Académique Documents

Professionnel Documents

Culture Documents

Nightly Business Report - Monday May 13 2013

Transféré par

Nightly Business Report by CNBCCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Nightly Business Report - Monday May 13 2013

Transféré par

Nightly Business Report by CNBCDroits d'auteur :

Formats disponibles

<Show: NIGHTLY BUSINESS REPORT> <Date: May 13, 2013> <Time: 18:30:00> <Tran: 051301cb.

118> <Type: SHOW> <Head: NIGHTLY BUSINESS REPORT for May 13, 2013, PBS> <Sect: News; Domestic> <Byline: Susie Gharib, Tyler Mathisen, Courtney Reagan, John Harwood, Jon Fortt> <Guest: Joe Feldman, Mike Mayo> <Spec: Business; Consumers; Economy; Retail Industry; Banking; Jamie Dimon; JPMorgan (NYSE:JPM) (NYSE:JPM); Policies; Education; Technology> <Time: 18:30:00>

ANNOUNCER: This is NIGHTLY BUSINESS REPORT with Tyler Mathisen and Susie Gharib, brought to you by --

(COMMERCIAL AD)

TYLER MATHISEN, NIGHTLY BUSINESS REPORT ANCHOR: Hitting the malls.

That`s what Americans did last month. And while they were there they shopped. But what are they buying? And is it a sign the economy is stronger than some think?

SUSIE GHARIB, NIGHTLY BUSINESS REPORT ANCHOR: Banking on Dimon. With JPMorgan (NYSE:JPM)`s chairman and CEO under pressure from shareholders, are investors better off with Jamie Dimon at the helm? One respected analyst says yes.

MATHISEN: Career boot camp. How some workers in the tech industry are jumpstarting their careers and doubling their salaries in the process.

All that and more tonight on NIGHTLY BUSINESS REPORT for Monday, May 13th.

And good evening, everyone. Welcome.

Susie, you know, stocks took a bit of a day off again today but the consumer is certainly not taking any time off.

GHARIB: Oh, you are absolutely right about that, Tyler.

American consumers are doing very well and, surprisingly, in the mood to spend. Cash registers across the country were ringing up more sales than expected in April and offering hope for some economic growth this spring.

Government figures out today show that retail sales rose a better than expected 0.1 of 1 percent last month. Now, that doesn`t sound like much, right? But remember, that reverses a sharp decline in March. Americans spent more on new autos, clothing, electronics and appliances. And they paid a lot less for gasoline. We saw the biggest drop in price in four and a half years.

We`ll get an even more insight into the health of the consumer this week and next week when Walmart, Macy`s (NYSE:M), Nordstrom (NYSE:JWN) (NYSE:JWN), Best Buy

(NYSE:BBY) (NYSE:BBY) and Tiffany (NYSE:TIF) (NYSE:TIF), to name just a few, will be reporting their earnings.

MATHISEN: And here with a closer look at the retailers and the consumers, Joe Feldman. He`s a retail analyst at the Telsey Advisory Group.

Mr. Feldman, welcome.

Susie just ran off the names of some companies out with results within the next few days. Walmart, Macy`s (NYSE:M), Nordstrom (NYSE:JWN) (NYSE:JWN), Best Buy (NYSE:BBY) (NYSE:BBY), Tiffany (NYSE:TIF) (NYSE:TIF). That runs the gamut from the discounters and the mass merchants, to the more specialized in the high end. Who`s doing best in this environment?

JOE FELDMAN, TELSEY ADVISORY GROUP RETAIL ANALYST: Well, the discounters continue to do quite well. You know, people are shopping for basic items, consumables, anything kind of grocery-related, household items that are related. And the discounters win in that environment. And we continue to see that.

You know, last week, Costco (NASDAQ:COST) (NASDAQ:COST) reported some sales numbers that were quite good yet again. We think that Walmart and Target (NYSE:TGT) (NYSE:TGT) next week will sound pretty solid when they do report.

