Académique Documents

Professionnel Documents

Culture Documents

Corporate Governance

Transféré par

M Javaid Arif QureshiTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Corporate Governance

Transféré par

M Javaid Arif QureshiDroits d'auteur :

Formats disponibles

How does Corporate Governance affect internationalization, globalization and performance of firms?

Title of the dissertation

How

does

Corporate

Governance

affect

internationalization, globalization and performance of firms? Student's name Reason for submitting the project Your department and name of university Date of submitting the work

Abstract

Corporate governance is on the reform agenda all over the world. The remarkable political economy of the post-Cold War era has made both democracy and marketoriented capitalism ascendant, even if not inevitably linked. Competition among radically different economic systems communism vs. capitalism has abated. States are withdrawing from ownership of the means of production by privatizing state-firms and withdrawing from strong control by deregulating widely. Economic decisions once made by the state are increasingly left to autonomous, privately owned firms. Even if private corporate governance characteristics continue to differ, the most general of economic contrasts private vs. government direction is fading. Global economic integration has been a key factor in the salience of corporate governance questions. Once confined to local economies differently governed firms now compete with one another, as multilateral trade agreements and regional economic blocks such as the European Union have internationalized product markets, capital markets, managerial markets, and, to a lesser extent, labor markets. Globalization affects the corporate governance reform agenda in two ways. First, it heightens anxiety over whether particular corporate governance systems confer competitive economic advantage. As trade barriers erode, the locally protected product marketplace disappears. A countrys firms performance is more easily measured against global standards. Poor performance shows up more quickly when a competitor takes away market share, or innovates quickly.

Corporate governance is on the reform agenda all over the world. How will global economic integration affect the worlds various national systems of corporate ownership and governance? Is the Anglo-American model of shareholder capitalism destined to become standard or will sharp differences persist? If there is change, which institutions will converge? Which will persist? This volume contains classic work from leading scholars addressing these questions as well as new essays. In a sophisticated political economy analysis that is also attuned to the legal framework, the authors bring to bear efficiency arguments, politics, institutional economics, international relations, industrial organization, path dependence, and property rights.

Despite the increased interest in corporate governance (CG), gained recently at the high price of corporate scandals, there is always some confusion, characterizing its general understanding and it is not surprising to see the extreme hesitation expressed by governments, all over the world, regarding the appropriate solution to face CG challenges. For some people, this is actually the result of the relative novelty of the concept, inevitably expected to be characterized by some lack of deep understanding. For others, it is mainly the confusion of the concept of governance with the concept of control, which creates the problem. They are alarmed to see CG often reduced to a simple question of separating control from ownership, within the organization a simple technical problem of supervision some would argue. Progressively, however, and under the pressure of daily life, we were forced to concede to governance a much larger recognition, a wider extent and a bigger framework (Cornell and Shapiro, 1987; OECD, 1999). At the corporate level, transparency and management rigor are becoming two basic organizational values. It is becoming obvious that each organization and all its partners have real interest in having in place, policies, procedures, and equitable and transparent

practices of CG. As representative of shareholders, the Board, assisted by its different committees, has the responsibility of overseeing the respect CG, to which everyone in the organization must adhere with honesty and conviction.

ACKNOWLEDGEMENTS

TABLE OF CONTENTS

TITLE OF THE DISSERTATION I II III IV 1 1.1 1.2 2 2.1 3 4 5 ABSTRACT ACKNOWLEDGEMENTS TABLE OF CONTENTS INTRODUCTION PROBLEM STATEMENT SIGNIFICANCE OF THE STUDY FINDINGS AND DISCUSSION IN EUROPEAN CONTEXT RECOMMENDATIONS CONCLUSION BIBLIOGRAPHY

1 2 3 4 5 5 6 11 12 15 16 22

INTRODUCTION Corporate governance has gained an increasingly high profile in the last decade. The interest in corporate governance spans countries and continents, and applies not only to large public corporations but also to a wider range of business forms including stateowned enterprises, family-owned firms and not-for-profit organizations. Sir Adrian Cadbury, who chaired the UKs Committee on the Financial Aspects of Corporate Governance which reported in 1992, stated that corporate governance was the system by which companies are directed and controlled (Cadbury 1992, p. 15). This definition is succinct but clearly conveys the importance of controls in the company. A wider definition was given by the Organization for Economic Cooperation and Development (OECD 2004), which stated that corporate governance was a set of relationships between a companys management, its board, its shareholders and other stakeholders. [It] also provides the structure through which the objectives of the company are set, and the means of attaining those objectives and monitoring performance are determined (p. 11). As we can see, this definition views corporate governance from a much wider perspective and takes account of the various stakeholder groups, not just the shareholders. It also emphasizes the importance of corporate governance as an enabling device for setting, achieving and monitoring corporate objectives and performance. From just these two definitions, it is easy to understand why corporate governance is so important to companies, investors and stakeholders, and why it is a topic that has a pan-European and indeed global appeal. It is fundamental to well-run firms and helps ensure that the assets of the firm are secure and not subject to expropriation by individuals or groups within the firm who could wield excessive power. Corporate governance therefore helps a firm to be sustainable in the longer term. The evolution of corporate governance in the UK is discussed, together with the influential growth in ownership of UK equity by institutional investors such as pension funds and insurance companies. At the same time that local governance has grown more complex and difficult to map, the world beyond the nation state has moved on. Not only has regional governance developed rapidly (in Europe, to the point at which a Constitution for the enlarged Union is under

debate), but manifold international agencies whose brief is global governance are now operating to regulate fields that are, in some cases, narrow and specialised but, in other cases, broad and general. If mapping municipal law has become more challenging, this applies a fortiori to governance at the regional or global level where the regulatory players and processes may be considerably less transparent. Moreover, these zones of governancethe local, the regional, and the globaldo not operate independently of one another. Accordingly, any account of governance in the Twenty-First Century must be in some sense an account of global governance because the activities of global regulators impinge on the activities of those who purport to govern in both local and regional zones. To a considerable extent, global governance has grown alongside the activities of organisations whose predominant concerns have been international security and the promotion of respect for human rights. However, it has been the push towards a globalised economy that has perhaps exerted the greater influencethat is to say, globalisation has served to accelerate both the actuality, and our perception, of global governance. With the lowering of barriers to trade and the making of new markets (traditional as well as electronic), the processes of integration and harmonisation have been set in motion and the governance activities of bodies such as the IMF, the World Bank and the WTO have assumed a much higher profile. If nation states still rule the world, their grip on the reins of governance seems much less secure. Against this background, Global Governance and the Quest for Justice is a four-volume set addressing the legal and ethical deficits associated with the current round of globalisation and discussing the building blocks for modes of global governance that respect the demands of legality and justice. To put this another way, this set explores the tension between the order that is being instated by the governance that comes with globalisation (the reality, as it were, of globalised governance) and the aspiration of a just world order represented by the ideal of global governance. Each volume focuses on one of four key concerns arising from globalised governance, namely: whether the leading internationl and regional organisations are sufficiently

