Académique Documents

Professionnel Documents

Culture Documents

Workmen Compensation ACt

Transféré par

Shiraz JafriCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Workmen Compensation ACt

Transféré par

Shiraz JafriDroits d'auteur :

Formats disponibles

1

Workmens Compensation Act, 1923

Objectives of the law One of the oldest legislation of social security in India. a workman who dies or suffers disablement (partial or total) due to accident is entitled to get compensation. Coverage even if one worker is employed The act is applicable on factories etc. (where ESI Act is not applicable), however, this act is applicable even when only one worker is employed and it is not a not a factory under Factories

Workmen under the act: Section : 2(1)(n) Workman means * railway servant * crew of ship * Crew of aircraft * Driver, cleaner, helper or mechanic of motor vehicle * Person recruited abroad * Employed in capacity specified in Schedule II

The central govt. or state govt. can add new class of workmen in schedule II after giving at least 3 month notice. Schedule II It includes manufacturing process, explosives, mine, ship, loading/unloading, construction, electricity generation and distribution, drivers, horticulture, circus etc. Cultivation of land, fishing, rearing of live stock is covered if more than 25 persons are employed. Persons employed outside are also covered. However, persons employed in clerical capacity are excluded.

Mode of compensation Mode of computation of compensation is given in section 4 of the Act. Compensation is payable to workmen. It is payable to dependents of workman in case of death.

Coverage : all the workers in factories etc. are covered Every employee, including those employed through contractor, but excluding casual employees who is engaged for purpose of employers business is eligible. The Act does not

2 cover employees employed in clerical capacity. However, workmen in manufacturing processes, mines, ships, construction, tractor or mechanical appliances in agriculture, circus etc. and also drivers, watchmen etc. are covered. The compensation is payable if accident arises out of and during the cause of employment, and such accident causes either death or disablement. Coverage- employees covered under ESIC not to be covered by this law Employee State Insurance Act is also similar law and therefore a worker cannot get compensation under two laws Since a workman is entitled to get compensation from ESIC, a workman covered under ESI Act is not entitled to get compensation under Workmens Compensation Act, as per section 53 of ESIC.

Employers liability to pay compensation An employer is liable to pay compensation if personal injury is caused to a workman by accident arising out of and in the course of his employment. [section 3(1)]

Exceptions when compensation is not available : In case of Injury which does not result in total or partial disablement of workman for a period exceeding 3 days Injury caused by an accident directly attributable to workman under influence of drinks or drugs willful disobedience of express orders for safety willful removal of safety guard or device. [Even if such case, if the workman dies or suffers permanent total disablement, the employer will be liable].

Who are dependent persons?

Sec. 2(1) (d) : (1)widow, minor legitimate or adopted son, an unmarried legitimate or adopted daughter, or a widowed mother (2) if wholly dependent, - son, daughter who has attained the age of 18 years, and who is infirm and (3) if wholly / partly dependent : Widower a parent other than widowed mother

3 Minor illegitimate son, unmarried illegitimate daughter Daughter legitimate or illegitimate or adopted if married and a minor or if widowed and a minor Widowed daughter in law A minor child of a pre=deceased son A minor child of a pre-deceased daughter where no parent of the child is alive A paternal grandparent, if no parent of the workman is alive

What is partial disablement? Where disablement reduces the earning capacity of the workman in the employment in which is was working at the time of accident - it is called temporary partial disablement. Where disablement reduces the earning capacity for all times in every employment in which he was capable earlier it is called permanent partial disablement. Schedule I gives list of diseases which causes permanent partial disablement.

What is total disablement? Whether temporary or permanent which incapacitates a workman for all work which he was able to perform at the time of accident (mentioned in part I of schedule I or combination of injuries mentioned in Part II of schedule I, where the aggregate of such injuries is 100% or more) Example: Pratap Narain Singh Deo Vs sriniwas Sabata : (1976) : a carpenter lost his left hand, it was held by the court that he suffered from total disablement as he would not get any job of carpentry as now he cannot do carpentry.

Employment disease Employer is liable if a workman contracts any specified occupational disease, while he is in service of employer for at least 6 months. [section 3(2)].

Compensation payable even if no fault of employer The compensation is payable even when there was no fault of employer. In New India Assurance Co. Ltd. v. Pennamna Kuriern - (1995) 84 Comp. Cas. 251 (Ker HC DB), claim of workmen for compensation under Motor Vehicle Act was rejected due to negligence of employee, but compensation was awarded under Workmens Compensation Act on the principle of no fault.

