Académique Documents

Professionnel Documents

Culture Documents

Sources of Funds

Transféré par

Nomi Khan0 évaluation0% ont trouvé ce document utile (0 vote)

19 vues2 pagesHBL offering very low charges on demand draft, telegraphy transfer and give other additional services to the customers. Potential entry of new competitors Whenever new firms easily enters a particular industry, the competition increases. Bargaining Power of Consumers When customers are concentrated or large, or buy in volume, their bargaining power represents a major force affecting intensity of competition.

Description originale:

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

DOC, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentHBL offering very low charges on demand draft, telegraphy transfer and give other additional services to the customers. Potential entry of new competitors Whenever new firms easily enters a particular industry, the competition increases. Bargaining Power of Consumers When customers are concentrated or large, or buy in volume, their bargaining power represents a major force affecting intensity of competition.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme DOC, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

19 vues2 pagesSources of Funds

Transféré par

Nomi KhanHBL offering very low charges on demand draft, telegraphy transfer and give other additional services to the customers. Potential entry of new competitors Whenever new firms easily enters a particular industry, the competition increases. Bargaining Power of Consumers When customers are concentrated or large, or buy in volume, their bargaining power represents a major force affecting intensity of competition.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme DOC, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

Porters Five Forces Model

This approach is widely used for competitive analysis. It is because of the high intensity of competition among companies there five main competitive forces.

Rivalry among competitive firms

It is a very powerful force among the competitive forces the strategies pursued by one firm can be successful only to extent that they provide competitive advantages over the competitor. These competitive strategies may be lowering prices, best quality services. The HBL offering very low charges on demand draft, telegraphy transfer, mail transfer and give other additional services to the customers.

Potential entry of new competitors

Whenever new firms easily enters a particular industry, the competition increases. Restrictions, tariffs, patents etc can stop new firm to enter into the business as per Banking industry is concerned this market is already very situated in Pakistan and there are banks with quality services and low charges. So there is no threat to HBL from potential entry and HBL is also a public sector bank because of that no other new bank not takes over it.

Potential Development of substitute products

This is the third factor affecting the competitions. There may be some other product can be substitute the product of that industry. For example, banks offering saving schemes in Pakistan and these schemes are also offered by GPOs in Pakistan so they must compete them in this field. If they offer low rates than GPOs so people will go to deposit in GPOs. People concentration high rates so thats why sawing PLS accounts are more then current accounts.

Bargaining Power of Suppliers

The bargaining power of supplier affects the intensity of competition, especially when there are a large number of suppliers. In case of banks the suppliers are customers they supply the money to banks. Now they must offer good services, quality, and safety. Low charges etc to customers. In

this field HBL is very good. They charge low charges on remittances. So thats it is a competition to other banks.

Bargaining Power of Consumers

When customers are concentrated or large, or buy in volume, their bargaining power represents a major force affecting intensity of competition. Now the number customers in Pakistan for banks are very high. Banks offering variety of products and services to their customers. HBL have a large number of customers. Now it must offer good services and products to their customers to attract them to come to HBL

Structure of Financial Sector in Pakistan

Scheduled Banks (47) - Commercial banks - Specialised banks NBFIs - Modarabas - Leasing companies - Mutual funds - Specialised financial (DFIs) - Investment banks - Housing Finance Companies

Specialised Banks

Commercial Banks

Foreign Banks (22)

Domestic Banks (25)

Vous aimerez peut-être aussi

- Excel Shortcut and Function KeysDocument13 pagesExcel Shortcut and Function KeysNomi KhanPas encore d'évaluation

- Pictures of ZTBLDocument4 pagesPictures of ZTBLNomi KhanPas encore d'évaluation

- Organizational HierarchyDocument3 pagesOrganizational HierarchyNomi KhanPas encore d'évaluation

- Viva Voce QZ MBADocument3 pagesViva Voce QZ MBANomi KhanPas encore d'évaluation

- How To Calculate The Market Value ofDocument6 pagesHow To Calculate The Market Value ofNomi KhanPas encore d'évaluation

- How To Calculate The Market Value ofDocument6 pagesHow To Calculate The Market Value ofNomi KhanPas encore d'évaluation

- Factors AffectingDocument3 pagesFactors AffectingNomi KhanPas encore d'évaluation

- How To Calculate The Market Value ofDocument6 pagesHow To Calculate The Market Value ofNomi KhanPas encore d'évaluation

- How To Calculate The Market Value ofDocument6 pagesHow To Calculate The Market Value ofNomi KhanPas encore d'évaluation

- Executive SummaryDocument287 pagesExecutive SummaryNomi KhanPas encore d'évaluation

- Return On Capital (ROC), Return On Invested Capital (ROIC) and Return On Equity (ROE) Measurement and ImplicationsDocument69 pagesReturn On Capital (ROC), Return On Invested Capital (ROIC) and Return On Equity (ROE) Measurement and Implicationsbauh100% (1)

- Title Page of EconomicsDocument1 pageTitle Page of EconomicsNomi KhanPas encore d'évaluation

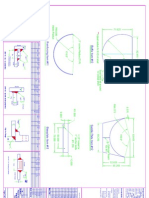

- Another DWG of Vessel No 3Document1 pageAnother DWG of Vessel No 3Nomi KhanPas encore d'évaluation

