Académique Documents

Professionnel Documents

Culture Documents

First Slot Finanacial Performance

Transféré par

anand_gsoft3603Description originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

First Slot Finanacial Performance

Transféré par

anand_gsoft3603Droits d'auteur :

Formats disponibles

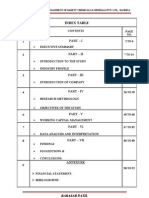

A Study on Financial Performance of Sandfits Foundries India Private Limited, Coimbatore

ABSTRACT Sandfits Foundries Private Limited one of the leading foundries in South India was started in 1962 at Coimbatore, primarily to cater to the captive needs of the local industry. Early in our inception, we carved a unique business model to success. With state of the art infrastructure, a team of qualified technical pool and a wide range of products and with excellent quality solutions, we have emerged as a Castings Solution provider to a diverse industrial clientele. To-day we are a well established entity with an emerging global presence.

STATEMENT OF THE PROBLEM The company current ratio analysis faces a slight decrease occurred in the year 2008-2009 and all the current ratio figures are not well about the fixed ratio. They are slowly recovering from such as verse condition and aim at becoming financially stable in future. Therefore, a detailed study is necessary to find the present financial condition and future scope for improvement in financials. Hence this study on financial performance of the company was undertaken to find the present financial condition of the company with a special emphasis on weakness in financials. This may benefit the management in evaluating the companys performance and take required action for a sustainable existence.

A Study on Financial Performance of Sandfits Foundries India Private Limited, Coimbatore

OBJECTIVE OF THE STUDY PRIMARY OBJECTIVE :1.To analyze the financial performance of Sandfits Foundries India Private Limited,Coimbatore 2. To give suggestion for improving the financial performance of the company

SECONDARY OBJECTIVE : 1. To analyze the liquidity position of the firm. 2. To find out the profitability of the firm. 3. To identify how effectively and efficiently the companys resource are being utilized. 4. To understand the long term solvency position of the firm.

RESEARCH METHODOLOGY

INTRODUCTION

Methodology is a systematic way to solve a research problem, it includes various steps that the generally adopted by a researcher in studying the problem along with the logic behind them. The present study was conducted at SANDFITS FOUNDRIES INDIA PRIVATE LIMITED, the study depends mainly on the secondary date namely the annual report of the company. Five years annual reports were collected from the company.

A Study on Financial Performance of Sandfits Foundries India Private Limited, Coimbatore

NEED FOR THE STUDY

The business world today is marked by stiff competition and innovation. Enhancing the competitive advantage is a must to win in the market, which requires a systematic appraisal of the performance of the company in term of parameters like return on assets, economic value added etc.

RESEARCH DESIGN

Research design stands for the frame work of research. Since the study aims to analyses the financial statements of the SANDFITS FOUNDRIES INDIA PRIVATE LIMITED . There are three types of research designs; they are exploratory research, descriptive research and hypothesis testing research. The research design utilized in the study is descriptive research. The following procedures have been undertaken: Based on the information and past records analysis and interpretations have been made.

SOURCES OF DATA

For the purpose of analyzing the financial performance of the company, the study relied only on the secondary data that was available in the company.

SECONDARY DATA

For the purpose of study secondary data have been use of which is collected from the published financial statement viz, trading, profit and loss account and balance sheet contained in the annual report of the company.

A Study on Financial Performance of Sandfits Foundries India Private Limited, Coimbatore PERIOD OF STUDY For the purpose of conducting the study in SANDFITS FOUNDRIES INDIA PRIVATE LIMITED, the researcher had taken the past five year records to analyze the performance of the company starting from the year April 2006-March 2011. The study was carried out for a period of six weeks. TOOLS USED FOR THE ANALYSIS 1. Ratio analysis 2. Comparative Balance Sheet 3. Common Size Statement LIMITATIONS OF THE STUDY 1) The study is only for a particular company, inter firm comparison was rendered impossible. 2) The period of study was limited up to 5 years

ANALYSIS AND INTERPRETATION

RATIO ANALYSIS Analysis and interpretation of financial statements with the help of ratios is termed as ratio analysis ratio analysis involves the process of computing, determining and presenting the relationship of items or group of items of financial statements. Ratio analysis was pioneered by Alexander wall who presented a system of ratio analysis in the year 1909. Alexander contention was that interpretation of financial statements can be made easier by establishing quantitative relationships between various items of financial statements.