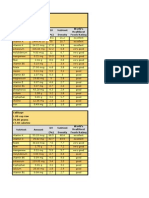

Quantum of compensation

4 In case of death resulting from injury, minimum compensation is Rs. 80,000. Maximum compensation is an amount equal to 50% of monthly wages of deceased workman multiplied by factor depending on age (More the age, lower the compensation). If salary exceeds Rs 4,000, it will be considered as Rs 4,000 only for purpose of calculating the compensation. Maximum compensation is Rs. 4,57,080 if a person at the time of death was 16 years of age an. In addition, funeral expenses upto Rs 2,500 are payable. [section 4(3)]. Quantum of compensation in case of disablement In case of permanent total disablement, minimum compensation is Rs. 90,000. Maximum compensation is an amount equal to 60% of monthly wages of deceased workman multiplied by factor depending on age (More the age, lower the compensation). Maximum compensation payable is Rs. 5,48,496, if workman was 16 years of age at the time of accident. - - In case of permanent partial disablement, compensation is payable on basis of percentage of loss of earning capacity. Compensation protected The compensation paid under the Act is protected, i.e. it cannot be attached or assigned. [section 9]. Compensation liability of principal employer even if employed through contractor Principal Employer is liable to pay the amount of compensation for the injury suffered by workman employed through contractor, if the accident arises as a result of accident arising out of and during the course of employment. [section 12].

Payment of compensation through commissioner A Commissioner for Workmens Compensation is appointed by Government. The compensation must be paid only through the Commissioner in case of death or total disablement. Any lump sum payment to workman under the Act must be made only through Commissioner. Direct payment to workman or his dependents is not recognised at all as compensation. However, in case of death, if employer has paid some compensation to dependent, that will be refunded to employer. [section 8(1)]. Expenditure by employer is not compensation Expenditure made by employer for medical treatment of workman is not considered for purposes of the compensation. Punishment to employee for disobedience etc. Any punishment of suspension or dismissal can be imposed after conducting a Domestic Enquiry. Principles of natural justice have to be followed. Termination of an employee without following principles of natural justice is violative of Article 21 of Constitution - D K Yadavv.

5 Procedure of enquiry For proper conduct of enquiry (1) Employee should be informed of charges leveled against him (2) Witnesses should be ordinarily examined before him. (3) The employee should be given fair opportunity to cross examine the witnesses, including himself (4) The enquiry officer should record his findings with reasons. Sur Enamel v. Workmen (1964) 3 SCR 616 = (1963) 2 LLJ 367 (SC) Compensation payable even if worker was careless Compensation is payable even if it is found that the employee did not take proper precautions. An employee is not entitled to get compensation only if (a) he was drunk or had taken drugs (b) he wilfully disobeyed orders in respect of safety (c) he wilfully removed safety guards of machines. However, compensation cannot be denied on the ground that workman was negligent or careless. Mar Themotheous v. Santosh Raj 2001 LLR 164 (Ker HC DB).

Vous aimerez peut-être aussi

- National Conference 21st Century's Socio-Economic ChallengesDocument1 pageNational Conference 21st Century's Socio-Economic ChallengesShiraz JafriPas encore d'évaluation

- Employee State Insurance Act 1948Document2 pagesEmployee State Insurance Act 1948Shiraz JafriPas encore d'évaluation

- Urdu Press ReleaseDocument1 pageUrdu Press ReleaseShiraz JafriPas encore d'évaluation

- What Is FranchisingDocument2 pagesWhat Is FranchisingShiraz JafriPas encore d'évaluation

- Introduction To RetailDocument5 pagesIntroduction To RetailShiraz JafriPas encore d'évaluation

- Resolution UrduDocument5 pagesResolution UrduShiraz JafriPas encore d'évaluation

- National Conference On Unpacking The 12 FYP: ResolutionDocument4 pagesNational Conference On Unpacking The 12 FYP: ResolutionShiraz JafriPas encore d'évaluation

- Introduction To RetailDocument5 pagesIntroduction To RetailShiraz JafriPas encore d'évaluation

