Académique Documents

Professionnel Documents

Culture Documents

2 Household Saving Rate

Transféré par

ROKOV ZHASACopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

2 Household Saving Rate

Transféré par

ROKOV ZHASADroits d'auteur :

Formats disponibles

School of Management Studies, Nagaland University 1 MFM 108 Securities & Portfolio Analysis

Trend in House Hold savings during 11th Five Year Plan

By Rokov N. Zhasa (NU Reg. No. 111291 of 2011-2012) Content 1. Introduction 2. Evolving Structure of Households Gross Financial Savings 3. Gross Financial Liabilities of the Households 4. Outlook for Instruments 5. Conclusion Reference 1. Introduction A striking feature of the 2000s is the leveling off of the household savings rate at about 23 per cent from around the middle of the decade in contrast to the upward movement in the previous years (Table 1 and Chart 3). Moreover, this leveling off occurred even as the economy generally cruised along a high growth trajectory (barring a brief hiccup in 2008-09). The factors underlying the stability in the household savings rate are discussed next.

As stated earlier, total saving of the households comprises financial savings and physical savings. Financial savings are treated on a net basis i.e. households (change in gross) financial assets less their (change in gross) financial liabilities. It is evident from Table 1 and Chart 3 that while physical savings of the households increased sharply

School of Management Studies, Nagaland University 2 MFM 108 Securities & Portfolio Analysis

during the first half of 2000s, the pace of increase in gross financial assets as well as gross financ ial liabilities slowed down. With the net financial savings rate resultantly showing a modest increase, most of the overall increase in the households sa vings during the first half of the 2000s was on account of physical savings. The household sectors preference for savings in the form of physical assets since 2000-01 could be a ttributed partly to the robust economic growth as well as rising availability of credit to meet financing needs of the household sector. During the second half of the decade, even though the gross financial savings (assets) and gross financial liabilities of the households increased sharply, the increase in net financial savings rate remained modest. At the same time, the rate of physical savings declined partly in response to the tightening in credit norms, offsetting the increase in the financial savings rate. Consequently, the households overall savings rate remained largely unchanged (at around 23 per cent) since mid-2000s. Since the 1970s, the allocation of household savings between financial assets and physical assets had been progressively moving in favour of the former, with the notable exception of the first half of the 2000s. The allocation became almost evenly balanced during the second half of the 2000s. 2. Evolving Structure of Households Gross Financial Savings 2.1 The composition of (changes in) the gross financial assets of households has also changed substantially over the years (Table 2).

The share of currency has declined to around 10 per cent in recent years reflective of the spread of banking facilities and the declining share of agriculture in GDP. Bank deposits continue to account for the predominant share of gross financial assets, with their share increasing sharply in the second half of 2000s in contrast to the declining trend in the previous years; part of the recent increase in the share of bank deposits could be attributable to the increase in deposit rates and aggressive deposit mobilization by banks.

School of Management Studies, Nagaland University 3 MFM 108 Securities & Portfolio Analysis

The share of life insurance funds continued to increase during 2000s, in line with higher insurance penetration and robust economic growth. The share of provident and pension funds has progressively declined over the years; this has been attributable to a number of factors viz.; o The EPF and MP Act, 1952 covers only those employees of organised sector whose salary is below ` 6500/- per month. This statutory limit is stagnant since 2002 while there has been a phenomenal growth in wage structure in industry over the years. Resultantly, in new coverages of the establishments, very few categories of employees are eligible for coverage under the Act. While the new enrolment of members has become difficult as mentioned above, the exit of members by way of retirement, retrenchment and death are keeping normal pace. The increasing job avenues in global age economy have stirred the job dynamics and owing to this there is a brisk movement of labour amongst the companies offering better rewards. This has also resulted in settlement of accounts rapidly and giving way to outflow of contributions, as many of exit ing members do not come back under coverage profile due to low statutory ceiling of wages. The Employees Provident Fund Organization (EPFO), of late, has taken a decision not to allow interest on those accounts in which no contributions have been received for last 36 months. This has been done with a view to dissuade the ex-members to consider this social security scheme as Investment Avenue. With obvious exit of such members, this may further erode the deposit base. Reflecting the impact of the above factors, the contributions received in the Employees Provident Funds Sc heme, 1952, Employees Pension Scheme, 1995 and Employees Deposit -Linked Insurance Scheme, 1976 framed under the EPF & MP Act, 1952, have been decelerating over the years as evident from the table below:

The share of claims on Government, which largely reflect Small Savings, which had picked up over the years, particularly durin g the first half of 2000s, declined

School of Management Studies, Nagaland University 4 MFM 108 Securities & Portfolio Analysis

during the second half larg ely in response to the unchanged (administered) interest rates on Sm all Savings since 2003-04. In fact, households disinvested their holdings of Small Savings during 2007-08 and 2008-09. The share of shares and debentures in the gross financial assets of households has remained quite small (les s than 10 per cent, on an average), even though it increased sharply during the (early) 1990s, spurred by the reforms in the capital market. Subs equently, the share of shares and debentures started declining ---largely reflecting stock market conditions impacted by irregularities and the downturn in industrial activity ---- and was placed at less than 3 per cent in the first half of 2000s . The share of shares & debentures picked up very sharpl y during 2005-06 to 2007-08 largely coinciding with the high growth phase and buoyant stock market trends, but then plummeted in 2008-09 in the face of knock-on effects of the global financial crisis; on the average, however, the share of s hares and debentures improved during the second half of 2000s. Contrasting movements were observed in the shares of bank deposits and shares and debentures in the households gross financial assets till around the first half of 2000s, indicative of households perception of substitutability between the two instruments in the allocation of their financial savings. In the second half of 2000s, however, the average shares of both the instruments increased sharply in response to the very buoyant economic conditions, pick up in primary market activity (in the case of shares and debentures) and increase in deposit rates (in the case of bank deposits), and disinvestment of Small Savings holdings by households during 2007-09. The share of Units of UTI, Mutual Funds, etc has generally been small and these turned negative during 2000s. Trade debt (net) has been negligible. In sum, bank deposits continue to account fo r the predominant share of gross financial savings of the households and their share has increased sharply during the second half of 2000s. The shar e of Life Insurance Funds has also increased progressively over the years. Provident and Pension Funds, non-banking deposits, claims on Government and currency have lost momentum over the years. Shares and debentures constitute a relatively small portion of household financial savings, even though t heir share has picked up in the recent period.

3. Gross Financial Liabilities of the Households Advances from banks have remained the largest component of the financial liabilities of households; their share had dipped during the 1990s, but picked up subsequently (Table 3). The shares of loans from other financial institutions, Government and cooperative non-credit societies have, on the other hand, declined in recent years; in fa ct, the shares of loans from the latter two institutions have become negligible.

School of Management Studies, Nagaland University 5 MFM 108 Securities & Portfolio Analysis

4. Outlook for Instruments of Household Savings 4.1 Bank Deposits In recent years, banks have moved to the Core Banking platform which has enabled them to offer a range of value-added products to customers across geographies and across all sections, on a real time basis 24x7, which has enhanced the attractiveness of bank deposits. More over, against the backdrop of financial sector reforms and financial inclusion, supported by favourable demographic pattern, bank deposits would continue to be one of the key drivers of the household financial savings during the Twelfth Five Year Plan period. 4.2 Life Insurance Funds Given the changes in policy with regard to ULIP, there has been some fall in the life fund segment in 2010-11. The progressive withdra wal of tax incentives have also impacted on the overall insurance segment. Going forward, however, the increasing penetration of insurance activity could increase the sh are of life insurance in total financial savings of households. 4.3 Provident Funds Since contributions to Employees Provident Fund is mandatory only with respect to monthly incomes below ` 6,500, the recent trends in terms of number of participants and their contributions indicated the prospects in respect of this instrument are dim, notwithst anding a very high rate of tax-free return. Prospects are likely to improve only after a couple of years once the proposal to increase the monthly income ceiling for mandatory contributions to ` 15,000 is accepted and implemented. 4.4 Shares and Debentures The Indian Securities market is growing rapidly with introduction of new products and processes. As seen from Char t 4, during the first five years of the current decade,

School of Management Studies, Nagaland University 6 MFM 108 Securities & Portfolio Analysis

resource mobilisation from the primary market has increased. In the next five years, the tempo continued at a fa ster pace until the global financial crisis affected the market. However, the trend in resource mobilisation in the post-crisis period signals a quick recovery.