A Study on Financial Performance of Sandfits Foundries India Private Limited, Coimbatore Ratio analysis is one of the important tools for financial analysis. Ratios are relationship expressed in mathematical terms between figures, which are connected with each other in some manner. A ratio is defined as the the indicated quotient of two mathematical expression. In financial analysis, a ratio is used as a bench mark for evaluating the financial performance of a firm. MEANING OF RATIO Ratios can be defined as relationships expressed in quantitative terms, between figures which have caused and cause and effect relationships or which are connected with each other in some manner or the other. SIGNIFICANCE OF RATIOS Ratios are exceptionally useful tools with which one can judge the financial performance of the enterprise over a period of time. The efficiency of the enterprise can also be judged against the industry averagely. In vertical analysis, ratios help the analyst to form a judgment whether performance of the firm at the point of time is good, quantitative or poor. At time, the investment decisions are based on the condition revealed by certain ratios, in this way, it serves as a land maid to the management. CLASSIFICATION OF RATIOS Ratios can be classified into different categories, depending upon the basis of classification has been on the basis on the financial statement to which the determinants of a ratio belong. On this basis the ratios could be classified as 1. solvency ratio Current ratio, liquidity ratio, etc. 2. Activity / performance ratio Capital turnover ratio, fixed asset turnover ratio, etc. 3. profitability ratio Net profit ratio, gross profit ratio, etc.

A Study on Financial Performance of Sandfits Foundries India Private Limited, Coimbatore

FINDINGS & SUGGESTIONS

6.1 FINDINGS Current ratio analysis shows a increasing trend though a slight decrease occurred 20082009 all the current ratio figures are not well about the fixed ratio of 2:1 the liquidity position is set to be the below satisfactory level

Quick ratio also registers a increase in trend except in 2008-2009.the ratio figures lower than the fixed ratio of 1:1. the acid test ratio of the concern is found to be below satisfactory.

Inventory turnover ratio that an increasing trend except in the 2008 2009 and 20092010.the ratio is not satisfied to the expected financial inventory turnover ratio.

Working capital turnover ratio registers an increase in trend except 2009-2010. It is projected that the concern is fully utilizing it working capital.

The total asset turnover ratio indicates a increasing trend from 2005-2006 to 20092010.so it is revealed that total asset net worth ratio of the concern is in the satisfactory level.

A Study on Financial Performance of Sandfits Foundries India Private Limited, Coimbatore Receivable turnover ratio of a concern shows a fluctuating trend for the financial years from 2005-06 to 2009-10. it indicates that it is not satisfactory level.

The gross profit ratio shows a fluctuating trend for the financial years from 2005-06 to 2009-10.the gross profit ratio of the concern is in satisfactory level

The net profit ratio of the concern depicts an increasing trend except the financial year of 2007-08.the net profit ratio shows a increasing trend of during the period of study. It is concluded that net profit of the concern is in a satisfactory level.

6.2 SUGGESTION The liquidity position of the company is less than the standard norm and in future it must be increased Company should control the operating expenses to increase the profitability Current ratio is less than 2; it shows the more investment in current liabilities. it is not favor to the organization. Therefore the company should reduce the current liabilities in order to increase the profitability The working capital shows the companies idle investment. So, in future it must be maintained Debtors turn over ratio is not in the satisfactory level, so the concern should take the steps to collect the outside amounts.

A Study on Financial Performance of Sandfits Foundries India Private Limited, Coimbatore

Conclusion :

The financial analysis of Sandfits Foundries India Private Limited, Coimbatore was conducted for the past 5 financial years starting from 2006-2007 to 2010-2011. The financial performance analysis is done by using the financial ratios, comparative balance sheet & Trend analysis. The firms strength and weakness can be understood with the help of financial ratios. The major strength of the company is its high liquidity position, its ability to raise long term funds and their effective utilization and the weakness is its very high rate of operating expense and its low profitability. This study reveals the impact of financial analysis in the profitability of the Sandfits Foundries India Private Limited. From the study it becomes clear that the overall financial position of the company have to be improved.