GHARIB: Right. And there a couple of stocks that you are recommending to investors to buy. Tell us a little bit about Best Buy (NYSE:BBY) (NYSE:BBY), Whole Foods and PetSmart (NASDAQ:PETM) (NASDAQ:PETM) -- all very different kinds of companies. Why do you like them?

FELDMAN: Yes. Well, it`s interesting. Best Buy (NYSE:BBY)

(NYSE:BBY) is a turnaround story. And it`s -- you know, everybody left best buy for dead thinking that -- well, Amazon (NASDAQ:AMZN) (NASDAQ:AMZN) was going to take over, any e-commerce kind of sales.

The company has been on a big effort to cut costs. They have brought down prices on their products so that they are parity with anybody on the Internet. And at the same time, you have this interesting dynamic where tax collection for Internet sales is being pushed on the states. And in some states, it`s already starting to happen. And where it is happening, you are seeing sales trends at Best Buy (NYSE:BBY) (NYSE:BBY) pick up a little bit.

So, if you can get more sales through the door at Best Buy (NYSE:BBY) (NYSE:BBY) and attract those customers with prices that are at parity, plus, the lower cost, suddenly, there`s a lot more earnings power. And so, we like that one. A name like PetSmart (NASDAQ:PETM) (NASDAQ:PETM) or even Whole Foods, they have been laggards lately. You know, they haven`t really participated in this rally.

There is really nothing wrong with the companies. They are still doing the same thing. There is still solid growth. PetSmart (NASDAQ:PETM) (NASDAQ:PETM), for example, is a play on the housing market a little bit. You know, household formation drives pet adoption. So, there`s two names right there that we do like.

MATHISEN: I thought Whole Foods had a good report last week and the stock gave it a good pop.

FELDMAN: They did. You know, and that was great evidence of the fact that it had been lagging. And that, you know, it was a misread on really the underlying trend there. You know, the trend was fine. And people, investors were a little nervous that sales had decelerated a little bit.

But they really hadn`t. And you saw how quickly the stock really came back up. And that was a laggard stock.

MATHISEN: I want to go back to Best Buy (NYSE:BBY) (NYSE:BBY) very quickly. Don`t they still have a massive real estate problem?

FELDMAN: Well, the interesting thing with the real estate is, the stores are still highly productive. You know, they are getting good sales per square foot. Look at the cash flow generation of the company, it`s quite a robust cash flow.

GHARIB: Tell us about JCPenney -- new management, new strategy. Would you buy the stock at $18?

FELDMAN: If we are investing for the longer term, we at Telsey think that they can get things right. Nearer term, I think it`s going to be a little tougher.

Once the promotions do come back into play and start to attract that customer we think that the earnings will start to follow through. That`s probably when you want to buy the stock.

I think Mike Ullman coming back at CEO is going to help and he`ll drive those promotions. But I think we need probably another half year before we see that starting to translate into stronger sales.

MATHISEN: All right. Joe Feldman, thank you for being with us. Joe is with Telsey Advisory Group.

GHARIB: The Gap (NYSE:GPS) (NYSE:GPS) is another retailer getting a lot of attention these days. The stock is up 30 percent this year and it`s expected to report strong earnings next week. Now, the Gap (NYSE:GPS) (NYSE:GPS) is popular again with shoppers after a long stretch of being criticized for fashion misstep.

Tonight, we take a closer look at the turnaround at the Gap (NYSE:GPS)

(NYSE:GPS) as we kick off a week-long series on "Comeback Companies".

Courtney Reagan has the story.

(BEGIN VIDEOTAPE)

COURTNEY REAGAN, NIGHTLY BUSINESS REPORT CORRESPONDENT (voiceover): The turnaround for Gap (NYSE:GPS) (NYSE:GPS) Inc. has taken nearly a decade. But now that the puzzle pieces are in place consumers and investors are falling back into the Gap (NYSE:GPS) (NYSE:GPS).

UNIDENTIFIED FEMALE: The denim seems to be better. I like the washes. I like the fit. So, that was always a draw at the Gap (NYSE:GPS) (NYSE:GPS). But now their novelties and their colors I like, as well.

