Académique Documents

Professionnel Documents

Culture Documents

Cost and Cost Classifications PDF

Transféré par

nkznhrgTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Cost and Cost Classifications PDF

Transféré par

nkznhrgDroits d'auteur :

Formats disponibles

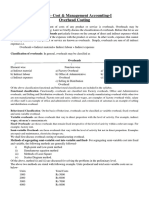

PART I

INDEX

A. COST . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 B. COST CLASSIFICATIONS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 B.1. Costs by Management Function . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 B.2. Direct Costs And Indirect Costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 B.3. Product Costs And Period Costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 B.4. Variable Costs, Fixed Costs, And Semivariable Costs . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 B.5. Costs For Planning, Control, And Decision Making . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 C. CONCLUSION . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 D. REFERENCE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

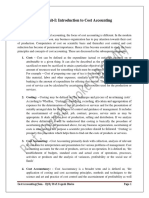

A. COST Cost has different meanings in financial accounting and managarial accounting. In financial accounting, it is defined as a measurement of the amount of resources used. In managarial accounting, it is described in many ways since there are different types of costs for different purposes. B. COST CLASSIFICATIONS Costs can be classified according to their 1. Management Function 1.1. Manufacturing costs 1.2. Nonmanufacturing costs 2. Ease of traceability 2.1. Direct costs 2.2. Indirect costs 3. Timing of charges against sales revenue 3.1. Product costs 3.2. Period costs 4. Behaviour in accordance with changes in activity 4.1. Variable costs 4.2. Fixed costs 4.3. Semivariable costs 5. Relevance to control and decision making 5.1. Controllable and noncontrollable costs 5.2. Standard costs 5.3. Incremental costs 5.4. Sunk costs 5.5. Opportunity cost 5.6. Relevant costs (Shim, Siegel, 1998) B.1. Costs by Management Function In a manufacturing firm, costs are divided into two in according to their functions, manufacturing costs and nonmanufacturing costs. Manufacturing costs are the costs that are related to manufactuing, which are direct materials, direct labor, and factory overhead. All materials that form the final product are called direct materials. Minor items used during the production are called indirect materials. Direct labour is the labour that directly 2

contributed to the production. Labour which does not involve directly in production is called indirect labour, such as security guards, accountants, supervisors. Lastly, factory overhead is defined as all costs except direct materials and direct labour. As examples depreciation, rent, taxes, insurance and cost of idle time can be given. Nonmanufacturing costs are divided into selling expenses and general and administrative expenses. Selling expenses are all expenses related to obtaining sales and delivery of the product. Shipping charges, advertising, sales commision can be given as examples. General and administrative expenses can be described as money spent in operating business that is not directly related to production, such as rent, salaries, legal expenses. B.2. Direct Costs And Indirect Costs Costs can be categorized in accordance with their traceability. Direct costs are the costs that can be traced directly to a costing object. Direct materials, direct labour are the examples of direct costs. Indirect cost is an expense incurred in joint usage and that is why it is difficult to assign to a specific cost object. For example, expenses of advertising, maintenance, security and supervision are called indirect costs. B.3. Product Costs And Period Costs Costs can be categorized due to being inventoriable. Product costs are inventoriable costs, therefore until they are sold they are assests. When they are sold, they are accepted as cost of goods sold. All manufacturing costs are product costs. Period costs are not inventoriable. Period costs are selling and general administrative expenses identified with the accounting period in which they are incurred. Selling and general and administrative expenses are period costs. B.4. Variable Costs, Fixed Costs, And Semivariable Costs These costs are classified by their behaviour. Costs that change according to change in volume are called variable costs, such as cost of direct labour and direct material. Fixed costs are the costs that does not vary depending on changes in activity, such as rent, insurance and taxes. Semi variable costs are composed of fixed and variable costs. Costs are fixed until a level of production or consumption but after exceeding that level, it becomes variable. Labour costs are semi-variable because the fixed protion is the wage paid to workers for regular working hours and variable portion is the overtime payment.

