Académique Documents

Professionnel Documents

Culture Documents

Mergers and Takeovers

Transféré par

Mocanu GabrielaDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Mergers and Takeovers

Transféré par

Mocanu GabrielaDroits d'auteur :

Formats disponibles

MERGERS AND TAKEOVERS

maMerger is defined as combination of two or more companies into a single company Merger is also defined as amalgamation or fusion. A typical merger, involves two companies, which combine to become one legal entity with the goal of producing a company that is worth more than the sum of its parts. In a merger of two corporations, the shareholders usually have their shares in the old company exchanged for an equal number of shares in the merged entity Types of mergers a)vertical mergers in vertical combinations, the merging undertaking would be either a supplier or a buyer using its product as intermediary material for final production b)horizontal mergers It is a merger of two competing firms which are at the same stage of industrial process. c)circular mergers Companies producing distinct products seek amalgamation to share common distribution and research facilities to obtain economies d)conglomerate mergers It is amalgamation of two companies engaged in unrelated industries

For example, back in 1998, Chrysler Corp. merged with, Daimler Benz to form DaimlerChrysler. In 2007 Daimler Benz sold 80% of stake hold in Chrysler Group to Cerberus Capital Management. Big oil got even bigger in 1999, when Exxon and Mobil signed an agreement to merge and form Exxon Mobil Disney and Pixar The merger of legendary Walt Disney and everything-we-create-kids-adore Pixar was a match made in cartoon heaven AOL and Time Warner At the height of the Internet craze, two media merged together to form what was seen as a revolutionary move to fuse the old with the new. In 2001, old-school media giant Time Warner consolidated with American Online (AOL), the Internet and email provider of the people. It was considered the combining of the best of both worlds: print and electronic, together at last. In 2005, another major communication merger occurred, this time between Sprint and Nextel Communication In January 2009, Fiat and Chrysler LLC announced that they were going to form a global alliance.

A takeover, or acquisition,is the purchase of one business or company by another company or other business entity.Takeovers are divided into "private" and "public", depending on whether the target company is listed on public stock markets. Achieving acquisition success has proven to be very difficult, while various studies have shown that 50% of acquisitions were unsuccessful. Types of takeovers a)friendly takeovers Before a bidder makes an offer for another company, it usually first informs the company's board of directors. b)hostile takeover A hostile takeover allows a suitor to take over a target company whose management is unwilling to agree to a takeover c)reverse takeover Takeover usually refers to a purchase of a smaller firm by a larger one. Sometimes, however, a smaller firm will acquire management control of a larger company and retain the name of the latter for the post-acquisition combined entity. d)backflip takeovers A backflip takeover is any sort of takeover in which the acquiring company turns itself into a subsidiary of the purchased company.

Pros and cons of takeovers Pros: Increase in sales Profitability of target company Increase market share Decrease competition Reduction of overcapacity in the industry Enlarge brand portfolio Increase in economies of scale Cons: Reduced competition and choice for consumers in oligopoly markets Cultural integration/conflict with new management Hidden liabilities of target entity. The monetary cost to the company. Lack of motivation for employees in the company being bought up. Example of takeovers: Apple has confirmed that it has acquired Anobit, an Israeli maker of flash storage technology. In 1999 Vodafone Group acquired Airtouch Communications In 2000 Tata Motors of India acquired Daewoo in 2004 and signed a deal with Ford which gave Tata control of both luxury makes Jaguar and Land Rover In November 2006 Google Inc. closed its acquisition of YouTube. Romanian producer Bere Mures was bought by Dutch giant Heineken. American firm Advent purchased the Romanian drug manufacturer LaborMed.

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1091)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Leveraged Buy Out Lecture 11Document4 pagesLeveraged Buy Out Lecture 11Aamir TankiwalaPas encore d'évaluation

- Insider: Chapter 4 Activity IdentificationDocument25 pagesInsider: Chapter 4 Activity IdentificationJE SingianPas encore d'évaluation

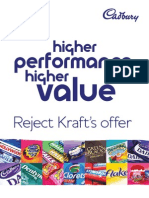

- Cadbury's Formal Defense Against KraftDocument56 pagesCadbury's Formal Defense Against KraftDealBookPas encore d'évaluation

- Hostile Takeover of MindtreeDocument4 pagesHostile Takeover of Mindtreeanuj rakheja100% (1)

- Minority Shareholder Protection in IndiaDocument18 pagesMinority Shareholder Protection in IndiaSai Kiran AdusumalliPas encore d'évaluation

- Strategic Management Case Studies 4th Sem MBADocument7 pagesStrategic Management Case Studies 4th Sem MBAdhanush60% (5)