INTRODUCTION

A Study on Financial Performance of Sandfits Foundries India Private Limited, Coimbatore In the economic environment prevailing today (particularly after the advent of the on going liberation process) the financial performance of companies has come into sharp focus in the country. The purpose of this particular study at SANDFITS FOUNDRIES INDIA PRIVATE LIMITED is an analyze the financial performance of the company, by scanning its financial statements from the year April 2006-March 2011 This analysis is a model attempt of throwing more light to the financial management statements and related aspects that affect the effective performance of SANDFITS FOUNDRIES INDIA PRIVATE LIMITED 1.2 FINANCIAL PERFORMANCE As long as accounting biases remain more or less the same over time, meaningful inferences can be drawn by examining trends in raw data and in financial Ratios. Since similar biases characterize various firms in the same industry, inter-firm comparisons are useful Experience seems to suggest that financial analysis works if one is aware of accounting biases and makes adjustments for the same. 1.3 FINANCIAL MANAGEMENT Financial management is concerned with the acquisition, financial and management of assets with it over all goals in mind. Financial management is the managerial activity, which is concerned with the planning and controlling of the firms financial resources. Though it was a branch of economic till 1890, as a separate activity or discipline it is of recent origin. Still, it has no unique body of knowledge of its own, and draws heavily on economics for its theoretical concepts even today. The subject of financial management is of immense interest both Academicians and practicing managers. It is of great interest to academicians because the subject is still developing, and there are still certain areas where controversies exist for which no unanimous solutions have

A Study on Financial Performance of Sandfits Foundries India Private Limited, Coimbatore been reached as yet practicing manager are interested in this subject because among the most crucial decisions of the firm are those which relate to finance, and an understanding of the theory of financial management provides them with conceptual and analytical insights to make these decisions skill fully. 1.4 IMPORTANCE OF FINANCIAL MANAGEMENT Financial management is applicable to every type of organization, Irrespective of its size, kind or nature. Thus it is important and useful for all type of its size, kind or nature. Thus it is important and useful for all type of ownership organizations where there is a use of finance; financial management is helpful way. So this subject is acquiring a universal applicability. It is indispensable in any organization as it helps in: Financial planning and successful promotion of an enterprise Acquisition of funds and when required at the minimum possible cost Proper use and allocation of funds Taking sound financial decisions Improving the profitability through financial controls Increasing the wealth of the investors and the nation Promoting and mobilizing individual and corporate savings

A Study on Financial Performance of Sandfits Foundries India Private Limited, Coimbatore

2 COMPANY PROFILE

Please Visit www.sandfits.com

A Study on Financial Performance of Sandfits Foundries India Private Limited, Coimbatore

REVIEW OF LITERATURE

3.1 INTRODUCTION: Once a topic has been decided upon, it is essential to review all relevant material, which has a bearing on the topic. In fact, of review of literature beings with a search for a suitable topic and continues throughout the duration of research project work. Since a research report, either is a dissertation or a thesis, is supposed to be a study in depth aiming contribution to knowledge, a careful check should be made that the proposed study has not previously been carried out. Since the related review about the topic under research is limited, an attempt was made to compile the views given by various people relating to the study. 3.2 REVIEW OF LITERATURE 1.Arthur Srourn, David Scon, john martin and William petty(1985) through their study on basic financial management have found that managing firms liquidity and managing the firms investment in current assets and its use of current liabilities are the important problems of working capital management. Each of these problems was shown to involve risk in trade. The study revealed that by investing in Current assets, a firm could reduce its risk of liquidity but at lower overall rate of return on its liquidity, reduce the rate of return on its assets. 2.Balakrishnan, G. in his study entitled financing small scale industries in India analyzed the financial performance of joint stock companies in the small scale sector and found that these had a low profit earning capacity due to higher cost of production and higher rate of interest. 3.Bears, W.H. (1966) was among the ones who focused on the ability of ratios to predict failure. Failure was defined as the liability of a firm to pay its financial obligations as the motive. He took 30 financial ratios and observed that some ratios were useful indicators of failure of the firm at least 5 years prior to failure

A Study on Financial Performance of Sandfits Foundries India Private Limited, Coimbatore 4.Chandrasekaran. N. in his study had measured the performance of cement companies through profitability efficiency and growth. He had also found out that external finance and cash flows are the important determinants of investment in the cement industry. 5.George Gallingar (2000) has examined the framework of financial statement analysis in five years. The part of his study has focused on return on asset performance. It has examined the profitability of Solton Company. He has examined the components related to return on sales and assets management in depth. According to him, inefficient asset management will result in destroyed market value of the company and will probably cause financial distress problems, which may even result in bankruptcy. He has also opined that if the weighted average cost of capital on a before tax basis exceeds the return on sales or increased asset turnover or both. 6.Helfert, in his study Ratio analysis guide and does especially spotting bonds towards better or poor performance and finding out significant deviations from any average or relatively applicable standard. 7.Jayamala (2002) in her study, financial performance analysis A study with reference to sakthi Finance Ltd. Observed that the profitability of sakthi finance ltd. was satisfactory and the financial soundness in respect of short term liquidity and long term financial strength was also satisfactory. 8.Kanchana Devi (1998) in her study, A comparative study on the financial performance of sakthi finance Ltd., and annamalai Finance Ltd., focused mainly on growth and related problems in finance companies. In her study she has observed that financial companies should maintain proper plan and adequate efforts must be made to overcome the difficulties through better performance. 9.Dr.kaveri in her study entitled, financial ratios as predictors of borrowers health with special reference to small scale industries in India carried out, and she examined the predictive ability of the ratios keeping in mind the banker-borrower relationship. The study has developed a

