Académique Documents

Professionnel Documents

Culture Documents

Business Trend in Agro Based Food Processing in Bangladseh 10.04.13

Transféré par

Golam MorshedCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Business Trend in Agro Based Food Processing in Bangladseh 10.04.13

Transféré par

Golam MorshedDroits d'auteur :

Formats disponibles

Preface: As a part of the educational program in post Graduate Diploma in Industrial Management at Bangladesh institute of Management we have had

to present an assignment under the course of Managerial Economics. In this context we have created a group named as Padma consisting three members and choose the subject on Business trend of Agro based processed food in Bangladesh. We have chosen the topic since the country like Bangladesh highly populated in nature faces the biggest challenge as feeding the people. On the other hand agro food processing sector helps most in the direct and indirect employment generation in rural area. To prepare this paper we have taken assistance from the world Banks study on Bangladesh development series paper 21, ILO report on Skills for trade and economic diversification in Bangladesh 2011 and Bangladesh Bureau of Statistics. We express our gratitude to the authors and publishers of those studies and book. Md. Golam Morshed, Md. Zakir Hossain, Md. Moniruzzaman.

Executive Summary: Bangladeshs economy has grown well in last two decades. Real Growth was about 5 percent in 1990s, and 5.8 percent in the first decade of twenty First Century. The Governments vision 21 envisages that growth will accelerate, reaching 10 percent in 2021. According to the industrial survey data from the Bangladesh Bureau of Statistics, the agro-food sector contributed 4.7% of GDP and 1.1% of total employment in 2005/06. According to the World Bank report on High Value Agriculture in Bangladesh in 2008, Bangladesh development Series paper no. 21 there were 6,139 companies operating in the agro food processing sector. Over 90% of these firms were found to be small (<50 employees). It shows that around two third of the agro-food firms are located in the rural areas and roughly 70% of the rural jobs are related to the food processing. The major processing firms engaged in the three major areas as Milling: Rice, pulse etc. Grinding: Flour, Spices etc. and Processing: transformation. the food manufacturing industry have a quantum index of industrial production in 2009-10 period at 193.0 which was 157.24 in 2003-04 based on the production in 1988-89 production. The contribution of food manufacturing sector to the GDP is Tk. 144,104 Mln. in 200910 which was Tk. 76,615 mln in 2004-05 and 54,118 in 2001-02. Though the investment climate in Bangladesh is still not attractive enough but there are a lot of opportunities like population, urbanization and increasing income and education the sector poses minimum risk and high potential. But we still need to improve the supply chain and operational efficiency alongwith adoption of advance technologies with improved business environment for excellence of the sector.

1.

Introduction:

Bangladeshs economy has grown well in last two decades. Real Growth was about 5 percent in 1990s, and 5.8 percent in the first decade of twenty First Century. The Governments vision 21 envisages that growth will accelerate, reaching 10 percent in 2021. The poverty rate has fallen significantly, reaching 31.5% in 2010 and according to the governments five year plan projection it will fall sharp to 22% by 2015 based on more inclusive growth. Rapid Export growth albeit from a low base has contributed significantly to Bangladeshs achievements. Fortunately Bangladeshs export dynamism is not confined to the ready -made Garments. Leather goods, Ship Building, Pharmaceuticals and parts of the agro-food sector are among the manufacturing sectors that are performing well. The agro-food sector processes raw materials produced by Bangladeshs farming. The sector is primarily domestically focused but has significant exports in spices and in ethnic foods of Bangladesh. Only a small fraction of food products produced in Bangladesh are exported while most are sold in domestic markets. Only a few typically large companies in the sector are engaged in exporting. According to the industrial survey data from the Bangladesh Bureau of Statistics, the agro-food sector contributed 4.7% of GDP and 1.1% of total employment in 2005/06. In addition to the direct employment and GDP contribution the sector is also important for a substantial number of employment and value added creation in the agriculture sector which supply its raw materials. With increasing incomes, education and ongoing urbanization it is estimated that food consumption patterns in Bangladesh will continue to shift from subsistence agriculture towards consumption of processed foods leading to projections (by world Bank report in 2008) of strong growth in domestic demand over the next decades. In addition to the above for different food attributes including health, safety, and convenience together rapidly changing food demand patterns presents many new opportunities for agricultural diversification and value addition in Bangladesh.

