Académique Documents

Professionnel Documents

Culture Documents

JP Morgan Interview For Financial Analyst

Transféré par

Vimalan ParivallalTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

JP Morgan Interview For Financial Analyst

Transféré par

Vimalan ParivallalDroits d'auteur :

Formats disponibles

JP MORGAN INTERVIEW FOR FINANCIAL ANALYST 1. Tell us about yourself!

"I am an outgoing person who interacts well with people, listen and understand to develop a deeper level of understanding. I like to prioritize my works and focus on its completion and Im very diligence. "I recently graduated MBA from Christ University, Also hold a degree in B.Com and D.Com in Sectorial practice. I started to my career at ISRO as commercial Apprentice during 2009, after completion of D.Com, as an Administrator trainee. After the successful completion of the training in 2010, I was appointed as Stenographer on contract and had chance to work with various other departments in the ISAC namely in the recruitment and finance departments of ISAC as a personnel secretary Also I had chance to work with few renounced pupil in ISRO namely Mr. Malik ex-Deputy Director, CMA. Mr. Mayavan, Ex Senior Admin officer. Im from Bangalore, My father owns a reputed Photo studio, mother works as Regional Manager in Tesco, PLC, and I have a sibling studying her Final year MBBS.

2.

Why do you like to join JP Morgan?

Im good with numbers and financial figures and my interest in Finance started as I started to work in the Finance Department of ISRO, and it also inspired me to opt for Finance as my area of Interest during MBA too. While reflecting my interest toward finance, I was looking for an opportunity to work for a core financial institution. JP Morgan being one such institution and best of its class, I would love to work with it. I believe it will provide me a better environment for me to learn, improve and test my skills; in return I can help JP Morgan in completing my task and contributing for my team.

3.

What you know about JP Morgan?

Founded in 1895 by John Pierpont Morgan, JPMorgan Chase & Co was formed by 2000. It is an American multinational banking and financial services holding company. It is the largest bank in the United States by assets, ranks as the second largest bank in the world by assets with total assets of $2.509 trillion. And recently according to Bloomberg JP Morgan will be worlds largest Bank by managing $4 trillion, surpassing the Industrial & Commercial Bank of China Ltd (ICBC) and Deutsche Bank AG.

Operating more than 100 countries, under the Harvardian, Jamie Dimon as its Chairman, has various portfolios such as asset management, investment banking, private banking, treasury and securities services, and commercial banking. JP Morgan is listed in New York Stock Exchange and was trading last at $55.23, record firstquarter 2013 net income of $6.5 billion, or a record $1.59 per share, on revenue of $25.8 billion. Ranked #1 in Global Investment Banking Fees for the three months ended March 31, 2013. Ranked #1 in Global Debt, Equity and Equity-related; #1 in Global Long-Term Debt; #1 in Global Syndicated Loans; #1 in Global Announced M&A; and #6 in Global Equity and Equity-related, based on volume, for the three months ended March 31, 2013. Where do you see yourself in 10 years time?

4.

Five year down the line I would like to see myself in a better position of the hierarchy, as an important part of JP Morgan. I would like to see myself as a more knowledgeable, well talented, experienced person, scaling to new heights. An efficient employee who will be more competent in skills and whom a company would not want to lose in any circumstances.

5.

Describe a problem you faced and how you dealt with it

The one situation I would consider here will about the topic selection for my MBA project. I was advised by my Professor to come out with a topic on Budgeting, while I was not very sure about which particular topic to be chosen and where to carry on the project, as it should align with my interest and also availability of resources. While being denied on few topics that I presented, I managed to contact the Finance department in ISAC and through discussion with a finance officer, I arrived with a topic on Zero Based Budgeting Also I was allowed by ISAC to carry out the project in their organization The project was selected one of the finest in ISAC as the results demonstrated conclusions on the present methodology and came out with few recommendations that would help to increase the efficiency further by 5-10% of applying ZBB in various other departments

6.

What is ZBB? What were your recommendations?

