Académique Documents

Professionnel Documents

Culture Documents

Dream's Trade Ideas 04.29.2013

Transféré par

dreamytraderCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Dream's Trade Ideas 04.29.2013

Transféré par

dreamytraderDroits d'auteur :

Formats disponibles

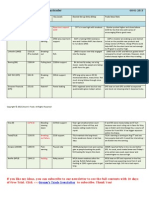

Dreams Trade Ideas by Dreamytrader

Stock Name

last Close Price Status Key Levels Desired Set-up Entry &Stop Trade Ideas Note

04-29-2013

Current Watch-list

S&P500 Index ETF (SPY) $159.30 Aiming for new historical high Near-term resistance is $160 $153.50-$154 lower support. SPYs renewed buying momentum positioned Index in front of another historical mark SPX 1600 or SPY $160. It is only Monday, we have time to advance. Today, a return of the Apple show, buyers charged over the weekend, and blasted through the $420 level and closed at high. $420 vital again for upside. A big range in building. Long-term still in Bullish mode. Not seeing very attractive new entry long. Just holding long is enough for this mover so far. UPS took out the $86 resistance and it needs to hold above this area for more upside. SPY is in attacking mode ahead of Feds meeting. Market does rested and jumped again, now it is time to see if this holds above $160. Sell in May and go away, could happen, for reminder AAPL beat EPS and REV, but guided lower for next Q. Hiked divided to $3.65and powerup share buyback plan to 60B from 10B to boot stock price. No big new products Until fall to 2014. Strong last earning numbers spiked NKE into all-time high and it has been a very strong retail stock among the sector. The up-trend is intact for NKE despite recent market chills. UPS is lucky and delivered a nice earning package to investors, reported EPS beat and REV in-line, reaffirmed guidance. This helped stock to stable. MCD reported EPS and REV in-line with the market, and guided very softly for its outlook. Marco environment still tough for growth but company is gaining its influence.

Apple(AAPL)

$430.12

Rallied to test $420

$420 lower support $445ish area next resistance

Nike (NKE)

$62.63

Grinding higher

$60ish lower support

UPS (UPS)

$86.27

Earning gap-up

$86 lower support $89 next resistance

McDonalds (MCD)

$102.18

Gaining buying interest

$97.50-$98ish support

MCD recovered most damage after the earning and so far buying long with reasonable risk/reward still make sense for this stock.

Copyright 2013 Dream's Trade. All Rights Reserved

LinkedIn (LNKD)

$187.76

Forming a range above previous support Trade lower but downside limited Trying to hold high

$182-$185 area near-term support.

LNKDs recent up and down swing is forming a new and narrowed range ahead of its earning and stand above the $185 level. Good earning could see $200. BAs next project is Holding the earning gap into near-future and forming a range is ideal before next entry long. HD is forming a range above $72 and as market sentiment continue to be bullish. A new entry long would be this buyable range. Below $72 is stop loss area. MON is working on a tradeable setup for the long-side. Trading against the $103-$105 range for long is doable. MOS has a good weekly chart that showing buying against the $62ish$63 resistance and break on upside is the trade with entry with volume.

LNKDs earning is coming up as earning season is heating up. Price action was mixed but overall, LNKDs bull defended stock and recent price action shown buying interest ahead of earning date of May 2nd, after market Boeings strong earning with huge beat on EPS and REV helped stock to close higher. Proved that Dreamliner didnt impact BA that much like people feared before. With more and more news about how housing market is recovering, HD certainly found reasons to go higher in this not so decisive market sentiment. Or, another housing bubble inflated by QE. MON reported EPS and REV beat on its Q2 earning and raised its guidance. Stock was in leading position before the earning and best among the sector. Agricultural sector lost its leadership a while ago. Long way to go. MOSs recent earning was somewhat mixed with EPS beat and miss on REV. Guidance was a bit downside. The buyers are still with the stock so the future could be brighter for now.

Boeing (BA)

$91.89

$89-$91 lower support area.

Home Depot (HD)

$73.35

$73 near-term lower support.

Monsanto (MON)

$106.50

Holding up

$103-$105 lower support

Mosaic (MOS)

$61.84

Holding up

$63 resistance

Copyright 2013 Dream's Trade. All Rights Reserved

Current Watch-list Featured Chart: Apple, Inc. (AAPL)

Todays Tech sector was in leading group, AAPLs return with other Big Tech names like GOOG, INTC and MSFT, pushed Tech ETF QQQ higher, outpacing other sectors. This week would be key for the Bulls and Bears since SP500 Index is close to mark the historical high. Market-wide surge and near key levels, time to get some cautions instead be super confident.

If you like my ideas, you can subscribe to our newsletter to see the full contents with 10 days of Free Trial. Click >>>Dream's Trade Newsletter to subscribe. Thank You!

