Académique Documents

Professionnel Documents

Culture Documents

CA AG Complaint Against JP Morgan Chase

Transféré par

SP BiloxiCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

CA AG Complaint Against JP Morgan Chase

Transféré par

SP BiloxiDroits d'auteur :

Formats disponibles

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

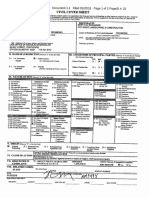

KAMALA D. HARRIS Attorney General of California FRANCES T. GRUNDER Senior Assistant Attorney General MICHELE VAN GELDEREN Supervising Deputy Attorney General WILLIAM R. PLETCHER (SBN 212664) BERNARD A. ESKANDARI (SBN 244395) TIMOTHY D. LUNDGREN (SBN 254596) Deputy Attorneys General 300 South Spring Street, Suite 1702 Los Angeles, CA 90013 Telephone: (213) 897-2000 Fax: (213) 897-4951 Email: bernard.eskandari@doj.ca.gov Attorneys for Plaintiff, the People of the State of California

[EXEMPT FROM FILING FEES UNDER GOVERNMENT CODE SECTION 6103]

SUPERIOR COURT OF THE STATE OF CALIFORNIA FOR THE COUNTY OF LOS ANGELES

THE PEOPLE OF THE STATE OF CALIFORNIA, Plaintiff, v. JPMORGAN CHASE & CO., a Delaware Corporation; CHASE BANK USA, N.A., a Delaware Corporation; CHASE BANKCARD SERVICES, INC., a Delaware Corporation; and DOES 1 through 100, inclusive, Defendants.

Case No. ____________________

COMPLAINT FOR PERMANENT INJUNCTION, CIVIL PENALTIES, RESTITUTION, AND OTHER EQUITABLE RELIEF (BUS. & PROF. CODE, 17200 et seq.)

[VERIFIED ANSWER REQUIRED PURSUANT TO CODE OF CIVIL PROCEDURE SECTION 446]

COMPLAINT People v. JPMorgan Chase & Co., et al.

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 1.

Plaintiff, the People of the State of California, by and through Kamala D. Harris, Attorney General of the State of California, alleges the following on information and belief: INTRODUCTION Defendants have committed debt collection abuses against tens of thousands of California

consumers. For years, Defendants have flooded Californias courts with collection lawsuits against defaulted credit card borrowers based on patently insufficient evidencebetting that borrowers would lack the resources or legal sophistication to call Defendants bluff. Rather than follow basic procedures to ensure fundamental fairness to California consumers, Defendants have run a massive debt collection mill that abuses the California judicial process to obtain default judgments, writs of execution, and wage-garnishment orders on the backs of lawsuits that cannot withstand scrutiny. At nearly every stage of the collection process, Defendants have cut corners in the name of speed, cost savings, and their own convenience, providing only the thinnest veneer of legitimacy to their lawsuits. 2. Defendants have directed their handful of in-house California lawyers to file a staggering

number of lawsuits against California consumersfor example, more than 100,000 lawsuits between January 2008 and April 2011, an average of well over 100 lawsuits each day the courts were open. Some days were more frenzied than others. For example, Defendants filed 469 lawsuits on April 1, 2010, and then followed it up with 226 lawsuits the next day. In addition to the lawsuits filed by Defendants in-house lawyers, outside firms retained by Defendants to assist with collections filed another 20,000 cases against California consumers between January 2008 and April 2011. 3. To maintain this breakneck pace, Defendants have employed unlawful practices as

shortcuts to obtain judgments against California consumers with speed and ease that could not have been possible if Defendants had adhered to the minimum substantive and procedural protections required by law. At the heart of Defendants unlawful conduct is the rampant use of robo-signinga practice of signing declarations, affidavits, and other documents in mass quantities, typically hundreds at a time, without any knowledge of the facts alleged in the document and without regard to the truth or accuracy of those facts. Robo-signing has infected

