Académique Documents

Professionnel Documents

Culture Documents

MAS Compilation of Questions

Transféré par

gon_freecs_4Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

MAS Compilation of Questions

Transféré par

gon_freecs_4Droits d'auteur :

Formats disponibles

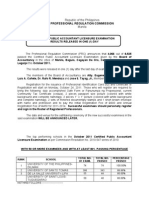

MANAGEMENT ADVISORY SERVICES QUESTIONS & ANSWERS COMPILED BY: MA. CRISTINA P. OBESO, CPA 1.

The following pertains to Sure Company: Sales (50,000 units) Direct Materials and Direct Labor Factory Overhead Variable Fixed Selling and General Expenses Variable Fixed

P1,000,000 300,000 40,000 70,000 10,000 60,000

How much was Sure's break-even point in number of units? a. 9,848 b. 10,000 c. 18,571

d. 15,700

2. Michael Company began its operations on Jan. 1,2008 and produces a single product that sells for P10/unit. Michael uses the actual (historical) cost system. In 2008, 100,000 units were produced and 80,000 units were sold. There was no work-in-process inventory at Dec. 31, 2008. Manufacturing costs and selling and administrative expenses for 2008 were as follows: Fixed costs Variable costs Raw materials 2.00/unit produced Direct labor 1.25/unit produced Factory overhead 120,000 0.75/unit produced Selling and administrative 70,000 1.00/unit produced What would be Michael's finished goods inventory at Dec. 31, 2008 under absorption costing method? a. 80,000 b. 104,000 c. 110,000 d. 210,000 3. Hope Company manufactures Part P for use in its production cycle. The cost per unit for 10,000 units of part P are as follows: Direct materials 3 Direct labor 15 Variable overhead 6 Fixed overhead 8 32 Hope can buy 10,000 units of Part P at P30 per unit. If Hope buys Part P. the released facilities could be used to save P45,000 in relevant costs in the manufacture of Part T. In addition, P5/unit of the fixed overhead applied to Part P would be totally eliminated. What alternative is more desirable and by what amount is it more desirable? a. Manufacture P10,000

b. c. d.

Manufacture P15,000 Buy P35,000 none of the choices

4. Bonifacio Company makes and sells a popular product and its average annual sales is 14,000 units at P65 each. Details of its costs are as follows:

Variable manufacturing costs per unit Variable selling expenses per unit Annual fixed manufacturing overhead Annual fixed selling and administrative

37 8 112,000 65,000

Sales are expected to go down to 1,200 units during the next three months due to road construction. Hence, management plans to close for three months and avoid 60% of all fixed costs. But additional shut down costs of P10,500 will be incurred. The company should operate since its expected sales in 3 months exceed a. 803 units b. 1,000 units c. 574 units d. 790 units 5. Right Corporation projects the following transactions for 2009, its first year of operations: Proceeds from issuance of common stock 1,000,000 Sales on account 2,200,000 Collections of accounts receivable 1,800,000 Cost of goods sold 1,400,000 Disbursements for purchases of merchandise and expenses 1,200,000 Disbursements for income tax 250,000 Disbursements for purchase of fixed assets 800,000 Depreciation on fixed assets 150,000 Proceeds from borrowings 700,000 Payments on borrowings 80,000 The projected cash balance at Dec. 31, 2009 is a. 1,170,000 b. 1,220,000 c. 1,370,000

d. 1,500,000

6. KC Corporation is planning to invest P80,000 in a three-year project.KC's expected rate of return is 10%. The present value of P1 is at 10% for one year is .909, for two years is .826, and for three years is .751. The cash flow, net of income tax, will be P30,000, for the first year (present value of P27, 270) and P36,000 for the second year (present value of of P29,736). Assuming the rate of return is exactly 10%, what will be the cash flow, net of income tax, for the third year? a. P22,000 b. P22, 994 c. P30,618 d. 27,270 7. The Dec. 31, 2007 balance sheet of Cyber Inc is presented below. These are only acounts in Cyber's balance sheet. Amounts indicated by a question mark (?) can be calculated from the additional information given