Copyright 2013 Dream's Trade. All Rights Reserved

Current Watch-list Featured Chart: Mosaic Co. (MOS)

Copyright 2013 Dream's Trade. All Rights Reserved

Vous aimerez peut-être aussi

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderPas encore d'évaluation

- Dream's Trade Ideas 07.22.2013Document3 pagesDream's Trade Ideas 07.22.2013dreamytraderPas encore d'évaluation

- Dream's Trade Ideas 07.15.2013Document3 pagesDream's Trade Ideas 07.15.2013dreamytraderPas encore d'évaluation

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderPas encore d'évaluation

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderPas encore d'évaluation

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderPas encore d'évaluation

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderPas encore d'évaluation

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderPas encore d'évaluation

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderPas encore d'évaluation

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock Namedreamytrader100% (1)

- Dream's Trade Ideas 04.30.2013Document9 pagesDream's Trade Ideas 04.30.2013dreamytraderPas encore d'évaluation

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderPas encore d'évaluation

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderPas encore d'évaluation

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Feasibility of Merging Naga, Camaligan and GainzaDocument5 pagesThe Feasibility of Merging Naga, Camaligan and Gainzaapi-3709906100% (1)

- International Tax PrimerDocument196 pagesInternational Tax PrimerMuhammadPas encore d'évaluation

- Format For BQDocument2 pagesFormat For BQAfroj ShaikhPas encore d'évaluation

- Btled He 221 Lesson 1Document18 pagesBtled He 221 Lesson 1DEOGRACIAS GERARDO100% (1)

- Erd 4 F 003Document3 pagesErd 4 F 003GCLT Logistics and Transport and Trucking ServicesPas encore d'évaluation

- Unilever Annual Report and Accounts 2018 - tcm244 534881 - en PDFDocument173 pagesUnilever Annual Report and Accounts 2018 - tcm244 534881 - en PDFDale burlatPas encore d'évaluation

- Mumbai Mint 07-07-2023Document18 pagesMumbai Mint 07-07-2023satishdokePas encore d'évaluation

- MCS CH 13 PPT FixDocument27 pagesMCS CH 13 PPT FixArtikaIndahsariPas encore d'évaluation

- Introduction To DerivativesDocument6 pagesIntroduction To DerivativesXiaoxi NiPas encore d'évaluation

- SUSTAINABLE TOURISM PrefinalsDocument4 pagesSUSTAINABLE TOURISM PrefinalsNicole SarmientoPas encore d'évaluation

- (Indian Economy - 2) UNIT - 1 POLICIES AND PERFORMANCE IN AGRICULTUREDocument31 pages(Indian Economy - 2) UNIT - 1 POLICIES AND PERFORMANCE IN AGRICULTUREAndroid Boy71% (7)

- India's Economy and Society: Sunil Mani Chidambaran G. Iyer EditorsDocument439 pagesIndia's Economy and Society: Sunil Mani Chidambaran G. Iyer EditorsАнастасия ТукноваPas encore d'évaluation

- 6 CHDocument27 pages6 CHjafariPas encore d'évaluation

- Access To Finance For Women Entrepreneurs in South Africa (November 2006)Document98 pagesAccess To Finance For Women Entrepreneurs in South Africa (November 2006)IFC SustainabilityPas encore d'évaluation

- Executive Programme In: Business ManagementDocument4 pagesExecutive Programme In: Business ManagementKARTHIK145Pas encore d'évaluation

- Mayor Kasim Reed's Proposed FY 2015 BudgetDocument585 pagesMayor Kasim Reed's Proposed FY 2015 BudgetmaxblauPas encore d'évaluation

- Deposit Slip ID: 192765 Deposit Slip ID: 192765: Fee Deposit Slip-Candidate Copy Fee Deposit Slip-BankDocument1 pageDeposit Slip ID: 192765 Deposit Slip ID: 192765: Fee Deposit Slip-Candidate Copy Fee Deposit Slip-BankAsim HussainPas encore d'évaluation

- Resume - Niyam ShresthaDocument3 pagesResume - Niyam ShresthaNiyam ShresthaPas encore d'évaluation

- Group 4 Amazon 45k01.1Document73 pagesGroup 4 Amazon 45k01.1Đỗ Hiếu ThuậnPas encore d'évaluation

- Sandeep Kumar Shivhare: ObjectiveDocument4 pagesSandeep Kumar Shivhare: ObjectiveSai Swaroop MandalPas encore d'évaluation

- 2 Annual Secretarial Compliance Report - NSE Clearing Limited - SignedDocument3 pages2 Annual Secretarial Compliance Report - NSE Clearing Limited - SignedAmit KumarPas encore d'évaluation

- Saxonville Case StudyDocument10 pagesSaxonville Case Studymissph100% (1)

- Retirement QuestionDocument2 pagesRetirement QuestionshubhamsundraniPas encore d'évaluation

- Glosario de SAP en InglésDocument129 pagesGlosario de SAP en InglésTester_10Pas encore d'évaluation

- Tck-In Day 9Document3 pagesTck-In Day 9Julieth RiañoPas encore d'évaluation

- Equity Research AssignmentDocument3 pagesEquity Research Assignment201812099 imtnagPas encore d'évaluation

- Introduction To Human Resource ManagementDocument5 pagesIntroduction To Human Resource ManagementJe SacdalPas encore d'évaluation

- MBA 509 Case Analysis ReportDocument10 pagesMBA 509 Case Analysis Reportcinthiya aliPas encore d'évaluation

- ICUMSA 45 Specifications and Proceduers - 230124 - 134605Document3 pagesICUMSA 45 Specifications and Proceduers - 230124 - 134605Alexandre de Melo0% (1)

- Espina v. Highlands CampDocument2 pagesEspina v. Highlands CampJerald Ambe100% (1)