constitutionalised, whether transnational corporations are sufficiently accountable, whether the distinctive interests of civil society are sufficiently represented and respected and whether human rights are given due weight and protection. If the pathology of globalised governance involves a lack of institutional transparency and accountability, the ability of the more powerful players to act outside the rules and to immunise themselves against responsibility, a yawning democratic deficit, and a neglect of human rights, environmental integrity and cultural identity, then this might be a new world order but it falls a long way short of the ideal of global governance. In the opening years of the Twenty-First Century, the prospects for legitimate and effective governancethat is to say, for lawful governanceare not overwhelmingly good. Local governance, even in the bestrun regimes, has its own problems with regard to the effectiveness and legitimacy of its regulatory measure; regionalisation does not always ease these difficulties; and globalised governance accentuates the contrast between the power of those who are unaccountable and the relative powerlessness of those who are accountable. Yet, in every sense, global governance surely is the project for the coming generation of lawyers. If the papers in these volumes set in train a sustained, focused and forward looking debate about the co-ordination of governance in pursuit of our best conception of an ordered and just global community, then they will have served their purposeand, if law plays its part in setting the framework for the elaboration and application of such global governance, then its purpose, too, will have been fulfilled.

Research Proposal: How does Corporate Governance affect internationalization, globalization and performance of firms? 1.1 PROBLEM STATEMENT

Essentially, corporate governance failures may come about for two broad reasons. First, management may operate the firm inefficiently, resulting in an overall decrease in firm profits, compared to the potential profitability of the firm. Second, while managers may operate the firm efficiently and generate maximum profits, they may divert a proportion of those profits from shareholders via the consumption of excessive perquisites, for example by paying excessive remuneration not limited to performance. Hence a system of corporate governance needs to consider both efficiency and stewardship dimensions of corporate management. Stewardship emphasizes issues concerning, for example, the misappropriation of funds by non-owner managers. Equally important, however, is the issue of how the structure and process of governance motivates entrepreneurial activities which increase the wealth of the business. Corporate entrepreneurship concerns the reallocation of economic resources in new combinations and may involve both new innovations as well as major corporate restructuring (Guth and Ginsberg, 1990). Good corporate governance is thus as much concerned with correctly motivating managerial behavior towards improving the performance of the business as it is directly controlling the behavior of managers. Given the above, it is clear that policy recommendations on corporate governance need to address both the accountability and enterprise aspects of governance.

Corporate governance issues, arising from the agency problems engendered by the separation of ownership and control and the inability to write complete contracts for all possible future eventualities (Hart, 1995; Shleifer and Vishny, 1997), have been recognized for many decades, if not centuries (Berle and Means, 1932; Marshall, 1920; Smith, 1776). Although a longstanding issue, the debate was given fresh impetus in the UK by a number of well-published corporate problems in the late 1980s. These involved creative accounting, spectacular business failures, the apparent ease with which unscrupulous directors could expropriate other stakeholders funds, the limited role of auditors, the claimed weak link between executive remuneration and company performance, and the roles played by the market for control and institutional investors in generating apparently excessive short-term perspectives to the detriment of economic performance. National decision makers must consider whether to protect locally favored corporate governance regimes if they regard the local regime as weakening local firms in product markets or capital markets. So, the Americans debated in the 1980s whether bankcentered systems in Japan and Germany better monitored management and better encouraged long term Investment than the home-grown variety. Today, Europe wonders whether it will lag in product markets if it does not get active securities markets. International development institutions believe that corporate governance affects the rate and sustainability of developing country growth. A famous case is the International Monetary Funds (IMF) criticism of the governance of Korean conglomerates, the chaebol, as allegedly producing unsustainable borrowing patterns that helped ignite the East Asian financial crisis of 1998. Concern about comparative economic performance induces concern about corporate governance. Globalizations second effect comes from capital markets pressure on corporate governance. First, firms have new reasons to turn to public capital markets. High tech firms following the US model want the ready availability of an initial public offering for the venture capitalist to exit and for the firm to raise funds. Firms expanding into global markets often prefer to use stock, rather than cash, as acquisition currency. If they want

American investors to buy and hold that stock, they are pressed to adopt corporate governance measures that those investors feel comfortable with. Despite a continuing bias in favor of home-country investing, the internationalization of capital markets has led to more cross-border investing. New stockholders enter, and they arent always part of any local corporate governance consensus. They prefer a corporate governance regime they understand and often believe that reform will increase the value of their stock. Similarly, even local investors may make demands that upset a prior local consensus. The internationalization of capital markets means that investment flows may move against firms perceived to have suboptimal governance and thus to the disadvantage of the countries in which those firms are based. An independent factor in the corporate governance debate is the wave of privatizations of large state-owned enterprises in the infrastructure, natural resource, and manufacturing areas. This has often been accompanied by deregulation. Corporate governance reformers have sought accountability from large economic actors when privatization and deregulation have devolved important decision making authority away from governments and into private firms. Often, political accountability and economic efficiency point in different directions. For example, in privatizing former state-owned enterprises, the state wants to maximize the price it gets from selling the firm, but it also wants to preserve political influence, often to control employment and service. The two do not always match. Corporate governance is onthereformagenda all over the world.How will global economic integration affect the worlds various national systems of corporate ownership and governance? Is the Anglo-American model of shareholder capitalism destined to become standard or will sharp differences persist? If there is change, which institutions will converge? Which will persist? This volume contains classic work from leading scholars addressing these questions as well as new essays. In a sophisticated political economy analysis that is also attuned to the legal framework, the authors bring to bear efciency arguments, politics, institutional economics, international relations, industrial organization, path dependence, and

property rights. The Enron-induced corporate governance events and reforms in the United States heighten the importance of this inquiry. Will Enron hold up a convergence that was in the works? Convergence and Persistence in Corporate Governance sets up the issues for study and analysis.

1.2

SIGNIFICANCE OF THE STUDY

Before moving directly into a discussion of good Corporate Governance, it is important to create a foundation based on the initial concepts of the corporation, its role in society, and its organization. The corporation, like no other fictional entity, has created an unprecedented volume of debate and discussion. There are those who argue for its existence, its reform, and its abolishment. There are groups that study the corporation in terms of its sociological impact on individuals and those who study the corporation in terms of its impact on itself. At the core of all meaningful discussions of the corporation is the concept of Corporate Governance. Corporate Structure It is sometimes helpful to think about corporations as imaginary people. In many ways they do have the same rights and powers that the average citizen does; they are able to open bank accounts, file taxes, make purchases, and own property. Unlike non incorporated businesses that do these things under their company name, the corporations assets are not directly owned by the company owner or partners. Specifically, when a non incorporated business purchases property, the deed is held by the company owner However, when a corporation does the same, the deed is held by the corporation itself.