Assets Cash Accounts receivable (net) Inventory Property, plant and equipment (net) 25,000 ? ? 294,000 432,000

Liabilities & Stockholders' Equity Current ratio (at year end) Total liabilities divided by total stockholders' equity Inventory turnover (based on ending inventory) Cost of sales for 2007

1.5 to 1 0.8 10.5 times 735,000

What was Cybers' Dec. 31, 2007 inventory? a. 21,000 b. 30,000 c. 70,000

d. 88,000

8. The Heaven Co. makes and sells a single product called Zoom. Overhead costs are applied to products on a basis of direct labor hours. The following data applies to the company's activities for the month of November: Actual fixed overhead cost incurred 161,450 Budgeted direct labor hours (denominator activity) 40,000 Number of zoom completed 21,000 Fixed overhead budget variance - favorable 11,450 Standard direct labor hours allowed per Zoom 2 Standard overhead rate 5 The volume variance for November is: a. 6,800 unfavorable c. 7,500 favorable

b. 6,800 favorable d. cannot be determined

9. The following information pertains to material R which is used by Barney Co. Annual usage in units 20,000 Working days per year 250 Safety stock in units 800 Normal lead time in working days 30 Units of material R will be required evenly throughout the year. The order point is a. 1,600 b. 2,400 c. 3,200 d. 3,600

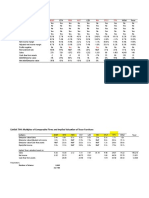

ANSWERS 1. B Total fixed costs (expenses) Div. by Contribution margin per unit Selling price (P1,000,000/50,000) Variable cost (350,000/50,000) Break-even point in units P130,000 20 7

13 10,000

2. B

Total manufacturing costs per unit: P4.00 + P1.20 = P5.20 Finished goods inventory: (20,000 x P5.20) = P104,000 If part P is purchased: Decrease in costs (savings): Variable manufacturing (P10,000 x P24) Fixed manufacturing eliminated (10,000 x P5) Relevant costs savings Total decrease in costs Increase in cost (purchase price): (10,000 x P30) Net cost savings if part P is bought Shut down costs: Fixed costs in 3 months (P177,000 x 1/4) Less: Avoidable cost (loss) div. by Contribution margin per unit Shutdown point

3. C

240,000 50,000 45,000 335,000 300,000 35,000

4. A

44,250 28,200 16,050 20 802.5

5. A

Cash receipts: Issuance of common stock Collection of accounts receivable Proceeds from borrowings Cash disbursements Disbursements for purchases of merchandise and expenses Disbursements for income tax Purchase of fixed assets Payments on borrowings Present value of cash flow: Cash flow PV Factor 30,000 x 0.909 36,000 x 0.826

1,000,000 1,800,000 700,000

3,500,000

1,200,000 250,000 800,000 80,000

2,330,000

6. C Year 1 Year 2

27,270.00 29,736.00

Year 3 ? x 0.75 Present value of cash flow: Investment outlay Net present value using 10% rate of return Total present value for the three years Less: Present value for 2 years( P27,270+29736) Present value of cash flow for the third year Divide by PV factor for the third year Cash flow for the third year 7. C Inventory turnover = Cost of sales = Inventory, end 10.5

? ? 80,000 0 80,000 57,006 22,994 0.751 30,618

10.5 =

735,000 ? Inventory, Dec. 31 = P735,000/10.5 = 70,000 8C Budget based on standard hours: Budgeted fixed overhead (P161,450-11,450) (Fixed overhead rate: 150,000/40,000= 3.75) Variable overhead 42,000 hrs x (P5.00-3.75) Standard overhead cost: 42,000 hours x P5.00 = Volume variance-favorable 9C

