Académique Documents

Professionnel Documents

Culture Documents

Dream's Trade Ideas 05.01.2013

Transféré par

dreamytraderCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Dream's Trade Ideas 05.01.2013

Transféré par

dreamytraderDroits d'auteur :

Formats disponibles

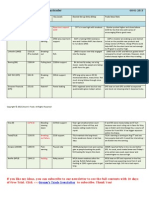

Dreams Trade Ideas by Dreamytrader

Stock Name

last Close Price Status Key Levels Desired Set-up Entry &Stop Trade Ideas Note

04-30-2013

Current Watch-list

S&P500 Index ETF (SPY) $158.28 Off high Near-term resistance is $160 $153.50-$154 lower support. $450ish-$460 area next resistance SPYs $160 still possible at any time. Pulling back and still high end of the range. AAPL stalled for a day, when market was in selling. Strong Apple is back for now to support the market. Long-term in Bullish mode. Seeing speeding for upside. Not seeing very attractive new entry long. Just holding long is enough for this mover so far. UPS fell back into the range and almost killed all the gains after the earning. Not a good sign here for long. MCD in early stage of a new range. Buying long with reasonable risk/reward still make sense for this stock. LNKDs in a stairway form of going higher. A very healthy price action into the earning. People are buying the stock in expectation of good earning. SPY was in selling mode and back-fired. Sell in May and go away spell is back for a day. Long month to go. AAPL got a confident investment from Russias Wealthy, and debt issuing for capitalreturn plan in progress. Investors are cheering the stock again. Strong last earning numbers spiked NKE into all-time high and it has been a very strong retail stock among the sector. The up-trend is intact for NKE despite recent market chills. UPS is lucky and delivered a nice earning package to investors, reported EPS beat and REV in-line, reaffirmed guidance. This helped stock to stable. MCD reported EPS and REV in-line with the market, and guided very softly for its outlook. Marco environment still tough for growth but company is gaining its influence. LNKDs earning is coming up as earning season is heating up. Price action was mixed but overall, LNKDs bull defended stock and recent price action shown buying interest ahead of earning date of May 2nd, after market

Apple(AAPL)

$439.29

Stall after rally

Nike (NKE)

$63.36

Speeding to higher

$62ish lower support

UPS (UPS)

$84.82

Earning gap-up

$86 resistance

McDonalds (MCD)

$101.38

Drifting lower

$97.50-$98ish support

LinkedIn (LNKD)

$194.80

Forming a range above previous support

$190ish area nearterm support.

Copyright 2013 Dream's Trade. All Rights Reserved

Boeing (BA)

$91.21

Traded lower but downside limited Broken near-term support of $73 Backing away from high

$89-$91 lower support area.

BAs next project is Holding the earning gap into near-future and forming a range is ideal before next entry long. HD is forming a range above $72, seeing multi-rejections on recent daily bars. A range is nice but the price action kind of weak here when market is advancing. MON is working on a tradeable setup for the long-side. Trading against the $103-$105 range for long is doable. MOS has a good weekly chart that showing buying against the $62ish$63 resistance and break on upside is the trade with entry with volume.

Boeings strong earning with huge beat on EPS and REV helped stock to close higher. Proved that Dreamliner didnt impact BA that much like people feared before. With more and more news about how housing market is recovering, HD certainly found reasons to go higher in this not so decisive market sentiment. Or, another housing bubble inflated by QE. MON reported EPS and REV beat on its Q2 earning and raised its guidance. Stock was in leading position before the earning and best among the sector. Agricultural sector lost its leadership a while ago. Long way to go. MOSs recent earning was somewhat mixed with EPS beat and miss on REV. Guidance was a bit downside. The buyers are still with the stock so the future could be brighter for now.

Home Depot (HD)

$72.79

$72 next lower support.

Monsanto (MON)

$104.74

$103-$105 lower support

Mosaic (MOS)

$60.32

Backing away from high

$63 resistance

If you like my ideas, you can subscribe to our newsletter to see the full contents with 10 days of Free Trial. Click >>>Dream's Trade Newsletter to subscribe. Thank You!

Copyright 2013 Dream's Trade. All Rights Reserved

Current Watch-list Featured Chart: NO

Copyright 2013 Dream's Trade. All Rights Reserved

Vous aimerez peut-être aussi

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- D. Michael Quinn-Same-Sex Dynamics Among Nineteenth-Century Americans - A MORMON EXAMPLE-University of Illinois Press (2001)Document500 pagesD. Michael Quinn-Same-Sex Dynamics Among Nineteenth-Century Americans - A MORMON EXAMPLE-University of Illinois Press (2001)xavirreta100% (3)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Value Chain AnalaysisDocument100 pagesValue Chain AnalaysisDaguale Melaku AyelePas encore d'évaluation

- Propht William Marrion Branham Vist IndiaDocument68 pagesPropht William Marrion Branham Vist IndiaJoshuva Daniel86% (7)

