Académique Documents

Professionnel Documents

Culture Documents

Chapter 3 Outline

Transféré par

Mah NoorCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Chapter 3 Outline

Transféré par

Mah NoorDroits d'auteur :

Formats disponibles

Chapter 03 - Reporting Operating Results on the Income Statement

CHAPTER 3 REPORTING OPERATING RESULTS ON THE INCOME STATEMENT

Summary of Related Video Program Spotlight Video Series

Chapter 3 Time is Money (approximately 4:00) This video program covers time period assumption. In 2000-01, Computer Associates violated the time period assumption to present a picture of smooth steady growth. This video illustrates the effect of shifting sales from one period to another and asks students to discuss its impact.

McGraw-Hill/Irwin Financial Accounting Video Series

Program #2 Transaction Analysis (9:35) This video program may be shown in connection with chapter 2 or chapter 3. The video covers transaction analysis in a lecture replacement format. Platinum Technology is featured during the general discussion of transactions. The video begins by defining and providing examples of assets, liabilities, equity, revenue, and expense. Then, the term, business transaction, is explained. The distinction between what is and what isnt a transaction is stressed. Platinum Technology is a real world company that must determine whether given events should be recorded as transactions. After the accounting equation is illustrated, its similarity to the balance sheet is noted. Then, transaction analysis is performed for a number of transactions. Most, but not all, of the transactions illustrated affect the balance sheet.

3-1

Chapter 03 - Reporting Operating Results on the Income Statement

Chapter Summary

LO 1 Describe common operating transactions and select appropriate income statement account titles. The income statement reports the effects of transactions that affect net income, which includes Revenuesamounts charged to customers for sales of goods or services provided. Expensescosts of business activities undertaken to earn revenues. See Exhibit 3.2 for basic income statement format. The two key concepts underlying accrual basis accounting and the income statement are Revenue principlerecognize revenues when they are earned. Matching principlerecognize expenses when they are incurred in generating revenue.

LO 2 Explain and apply the revenue and matching principles.

LO 3 Analyze, record, and summarize the effects of operating transactions, using the accounting equation, journal entries, and T-accounts. The expanded transaction analysis model includes revenues and expenses as subcategories of Retained Earnings. Increases, decreases, and normal account balances are shown below:

ASSETS

+ dr cr

= LIABILITIES

dr + cr

STOCKHOLDERS EQUITY

Contributed Capital

dr + cr

Retained Earnings

dr

Net Income

+ cr

Revenues (and Gains)

dr + cr

Expenses (and Losses)

+ dr cr

LO 4 Prepare an unadjusted trial balance. The unadjusted trial balance is a list of all accounts and their unadjusted balances, and is used to check on the equality of recorded debits and credits. LO 5 Describe limitations of the income statement. The income statement indicates whether the company is profitable, but this might not explain whether cash increased or decreased. Does not directly measure the change in value of a company during the period. Estimation plays a key role when measuring income.

3-2

Chapter 03 - Reporting Operating Results on the Income Statement

Chapter Outline

I. Understand the Business LO 1 Describe common operating transactions and select appropriate income statement account titles. A. Operating Activities 1. Operating activities The day-to-day functions involved Illustrated in Exhibit 3.1 in running a business. Operating activities include: a. Buying goods and services from suppliers. b. Selling goods and services to customers and then collecting cash from them. 2. Most businesses have the same steps in their operating cycles; the length of time for each step varies from company to company. 3. Operating activities are the primary source of revenues and expenses and, thus, can determine whether a company earns a profit (or incurs a loss). B. Income Statement Accounts 1. Revenues sales of goods or services to customers. Examples provided in 2. Expenses costs of business necessary to earn revenues. Exhibit 3.2 3. Net income the excess of revenues over expenses. C. The time period assumption assumes that the long life of a company can be divided into shorter time periods, such as months, quarters, and years. The Stoplight on Ethics 1. The income statement reports the financial effects of feature notes that some business activities that occurred during just the current managers havent learned the period. They relate only to the current period. time period assumption. 2. Key distinction between the income statement and the balance sheet. a. The revenues and expenses on an income statement report the financial impact of activities in just the current period. b. Items on a balance sheet will continue to have a financial impact beyond the end of the current period. II. Study the Accounting Methods A. Cash Basis Accounting 1. Cash basis accounting reports revenues when cash is received and expenses when cash is paid. 2. Cash basis accounting doesnt measure financial performance very well when transactions are conducted using credit rather than cash. 3. Because most companies use credit for their transactions, cash basis accounting is not likely to correspond to the business activities that actually occur during a given period. 4. This leads to a rather distorted view of the companys financial performance

