Académique Documents

Professionnel Documents

Culture Documents

The Role of Managerial Accounting in The Management Process

Transféré par

Bufan Ioana-DianaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

The Role of Managerial Accounting in The Management Process

Transféré par

Bufan Ioana-DianaDroits d'auteur :

Formats disponibles

THE ROLE OF MANAGERIAL ACCOUNTING IN THE MANAGEMENT PROCESS

BUFAN IOANA-DIANA WEST UNIVERSITY OF TIMISOARA, 4 Vasile Prvan Blvd, 300223, Timioara, Romania, ioana_diana_bufan@yahoo.com Abstract: The process of accounting is in charge with identifying, measuring and communicating economic information in order to allow its users to make the correct decisions and judgments. First of all, it is important to distinguish between the two branches of accounting: managerial accounting, which deals with internal users of accounting information, and financial accounting, which provides information to external users. On the other hand, the concept of cost accounting is different from the one of managerial accounting, because it deals with the aggregation of costs that are used in valuation of stocks in order to meet external reporting requirements. Considering the functions of the management process, management accounting plays an important role in helping managers to lead the organization in an efficient way, regarding any of these functions. Key words: accounting information, cost accounting, financial accounting, managerial accounting, management process JEL classification: M40, M41, M49

INTRODUCTION

There are many definitions of management accounting, but this paper will only present the one formulated by the American Accounting Association. It refers to accounting as the process of identifying, measuring and communicating economic information to permit informed judgments and decisions by users of the information. In other words, accounting is used for providing information (both financial and non-financial) to those who will make decisions in order to make the best possible ones. The terminology used in this definition indicates that a grasp of the accounting process requires an understanding of the attributes of economic information and of the following actions: identification, measurement and communication of the information. Furthermore, we need to understand the decision-making process and be able to identify the users of the accounting information. The objective of this paper is to study each component of the definition of accounting to provide a framework that will allow a more thorough understanding of the issues and aspects that are involved in the accounting process. The first important aspect is to start looking at the users of accounting information and identify their requirements.

THE USERS OF THE ACCOUNTING INFORMATION

Accounting is a language that communicates economic information to those who are interested in an organization - managers, shareholders, potential investors, employees, creditors and the government. Managers request the information that they need in the decision-making process and control activities. Shareholders ask for information on the value of their investments and profits. Employees need information in order to be sure that the company is capable

to meet various requirements and avoid redundancies. Creditors and banks request information on the company's ability to sustain its financial obligations and liabilities. Government agencies collect accounting information necessary to establish macroeconomic development policy. This doesnt apply only to the business organizations. Accounting information about individuals is also important and is used by other individuals. Therefore, there are many users of the accounting information that need information in the decision-making process. The main goal of the accounting is to provide sufficient information for different users in order to fulfill their needs with lower costs. However, the benefits of using an informational system for decisionmaking must be greater than the costs of the operating system. There are various users of the accounting information, but they can be classified in two big categories: internal groups within the organization and external groups outside it. It is important to distinguish between the two branches of accounting, based on the existence of these two types of users of the accounting information: internal users and external users. Managerial accounting, which provides information to people inside the organization in order to make the best decisions, is different than the financial accounting, which deals with providing information to persons outside the organization who request it.

COST ACCOUNTING AND MANAGERIAL ACCOUNTING

Managerial accounting is aimed at providing information to managers in order to make the best decisions, while financial accounting provides information to parties outside the organization. Financial accounting compares expenses with revenues to calculate the profit. Usually, any unsold finished goods or production in progress will not be included in the cost of goods sold which are compared with the sales revenue in a given period of time. In an organization that produces a wide range of different products (or services), it will be necessary in order to evaluate stocks to divide expenses on each type of service or product. Costs are divided on each product according to the needs of financial accounting, in order to allocate costs over a period of time, between the cost of goods sold and stock (inventory). Cost accounting was developed in order to provide this kind of information. The production costs that have been established for financial accounting were also used by executive managers for decision making. During the 1950s, emphasis switched from external users to internal users of cost accounting data, which made the cost data used by management to be collected in a different manner than that used in financial accounting. This difference in emphasis has led to a new type of accounting, managerial accounting. Currently, it is possible to distinguish between cost accounting and managerial accounting. Cost accounting deals with the aggregation of costs that are used in valuation of stocks in order to meet external reporting requirements, while managerial accounting refers to providing the adequate information to the staff within the organization in order to make the best decisions, for managerial activities such as planning and control decisions.