A Study on Financial Performance of Sandfits Foundries India Private Limited, Coimbatore discriminate model for predicting the borrowers health. This model is of much use to the bankers in managing their accounts of small industrial units. 10.Latha (1998) in he restudy, A study on the financial performance with special reference to seshayee paper boards limited, mainly focused on the performance of the company. The study has concluded that overall financial trend viewed from the point of liquidity, profitability, activity and leverage trend were satisfactory. 11.Paul j. Fitz Patrick (1932) conducted a study about ratios and observed that the network to debt and net profits to network were the best indicators of failure among the ratios used. 12.Sastry. K.S. Had developed organizational index combining financial and non-financial performance measures to evaluate the performance of public enterprises. 13.Sherly Roselin (1994) in her study financial performance appraisal a case study of associated cement companys ltd., focused on the performance appraisal of associated cement companys ltd. The study has provided reliable financial information about economic resources and other needed information about changes in such resources and obligations.

A Study on Financial Performance of Sandfits Foundries India Private Limited, Coimbatore

Vous aimerez peut-être aussi

- A Study On Working Capital Management of Shanthi Gears LTDDocument15 pagesA Study On Working Capital Management of Shanthi Gears LTDKarthika ArvindPas encore d'évaluation

- Balanced Scorecard for Performance MeasurementD'EverandBalanced Scorecard for Performance MeasurementÉvaluation : 3 sur 5 étoiles3/5 (2)

- A Study On Financial Performance Analysis of Dabur India LimitedDocument7 pagesA Study On Financial Performance Analysis of Dabur India Limitedutsav9maharjanPas encore d'évaluation

- Corporate Governance, Firm Profitability, and Share Valuation in the PhilippinesD'EverandCorporate Governance, Firm Profitability, and Share Valuation in the PhilippinesPas encore d'évaluation

- Aditya PatnaikDocument55 pagesAditya PatnaikAD CREATIONPas encore d'évaluation

- The Balanced Scorecard (Review and Analysis of Kaplan and Norton's Book)D'EverandThe Balanced Scorecard (Review and Analysis of Kaplan and Norton's Book)Évaluation : 4.5 sur 5 étoiles4.5/5 (3)

- Chapter-1 Introduction of The Study: A Study On Financial Performance by Ratio AnalysisDocument47 pagesChapter-1 Introduction of The Study: A Study On Financial Performance by Ratio Analysisjayan panangadanPas encore d'évaluation

- The Balanced Scorecard: Turn your data into a roadmap to successD'EverandThe Balanced Scorecard: Turn your data into a roadmap to successÉvaluation : 3.5 sur 5 étoiles3.5/5 (4)

- Ksfe MINI PROJECT 2016Document47 pagesKsfe MINI PROJECT 2016jayan panangadanPas encore d'évaluation

- P 1196 Financial PerformanceDocument15 pagesP 1196 Financial PerformanceChithresh ShettyPas encore d'évaluation

- Objectives of The StudyDocument9 pagesObjectives of The Studysarvesh.bhartiPas encore d'évaluation

- Report On Paper MillDocument102 pagesReport On Paper MillsanejaPas encore d'évaluation

- N19070293101 PDFDocument9 pagesN19070293101 PDFOwais KadiriPas encore d'évaluation

- A Study On Financial Analysis of Maruthi Suzuki India Limited CompanyDocument9 pagesA Study On Financial Analysis of Maruthi Suzuki India Limited CompanyVandanaPas encore d'évaluation

- A Project Report On Cost AnalysisDocument5 pagesA Project Report On Cost AnalysisShebeerPas encore d'évaluation

- Executive Summary: Avnet India PVT LTDDocument2 pagesExecutive Summary: Avnet India PVT LTDPrajay KhPas encore d'évaluation

- Ratio Analysis - NATRAJ OILDocument8 pagesRatio Analysis - NATRAJ OILRaja MadhanPas encore d'évaluation