3-3

Chapter 03 - Reporting Operating Results on the Income Statement

Chapter Outline

B. Accrual Basis Accounting 1. Accrual basis accounting reports revenues when they are earned and expenses when they are incurred, regardless of the timing of cash receipts or payments. a. Accrual basis accounting produces a better measure of the profits arising from the companys activities. b. According to generally accepted accounting principles (GAAP), the accrual basis is the only acceptable method for external reporting of income. c. The cash basis can be used internally by some small companies, but GAAP do not allow it to be used for external reporting. LO 2 Explain and apply the revenue and matching principles. 2. Revenue Principle Revenue Recognition a. Revenue principle requires that revenues be recorded when they are earned, not necessarily when cash is received for them. b. All companies expect to receive cash in exchange for providing goods and services, but the timing of cash receipts does not dictate when revenues are recognized. Instead key factor in recognizing revenue is whether the company has done what it promised. c. Timing of related transactions: i. Cash is received in the same period as the promised acts are performed Company will record the cash received and the revenue earned. ii. Cash is received in a period before the promised acts are performed. The company will record the cash received, but hasnt provided the promised goods/services, so no revenue is recorded yet. The obligation is a liability called Unearned Revenue. Unearned Revenue is recorded as a liability on the balance sheet. iii. Cash is to be received in a period after the promised acts are performed. Situation typically arises when a company sells to a customer on account. Selling on account means the company provides goods or services to a customer not for cash, but instead for the right to collect cash in the future. The right is an asset, Accounts Receivable. As dictated by the revenue principle, the company records revenue when the goods/services are provided.

Spotlight Video Chapter 3

3-4

Chapter 03 - Reporting Operating Results on the Income Statement

Chapter Outline

3. Matching Principle Expense Recognition a. The matching principle requires that expenses be recorded in the same period as the revenues they generate, not necessarily the period in which cash is paid for them. b. If an expense cannot be directly associated with revenues, it is recorded in the period that the underlying business activity occurs. c. Timing of related transactions: i. Cash is paid at the same time as the cost is incurred to generate revenue Company will record the expense incurred and the cash paid ii. Cash is paid before the cost is incurred to generate revenue. The company will record the cash paid, but hasnt used the related goods/services obtained to generate revenues, so no expense is recorded yet. The goods/services paid for in advance represent an asset (typically referred to as prepaid) because they will benefit future periods. When the goods/services are later used to generate revenues, the related expense will be reported on the income statement of that period and the asset originally recorded will decrease. iii. Cash is paid after the cost is incurred to generate revenue. Because the cost of the goods/services obtained relates to revenues earned this month, it represents an expense that will be reported on this months income statement. By using the goods/services, the company has incurred an expense and has the obligation to pa the vendor/supplier. This obligation is a liability. When the company later pays cash to the vendor/ supplier, the liability will decrease and the related liability will decrease. No additional expense is reported at that time.