Zero-base budgeting (ZBB) is a budgeting process that asks managers to build a budget from the ground up, starting from zero. It helps to allocate resources more efficiently than traditional budgeting. A better awareness and training among various departments is needed, so that ZBB can be followed locally within their department which can increase the overall efficiency of ZBB by 5-10%.

7.

What are the roles of a Financial Analyst?

1) Analyse financial information to produce forecasts of business, industry, and economic conditions for use in making investment decisions. 2) Assemble spread sheets and draw charts and graphs used to illustrate technical reports, using computer. 3) Evaluate and compare the relative quality of various securities in a given industry. 4) Interpret data affecting investment programs, such as price, yield, stability, future trends in investment risks, and economic influences. 5) Maintain knowledge and stay abreast of developments in the fields of industrial technology, business, finance, and economic theory. 6) Monitor fundamental economic, industrial, and corporate developments through the analysis of information obtained from financial publications and services, investment banking firms, government agencies, trade publications, company sources, and personal interviews. 7) Prepare plans of action for investment based on financial analyses. 8) Present oral and written reports on general economic trends, individual corporations, and entire industries. 9) Recommend investments and investment timing to companies, investment firm staff, or the investing public. 10) Collaborate with investment bankers to attract new corporate clients to securities firms. 11) Contact brokers and purchase investments for companies, according to company policy. 12) Determine the prices at which securities should be syndicated and offered to the public.

8.

You have not done Financial Analyst job before. How will you succeed?

Although I have limited experience in core finance, I have worked previously in the finance department with my current employer. Apart from finance being dealing about financial figures, formulas, it requires strategic thinking, wider economical views, reading on markets, investments in which I have a strong knowledge. Any business you deal is a Peoples business Working as a financial analyst will not only look into just numbers but could benefit my team by actively contributing ideas, also have the ability to deal positively with customers & other stakeholders.

9.

What do you believe are your key strengths? Im good at managing people, which can help in team building, increasing reputation from stakeholders. Im a good Listener that can aid better Communication with my co-workers and seniors. Keen to look at a tasks successful completion on time, with managing constraints and obstacles if any.

10.

What are your weaknesses? Gets hassled when my given task is not being completed on time, and find hard when I face procrastination. I take a little more time to understand subjects or the given task, but I manage to overcome them by doing my homework on that particular subject.

11.

Give an example of how you set goals and achieve them.

I usually set short but sure goals that are realistic and I then manage to find the ways to achieve them through getting information, planning accordingly with constraints of time and resource in mind, and devise the plan, implement it and make sure that I carry out with the plan until the goal is achieved. If failed, I take that as experience, I exam my plan and work on it to find the path to success.

12.

Tell me about a time where you had to deal with conflict on the job.

In my current employment I hardly faced any conflicts as my role was to work as a Stenographer with senior officials where I was assisting them in managing their files, organising events. But I did find conflict with my team mates while doing a group project over distribution of the task. We were facing absenteeism in the group whenever we arrange a group meeting. We did manage to fix it by posting them the benefits that they might be missing for not contributing to the team.

13.

Did you feel you progressed satisfactorily in your last/current job?

Yes, Im satisfied with my progress, I managed to acquire skills like dealing with people, have become a good listener, learnt to be self-organised and I felt proud of myself on few occasions when my contribution have been acknowledged and appreciated by my senior officials for my work, efficiency and dedication towards completion of the given task.

14.

What were the responsibilities of your last position? Scheduling and organizing meetings and keeping records of the agenda, minutes and maintain a follow-up of the tasks. Compile, transcribe, and distribute minutes of meetings. Preparing the list of tasks assigned by MD for the execution purpose and ensuring the communication to the concerned person. Keeping track of allocated task and updating the status to MD Sourcing and screening of valid profiles/ Applications as per the cut- off marks for different qualification. Preparing monthly, quarterly and half yearly reports of the Recruitment Section. Assisting in arranging logistics for the Recruitment

15.