THE MANAGEMENT PROCESS

Considering the functions of the management process, managerial accounting plays an important role in helping managers to lead the organization in an efficient way, regarding any of these functions.

Table 1 The Management Process Management functions Planning Description - the planning process can be done both on long term and short term; - long-term planning centralizes the future management expectations, for a period of three or five years, or even longer; - later, long-term plans are converted in immediate needs and detailed plans in the form of an annual budget. - a comparison between achieved and planned performance, so that deviations from the plan can be identified and corrected. - establishes the internal frame in which the required activities must be carried out and designates who will perform them - requires a clear definition of managerial responsibilities and lines of authority -involves decentralization - departments are linked in a hierarchy of formal communication structure(vertically) and a staff relationship (horizontally). Managerial accounting - helps establish future plans, providing accounting information used in the decisionmaking process, about which products should be sold, on which markets and at what price, and evaluating proposals for capital spending. - plays a very important role in the short-term planning process. - provides data on past performance which could be particularly useful as a model for future performance. - establishes budget (planning) procedures and prepares schedules and coordinates short-term plans on all business sections and makes sure that the plans harmonize with one another. - centralizes the various plans into one general plan for the whole business (the master budget), and takes the plan for approval by the upper management. - is useful for the control process because it draws up performance reports that compare the actual to budgeted revenue for each responsibility center. - managers are warned about those specific activities that are not accourding to the plan - assist the control function providing immediate action measures and identifying problems. - identifying the elements of an organizational structure more relevant and essential for proper functioning of the management accounting system allows the preparation of an internal reporting system for this structure and suggest a more appropriate organizational structure. - whereas, the organizational structure is dealing with authority, responsibility and expertise to ensure actual performance, managerial accounting is designing and implementing accounting system to better define and strengthen these connections. - establishment and maintenance of an efficient communication and an efficient reporting system. - the reports about performance prepared by accountants communicate important information to a manager, show him how well he manages his activities and highlighting those issues that require a more thorough investigation by the management by exception activity.

Controlling

Organizing

Comunicating

Motivating

- influencing human behavior so that participants can identify themselves with the goals of the organization and make decisions that align to them. - a good manager is able to motivate his subordinates to achieve objectives established by the upper management.

- the budgets (planning) and performance reports that are prepared by accountants have an important influence in motivating organization staff. - the budgets are targets intending to motivate managers to achieve organizational objectives. - performance reports plan to motivate individual performance, by communicating performance information linked to the targets - the accountant participates in staff motivation by providing valuable assistance in identifying the area with potential management problems and highlighting those issues for a detailed investigation.

As seen in the table above, managerial accounting has an important role in each function of the management process: planning, controlling, organizing, comunicating, motivating. Figure 1 The management process

Managerial Managerial accounting accounting Planning Planning Controlling Controlling Organizing Organizing Comunicating Comunicating Motivating Motivating

The management process

All these functions play a significant part in the decision making process and therefore, any manager should know how to use the accounting information that the managerial accounting provides.

CONCLUSION

As a conclusion, it is important to understand the differences and to distinguish between three concepts: cost accounting, managerial accounting and financial accounting. A good manager must know the usefulness of each of these concepts. It must be pointed out that managerial accounting is a complex process mainly used in the decision-making by managers in order to achieve the organizational objectives. Therefore, it is neccesary to learn how this process influences each one of the management functions: planning, organizing, comunicating, controlling and motivating. It has been established that the role of the management accounting in an organization is to support the information needs of management. The type, size, structure and form of ownership of the organization will influence the management role, and thus, determine the complexity of the management accounting. Such differences in size do not change the basic role of the management accounting, nor the basic work

which he or she does. However, the size of the organization may change the degree of formality or sophistication with which the function is carried out, or the level of resources devoted to management accounting. But, the management accounting function remains essentially the same. Managerial accounting plays an important role in the management process, mainly in providing information to internal users (persons inside the organization) in order to make the right decisions. Whitout a thorough understanding of this concept, managers cant be certain of the results obtained in the decision-making process.