1 COMPLAINT People v. JPMorgan Chase & Co., et al.

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

all aspects of Defendants unlawful debt collection practicesfrom pre-lawsuit correspondence, to litigation in California courts, to affidavits provided to purchasers of Defendants debt for filing in third-party collection lawsuits against consumers. 4. In this action, the People seek an order permanently enjoining Defendants from engaging

in these unlawful, unfair, and fraudulent practices, and request restitution to California consumers as appropriate, civil penalties, and all other relief available under California law. DEFENDANTS AND VENUE 5. Defendant J.P. Morgan Chase & Co. (JPMC), a financial holding company, provides

various financial services worldwide. JPMC is a Delaware corporation, headquartered in New York, New York. At all relevant times, JPMC has transacted and continues to transact business throughout California, including Los Angeles County. 6. Defendant Chase Bank USA, N.A. (Chase USA) is one of JPMCs principal bank

subsidiaries and its issuer of consumer credit cards. JPMCs legal department provides in-house counsel to Chase USA. Chase USA is a Delaware corporation, headquartered in Newark, Delaware. At all relevant times, Chase USA has transacted and continues to transact business throughout California, including Los Angeles County. 7. Defendant Chase BankCard Services, Inc. (BankCard Services) is a subsidiary of Chase

USA and provides credit card services, including debt collection support, to JPMC and Chase USA. BankCard Services is a Delaware corporation, headquartered in Newark, Delaware. At all relevant times, BankCard Services has transacted and continues to transact business throughout California, including Los Angeles County. 8. Plaintiff is not aware of the true names and capacities of defendants sued herein as DOES

1 through 100, inclusive, and, therefore, sues these defendants by such fictitious names. Each fictitiously named defendant is responsible in some manner for the violations of law alleged. Plaintiff will amend this Complaint to add the true names of the fictitiously named defendants once they are discovered. Whenever reference is made in this Complaint to Defendants, such reference shall include DOES 1 through 100 as well as the named defendants. 9. At all relevant times, each Defendant acted individually and jointly with every other

2 COMPLAINT People v. JPMorgan Chase & Co., et al.

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

named Defendant in committing all acts alleged in this Complaint. 10. At all relevant times, each Defendant acted: (a) as a principal; (b) under express or

implied agency; and/or (c) with actual or ostensible authority to perform the acts alleged in this Complaint on behalf of every other named Defendant. 11. At all relevant times, some or all Defendants acted as the agent of the others, and all

Defendants acted within the scope of their agency if acting as an agent of another. 12. At all relevant times, each Defendant knew or realized, or should have known or realized,

that the other Defendants were engaging in or planned to engage in the violations of law alleged in this Complaint. Knowing or realizing that the other Defendants were engaging in such unlawful conduct, each Defendant nevertheless facilitated the commission of those unlawful acts. Each Defendant intended to and did encourage, facilitate, or assist in the commission of the unlawful acts, and thereby aided and abetted the other Defendants in the unlawful conduct. 13. Defendants have engaged in a conspiracy, common enterprise, and common course of

conduct, the purpose of which is and was to engage in the violations of law alleged in this Complaint. The conspiracy, common enterprise, and common course of conduct continue to the present. 14. The violations of law alleged in this Complaint occurred in Los Angeles County and

throughout the State of California. DEFENDANTS BUSINESS PRACTICES 15. Before filing a lawsuit against a California consumer on an alleged defaulted credit card

account, Defendants attorneys send correspondence to the consumer demanding payment of the balance allegedly due. In this correspondence to the consumer, Defendants attorneys: (a) state that they have been instructed to file suit; (b) claim that the consumer may be liable for additional amounts due, including attorneys fees when allowed by law; and (c) threaten to garnish the consumers income, levy personal property, and place liens on real property. 16. Through each of these communications with a California consumer, Defendants commit

unlawful, unfair, and/or fraudulent acts or practices, including, but not limited to, the following: a. Although Defendants correspondence is signed by an attorney, no attorney has