If offered this Financial Analyst job, how long do you plan to stay at company?

JP Morgan being the world leader in the industry, one would not have a second though to make a plan to move to any other company or a competitor. I believe that there is a vast growth opportunity within the company and it will provide a perfect track to scale up heights for my hard work. I also believe I will be better recognised for my work and amid progress along with the organization. So I dont find the question of longevity about my service for this company, if Im offered this job.

16.

What do you do if you disagree with your boss?

I believe that A boss is a boss. Definitely would be well experienced, expert in that specific area with a vast knowledge about the activity. His views will be much aligned on achieving business objectives, and if any point arises that my views or ideas contradict to that of my boss, I must study it twice, double ensure that my view is worthy and shall try to generate a case scenario that will demonstrate the effects of his views to that of mine.

17.

What do you find are the most difficult decisions to make?

Choice about consumables; let it be a two wheeler or mobile, I hardly make any research about it, until it satisfies my requirements. But zero in for a particular stuff is a little hard time for me.

Basic Finance Terminologies

Asset The property of the business entity such as land, building, stocks etc. Usually split into current assets, i.e., working capital assets and long-term assets, i.e., fixed assets A summary picture of what the business owns, i.e., assets and what it owes, i.e., liabilities as on a particular date. Usually balance sheet is prepared at the end of one year. However it can be prepared as at the end of every month also. Normally means permanent or long-term funds of the business introduced by the owners of the enterprise and/or borrowed in the form of long-term loans from banks and financial institutions. In the case of a limited company, the owners capital is called share capital. The borrowings are called debt capital. This usually means a statement showing all cash inflow, i.e., cash receipts and cash outflow, i.e., cash expenditure. The statement is prepared at least for a period of one month with the objective of monitoring cash flows in the business and managing liquidity. Persons to whom the business enterprise owes money due to goods or services supplied by them or for expenses. Working capital assets which enable a business enterprise to achieve what is known as sales revenue by the process of turn-over of the current assets. Current assets constantly change form from cash back to cash through the activity of the firm, i.e., trading or manufacturing or service. Debt of the business enterprise which is to be settled within a period of 12 months. They are also called short-term liabilities or working capital liabilities, like creditors, accrued expenses etc. Money owed to external agencies, like loans, creditors etc. This is classified into short-term, medium-term/long-term etc. depending upon the period of repayment as well as the purpose for which it has been incurred. If it is for fixed asset, it is medium to long-term and if it is for working capital, it is short-term. The money that is owned by the business and owed to it by the customers to whom it has sold goods or supplied services on credit basis. A charge against business income to enable a business enterprise to keep a certain % of the value of a fixed asset every year with a view to replace it at the required time. It is a book or non-cash expense but is recognised as a business expense by the revenue authorities. Return to a shareholder in a limited company on its equity investment paid by the company out of its taxed profits every year and is often referred to as profit distributed to shareholders. Money brought in by the owners in the case of a limited company. It is permanent investment in the company and is paid back to the owners only upon liquidation of the company.

Balance Sheet

Capital

Cash flow

Creditors

Current asset

Current liability

Debt

Debtors

Depreciation

Dividend

Equity

Fixed assets

Long-term business assets, like land, building, machinery, vehicles etc. which act as catalysts in the activity of the enterprise but do not form a part of the finished goods of the manufacturing company or stocks in trade in the case of a trading enterprise. They are subject to wear and tear and hence require replacement after some time. Hence, the business enterprise claims depreciation on these assets and charges the amount to its revenue income. Same as leverage. A measure of external debt in relation to the capital of the owners of the enterprise. The higher the gearing, the greater the risk and viceversa. Comprises materials like raw materials, consumables/ machinery spares and packing material, work-in-progress and finished goods. Together with bills receivables, form bulk of current or working capital assets. A business enterprise is considered insolvent when it is not able to pay its liabilities in full from the proceeds of its assets. Amount owed by the business enterprise to outside agencies, which have provided resources either in the form of money, as in the case of bank over draft or goods as in case of creditors or services as in the case of accrued expenses. Excess of expenditure over income in a particular accounting period. Difference between current assets and current liabilities. This is called as Net working capital. Gross fixed assets (purchase price) as diminished by depreciation (cumulative). A credit facility by which a customer of the bank can draw up to a pre determined limit against some tangible security like inventory or receivables or mortgage. Also known as bills payables or money owed by the enterprise to various creditors. An excess of sales revenue over expenditure.