- IGCSE Business Studies A - Notes C1 Understanding Business ActivityDocument38 pagesIGCSE Business Studies A - Notes C1 Understanding Business Activitymohamed100% (1)

- Invata-L Sa Faca La OlitaDocument51 pagesInvata-L Sa Faca La OlitaMocanu GabrielaPas encore d'évaluation

- 20141211163138252subiect Examen Partial Sibi 1-1Document18 pages20141211163138252subiect Examen Partial Sibi 1-1Mocanu GabrielaPas encore d'évaluation

- Contracts I. Match The Listed Words With The Definitions GivenDocument4 pagesContracts I. Match The Listed Words With The Definitions GivenMocanu GabrielaPas encore d'évaluation

- Mergers and TakeoversDocument4 pagesMergers and TakeoversMocanu GabrielaPas encore d'évaluation

- Capital Gains by R. Devarajan Additional Director, ICAIDocument43 pagesCapital Gains by R. Devarajan Additional Director, ICAIkiranshingotePas encore d'évaluation

- Cadbury and KraftDocument3 pagesCadbury and KraftJayvison Sagana100% (2)

- 9609 w17 QP 31Document8 pages9609 w17 QP 31BabarAkhtarPas encore d'évaluation

- Group5 PGFinance KotakINGDocument39 pagesGroup5 PGFinance KotakINGRoli DubePas encore d'évaluation

- CaseDocument1 pageCasedrbrijsharma0% (1)

- Studi Kasus C.K. TangCorporate GovernanceDocument12 pagesStudi Kasus C.K. TangCorporate Governanceadvent0% (2)

- NEW Takeover Code HighlightsDocument5 pagesNEW Takeover Code HighlightsKarunamoorthy SelvarajPas encore d'évaluation

- NISM-Series-IX: Merchant Banking Certification Examination Test Objectives Chapter 1: Introduction To The Capital MarketDocument6 pagesNISM-Series-IX: Merchant Banking Certification Examination Test Objectives Chapter 1: Introduction To The Capital MarketSanket MohapatraPas encore d'évaluation

- National Law Institute University, Bhopal: Case Comment: Miheer H. Mafatlal v. MafatlalDocument30 pagesNational Law Institute University, Bhopal: Case Comment: Miheer H. Mafatlal v. MafatlalDikshaPas encore d'évaluation

- TYBFMDocument20 pagesTYBFMshoaib8682Pas encore d'évaluation

- Takeover of Arcelor by Mittal SteelDocument6 pagesTakeover of Arcelor by Mittal SteelRanjith KumarPas encore d'évaluation

- FN2191 Commentary 2022Document27 pagesFN2191 Commentary 2022slimshadyPas encore d'évaluation

- Questions On AccountancyDocument34 pagesQuestions On AccountancyAshwin ChoudharyPas encore d'évaluation

- Sabero ValueDocument1 pageSabero ValuePrem KumarPas encore d'évaluation

- Unit - 5 B Mergers & AcquisitionDocument37 pagesUnit - 5 B Mergers & AcquisitionShivam PalPas encore d'évaluation

- Chapter 6Document13 pagesChapter 6ERICKA MAE NATOPas encore d'évaluation

- 01 Merger and Acquisition QADocument5 pages01 Merger and Acquisition QApijiyo78Pas encore d'évaluation

- FM - Quiz #1Document7 pagesFM - Quiz #1Micah ErguizaPas encore d'évaluation

- Delisting: Strategic Financial ManagementDocument38 pagesDelisting: Strategic Financial ManagementloveatnetPas encore d'évaluation

- Adjudication Order in respect of Mr. Madhur Somani, Mr. Rangnath Somani, Ms. Kanak Somani, Master Tanay Somani, Ms. Sarla Somani and Mr. Rangnath Somani HUF in the matter of M/s Kidderpore Holdings LimitedDocument28 pagesAdjudication Order in respect of Mr. Madhur Somani, Mr. Rangnath Somani, Ms. Kanak Somani, Master Tanay Somani, Ms. Sarla Somani and Mr. Rangnath Somani HUF in the matter of M/s Kidderpore Holdings LimitedShyam SunderPas encore d'évaluation

- RFP MV For EPC Works 25.04.2017 NH-121Document79 pagesRFP MV For EPC Works 25.04.2017 NH-121rohtasmalikPas encore d'évaluation

- Ringkasan AKL1Document98 pagesRingkasan AKL1BagoesadhiPas encore d'évaluation

- Acc414 Fin43 mgt45 Midterm-ExamDocument11 pagesAcc414 Fin43 mgt45 Midterm-ExamNicole Athena CruzPas encore d'évaluation