In todays economy, the concept of the borderless corporation is becoming increasingly ubiquitous. There are few restrictions placed on investors who would like to purchase shares in international companies. There is also a strong trend toward the globalization of markets in which corporations themselves do not operate within confined borders but hold subsidiaries in several countries. The international marketplace creates very specific complications for the establishment of good Corporate Governance practices. As previously discussed, corporations and their structure are unique to the countries in which they are situated. Their structures and practices have evolved from the unique political and social landscapes in which they are embedded. This is the primary reason why Corporate Governance best practices are designed as guides to be adapted for specific circumstances rather than uniform implementation. Complications arise when companies are established in several unique marketplaces or when partnerships are created across international borders. In these situations the corporation may find it difficult to create a company wide set of policies, since not every subsidiary will fit the bill. In the past, international corporations have benefited from diminished regulations, the ability to operate in regions with fewer laws, and a perception of unlimited freedom. Additionally, inexpensive labor and lower tax rates have been large factors in drawing company activities away from developed countries and into emerging nations. These activities have created the image of corporations living a lawless existence in which they are able to manipulate their international standing to avoid penalties, labor codes, and environmental regulations. Although such an existence can assist the company in increasing revenue by limiting expenditures, the actions are frequently unsavory to investors and the general public. Past years have shown increasing interest in the international activities of corporations, especially those that originate in developed markets and shift all or part of their operations to emerging countries. Public concern centers on environmental and labor practices as well as the effects that international accounting has on share values.

Overall, the message is becoming clear that shareholders and societies do care what happens beyond their borders. As a result, many corporations and organizations are working to improve the image of the international corporation and instill at least a semblance of good Corporate Governance practices. The difficulty that arises in these efforts stems from the unique nature of each marketplace. It is feasible, and common, that an international corporation will exist concurrently in several nations, all of which have their own unique market structures. Frequently, differences in laws and customs will hinder a corporations ability to apply one uniform set of Corporate Governance policies to all of its subsidiaries. The purpose of this study is to examine the forces within the process of economic globalization that might be giving rise to pressures on institutions in insider corporate governance systems to conform to a shareholder orientation. As we see it, through the process of economic globalization led by capital and product market liberalization, conditions that promote securitization of financial systems, externalization of labor markets, promote shareholder corporate law norms and introduce highly competitive product markets, have been created which have the potential to cause change in insider systems. In doing so we examine in turn the economic history of globalization, to get a picture of the overall process we are dealing with, before then turning to examine the interaction between economic globalization and national institutional structures that determine corporate governance. However, before doing so, some conceptual clarifications are necessary. Defning globalization Although the phrase had been used much earlier, in 1983 Levitt popularized the term globalization among key opinion formers in observing that increasing integration of product markets provided the opportunity for frms to offer globally standardized products. Since then it has assumed a ubiquitous but vague status. As Cotterrell notes:

the idea of globalization embraces so much, and entails such huge claims about social and economic forces and the movements of history that it is hard to grapple with. It is also widely seen as weighed down with valuations positive or negative. Attempted descriptions of phenomena associated with globalization usually carry with them arguments or assumptions about the causes of these phenomena. They are seen, for example, sometimes as the product of inevitable, almost natural forces (a global invisible hand), or as the result of more deliberate political, economic, cultural or other strategies (often seen as imperialistic). And judgments are made about the consequences of globalization. As a result before we can even begin writing about globalization we must take a position within contested territory as to the nature of globalization, as some regard it as a theory, others as a historical epoch or new paradigm, and others as a process. In this study we view it as a process as it appears to be the most accurate for a number of reasons. Firstly, globalization, it seems to us, cannot be a theory because it does not contain and prove any hypotheses that would help us understand or explain any phenomenon. On the contrary, globalization requires a theory or theories to aid our understanding of it as a socio-economic phenomenon. Secondly, globalization cannot be regarded as a specifc historical epoch or a new paradigm, because as we will demonstrate it is a phenomenon that has occurred before and it can also be reversed as well as reoccur in the future. Finally, the grammatical ending of the word itself, although not determinative, signifes that it is a process rather than a static state of affairs. The term should also be distinguished from the process of internationalization. This term, which is also a process, contains the word nation as one of its main ingredients whereas globalization does not. This is because internationalization describes a world of nations which increasingly act and interact with each other as separate and autonomous units, either directly or through their citizens. Similarly regionalization projects such as the European Union (EU) exhibits elements of both increasing internationalization and denationalization as partial sovereignty is passed to

the EU regional level. Globalization on the other hand, does not contain this national element. This is because it inherently involves national units going through a process of becoming increasingly integrated, until they eventually disappear as separate entities and are replaced by the holistic state of affairs that globalism describes; that is, globalization contains the element of loss of national autonomy. However, internationalization, regionalization and globalization are processes that are closely linked with each other, because the former pair can ultimately lead to the latter. That is, increasing international and regional activity and interaction can cause and promote global integration. This perhaps explains why the terms are sometimes used interchangeably. As such because we view globalization as a process in which internationalization and regionalization play a part.

2.

FINDINGS AND DISCUSSION

THE TERM CORPORATE governance has a range of meanings. For present purposes two stand out. The first refers to the various ways in which society attempts to control company behaviour in the public interest. 1 Here what is being governed is the company itself, the most obvious modality being regulation by the state external to the company, for example, the requirements of employment law, consumer law, or environmental law. The second meaning is the one more familiar to company lawyers, of company-level governance: in the words of the Higgs review, the architecture of accountability or structures and processes that ensure that those responsible for managing companies do so in accordance with the legitimate objectives of the business. Directors duties, boards that contain members with a monitoring role, and disclosure of financial and other information are examples of mechanisms of governance so understood. While some would argue otherwise, corporate governance in the second sense can be regarded as a sub-set of governance in the first. That is, company-level controls reflect at least in part a state determination of what corporate objectives should be and of corresponding accountability arrangements. In the Anglo-American corporate world the purpose of such controls is generally viewed as being to enforce a goal of shareholder wealth maximisation, justified as the best means of maximising the wealth of society as a whole. The aims of governance need not, however, be so narrowly defined. It is with using company-level governance (from now on, just corporate governance) for the wider purpose of influencing the social and environmental performance of companies that this is concerned. While policy makers normally look to external regulation as the means of controlling the social and environmental impacts of business, corporate governance is important as well, for two reasons. First, governance arrangements are likely to affect a companys propensity to comply with regulation. Companies are complex organisations and internal accountability structures that can cope with this complexity are needed to secure conformity with law down the lines of command. At a more general level, the commitment to compliance is likely to be affected by the incentives that governance frameworks create. Where, for instance, the culture of the organisation is short-termist because of pressures or inducements to maximise current