- 303am 62.EPRA Journals-4113Document6 pages303am 62.EPRA Journals-4113Amogh AroraPas encore d'évaluation

- Working Capital Management PROJECT REPORT MBADocument90 pagesWorking Capital Management PROJECT REPORT MBABabasab Patil (Karrisatte)100% (14)

- Working Capital ManagementDocument92 pagesWorking Capital Managementletter2lalPas encore d'évaluation

- Arjun FinalDraftDocument17 pagesArjun FinalDraftspiderverse.arunPas encore d'évaluation

- Project On Ratio AnalysisDocument18 pagesProject On Ratio AnalysisSAIsanker DAivAMPas encore d'évaluation

- RelianceDocument63 pagesRelianceSairam PandaPas encore d'évaluation

- Untitled PresentationDocument11 pagesUntitled PresentationRishi vardhiniPas encore d'évaluation

- A Study On Financial Performance Analysis: 1. Short-Term SolvencyDocument4 pagesA Study On Financial Performance Analysis: 1. Short-Term SolvencysujithvijiPas encore d'évaluation

- Sudeshnaa Final Yr ProjectDocument15 pagesSudeshnaa Final Yr ProjectShri hariniPas encore d'évaluation

- Profitability Analysis: CHADARGHAT Hyderabad TelanganaDocument10 pagesProfitability Analysis: CHADARGHAT Hyderabad TelanganakhayyumPas encore d'évaluation

- "A Study of Financial Statement Analysis Through Ratio Analysis at Sids Farm Pvt. LTDDocument14 pages"A Study of Financial Statement Analysis Through Ratio Analysis at Sids Farm Pvt. LTDAbdul WadoodPas encore d'évaluation

- CGSC 2019 1Document30 pagesCGSC 2019 1Astik TripathiPas encore d'évaluation

- Ratio Analysis - FinanceDocument46 pagesRatio Analysis - FinancePragya ChauhanPas encore d'évaluation

- Project Report Sem 4 BbaDocument43 pagesProject Report Sem 4 BbaTanya RajaniPas encore d'évaluation

- A Project Report On Analysis of Working Capital ManagementDocument83 pagesA Project Report On Analysis of Working Capital ManagementParveen NarwalPas encore d'évaluation

- Financial Ratios at B.D.K. Ltd. Hubli PROJECT REPORTDocument69 pagesFinancial Ratios at B.D.K. Ltd. Hubli PROJECT REPORTBabasab Patil (Karrisatte)100% (1)

- KBL ProjectDocument63 pagesKBL ProjectSunil Darak100% (1)

- 830pm 50.epra Journals-5705Document7 pages830pm 50.epra Journals-5705DedipyaPas encore d'évaluation

- A Study On Financial Performance of Reliance Industries LimitedDocument5 pagesA Study On Financial Performance of Reliance Industries LimitedMadhuri PurohitPas encore d'évaluation

- Working Capital Management ProjectDocument91 pagesWorking Capital Management ProjectManas Dutta100% (1)

- Project ArticleDocument12 pagesProject ArticleAkash SPas encore d'évaluation

- of STRDocument4 pagesof STRGulshan kumarPas encore d'évaluation

- I. Executive Summary: Oil India Limited (OIL)Document5 pagesI. Executive Summary: Oil India Limited (OIL)pawan995470Pas encore d'évaluation

- Major Project 2Document40 pagesMajor Project 2lordansarrii786Pas encore d'évaluation

- Financial Performance Analysis Through Position Statements of Selected FMCG CompaniesDocument8 pagesFinancial Performance Analysis Through Position Statements of Selected FMCG Companiesswati jindalPas encore d'évaluation

- Financial StatementsDocument21 pagesFinancial Statementsastute kidPas encore d'évaluation

- A Study On Ratio Analysis in Heritage: Vol 11, Issue 5, May/ 2020 ISSN NO: 0377-9254Document7 pagesA Study On Ratio Analysis in Heritage: Vol 11, Issue 5, May/ 2020 ISSN NO: 0377-9254DedipyaPas encore d'évaluation

- A Study On Financial Performance With Special Reference To Kse LTD, IrinjalakudaDocument134 pagesA Study On Financial Performance With Special Reference To Kse LTD, IrinjalakudaHIJAS HAMSA100% (12)

- S&P BSE 100 Companies: Corporate Governance ScoresDocument13 pagesS&P BSE 100 Companies: Corporate Governance ScoresAstik TripathiPas encore d'évaluation

