Académique Documents

Professionnel Documents

Culture Documents

How Plastic Pollution Harms Our Oceans and Health

Transféré par

Quil RéjaneDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

How Plastic Pollution Harms Our Oceans and Health

Transféré par

Quil RéjaneDroits d'auteur :

Formats disponibles

Plastic Bags

Twelve years ago, oceanographer Captain Charlie Moore was skippering his yacht the Alguita in the North Pacific. He sailed into a mass of floating plastic rubbish which took him and his crew a week to cross. This floating rubbish dump is now called the Great Pacific Garbage Patch and doubles the size of the USA. The United Nations says there are now 18,000 pieces of plastic in every square kilometre of sea everywhere in the world. A walk along any beach will give you some idea of the seriousness of plastic pollution.

The trouble is, when we throw out plastic with the trash, the plastic doesnt go away. Plastic does not biodegrade. It photo degrades into smaller and smaller particles which then enter the food chain. Plastics contain cancer-causing chemicals such as vinyl chloride which travel along the food chain in increasing concentrations and end up in our fish and chips, along with hormone disruptors such as bisphenol A. Scientists try to tell us that we are killing ourselves as well as other animals. At least 200 species are, as I speak, being killed by plastic. Whales, dolphins, turtles and albatross confuse floating plastic, especially shopping bags and six pack rings, with jellyfish. A dead Minke whale, washed up on a Normandy beach, was found to have eaten plastic bags from supermarkets and had died a dreadful death.

8% of all the worlds oil production is for plastic. According to the United States Environmental Protection Agency, companies manufacture 5 billion plastic bags a year. Of all the plastic produced annually, half is for packaging which gets thrown out with the trash a few minutes after purchase. And 10% of all rubbish is plastic bags which take from 400 to 1000 years to degrade. Less than one per cent of plastic bags are recycled and only 4% of all other plastic waste, the reason being it is simply too expensive to do.

The same lobbies that work against electric vehicles and renewable energies, put governments under pressure not to act against plastic pollution. This is because plastic represents 8% of all the worlds oil production. These lobbies, acting on behalf of oil companies, represent an unsustainable approach to profit. To paraphrase the Cree Indian prophecy, only when we have wiped everything out will we realise that money cannot be eaten.

Some countries have rebelled and banned plastic bags. And the first was brave Bangladesh. Then China took the same decision and, according to CNN Asia, saves itself 37 million barrels of oil a year. Botswana, Canada, Israel, Kenya, Rwanda, Singapore and South Africa have also banned plastic bags. Notice how many of the worlds richest countries are not on this list. Its an absolute disgrace.

Alright, then. If we cant use plastic bags, how do we carry home the shopping? Take a back pack or a folding shopping trolley. Change supermarket to one that provides biodegradable bags, made from potato starch for example. Use consumer power.

Personally speaking, what I need to find now, is a supermarket that sells biodegradable bin liners, otherwise I still end up using plastic. I recently spent a week in New Zealand on honeymoon and saw that everyone was using special paper bin liners. I wish we did something similar here in Spain.

Think globally, act locally. A small Australian town is now one step ahead of the rest of the world. The inhabitants of Bundanoon in New South Wales have banned plastic bottles from the town. We need to follow their example and eliminate plastic from our lives, take care of the earth and vote for people we think will do the same.

1. The writer says that we can get an idea of how much plastic rubbish there is in the oceans 1. by sailing across the Pacific. 2. by taking a walk along any beach. 3. by travelling across the USA. 4. by looking at the sea. 2. The reader learns that toxic chemicals get into our food 1. from plastic bags from supermarkets. 2. when plastic becomes small enough to enter our food chain. 3. because plastic does not biodegrade. 4. because other animals are being killed by plastic. 3. In the last sentence of the third paragraph, what does 'it' refer to? 1. recycling 2. plastic waste 3. money 4. plastic bags 4. Which of the following best explains the Cree Indian prophecy? 1. If we destroy our environment, we will destroy ourselves. 2. Money isn't food. 3. Oil companies are polluting the earth. 4. People are greedy. 5. In the fifth paragraph the writer is angry because 1. not many of the world's richest countries have banned plastic bags. 2. Most of the countries are African. 3. countries aren't saving enough oil. 4. not many countries have banned plastic bags. 6. What does the reader learn about New Zealand? 1. People use biodegradable bags for the rubbish. 2. The supermarkets don't have plastic bags. 3. The writer was on holiday there. 4. It is a nuclear free country. 7. In the final paragraph the writer advises us to 1. take individual action. 2. stop buying plastic bottles. 3. stop voting. 4. visit Australia.