- 2nd Quarter Exam All Source g12Document314 pages2nd Quarter Exam All Source g12Bobo Ka100% (1)

- 61 Point MeditationDocument16 pages61 Point MeditationVarshaSutrave100% (1)

- Army War College PDFDocument282 pagesArmy War College PDFWill100% (1)

- Dream's Trade Ideas 07.15.2013Document3 pagesDream's Trade Ideas 07.15.2013dreamytraderPas encore d'évaluation

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderPas encore d'évaluation

- Dream's Trade Ideas 07.22.2013Document3 pagesDream's Trade Ideas 07.22.2013dreamytraderPas encore d'évaluation

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderPas encore d'évaluation

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderPas encore d'évaluation

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderPas encore d'évaluation

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderPas encore d'évaluation

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderPas encore d'évaluation

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock Namedreamytrader100% (1)

- Dream's Trade Ideas 04.30.2013Document9 pagesDream's Trade Ideas 04.30.2013dreamytraderPas encore d'évaluation

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderPas encore d'évaluation

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderPas encore d'évaluation

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderPas encore d'évaluation

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderPas encore d'évaluation

- Highway Capacity ManualDocument13 pagesHighway Capacity Manualgabriel eduardo carmona joly estudiantePas encore d'évaluation

- Bike Chasis DesignDocument7 pagesBike Chasis Designparth sarthyPas encore d'évaluation

- Social Networking ProjectDocument11 pagesSocial Networking Projectapi-463256826Pas encore d'évaluation

- Latvian Adjectives+Document6 pagesLatvian Adjectives+sherin PeckalPas encore d'évaluation

- Black Body RadiationDocument46 pagesBlack Body RadiationKryptosPas encore d'évaluation

- Effect of Innovative Leadership On Teacher's Job Satisfaction Mediated of A Supportive EnvironmentDocument10 pagesEffect of Innovative Leadership On Teacher's Job Satisfaction Mediated of A Supportive EnvironmentAPJAET JournalPas encore d'évaluation

- January Payslip 2023.pdf - 1-2Document1 pageJanuary Payslip 2023.pdf - 1-2Arbaz KhanPas encore d'évaluation

- 1 3 Quest-Answer 2014Document8 pages1 3 Quest-Answer 2014api-246595728Pas encore d'évaluation

- Linux Command Enigma2Document3 pagesLinux Command Enigma2Hassan Mody TotaPas encore d'évaluation

- Tutorial Class 4: Finders As Bailee Right of A Bailee General LienDocument26 pagesTutorial Class 4: Finders As Bailee Right of A Bailee General Lienchirag jainPas encore d'évaluation

- 7 кмжDocument6 pages7 кмжGulzhaina KhabibovnaPas encore d'évaluation

- HUAWEI P8 Lite - Software Upgrade GuidelineDocument8 pagesHUAWEI P8 Lite - Software Upgrade GuidelineSedin HasanbasicPas encore d'évaluation

- Forensic BallisticsDocument23 pagesForensic BallisticsCristiana Jsu DandanPas encore d'évaluation

- CASE: Distributor Sales Force Performance ManagementDocument3 pagesCASE: Distributor Sales Force Performance ManagementArjun NandaPas encore d'évaluation

- Didhard Muduni Mparo and 8 Others Vs The GRN of Namibia and 6 OthersDocument20 pagesDidhard Muduni Mparo and 8 Others Vs The GRN of Namibia and 6 OthersAndré Le RouxPas encore d'évaluation

- Analysis of Pipe FlowDocument14 pagesAnalysis of Pipe FlowRizwan FaridPas encore d'évaluation

- Mythologia: PrologueDocument14 pagesMythologia: ProloguecentrifugalstoriesPas encore d'évaluation

- Visual Acuity: Opthalmology CEX StepsDocument5 pagesVisual Acuity: Opthalmology CEX StepsVanessa HermionePas encore d'évaluation

- 2011 06 13-DI-PER8-Acoustic Insulation Catalogue-Rev 01Document12 pages2011 06 13-DI-PER8-Acoustic Insulation Catalogue-Rev 01Tien PhamPas encore d'évaluation

- Vocabulary Inglés.Document14 pagesVocabulary Inglés.Psicoguía LatacungaPas encore d'évaluation

- Civil and Environmental EngineeringDocument510 pagesCivil and Environmental EngineeringAhmed KaleemuddinPas encore d'évaluation

- 1907 EMarketer GEN XDocument16 pages1907 EMarketer GEN XRodolfo CampaPas encore d'évaluation

- Design and Experimental Performance Assessment of An Outer Rotor PM Assisted SynRM For The Electric Bike PropulsionDocument11 pagesDesign and Experimental Performance Assessment of An Outer Rotor PM Assisted SynRM For The Electric Bike PropulsionTejas PanchalPas encore d'évaluation

- List of Notified Bodies Under Directive - 93-42 EEC Medical DevicesDocument332 pagesList of Notified Bodies Under Directive - 93-42 EEC Medical DevicesJamal MohamedPas encore d'évaluation