- Bba&mbaDocument9 pagesBba&mbaShiraz JafriPas encore d'évaluation

- Ques. 4 What Do You Mean by Wages and Salary Administration. (Wages Schemes, Time Rate and Piece Rate System)Document6 pagesQues. 4 What Do You Mean by Wages and Salary Administration. (Wages Schemes, Time Rate and Piece Rate System)Shiraz JafriPas encore d'évaluation

- Consumer Decision MakingDocument46 pagesConsumer Decision MakingShiraz JafriPas encore d'évaluation

- Paper SchdeuleDocument1 pagePaper SchdeuleShiraz JafriPas encore d'évaluation

- Nutrient and calorie data for common fruits and vegetablesDocument12 pagesNutrient and calorie data for common fruits and vegetablesShiraz JafriPas encore d'évaluation

- Modern Modes of BusinessDocument18 pagesModern Modes of BusinessShiraz JafriPas encore d'évaluation

- Bba&mbaDocument9 pagesBba&mbaShiraz JafriPas encore d'évaluation

- C.S.J.M. University, Kanpur M.B.A. Full Time Scheme of Examination (July 12 To Dec. 12 Sem.)Document5 pagesC.S.J.M. University, Kanpur M.B.A. Full Time Scheme of Examination (July 12 To Dec. 12 Sem.)Shiraz JafriPas encore d'évaluation

- Retail ManagementDocument33 pagesRetail ManagementShiraz JafriPas encore d'évaluation

- Business Support ServicesDocument32 pagesBusiness Support ServicesShiraz JafriPas encore d'évaluation

- C.S.J.M. University, Kanpur M.B.A. Full Time Scheme of Examination (July 12 To Dec. 12 Sem.)Document5 pagesC.S.J.M. University, Kanpur M.B.A. Full Time Scheme of Examination (July 12 To Dec. 12 Sem.)Shiraz JafriPas encore d'évaluation

- Compensation Management Assignment's QuestionsDocument2 pagesCompensation Management Assignment's QuestionsShiraz JafriPas encore d'évaluation

- Nutrient and calorie data for common fruits and vegetablesDocument12 pagesNutrient and calorie data for common fruits and vegetablesShiraz JafriPas encore d'évaluation

- Compensation ManagementDocument264 pagesCompensation ManagementPaul Russel100% (1)

- MAccounting Variances and Overhead PDFDocument6 pagesMAccounting Variances and Overhead PDFShiraz JafriPas encore d'évaluation

- C.S.J.M. University, Kanpur M.B.A. Full Time Scheme of Examination (July 12 To Dec. 12 Sem.)Document5 pagesC.S.J.M. University, Kanpur M.B.A. Full Time Scheme of Examination (July 12 To Dec. 12 Sem.)Shiraz JafriPas encore d'évaluation

- CAMPSCHDEC Oddsem 29dec10Document30 pagesCAMPSCHDEC Oddsem 29dec10Shiraz JafriPas encore d'évaluation

- International TradeDocument103 pagesInternational Tradevinothkumararaja824975% (4)

- C.S.J.M. University, Kanpur M.B.A. Full Time Scheme of Examination (July 12 To Dec. 12 Sem.)Document5 pagesC.S.J.M. University, Kanpur M.B.A. Full Time Scheme of Examination (July 12 To Dec. 12 Sem.)Shiraz JafriPas encore d'évaluation

- C.S.J.M. University, Kanpur M.B.A. Full Time Scheme of Examination (July 12 To Dec. 12 Sem.)Document5 pagesC.S.J.M. University, Kanpur M.B.A. Full Time Scheme of Examination (July 12 To Dec. 12 Sem.)Shiraz JafriPas encore d'évaluation

- C.S.J.M. University, Kanpur M.B.A. Full Time Scheme of Examination (July 12 To Dec. 12 Sem.)Document5 pagesC.S.J.M. University, Kanpur M.B.A. Full Time Scheme of Examination (July 12 To Dec. 12 Sem.)Shiraz JafriPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Day 1 Introduction To OSH NewDocument88 pagesDay 1 Introduction To OSH Newmike cams85% (20)

- Department of Labor: CASESTUDY Cascade EngineeringDocument10 pagesDepartment of Labor: CASESTUDY Cascade EngineeringUSA_DepartmentOfLaborPas encore d'évaluation

- Awa Compilation of All Read The Beat The GMAT Myohomy TemplateDocument67 pagesAwa Compilation of All Read The Beat The GMAT Myohomy Templateprasant goelPas encore d'évaluation