2.

Nature of business:

Most of the agro-food processing business in Bangladesh has grown depending on the availability of raw materials produced in Bangladesh. The major raw materials can be defined as a. Grains and Cereals: Rice, Wheat, Maize, millet etc. b. Oil Seeds: Mustard seeds, Soybean, peanut, sesame etc.

c. Pulses: Lentils, Green Gram, Pea, Lathyrus pea etc. d. Spices: Chili, Turmeric, Coriander, Black Cumin etc. e. Vegetables: Potatoes, Tomatoes, green vegetables etc. The major processing firms engaged in the three major areas as under. i. ii. iii. Milling: Rice, pulse etc, Grinding: Flour, Spices etc. Processing: the major processed foods includes the following categoriesa. Tea b. Edible Oil, c. Bakery, d. Ready to cook spices mix, e. Tomato paste and maize & potato starch and f. Snacks and other ethnic foods.

According to the World Bank report on High Value Agriculture in Bangladesh in 2008, Bangladesh development Series paper no. 21 there were 6,139 companies operating in the agro food processing sector. Over 90% of these firms were found to be small (<50 employees) and the majority of them were Rice milling (3,885) and Bakery (1,145) companies. Other significant categories are grain milling (226) and vegetable Oil (133) and confectioneries (100). Following table 2.1 depicts the size of food processing firms in Bangladesh in 2006. Table: 2.1 No. Firms 6,139 3,974 2,165 Firms size in % of Small Medium Large 93 93 93 4 3 4 3 3 3

Agro-Processing Enterprise Rural Agro-Processing Enterprise Urban Agro-Processing Enterprise Note:

Small Enterprise: Employee 10-50, Medium Enterprise: Emploee 50-100, Lrage Enterprise: Employee Moe than 100. And the firms having employee less than 10 were not captured in the census.

It shows that around two third of the agro-food firms are located in the rural areas and roughly 70% of the rural jobs are related to the food processing. Roughly one tenth of the firms are engaged in export business alongwith serving into domestic market and those companies are relatively larger both in terms of Sales value and volume who are most likely to launch new products, adopt new technologies and introduce new process.

3.

Business Environment:

According to the world Bank study some major improvements in the macro-economic area has improve the business and investment in this sector also some major constraints also noted that hinder the business in Bangladesh. The table 3.1 shows the major areas of improvement and constraints. Table: 3.1 Sl Improvements No. 1 Telecommunications 2 Access to finance 3 Crime, Theft and disorder 4 Transportation 5 Custom and Trade regulation

Constraints Power (Electricity in particular) Cost of Finance Macro economic stability Tax administration Skilled workforce.

Bangladesh maintain a good export potentiality since it is enjoying duty and quota free access to the US and EU markets as an LDC. In addition governments provides cash incentives programs and also VAT exemption for agro-food exporters that is one of the key to be competitive in the global market. According to the world banks enterprise survey firms report 100 days power outage in an average that accounts a loss of 3.5% output which is extremely large i.e. three times those in Thailand and even double from Vietnam.

4.

Contribution and growth of the sector:

Agro food processing is an important manufacturing Industry in Bangladesh. This sector including beverage and tobacco contributed 33% in the manufacturing value addition in 2005 whereas it was 25% in 1985 with a growth rate of 8%. According to the data revealed by the Bangladesh Bureau of Statistics (BBS) the contribution of food manufacturing sector to the GDP is Tk. 144,104 Mln. in 2009-10 which was Tk. 76,615 mln in 2004-05 and 54,118 in 2001-02. Figure 4.1 shows the growth.