- Ratio Analysis Heritage Foods Ltd-2Document64 pagesRatio Analysis Heritage Foods Ltd-2Varun ThatiPas encore d'évaluation

- IJCRT2105257Document9 pagesIJCRT2105257DebitCredit Accounts LearningPas encore d'évaluation

- Impact of Financial Leverage On Firm'S Performance and Valuation: A Panel Data AnalysisDocument8 pagesImpact of Financial Leverage On Firm'S Performance and Valuation: A Panel Data AnalysissaefulPas encore d'évaluation

- A Study On Cash Management in The Flavors India (P) LTDDocument16 pagesA Study On Cash Management in The Flavors India (P) LTDPriyesh AgrawalPas encore d'évaluation

- Zuwari CementDocument81 pagesZuwari Cementnightking_1Pas encore d'évaluation

- Intern Project On Cio TyresDocument45 pagesIntern Project On Cio TyresMohammad Ajmal AnsariPas encore d'évaluation

- Index Table: Part - IDocument91 pagesIndex Table: Part - ISayedMohammadAkhtarPas encore d'évaluation

- Submitted By: Project Submitted in Partial Fulfillment For The Award of Degree ofDocument21 pagesSubmitted By: Project Submitted in Partial Fulfillment For The Award of Degree ofMOHAMMED KHAYYUMPas encore d'évaluation

- A Comparative Study On MRF & Good Year Financial PerformanceDocument9 pagesA Comparative Study On MRF & Good Year Financial Performancechelsea fabrinaPas encore d'évaluation

- Chapter - 1: Introduction and Design of The StudyDocument10 pagesChapter - 1: Introduction and Design of The StudyPrithivi SPas encore d'évaluation

- Sahil Mehta - 170 - Bba 4c Final ReportDocument48 pagesSahil Mehta - 170 - Bba 4c Final Reportsahil mehtaPas encore d'évaluation

- Working Capital ManagementDocument8 pagesWorking Capital ManagementHarish.PPas encore d'évaluation

- Project Statement of ProblemDocument7 pagesProject Statement of ProblemVRajamanikandan100% (3)

- E-Work Order Monitoring System: 2010 As Front End Tool and Microsoft SQL Server 2008 As Back End ToolDocument1 pageE-Work Order Monitoring System: 2010 As Front End Tool and Microsoft SQL Server 2008 As Back End Toolanand_gsoft3603Pas encore d'évaluation

- Data Flow DiagramDocument3 pagesData Flow Diagramanand_gsoft3603Pas encore d'évaluation

- Synopsis: 2008 As Back End Tool. The Software Mainly Developed For Retail Furniture ShowroomsDocument15 pagesSynopsis: 2008 As Back End Tool. The Software Mainly Developed For Retail Furniture Showroomsanand_gsoft3603Pas encore d'évaluation

- A Study On Reverse Logistics Towards Retail Store ProductsDocument1 pageA Study On Reverse Logistics Towards Retail Store Productsanand_gsoft3603Pas encore d'évaluation

- Chapter - 1: 1.1 Meaning and Definition of Performance AppraisalDocument8 pagesChapter - 1: 1.1 Meaning and Definition of Performance Appraisalanand_gsoft3603Pas encore d'évaluation

- Care Giver Suppliers QuestionnaireDocument5 pagesCare Giver Suppliers Questionnaireanand_gsoft3603Pas encore d'évaluation

- Chapter - 3 Research MethodologyDocument3 pagesChapter - 3 Research Methodologyanand_gsoft36030% (1)

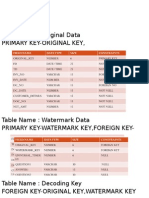

- Table Design DhansiaDocument6 pagesTable Design Dhansiaanand_gsoft3603Pas encore d'évaluation

- A Study On Brand Awareness Towards Sony Television With Special Reference To Coimbatore CityDocument9 pagesA Study On Brand Awareness Towards Sony Television With Special Reference To Coimbatore Cityanand_gsoft3603Pas encore d'évaluation

- Online Shopping DFDDocument5 pagesOnline Shopping DFDanand_gsoft3603Pas encore d'évaluation

- Extra ContentsDocument6 pagesExtra Contentsanand_gsoft3603Pas encore d'évaluation

- Existing System:: Title: Secured Finger Friction Ridges Based ATM System ModulesDocument2 pagesExisting System:: Title: Secured Finger Friction Ridges Based ATM System Modulesanand_gsoft3603Pas encore d'évaluation

- Table Design Table Name: Student RegistrationDocument2 pagesTable Design Table Name: Student Registrationanand_gsoft3603Pas encore d'évaluation