REAGAN: Wall Street credits the inflow of talents, improved supply chain, e-commerce prowess, and, of course, those brightly colored skinny jeans for stronger sales at Gap (NYSE:GPS) (NYSE:GPS) and its Banana Republic and Old Navy chains. After years of what many described as being stuck somewhere between H&M and J. Crew on price and style, Gap (NYSE:GPS) (NYSE:GPS) seems to have finally rediscovered its sweet spot.

ED YRUMA, KEYBANC RETAIL ANALYST: People have a pretty positive bias on the leadership team. I think they have done a great job of controlling expenses and building the business for the longer term. I think what`s been interesting as of late is the product has really turned and they`ve embraced the message of what really Gap (NYSE:GPS) (NYSE:GPS) stands for.

REAGAN: Gap (NYSE:GPS)`s fourth quarter profit increased 61 percent year over year. Operating margin improved from 7.6 percent in `07, to 12.4 percent in 2012.

April same store sales increased 7 percent. The retailer increased its first quarter earnings guidance. And on Friday, S&P upgraded Gap (NYSE:GPS)`s credit to investment grade.

CEO and Chairman Glenn Murphy says, "Gap (NYSE:GPS) (NYSE:GPS) Inc. has been executing its strategic plan to become a global retailer with a dominant portfolio of brands since 2008. We`ve made meaningful progress each year and we`re pleased that investors have taken notice, especially since early last year."

Gap (NYSE:GPS) (NYSE:GPS) shares have returned 78 percent to investors over the past two years, doubling the performance of the S&P retail index - though some question whether the strength is sustainable.

(on camera): While the average analysts rate Gap (NYSE:GPS) (NYSE:GPS) shares with a buy, Sterne Agee has an under perform on the shares, concerned about the recent departure of creative adviser, Tracy Gardner. KeyBanc has a hold on the stock, believing that shares are currently fairly valued.

(voice-over): But the company is only looking forward. Part of its growth strategy includes international expansion. Gap (NYSE:GPS) (NYSE:GPS) says this year for the first time, it will be entering Hungary and Paraguay with Gap (NYSE:GPS) (NYSE:GPS) stores. Mexico will get a Banana Republic to join Gap (NYSE:GPS) (NYSE:GPS) stores, and Costa Rica will get both a Gap (NYSE:GPS) (NYSE:GPS) and a Banana Republic location for the first time.

For NIGHTLY BUSINESS REPORT, I`m Courtney Reagan.

(END VIDEOTAPE)

GHARIB: And tomorrow, we continue our series on companies making remarkable comebacks with a look at Yahoo (NASDAQ:YHOO) (NASDAQ:YHOO).

What it`s doing right and the challenges ahead.

MATHISEN: On Wall Street stocks, ended the session mixed, little change really. The markets opened lower on some profit-taking and on concerns about a weekend report that Federal Reserve members were mulling over a time frame to start scaling back its bond buying stimulus program. No comment from the Fed, but the Dow did end 26 points lower. NASDAQ was up by two points and the S&P added a fraction of a point. But that was just enough to close at a new all time high.

GHARIB: Shares of JPMorgan (NYSE:JPM) (NYSE:JPM) rose 1 1/2 percent today, despite a lot of investors` worries about the future of the bank`s chairman and CEO Jamie Dimon. His tenure and performance come for a vote next week when shareholders decide on whether or not to separate his dual roles as chairman and chief executive.

Dimon has been criticized for huge losses following those controversial trades from the bank`s London office, raising concerns about oversight at the giant bank. Now, according to a report in "The Wall Street Journal", Dimon told colleagues that if the positions are separated, he would consider, quote, "leaving the bank."

Now, if Dimon does leave, JPMorgan (NYSE:JPM) (NYSE:JPM) stock could get slammed. That`s according to a note today from CLSA banking analyst Mike Mayo, who shares could fall by 10 percent or about $20 billion.