150,000 52,500 202,500 210,000 7,500

The order point (reorder point) = lead time usage + safety stock Lead time usage: Daily usage (20,000 units / 250 days) 80 units Normal lead time x 30 Lead time usage 2,400 units Add: Safety stock 800 Order point 3,200 units

1,170,000

Vous aimerez peut-être aussi

- CASO Pantry ShopperDocument2 pagesCASO Pantry ShopperDiana0% (1)

- Income Statement - ProblemsDocument19 pagesIncome Statement - ProblemsIris Mnemosyne50% (2)

- Electrolux Case StudyDocument4 pagesElectrolux Case StudyEmily GevaertsPas encore d'évaluation

- Model Residential Construction Contract Cost Plus Version 910Document30 pagesModel Residential Construction Contract Cost Plus Version 910Hadi Prakoso100% (2)

- Chapters-1-10-Exam-Problem (2) Answer JessaDocument6 pagesChapters-1-10-Exam-Problem (2) Answer JessaLynssej BarbonPas encore d'évaluation

- Sample MidTerm MC With AnswersDocument5 pagesSample MidTerm MC With Answersharristamhk100% (1)

- Multiple Choice: Shade The Box Corresponding To Your Answer On The Answer SheetDocument10 pagesMultiple Choice: Shade The Box Corresponding To Your Answer On The Answer SheetRhad Estoque0% (1)

- P1 - Winding UpDocument23 pagesP1 - Winding Upjinky2470% (10)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionD'EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionPas encore d'évaluation

- Seminar 11answer Group 10Document75 pagesSeminar 11answer Group 10Shweta Sridhar40% (5)

- Finals SolutionsDocument9 pagesFinals Solutionsi_dreambig100% (3)

- Asad NotesDocument15 pagesAsad NotesassadjavedPas encore d'évaluation

- Quiz For Finals For PrintingDocument4 pagesQuiz For Finals For PrintingPopol KupaPas encore d'évaluation

- Cpa Aditional CorlynDocument34 pagesCpa Aditional CorlynAlexaMarieAliboghaPas encore d'évaluation

- Assignment in Intermediateaccounting October 21Document12 pagesAssignment in Intermediateaccounting October 21Monica mangobaPas encore d'évaluation

- Semi-Finals Financial Accounting and ReportingDocument23 pagesSemi-Finals Financial Accounting and Reportingjoyce KimPas encore d'évaluation

- Reviewer in Financial MarketDocument6 pagesReviewer in Financial MarketPheobelyn EndingPas encore d'évaluation

- Quiz 2 Statement of Comprehensive Income Cash Vs Accrual BasisDocument11 pagesQuiz 2 Statement of Comprehensive Income Cash Vs Accrual BasisHaidee Flavier SabidoPas encore d'évaluation

- Afar (2018-2022)Document49 pagesAfar (2018-2022)Princess KeithPas encore d'évaluation

- Ma1 Sfe KaDocument6 pagesMa1 Sfe KaMarc MagbalonPas encore d'évaluation

- Commerce: Please Sub YTC: KnowledgeDocument5 pagesCommerce: Please Sub YTC: KnowledgeMuhammad HamidPas encore d'évaluation

- Lagura - Ass04 Statement of Comprehensive IncomeDocument7 pagesLagura - Ass04 Statement of Comprehensive IncomeShane LaguraPas encore d'évaluation

- MGT Adv Serv 09.2019Document11 pagesMGT Adv Serv 09.2019Weddie Mae VillarizaPas encore d'évaluation

- B. Sales Less Variable: Absorption CostingDocument3 pagesB. Sales Less Variable: Absorption CostingLaraPas encore d'évaluation

- Problems 1Document6 pagesProblems 1Russel BarquinPas encore d'évaluation

- LEVEL 2 Online Quiz - Questions SET ADocument8 pagesLEVEL 2 Online Quiz - Questions SET AVincent Larrie MoldezPas encore d'évaluation

- Practice FinalDocument13 pagesPractice FinalngStephanie26Pas encore d'évaluation