Gearing

Inventory

Insolvent

Liability

Loss Net current Asset

Net Fixed assets Overdraft

Payables

Profit

Profit and loss Statement A detailed and consolidated statement of all income and expenditure prepared at the end of a specific period, like month, quarter, half-year and year. However, the revenue authorities are insistent on yearly statements and the other statements are meant for management purposes. Receivables Also known as sundry debtors or bills receivables or book debts. Represent money owed to the enterprise by debtors. Accumulated profits retained in business over a period of

Reserves or Retained Earnings time.

This is net of profit distributed in the form of dividend. Returns Either purchase returns or sales returns representing goods returned on purchases or sales due to defects which stand adjusted either in the amounts due from us or

due to us or by replenishment of stocks with quality goods. Purchase return is also called return outward and sales return is also called return inward. Shareholders Funds Solvent Working capital Share capital plus all kinds of reserves representing profit retained in business over a period of time. Means that the business enterprise is able to meet its liabilities with all its assets. Gross working capital = Total current assets

Net working capital = Total current assets (-) total current liabilities

JP Morgan Interview Tips Before the interview Make sure you walk into the interview knowing as much about the firm as possible. Prepare by going to the on-campus presentations and talking to as many J.P. Morgan people as you can. It's a good idea to study our website, our programs and our culture as well. If you know people who work at J.P. Morgan, particularly within the business area for which you are interviewing, contact them and ask questions. During the interview On the day of the interview, be ready to articulate why you want the job and more specifically, why this particular job at J.P. Morgan. What do you bring to the mix? If you've done your homework, you should have a pretty convincing answer. Most of our interviews are based on competency, so be prepared to think on your feet. Also, be prepared to answer questions about previous jobs and your experience solving problems and leading teams. Take the time to think before you answer. If you haven't had much interview experience, enroll in practice sessions at your university career services center, or videotape yourself to see how you come across to interviewers. J.P. Morgan also offers sessions on several campuses that will help you construct your candidacy. Check our campus schedule to view dates for your school. Remember that however prepared you are, you will still need to show that you can think on your feet. For undergraduate and MBA candidates, here are some additional tips from our recruiters and employees who just went through the process:

You have exactly five seconds to make a great first impression, so dress for the part. Usually,

this means professional, formal business attire.

The way you interact with interviewers gives them an indication as to how you might behave

with clients.

Stay friendly and professional. If there are two interviewers, be sure and include both in your

conversation with equal eye contact, even if one dominates the proceedings.

Be prepared to discuss topical business issues. If you're asked for your opinions, be prepared to state them tactfully and support the thought

process you put into them.

Phrase your answers using the Problem-Actions-Results (PAR) approach wherever possible

to demonstrate your problem-solving skills. State a problem you encountered at work or school, the actions you took to solve it and the beneficial outcome quantified, if possible.

Follow up after the interview. Ask for a business card and send a timely thank-you email.

It's easier said than done, but relax and be yourself; your interviewers are only human. Demonstrate your interest by having some questions for us. "What distinguishes a great

Analyst/Associate from a good Analyst/Associate?" is a good way to elicit information that can be invaluable in your next interview. Interviewers may interpret a lack of questions as a lack of genuine interest.

Make sure your cell phone is switched off.