Timing of reporting revenue versus cash receipts illustrated in Exhibit 3.5

Timing of reporting expenses versus cash payments illustrated in Exhibit 3.6

3-5

Chapter 03 - Reporting Operating Results on the Income Statement

Chapter Outline

LO 3 Analyze, record, and summarize the effects of operating transactions, using the accounting equation, journal entries, and T-accounts. C. The Expanded Accounting Equation 1. Stockholders equity represents the stockholders investment in the company, which comes from either: a. Contributed capital, given to the company by stockholders in exchange for stock or b. Retained earnings, generated by the company itself through profitable operations. 2. Because revenues and expenses as subcategories within retained earnings, they are affected by debits and credits in the same way as all stockholders equity accounts: a. Increases in stockholders equity are on the right. Illustrated in Exhibit 3.7 Revenues increase stockholders equity, so revenues are recorded on the right (credit). b. Decreases in stockholders equity are recorded on the left. Expenses decrease net income and retained earnings, so expenses are recorded on the left (debit). D. Transactions Analysis, Recording, and Summarizing Video Program #2 (a) Provide services for cash In September, Pizza Aroma delivered pizza to customers for $15,000 cash. 1. Analyze: Assets = Liabilities + Stockholders Equity Cash (A) + 15,000; Pizza Revenue (R, SE) + 15,000 2. Record: Refer to illustrations of dr Cash (+A) 15,000 transactions in textbook for cr Pizza Revenue (+R, +SE) 15,000 Step 3 Summarize (which (b) Receive cash for future services Pizza Aroma sold three includes posting to T$100 gift cards at the beginning of September. accounts). 1. Analyze: Assets = Liabilities + Stockholders Equity Cash (A) + 300; Unearned Revenue (L) + 300 2. Record: dr Cash (+A) 300 cr Unearned Revenue (+L) 300 (c) Providing services on credit Pizza Aroma delivers $500 of pizza to a college organization, billing this customer on account. 1. Analyze: Assets = Liabilities + Stockholders Equity Accounts Receivable (A) + 500; Pizza Revenue (R, SE) + 500 2. Record: dr Accounts Receivable (+A) 500 cr Pizza Revenue (+R, +SE) 500

3-6

Chapter 03 - Reporting Operating Results on the Income Statement

Chapter Outline

(d) Receive payment on account Pizza Aroma received a $300 check from the college organization, as partial payment of its account balance. 1. Analyze: Assets = Liabilities + Stockholders Equity Cash (A) + 300; Accounts Receivable (A) 300 2. Record: dr Cash (+A) 300 cr Accounts Receivable (A) 300 (e) Pay cash to employees Pizza Aroma wrote checks to employees, totaling $8,100 for wages related to hours worked in September. 1. Analyze: Assets = Liabilities + Stockholders Equity Cash (A) 8,100; Wages Expense (E) 8,100 2. Record: dr Wages Expense (+E, SE) 8,100 cr Cash (A) 8,100 (f) Pay cash in advance On September 1, Pizza Aroma paid $7,200 in advance for September, October, and November rent. 1. Analyze: Assets = Liabilities + Stockholders Equity Cash (A) 7,200; Prepaid Rent (A) + 7,200 2. Record: dr Prepaid Rent (+A) 7,200 cr Cash (A) 7,200 (g) Pay cash in advance On September 2, Pizza Aroma wrote a check for $1,600 for pizza sauce, dough, cheese, and other toppings. 1. Analyze: Assets = Liabilities + Stockholders Equity Supplies (A) + 1,600; Cash (A) 1,600 2. Record: dr Supplies (+A) 1,600 cr Cash (A) 1,600 (h) Incur cost to be paid later Pizza Aroma received a bill for $400 for running a newspaper ad. The bill will be paid in October. 1. Analyze: Assets = Liabilities + Stockholders Equity Accounts Payable (L) +400; Advertising Expense (E) 400 2. Record: dr Advertising Exp. (+E, SE) 400 cr Accounts Payable (+L) 400