Mike Mayo joins us now to share his outlook.

So, Mike, is Jamie Dimon really the $20 billion man? I mean, what does this say about his performance since he became CEO back in 2005?

MIKE MAYO, CLSA BANKING ANALYST: Well, Jamie Dimon, under his helm, the stock price has performed better than any other bank CEO. So, Jamie Dimon has made investors money. And my report today talks about the market value of the company could decline by $20 billion if Jamie Dimon stepped down as CEO, which I think he put on the table.

Now, that`s for two reasons. One, you`d leave -- you would lose somebody who has made investors a lot of money.

But the other reason is, I don`t see a clear successor at JPMorgan (NYSE:JPM) (NYSE:JPM). So, that highlights also key main (ph) risk. Jamie Dimon is very valuable, perhaps too valuable. And that`s the important point I think the board needs to take up more seriously.

Do you believe that Mr. Dimon might actually leave? You take him at his word, or his reported word?

MAYO: Right. I`m not sure if he is bluffing or if he`s serious. But, you know, he`s the one who put this on the table. So let`s take that remote possibility seriously and that creates a new degree of management tail risk under certain circumstances if he were to go, you would see the stock price decline I think by at least 10 percent.

GHARIB: But, Mike, does this vote really matter? From my understanding, it`s a nonbinding shareholder vote. So even if they vote in favor of splitting these two roles, it`s up to the board of JPMorgan (NYSE:JPM) (NYSE:JPM) Chase to decide whether or not they`ll accept it, right?

MAYO: Well, look, if over 50 percent say we want to see the chairman role split from the CEO overall, I think the board has some very serious decisions to make.

Having said that, I don`t see the splitting of these two roles as my issue. The bigger issue is, does the board ensure enough transparency, accountability and oversight? So, I`m going down to Tampa at the annual meeting, May 21st, to ask the directors, be reassured by the directors that they have that proper oversight. And I think that issue transcends the issue of the chairman/CEO separation.

MATHISEN: So, does it tell you anything that 8 of 11 of Mr. Dimon`s direct reports have left in the last couple of years?

MAYO: Boy, talk about management tail risk, you have regulatory tail risk. And JPMorgan (NYSE:JPM) (NYSE:JPM) is in the line of fire. There`s many agencies that are taking a look at JPMorgan (NYSE:JPM) (NYSE:JPM). Their annual report mentions, expect more regulatory action to come, and you have seen so much management change the company can ill afford to lose its CEO at a time like this.

Jamie Dimon is a lot of the glue that holds this company together. And JPMorgan (NYSE:JPM) (NYSE:JPM) can ill afford to lose Jamie Dimon at this time.

GHARIB: A lot has been made that on the board of directors of JPMorgan (NYSE:JPM) (NYSE:JPM) is the lead director, former CEO of Exxon, Lee Raymond, known to be a really tough manager and, you know, good questioner of practices, business practices. Is that -- how important is all of that in terms of oversight?

MAYO: That`s extremely important. Lee Raymond, co-authored a letter to shareholders, a seven-page letter last Friday, saying that he has adequate oversight, that he thinks that Jamie Dimon should remain CEO and chairman.

Having said that, I have covered banks for 25 years and I have never met one director on the board of JPMorgan (NYSE:JPM) (NYSE:JPM). That`s why I`m going to annual meetings for the first time in my 25-year history of doing this job.

And so, I need to meet Lee Raymond face to face and look at him at the eye. He is 73 years old. So, is Lee Raymond today is the Lee Raymond of 20 years ago?

Now, large investors do have the chance to meet him. So, perhaps JPMorgan (NYSE:JPM)`s tilting the balance in favor of Jamie Dimon, it waits to be seen.

GHARIB: All right. Mike, thank you so much for your insights. I really appreciate it. Mike Mayo, bank analyst at CLSA.

Tyler?

MATHISEN: And still ahead, Susie, the IRS under fire for unfairly targeting specific groups. We will look at how deep this scandal may run.

But, first, here`s how the international markets closed today.