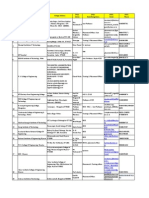

Vous aimerez peut-être aussi

- StreetOfWalls - Question Set PDFDocument21 pagesStreetOfWalls - Question Set PDFEric LukasPas encore d'évaluation

- Investment Banking Interview GuideDocument11 pagesInvestment Banking Interview GuideJack Jacinto100% (1)

- Investment Banking Interview Questions and Answers Prep Guide (200 Q&As) Ace Your Technical Questions and Tell Your Unique Story That Will Intrigue The ... Your Background. (Entrepreneur Pursuits)Document44 pagesInvestment Banking Interview Questions and Answers Prep Guide (200 Q&As) Ace Your Technical Questions and Tell Your Unique Story That Will Intrigue The ... Your Background. (Entrepreneur Pursuits)Jithin Rajan100% (1)

- Goldman Sachs QuestionsDocument6 pagesGoldman Sachs Questionsladyjacket42100% (1)

- INTERVIEW PREP GUIDEDocument12 pagesINTERVIEW PREP GUIDENeil GriggPas encore d'évaluation

- IBanking Interview - DCF-GuideDocument61 pagesIBanking Interview - DCF-GuideElianaBakerPas encore d'évaluation

- PE Interview Technical Collection - 0Document4 pagesPE Interview Technical Collection - 0Politics RedefinedPas encore d'évaluation

- Investment Banking Case Studies: The Unreleased Interview GuideDocument9 pagesInvestment Banking Case Studies: The Unreleased Interview GuideKartheek Chowdary100% (1)

- Investment Banking Interview QuestionsDocument9 pagesInvestment Banking Interview QuestionsJack JacintoPas encore d'évaluation

- FAQs Recent College Graduate Job Opportunities Morgan StanleyDocument13 pagesFAQs Recent College Graduate Job Opportunities Morgan StanleydianwenPas encore d'évaluation

- Investment Banking Interview QuestionsDocument3 pagesInvestment Banking Interview QuestionsdaweiliPas encore d'évaluation

- Investment Banking Interview Questions - The Definitive GuideDocument34 pagesInvestment Banking Interview Questions - The Definitive GuideRohan SaxenaPas encore d'évaluation

- Investment Banking Interview PrepDocument18 pagesInvestment Banking Interview PrepNeil GriggPas encore d'évaluation

- Investment Banking Job InterviewDocument11 pagesInvestment Banking Job InterviewJack JacintoPas encore d'évaluation

- Why equity research grows faster than salesDocument12 pagesWhy equity research grows faster than salesShanthi Selvam100% (3)

- Q&A - 300+ Finance Interview Questions Leverage Academy ForumDocument21 pagesQ&A - 300+ Finance Interview Questions Leverage Academy Forumsaw4321Pas encore d'évaluation

- Finance InterviewDocument53 pagesFinance InterviewYash Nyati100% (1)

- 03 04 Technical Interview More AdvancedDocument11 pages03 04 Technical Interview More AdvancedAgung Racers WeightliftingPas encore d'évaluation

- Barclays Investment Banking Case CompetitionDocument15 pagesBarclays Investment Banking Case Competitionseandsmith93Pas encore d'évaluation

- JP Morgan Interview QuestionsDocument14 pagesJP Morgan Interview Questionshussien80% (15)

- Finance Interview PracticeDocument126 pagesFinance Interview PracticeChetankabra100% (1)

- LBO Modeling Test Example - Street of WallsDocument18 pagesLBO Modeling Test Example - Street of WallsVineetPas encore d'évaluation

- 100 Top Banking Interview Questions and How To Answer ThemDocument10 pages100 Top Banking Interview Questions and How To Answer ThemhusokijemailurenetPas encore d'évaluation

- Investment Banking Interview Questions and Overview 2Document9 pagesInvestment Banking Interview Questions and Overview 2Rohan SaxenaPas encore d'évaluation

- Investment Banking Interview PrepDocument56 pagesInvestment Banking Interview PrepNeil Grigg100% (3)

- Investment Banking PrepDocument6 pagesInvestment Banking PrepNeil GriggPas encore d'évaluation