Figure: 4.1

Contribution in mln. to GDP

160000 140000 120000 100000 80000 60000 40000 20000 0 2001-02 2004-05 2009-10 Contribution

The same source also revealed that the food manufacturing industry have a quantum index of industrial production in 2009-10 period at 193.0 which was 157.24 in 2003-04 based on the production in 1988-89 production. 5. Potentiality and opportunity of Agro-food processing business:

Domestic Market is the main market of the process food business in Bangladesh. The following table 5.1 demographic characteristics of the country that justifies more concentration and investment in the agro-food sector with high profit potential. Table: 5.1 Sl no. Findings 1 Literacy Rate (over 7 years) 2. Income per capita. 3. Population 15+ years 4. Employed labor force (over 15 years)

2005 51.9 1485 84.6 mln. 49.5 (mln.)

2010 57.91 2553 94.5 mln. 57.1 (mln.)

All of the above indices shows high growth and potential demand of agro-food products. It is a continuous growing challenge for Bangladesh to feed its large population. The growth of literacy rate and growing per capita income leads to higher demand of processed food. In addition ever increasing urbanization and women employment and empowerment accelerate the demand for food processing.

In addition extreme density of population leads to labour intensive economic activities therefore the agricultural sector will remain always in priority sector to the government. In addition cheap labor supply and woman engagement in this sector make it most attractive. High potential to the export market since a huge Bangladeshi people working abroad who merely accept foreign product when local product is available. In addition there is huge opportunity for Bangladeshi companies to export light and heavy processed foods to the mainstream International Markets. 6. Challenges to this business:

Operating business in agricultural sector remains a huge challenges which increases manifold when it is concerned to the very unstructured agro based RM production and supply market. The following are the major challenges the sector are facing in Bangladesh. Value Chains: Value Chains for Agro-food industries are typically rather complex, with a number of middlemen involved between the usually small producers and the processing firms. The complexity of the value chain poses challenges for many Agrofood companies to ensure that they get the type and quality of Raw materials they need at the right time. In addition managing inbound logistics, including relationship with suppliers, cold storage and transport management is seen as a major challenge by the industry. Operational effectiveness and Food safety: An well designed production processes and procedure are not enough by themselves, if they are not followed it can cause out comes as deficiencies in quality, problem with the food safety, waste of materials and loss of production efficiency. Strong capabilities in this areas therefore depend on the culture of compliance backed up by effective quality assurance system. Products development: Successful products development in food requires a combination of technical and business capabilities- technically perfect food products that can be produced efficiently will not sell if they fail to meet customer wants and products that consumers love will fail if they cannot manufactured and distributed costeffectively, to high quality and with an adequate shelf life. But most of the Bangladeshi companies are reluctant to invest much in R&D at the same time there is no research institute in Bangladesh that can help development of agro-food products. India our neighboring country has established Central Food Technological research Institute in 1950.

7.

Mitigation of Challenges:

Though the sector facing adverse investment environment and operational challenges there are the ways to mitigate the challenges. A few major initiatives that can be taken is mentioned hereunder. Improve value chain efficiency: It includes the capacity building of the small farmers that can be achieved through Short training on farming, post harvest handing storing and packing. Provide Advisory services to the farmers on good agriculture practice (GAP). Easy access to the information of GAP of the farmers. Development of infrastructure like cold storage, power etc.

Laboratory and testing facilities: Compliance with sanitary and phytosanitary standards remains a concern of many Bangladeshi companies. They used to use their own standard rather than using strict standards. Therefore affordable testing and certification facilities in the country are utmost importance for food safety. Rearrange tax administration for agro-food industry along with tax holidays.

8.

Conclusion:

Agro-food business in Bangladesh is very basic in nature. Only minimum processed foods are produced and marketed domestically and in the global market. So there is the naked scope of high value agro processed food development in Bangladesh. Therefore we should take initiative to improve the investment climate, increase efficiency of value chain and development of technical skill at operational level.