- Verka Project FinalDocument26 pagesVerka Project FinalMT RAPas encore d'évaluation

- Editable - Service Agreement v1.1Document5 pagesEditable - Service Agreement v1.1rental agreement100% (1)

- Mario N. Felicilda, vs. Manchesteve H. Uy,: Block 2A, 11-23724Document2 pagesMario N. Felicilda, vs. Manchesteve H. Uy,: Block 2A, 11-23724emen penaPas encore d'évaluation

- Education Encompasses Teaching and Learning Specific SkillsDocument6 pagesEducation Encompasses Teaching and Learning Specific SkillsA.S.KHANPas encore d'évaluation

- Chapter 8-14 Nuclear Plant Problem (Solution)Document3 pagesChapter 8-14 Nuclear Plant Problem (Solution)eunnahjane100% (1)

- Chpt21 PowerpointDocument22 pagesChpt21 PowerpointConor O'NeillPas encore d'évaluation

- New Income Tax Software FY 2020-21 With Relief Under Section-89Document55 pagesNew Income Tax Software FY 2020-21 With Relief Under Section-89Raghavendra BiduruPas encore d'évaluation

- SPX SQE Job DescriptionDocument3 pagesSPX SQE Job DescriptionSushil Kr ChaurasiaPas encore d'évaluation

- 411-Short Assignment.Document17 pages411-Short Assignment.Md. Nazmul Islam100% (1)

- COVID 19 Return To Work 1591258538Document1 pageCOVID 19 Return To Work 1591258538rememberPas encore d'évaluation

- NQESH MOCK TEST APRIL 02, 2021Document24 pagesNQESH MOCK TEST APRIL 02, 2021ANTONETTE BALANSAG100% (1)

- Construction in Favor of Labor CASES and DigestDocument7 pagesConstruction in Favor of Labor CASES and DigestRaiza SartePas encore d'évaluation

- SOCIAL SECURITY SCHEMES IN INDIADocument38 pagesSOCIAL SECURITY SCHEMES IN INDIASourav BhattacharjeePas encore d'évaluation

- Offer LetterDocument3 pagesOffer LetterGautam kumarPas encore d'évaluation

- Group Term Life and Medical Insurance BenefitsDocument1 pageGroup Term Life and Medical Insurance BenefitsLimKangPas encore d'évaluation

- Director Business Development Sales in San Antonio TX Resume Dennis ReyesDocument2 pagesDirector Business Development Sales in San Antonio TX Resume Dennis ReyesDennisReyesPas encore d'évaluation

- Ashraf UlDocument56 pagesAshraf UlMd Khaled NoorPas encore d'évaluation

- Assignment Assessment 3 - Individual Essay - Pham Duc Long-1Document8 pagesAssignment Assessment 3 - Individual Essay - Pham Duc Long-1Long Pham DucPas encore d'évaluation

- Conflict - Triple Eight Integrated Services, Inc. v. NLRC (Class)Document16 pagesConflict - Triple Eight Integrated Services, Inc. v. NLRC (Class)All BluePas encore d'évaluation

- Sales & Distribution Management WorkbookDocument16 pagesSales & Distribution Management Workbookanindya_kunduPas encore d'évaluation

- Occupational Standards for Construction IndustryDocument53 pagesOccupational Standards for Construction IndustryFazil YousufPas encore d'évaluation

- Test Bank For Labor Relations 11th Edition John FossumDocument20 pagesTest Bank For Labor Relations 11th Edition John FossumGreg RainsPas encore d'évaluation

- Code of Ethics For Professional TeachersDocument4 pagesCode of Ethics For Professional TeachersBapa LoloPas encore d'évaluation

- Roha General Trading PLC G-35A: Payroll Register For The Period From Mar 1, 2014 To Mar 31, 2014Document1 pageRoha General Trading PLC G-35A: Payroll Register For The Period From Mar 1, 2014 To Mar 31, 2014Beky ManPas encore d'évaluation

- It's Time To Train: Key FindingsDocument4 pagesIt's Time To Train: Key Findingsapi-17312131Pas encore d'évaluation

- Organizational Behavior ImportanceDocument6 pagesOrganizational Behavior ImportanceSurya KiranPas encore d'évaluation

- OutlineDocument71 pagesOutlineMaxwell NdunguPas encore d'évaluation