(MUSIC)

GHARIB: Time now for "Market Focus".

And we begin tonight with Biogen Idec (NASDAQ:BIIB) (NASDAQ:BIIB). The shares surged 4 1/2 percent on news that the Food and Drug Administration has accepted the company`s treatment for hemophilia. Biogen Idec (NASDAQ:BIIB) (NASDAQ:BIIB) now has two hemophilia treatments under review for different types of the condition.

Shares are up more than 50 percent this year. And today, they continue to rise, closing at $222 and change.

Investors taking a second look at Take-Two Interactive, after the video game developer reported higher than expected profits after the bell. Take-Two also raised its outlook for fiscal year beginning with the current quarter. The shares were down a fraction in the regular session, closing at $16.30 and then surged more than 5 percent in after hours trading.

MATHISEN: Well, as the TV networks begin their preseason sales meetings, Disney (NYSE:DIS)`s ABC said it will begin to live stream programming in some cities on mobile devices, but only to paying subscribers of cable and satellite providers. The dynamic changed in the way TV programs are distributed nonetheless. Disney (NYSE:DIS) (NYSE:DIS) shares touched a new all-time high at $67.52 before falling back slightly at the end of the session.

And shares of BlackBerry gained ahead of its live user conference this week in part because of favorable analyst comments on its operating system. Investors bid up BlackBerry more than 2 percent. It closed at $15.88.

GHARIB: And Google (NASDAQ:GOOG) (NASDAQ:GOOG) set a new all-time high today, $882.47 a share, before falling back a fraction. Investors have been bullish on Google (NASDAQ:GOOG) (NASDAQ:GOOG) for a while now. Shares have set new all-time highs for seven consecutive trading days, gaining almost 6 percent during that time.

The editor-in-chief of "Bloomberg News" has apologized for the actions of some of his reporters who accessed sensitive data about how clients use their Bloomberg information terminals found on just about every stock trading desk on Wall Street and are used by policymakers, the reserve, the Central European Bank and Germany Central Bank. They`re all examining whether there could have been any possible breaches of data usage.

MATHISEN: Outrageous, that`s how President Obama described the revelation that the Internal Revenue Service targeted conservative political groups that applied for nonprofit status ahead of last year`s general elections.

Speaking at the White House, the president said he will not tolerate the targeting of specific groups by a federal agency.

(BEGIN VIDEO CLIP)

BARACK OBAMA, PRESIDENT OF THE UNITED STATES: The IRS as an independent agency requires absolute integrity and people have to have confidence that they are

applying it in a nonpartisan way, applying the laws in a nonpartisan way. And you should feel that way regardless of party, I don`t care whether you are Democrat, independent or a Republican.

(END VIDEO CLIP)

MATHISEN: John Harwood joins us now from the White House on the fallout of the IRS` admitted bias.

John, what if anything did we learn new today from the president and his aides?

JOHN HARWOOD, NIGHTLY BUSINESS REPORT CORRESPONDENT: Well, we learn two things. One was that the president of the United States decided that he was going to project unequivocal anger and condemnation about what`s been reported.

And the second was we learned that, in response to a question about when anyone at the White House learned of this scandal, Jay Carney, while briefing reporters, said that while he and the president didn`t learn about it until Friday when news reports emerged that the inspect -- the White House lawyer, the president`s counsel had been informed on April 22nd that the I.G. report within the IRS was about to be completed, not the substance of the conclusions but that the report was about to be completed.

GHARIB: What about, John, the reaction on the Hill? I mean, what have you been hearing from lawmakers? Whether they are Democrats or Republicans, are there going to be hearings? There has been some talk about looking into some possible criminal behavior. What are you hearing?

HARWOOD: This is one case where the partisan differences have melted away and Democrats and Republicans are both saying this is unequivocally wrong. We need to have congressional investigation.