B.5. Costs For Planning, Control, And Decision Making Controllable And Noncontrollable Costs: If the amount of the cost is assigned to a member of undertaking and the level of the cost is mostly under this members influence, this cost is called controllable. Costs that are not subject to influence of managerial supervision are called noncontrollable. Standard Costs: Startard costs are the estimated production or operating costs. It is a target cost and it is used to measure performance by comparing with actual cost. Incremental Costs: It is the difference in costs between two or more alternatives. Sunk Costs: Money already spend and lost is called sunk cost. They are irretrievable and that is why they are irrelevant to future decion making. Opportunity Cost: Net value forgone by rejecting an alternative is called opportunity cost. Relevant Cost: Expected future costs that will differ between alternatives are called relevant costs. C. Conclusion Knowing all these classifications helps us to know terminology and facilitates using costing methods. That is why cost classifications form the basis of costing methods. To illusrate, lets take a look at ABC method. Increase in the automation of manufacturing led to change in nature of composition of total product cost because while significance of direct labor cost has decreased, significance of overhead costs has increased. Since overhead application rates based on direct labour and any other volume-based cost driver would not provide accurate overhead charges any more, activity based costing is used in order to get around this problem. In this method, costs are assigned to pools based on the activities not volumes and the costs in the activity cost pools are allocated to products using a variety of cost drivers. (Edmonds et al., 2011, p.207) As it can be understood, without knowing the meaning of direct labour and overhead cost, it is difficult to use this method.

REFERENCE Shim, J.K., Siegel, J.G. 1998. Managerial Accounting 2nd ed. S.l.: McGraw-Hill Edmonds, T. P., Tsay, B. and Olds, R.R. 2011. Fundamental Managerial Accounting Concepts 6th ed. S.l.: Vertovec, T.

Vous aimerez peut-être aussi

- Introduction To Cost Accounting: Prof. Chandrakala.M Department of Commerce Kristu Jayanti College BengaluruDocument11 pagesIntroduction To Cost Accounting: Prof. Chandrakala.M Department of Commerce Kristu Jayanti College BengaluruChandrakala 10Pas encore d'évaluation

- Cost Accounting, Job Costing & Batch CostingDocument10 pagesCost Accounting, Job Costing & Batch Costing✬ SHANZA MALIK ✬Pas encore d'évaluation

- Chapter 5 - Tayler Et Al (2020)Document44 pagesChapter 5 - Tayler Et Al (2020)Mai TuấnPas encore d'évaluation

- Cost and Management AccountingDocument84 pagesCost and Management AccountingKumar SwamyPas encore d'évaluation

- Management Accounting Concepts and Techniques PDFDocument310 pagesManagement Accounting Concepts and Techniques PDFvishnupriya100% (1)

- Fusion HCM OTBI Security Customization White Paper 11.1.1.8.0Document28 pagesFusion HCM OTBI Security Customization White Paper 11.1.1.8.0amruthageethaPas encore d'évaluation

- ABC Costing 12 NewDocument20 pagesABC Costing 12 Newsyed khaleel0% (1)

- Unit 1 Opportunity CostDocument10 pagesUnit 1 Opportunity CostSUSHANTH E REVANKARPas encore d'évaluation

- Identity and Access Management: Program PlanDocument33 pagesIdentity and Access Management: Program Planfaltu account100% (1)

- CH 12 ABC Costing ExampleDocument33 pagesCH 12 ABC Costing ExampleSweetu Nancy100% (1)

- Claasification of CostsDocument21 pagesClaasification of CostsSaima Nazir KhanPas encore d'évaluation

- ACCT 311 - Chapter 5 Notes - Part 1Document4 pagesACCT 311 - Chapter 5 Notes - Part 1SummerPas encore d'évaluation

- Chapter - 6 Activity Based CostingDocument41 pagesChapter - 6 Activity Based CostingAlyssa GalivoPas encore d'évaluation

- Cpim - MPR (Sop & MPS)Document118 pagesCpim - MPR (Sop & MPS)Mohammad S. Abu SbeihPas encore d'évaluation

- Exercise Job CostingDocument8 pagesExercise Job Costingrkailashinie50% (2)

- Presentation1 170912062501 PDFDocument50 pagesPresentation1 170912062501 PDFKingPas encore d'évaluation

- Breakeven AnalysisDocument30 pagesBreakeven Analysisrameshpersonal2000Pas encore d'évaluation

- Balance Scorecard and BenchmarkingDocument12 pagesBalance Scorecard and BenchmarkingGaurav Sharma100% (1)

- ABC Costing Lecture NotesDocument12 pagesABC Costing Lecture NotesMickel AlexanderPas encore d'évaluation

- Credit Policy ManualDocument2 pagesCredit Policy ManualAkther Hossain100% (8)

- Relevant Costing or Incremental AnalysisDocument48 pagesRelevant Costing or Incremental Analysis06162kPas encore d'évaluation

- Mixed Cost High-Low Method ProblemDocument1 pageMixed Cost High-Low Method ProblemAnj HwanPas encore d'évaluation

- Chapter 9 Inventory FundamentalsDocument5 pagesChapter 9 Inventory FundamentalsKamble Abhijit100% (1)

- Mobilization of Manpower PDFDocument9 pagesMobilization of Manpower PDFrajaPas encore d'évaluation