Gross resource mobilisation in mutual funds has gone up at an accelerated rate in the current decade, though net resource mobilisation has shown a volatile trend. Asset under management has also increased during this period, except the fall in the crisis-affected year 2008-09 (Chart 5).

School of Management Studies, Nagaland University 7 MFM 108 Securities & Portfolio Analysis

Number of investors in the country has also increased manifold. At present, India is the second fastest growing country in the world next to China. With increase in per capita income, the households are le ft with more investible resources. The increase in number of investors is reflect ed in the increase in the value of shares settled in demat format (Chart 6). Besides, the Securi ties and Exchange Board of India (SEBI) is trying to improve the transparency in the market with better regulations, efficient surveillance of the market and better availability of information to the investors. Investor education workshops are bei ng conducted all over the country. Looking at the past trend of Indian securities market, which has witnessed remarkable growth in last two decades, it may be conjectured that in next five years the expansion will continue at a faster pace with more investors participating in the securities market in India.

4.8 Physical Savings The trend is that households are investing more on acquisition of physical assets rather than financial assets. With in physical assets, households are now investing more on construction activities . These trends are expected to continue. 5. Conclusion Despite the economy generally cruising along a high growth trajectory (barring a brief hiccup in 2008-09) it has been observed that there was a tendency leveling off of the household savings rate at about 23 per cent from around the middle of the decade in contrast to the upward movement in the previous years. Addressing the factors behind this trend is crucial to understand the direction of individual savings and developing necessary policy measures so as boost savings and investments by individual households.

School of Management Studies, Nagaland University 8 MFM 108 Securities & Portfolio Analysis

Reference: 1. Report of the Working Group on Savings during the Twelfth Five-Year Plan (201213 to 2016-17) , Planning Commision, 2011

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Bamboo Entrepreneurship Presentation 1Document27 pagesBamboo Entrepreneurship Presentation 1ROKOV ZHASA100% (2)

- Technology Intelligence PPT R N ZhasaDocument19 pagesTechnology Intelligence PPT R N ZhasaROKOV ZHASAPas encore d'évaluation

- Delegation, Centralization and DecentralizationDocument31 pagesDelegation, Centralization and DecentralizationROKOV ZHASA50% (2)

- Total Productive MaintenanceDocument11 pagesTotal Productive MaintenanceROKOV ZHASA100% (1)

- Counselling in The Work PlaceDocument12 pagesCounselling in The Work PlaceROKOV ZHASAPas encore d'évaluation

- Liberalisation 1991Document5 pagesLiberalisation 1991ROKOV ZHASAPas encore d'évaluation

- Trade Unions Act 1926Document21 pagesTrade Unions Act 1926ROKOV ZHASAPas encore d'évaluation

- Anna HazareDocument14 pagesAnna HazareROKOV ZHASAPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Impression TakingDocument12 pagesImpression TakingMaha SelawiPas encore d'évaluation

- A6V10424583 - 2 - and 3-Port Valves With - BR - Flanged Connections - enDocument14 pagesA6V10424583 - 2 - and 3-Port Valves With - BR - Flanged Connections - enAjdin BuljubasicPas encore d'évaluation

- Debunking The Evergreening Patents MythDocument3 pagesDebunking The Evergreening Patents Mythjns198Pas encore d'évaluation

- EF4e Beg Quicktest 05Document3 pagesEF4e Beg Quicktest 05terrenoruralcamboriuPas encore d'évaluation