share price, obeying the law may not be regarded as an issue of overriding importance. 6 The second reason for a concern with governance is the well known limitations of regulation as a means of prescribing socially desired outcomes. These limitations result in part from problems inherent in the use of general rules. For example, regulation has a tendency to be under- (or over-) inclusive, to set only base-line standards when many companies with- out undue cost could perform to a higher level, and to offer few incentives for continuous improvement. Of particular relevance to this volumes themeof globalisation, there may also be gaps in regulatory coverage. The standards imposed on multinationals by host jurisdictions are often non-existent or inadequate, and there is an absence of binding norms of international law to compensate. The analyses of corporate governance systems remain one of the most fascinating research topics. They deliver even more interesting insights and observation when they refer not to individual countries but when they attempt to track characteristics or differences of the wider geographical region. The comparative analysis of corporate governance systems that evolved in Europe may seem to be a relatively easy task due to the assumed harmonization or unification of solutions adopted across Europe. However, the deeper discussion on the current stage of control structure, the development of the regulatory framework and predominantly the historic experience and recent reform efforts become an evidence for great variety of the existing systems. Thus the comparative analysis of corporate governance in Europe shows the variety of possible solutions applied. The differences depicted in national systems are substantial and their analyses deliver interesting insights on control mechanisms development process and efficiency. Corporate governance, its shape and efficiency has been for many years, and remains, up-to-date in the centre of management research and business debate. Comparative analysis of national systems deliver more insights and understanding to what corporate governance really is, how it is created as well as what challenges it needs to face within the nearest future (Morck, 2002). It must be, however, emphasized that the majority of research conducted so far refers predominantly to the most developed countries including the United States,

United Kingdom, Germany and Japan (Kojima, 1997). Recently there has been more work on other countries of Western Europe as well as South East Asia (Wallace and Zinkin, 2005) Understanding Globalizations Corporate Governance impact: As was noted the experiences of the Great Depression and WWII gave rise to an unprecedented consensus for the establishment of a stable international system, along Keynesian interventionist lines, which would provide the foundations for the reconstruction of devastated economies worldwide. The institutional arrangements that emerged Within from that the Bretton Woods order, agreements ensured that a stable to macroeconomic environment was in place to stimulate continuous investment and growth. international national governments were able implement expansionary policies which ensured that effective demand was suffcient to absorb increasing industrial output. This was combined, with the managerial corporation emerging as a signifcant force in society. Crucially, management exercised a wide discretion as to the allocation of retained earnings which played a key role in managers making long-term commitments to stakeholders. Therefore, managerial autonomy from shareholders allowed managers to undertake a central coordinating role within the frm and deploy resources in a way that resolved conficts among different resource providers within a macroeconomic frame work that allowed governments to pursue policies that complemented the managerial corporation. The result was a period of unprecedented economic growth, stability and wealth creation often referred to as the golden age of capitalism. In trying to understand the impact of globalization on corporate governance systems we draw upon aspects of macroeconomic theory that emphasize the connection between frm growth and government demand policy. In 1928, the economist Allyn A. Young departed from traditional equilibrium theory and argued that, contrary to the neoclassical assumption that an output increase is impossible without a proportional increase of costs, increases in scale also lead to increases in returns.

This is because the division of labour associated with increases in scale reduces the cost and price of commodities, which leads to an expansion of the market. In turn, a growing market makes further increases in the division of labour proftable, and starts a new circle of cumulative growth. In other words, an increase in production creates a virtuous production cycle where the more you produce, the more demand you create, which in turn leads to a further increase in production. To use Youngs terminology, growth, i.e. Increasing output creates reciprocal demand that absorbs the growth and initiates a new cycle. However, others recognized that there were weaknesses at the heart of this model because frms may lack the funds to increase production, and even if they do increase production, the element of reciprocal demand may not be triggered. To address these failings, Kaldor argued that, provided that frms can retain and use their earnings, organizational higher proftability and production translates into and increased in an investment in increase in technologies results

productivity and output. To ensure that demand is present, Kaldor argued that government demand-management policies are crucial for the completion and perpetuation of this virtuous circle of cumulative economic growth. If suffcient demand is ensured to absorb increased output, a new cycle can begin which will further promote growth and economic welfare. Kaldor argued, along Keynesian lines, that demand was not only a key to sustainable economic growth but also the weak link which markets cannot always provide without intervention; hence the important role of government as a regulator of effective demand through the implementation of full employment policies, protective trade and public investment spending. Ideally, for the cumulative causation model, government trade policy should be an imbalance of protective home markets and open access to foreign markets. In such a model the frm can expand abroad from a protected home base. If these conditions were in place they should sustain a sequence of rising industrial growth leading to increased consumption, which would

increase proftability, which would promote industrial growth.

investment

and ultimately

lead

to

Without government demand intervention, demand slumps can in turn lead to vicious circles of diminishing output, investment, growth, and demand; with negative welfare consequences. Understanding Globalizations Corporate Governance impact: ii The dramatic reduction of trade barriers after a series of GATT negotiations during the second half of the twentieth century has enabled frms to gradually view the world, rather than each particular country, as a single product market. As a result FDI has grown enormously. As we noted, one of the key differences between this current globalization period and the late nineteenth/early twentieth century one, has been the growth of FDI in the form either of locating manufacturing abroad or M&As in the developing world. These patterns need to be explained in detail if we are to draw some lessons about the impact of FDI on core institutions that affect corporate governance outcomes. Indeed, these patterns at frst sight contradict standard neoclassical theory of foreign investment which tends to regard trade and FDI as substitutes so that an increase in trade impediments stimulates factor movements and an increase in impediments to factor movements stimulates trade and suggest something other than trade barriers is driving FDI. The international corporate governance research that we label rst generation is patterned after a large body of US research. In this section, we review the international evidence on internal control mechanisms, in particular the board of directors and equity ownership structure, and on the external market for corporate control. The rst generation of research on corporate governance mechanisms generally concerns itself with two questions regarding a particular mechanism. First, does that mechanism affect rm performance, where performance is typically measured by protability or relative market value? Second, does that mechanism affect the particular decisions made by rms; for