FCE Reading Part 1

Read the text and answer the questions below. You have 20 minutes.

Why the Crisis Happened

After the Wall Street Crash in 1929, the US Congress passed a new law called the Glass-Steagall Act history could not repeat itself. Fifty years later, Congress repealed this law and consequently, history repeat itself. There are two principal causes to the current global crisis. The first is overproduction a second is the deregulation of the financial markets, which is, in fact, a direct result of the first cause overproduction.

Since the Second World War, humans, in particular production engineers and economists, have becom at manufacturing on a large scale high quality goods by top brands that people want to buy. Engineers economists have used both robotics and the outsourcing of production to parts of the world where th labour is low. Fantastic products are made very cheaply, sent all over the world in containers and sold prices. All this has happened in a highly competitive environment.

This intense activity caused two important things to happen. The governments of manufacturing count China became very rich and formed the now famous sovereign wealth funds with the objective of inve this lovely capital. Investing in industry was unattractive as profit margins were very slim. Investors w bigger profits. Strict banking regulations also made life very difficult for investors. Secondly, all this caused a continued increase in the price of real estate, just like in the 1920s.

When the US Congress repealed the Glass-Steagall Act, investment banks and retail banks were able together again for the first time in 50 years. Next, not to be left behind, the European financial sect the European Union, mostly in secret, to liberate the European market. This deregulation put an end t transparency in the banking world. Hedge funds, whose investments are carried out under the cover o darkness, mushroomed. Simplicity was replaced by complexity and uncertain risk. Credit default swaps investors large payouts for loans gone bad and futures, which are more like bets than investments, of juicy returns. The world now had a stagnant real economy and a very busy financial sector. In the USA financial sector accounted for 40% of the nations total profits but less than 5% of the GNP.

Hungry investors then began speculating on the price of food commodities, especially rice and wheat a was when we saw the first signs of trouble. The price of wheat flour increased more than 25% due to speculation and the Spaghetti Riots broke out in Italy. Petrol prices increased further and further st Farmers complained that they could not afford to refuel their tractors and truck drivers went on str Spain.

On January 24 2008, the French investment bank Socit Gnrale announced that it had lost an asto billion dollars of its clients money from futures which went the wrong way. Next, in the space of just the price of a barrel of crude oil fell from $150 a barrel in July to less than fifty by October. Then w out about sub-prime loans. Investment banks and retail banks, working together, had lent vast quantit their clients money to high risk borrowers. This means borrowers who are likely to default on their h or mortgages because of low incomes and job instability. And guess what? They defaulted, handed bac to the house and the banks are now left with properties that nobody wants and whose value continues What a disaster! After that, it was the turn of the hedge funds. Many banks, such as Grupo Santande on investors money to hedge funds who then passed the money on to... Bernard Madoff.

Governments have now spent billions of taxpayers money because of the mistakes made by greedy an irresponsible bankers and The White House has said that the US deficit will rise to $1.6 trillion in 20 Bank of England puts the cost of the global crisis at $2.8 trillion but nobody really knows and nobody knows what all this means for the future. 1. In the first paragraph we learn that the Glass-Steagall Act was repealed 1. because it was no longer necessary. 2. to stop overproduction. 3. in order to regulate banks. 4. to free up financial markets. 2. Which of the following best explains why quality goods have become cheaper? 1. Quality goods are now manufactured using advanced technology and low salaries. 2. The quality of manufactured goods has improved dramatically. 3. production methods have improved a lot since WWII. 4. cheap overseas transport is now widely available. 3. In the third paragraph the writer explains that sovereign wealth funds were interested in 1. large profits. 2. safe investments. 3. helping their governments. 4. reinvesting in industry. 4. The risks involved in an investment now became 1. transparent. 2. difficult to ascertain. 3. lower. 4. higher. 5. Spanish truck drivers went on strike as a result of 1. sympathy for the farmers. 2. increased food prices. 3. fuel prices going up. 4. riots in Italy. 6. From what the text tells us about sub-prime loans, bankers can be described as 1. having great insight into financial markets. 2. not very intelligent.

3. skillful investors. 4. being caring about their clients' money. 7. From the article we understand that ordinary citizens 1. have to pay the bill for the banks' irresponsible behaviour. 2. have an uncertain future. 3. now have huge debts. 4. are angry with their governments.