- Afar 5Document4 pagesAfar 5Tk KimPas encore d'évaluation

- Managerial AccountingDocument9 pagesManagerial AccountingChristopher Price100% (1)

- Final AFSTDocument7 pagesFinal AFSTCatherine ValdezPas encore d'évaluation

- Variable Costing vs. Absorption CostingDocument3 pagesVariable Costing vs. Absorption CostingLaraPas encore d'évaluation

- Cost AcctgDocument10 pagesCost AcctgCarl AngeloPas encore d'évaluation

- Cost Sheet Practical ProblemsDocument2 pagesCost Sheet Practical Problemssameer_kiniPas encore d'évaluation

- Mas Quizzer - Anaylysis 2021 Part 1Document6 pagesMas Quizzer - Anaylysis 2021 Part 1Ma Teresa B. CerezoPas encore d'évaluation

- Master Budget.5Document2 pagesMaster Budget.5Hiraya ManawariPas encore d'évaluation

- Accounting For Managers-Assignment MaterialsDocument4 pagesAccounting For Managers-Assignment MaterialsYehualashet TeklemariamPas encore d'évaluation

- MASDocument11 pagesMASgray downeyPas encore d'évaluation

- Tutorial Questions CVPDocument6 pagesTutorial Questions CVPChristopher LoisuliePas encore d'évaluation

- Quiz Bowl 10Document9 pagesQuiz Bowl 10mark_somPas encore d'évaluation

- Intermediate Accounting Chapters 9,10Document31 pagesIntermediate Accounting Chapters 9,10Jonathan NavalloPas encore d'évaluation

- MASPDocument3 pagesMASPSteeeeeeeephPas encore d'évaluation

- Management InformationDocument10 pagesManagement InformationTanjil AhmedPas encore d'évaluation

- Managerial AccountingDocument9 pagesManagerial AccountingJelyn RuazolPas encore d'évaluation

- 673 Quirino Highway, San Bartolome, Novaliches, Quezon CityDocument4 pages673 Quirino Highway, San Bartolome, Novaliches, Quezon CityRodolfo ManalacPas encore d'évaluation

- AttDocument8 pagesAttKath LeynesPas encore d'évaluation

- Mas MockboardDocument7 pagesMas MockboardMaurene DinglasanPas encore d'évaluation

- Financial Accounting Part 3Document6 pagesFinancial Accounting Part 3Christopher Price67% (3)

- College of Business Education PR 4 Management Advisory Services Diagnostic ExamDocument6 pagesCollege of Business Education PR 4 Management Advisory Services Diagnostic ExamMendoza Ron NixonPas encore d'évaluation

- Instruction: Shade The Letter of Your Choice in The Answer Sheet Provided. No Erasures AllowedDocument6 pagesInstruction: Shade The Letter of Your Choice in The Answer Sheet Provided. No Erasures AllowedmarygraceomacPas encore d'évaluation

- Cost FM Sample PaperDocument6 pagesCost FM Sample PapercacmacsPas encore d'évaluation

- Self Practice Cost AccountingDocument17 pagesSelf Practice Cost AccountingLara Alyssa GarboPas encore d'évaluation

- MSDocument9 pagesMSAeson Dela CruzPas encore d'évaluation

- Mas - ProblemsDocument14 pagesMas - ProblemsIyang LopezPas encore d'évaluation

- MS-1stPB 10.22Document12 pagesMS-1stPB 10.22Harold Dan Acebedo0% (1)

- Cma Part 1 Mock 2Document44 pagesCma Part 1 Mock 2armaghan175% (8)

- 0405 MAS Preweek QuizzerDocument22 pages0405 MAS Preweek QuizzerSol Guimary60% (10)

- Which of The Following Will Not Improve Return On Investment If Other Factors Remain Constant?Document3 pagesWhich of The Following Will Not Improve Return On Investment If Other Factors Remain Constant?Kath LeynesPas encore d'évaluation

