Académique Documents

Professionnel Documents

Culture Documents

11

Transféré par

Xin GuTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

11

Transféré par

Xin GuDroits d'auteur :

Formats disponibles

2 In modern taxis systems 0 rate usually formedtax as: a amount of money, ) as a percentage, b ) quantity of taxable c ) none goods; d of above

) Which answers correct. tax,s 2 ofis the 1 following is not feature a Simple, ) b Gratuitous, ) Compulsory, c ) Refundable. d ) 2 status have a: 2 The taxpayer inof Poland a Jan Kowalski [place in ) Jan of tax residence China], b Kowalski, [place of tax ) Ltd., residence inis Poland], c which ) registered in . , No t a tax because Jan avoide could have d if Kowalski she difd not speed Sin taxes a t assessed by religious ) a assessed organizations b t on acts ) a assessed certain to c t desira ) a discourage ble behavi d or t assessed to purpos ) a fund a e None of the above e [jj 20 ) calcul T a , yo u need to o ate t know: i the tax base i the taxing i agency the tax rate i the purpose v of the Which following istax. of true? the >a) A regressive W-lazdym-pytaniu tax rate structure imposes an iedna odDQwiedz.DQDrawna CQ najmniej W kazdym pytaniu co naimniei jedna odpowiedz popmwna Imi d)i Ltd., which is .Godz. -nazwis Data 23. A tax remroittor is and individual, ............. ko. W legal entity, or paying ch of the not one of Adam Tax Law h collecting taxes, organizational unit without legal b taxes, Tax La' following is i personality obligated to: 33. ) a tax Fairness, collection, which a) to calculate tax, to collect c collector Certainty, supposed to be tax from collector, and to pay a lapse, Legality, the tax to a tax authority, a waiver of Transparency. the following may be deemed b) to calculate tax, to collect as a third person in the tax from taxpayer, and to pay An tax indirect tax authority, is a tax that: the to directly a tax Polish Tax Law: is levied on an a shareholder of Ltd., individual when a taxpayer is Ltd. liability may arise: 24.T is serving based on earnings of an a family member of authority's x by individual a tax shareholder of Ltd. , when administrative decision, which b) is 35. a the amount is determining paid indirectly to the of tax Ltd . , as increasing taxpayer marginal is tax rate such liability, by serving a authorities the tax base increases b) tax authority's c) a divorced spouse of is levied on one person for with c) administrative Regressive (a tax structures decision tax shareholder physical the intention that it is are the most common tax which is describing the person) of Ltd . , when a taxpayer d) payer, c rate structure An example of a* passed of on such to another. amount liability, is Ltd., . regressive tax is an of above answers is of Which of provided the following is not )^ d) none excise tax In terms 25. In scope by tax the Polish correct. usually source of rules effective. law, a a tax reinmitor shall be frTax in a country: ''*13.federal The provisions income of Eitployers liable: 36. omto: Domestic primary legislation Ordinance Act shall apply taxes directly often a) with his entire property, International tax treaties a) all taxes, withhold b) with The practice his entire of property the tax Conve a) b) charges, and authorities entire property International of a nienc a taxpayer, law. e to pecuniary performances ) c) Certa from relationships resulting c)b with his entire property for Which of the following is not above inty under civil law, from tax c ) tax proceeding one of tax's features? Econo tax-dues to following the state state 37.)d) non Simple, c liabilities, of the budget. d) none of above answers is government actions would make d 14. An indirect tax is a tax that: A correct. tax reramittor is and individual, if a tax system fails to e) is levied directly on an legal entity, or provide sufficient tax 26. A tax liability may be terminated individual revenue? organizational unit without legal 27. a) based Issue on treasury bonds Which of the obligated following to: may be f) is earnings of an personality deemed as a third person in the individual calculate tax, towhen collect b) Cut funding to various shareholder of Ltd., a a) ato tax fromis collector, and to apay g) is paid indirectly to system the tax ) taxpayer Ltd. the current of 38. Eliminating the tax to a tax authority, authorities family member of shareholder of withholding Income taxes directly b) to calculate tax, to collect c) Ltd., h) is levied on one person when taxpayer, a taxpayer and is to pay from eir^>loyee salary with would: tax from the intention that it is i. Violate the the tax to a tax authority, d) Ltd., passed convenience on to another. criterion a divorced spouse of of state taxation ii. < liability inay arise: T 28. A party to tax proceedings shall Increase thein rate of [PIT] 15. Income taxation a serving authority's be a , tax which due towhich their compliance iii.Poland Make x by is: administrative decision, collection of state legal demand acts of a b) is interests a) progressive, determining the amount of income taxes easier tax such authority, and to which an by serving b) proportional, iv. All of the above act tax of authority's aliability, tax authority refersa or administrative c) regressive, v. None of the above whose legal interests are c) decision for tax payer, which d) none of above answers is affected by an act of amount a tax: of is describing the Which of the following is not a correct. a) asuch taxpayer, liability, factor that determines whether a 16. taxpayer Which of is the following not required to is file a 29. A px'OVXdd natural person be served by may Polish law, usually a source of tax rules remmi cor tax return? with tax proceeding documents in shall be in a country: a) Filing Status. their: with his entire property, 40. a) Domestic primary legislation a) living accommodations> b) Taxpayer1s gross income. with his place entire property and b) International treaties c) Taxpayer *tax s employment. b) any where property of a the C) entire addressee is found, c) The practice of the tax _ d) .Taxpayer's age. taxpayer, authorities 30. A d consumption tax e) None of the above. with his entire property for d) International law. is tax a tax on: proceeding from tax If Jan Kowalski requests an a) ) income, The inheritance tax return, is the tax payment deadline shall be: extension to file his tax name given to various taxes b) a) nonfourteen days from the day an investment administrative decision determining the amount of tax liability is served; fifteen days from 31.c) A value added tax (VAT) is athe [inday Poland]: direct an administrative decision tax, determining the amount of tax d) liability consumpti is served; seven days on the tax, from day an administrative state 32.FWhich Jan Kowalski of the following may be was issued aThis 800 o deemed asspeeding a tax arr r ___ _ _ _ zloty ticket. r a) A tax not paid by the tax because payment is deadline; i A required by installment law A tax because b) A tax not to paid the payment is not related any specific benefit received fromliability the government a tax tax may be Not terminated entirely as a result of: because it is considered a fine a)Hc)d) A / op a)w dd)