- Cost AccountingDocument25 pagesCost AccountingkapilmmsaPas encore d'évaluation

- Management AccountingDocument112 pagesManagement AccountingSugandha Sethia100% (1)

- Short-Run Decision Making and CVP AnalysisDocument43 pagesShort-Run Decision Making and CVP AnalysisHy Tang100% (1)

- The Purpose of Cost SheetDocument5 pagesThe Purpose of Cost SheetRishabh SinghPas encore d'évaluation

- Introduction Cost Concepts Terms and BehaviorDocument43 pagesIntroduction Cost Concepts Terms and BehaviorZACARIAS, Marc Nickson DG.Pas encore d'évaluation

- CH 1 Managerial Accounting BasicsDocument53 pagesCH 1 Managerial Accounting BasicsIra AdraPas encore d'évaluation

- Makerere University College of Business and Management Studies Master of Business AdministrationDocument15 pagesMakerere University College of Business and Management Studies Master of Business AdministrationDamulira DavidPas encore d'évaluation

- Business Management (Bcom-Juraz Short Note)Document44 pagesBusiness Management (Bcom-Juraz Short Note)Akshay K RPas encore d'évaluation

- Chapter 5 NotesDocument6 pagesChapter 5 NotesXenia MusteataPas encore d'évaluation

- I. Product Costs and Service Costs: Absorption CostingDocument12 pagesI. Product Costs and Service Costs: Absorption CostingLinyVatPas encore d'évaluation

- SMChap 007Document86 pagesSMChap 007Huishan Zheng100% (5)

- TQM Chapter 8Document21 pagesTQM Chapter 8Yatin Gupta100% (2)

- Absorption Costing (Or Full Costing) and Marginal CostingDocument11 pagesAbsorption Costing (Or Full Costing) and Marginal CostingCharsi Unprofessional BhaiPas encore d'évaluation

- Microeconomics Exercises PDFDocument14 pagesMicroeconomics Exercises PDFVinaPas encore d'évaluation

- Chitra de Silva PDFDocument268 pagesChitra de Silva PDFRamadona SimbolonPas encore d'évaluation

- 05 AC212 Lecture 5-Marginal Costing and Absorption Costing PDFDocument22 pages05 AC212 Lecture 5-Marginal Costing and Absorption Costing PDFsengpisalPas encore d'évaluation

- Budget ProcessDocument24 pagesBudget ProcessSuzzie JeanPas encore d'évaluation

- Budgeting ProcessDocument3 pagesBudgeting Processpurity NgasiPas encore d'évaluation

- Short Run Decision AnalysisDocument31 pagesShort Run Decision AnalysisMedhaSaha100% (1)

- Shukrullah Assignment No 2Document4 pagesShukrullah Assignment No 2Shukrullah JanPas encore d'évaluation

- Principles of FinanceDocument1 pagePrinciples of FinanceSaiful Islam100% (1)

- Cost Accounting IIDocument62 pagesCost Accounting IIShakti S SarvadePas encore d'évaluation

- Chapter 9 - Inventory Costing and Capacity AnalysisDocument40 pagesChapter 9 - Inventory Costing and Capacity AnalysisBrian SantsPas encore d'évaluation

- Rostow's TheoryDocument3 pagesRostow's TheoryNazish SohailPas encore d'évaluation

- CA Final AMA Theory Complete R6R7GKB0 PDFDocument143 pagesCA Final AMA Theory Complete R6R7GKB0 PDFjjPas encore d'évaluation

- Chap 001Document17 pagesChap 001Rezart GolemajPas encore d'évaluation

- Marginal Costing and Absorption CostingDocument28 pagesMarginal Costing and Absorption Costingmanas_samantaray28Pas encore d'évaluation

- Activity Based CostingDocument4 pagesActivity Based CostingPetar BojovicPas encore d'évaluation

- Creativity, Innovation, AND EntrepreneurshipDocument52 pagesCreativity, Innovation, AND EntrepreneurshipBilawal ShabbirPas encore d'évaluation

- Cost Accounting SystemDocument11 pagesCost Accounting SystemachuvjPas encore d'évaluation

- SEM-II-Cost & Management Accounting-I Overhead CostingDocument8 pagesSEM-II-Cost & Management Accounting-I Overhead CostingTanishq KambojPas encore d'évaluation

- Absorption Costing Vs Variable CostingDocument2 pagesAbsorption Costing Vs Variable Costingneway gobachew100% (1)

- Portfolio ManagementDocument28 pagesPortfolio Managementagarwala4767% (3)

- ValuationDocument23 pagesValuationishaPas encore d'évaluation

- Midterm Bi ADocument13 pagesMidterm Bi AFabiana BarbeiroPas encore d'évaluation