3 COMPLAINT People v. JPMorgan Chase & Co., et al.

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

exercised any independent legal judgment in sending the correspondence, and no attorney has even reviewed the consumers file to determine if the letter is accurate, including accuracy as to the claimed amount due. b. c. the consumer. d. Despite their threat to the contrary, Defendants do not place liens on the The amounts claimed are often inaccurate. Despite their threat to the contrary, Defendants do not recover attorneys fees from

consumers real property. 17. When Defendants file a lawsuit against a California consumer, Defendants commit

additional unlawful, unfair, and/or fraudulent acts or practices, including, but not limited to, the following: a. Defendants file a verification of the complaint in which the declarant states, under

penalty of perjury, that the declarant is an assistant treasurer and officer of Chase USA, and that the matters alleged in the complaint are true. These statements are false. The declarant is neither an assistant treasurer nor an officer of Chase USA, but rather a low-level employee of BankCard Services who has never even seen the complaint. The declarant has no personal knowledge about whether or not the complaints allegations are truefor example, that venue is proper, that the consumer owes the amount claimed, or that the consumers contract with Defendants provides for the recovery of reasonable attorneys fees. b. Defendants do not properly serve consumers with the summons and complaint,

despite filing proofs of service that declare under penalty of perjury that service was complete. For example, Defendants, through their agents for service of process, falsely state in proofs of service that the consumer was personally served, when, in fact, he or she was not served at alla practice known as sewer service. Other times, Defendants falsely state in proofs of service that substitute service was properly effected, even though Defendants made no reasonable attempts to personally serve the consumer. In any event, to more quickly generate seemingly legitimate process-server returns, Defendants often file proofs of service that bear only a digitally applied facsimile of the declarants signature, instead of the declarants original, wet-ink signature, as

4 COMPLAINT People v. JPMorgan Chase & Co., et al.

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

required for documents signed under penalty of perjury. 18. If the consumer does not appear to defend the lawsuitwhich happens in the majority of

the casesDefendants engage in unlawful, unfair, and/or fraudulent acts or practices to obtain a default judgment. These acts and practices include, but are not limited to, the following: a. Defendants file a declaration in support of the entry of default judgment in which

the declarant states, under penalty of perjury, that the declarant is an officer of Chase USA and a custodian of Chase USAs business books and records, and that he or she has personal knowledge of the facts supporting the entry of default. These statements are false. The declarant is not an officer of Chase USA but rather a low-level employee of BankCard Services (often the same purported officer who signed the complaint verification), who has no personal knowledge of the facts set forth in the declaration. For example, the declarant has no personal knowledge of the balance that he or she states is owed by the consumer and has not reviewed the books and records necessary to determine the amount owed. b. In these same declarations in support of the entry of default judgment, the

declarant states that Defendants will not produce the purported contract with the consumer and so waive the claim for attorneys fees allegedly authorized by the contract. This is despite the threat previously made to the California consumer in pre-lawsuit correspondence that Defendants may claim reasonable attorneys fees. c. In requesting entry of default judgment, Defendants attorneys declare under

penalty of perjury that the debtor against whom a default judgment is requested is not in the military service. In fact, Defendants have made no inquiry and have no personal knowledge about whether or not the debtor is a service member and thus entitled to certain benefits under California Military and Veterans Code section 400 et seq. One of these benefits, for example, is that a court may not enter a default judgment against a defendant in the military service until an attorney is appointed to represent him or her. d. As an attachment to the declaration in support of the entry of default judgment, the

declarant attaches one of the consumers credit card statements, but rarely redacts the consumers private information protected under California law, such as the consumers credit card account

5 COMPLAINT People v. JPMorgan Chase & Co., et al.

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

number. 19. After securing the default judgment through unlawful, unfair, and/or fraudulent acts or

practices, Defendants: (a) obtain a writ of execution and other court orders to take the consumers personal property; including wages and bank accounts, to satisfy the default judgment; and (b) submit negative credit information concerning the default judgment against the consumer to consumer credit reporting agencies. 20. Defendants also engage in unlawful, unfair, and/or fraudulent acts or practices when

providing affidavits to third parties who purchase Defendants defaulted credit card accounts. For example, in support of these third parties collection actions, Defendants provide affidavits to the third parties in which the affiant states that Defendants sold the consumers account to the third party and that the consumer owes the amount stated in the affidavit. In fact, the affiant does not review Defendants books and records in a manner sufficient to support the facts to which he or she attests, does not have personal knowledge of the facts, and does not set forth those facts with particularity. Moreover, the affiant is not administered an oath prior to signing the affidavit, and no notary public is present to witness the signing. FIRST CAUSE OF ACTION AGAINST ALL DEFENDANTS VIOLATIONS OF BUSINESS AND PROFESSIONS CODE SECTION 17200 (Unfair Competition Law) 21. Plaintiff realleges and incorporates herein by this reference paragraphs 1 through 20,

inclusive, as through set forth here in full. 22. Defendants have engaged in, and continue to engage in, acts or practices that constitute

unfair competition as defined in Business and Professions Code section 17200. These acts or practices include, but are not limited to, the following: a. Violating Civil Code section 1788.13, part of the Rosenthal Fair Debt Collection