3-7

Chapter 03 - Reporting Operating Results on the Income Statement

Chapter Outline

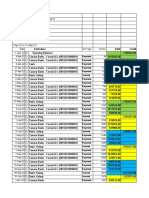

(i) Pay cash for expenses Pizza Aroma received a bill for $400 for running a newspaper ad. The bill will be paid in October. 1. Analyze: Assets = Liabilities + Stockholders Equity Cash (A) 400; Advertising Expense (E) 400 2. Record: dr Advertising Expense (+E, SE) 400 cr Cash (A) 400 LO 4 Prepare an unadjusted trial balance. E. Unadjusted Trial Balance 1. The best way to ensure accounts are in balance is to prepare a trial balance list of all accounts and their balances, which is used to check on the equality of recorded debits and credits. 2. Ending balances obtained from ledger (T-accounts) are listed in the appropriate debit or credit column. 3. If the trial balance does not balance, look at the difference between total debits and credits. 4. If the trial balance does balance, its still possible that youve made an error. An entry might include the wrong account or have been posted to the wrong account in the general ledger. 5. If title says unadjusted trial balance then several adjustments will have to be made at the end of the accounting period to update the accounts. F. Review of Revenues and Expenses 1. Remember that revenues are recorded when the business fulfills its promise to provide goods or services to customers, which is not necessarily the same time that cash is received. 2. Under accrual accounting, expenses are recorded when incurred (by using up the economic benefits of acquired items). Expenses are not necessarily incurred at the same time that cash is paid. III. Evaluate the Results LO 5 Describe limitations of the income statement. A. Income Statement Limitations 1. One of the most common limitations is that some people think net income equals the amount of cash generated by the business during the period. 2. A second limitation is that net income does not measure the change in the value of a company during a period. While net income is something that analysts consider when valuing a company, its not a measure of it. 3. A third common misconception is that measuring income just involves counting.

Illustrated in Exhibit 3.9

The adjustments will be covered in chapter 4.

The Stoplight on Ethics feature notes that greed is the reason behind recent accounting scandals.

3-8

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Ruqya Ben HalimaDocument122 pagesRuqya Ben HalimaAbdulRahaman67% (3)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- 361 Chapter 10 MC SolutionsDocument28 pages361 Chapter 10 MC Solutionsspectrum_48Pas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Chapter 3 NotesDocument10 pagesChapter 3 NotesMah NoorPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- 8-16 Smoky Mountain CorpDocument2 pages8-16 Smoky Mountain CorpMah Noor0% (2)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Chapter 2 Debits - CreditsDocument3 pagesChapter 2 Debits - CreditsMah NoorPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Chapter 2 OutlineDocument11 pagesChapter 2 OutlineMah NoorPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Chapter 2 NotesDocument14 pagesChapter 2 NotesMah NoorPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Multiple choice problems solvedDocument11 pagesMultiple choice problems solvedBenedict Tumlos0% (1)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Bsa Midterm Non Graded Exercises Journalizing Periodic and Perpetual Method FFFDocument6 pagesBsa Midterm Non Graded Exercises Journalizing Periodic and Perpetual Method FFFGarp BarrocaPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- Acc Ledger LatesDocument14 pagesAcc Ledger LatesVinayak SinghPas encore d'évaluation

- Omnichannel Supply Chain in FocusDocument17 pagesOmnichannel Supply Chain in FocusalejandrosantizoPas encore d'évaluation

- Maybank Islamic account statement summaryDocument18 pagesMaybank Islamic account statement summaryAdeela fazlinPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Salary Sheet 22 23 (Audited)Document72 pagesSalary Sheet 22 23 (Audited)Manojit GamingPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- ﻲﻟودﻟا ﻲﻟﺎﻣﻟا غﻼﺑﻹا رﺎﯾﻌﻣ تﺎﺑﻠطﺗﻣ قﯾﺑطﺗ رﺎﺛآ) Ifrs 16 (" رﺎﺟﯾﻹا دوﻘﻋ " تﺎﺳﺳؤﻣﻠﻟ ﺔﯾﻟﺎﻣﻟا مﺋاوﻘﻟا ﻰﻠﻋDocument24 pagesﻲﻟودﻟا ﻲﻟﺎﻣﻟا غﻼﺑﻹا رﺎﯾﻌﻣ تﺎﺑﻠطﺗﻣ قﯾﺑطﺗ رﺎﺛآ) Ifrs 16 (" رﺎﺟﯾﻹا دوﻘﻋ " تﺎﺳﺳؤﻣﻠﻟ ﺔﯾﻟﺎﻣﻟا مﺋاوﻘﻟا ﻰﻠﻋRå NĩmPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Receiving Copy For RaincoatsDocument19 pagesReceiving Copy For RaincoatsJeca BellsPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Cuono Company TB StatementDocument4 pagesCuono Company TB StatementTuwinanto NantoPas encore d'évaluation