REFERENCES

1. Collier, P. M. (2003), Accounting for Managers: Interpreting Accounting Information for Decision Making, England, Chichester: John Wiley & Sons Ltd 2. Hansen, Don R. & Mowen M. M. (2006), Cost Management: Accounting and Control, Cincinnati, Ohio: South-Western/Thomson Learning 3. Jackson, S. & Sawyers, R. (2002), Managerial Accounting: A Focus on Decision Making, Cincinnati, Ohio: South-Western/Thomson Learning 4. Kidane, F. (2012) Decision Making and the Role of Management Accounting Function a Review of Empirical Literature, Radix International Journal of Banking, Finance and Accounting, vol. 1, issue 4, 77-97 5. Martin, J. R. (1990), Management Accounting: Concepts, Techniques & Controversial Issues, Cambridge: Cambridge publishers 6. Tabr, N. & Briciu, S. (2012) , Actualiti i perspective n contabilitate i control de gestiune, Iai: Tipo Moldova

Vous aimerez peut-être aussi

- Shelter Partnership2Document2 pagesShelter Partnership2Raj GuptaPas encore d'évaluation

- What Motivates Tax Compliance - James AlmDocument35 pagesWhat Motivates Tax Compliance - James AlmHalida An NabilaPas encore d'évaluation

- Micro Economic AnalysisDocument11 pagesMicro Economic Analysisdranita@yahoo.comPas encore d'évaluation

- Financial Statements and Ratio Analysis: All Rights ReservedDocument68 pagesFinancial Statements and Ratio Analysis: All Rights ReservedAshis Ur RahmanPas encore d'évaluation

- BodyShop Group9Document9 pagesBodyShop Group9Gitanshu SoniPas encore d'évaluation

- Ethical and Social Issues of Information SystemsDocument2 pagesEthical and Social Issues of Information SystemsNadya AlexandraPas encore d'évaluation

- Open InnovationDocument5 pagesOpen InnovationBerthaPas encore d'évaluation

- Case of Managing Demand & Controlling CapacityDocument9 pagesCase of Managing Demand & Controlling CapacityRaj PatelPas encore d'évaluation

- Managerial Accounting:: Fundamental ConceptsDocument19 pagesManagerial Accounting:: Fundamental ConceptsRed GaonPas encore d'évaluation

- Pestle AnalysisDocument11 pagesPestle Analysislippslips_22Pas encore d'évaluation

- Hitachi Case StudyDocument2 pagesHitachi Case StudyBHuwanPas encore d'évaluation

- Mployee Stakeholders and Workplace IssuesDocument25 pagesMployee Stakeholders and Workplace IssuesAlexander Agung HRDPas encore d'évaluation

- Behavioral Accounting Research FrameworkDocument44 pagesBehavioral Accounting Research FrameworkIrhamKentingBaehaqiPas encore d'évaluation

- Maasai Mara University School of Business and EconomicsDocument12 pagesMaasai Mara University School of Business and Economicsjohn wambuaPas encore d'évaluation

- Gamification in Consumer Research A Clear and Concise ReferenceD'EverandGamification in Consumer Research A Clear and Concise ReferencePas encore d'évaluation

- Strategic Management Accounting Summary SampleDocument5 pagesStrategic Management Accounting Summary SampleGreyGordonPas encore d'évaluation

- The Boston Beer Company, IncDocument7 pagesThe Boston Beer Company, IncVikrant Sharma0% (1)

- Inventory ManagementDocument11 pagesInventory ManagementRizky KurniawanPas encore d'évaluation

- Waste Management, Inc.: Manipulating Accounting EstimatesDocument10 pagesWaste Management, Inc.: Manipulating Accounting EstimatesJimmy NdawaPas encore d'évaluation

- StudyDocument33 pagesStudyYasmin GuzmanPas encore d'évaluation

- Chapter 13 Mini-CaseDocument5 pagesChapter 13 Mini-CaseSaima Fazal0% (1)

- Japan Economic MiracleDocument9 pagesJapan Economic MiracleJoseph LiPas encore d'évaluation

- Case 5.6 Waste ManagementDocument6 pagesCase 5.6 Waste Managementermiastenaw7401Pas encore d'évaluation

- Pestel Analysis of Indian Telecom Sector Economics EssayDocument9 pagesPestel Analysis of Indian Telecom Sector Economics EssayshanmukhaPas encore d'évaluation