Practices Act, Civil Code section 1788 et seq. (Rosenthal Act), by making misrepresentations and engaging in unlawful practices in connection with the collection of a debt, as alleged in Paragraphs 15 through 20; b. Violating Civil Code section 1788.17, part of the Rosenthal Act, by using false,

6 COMPLAINT People v. JPMorgan Chase & Co., et al.

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

deceptive, or misleading representations or means in connection with the collection of a debt, as alleged in Paragraphs 15 through 20; c. Violating Business and Professions Code section 6077.5, subdivision (a), by

making misrepresentations and engaging in unlawful practices in connection with the collection of a debt; and by using false, deceptive, or misleading representations or means in connection with the collection of a debt, as alleged in Paragraphs 15 through 20; d. Violating Code of Civil Procedure sections 396a and 446, subdivision (a), by

failing to properly verify complaints, as alleged in Paragraph 17; e. Violating Code of Civil Procedure section 1010.6, subdivision (b)(2)(B), by

electronically filing proofs of service of summons, signed under penalty of perjury, that were never actually wet-ink signed by the declarant but bear only his or her facsimile signature, and for which no printed form of the document is maintained bearing an original signature, as alleged in Paragraph 17; f. Violating Code of Civil Procedure section 585 in obtaining default judgments by

offering declarations containing facts that are not within the personal knowledge of the declarant and that are not set forth with particularity, as alleged in Paragraph 18; g. Violating California Rules of Court, rule 1.20, by filing documents without

redacting all but the last four digits of the consumers financial account number, as alleged in Paragraph 18; h. Declaring under penalty of perjury that no defendant was in the military service so

as to be entitled to the benefits of California Military and Veterans Code section 400 et seq., when in fact Defendants have no knowledge of and make no inquiry into the defendants military status, as alleged in Paragraph 18; and i. Violating Penal Code section 118 et seq., by committing or suborning perjury, as

alleged in Paragraphs 15 through 20. 23. Defendants conduct was in continuing violation of the Unfair Competition Law,

beginning at a time unknown to Plaintiff but no later than January 2008, and continuing to within four years of the filing of this Complaint.

7

COMPLAINT People v. JPMorgan Chase & Co., et al.

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 1.

PRAYER FOR RELIEF WHEREFORE, the People pray for judgment as follows: That Defendants, their successors, agents, representatives, employees, and all persons who

act in concert with them be permanently enjoined from engaging in unfair competition as defined in Business and Professions Code section 17200, including, but not limited to, the acts and practices alleged in this Complaint, under the authority of Business and Professions Code section 17203; 2. That the Court make such orders or judgments as may be necessary to prevent the use or

employment by any Defendant of any practice that constitutes unfair competition or as may be necessary to restore to any person in interest any money or property that may have been acquired by means of such unfair competition, under the authority of Business and Professions Code section 17203; 3. That the Court assess a civil penalty of $2,500 against each Defendant for each violation

of Business and Professions Code section 17200 in an amount according to proof, under the authority of Business and Professions Code section 17206; 4. In addition to any penalty assessed under Business and Professions Code section 17206,

that the Court assess a civil penalty of $2,500 against each Defendant for each violation of Business and Professions Code section 17200 perpetrated against a senior citizen or disabled person, in an amount according to proof, under the authority of Business and Professions Code section 17206.1; 5. /// /// /// /// /// /// ///

8 COMPLAINT People v. JPMorgan Chase & Co., et al.

That the People recover their costs of suit; and

6.

For such other and further relief that the Court deems just and proper.