- Consolidated Interview Questions (IB) PDFDocument7 pagesConsolidated Interview Questions (IB) PDFEric LukasPas encore d'évaluation

- IBanking Interview - Accounting GuideDocument73 pagesIBanking Interview - Accounting GuideElianaBaker100% (1)

- IBanking Interview - LBO Model GuideDocument58 pagesIBanking Interview - LBO Model GuideElianaBakerPas encore d'évaluation

- Apax PE Associate Recruiting PromptDocument2 pagesApax PE Associate Recruiting PromptLuisPas encore d'évaluation

- Investment Banking Generic Cover LetterDocument1 pageInvestment Banking Generic Cover LetterbreakintobankingPas encore d'évaluation

- Access Top IB Interview Guide ModuleDocument24 pagesAccess Top IB Interview Guide ModuleSuhasPas encore d'évaluation

- CFADocument74 pagesCFAShuyang ZhengPas encore d'évaluation

- Paper LBODocument2 pagesPaper LBOAljon Del Rosario0% (1)

- Private Equity Resume GuideDocument7 pagesPrivate Equity Resume GuideJack JacintoPas encore d'évaluation

- Ib Club Careers - Interview Tips PDFDocument9 pagesIb Club Careers - Interview Tips PDFqcrvtbPas encore d'évaluation

- Financial Industry Real-Life Interview CheatSheet 2020Document93 pagesFinancial Industry Real-Life Interview CheatSheet 2020NKRI Harga MatiPas encore d'évaluation

- Investment Banking Interview GuideDocument228 pagesInvestment Banking Interview GuideNeil Grigg100% (2)

- Corporate Banking InterviewDocument12 pagesCorporate Banking InterviewAlethea AinePas encore d'évaluation

- 21 Finance Interview Questions and AnswersDocument17 pages21 Finance Interview Questions and Answersdaniel18ct100% (1)

- Top 20 Corporate Finance Interview Questions (With Answers) PDFDocument19 pagesTop 20 Corporate Finance Interview Questions (With Answers) PDFDipak MahalikPas encore d'évaluation

- Completed Exam - Wall Street PrepDocument12 pagesCompleted Exam - Wall Street PrepBhagwan BachaiPas encore d'évaluation

- Breaking Into Wall Street - SyllabusDocument16 pagesBreaking Into Wall Street - SyllabusRajkumar35100% (1)

- Financial Analyst Interview QuestionsDocument3 pagesFinancial Analyst Interview QuestionsCharish Jane Antonio CarreonPas encore d'évaluation

- 62 BIWS Bank Valuation PDFDocument6 pages62 BIWS Bank Valuation PDFsm1205Pas encore d'évaluation

- IBanking Interview - Equity Value Enterprise Value GuideDocument27 pagesIBanking Interview - Equity Value Enterprise Value GuideElianaBakerPas encore d'évaluation

- BIWS Premium Financial Modeling Program OutlineDocument9 pagesBIWS Premium Financial Modeling Program OutlinehishamPas encore d'évaluation

- IBI Interview and Resume GuideDocument63 pagesIBI Interview and Resume GuideHendrik Joof Sturgeon100% (2)

- Introduce Yourself.: 5 Year - Having Completed My MBA, in Next 5 Years, I See Myself Working at A RespectableDocument3 pagesIntroduce Yourself.: 5 Year - Having Completed My MBA, in Next 5 Years, I See Myself Working at A RespectableAakash KhokharPas encore d'évaluation

- Essay For MBADocument4 pagesEssay For MBALabdhi Chopda100% (2)

- Common Big 4 Accounting Firm Interview QuestionsDocument7 pagesCommon Big 4 Accounting Firm Interview Questionsxepholion0% (1)

- Interview Questions.Document39 pagesInterview Questions.sagar meshramPas encore d'évaluation

- Questions for a business analyst interviewDocument10 pagesQuestions for a business analyst interviewChandni YadavPas encore d'évaluation