- Fake Product Review Monitoring and Removal Using Opinion MiningDocument10 pagesFake Product Review Monitoring and Removal Using Opinion Mininganand_gsoft3603Pas encore d'évaluation

- Index: 3.1.1 Drawbacks 3.2.1 FeaturesDocument1 pageIndex: 3.1.1 Drawbacks 3.2.1 Featuresanand_gsoft3603Pas encore d'évaluation

- Rubana WorksDocument43 pagesRubana Worksanand_gsoft3603Pas encore d'évaluation

- Column Name Data Type: 1. Tab LeDocument3 pagesColumn Name Data Type: 1. Tab Leanand_gsoft3603Pas encore d'évaluation

- Computer Aided DesignDocument2 pagesComputer Aided Designanand_gsoft3603Pas encore d'évaluation

- Table Name: Original Data Primary Key-Original Key, Foreign Key-Invoice No, DC - NoDocument4 pagesTable Name: Original Data Primary Key-Original Key, Foreign Key-Invoice No, DC - Noanand_gsoft3603Pas encore d'évaluation

- Emotion Code-Body Code Consent AgreementDocument1 pageEmotion Code-Body Code Consent Agreementapi-75991446100% (1)

- Statement of Purpose - ManchesterDocument3 pagesStatement of Purpose - ManchesterSam HoodPas encore d'évaluation

- Full Download Invitation To Health 17th Edition Hales Solutions ManualDocument13 pagesFull Download Invitation To Health 17th Edition Hales Solutions Manualjameschavezh5w100% (37)

- Colegiul National'Nicolae Balcescu', Braila Manual English Factfile Clasa A Vi-A, Anul V de Studiu, L1 Profesor: Luminita Mocanu, An Scolar 2017-2018Document2 pagesColegiul National'Nicolae Balcescu', Braila Manual English Factfile Clasa A Vi-A, Anul V de Studiu, L1 Profesor: Luminita Mocanu, An Scolar 2017-2018Luminita MocanuPas encore d'évaluation

- Grading Rubric For A Research Paper-Any Discipline: Introduction/ ThesisDocument2 pagesGrading Rubric For A Research Paper-Any Discipline: Introduction/ ThesisJaddie LorzanoPas encore d'évaluation

- Relationship Between Reading Habits, University Library and Academic Performance in A Sample of Psychology StudentsDocument22 pagesRelationship Between Reading Habits, University Library and Academic Performance in A Sample of Psychology StudentsDwi MegawatiPas encore d'évaluation

- Day Bang - How To Casually Pick Up Girls During The Day-NotebookDocument11 pagesDay Bang - How To Casually Pick Up Girls During The Day-NotebookGustavo CastilloPas encore d'évaluation

- Zodiac Meanings Aux Mailles GodefroyDocument12 pagesZodiac Meanings Aux Mailles GodefroyMia BukovskyPas encore d'évaluation

- What Is Mental ScienceDocument86 pagesWhat Is Mental Sciencewoodspat100% (2)

- 3rd Grade Hidden Letters 2Document2 pages3rd Grade Hidden Letters 2Asnema BatunggaraPas encore d'évaluation

- Growing Spiritually: How To Exegete 1 Peter 2:1-3?Document61 pagesGrowing Spiritually: How To Exegete 1 Peter 2:1-3?PaulCJBurgessPas encore d'évaluation

- Generic Letter of Rec - Natalia Lopez Medrano 1Document2 pagesGeneric Letter of Rec - Natalia Lopez Medrano 1api-460367917Pas encore d'évaluation

- People Seller From My Eyes-Mishra BPDocument13 pagesPeople Seller From My Eyes-Mishra BPBishnu Prasad MishraPas encore d'évaluation

- La PutizaDocument18 pagesLa PutizaGus SuberoPas encore d'évaluation

- Tanner Chapter8Document15 pagesTanner Chapter8Malik Yousaf AkramPas encore d'évaluation

- Drug Use and Abuse and Their Signs and Symptoms OutsideDocument1 pageDrug Use and Abuse and Their Signs and Symptoms OutsideReynosa MalinaoPas encore d'évaluation

- 20 Angel Essences AttunementDocument26 pages20 Angel Essences AttunementTina SarupPas encore d'évaluation

- Analytical Exposition Sample in Learning EnglishDocument1 pageAnalytical Exposition Sample in Learning EnglishindahPas encore d'évaluation