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Raw Food EbookDocument33 pagesRaw Food Ebookzimaios100% (3)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Agro Tourism ProjectDocument20 pagesAgro Tourism ProjectsekarkkPas encore d'évaluation

- Fort Wingate's Colorful HistoryDocument56 pagesFort Wingate's Colorful Historynod284100% (1)

- Agricultural Machinery Types and ImportanceDocument14 pagesAgricultural Machinery Types and ImportanceEzekiel Kyll Relampago100% (1)

- 50 Things Everyone Should KnowDocument5 pages50 Things Everyone Should KnowSkittles Chong Peik-JinnPas encore d'évaluation

- Overview of Honey Bees Facts, Types & CharacteristicsDocument7 pagesOverview of Honey Bees Facts, Types & CharacteristicsAndrea Maria Carbajal LagosPas encore d'évaluation

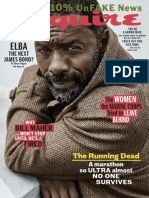

- Esquire USA August 2017Document109 pagesEsquire USA August 2017Anonymous M1Exa1E100% (1)

- African Women: A Modern HistoryDocument337 pagesAfrican Women: A Modern HistoryJuliana Paiva100% (1)

- Outline of RA 6657 As AmendedDocument35 pagesOutline of RA 6657 As AmendedAngelica Claire LunaPas encore d'évaluation

- Total Quality Management at AMULDocument15 pagesTotal Quality Management at AMULRajan Singh100% (2)

- Development and Performance Evaluation of Maize Threshing and Grinding MachineDocument6 pagesDevelopment and Performance Evaluation of Maize Threshing and Grinding MachineAJER JOURNAL100% (1)

- Genetc Modified CropsDocument30 pagesGenetc Modified CropsSanidhya PainuliPas encore d'évaluation

- Leeuwpoort EMP 24-08-12Document82 pagesLeeuwpoort EMP 24-08-12Bheki TshimedziPas encore d'évaluation

- Murray's Cheese 2014-2015 Entertaining and Gift GuideDocument16 pagesMurray's Cheese 2014-2015 Entertaining and Gift GuidemurrayscheesePas encore d'évaluation

- PALOMPO - Political Economy of Quantitative Restriction On Rice Importation and Its Implication To Phiippine Rice SectorDocument15 pagesPALOMPO - Political Economy of Quantitative Restriction On Rice Importation and Its Implication To Phiippine Rice SectorMariella PalompoPas encore d'évaluation

- Future Perfect Story 1Document7 pagesFuture Perfect Story 1Alisa BilokinPas encore d'évaluation

- The Legend of The Christmas Rose - Selma Lagerlof PDFDocument19 pagesThe Legend of The Christmas Rose - Selma Lagerlof PDFYêu Văn HọcPas encore d'évaluation

- 10.1.1.598.7464 Internasional JurnalDocument9 pages10.1.1.598.7464 Internasional JurnalAnisaPas encore d'évaluation

- Dukan PancakesDocument85 pagesDukan Pancakesfunky_ciupike8716Pas encore d'évaluation

- English For EthiopiaDocument125 pagesEnglish For EthiopiaMandela KumssAPas encore d'évaluation

- Dairy Visit in OrissaDocument2 pagesDairy Visit in OrissaSABYASACHI SENGUPTAPas encore d'évaluation

- 2015 Audubon Catalog PDFDocument48 pages2015 Audubon Catalog PDFptinker5201Pas encore d'évaluation

- CHR Hansen Q3 Roadshow Presentation 201819 PDFDocument38 pagesCHR Hansen Q3 Roadshow Presentation 201819 PDFAravind100% (1)

- Farm animal feed pellet machineDocument2 pagesFarm animal feed pellet machinejohn guinyangPas encore d'évaluation

- English Quarter 3 Module 4: Gian Kristian Georsua 9 - AlexandriteDocument2 pagesEnglish Quarter 3 Module 4: Gian Kristian Georsua 9 - AlexandriteJames Carlo AlertaPas encore d'évaluation

- Dimsum MenuDocument2 pagesDimsum MenuJosephLePas encore d'évaluation

- Eapp Lesson 2 - Journal ArticlesDocument33 pagesEapp Lesson 2 - Journal ArticlesCrestfallen LachrymatorPas encore d'évaluation

- Graffigna - Centenario Chardonnay 2010Document2 pagesGraffigna - Centenario Chardonnay 2010lozovnPas encore d'évaluation

- Cost Volume ProfitDocument45 pagesCost Volume ProfitkodiraRakshith100% (1)

- Indian Economy On The Eve of Independence (Autosaved)Document13 pagesIndian Economy On The Eve of Independence (Autosaved)katariamanojPas encore d'évaluation