2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21

22

Dated: May 9,2013

Respectfully Submitted,

KAMALA D. HARRIS

Attorney General of California

FRANCES T. GRUNDER

Senior Assistant Attorney General

MICHELE V AN GELDEREN

Supervising Deputy Attorney General

~~A~

Deputy Attorney General Attorneys for Plaintiff, the People of the State o/California

23 24 25 26 27 28

9

COMPLAINT People v. JPMorgan Chase & Co., et al.

Vous aimerez peut-être aussi

- Margaret Keenan LawsuitDocument31 pagesMargaret Keenan LawsuitWKYC.comPas encore d'évaluation

- Alec Arapahoe v. The United States of America, Et Al.Document28 pagesAlec Arapahoe v. The United States of America, Et Al.Michael_Lee_RobertsPas encore d'évaluation

- ICM ComplaintDocument28 pagesICM ComplaintTHRPas encore d'évaluation

- Ketola v. McLaren Greater LansingDocument16 pagesKetola v. McLaren Greater LansingLansingStateJournalPas encore d'évaluation

- First Amended ComplaintDocument30 pagesFirst Amended ComplaintBasseem100% (1)

- Cumberland Hospital LawsuitDocument65 pagesCumberland Hospital LawsuitWTVR CBS 6Pas encore d'évaluation

- United Health WarnDocument18 pagesUnited Health WarnJakob EmersonPas encore d'évaluation

- California AG's Office Notice of Motion and Motion For Leave To Intervene in Guenoc Valley ProjectDocument34 pagesCalifornia AG's Office Notice of Motion and Motion For Leave To Intervene in Guenoc Valley ProjectLakeCoNewsPas encore d'évaluation

- Class Action Lawsuit Against StarbucksDocument43 pagesClass Action Lawsuit Against StarbucksLaw&CrimePas encore d'évaluation

- CA Court Ruling Re Malicious Prosecution For Trademark and False Advertising ClaimsDocument85 pagesCA Court Ruling Re Malicious Prosecution For Trademark and False Advertising ClaimsDaniel Ballard100% (1)

- Doe v. Starbucks (Order)Document29 pagesDoe v. Starbucks (Order)Siouxsie Law100% (1)

- Jointed Cue Scott Johnson Complaint 15 PagesDocument15 pagesJointed Cue Scott Johnson Complaint 15 PagesABC10Pas encore d'évaluation

- SolomanDocument19 pagesSolomanABC10Pas encore d'évaluation

- Trader Joes ComplaintDocument24 pagesTrader Joes ComplaintSouthern California Public RadioPas encore d'évaluation

- Coley Lawsuit PDFDocument36 pagesColey Lawsuit PDFwamu885Pas encore d'évaluation

- Victoria White LawsuitDocument22 pagesVictoria White LawsuitMartin AustermuhlePas encore d'évaluation

- Maddie WadeDocument37 pagesMaddie WadePaige McIntyrePas encore d'évaluation

- Trevino Amended ComplaintDocument23 pagesTrevino Amended Complaintjonathan_skillingsPas encore d'évaluation

- Jordan v. Maine Unemployment Ins. Comm'n, CUMap-08-028 (Cumberland Super. CT., 2009)Document8 pagesJordan v. Maine Unemployment Ins. Comm'n, CUMap-08-028 (Cumberland Super. CT., 2009)Chris BuckPas encore d'évaluation

- Jorno v. Newegg - ComplaintDocument15 pagesJorno v. Newegg - ComplaintSarah BursteinPas encore d'évaluation

- Rodriguez v. Oakland Unified School District Et Al.Document37 pagesRodriguez v. Oakland Unified School District Et Al.KQED NewsPas encore d'évaluation

- In The United States District Court For The Northern District of Illinois Eastern DivisionDocument28 pagesIn The United States District Court For The Northern District of Illinois Eastern DivisionLegal WriterPas encore d'évaluation

- Salesforce Lawsuit Alleging Sales To BackpageDocument21 pagesSalesforce Lawsuit Alleging Sales To BackpageCNBC.com100% (5)

- GM MotionDocument230 pagesGM MotionGMG Editorial100% (1)

- Richardson v. FRB AmendedDocument34 pagesRichardson v. FRB AmendedEdward RichardsonPas encore d'évaluation