example, with respect to such issues as management turnover and replacement, investment policy, and reactions to outside offers for control? CG BENEFITS There still subsists a general feeling of incomprehension with regard to the potential benets which can be withdrawn from CG improvement. CG opponents often, however, try to justify their opposition based on the Smithsonian notion of the invisible hand. Adam Smith claims that, in capitalism, an individual pursuing his own good tends also to promote the good of his community, through a principle that he called the invisible hand of the market. Such a hand ensures that those activities most benecial and efcient will naturally be those that are most protable (Smith, 1776). Free enterprise systems can certainly emphasize the best part of each individual, by developing his creativity, his energy while increasing his aspiration to a better life. But such a system can function without a minimum of good governance and such governance would be realizable, given the multiple challenges which confront it? Recent nancial audacious frauds were surprising by both their impact and ingeniousness, they draw attention, not only on the dramatic consequences of weak CG, but they also give the CG issue urgent priority. Such frauds have underscored the critical importance of structural reforms in the governance of companies and nancial institutions. They also show that CG issues transcend national boundaries. Although the Western corporations have been the home of the bulk of recent corporate controversies, no doubt other economies of the world are not innocent either. Weak CG has always borrowed the vehicle of nancial information opacity. Information transparency, as we know, occurs only when there is no obstacle to the harmonious ow of quality information which is also relevant and credible. Similarly, information opacity occurs whenever irritants are deliberately placed on its harmonious ow, preventing users its free access. Weak transparency and uncertainty are, however, nancial information inherent characteristics. The main reason is that nancial markets are constantly engaged in a timeless and dubious trade, not only in monetary terms, but

especially in informational terms. Information collected and treated by the market relates mainly to project selections and performance monitoring and follow-up. Interest for good governance (or concern as for its absence) comes mainly from its triple action, particularly its impact on organization effectiveness on market effectiveness, and on social harmony. With regard to organization effectiveness, it is easy to understand, at least at the theoretical level, that a transparency culture would have many benets to any organization. Although the primary objective of corporations remains the maximization of their shareholders wealth, it becomes progressively obvious that if a wealth maximization objective has to be achieved it must go through the respect of other corporate stakeholders interests, including community interests. These diverse interests must, not only be assured, but also harmonized. Indeed, one organization is likely to create more wealth, for itself and for the whole society, by an ethical strategy, and this will gain the corporation an integrity reputation. As shareholders agents, members of the board of directors play a crucial and determinant role in organization governance. They should themselves be transparent and such transparency must be reected in the rst place, in their own selection criteria. For example, board transparency can also facilitate the separation of management from the capital and avoiding the negligence of shareholders interests and non respect of other stakeholders rights. Such a situation, as we know, is capable of weakening employees corporate commitment and leading to much skepticism by customers and suppliers. The board then becomes value creator. One can only deplore (until recently) the absence of interest at this level. Concerning the nancial market, nancial literature abounds with arguments suggesting the positive impact of good CG on scarce resources allocation, capital movement and general economic effectiveness, since CGs main component nancial transparency makes direct investment more productive and this in turn leads to more efciency and growth. But the highest cost of CG absence resides in the excess of corruption and frauds it leads to, along with the misallocation of resources it ends up to. iii At the social level, good CG makes it possible for honest individuals to be consolidated in their honesty and

to those which are less convinced, to think seriously before committing themselves to transforming their job into a one- man business, for the sole purpose of maximizing their own utility, even at the price of fraudulent acts, creating a harmful corporate atmosphere of injustice and frustration.

3.

RECOMMENDATIONS

The literature on international corporate governance tells us much about corporate governance but the message in the information is far from clear or complete. Much more work remains to be done. Our understanding of the relationship between systems of governance and the value of economies and the rms within them is of increasing importance as emerging markets around the world look to the developed markets to decide how to set up their own economic and corporate governance systems. We review existing international corporate governance research. The rst generation of this research is broadly patterned after the large body of evidence on governance mechanisms in US rms. These rst generation studies examine governance mechanisms that have been studied in the US particularly board composition and ownership structure for one or more non-US countries. The rst generation of international corporate governance research examines individual countries in depth and establishes that there are important differences in governance systems across economies. Early international research focused primarily on Germany, Japan, and the UK. Even across these very developed economies, signicant differences in ownership and board structure were observed. As international research expanded into other countries, the differences in corporate governance systems mounted. Of particular note are the very distinct differences in ownership structure across countries. The typical large US Corporation, with its diffuse equity ownership structure and its professional manager, appears to be typical only in the US and the UK. Ownership concentration in virtually every other country is higher than it is in these two countries. In many countries, majority ownership by a single shareholder is common. It is also common in many countries that major shareholders control rights exceed their cashow rights. The realities of ownership and control are such that the primary agency conict in the US that between professional managers and their widely dispersed shareholders is relatively unimportant inmany other countries. In its place, however, there is a

different agency conict, that between controlling shareholders and minority shareholders. Evidence suggests that the private benets of control of companies can be signicant and that they are value reducing. The typical rst generation international corporate governance study examines one particular country. Taken together, these studies reveal differences in governance systems across countries. Such a fragmented approach, however, does not yield much understanding of why we observe the differences we do. To be able to explain these differences, examination of many countries in a unied framework is required. This task is taken up in the second generation of international corporate governance research. An important insight generated from the second generation research is that a countrys legal system in particular, the extent to which it protects investor rights has a fundamental effect on the structure of markets in that country, on the governance structures that are adopted by companies in that country, and on the effectiveness of those governance systems. This insight, along with newly developed measures of the strength of countries legal protection of investors, will continue to generate a rich body of comparative corporate governance studies. Strong legal protection for shareholders appears to be a necessary condition for diffuse equity investment. The relatively diverse ownership of US rms can be attributed, at least in part, to the relatively strong legal protection available to potential investors in the US. The general lack of a relationship between ownership structure and rm value could simply mean that the strong legal protection in the US allows US rms to pick and choose among a menu of potential governance mechanisms to achieve optimal structures. In countries with weak protection, however, it appears that only ownership concentration can overcome the lack of protection. While there is a large body of evidence on individual corporate governance mechanisms in the US, there is much less published evidence addressing the interrelationships among them and the factors that determine the optimal governance structure for a particular rm. In addition, the recent evidence on the importance of legal structure poses new questions even for the US. LLSV (1998) argue that, while protection of shareholder rights in the US is the strongest in the world, such protection is not particularly strong anywhere. Would greater

protection in the US improve corporate governance, and with it rm values? Clearly there are limits to the value of protection. For example, a system in which shareholders have the right to approve or disapprove every decision made by managers would be neither practical nor valuable. But what are these limits? Does the US have an optimal level of shareholder protection, or is there room for improvement? International governance structures are evolving as governments, private parties, and markets seek to strengthen their economies and rms. Such evolution will provide opportunities for rich new data. For many countries, there is relatively little empirical evidence on governance mechanisms other than legal protection and ownership structure. Such issues as board structure, compensation, and changes in control have been extensively studied in the US, but have been studied much less if at all for many other world economies. This may reect the dominant role of ownership structure in these economies, a dominance that appears to be driven at least in part by weaknesses in legal systems. Evolutions in legal structure provide for natural corporate governance experiments. What aspects of legal systems evolve? What are the effects of such changes on the role of other rm-specic governance mechanisms? What, ultimately, are the effects of such changes on the strength of economies and on the actions and value of companies within them? Answers to these questions will increase our understanding of the role of corporate governance throughout the world. A whole market to blame, but who dares? It is commonly admitted that from early 2001 until the collapse of Enron in October of the same year, all major investment banks analysts in the US were still strongly recommending buying Enrons securities, stocks and bonds alike. Some of these analysts admitted in their private emails that many of the shares they were recommending to clients were actually junk stocks. After the collapse of Enron, some analysts, linked to investment banks or funds houses, were even condemned for conicts of interests.