Vous aimerez peut-être aussi

- Ready For CAE - TB Unit 2 PDFDocument12 pagesReady For CAE - TB Unit 2 PDFSol IBPas encore d'évaluation

- FCE Practice Tests Plus 1-10Document1 pageFCE Practice Tests Plus 1-10Anastasia LustaPas encore d'évaluation

- Practising Fce Reading Part 2Document9 pagesPractising Fce Reading Part 2daveturnerspainPas encore d'évaluation

- Purpose ClausesDocument2 pagesPurpose Clausesr22522Pas encore d'évaluation

- FCE Test 3 TapescriptsDocument5 pagesFCE Test 3 TapescriptsMabel CorpaPas encore d'évaluation

- CAE Exam 2 Reading and Use of EnglishDocument13 pagesCAE Exam 2 Reading and Use of Englishleo.king.1480.3Pas encore d'évaluation

- Tense Review: Sentence TransformationDocument3 pagesTense Review: Sentence Transformationmafalda12860% (1)

- PARTICIPLE CLAUSES EXERCISES With KeyDocument6 pagesPARTICIPLE CLAUSES EXERCISES With KeyYolandaPas encore d'évaluation

- Listening Part 2Document6 pagesListening Part 2Giovanna Cavo100% (1)

- Phrasal verbs and word formationDocument4 pagesPhrasal verbs and word formationNaruto UzumakiPas encore d'évaluation

- Practice Test 4: Part 1 (Page 13)Document5 pagesPractice Test 4: Part 1 (Page 13)ClaraPas encore d'évaluation

- Article For The FCE Writing Paper-ModelDocument2 pagesArticle For The FCE Writing Paper-Modelbia andreeaPas encore d'évaluation

- Task 1 - Essay (40 Minutes)Document5 pagesTask 1 - Essay (40 Minutes)Iryna DribkoPas encore d'évaluation

- Reading book comments under 40 charsDocument2 pagesReading book comments under 40 charsPablo SalcedoPas encore d'évaluation

- 0 19 456501 1 ADocument0 page0 19 456501 1 ALaura NaPas encore d'évaluation

- Letter of Complaint C2Document1 pageLetter of Complaint C2JuanPas encore d'évaluation

- FCE For Schools 1 - TEST 2 PDFDocument20 pagesFCE For Schools 1 - TEST 2 PDFArantza PratsPas encore d'évaluation

- English Book FrontmatterDocument7 pagesEnglish Book FrontmatterKa RYPas encore d'évaluation

- FceDocument12 pagesFceemirbed0% (1)

- Complete The Second Sentence So That It Has A Similar Meaning To The First SentenceDocument3 pagesComplete The Second Sentence So That It Has A Similar Meaning To The First SentenceVicen PozoPas encore d'évaluation

- C1 Advanced Sample Paper 2 Reading and Use of English 2022Document15 pagesC1 Advanced Sample Paper 2 Reading and Use of English 2022ePas encore d'évaluation

- Cambridge English:: First Reading and Use of English PR Actice TestDocument9 pagesCambridge English:: First Reading and Use of English PR Actice TestJUAN MARCELO CEVALLOS DURANPas encore d'évaluation

- PET Practice Exam: Reading: Questions 1-5Document8 pagesPET Practice Exam: Reading: Questions 1-5Ingrid Garcia MoyaPas encore d'évaluation

- Practice Test 6: Actress and TV Presenter Amanda Buxton Talks About London, Her Newly Adopted HomeDocument14 pagesPractice Test 6: Actress and TV Presenter Amanda Buxton Talks About London, Her Newly Adopted HomeClara50% (2)

- PREPARE 4 Grammar Standard Unit 04Document2 pagesPREPARE 4 Grammar Standard Unit 04Jhonny LarrotaPas encore d'évaluation

- 03 - FCE - B2 First Exam Format - Reading and Use of English - Paper 1Document3 pages03 - FCE - B2 First Exam Format - Reading and Use of English - Paper 1BernadetePas encore d'évaluation

- CAE I Vocabulary I Unit 1 - Quiz 04Document4 pagesCAE I Vocabulary I Unit 1 - Quiz 04Nguyễn Hương LyPas encore d'évaluation

- Cambridge English B1 Preliminary For Schools EXAM TRAINER OXFORDDocument218 pagesCambridge English B1 Preliminary For Schools EXAM TRAINER OXFORDRosi IvanovaPas encore d'évaluation

- Wider World Starter Tests GrammarCheck 8B FinalDocument1 pageWider World Starter Tests GrammarCheck 8B FinalanaisPas encore d'évaluation