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsD'EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsPas encore d'évaluation

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionD'EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionPas encore d'évaluation

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryD'EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsD'EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsPas encore d'évaluation

- Finance for IT Decision Makers: A practical handbookD'EverandFinance for IT Decision Makers: A practical handbookPas encore d'évaluation

- Fa 1 - Q1Document3 pagesFa 1 - Q1gon_freecs_4Pas encore d'évaluation

- TOS FinalsDocument1 pageTOS Finalsgon_freecs_4Pas encore d'évaluation

- Advanced Accounting 4 25Document2 pagesAdvanced Accounting 4 25gon_freecs_4Pas encore d'évaluation

- Advanced 5 24Document1 pageAdvanced 5 24gon_freecs_40% (1)

- TOS FinalsDocument1 pageTOS Finalsgon_freecs_4Pas encore d'évaluation

- Access 2007 TutorialsDocument34 pagesAccess 2007 Tutorialsbogsbest100% (4)

- Accounting 5 8Document1 pageAccounting 5 8gon_freecs_4Pas encore d'évaluation

- Sample Cash FlowDocument1 pageSample Cash Flowgon_freecs_4Pas encore d'évaluation

- Price List and Order Form 1st Sem., SY 2008-2009 Eff. June 2008 DeliveriesDocument1 pagePrice List and Order Form 1st Sem., SY 2008-2009 Eff. June 2008 Deliveriesgon_freecs_4Pas encore d'évaluation

- Price List and Order Form 1st Sem., SY 2008-2009 Eff. June 2008 DeliveriesDocument1 pagePrice List and Order Form 1st Sem., SY 2008-2009 Eff. June 2008 Deliveriesgon_freecs_4Pas encore d'évaluation

- Price List and Order Form 1st Sem (1) - SY 2007 2008 Revised May 30 2007Document1 pagePrice List and Order Form 1st Sem (1) - SY 2007 2008 Revised May 30 2007gon_freecs_4Pas encore d'évaluation

- VatDocument170 pagesVatgon_freecs_4Pas encore d'évaluation

- RO15 ProDocument5 pagesRO15 Progon_freecs_4Pas encore d'évaluation

- Full Text of The Official Result of October 2011 Certified Public Accountants Licensure ExaminationDocument17 pagesFull Text of The Official Result of October 2011 Certified Public Accountants Licensure ExaminationPaul Michael Camania JaramilloPas encore d'évaluation

- PhotoshopDocument6 pagesPhotoshopGon FreecsPas encore d'évaluation

- VatDocument170 pagesVatgon_freecs_4Pas encore d'évaluation

- Full Text of The Official Result of October 2011 Certified Public Accountants Licensure ExaminationDocument17 pagesFull Text of The Official Result of October 2011 Certified Public Accountants Licensure ExaminationPaul Michael Camania JaramilloPas encore d'évaluation

- Performance of Schools in Alphabetical Order: (October 2011 Certified Public Accountant Licensure Examination)Document18 pagesPerformance of Schools in Alphabetical Order: (October 2011 Certified Public Accountant Licensure Examination)tristan20Pas encore d'évaluation

- May 2012 Certified Public Accountant Licensure ExaminationDocument1 pageMay 2012 Certified Public Accountant Licensure ExaminationPaul Michael Camania JaramilloPas encore d'évaluation

- CSForm 100 Rev 2012Document2 pagesCSForm 100 Rev 2012Agnes Antonio RodriguezPas encore d'évaluation

- CLS 12Document27 pagesCLS 12aarchi goyalPas encore d'évaluation

- Ar 2019 # Samindo-4 PDFDocument271 pagesAr 2019 # Samindo-4 PDFpradityo88100% (1)

- Fixed DepositDocument16 pagesFixed DepositPrashant MathurPas encore d'évaluation