So, the House Ways and Means Committee is going to have a hearing on this on Friday and the Senate Finance Committee chaired by a Democrat, the House committee I just referred

to, chaired by a Republican, Senate Finance Committee said they are going to have hearings, too. So, everybody is jumping on this. It`s an opportunity for Democrats to say we don`t want conservatives treated unfairly either.

MATHISEN: How much staying power does this scandal have? John, you`ve been covering the White House and Washington a long time. Does this one have legs?

HARWOOD: It`s only going to have legs, Tyler, beyond the IRS if somebody can show a connection to the White House -- to the White House knowing about it and condoning it. What put the Nixon in Nixonian was presidential involvement. There is no evidence of that so far.

If any emerges, that`s going to be a big problem and keep the story alive for a long time.

MATHISEN: All right, John. John Harwood, reporting from the White House for us tonight.

GHARIB: And coming up on the program, a new way to give your career in technology a boost. And maybe even double your salary.

First, let`s take a look at how commodities, treasuries and currencies fared today.

(MUSIC)

MATHISEN: This year`s rise in the stock markets has resuscitated the markets for initial public stock offerings, 64 of them so far this year. New companies are launching bigger IPOs and seeing more leaping in stocks on their debuts.

According to Dealogic, this year is on track to see the most money raised by newly listed companies in at least five years.

GHARIB: Chrysler is recalling 469,000 Jeep Grand Cherokees and Jeep Commanders made between the years 2005 and 2010, because they can shift into neutral without warning when the vehicles are started up. Chrysler says the problem has caused 26 crashes and two injuries. The company began looking into the problem early last year after a customer complained that the car rolled away after being started remotely.

MATHISEN: Well, Susie, workers who are skilled in information technology and computer programming are some of the most sought after job seekers in the whole economy and now, potential employees may be able to pay to get years worth of I.T. schooling in just a matter of weeks in order to get one of those coveted jobs.

As Jon Fortt shows us, more and more of us are doing just that and it`s paying off.

(BEGIN VIDEOTAPE)

JON FORTT, NIGHTLY BUSINESS REPORT CORRESPONDENT: What if you could get super powers from a nine-week crash course? In digital terms at least, that`s the promise of Dev Bootcamp, a San Francisco program that promises to take people from zero to beginning web programmer in just over two months.

(voice-over): Co-founder Jesse Farmer isn`t saying you`ll have the programming chops of Bill Gates or Mark Zuckerberg overnight, but graduates have learned enough to land $80,000 a year jobs out the door.

JESSE FARMER, DEV BOOTCAMP CO-FOUNDER: After about two months of graduation, about 80 percent of those students have found jobs and working three months. That`s between 90 percent and 95 percent.

FORTT: To enlist in Dev Bootcamp, you need $12,000 and you got to survive the screening process.

FARMER: One is sort of check their interest and motivation.

FORTT: He takes only 20 percent of applicants. You don`t have to be a math genius.

CHRIS MALIN, PORT ORANGE, FL: Most recently, I was working as a writer.

GAVIN ST. OURS, SAN FRANCISCO, CA (NASDAQ:CA) (NASDAQ:CA (NASDAQ:CA)): I was a technical trainer at a telecommunications company in Florida.

FORTT: Katey Basye was a special education teacher in San Francisco before she signed up. She was frustrated with the lack of technology tools from public schools and decided to learn to build them herself.

KATEY BASYE, DEV BOOTCAMP GRADUATE: I really appreciated that boot camp for -- it just packed so much in and I never had a chance to be bored or restless or wonder what I`m doing.

FORTT: Gild is another San Francisco start-up that`s trying to address the programmer shortage. Its software analyzes the code that programmers write and gives them an unbiased score that companies can use to recruit.

SHEEROY DESAI, CO-FOUNDER & CEO: Anything anybody is doing to actually encourage people to take on programming and learn programming and therefore help on the supply side of the equation, we champion -- we love that.

FORTT: Even established operations like eBay (NASDAQ:EBAY)`s PayPal unit are hungry for fresh approaches.