- Intrebari InterviuDocument11 pagesIntrebari InterviuMariana Popa100% (1)

- UntitledDocument7 pagesUntitledAbdelrahman MamounPas encore d'évaluation

- Latest Bank Interview Questions and Sample AnswersDocument4 pagesLatest Bank Interview Questions and Sample AnswersMurali MohanPas encore d'évaluation

- Sample Excellent Response:: Job Interviewing TutorialDocument50 pagesSample Excellent Response:: Job Interviewing Tutorialsiwel74Pas encore d'évaluation

- Job Interviewing TutorialDocument49 pagesJob Interviewing TutorialTom MarcioPas encore d'évaluation

- Operational Level Interview QuestionsDocument6 pagesOperational Level Interview QuestionsPanoramicConsultantPas encore d'évaluation

- Primavera ConceptsDocument56 pagesPrimavera ConceptsVimalan ParivallalPas encore d'évaluation

- Formac Industry Readiness ProgramDocument7 pagesFormac Industry Readiness ProgramVimalan ParivallalPas encore d'évaluation

- Model of Fire Water Line of Petrochemical PlantDocument1 pageModel of Fire Water Line of Petrochemical PlantVimalan ParivallalPas encore d'évaluation

- Mechnical Oriented CompaniesDocument21 pagesMechnical Oriented CompaniesVimalan ParivallalPas encore d'évaluation

- Hard QuestionDocument183 pagesHard QuestionWidodo Muis100% (1)

- Epracto Product Booklet PDFDocument6 pagesEpracto Product Booklet PDFVimalan ParivallalPas encore d'évaluation

- Sample WBSfor Oil, Gasand Petrochemical ProjectDocument3 pagesSample WBSfor Oil, Gasand Petrochemical Projectmohammed_1401Pas encore d'évaluation

- College SPOC Contact ListDocument5 pagesCollege SPOC Contact ListVimalan Parivallal88% (26)

- Zero Based Budgeting in ISRODocument100 pagesZero Based Budgeting in ISROVimalan Parivallal100% (1)

- Drilling FloorDocument1 pageDrilling FloorVimalan ParivallalPas encore d'évaluation

- Primavera P6 PM Course MaterialDocument75 pagesPrimavera P6 PM Course Materialsunilas21840896% (27)

- ISRO Questions Personal DetailsDocument21 pagesISRO Questions Personal DetailsVimalan Parivallal0% (1)

- ISRO Interview TipsDocument10 pagesISRO Interview TipsVimalan ParivallalPas encore d'évaluation

- Isac OverviewDocument47 pagesIsac OverviewVimalan ParivallalPas encore d'évaluation

- 13-Secrets - Napoleon HillDocument14 pages13-Secrets - Napoleon HillGastorePas encore d'évaluation

- Ecw 2Document14 pagesEcw 2Vimalan ParivallalPas encore d'évaluation

- An Insight of Growth and Development of United States of AmericaDocument14 pagesAn Insight of Growth and Development of United States of AmericaVimalan ParivallalPas encore d'évaluation

- Women's Clothing Buying During RecessionDocument109 pagesWomen's Clothing Buying During RecessionVimalan Parivallal100% (1)

- Durai STMDocument14 pagesDurai STMVimalan ParivallalPas encore d'évaluation

- Indian Steel IndustryDocument13 pagesIndian Steel IndustryVimalan ParivallalPas encore d'évaluation

- Evaluation of Ebusiness Systems of Screwfix ComDocument18 pagesEvaluation of Ebusiness Systems of Screwfix ComVimalan ParivallalPas encore d'évaluation

- Case 2 SolutionDocument9 pagesCase 2 SolutionarunPas encore d'évaluation

- LRDI Assignment 15 SETSDocument43 pagesLRDI Assignment 15 SETSAntara GangulyPas encore d'évaluation

- Article IFRS 3 Business Combinations PDFDocument14 pagesArticle IFRS 3 Business Combinations PDFEhsanulPas encore d'évaluation