- Progress Test Level A2Document5 pagesProgress Test Level A2Dobre CarmenPas encore d'évaluation

- Disaster Test PDFDocument3 pagesDisaster Test PDFEdurne De Vicente PereiraPas encore d'évaluation

- OA2 2b vocabularyAnswerKey PDFDocument3 pagesOA2 2b vocabularyAnswerKey PDFHerber Herber100% (1)

- ShapeFuture Brochure2022 EnglishDocument36 pagesShapeFuture Brochure2022 EnglishJenifer Yajaira Rodríguez ChamorroPas encore d'évaluation

- Contrast and addition connectors in sentencesDocument1 pageContrast and addition connectors in sentencesAnonymous 8AHCMsPuPas encore d'évaluation

- FCE Exam 3 ListeningDocument6 pagesFCE Exam 3 ListeningSaul MendozaPas encore d'évaluation

- Amazing English 2 Extra Tasks & KeyDocument28 pagesAmazing English 2 Extra Tasks & KeyMaria KyrlagkitsiPas encore d'évaluation

- Ingles Admision SEPT (Key)Document3 pagesIngles Admision SEPT (Key)Lucia Moya CastilloPas encore d'évaluation

- Aptis Listening 2020 Test1Document4 pagesAptis Listening 2020 Test1Teacher AlbaPas encore d'évaluation

- B2 First Unit 10 Test: VocabularyDocument2 pagesB2 First Unit 10 Test: VocabularyNatalia KhaletskaPas encore d'évaluation

- 225 Answer KeyDocument16 pages225 Answer KeyJustyna Smoleń100% (1)

- First Trainer 2 Six Practice Tests With AnswerspdfDocument257 pagesFirst Trainer 2 Six Practice Tests With AnswerspdfSimone SalvadorePas encore d'évaluation

- Pet Reading Part 5Document6 pagesPet Reading Part 5Paqui Martin AcuñaPas encore d'évaluation

- Word Formation Adj To N VDocument2 pagesWord Formation Adj To N Vinfinityline11102Pas encore d'évaluation

- FCE Listening Practice Test 8Document3 pagesFCE Listening Practice Test 82021-Year9-10 KingsoakschoolPas encore d'évaluation

- Fce Exam With AnswersDocument2 pagesFce Exam With AnswersSafure ArslanPas encore d'évaluation

- Words With Negative Prefixes For CAEDocument2 pagesWords With Negative Prefixes For CAETatiana MitrokhinaPas encore d'évaluation

- Use of English and Reading Exam Practice HW KeyDocument11 pagesUse of English and Reading Exam Practice HW KeySimon Griffith La RondePas encore d'évaluation

- Grammar and Vocabulary Aptis GeneralDocument7 pagesGrammar and Vocabulary Aptis GeneralMaria EsterPas encore d'évaluation

- Word Formation 1 - NounsDocument3 pagesWord Formation 1 - NounsteacherbusyPas encore d'évaluation

- Reading Test FCEDocument3 pagesReading Test FCEMiguel Canela JuliaPas encore d'évaluation

- Past Simple Vs Past Continuous Test Grammar Guides Tests - 84131Document3 pagesPast Simple Vs Past Continuous Test Grammar Guides Tests - 84131No Name100% (2)

- Towards a Quieter WorldDocument10 pagesTowards a Quieter WorldestbeinsPas encore d'évaluation

- Ingles Ord Reserva ExamenDocument3 pagesIngles Ord Reserva ExamenMario Merchán Romero0% (1)

- Alphabet quiz 1-3 questions and answersDocument4 pagesAlphabet quiz 1-3 questions and answersChiqui LennonPas encore d'évaluation

- Read The Text and Answer The Questions Below FCEDocument15 pagesRead The Text and Answer The Questions Below FCEDat NguyenPas encore d'évaluation

- Plastic Bags: English 4-02 Utp Ilex Reading 2Document3 pagesPlastic Bags: English 4-02 Utp Ilex Reading 2Maria Jimenez VillaPas encore d'évaluation

- Reading First CertificateDocument4 pagesReading First CertificateCarla BonanoPas encore d'évaluation

- Toxic Capitalism: The Orgy of Consumerism and Waste: Are We the Last Generation on Earth?D'EverandToxic Capitalism: The Orgy of Consumerism and Waste: Are We the Last Generation on Earth?Pas encore d'évaluation

- Yds Hazirlik Grubu Ders KitaplariDocument163 pagesYds Hazirlik Grubu Ders Kitaplarideniz erçavuşPas encore d'évaluation