- Role of CfoDocument2 pagesRole of CfoNomi KhanPas encore d'évaluation

- Dissolution of PartnershipDocument20 pagesDissolution of PartnershipChandrasekaran Iyer100% (4)

- 3 - Mulhern Customer Profitability AnalysisDocument16 pages3 - Mulhern Customer Profitability AnalysisRood BwoyPas encore d'évaluation

- Hey Every One This Is Going Out To YouDocument1 pageHey Every One This Is Going Out To YouNomi KhanPas encore d'évaluation

- Nestle Corporate Business Principles Uk English-1Document18 pagesNestle Corporate Business Principles Uk English-1Cristina MaximPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Public Finances in EMU - 2011Document226 pagesPublic Finances in EMU - 2011ClaseVirtualPas encore d'évaluation

- Managing Demand and CapacityDocument21 pagesManaging Demand and CapacityheeyaPas encore d'évaluation

- Difference Between Job Costing and Process CostingDocument2 pagesDifference Between Job Costing and Process CostingJayceelyn OlavarioPas encore d'évaluation

- Short Answer QuestionsDocument2 pagesShort Answer QuestionsHoàng TrâmPas encore d'évaluation

- CV Tarun Das PFM Expert January 2018Document12 pagesCV Tarun Das PFM Expert January 2018Professor Tarun DasPas encore d'évaluation

- Lecture 1-2 BEPDocument19 pagesLecture 1-2 BEPAfzal AhmedPas encore d'évaluation

- "Energy Demand in Rural Ethiopia From A Household Perspective: A Panel Data Analysis," by Dawit Diriba GutaDocument20 pages"Energy Demand in Rural Ethiopia From A Household Perspective: A Panel Data Analysis," by Dawit Diriba GutaThe International Research Center for Energy and Economic Development (ICEED)100% (1)

- Econ401 - Syllabus - W22 UmichDocument5 pagesEcon401 - Syllabus - W22 UmichNecromancerPas encore d'évaluation

- Market Failure Tyler CowanDocument34 pagesMarket Failure Tyler CowanalexpetemarxPas encore d'évaluation

- Karlan Microeconomics 2ce - Ch. 12Document28 pagesKarlan Microeconomics 2ce - Ch. 12Gurnoor KaurPas encore d'évaluation

- Gross, S., Klemmer, L. (Eds.) - Introduction To Tourism Transport-CABI (2014)Document250 pagesGross, S., Klemmer, L. (Eds.) - Introduction To Tourism Transport-CABI (2014)Camila Teixeira50% (2)

- Human Resource Planning &development (HRPD) - PPT Slides 2012Document28 pagesHuman Resource Planning &development (HRPD) - PPT Slides 2012Rehna Mohammed Ali100% (1)

- Case Study-Istisna NewDocument2 pagesCase Study-Istisna Newmali27a767100% (1)

- This Syllabus Was Patterned From The Term 2 AY 2011-2012 Syllabus of Mr. Redencio B. Recio With Consent. Slight Modifications Were MadeDocument8 pagesThis Syllabus Was Patterned From The Term 2 AY 2011-2012 Syllabus of Mr. Redencio B. Recio With Consent. Slight Modifications Were MadeClyde CazeñasPas encore d'évaluation

- Factors That Affect The Economic GrowthDocument4 pagesFactors That Affect The Economic GrowthHimuraSutomoPas encore d'évaluation

- Forster's MarketDocument1 pageForster's MarketBrad Hollenbeck100% (1)

- Amtek Auto Analysis AnuragDocument4 pagesAmtek Auto Analysis AnuraganuragPas encore d'évaluation

- Measuring Investment Returns of Portfolios Containing Futures and OptionsDocument9 pagesMeasuring Investment Returns of Portfolios Containing Futures and Optionskusi786Pas encore d'évaluation

- Management of Financial ServicesDocument76 pagesManagement of Financial ServicesVickey Chouhan100% (2)

- IKEA Case StudyDocument13 pagesIKEA Case StudyPravesh AnandPas encore d'évaluation

- Chapter 1 - MCQ Without AnswreDocument4 pagesChapter 1 - MCQ Without AnswreKabuye JoelPas encore d'évaluation

- Entry and Exits 1.0Document1 pageEntry and Exits 1.0Yarex Mason100% (1)

- Intro To Economics 2022Document32 pagesIntro To Economics 2022wrfePas encore d'évaluation

- Multinational Financial ManagementDocument37 pagesMultinational Financial ManagementjadudhahPas encore d'évaluation

- Niti AayogDocument46 pagesNiti AayogLavkesh Bhambhani100% (1)

- BST CT2 Test QDocument1 pageBST CT2 Test QNikhet reddy ReddyPas encore d'évaluation

- America and Europe - Clash of The TitansDocument16 pagesAmerica and Europe - Clash of The TitansSergey BelousPas encore d'évaluation

- A Visit To Ludhiana Stock ExchangeDocument3 pagesA Visit To Ludhiana Stock ExchangeKaran BhatiaPas encore d'évaluation

- Business Activity: Revision QuestionsDocument1 pageBusiness Activity: Revision QuestionsFarrukhsg100% (1)

- UST IncDocument16 pagesUST IncNur 'AtiqahPas encore d'évaluation