- Compare Projects Using Equivalent Annual AnnuityDocument38 pagesCompare Projects Using Equivalent Annual AnnuityAlexandra ErmakovaPas encore d'évaluation

- Capital Gains Tax ProvisionsDocument27 pagesCapital Gains Tax ProvisionsdeepakadhanaPas encore d'évaluation

- Soal Latihan Pertemuan KelimaDocument7 pagesSoal Latihan Pertemuan KelimaErvian RidhoPas encore d'évaluation

- Charles P. Jones, Investments: Analysis and Management, Ninth Edition, John Wiley & SonsDocument23 pagesCharles P. Jones, Investments: Analysis and Management, Ninth Edition, John Wiley & SonsAsad JalalPas encore d'évaluation

- Petrozuata Financial ModelDocument3 pagesPetrozuata Financial ModelRialeePas encore d'évaluation

- Cavalier Fund Portfolio StrategyDocument8 pagesCavalier Fund Portfolio StrategyKshitishPas encore d'évaluation

- M5 Mock Exam 2Document23 pagesM5 Mock Exam 2Eveleen Gan83% (6)

- Ambit - Strategy-eRrgrp - Ten Baggers 4.0Document30 pagesAmbit - Strategy-eRrgrp - Ten Baggers 4.0shahavPas encore d'évaluation

- Practical Accounting Problems 2 SolutionsDocument9 pagesPractical Accounting Problems 2 SolutionsJimmyChaoPas encore d'évaluation

- Finance Is The Lifeline of Any BusinessDocument22 pagesFinance Is The Lifeline of Any BusinessmeseretPas encore d'évaluation

- Course Out BoomDocument8 pagesCourse Out BoomrahulkatareyPas encore d'évaluation

- Sprint Corporation Case Study - v5Document25 pagesSprint Corporation Case Study - v5jbblackshire100% (1)

- Amit Black Book Financial Analysis of Idbi BankDocument81 pagesAmit Black Book Financial Analysis of Idbi Bankamit100% (1)

- Behavior Finance MCQDocument27 pagesBehavior Finance MCQBattina Abhisek81% (16)

- (BNP Paribas) Understanding Credit Derivatives Vol. 5 - First-To-Default BasketsDocument32 pages(BNP Paribas) Understanding Credit Derivatives Vol. 5 - First-To-Default BasketsanuragPas encore d'évaluation

- Kotra GuideDocument153 pagesKotra GuideislimaPas encore d'évaluation

- 2nd Sem ProjectDocument49 pages2nd Sem ProjectNilesh Pawar100% (4)

- Reseacrh PaperDocument14 pagesReseacrh Paperpachpind jayeshPas encore d'évaluation

- Silvia Caffe - SolutionDocument1 pageSilvia Caffe - SolutionMurtaza BadriPas encore d'évaluation

- Steps To Private Placement Programs (PPP) DeskDocument7 pagesSteps To Private Placement Programs (PPP) DeskPattasan U100% (1)

- UnileverDocument5 pagesUnileverKevin PratamaPas encore d'évaluation

- A Project Report On Study On Investor Behaviour Towards Stock MarketDocument54 pagesA Project Report On Study On Investor Behaviour Towards Stock MarketMridula Singh59% (34)

- RAju SahuDocument48 pagesRAju SahuXM V KASSKPas encore d'évaluation

- International Accounting 3e by Doupnik and Perera ch1 Test BankDocument12 pagesInternational Accounting 3e by Doupnik and Perera ch1 Test BankAhmed Dapoor60% (5)

- Instructions LetterDocument1 pageInstructions LetterHAN SOLOPas encore d'évaluation

- Normal Acc BalanceDocument1 pageNormal Acc BalanceRavi Shankar SPas encore d'évaluation

- 2015 Beijing Airport Annual ReportDocument147 pages2015 Beijing Airport Annual ReportJeffrey AuPas encore d'évaluation