- M1 - Introduction To Valuation HandoutDocument6 pagesM1 - Introduction To Valuation HandoutPrince LeePas encore d'évaluation

- Cost Accounting UNIT I Theroy (1) New PDFDocument18 pagesCost Accounting UNIT I Theroy (1) New PDFyogeshPas encore d'évaluation

- Chapter 13Document19 pagesChapter 13prachi aroraPas encore d'évaluation

- Responsibility Accounting and Transfer PricingDocument4 pagesResponsibility Accounting and Transfer PricingMerlita TuralbaPas encore d'évaluation

- Value Chain Management Capability A Complete Guide - 2020 EditionD'EverandValue Chain Management Capability A Complete Guide - 2020 EditionPas encore d'évaluation

- Corporate Financial Analysis with Microsoft ExcelD'EverandCorporate Financial Analysis with Microsoft ExcelÉvaluation : 5 sur 5 étoiles5/5 (1)

- Organizational behavior management A Complete Guide - 2019 EditionD'EverandOrganizational behavior management A Complete Guide - 2019 EditionPas encore d'évaluation

- Inventory valuation Complete Self-Assessment GuideD'EverandInventory valuation Complete Self-Assessment GuideÉvaluation : 4 sur 5 étoiles4/5 (1)

- Strategic Human Resource ManagementDocument12 pagesStrategic Human Resource Managementchandan singhPas encore d'évaluation

- Chester M. ChuaDocument20 pagesChester M. ChuaNikko ValenzonaPas encore d'évaluation

- CH 19Document30 pagesCH 19Phát TNPas encore d'évaluation

- Establishing Strategic PayDocument17 pagesEstablishing Strategic PayRain StarPas encore d'évaluation

- Oviedo 2016Document15 pagesOviedo 2016Dernival Venâncio Ramos JúniorPas encore d'évaluation

- Top ISTQB Interview Questions and Answers Part 2Document13 pagesTop ISTQB Interview Questions and Answers Part 2sabbam s deekshithPas encore d'évaluation

- Post-Implementation Evaluation of An ERP/SISDocument30 pagesPost-Implementation Evaluation of An ERP/SISAYUSHNEWTONPas encore d'évaluation

- Chap13 Project Audit and ClosureDocument27 pagesChap13 Project Audit and Closuremuiz_jojoPas encore d'évaluation

- The Correct Answer For Each Question Is Indicated by ADocument19 pagesThe Correct Answer For Each Question Is Indicated by Aakash deepPas encore d'évaluation

- E-Commerce Business in Nepal - Registration and MoreDocument5 pagesE-Commerce Business in Nepal - Registration and MoreManish Modi100% (1)

- BP CRM Master DataDocument5 pagesBP CRM Master DatajoheleduPas encore d'évaluation

- Published By: Transport Canada Civil AviationDocument26 pagesPublished By: Transport Canada Civil AviationRichard R M ThodéPas encore d'évaluation

- Plagiarised M&ADocument9 pagesPlagiarised M&ATusharPas encore d'évaluation

- Steve Hanke Publications ListDocument49 pagesSteve Hanke Publications Listshanke1Pas encore d'évaluation

- Chaper 1 - Version1Document39 pagesChaper 1 - Version1raxhelammPas encore d'évaluation

- Enterprise Resource Planning 3rd Edition Monk Test BankDocument22 pagesEnterprise Resource Planning 3rd Edition Monk Test Bankkieranthang03m100% (24)

- 2007, JP PDFDocument21 pages2007, JP PDFJATINPas encore d'évaluation

- 5A. Consultants Professionals A4S Essential Guide To Management Information - Pdf.downloadassetDocument56 pages5A. Consultants Professionals A4S Essential Guide To Management Information - Pdf.downloadassetsdfgvbnhjvPas encore d'évaluation

- Masters of Business Administration MBADocument12 pagesMasters of Business Administration MBASachin KirolaPas encore d'évaluation

- Entrepreneurship Diagnostic TestDocument6 pagesEntrepreneurship Diagnostic TestKathleen GulisPas encore d'évaluation

- Strategy in Global Context: Session 1Document17 pagesStrategy in Global Context: Session 1Louis-Kevin EtchiPas encore d'évaluation

- Profiles of Admirable Individuals INSTRUCTIONS: Analyze The Given Scenarios and Answer The Following Items in One (1) Whole Sheet ofDocument2 pagesProfiles of Admirable Individuals INSTRUCTIONS: Analyze The Given Scenarios and Answer The Following Items in One (1) Whole Sheet ofAshley Mae SarmientoPas encore d'évaluation

- Models & Theories (Sbl-Acca)Document9 pagesModels & Theories (Sbl-Acca)scribdsblPas encore d'évaluation