- A Study On Financial Forecasting and Performance of ZOHO CORPORATION PRIVATE LIMITEDDocument22 pagesA Study On Financial Forecasting and Performance of ZOHO CORPORATION PRIVATE LIMITEDmanoj saravanan0% (1)

- Cost Management ch1Document34 pagesCost Management ch1Ahmed DapoorPas encore d'évaluation

- Sample Research ProposalDocument14 pagesSample Research ProposalTafadzwa James ZibakoPas encore d'évaluation

- Unsolved Paper Part IDocument107 pagesUnsolved Paper Part IAdnan KazmiPas encore d'évaluation

- P and G Company Strategies and Challenge PDFDocument15 pagesP and G Company Strategies and Challenge PDFLee Kah WeiPas encore d'évaluation

- Case16 1 HospitalSupplyDocument1 pageCase16 1 HospitalSupplyChristine Joy RoxasPas encore d'évaluation

- Problem StatementDocument5 pagesProblem StatementHazel TePas encore d'évaluation

- Nakamura Lacquer CompanyDocument12 pagesNakamura Lacquer CompanyAbhishek Jhaveri50% (2)

- Chap 010Document17 pagesChap 010debasispahiPas encore d'évaluation

- Analysis of Crown Point Cabinetry-By Group JDocument2 pagesAnalysis of Crown Point Cabinetry-By Group Jvinayak1511Pas encore d'évaluation

- 543 33 Powerpoint-slidesChap 12 Business EnvironmentDocument19 pages543 33 Powerpoint-slidesChap 12 Business EnvironmentTashuYadavPas encore d'évaluation

- Acj Manufacturing Case 2019Document1 pageAcj Manufacturing Case 2019Aaron Ashley DiazPas encore d'évaluation

- Dmse2EA Case 13.1 Pritam Gogoi 16Document4 pagesDmse2EA Case 13.1 Pritam Gogoi 16Pritam GogoiPas encore d'évaluation

- Primus Automotion Devision Case 2002Document9 pagesPrimus Automotion Devision Case 2002Devin Fortranansi FirdausPas encore d'évaluation

- Performance Measurement. The ENAPS ApproachDocument33 pagesPerformance Measurement. The ENAPS ApproachPavel Yandyganov100% (1)

- ProformaDocument4 pagesProformadevanmadePas encore d'évaluation

- CSAA AnalysisDocument5 pagesCSAA AnalysisJennifer Guanco100% (2)

- CP 1 & 2 Consolidated Foods DataDocument2 pagesCP 1 & 2 Consolidated Foods DataPrarthuTandonPas encore d'évaluation

- Case Study 5.6.1 JOHNSON AND JOHNSONDocument2 pagesCase Study 5.6.1 JOHNSON AND JOHNSONnaman0% (1)

- Porter Worksheet - Pontier E-CigarettesDocument4 pagesPorter Worksheet - Pontier E-CigarettesCharlesPontier100% (1)

- AcctTheory Chap01Document20 pagesAcctTheory Chap01Ardiyan PutraPas encore d'évaluation

- Management Accounting Assignment 1: Group No 24Document7 pagesManagement Accounting Assignment 1: Group No 24SaumyaKumarGautamPas encore d'évaluation

- Business in A Global EnvironmentDocument17 pagesBusiness in A Global Environmentria fajrianiPas encore d'évaluation

- Summary For Strategic AlliancesDocument6 pagesSummary For Strategic AllianceseileenPas encore d'évaluation

- National Systems To Support Drinking-Water Sanitation and Hygiene Global Status Report 2019Document144 pagesNational Systems To Support Drinking-Water Sanitation and Hygiene Global Status Report 2019The Independent MagazinePas encore d'évaluation

- Auditing Sols To Homework Tute Qs - S2 2016 (WK 4 CH 8)Document6 pagesAuditing Sols To Homework Tute Qs - S2 2016 (WK 4 CH 8)sonima aroraPas encore d'évaluation

- Case Format ProcterDocument6 pagesCase Format Procterlovelysweet_gaby100% (1)

- Nike Internal External Assessment 1218783971527971 8Document26 pagesNike Internal External Assessment 1218783971527971 8Shahaen Baloch100% (1)

- Strategic ManagementDocument4 pagesStrategic ManagementA CPas encore d'évaluation

- Operatons Decisions - A FrameworkDocument4 pagesOperatons Decisions - A FrameworkvivekPas encore d'évaluation