Obviously weak governance, as a major evil, has more extent and ramications than rst expected, it is actually a systemic crisis. Indeed, CG seems to be missing in many organizations because of the favorable environment gradually encouraged and instituted. For some time, for instance, it was believed that because of its efciency, the market was capable of separating wheat from the chaff. Quite naturally, interest was shifted toward market value instead of accounting value. No one, however, has yet successfully dened what market value exactly means or how it is computed. Consequently, it should be no surprise that having lost its bench- marks, the evaluation process was confused and weakened and had ended up letting nancial analysts and rating agencies, armed with approximation and a lack of rigor, to have precedence in security evaluation. Gradually, their control over security evaluation activity became without partition. Since then only one law prevails on the market analysts law, a law that promises punishment for corporations unable to meet analysts prot anticipations and blessing for those that conform to it. With the help of the last stock exchange euphoria, conforming corporations had been indeed largely but unduly rewarded for their assiduity, by exorbitant and abnormal market returns, while others, although economically viable were ruined, quite simply because they prove to be unable to conform to the irrational analysts desires. As underlined previously, analysts decision models were never, neither proved nor demonstrated, nor even commonly agreed on. Some analysts were, for instance, recommending strong purchases of companies securities on the verge of collapsing and some rating agencies did not, at certain times, hesitate to low down Japan quotation to Malawi level. Often, inexperienced or unprofessional analysts make subjective earnings forecasts on the basis of simple data that is supplied by listed rms. Despite their illegitimate process, they can become market forces that drive concerned rms to adjust their strategies. Many people are convinced that the business relationship between an analysts investment bank and a client rm affects the independence of the analyst to the point that they tend not to disclose, or delay disclosing, any negative news about the client rm. It is, for instance, mentioned

(The Economist, 2007) that some well-known international credit rating agencies had intentionally, and for generous fees, delayed their announcements of negative rating reports on Enron and certainly on other listed rms. Christopher Cox, as chairman of the Security Exchange Commission (SEC) since 2005, keen for regaining the lead, has made ghting insider traders a priority. According to Walter Ricciardi from the SEC, the commission must prevent any buzz in the markets that you can get away with it. He adds: Nothing paints a picture as well as people being led away in handcuffs. It is believed the SEC will act even when it has no one to put the cuffs on. Very recently, indeed, the SEC led a suit against unknown investors who had proted in the options market before the announcement of a takeover of TXU (Texan utility). (SEC). To match analysts predicted earnings and restraining their stock prices from collapsing, some companies, unable to meet the challenge honestly, learned how to use creative accounting methods to x their account books and this opened the door to all corporate abuses and scandals. Theoretically, managers can be discouraged from undertaking suboptimal decisions, privileging their own interests at the expense of the shareholders, quite simply by conceding them generous employment conditions. Some managers had quickly, however, invented the magic potion which will allow them to unduly inate options value included in compensation plans and which deate only in future purchasers hands. Large shareholding dispersion makes it possible for managements to control without sharing company destinies. The extent of their hegemony is so strong it allows them to treat all shareholders as minority interests. In these conditions voluntary governance would seem difcult to achieve and public intervention becomes desirable and unavoidable. Thinking must, however, precede legal action, Intervention has to deal with relevance, cost benet and market transparency. Especially that those most eminent CG failures emanated from companies most respectful of standards. Following Max Weber, we can assume individual actions to be initiated by anticipating others reactions. Management fraudulent behavior can thus be explained by the anticipation of investors behavior on the market, and CG

weaknesses can only be the consequence of a favorable environment to fraud, one which was gradually encouraged by the market. Interest for CG did not really wait for the recent corporate crisis to impose itself. Actually, major accounting legislations throughout the world were concerned, very early, with the issue, to the point where most of their accounting conceptual frameworks were based on it. Although such early awareness and the various accounting standards have contributed to CG improvement, they did not prove to be sufcient in avoiding resounding accounting frauds. In any case perfect CG would prove difcult to realize, as long as the nancial market is not ready to adopt it, to require it and to remunerate for it. Instead the market was always requiring non realizable higher returns coupled with lower risks, and some corporations, looking for an alternative, have discovered that it was possible to please the market by simply manipulating the numbers. It was often stated that the market because of its supposed efciency was able to operate without accounting information. More seriously, it was loudly announced that in the event of accounting method choices, any accounting method will make it. The market was supposed to have the ability to go to the heart of the problem. Market operators were always keen on getting freed from accounting numbers burden, despite the fact that accounting information constitutes the only measurable data that exists. Quite naturally interest was moved toward the subjective and uneasy to handle concept of the fair value, neglecting at the same token the much more objective concept of historical value, which of course accuses its won limits, except non-measurability. Analysts insistence was so strong as to bring the standard setter to require measuring assets and liabilities in fair value terms, knowing that no one can yet explain what such notion means and nobody has ever been able to test its usefulness. Consequently, having lost its references, the evaluation process was weakened and so auditing activities, information transparency and nancial reporting quality, in a word CG.

4.

CONCLUSION

Overall, the message is becoming clear that shareholders and societies do care what happens beyond their borders. As a result, many corporations and organizations are working to improve the image of the international corporation and instill at least a semblance of good Corporate Governance practices. The difficulty that arises in these efforts stems from the unique nature of each marketplace. It is feasible, and common, that an international corporation will exist concurrently in several nations, all of which have their own unique market structures. Frequently, differences in laws and customs will hinder a corporations ability to apply one uniform set of Corporate Governance policies to all of its subsidiaries. International Corporate Governance practices. Those companies that make conscious efforts to do so are not alone, however, and have the support of internationally conscious Corporate Governance organizations such as the OECD. Corporate structure and practices will be influenced by the political, legal, and cultural environment of the corporations home country. _ International differences demand flexibility in Corporate Governance practices to effectively compensate for varying corporate structures. _ Corporations that exist between international borders are becoming increasingly visible as the global economy spreads. _ International corporations present unique problems for Corporate Governance because they must contend with different structures and regulations within their own company. _ The OECD and World Bank are key players in facilitating the establishment of flexible Corporate Governance frameworks. While the above has given an indication of the effects of economic globalization on core institutional sub-systems such as fnance, competition and effective demand and industrial relations we have not yet discussed the impact of globalization on corporate law. Obviously the lack of a global corporate law is one reason for this. Additionally our focus on economic globalization brings those institutions with primarily economic functions into closer focus but the effects of economic globalization are felt in corporate law too as international organizations have