- P2 06Document9 pagesP2 06Herald Gangcuangco33% (3)

- Director Merchandise Planning Allocations in NYC NY Resume Leonora ScalaDocument2 pagesDirector Merchandise Planning Allocations in NYC NY Resume Leonora ScalaLeonaraScalaPas encore d'évaluation

- P5-1A Dan P5-2ADocument6 pagesP5-1A Dan P5-2ASherly Meliana Geraldine100% (1)

- Effective Supply Chain Management in ConstructionDocument14 pagesEffective Supply Chain Management in ConstructionSimona BerariuPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Bank Reconciliation SpreadsheetDocument7 pagesBank Reconciliation Spreadsheetcrisjay ramosPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- Kantor Akuntan Drs. Purnomo General Journal May 2021: Tanggal Keterangan Ref Debit CreditDocument70 pagesKantor Akuntan Drs. Purnomo General Journal May 2021: Tanggal Keterangan Ref Debit CreditRizky HidayattPas encore d'évaluation

- SAGE 50 Inventory Management Implementation GuideDocument6 pagesSAGE 50 Inventory Management Implementation GuideJan Dave OgatisPas encore d'évaluation

- Job Costing Problems and SolutionsDocument5 pagesJob Costing Problems and SolutionsMary Grace NaragPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Tugas 2016051614453700012622 - ACCT6174-Tugas Personal 2-W7-S11-R1Document3 pagesTugas 2016051614453700012622 - ACCT6174-Tugas Personal 2-W7-S11-R1factorchrist0% (1)

- T3int 2010 Jun QDocument9 pagesT3int 2010 Jun QlowchangsongPas encore d'évaluation

- Managing Cosg V'S Cogs: February 2012Document2 pagesManaging Cosg V'S Cogs: February 2012Susi BunawanPas encore d'évaluation

- MPS, RCCP, MRP, CRP, & ERPDocument39 pagesMPS, RCCP, MRP, CRP, & ERPAnshu Kumar SrivastavaPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- ch03 Part6Document6 pagesch03 Part6Sergio HoffmanPas encore d'évaluation

- Introduction For Scs Supplier Collaboration SystemDocument16 pagesIntroduction For Scs Supplier Collaboration SystemAwojobi Alexander Habeeb OloladePas encore d'évaluation

- ACCTG CONCEPTS & PRINCIPLESDocument11 pagesACCTG CONCEPTS & PRINCIPLESAndrea Nicole De LeonPas encore d'évaluation

- Fish RUsDocument11 pagesFish RUseia aiePas encore d'évaluation

- Top 40 Property Management CompaniesDocument9 pagesTop 40 Property Management Companiessudeeksha dhandhaniaPas encore d'évaluation

- Adjusting Entries Discussion and Solution5Document23 pagesAdjusting Entries Discussion and Solution5Garp BarrocaPas encore d'évaluation

- Xi - Accounting: PrivateDocument15 pagesXi - Accounting: PrivateAdnan SajidPas encore d'évaluation

- Soal Oan BaruuuuDocument17 pagesSoal Oan BaruuuuAbi ErorPas encore d'évaluation

- CHAPTER 14 Business Combination PFRS 3Document3 pagesCHAPTER 14 Business Combination PFRS 3Richard DuranPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)