- Insurance Types Importance Objective Alternative Takaful Feature of Takaful, Re Insurance, Takaful WorldwideDocument11 pagesInsurance Types Importance Objective Alternative Takaful Feature of Takaful, Re Insurance, Takaful WorldwideMD. ANWAR UL HAQUEPas encore d'évaluation

- GHope-Contents-Directors Profile-Letter To Shareholders-CEO ReviewDocument98 pagesGHope-Contents-Directors Profile-Letter To Shareholders-CEO ReviewGerald ChowPas encore d'évaluation

- Teuer B DataDocument41 pagesTeuer B DataAishwary Gupta100% (1)

- Indian Accounting StandardsDocument9 pagesIndian Accounting StandardsAman Singh0% (1)

- Industrial Tour Report On CSE (Chittagong Stock Exchange)Document42 pagesIndustrial Tour Report On CSE (Chittagong Stock Exchange)Khan Md Fayjul100% (2)

- Runaway Corporations: Political Band-Aids vs. Long-Term Solutions, Cato Tax & Budget BulletinDocument2 pagesRunaway Corporations: Political Band-Aids vs. Long-Term Solutions, Cato Tax & Budget BulletinCato InstitutePas encore d'évaluation

- Nego Digest Week 2Document13 pagesNego Digest Week 2Rufino Gerard MorenoPas encore d'évaluation

- Stanley Black DeckerDocument9 pagesStanley Black Deckerarnabkp14_7995349110% (1)

- Wikborg Global Offshore Projects DEC15Document13 pagesWikborg Global Offshore Projects DEC15sam ignarskiPas encore d'évaluation

- I Dunno What de Puck Is This2010-06-06 - 1901 I Do03 - EdmomdDocument2 pagesI Dunno What de Puck Is This2010-06-06 - 1901 I Do03 - EdmomdMuhammad Dennis AnzarryPas encore d'évaluation

- High Conviction BreakoutsDocument4 pagesHigh Conviction BreakoutsRajeshPas encore d'évaluation

- Job Sheet Od Buku BesarDocument13 pagesJob Sheet Od Buku Besarjuandry andryPas encore d'évaluation

- CheatsheetDocument2 pagesCheatsheetSafi NurulPas encore d'évaluation

- Life Insurance Advertising in India Analysis of Recen 337186587Document12 pagesLife Insurance Advertising in India Analysis of Recen 337186587Raghav DudejaPas encore d'évaluation

- Introduction To IPOsDocument1 pageIntroduction To IPOsaugusthrtrainingPas encore d'évaluation

- JDF 208 Application For Court-Appointed Counsel or GAL - R10 2015Document2 pagesJDF 208 Application For Court-Appointed Counsel or GAL - R10 2015Antoinette MoederPas encore d'évaluation

- Module 4 PDFDocument19 pagesModule 4 PDFRAJASAHEB DUTTAPas encore d'évaluation

- LCCI Level 3 - Advanced Business Calculations (Exam Kit)Document332 pagesLCCI Level 3 - Advanced Business Calculations (Exam Kit)BethanyPas encore d'évaluation

- NpaDocument22 pagesNpaDeepika VermaPas encore d'évaluation

- Perbandingan Akuntansi Akrual Di Swedia Dan FinalndiaDocument30 pagesPerbandingan Akuntansi Akrual Di Swedia Dan FinalndiaAbdul RohmanPas encore d'évaluation

- Synopsis and Points To Be UrgedDocument8 pagesSynopsis and Points To Be UrgedGeet ShikharPas encore d'évaluation

- Wise & Co. Vs TanglaoDocument5 pagesWise & Co. Vs Tanglaodominicci2026Pas encore d'évaluation

- MSC Ariel ZadikovDocument119 pagesMSC Ariel ZadikovAkansha JadhavPas encore d'évaluation

- GM Coogan - Money Creators Who Creates Money Who Should Create It 1935Document176 pagesGM Coogan - Money Creators Who Creates Money Who Should Create It 1935mrpoisson100% (1)