- Human Resource ManagementDocument25 pagesHuman Resource ManagementhannaPas encore d'évaluation

- A New Mandate For Human ResourcesDocument5 pagesA New Mandate For Human Resourcesbinzidd007Pas encore d'évaluation

- Importance of Management AccountingDocument4 pagesImportance of Management AccountingKhairul AslamPas encore d'évaluation

- Student Name: Nishat Shabbir Management Accounting AssignmentDocument13 pagesStudent Name: Nishat Shabbir Management Accounting AssignmentaliPas encore d'évaluation

- Copy Cost Accting-1Document205 pagesCopy Cost Accting-1Kassawmar DesalegnPas encore d'évaluation

- Management AccountingDocument19 pagesManagement Accountingfahmeetha100% (1)

- Transactions and Reports (Sales Ledger)Document41 pagesTransactions and Reports (Sales Ledger)Bufan Ioana-DianaPas encore d'évaluation

- Transactions (General Ledger)Document55 pagesTransactions (General Ledger)Bufan Ioana-DianaPas encore d'évaluation

- Special Settings and Transactions (General Ledger)Document23 pagesSpecial Settings and Transactions (General Ledger)Bufan Ioana-DianaPas encore d'évaluation

- Transactions (General Ledger)Document55 pagesTransactions (General Ledger)Bufan Ioana-DianaPas encore d'évaluation

- Transactions and Reports (Purchase Ledger)Document47 pagesTransactions and Reports (Purchase Ledger)Bufan Ioana-DianaPas encore d'évaluation

- Supliment - ECTAP - Volum AAP - UVT-FEAA-DCA PDFDocument558 pagesSupliment - ECTAP - Volum AAP - UVT-FEAA-DCA PDFBufan Ioana-DianaPas encore d'évaluation

- Reports (General Ledger)Document46 pagesReports (General Ledger)Bufan Ioana-DianaPas encore d'évaluation

- Sea 3 9 PDFDocument7 pagesSea 3 9 PDFBufan Ioana-DianaPas encore d'évaluation

- AnaleFSE 2012 2 019 PDFDocument8 pagesAnaleFSE 2012 2 019 PDFBufan Ioana-DianaPas encore d'évaluation

- Evolution in Time of An Economic Entity's PerformanceDocument4 pagesEvolution in Time of An Economic Entity's PerformanceBufan Ioana-DianaPas encore d'évaluation

- Budgeting PDFDocument22 pagesBudgeting PDFBufan Ioana-Diana100% (1)

- The Role of Budgeting in The Management Process: Planning and ControlDocument22 pagesThe Role of Budgeting in The Management Process: Planning and ControlBufan Ioana-Diana33% (3)

- Importance of Management AccountingDocument4 pagesImportance of Management AccountingKhairul AslamPas encore d'évaluation

- Activity-Based Costing in The Manufacturing Sector: A Managerial Instrument For Decision-MakingDocument7 pagesActivity-Based Costing in The Manufacturing Sector: A Managerial Instrument For Decision-MakingBufan Ioana-DianaPas encore d'évaluation

- Evolution in Time of An Economic Entity's PerformanceDocument4 pagesEvolution in Time of An Economic Entity's PerformanceBufan Ioana-DianaPas encore d'évaluation

- Assisting To The Stock Count - A Procedure of The Audit AssignmentDocument21 pagesAssisting To The Stock Count - A Procedure of The Audit AssignmentBufan Ioana-DianaPas encore d'évaluation

- Case Study Regarding The Assistance of An Auditor To A Stock CountDocument8 pagesCase Study Regarding The Assistance of An Auditor To A Stock CountBufan Ioana-DianaPas encore d'évaluation

- Case Study Regarding The Assistance of An Auditor To A Stock CountDocument8 pagesCase Study Regarding The Assistance of An Auditor To A Stock CountBufan Ioana-DianaPas encore d'évaluation

- AFAR.020 JIT and Backflush CostingquestDocument3 pagesAFAR.020 JIT and Backflush CostingquestZao MeshikovPas encore d'évaluation

- Chapter 7Document15 pagesChapter 7YnaPas encore d'évaluation

- (Always Learning) - Controlling Foodservice Costs.-Pearson Education (2013)Document323 pages(Always Learning) - Controlling Foodservice Costs.-Pearson Education (2013)Kim Arggie75% (4)