- DocumentDocument2 pagesDocumentQuil RéjanePas encore d'évaluation

- Unit 3: Is Marriage Changing?Document5 pagesUnit 3: Is Marriage Changing?Alex8mRPas encore d'évaluation

- 1eso Thereis Thereare1Document1 page1eso Thereis Thereare1Fatima Vazquez100% (1)

- Ejercicios Verano 3ºESODocument10 pagesEjercicios Verano 3ºESONatalia Cuevas MoralesPas encore d'évaluation

- NarrativeDocument1 pageNarrativeQuil RéjanePas encore d'évaluation

- English Starter Level Teachers ResourceDocument5 pagesEnglish Starter Level Teachers ResourceMercedes López PortilloPas encore d'évaluation

- Verb Tenses and Modal Verbs Practice KeyDocument2 pagesVerb Tenses and Modal Verbs Practice KeyHola adiosPas encore d'évaluation

- Network 1 - Revision Pendientes 1ST Eso - Modules 1 3Document10 pagesNetwork 1 - Revision Pendientes 1ST Eso - Modules 1 3Quil RéjanePas encore d'évaluation

- Analysis Beowulf PoemDocument5 pagesAnalysis Beowulf PoemQuil RéjanePas encore d'évaluation

- Modal VerbsDocument7 pagesModal VerbsQuil RéjanePas encore d'évaluation

- Host Families SoughtDocument1 pageHost Families SoughtQuil RéjanePas encore d'évaluation

- Conditionals GuideDocument2 pagesConditionals GuideFra FraPas encore d'évaluation

- Book Review PDFDocument1 pageBook Review PDFQuil RéjanePas encore d'évaluation

- FCE WritingDocument24 pagesFCE WritingQuil Réjane100% (1)

- Countries and NationalitiesDocument1 pageCountries and NationalitiesQuil RéjanePas encore d'évaluation

- Ejercicios Gramatica InglesaDocument36 pagesEjercicios Gramatica InglesaQuil RéjanePas encore d'évaluation

- 3897 Vocabulary Matching Worksheet TransportDocument1 page3897 Vocabulary Matching Worksheet TransportDraganaPas encore d'évaluation

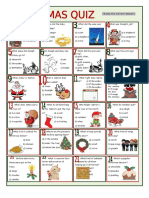

- Christmas QuizDocument1 pageChristmas QuizQuil RéjanePas encore d'évaluation

- b2 Opinion Essay TopicsDocument1 pageb2 Opinion Essay TopicsQuil RéjanePas encore d'évaluation

- Christmas Fun CrosswordDocument2 pagesChristmas Fun CrosswordQuil Réjane100% (2)

- FIRST (Reading Sample Test Dec.2009)Document2 pagesFIRST (Reading Sample Test Dec.2009)TheBestMan2Pas encore d'évaluation

- b1 Test MurciaDocument4 pagesb1 Test MurciaQuil RéjanePas encore d'évaluation

- 3897 Vocabulary Matching Worksheet TransportDocument1 page3897 Vocabulary Matching Worksheet TransportDraganaPas encore d'évaluation

- Fce Review Work and Word Formation SheetDocument3 pagesFce Review Work and Word Formation SheetQuil RéjanePas encore d'évaluation

- Landlord and Tennant - DialogueDocument2 pagesLandlord and Tennant - DialogueQuil RéjanePas encore d'évaluation

- FCE WritingDocument24 pagesFCE WritingQuil Réjane100% (1)

- FIRST (Reading Sample Test Dec.2009)Document2 pagesFIRST (Reading Sample Test Dec.2009)TheBestMan2Pas encore d'évaluation

- A2 Unit1Test SpeakingPaperDocument2 pagesA2 Unit1Test SpeakingPaperQuil RéjanePas encore d'évaluation

- Ejercicios Verano 3ºESODocument10 pagesEjercicios Verano 3ºESONatalia Cuevas MoralesPas encore d'évaluation

- Opinion EssayDocument1 pageOpinion EssayQuil RéjanePas encore d'évaluation

- Privatization of Railways: A Comparative AnalysisDocument16 pagesPrivatization of Railways: A Comparative AnalysisKUSHAL PAWARPas encore d'évaluation

- The Globalization of Corporate Media HegemonyDocument320 pagesThe Globalization of Corporate Media HegemonyNur Aeni Musyafak100% (1)

