pagesLabor Case 251 Scra 354itsjennnyphPas encore d'évaluation

- Villaroel Vs EstradaDocument1 pageVillaroel Vs EstradaLylo BesaresPas encore d'évaluation

- Lachenal Vs SalasDocument4 pagesLachenal Vs SalasMaria TheresePas encore d'évaluation

- Limited Partnership AgreementDocument9 pagesLimited Partnership AgreementRocketLawyer81% (16)

- The Merchants National Bank of Mobile v. Robert H. Ching, JR., Etc., 681 F.2d 1383, 11th Cir. (1982)Document10 pagesThe Merchants National Bank of Mobile v. Robert H. Ching, JR., Etc., 681 F.2d 1383, 11th Cir. (1982)Scribd Government DocsPas encore d'évaluation

- Financial Ratios and The State of Health of Nigerian BanksDocument15 pagesFinancial Ratios and The State of Health of Nigerian BanksvatsonwizzluvPas encore d'évaluation

- Bad Debts, Bad Debts Recovered & Provision For Bad DebtsDocument7 pagesBad Debts, Bad Debts Recovered & Provision For Bad Debtssnap100% (1)

- Debt-to-Equity Conversion Revised PDFDocument0 pageDebt-to-Equity Conversion Revised PDFAnonymous qDb8S3koEPas encore d'évaluation

- Case 5Document5 pagesCase 5Anna Azriffah Janary GuilingPas encore d'évaluation

- Slides Successionrev2005Document182 pagesSlides Successionrev2005dempearl2315Pas encore d'évaluation

- General Motors CompanyDocument9 pagesGeneral Motors CompanyMitali ShethPas encore d'évaluation

- Do This FirstDocument4 pagesDo This FirstYarod EL93% (15)

- The Doñ Quijoté School of Law: By: Don Quijote, JDDocument84 pagesThe Doñ Quijoté School of Law: By: Don Quijote, JDEL Heru Al AmenPas encore d'évaluation

- Serrano v. Central Bank of The PhilippinesDocument2 pagesSerrano v. Central Bank of The PhilippinesErick Jay InokPas encore d'évaluation

- Status Report June 2019Document14 pagesStatus Report June 2019the kingfishPas encore d'évaluation

- Class Exercise Final Accounts and End of Year AdjusmentsDocument1 pageClass Exercise Final Accounts and End of Year AdjusmentsJoshua OtienoPas encore d'évaluation

- Article On Debt Recovery Tribunal - FinalDocument6 pagesArticle On Debt Recovery Tribunal - Finalvasantharao venkataraoPas encore d'évaluation

- ACT204 S12017 Week 11 Tutorial SolutionsDocument4 pagesACT204 S12017 Week 11 Tutorial SolutionsCJPas encore d'évaluation

- 10000029568Document69 pages10000029568Chapter 11 DocketsPas encore d'évaluation

- Mba 804 Company LawDocument92 pagesMba 804 Company LawBukola BukkyPas encore d'évaluation

- LCC ListDocument5 pagesLCC ListNavaneeth Krishna RPas encore d'évaluation

- Browerville Blade - 12/15/2011Document14 pagesBrowerville Blade - 12/15/2011bladepublishingPas encore d'évaluation

- Report PublicDocument5 pagesReport PublicIpe DimatulacPas encore d'évaluation

- Valdes vs. RTCDocument15 pagesValdes vs. RTCCofeelovesIronman JavierPas encore d'évaluation