- Kim v. Tinder ComplaintDocument15 pagesKim v. Tinder ComplaintRussell BrandomPas encore d'évaluation

- Luke Rankin Sued For DefamationDocument84 pagesLuke Rankin Sued For DefamationMyrtleBeachSC newsPas encore d'évaluation

- FACDocument20 pagesFACCharlesCarreonPas encore d'évaluation

- Case Management StatementDocument6 pagesCase Management StatementdarwinbondgrahamPas encore d'évaluation

- Howlett First Amended ComplaintDocument25 pagesHowlett First Amended ComplaintClickon DetroitPas encore d'évaluation

- Order of Dismissal Bernie Backers LawsuitDocument28 pagesOrder of Dismissal Bernie Backers LawsuitLaw&Crime100% (3)

- 4.26.21 Filed Complaint Washington Et Al v. Raleigh Et AlDocument24 pages4.26.21 Filed Complaint Washington Et Al v. Raleigh Et AlAbraham Rubert-SchewelPas encore d'évaluation

- Shannon Blick LawsuitDocument35 pagesShannon Blick LawsuitWXYZ-TV Channel 7 DetroitPas encore d'évaluation

- GC LLC Civil ActionDocument24 pagesGC LLC Civil ActionJordanTurnerPas encore d'évaluation

- GOP Defamation LawsuitDocument7 pagesGOP Defamation LawsuitColton LochheadPas encore d'évaluation

- Fenner ComplaintDocument29 pagesFenner ComplaintTheBusinessInsiderPas encore d'évaluation

- The Corruption at The Los Angeles Superior Court As Lawyers Paz, Mercado, Conway, Maccarley Counts, Shomer, Felton, Overton, Berke, Rykoff, and Judge Hickok Apparently Lie in Court!Document48 pagesThe Corruption at The Los Angeles Superior Court As Lawyers Paz, Mercado, Conway, Maccarley Counts, Shomer, Felton, Overton, Berke, Rykoff, and Judge Hickok Apparently Lie in Court!Jose SalazarPas encore d'évaluation

- Hhse - Uptone Motion For Def Judgement Vs MedallionDocument3 pagesHhse - Uptone Motion For Def Judgement Vs MedallionYTOLeaderPas encore d'évaluation

- AR V Interim Care Foster Family Agency Civil Complaint June 25 2015Document70 pagesAR V Interim Care Foster Family Agency Civil Complaint June 25 2015Rick ThomaPas encore d'évaluation

- Civil Rights Groups' Challenge To HHS Final RuleDocument183 pagesCivil Rights Groups' Challenge To HHS Final RuleBasseemPas encore d'évaluation

- Hurt v. KrogerDocument14 pagesHurt v. KrogerBecca Godwin100% (1)

- Complaint - Zajonc v. Electronic Arts (NDCA 2020)Document22 pagesComplaint - Zajonc v. Electronic Arts (NDCA 2020)Darius C. GambinoPas encore d'évaluation

- Essie Grundy Lawsuit Against WalmartDocument6 pagesEssie Grundy Lawsuit Against WalmarttdogsmanPas encore d'évaluation

- Hall V United Airlines - ComplaintDocument11 pagesHall V United Airlines - ComplaintLaw&CrimePas encore d'évaluation

- Fairview Federal Complaint File StampedDocument26 pagesFairview Federal Complaint File StampedUSA TODAY NetworkPas encore d'évaluation

- Ethics StarbucksDocument20 pagesEthics StarbucksShivangi ChaudharyPas encore d'évaluation

- Proof of ServiceDocument2 pagesProof of ServiceMMA PayoutPas encore d'évaluation

- 36 - Motion To StrikeDocument13 pages36 - Motion To StrikeRipoff ReportPas encore d'évaluation

- Page 1 of 55Document55 pagesPage 1 of 55Greg aymondPas encore d'évaluation

- Jones v. Local 798Document13 pagesJones v. Local 798jeffbradynpr100% (1)

- Trotter v. City of PhoenixDocument15 pagesTrotter v. City of PhoenixDanny ShapiroPas encore d'évaluation

- Boston Scientific Corporation v. Mabey, 10th Cir. (2011)Document8 pagesBoston Scientific Corporation v. Mabey, 10th Cir. (2011)Scribd Government DocsPas encore d'évaluation