LAURA CHAMBERS, PAYPAL: We hire approximately 25 percent of engineers into entry level roles. And those come from universities or from programs like Dev Bootcamp. When we look for those candidates, obviously, their experience is most important as things like drive, entrepreneurial passion and learning agility.

FORTT: These days, demand for programmers is so fierce that it`s not so much about who you know or even where you went to school as what you can do.

For NIGHTLY BUSINESS REPORT, I`m Jon Fortt.

(END VIDEOTAPE)

GHARIB: We certainly need to see more of these kinds of programs. Every CEO you talk to says we need more engineers and more people studying math.

But who wants to go back to school for all of that? If you can take a course like this and have the money to pay for it.

MATHISEN: And there is an investment of $12,000 for this boot camp course that hopefully will pay off big time down that road.

GHARIB: Handsomely, exactly.

MATHISEN: I`m going to tell my 7 year old when I go home tonight, study your math. Start programming. Don`t just play on that iPad. Start using it, start work in it.

GHARIB: Good advice.

And finally tonight, how many mobile phones did you own? More than one?

Well, a new report from the United Nations suggests that mobile phones will soon outnumber the world`s population. Get this -- the U.N. predicts that mobile phone subscriptions will surpass 7 billion early next year. And despite that incredible number, the agency says more than 60 percent of the world`s population still has no access to the Internet.

MATHISEN: Are you a one-phone woman? Or --

GHARIB: I`m a one phone, for now. I have an iPad, though.

MATHISEN: I am a two-phone guy, one for work and one for personal use. But I`m surprised by that number, that there will be 7 billion phone accounts. That`s just stunning. But U.N. says it. So, I guess it`s true.

All right. Tomorrow on NIGHTLY BUSINESS REPORT, we`ll hear from the National Federation of Independent Business. And we`ll get their monthly optimism index. We`ll have a report on the rising number of auto loan delinquencies and we`ll get data on import prices for April. That and more is tomorrow right here on NBR.

GHARIB: For tonight, that`s it -- for tonight, that`s it for us, for NIGHTLY BUSINESS REPORT. I`m Susie Gharib, thanks for joining us.

MATHISEN: And thanks from me as well. I`m Tyler Mathisen. Have a great evening, everyone. And we hope to see you right back here tomorrow evening.

END

Nightly Business Report transcripts and video are available on-line post broadcast at http://nbr.com. The program is transcribed by CQRC Transcriptions, LLC. Updates may be posted at a later date. The views of our guests and commentators are their own and do not necessarily represent the views of Nightly Business Report, or CNBC, Inc. Information presented on Nightly Business Report is not and should not be considered as investment advice. (c) 2013 CNBC, Inc.

<Copy: Content and programming copyright 2013 CNBC, Inc. Copyright 2013 CQ- Roll Call, Inc. All materials herein are protected by United States copyright law and may not be reproduced, distributed, transmitted, displayed, published or broadcast without the prior written permission of CQ-Roll Call. You may not alter or remove any trademark, copyright or other notice from copies of the content.>

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Temperature Performance Study-SilviaDocument11 pagesTemperature Performance Study-SilviadalheimerPas encore d'évaluation

- Sample Business Report FormatDocument1 pageSample Business Report FormatmironkoprevPas encore d'évaluation

- REXTAR User and Service GuideDocument58 pagesREXTAR User and Service GuidewellsuPas encore d'évaluation

- Ferrari Challenge ManualDocument121 pagesFerrari Challenge ManualStakos MakPas encore d'évaluation

- 747-400F Specifications - Atlas AirDocument1 page747-400F Specifications - Atlas AirRoel PlmrsPas encore d'évaluation

- NR # 2484B 08.03.2011 - B - Probe On Government's Tenement Housing Program PushedDocument1 pageNR # 2484B 08.03.2011 - B - Probe On Government's Tenement Housing Program Pushedpribhor2Pas encore d'évaluation

- Engineering Mechanics: StaticsDocument44 pagesEngineering Mechanics: StaticsDaya AhmadPas encore d'évaluation