- Chap 010Document18 pagesChap 010Ahmed A HakimPas encore d'évaluation

- (Don Hansen, Guan) Cost Management 1Document4 pages(Don Hansen, Guan) Cost Management 1Muhammad Fareiz KayoshiPas encore d'évaluation

- Paper H.V. (Honours) Corporate Accounting & Reporting MODULE I - 50 MarksDocument12 pagesPaper H.V. (Honours) Corporate Accounting & Reporting MODULE I - 50 MarkssangkitaPas encore d'évaluation

- CN04HODocument51 pagesCN04HOAbood AlissaPas encore d'évaluation

- Unit 1 - Introduction To Cost AccountingDocument13 pagesUnit 1 - Introduction To Cost AccountingVaidehi sonawaniPas encore d'évaluation

- TOPSIM - General Management II: Participants' ManualDocument38 pagesTOPSIM - General Management II: Participants' ManualMaria AdelinePas encore d'évaluation

- Managerial Accounting Absorption and Variable Costing 081712Document14 pagesManagerial Accounting Absorption and Variable Costing 081712Mary Ann Jacolbe BaguioPas encore d'évaluation

- Fusion Cost Accounting SetupDocument54 pagesFusion Cost Accounting SetupVenkata Ramanaiah KokaPas encore d'évaluation

- Porter Five ForcesDocument2 pagesPorter Five ForcesRavishekhar Kumar100% (1)

- Financial Accounting Management Accounting Primary Users Purpose of InformationDocument3 pagesFinancial Accounting Management Accounting Primary Users Purpose of Informationpanda 1Pas encore d'évaluation

- SYBCOMDocument79 pagesSYBCOMKiran TakalePas encore d'évaluation

- Business Studies 2016 HSC PaperDocument7 pagesBusiness Studies 2016 HSC PapernoPas encore d'évaluation

- Cost Control Techniques PDFDocument3 pagesCost Control Techniques PDFHosamMohamed100% (1)

- Customizing Manual: Maxion Wheels Czech S.R.ODocument44 pagesCustomizing Manual: Maxion Wheels Czech S.R.OAmit ShindePas encore d'évaluation

- Study Guide For Students in Cost AccountingDocument41 pagesStudy Guide For Students in Cost Accountingjanine moldinPas encore d'évaluation

- Activity-Based Costing: A Tool To Aid Decision Making: Chapter SevenDocument49 pagesActivity-Based Costing: A Tool To Aid Decision Making: Chapter SevenFahim RezaPas encore d'évaluation

- Cat t7 Variance Q PJ KLDocument11 pagesCat t7 Variance Q PJ KLati19Pas encore d'évaluation

- Cost ManagementDocument7 pagesCost ManagementmerokitabPas encore d'évaluation

- Afar Study Plan: May 2019 Exam RecapDocument4 pagesAfar Study Plan: May 2019 Exam RecapLoise Anne MadridPas encore d'évaluation

- Strategic Management AccountingDocument2 pagesStrategic Management AccountingMugi SahadevanPas encore d'évaluation

- Strategic Cost ManagementDocument3 pagesStrategic Cost ManagementShubakar ReddyPas encore d'évaluation

- CH 17Document15 pagesCH 17emmyindraPas encore d'évaluation

- 1.1 Evolution of Management Accounting - Part 1Document23 pages1.1 Evolution of Management Accounting - Part 1Dabbie JoyPas encore d'évaluation

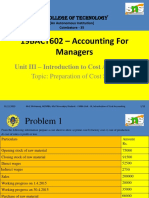

- 19BACT602 - Accounting For Managers: Unit III - Introduction To Cost AccountingDocument12 pages19BACT602 - Accounting For Managers: Unit III - Introduction To Cost AccountingReetaPas encore d'évaluation

- Garfield Cost Accounting Chapter 2Document18 pagesGarfield Cost Accounting Chapter 2ViancaPearlAmores100% (1)

- Level 3 Cost Accounting - SyllabusDocument17 pagesLevel 3 Cost Accounting - SyllabusChan Siew ChongPas encore d'évaluation

- Generally Accepted Cost Accounting Principles (GACAP)Document72 pagesGenerally Accepted Cost Accounting Principles (GACAP)Gaurav Jain100% (1)