- 3 Ways To Take Isabgol - WikiHowDocument6 pages3 Ways To Take Isabgol - WikiHownasirPas encore d'évaluation

- Postoperative Care in Thoracic Surgery A Comprehensive GuideDocument397 pagesPostoperative Care in Thoracic Surgery A Comprehensive GuideΑΘΑΝΑΣΙΟΣ ΚΟΥΤΟΥΚΤΣΗΣ100% (1)

- Plumbing Breakup M 01Document29 pagesPlumbing Breakup M 01Nicholas SmithPas encore d'évaluation

- 21A Solenoid Valves Series DatasheetDocument40 pages21A Solenoid Valves Series Datasheetportusan2000Pas encore d'évaluation

- Iso 9227Document13 pagesIso 9227Raj Kumar100% (6)

- Resume Massage Therapist NtewDocument2 pagesResume Massage Therapist NtewPartheebanPas encore d'évaluation

- Thorley Amended Complaint (Signed)Document13 pagesThorley Amended Complaint (Signed)Heather ClemenceauPas encore d'évaluation

- The Problem of Units and The Circumstance For POMPDocument33 pagesThe Problem of Units and The Circumstance For POMPamarendra123Pas encore d'évaluation

- Free Higher Education Application Form 1st Semester, SY 2021-2022Document1 pageFree Higher Education Application Form 1st Semester, SY 2021-2022Wheng NaragPas encore d'évaluation

- Pyq of KTGDocument8 pagesPyq of KTG18A Kashish PatelPas encore d'évaluation

- Case StudyDocument7 pagesCase StudyLeighvan PapasinPas encore d'évaluation

- People of The Philippines V. Crispin Payopay GR No. 141140 2003/07/2001 FactsDocument5 pagesPeople of The Philippines V. Crispin Payopay GR No. 141140 2003/07/2001 FactsAb CastilPas encore d'évaluation

- Electric Field Summary NotesDocument11 pagesElectric Field Summary NotesVoyce Xavier PehPas encore d'évaluation

- Uttarakhand District Factbook: Almora DistrictDocument33 pagesUttarakhand District Factbook: Almora DistrictDatanet IndiaPas encore d'évaluation

- Amul Amul AmulDocument7 pagesAmul Amul Amulravikumarverma28Pas encore d'évaluation

- BS 65-1981Document27 pagesBS 65-1981jasonPas encore d'évaluation

- White Vaseline: Safety Data SheetDocument9 pagesWhite Vaseline: Safety Data SheetHilmi FauziPas encore d'évaluation

- AA-036322-001 - Anchor Bolt DetailsDocument1 pageAA-036322-001 - Anchor Bolt DetailsGaurav BedsePas encore d'évaluation

- Intoduction To WeldingDocument334 pagesIntoduction To WeldingAsad Bin Ala QatariPas encore d'évaluation

- User Manual: 3603807 CONTACT US - 09501447202,8070690001Document1 pageUser Manual: 3603807 CONTACT US - 09501447202,8070690001Arokiaraj RajPas encore d'évaluation

- OKRA Standards For UKDocument8 pagesOKRA Standards For UKabc111007100% (2)

- Drawing Submssion Requirements - September - 2018Document66 pagesDrawing Submssion Requirements - September - 2018Suratman Blanck MandhoPas encore d'évaluation

- General Session Two - Work Life BalanceDocument35 pagesGeneral Session Two - Work Life BalanceHiba AfandiPas encore d'évaluation

- Campus Sexual Violence - Statistics - RAINNDocument6 pagesCampus Sexual Violence - Statistics - RAINNJulisa FernandezPas encore d'évaluation

- A.8. Dweck (2007) - The Secret To Raising Smart KidsDocument8 pagesA.8. Dweck (2007) - The Secret To Raising Smart KidsPina AgustinPas encore d'évaluation

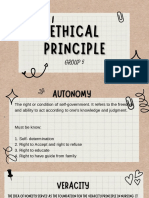

- Group 5 - Ethical PrinciplesDocument11 pagesGroup 5 - Ethical Principlesvirgo paigePas encore d'évaluation