- PA-STARNet Overview and Fact SheetDocument2 pagesPA-STARNet Overview and Fact SheetDaryl JonesPas encore d'évaluation

- Hose Reel System For Primary School at Alor Setar KedahDocument6 pagesHose Reel System For Primary School at Alor Setar KedahSyafiqah ShahuriPas encore d'évaluation

- A. Introduction: Module Gil BasicsDocument12 pagesA. Introduction: Module Gil BasicsMayuresh JoshiPas encore d'évaluation

- Azeez Gupta BainCover LetterDocument1 pageAzeez Gupta BainCover LetterShubhamGuptaPas encore d'évaluation

- Ultrasync Relay Expansion Modules: Um-R4 & Um-R10Document2 pagesUltrasync Relay Expansion Modules: Um-R4 & Um-R10Omar Andres Novoa MartinezPas encore d'évaluation

- FIN350 Quiz 2 Monday First Name - Last Name - Version BDocument6 pagesFIN350 Quiz 2 Monday First Name - Last Name - Version BHella Mae RambunayPas encore d'évaluation

- Da Series: Intelligent by DesignDocument2 pagesDa Series: Intelligent by DesignJames GrayPas encore d'évaluation

- J2018Sudarman-JPP-Development of Interactive Infographic Learning Multimedia - PDF InfografisDocument14 pagesJ2018Sudarman-JPP-Development of Interactive Infographic Learning Multimedia - PDF InfografissafiraPas encore d'évaluation

- January 01 To 31 2023 Rbi GR B Sebi GR A Nabard GR A Lyst3150Document95 pagesJanuary 01 To 31 2023 Rbi GR B Sebi GR A Nabard GR A Lyst3150kulvender singh100% (1)

- Master Formula New UpdateDocument5 pagesMaster Formula New UpdateAdhoPas encore d'évaluation

- VP422 HDTV10A Service Manual PDFDocument25 pagesVP422 HDTV10A Service Manual PDFDan Prewitt0% (1)

- Energies 10 02018 PDFDocument20 pagesEnergies 10 02018 PDFيوليسيس أوريروPas encore d'évaluation

- Syllabus Rhe306 Onramps C Fall 2018 CDocument8 pagesSyllabus Rhe306 Onramps C Fall 2018 Capi-213784103Pas encore d'évaluation

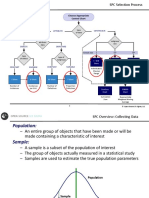

- Control - Statistical Process Control SPCDocument22 pagesControl - Statistical Process Control SPCHalimPas encore d'évaluation

- Regional Memorandum: Adjusted Search Timeline Activity Date RemarksDocument2 pagesRegional Memorandum: Adjusted Search Timeline Activity Date RemarksKimttrix WeizsPas encore d'évaluation

- Wireless-N ADSL2+ Gateway: User GuideDocument41 pagesWireless-N ADSL2+ Gateway: User GuidenaweedqadirPas encore d'évaluation

- Four Daewoo Motors Ex-Executives Acquitted of Fraud Charges - The Economic TimesDocument1 pageFour Daewoo Motors Ex-Executives Acquitted of Fraud Charges - The Economic TimescreatePas encore d'évaluation

- Schiavi Enc Met Page023Document1 pageSchiavi Enc Met Page023Adel AdelPas encore d'évaluation

- Puyat V de GuzmanDocument6 pagesPuyat V de GuzmanDwight LoPas encore d'évaluation

- Occupational Noise Hazard Assessment: A Case Study of Bangladesh Rail Transport SystemDocument27 pagesOccupational Noise Hazard Assessment: A Case Study of Bangladesh Rail Transport SystemShuvashish RoyPas encore d'évaluation

- WIWA Airless Spray GunsDocument52 pagesWIWA Airless Spray Gunsosvaldo lopezPas encore d'évaluation

- SynopsysDocument27 pagesSynopsyssalmanPas encore d'évaluation

- MACFOS Investors-PresentationDocument29 pagesMACFOS Investors-PresentationIDEasPas encore d'évaluation