- Defamation, Civil Conspiracy, Being Filed in DCDocument27 pagesDefamation, Civil Conspiracy, Being Filed in DCRyan GallagherPas encore d'évaluation

- Vince Murdock vs. City of FolsomDocument52 pagesVince Murdock vs. City of FolsomABC10Pas encore d'évaluation

- Manual on the Character and Fitness Process for Application to the Michigan State Bar: Law and PracticeD'EverandManual on the Character and Fitness Process for Application to the Michigan State Bar: Law and PracticePas encore d'évaluation

- Swindled: If Government is ‘for the people’, Why is the King Wearing No Clothes?D'EverandSwindled: If Government is ‘for the people’, Why is the King Wearing No Clothes?Évaluation : 5 sur 5 étoiles5/5 (2)

- California Supreme Court Petition: S173448 – Denied Without OpinionD'EverandCalifornia Supreme Court Petition: S173448 – Denied Without OpinionÉvaluation : 4 sur 5 étoiles4/5 (1)

- Michigan Responds To Texas SuitDocument53 pagesMichigan Responds To Texas SuitCraig Mauger100% (1)

- Pennsylvania Opp To Bill of Complaint V.finalDocument43 pagesPennsylvania Opp To Bill of Complaint V.finalWXYZ-TV Channel 7 DetroitPas encore d'évaluation

- Impeaching Donald John Trump, President of The United States, For High Crimes and MisdemeanorsDocument4 pagesImpeaching Donald John Trump, President of The United States, For High Crimes and MisdemeanorsNicholas M. MocciaPas encore d'évaluation

- Georgia - Brief in OppositionDocument42 pagesGeorgia - Brief in OppositionMichael King0% (1)

- Inimicus Brief in Opposition To Texas Filed by California, New York Et Al.Document29 pagesInimicus Brief in Opposition To Texas Filed by California, New York Et Al.Nicholas M. MocciaPas encore d'évaluation

- Scotus FilingDocument154 pagesScotus FilingNatalie Winters100% (4)

- 16 States JoinTexas v. Pennsylvania - Amicus Brief of Missouri Et Al. - Final With TablesDocument30 pages16 States JoinTexas v. Pennsylvania - Amicus Brief of Missouri Et Al. - Final With TablesJim Hoft100% (17)

- Order To Show Cause Against Marylou Shanahan For Illegal Lockout of Hasna JalalDocument14 pagesOrder To Show Cause Against Marylou Shanahan For Illegal Lockout of Hasna JalalNicholas M. Moccia100% (1)

- 01 3 PDFDocument234 pages01 3 PDFCitizen StringerPas encore d'évaluation

- 2020 11 09 Complaint As FiledDocument105 pages2020 11 09 Complaint As FiledDave50% (2)

- Hasna Jalal v. Mary Lou Shanahan Complaint, District Court of The Eastern District On New York 16-CV-281Document26 pagesHasna Jalal v. Mary Lou Shanahan Complaint, District Court of The Eastern District On New York 16-CV-281Nicholas M. MocciaPas encore d'évaluation

- Hasna Jalal v. Mary Lou Shanahan Complaint, District Court of The Eastern District On New York 16-CV-281Document26 pagesHasna Jalal v. Mary Lou Shanahan Complaint, District Court of The Eastern District On New York 16-CV-281Nicholas M. MocciaPas encore d'évaluation

- Judge Whelan of Suffolk County, NY, Issues Bank Friendly Decision Declining To Dismiss Pursuant To CPLR 3215 (C)Document7 pagesJudge Whelan of Suffolk County, NY, Issues Bank Friendly Decision Declining To Dismiss Pursuant To CPLR 3215 (C)Nicholas M. MocciaPas encore d'évaluation

- NMLaw Summons and Complaint For Assault, Battery and Harassment in The Housing ContextDocument34 pagesNMLaw Summons and Complaint For Assault, Battery and Harassment in The Housing ContextNicholas M. MocciaPas encore d'évaluation

- Elpiniki Bechakas Signature SamplerDocument6 pagesElpiniki Bechakas Signature SamplerNicholas M. MocciaPas encore d'évaluation