- Us - Dot - Bureau of Transportation Statistics - Us - Dot - Bureau of Transportation Statistics - The Changing Face of Transportation - EntireDocument368 pagesUs - Dot - Bureau of Transportation Statistics - Us - Dot - Bureau of Transportation Statistics - The Changing Face of Transportation - Entireprowag0% (1)

- External Income Outsourcing (1) - 1Document100 pagesExternal Income Outsourcing (1) - 1kunal.gaud121103Pas encore d'évaluation

- International Handbook of Economic RegulationDocument419 pagesInternational Handbook of Economic RegulationJohn MartinezPas encore d'évaluation

- Department of Labor: Cedaug00Document24 pagesDepartment of Labor: Cedaug00USA_DepartmentOfLaborPas encore d'évaluation

- External Environment Factors for MarketersDocument31 pagesExternal Environment Factors for MarketersKrystle DseuzaPas encore d'évaluation

- Unit 3: The Role of Public Policies in Governing BusinessDocument41 pagesUnit 3: The Role of Public Policies in Governing BusinessAnonymous 5RO7Xov3A4Pas encore d'évaluation

- Tatad v. Sec of DOEDocument6 pagesTatad v. Sec of DOEJill BagaoisanPas encore d'évaluation

- DahlsenThe Dairy Industry Crisis - Ed 3 - May 2020Document107 pagesDahlsenThe Dairy Industry Crisis - Ed 3 - May 2020NeenPas encore d'évaluation

- 10 Reform RailDocument58 pages10 Reform RailIgor MarkovicPas encore d'évaluation

- Transportation Laws SummaryDocument9 pagesTransportation Laws SummaryCarlo LandichoPas encore d'évaluation

- Barriers To Trade in Services. Services Trade LiberalizationDocument23 pagesBarriers To Trade in Services. Services Trade LiberalizationVanillaheroinePas encore d'évaluation

- Urban Bus Situation in The UKDocument14 pagesUrban Bus Situation in The UKdgutierrezsPas encore d'évaluation

- Strategic Business Management Review & Practice Kit (For 2nd & Subsequent Attempt) For Exam May June 2020Document314 pagesStrategic Business Management Review & Practice Kit (For 2nd & Subsequent Attempt) For Exam May June 2020Optimal Management Solution100% (2)

- Electricity Restructuring: Deregulation or Reregulation?: Is There A Coherent Vision For Competitive Electricity Markets?Document7 pagesElectricity Restructuring: Deregulation or Reregulation?: Is There A Coherent Vision For Competitive Electricity Markets?Jatin ChaudhariPas encore d'évaluation

- Econreg ChIVDocument90 pagesEconreg ChIVAbongwe LunguPas encore d'évaluation

- Privatization in IndiaDocument56 pagesPrivatization in IndiaManoj VermaPas encore d'évaluation

- National Differences in Economic Development (Lecture Material)Document33 pagesNational Differences in Economic Development (Lecture Material)Eva StafaPas encore d'évaluation

- The Contemporary WorldDocument20 pagesThe Contemporary WorldlittlepreyPas encore d'évaluation

- Integrated Energy Plan 2009-2022: A Roadmap for Pakistan's Energy SecurityDocument222 pagesIntegrated Energy Plan 2009-2022: A Roadmap for Pakistan's Energy Securitychacher100% (1)

- LGU Authority to Regulate CATV RatesDocument43 pagesLGU Authority to Regulate CATV RateshlcameroPas encore d'évaluation

- A Study On Customer Perception of Various Oil Marketing CompaniesDocument8 pagesA Study On Customer Perception of Various Oil Marketing CompaniesjohnmanorajPas encore d'évaluation

- Enron Case Study PetersonDocument19 pagesEnron Case Study PetersonTou Joon HauPas encore d'évaluation

- LPG IndiaDocument10 pagesLPG IndiabondwithacapitalbPas encore d'évaluation

- PSODocument66 pagesPSOAsad Mazhar91% (11)

- Workshop 4 Economic PolicyDocument2 pagesWorkshop 4 Economic PolicyNatala EtheringtonPas encore d'évaluation

- Button & Hensher - Handbook of Transport Strategy, Policy and Institutions - 2005Document861 pagesButton & Hensher - Handbook of Transport Strategy, Policy and Institutions - 2005dds100% (1)

- Restructuring of The Egyptian Electricity Industry: MemberDocument5 pagesRestructuring of The Egyptian Electricity Industry: Memberapi-3697505Pas encore d'évaluation

- Us Banking Regulatory Outlook 2020Document48 pagesUs Banking Regulatory Outlook 2020Pallavi ReddyPas encore d'évaluation