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Print Money ReceiptDocument1 pagePrint Money ReceiptBorshon Bayzid100% (5)

- Budget For Fundraiser Event TemplateDocument3 pagesBudget For Fundraiser Event TemplateM.Maulana Iskandar ZulkarnainPas encore d'évaluation

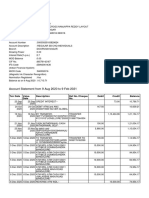

- Account Statement From 9 Aug 2020 To 9 Feb 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument5 pagesAccount Statement From 9 Aug 2020 To 9 Feb 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSuma0% (1)

- Tax Remedies NotesDocument44 pagesTax Remedies Notesyasser lucmanPas encore d'évaluation

- Sample Question AnswerDocument57 pagesSample Question Answerসজীব বসুPas encore d'évaluation

- National Democratic Redistricting Committee Form 8871Document3 pagesNational Democratic Redistricting Committee Form 8871Noyb NalPas encore d'évaluation

- Bangladesh Electronic Funds Transfer Network (Beftn) : Presented By: Central BACH, Payment Service Department, (PSD)Document19 pagesBangladesh Electronic Funds Transfer Network (Beftn) : Presented By: Central BACH, Payment Service Department, (PSD)Tanvir MahmudPas encore d'évaluation

- Confirmation1Document2 pagesConfirmation1Ignas Getsema Agasi SuryaPas encore d'évaluation

- JanDocument1 pageJanAnaya RantaPas encore d'évaluation

- Eft8502019121306440021 748Document2 pagesEft8502019121306440021 748HermielenePas encore d'évaluation

- Transfer Speed: ACH Transfers Often Take Wire Transfers MoveDocument3 pagesTransfer Speed: ACH Transfers Often Take Wire Transfers MoveAtulWalvekarPas encore d'évaluation

- Value Added Tax-White Paper DocumentDocument117 pagesValue Added Tax-White Paper DocumentVikas MarwahaPas encore d'évaluation

- Last Date of Submission 14/11/19: S.no Student - Name ClassDocument2 pagesLast Date of Submission 14/11/19: S.no Student - Name ClassAmritansh ShrivastavaPas encore d'évaluation

- CTS, Neft, RTGSDocument24 pagesCTS, Neft, RTGSSakthiPas encore d'évaluation

- Light Bill Sept 2019Document1 pageLight Bill Sept 2019Sanjyot KolekarPas encore d'évaluation

- Guidelines For Standardization of ATM OperationsDocument6 pagesGuidelines For Standardization of ATM Operationsarslan0989Pas encore d'évaluation

- Chapter 9 - RIT - Inclusions in Gross IncomeDocument3 pagesChapter 9 - RIT - Inclusions in Gross Incomeclaritaquijano526Pas encore d'évaluation

- F6 PIT AnswersDocument18 pagesF6 PIT AnswersHuỳnh TrungPas encore d'évaluation

- SAP Business One Tables - Business One - SCN WikiDocument7 pagesSAP Business One Tables - Business One - SCN WikiMaicon Macedo100% (1)

- Form Vat 17: Notice For Payment of DemandDocument1 pageForm Vat 17: Notice For Payment of DemandPratik jainPas encore d'évaluation

- Vat ConfigurationDocument27 pagesVat ConfigurationsreekumarPas encore d'évaluation

- Fiscal PolicyDocument8 pagesFiscal Policymegha_mundra_7633614Pas encore d'évaluation

- Heidelbergcement India Limited: Two Lakh Sixty Three Thousand Nine Hundred Fifty Three RupeesDocument1 pageHeidelbergcement India Limited: Two Lakh Sixty Three Thousand Nine Hundred Fifty Three RupeesPankaj PandeyPas encore d'évaluation

- Chapter C:4 Corporate Nonliquidating Distributions Discussion QuestionsDocument29 pagesChapter C:4 Corporate Nonliquidating Distributions Discussion QuestionsYang LiPas encore d'évaluation

- Tax Rights and RemediesDocument122 pagesTax Rights and RemediesMiguel Cornelius HerreraPas encore d'évaluation

- Ir 292Document22 pagesIr 292samsujPas encore d'évaluation

- 1999 68 ITD 95 Mumbai 03 10 1997Document9 pages1999 68 ITD 95 Mumbai 03 10 1997shubhit shokeenPas encore d'évaluation

- NSHM Knowledge Campus - Group of InstitutionsDocument2 pagesNSHM Knowledge Campus - Group of InstitutionsfjygfjygPas encore d'évaluation

- 0055450928Document1 page0055450928chandramouliyadavPas encore d'évaluation

- 6072 p1 Lembar JawabanDocument49 pages6072 p1 Lembar JawabanAhmad Nur Safi'i100% (2)