formulated strategies for the promotion of the shareholder supremacy principle and therefore deserve a mention. Organizations in modern economies were granted extraordinary privileges allowing them to participate effectively in social and economic human advances. Unfortunately, abuses were quickly emerging and becoming more and more unbearable and subject to many citizens virulent denunciations and desperate protests. They also proved to be extremely detrimental to economic growth and social development. Not only were they of a doubtful morality, but they also seemed to be questioning the free enterprise system basis. The most notable abuse resides in weak corporate governance (CG) initiated under the cover of false transparency and misused regulated nancial reporting. We would obviously like to think that the majority of our corporations aspire to a faultless behavior and that their advisers, lawyers, etc. do not see themselves as simple legality traders for payment, allowing the respect of the letter of the law, but disregarding its spirit. Unfortunately, in the eld, little is already too much and it was thus necessary to act and quickly, given that recent corporate misconducts have proven to be extremely dangerous for all. Given market globalization and information technology development, it is expected that CG practices will converge more and more. It is necessary, however, to give enough time to such convergence to materialize efciently. It may be reasonable to say that the CG system of any country has its advantages and limitations and that cross fertilization through comparative studies among countries should be performed to the mutual benet of all. Companies in exchanges can, obviously, recourse to either internal and/or external corporate mechanisms, as insured by the board, nancial markets, rating agencies, auditing rms, banks and institutional investors, playing a signicant role in detecting fraudulent behavior and reducing information asymmetries. Shareholders of non-listed companies can benet from none of the previous CG external mechanisms and they seem to be neglected by the majority of national systems of CG. This situation is also obvious especially when we consider current efforts of international agencies to improve CG in developing countries. They are advocating dynamic exchanges, diffused shareholdings and so

on, whereas often there are no real exchanges and no real shareholders in those environments. In our opinion, addressing the CG issue in developing environments is like addressing the issue of development itself. Rich countries and international organizations have all the reasons to underscore the fundamental role of governance in development, but they should nd a way to adapt their requirements to the conditions of developing countries. Due to the complexity of the issue, the road map toward the attainment of such objectives should be worked out with each developing country. Of course, basic CG principles like transparency, corporate democracy, etc., should be respected by all. It is commonly believed that the 1997 Asian financial crisis was mainly the consequence of a lack of effective CG and transparency within most of Asias financial markets and institutions and so the recent collapse of the Enron Corporation and similar frauds in other developed countries. These events have underlined the critical importance of structural reforms in the governance of large companies, particularly, and the financial system in general. For sure the CG issue transcends national boundaries, but CG responsibility within the organizations always remains shareholders own, via their elected boards of directors. In this respect the board and its various committees must work for sowing germs of good governance, by addressing problem causes and not limiting themselves to symptom treatments. In others words, they must stay tuned to corporate operations, so that internal tensions or external events will not affect organization immunizing capacity against non ethical behaviors. Board members should be encouraged and oriented toward corporate problem solving; it is only a simple question of common sense and good governance.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Direct Tax Case Email # 127-2014 Ms DHA LahoreDocument5 pagesDirect Tax Case Email # 127-2014 Ms DHA LahoreM Javaid Arif QureshiPas encore d'évaluation

- Sales Tax Case Email No. 78-2014 24/05/2014Document11 pagesSales Tax Case Email No. 78-2014 24/05/2014M Javaid Arif QureshiPas encore d'évaluation

- Sales Tax Case Email 852014 Muhammad HanifDocument11 pagesSales Tax Case Email 852014 Muhammad HanifM Javaid Arif QureshiPas encore d'évaluation

- Sales Tax Case Email 852014 Muhammad HanifDocument11 pagesSales Tax Case Email 852014 Muhammad HanifM Javaid Arif QureshiPas encore d'évaluation

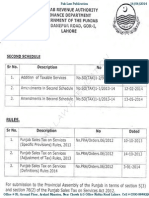

- Amendment Notification Punjab 2014Document8 pagesAmendment Notification Punjab 2014M Javaid Arif QureshiPas encore d'évaluation

- Direct Tax Case Email No. 113-2014 05/06/2014Document26 pagesDirect Tax Case Email No. 113-2014 05/06/2014M Javaid Arif QureshiPas encore d'évaluation

- July 1, 2014 Jma - SR - 01072k14Document5 pagesJuly 1, 2014 Jma - SR - 01072k14M Javaid Arif QureshiPas encore d'évaluation

- Direct Tax Case Email # 126-2014 Ms Muhammad Al-AdwaieDocument4 pagesDirect Tax Case Email # 126-2014 Ms Muhammad Al-AdwaieM Javaid Arif QureshiPas encore d'évaluation

- Email # 05-2013 DT SRO 212 of 2013Document1 pageEmail # 05-2013 DT SRO 212 of 2013M Javaid Arif QureshiPas encore d'évaluation

- Email # 01-2013 DT Circular Dated 31-01-2013Document1 pageEmail # 01-2013 DT Circular Dated 31-01-2013M Javaid Arif QureshiPas encore d'évaluation

- Jma SR 25062k14Document6 pagesJma SR 25062k14M Javaid Arif QureshiPas encore d'évaluation

- Direct Tax Case Email No. 165-2014 23/08/2014Document9 pagesDirect Tax Case Email No. 165-2014 23/08/2014M Javaid Arif QureshiPas encore d'évaluation

- Direct Tax Case Email # 124-2014 Ms Pak Arab Refinery LTDDocument2 pagesDirect Tax Case Email # 124-2014 Ms Pak Arab Refinery LTDM Javaid Arif QureshiPas encore d'évaluation

- Direct Tax Case Email 1042014 Ms Hyderabad Electric Supply Co 2014 PCTLR278Document5 pagesDirect Tax Case Email 1042014 Ms Hyderabad Electric Supply Co 2014 PCTLR278M Javaid Arif QureshiPas encore d'évaluation

- Provincial Budget 2014 KPKDocument7 pagesProvincial Budget 2014 KPKM Javaid Arif QureshiPas encore d'évaluation

- Direct Tax Case Email # 121-2014 Ms Sharif Oxygen PVT LTDDocument3 pagesDirect Tax Case Email # 121-2014 Ms Sharif Oxygen PVT LTDM Javaid Arif QureshiPas encore d'évaluation

- Sales Tax Case Email # 93-2014 Ms Islam Engineering PVT LTDDocument3 pagesSales Tax Case Email # 93-2014 Ms Islam Engineering PVT LTDM Javaid Arif QureshiPas encore d'évaluation

- Direct Tax Case Email # 145-2014 Ms HESCODocument4 pagesDirect Tax Case Email # 145-2014 Ms HESCOM Javaid Arif QureshiPas encore d'évaluation

- Direct Tax Case Email # 126-2014 Ms Muhammad Al-AdwaieDocument4 pagesDirect Tax Case Email # 126-2014 Ms Muhammad Al-AdwaieM Javaid Arif QureshiPas encore d'évaluation