- Industrial Organizational I O Psychology To Organizational Behavior Management OBMDocument18 pagesIndustrial Organizational I O Psychology To Organizational Behavior Management OBMCarliceGPas encore d'évaluation

- Workplace CommunicationDocument6 pagesWorkplace CommunicationKristel Gail Santiago BasilioPas encore d'évaluation

- Why Did Jose Rizal Become National HeroDocument2 pagesWhy Did Jose Rizal Become National HeroWilson MagnayePas encore d'évaluation

- Handling Difficult CustomersDocument58 pagesHandling Difficult CustomersSheng Sygil100% (1)

- Ethics in Child Psychotherapy: A Practitioner 'S PerspectiveDocument19 pagesEthics in Child Psychotherapy: A Practitioner 'S PerspectiveSimona TintaPas encore d'évaluation

- ConclusionDocument6 pagesConclusioncoribrooks4Pas encore d'évaluation

- Capstone Project ReviewerDocument4 pagesCapstone Project Reviewerkaye anne100% (1)

- CS708 Lecture HandoutsDocument202 pagesCS708 Lecture HandoutsMuhammad Umair50% (2)

- Bab IV Daftar PustakaDocument2 pagesBab IV Daftar PustakaNumbi HerizasiwiPas encore d'évaluation

- Spatial Trauma/Desire: A Postmodern Sociocultural PhenomenonDocument0 pageSpatial Trauma/Desire: A Postmodern Sociocultural PhenomenonLesleigh Ochavillo ManginsayPas encore d'évaluation

- 03 00 Tutor Multiple Choice Questions 2Document13 pages03 00 Tutor Multiple Choice Questions 2sameer mane100% (1)

- Sophie Lee Cps Lesson PlanDocument16 pagesSophie Lee Cps Lesson Planapi-233210734Pas encore d'évaluation

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSND'Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNÉvaluation : 4.5 sur 5 étoiles4.5/5 (3)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 3.5 sur 5 étoiles3.5/5 (8)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthD'EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthÉvaluation : 4 sur 5 étoiles4/5 (20)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (14)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialD'EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialPas encore d'évaluation

- Built, Not Born: A Self-Made Billionaire's No-Nonsense Guide for EntrepreneursD'EverandBuilt, Not Born: A Self-Made Billionaire's No-Nonsense Guide for EntrepreneursÉvaluation : 5 sur 5 étoiles5/5 (13)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisD'EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisÉvaluation : 5 sur 5 étoiles5/5 (6)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingD'EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingÉvaluation : 4.5 sur 5 étoiles4.5/5 (17)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successD'EverandReady, Set, Growth hack:: A beginners guide to growth hacking successÉvaluation : 4.5 sur 5 étoiles4.5/5 (93)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamD'EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamPas encore d'évaluation

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialD'EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialÉvaluation : 4.5 sur 5 étoiles4.5/5 (32)

- An easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyD'EverandAn easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyÉvaluation : 3 sur 5 étoiles3/5 (1)

- The Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsD'EverandThe Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsPas encore d'évaluation

- Creating Shareholder Value: A Guide For Managers And InvestorsD'EverandCreating Shareholder Value: A Guide For Managers And InvestorsÉvaluation : 4.5 sur 5 étoiles4.5/5 (8)

- Product-Led Growth: How to Build a Product That Sells ItselfD'EverandProduct-Led Growth: How to Build a Product That Sells ItselfÉvaluation : 5 sur 5 étoiles5/5 (1)

- The Illusion of Innovation: Escape "Efficiency" and Unleash Radical ProgressD'EverandThe Illusion of Innovation: Escape "Efficiency" and Unleash Radical ProgressPas encore d'évaluation

- Valley Girls: Lessons From Female Founders in the Silicon Valley and BeyondD'EverandValley Girls: Lessons From Female Founders in the Silicon Valley and BeyondPas encore d'évaluation

- Mind over Money: The Psychology of Money and How to Use It BetterD'EverandMind over Money: The Psychology of Money and How to Use It BetterÉvaluation : 4 sur 5 étoiles4/5 (24)

- Mastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsD'EverandMastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsÉvaluation : 4.5 sur 5 étoiles4.5/5 (21)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)D'EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Évaluation : 4.5 sur 5 étoiles4.5/5 (4)

- Applied Corporate Finance. What is a Company worth?D'EverandApplied Corporate Finance. What is a Company worth?Évaluation : 3 sur 5 étoiles3/5 (2)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorD'EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorPas encore d'évaluation

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursD'EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursÉvaluation : 4.5 sur 5 étoiles4.5/5 (8)