- Direct Tax Case Email # 122-2014 MR Muhammad AminDocument3 pagesDirect Tax Case Email # 122-2014 MR Muhammad AminM Javaid Arif QureshiPas encore d'évaluation

- Strategic ManagementoptimizedDocument235 pagesStrategic ManagementoptimizedM Javaid Arif QureshiPas encore d'évaluation

- Contemporary CommunicationDocument5 pagesContemporary CommunicationM Javaid Arif QureshiPas encore d'évaluation

- Ontemporary Ommunication: 1.1 Extending Personal CapabilitiesDocument34 pagesOntemporary Ommunication: 1.1 Extending Personal CapabilitiesM Javaid Arif QureshiPas encore d'évaluation

- Sostac Plan DNA FinlandDocument71 pagesSostac Plan DNA Finlandgoodluck788Pas encore d'évaluation

- A Case Study On QualityDocument15 pagesA Case Study On QualityM Javaid Arif QureshiPas encore d'évaluation

- 04 Popescul D, Genete LD - Advantages and Risks Related To Using Information and Communication TechnologiesDocument7 pages04 Popescul D, Genete LD - Advantages and Risks Related To Using Information and Communication TechnologiesM Javaid Arif QureshiPas encore d'évaluation

- A Case Study in Integrated Quality AssuranceDocument10 pagesA Case Study in Integrated Quality AssuranceM Javaid Arif QureshiPas encore d'évaluation

- Managing Public Money AA v2 - Chapters Annex WebDocument212 pagesManaging Public Money AA v2 - Chapters Annex WebM Javaid Arif Qureshi100% (1)

- Supply Chain ManagementDocument27 pagesSupply Chain ManagementskibcobsaivigneshPas encore d'évaluation

- TW10 - Budet and ActualsRevision Class Exercise - Solutions GuidanceDocument4 pagesTW10 - Budet and ActualsRevision Class Exercise - Solutions GuidanceM Javaid Arif QureshiPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Introduction To History AnswerDocument3 pagesIntroduction To History AnswerLawrence De La RosaPas encore d'évaluation

- A Short History of Denim: (C) Lynn Downey, Levi Strauss & Co. HistorianDocument11 pagesA Short History of Denim: (C) Lynn Downey, Levi Strauss & Co. HistorianBoier Sesh PataPas encore d'évaluation

- Matokeo CBDocument4 pagesMatokeo CBHubert MubofuPas encore d'évaluation

- Elerick Ron Cynthia 1983 SouthAfricaDocument4 pagesElerick Ron Cynthia 1983 SouthAfricathe missions networkPas encore d'évaluation

- A Sample Script For Public SpeakingDocument2 pagesA Sample Script For Public Speakingalmasodi100% (2)

- NASA Gemini 4 Press KitDocument94 pagesNASA Gemini 4 Press KitOrion2015100% (1)

- Makerere University Is Inviting Applications For Undergraduate Admissions On Private Sponsorship For Academic Year 2015/2016Document9 pagesMakerere University Is Inviting Applications For Undergraduate Admissions On Private Sponsorship For Academic Year 2015/2016The Campus TimesPas encore d'évaluation

- Ioi Group - Capric Acid 98%Document7 pagesIoi Group - Capric Acid 98%Wong MjPas encore d'évaluation

- S O S Services Alert Level Help Sheet - REFERENCIALESDocument20 pagesS O S Services Alert Level Help Sheet - REFERENCIALESDavid Poma100% (1)

- Abacus 1 PDFDocument13 pagesAbacus 1 PDFAli ChababPas encore d'évaluation

- Invitation of Nomination For The Rajiv Gandhi Wildlife Conservation Award For The Year 2011&2012Document2 pagesInvitation of Nomination For The Rajiv Gandhi Wildlife Conservation Award For The Year 2011&2012Naresh KadyanPas encore d'évaluation

- Amsterdam Pipe Museum - Snuff WorldwideDocument1 pageAmsterdam Pipe Museum - Snuff Worldwideevon1Pas encore d'évaluation

- BDRRM Sample Draft EoDocument5 pagesBDRRM Sample Draft EoJezreelJhizelRamosMendozaPas encore d'évaluation

- ENG 102 Essay PromptDocument2 pagesENG 102 Essay Promptarshia winPas encore d'évaluation

- A Vision System For Surface Roughness Characterization Using The Gray Level Co-Occurrence MatrixDocument12 pagesA Vision System For Surface Roughness Characterization Using The Gray Level Co-Occurrence MatrixPraveen KumarPas encore d'évaluation

- Business OrganizationDocument32 pagesBusiness OrganizationSaugandh GambhirPas encore d'évaluation

- Plant Vs Filter by Diana WalstadDocument6 pagesPlant Vs Filter by Diana WalstadaachuPas encore d'évaluation

- O Repensar Da Fonoaudiologia Na Epistemologia CienDocument5 pagesO Repensar Da Fonoaudiologia Na Epistemologia CienClaudilla L.Pas encore d'évaluation

- Drawbot 1Document4 pagesDrawbot 1SayanSanyalPas encore d'évaluation

- Heisenberg, "Über Den Anschaulichen Inhalt Der Quantentheoretischen Kinematik Und Mechanik"Document16 pagesHeisenberg, "Über Den Anschaulichen Inhalt Der Quantentheoretischen Kinematik Und Mechanik"Benjamin Crowell0% (1)

- 506 Koch-Glitsch PDFDocument11 pages506 Koch-Glitsch PDFNoman Abu-FarhaPas encore d'évaluation

- Malampaya Case StudyDocument15 pagesMalampaya Case StudyMark Kenneth ValerioPas encore d'évaluation

- Mtech Vlsi Lab ManualDocument38 pagesMtech Vlsi Lab ManualRajesh Aaitha100% (2)

- Chemical Safety ChecklistDocument3 pagesChemical Safety ChecklistPillai Sreejith100% (10)

- Pepcoding - Coding ContestDocument2 pagesPepcoding - Coding ContestAjay YadavPas encore d'évaluation

- Qcfi Durgapur Chapter: Question & Answers BankDocument13 pagesQcfi Durgapur Chapter: Question & Answers Bankdeepakhishikar24Pas encore d'évaluation

- Bofa Turkish Banks-Back On The RadarDocument15 pagesBofa Turkish Banks-Back On The RadarexperhtmPas encore d'évaluation

- Datalogic tl46 A Manual - 230104 - 140343Document2 pagesDatalogic tl46 A Manual - 230104 - 140343Emmanuel Baldenegro PadillaPas encore d'évaluation

- Bankers ChoiceDocument18 pagesBankers ChoiceArchana ThirunagariPas encore d'évaluation

- Module 4 How To Make Self-Rescue Evacuation Maps?Document85 pagesModule 4 How To Make Self-Rescue Evacuation Maps?RejiePas encore d'évaluation