Académique Documents

Professionnel Documents

Culture Documents

Role of MPB of Ibbl Serajul Islam Revised 07-02-2012

Transféré par

gzelle444Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Role of MPB of Ibbl Serajul Islam Revised 07-02-2012

Transféré par

gzelle444Droits d'auteur :

Formats disponibles

Thoughts on Economics Vol. 21, No.

04

The Role of Mudaraba Perpetual Bond (MPB) of IBBL for Development of Bangladesh Bond Market

Serajul Islam Nazneen Jahan Chowdhury Mohammad Rokibul Kabir

Abstract: Islami Bank Bangladesh Limited (IBBL) is a first generation private

commercial bank in Bangladesh under Companies Act, 1913 (Amended in 1994) and Banking Companies Ordinance, 1962 (Amended in 1991). IBBL is the first of its kind in South East Asia operates under Islamic Shariah with a vision of establishing interest free economic and Banking system for ensuring the economic and social justice. Islami Bank Bangladesh Limited had issued a bond named MPB in Bangladesh bond market to raise fund to meet the Capital Adequacy Ratio (CAR) of the bank. Since private sector is the engine of economic growth, Government policy encourages financing for the private sectors. The IBBL being the largest private sector bank has been providing both long term and short term funds to the private sectors. Therefore IBBL is always keeping in mind the maintenance of capital adequacy requirement set by BB as per requirement of BASEL-II and had to go for right offers and bonus shares for several times to raise capital. Further increase of capital from the right shares may reduce the value and return of shareholders investments. Another purpose of the issuance of Mudaraba Perpetual Bond (MPB) is to enhance the ability of the bank to make further investments by increasing the CAR. One of the main objectives is to utilize the fund in prospective and profitable sectors. The paper reveals that through the issuance of the MPB, IBBL has played a pioneering role in creating a bond market in Bangladesh, as this is the first corporate bond in the country. Through the issuance of MPB, IBBL has created a new investment avenue for the investors to help creating an Islamic capital market. Key Words: Mudaraba, Capital Adequacy Ratio, perpetual, riba, rabb al-mal,

mudarib.

Associate Professor, Department of Business Administration, International Islamic University Chittagong (IIUC).

Assistant Professor, Department of Business Administration, IIUC.

Lecturer, Department of Business Administration, IIUC.

40

The Role of Mudaraba Perpetual Bond

1. Introduction

When a company wishes to borrow money from the public for a longterm basis, it usually does so by issuing or selling debt securities that is generally called bonds. A bond is normally a fixed interest-bearing loan instrument, meaning that the borrower will pay the fixed interest on predetermined time schedules but the principal will be repaid at the end of maturity. The amount that will be repaid at the end of the loan period is called the bonds face value or par value or maturity value. Government Bonds have much larger face value. The number of years until the face value is paid is called the bonds time to maturity. Interest rates change over time. The cash flows from a bond, however, stay the same. As a result, the value of the bond will fluctuate. When interest rate rises, the present value of the bond s remaining cash flow declines, and the bond is worth less. When interest rate falls, the bond worth is more. To determine the value of a bond at a particular point of time, we need to know the number of periods remaining until maturity, the face value, and the market interest rate for bonds with similar features. This interest rate required in the market on a bond is called the bonds Yield to Maturity (YTM). But for calculating the value of Islamic bonds requires average rate of return of market rather than market interest rate because interest is prohibited in Shariah. By using this information, we can calculate the present value of the cash flows as an estimate of bonds current market value. Islami Bank Bangladesh Limited (IBBL) raised fund of Tk.3, 000.00 million in the year 2007 by issuing Mudaraba Perpetual Bond (MPB). This bond is a new instrument in the capital market of Bangladesh. It differs from other category of securities available in the market, as it has no redemption facility and predetermined interest rate.

2. Objectives of the study

The objectives of the study are as follows: i) ii) To highlight the Bond Market status of Bangladesh To highlight the pioneering role of MPB for the development of bond market in Bangladesh

iii) To identify the problems that impede the investments in this bond iv) To suggest some important measures for the development of bond market in Bangladesh.

Thoughts on Economics

41

3. Methodology of the Study

The researchers have used secondary data only in this study. The sources are the publications of IBBL regarding MPB, the websites of IBBL, SEC, CSE and DSE, different types of publications regarding bond & capital market and books.

4. Literature Review

The development of economy of any country depends mostly on the establishment of sound, effective and efficient financial system in that country. A well-developed financial system plays an important role in accelerating economic growth by mobilizing savings and facilitating investment in an efficient manner (Mu, 2007). Financial market consists of money market, capital market, and derivative markets etc and play an important role for the development of economy. The debt market being an integral part of financial market plays a complementary role in developing economy through allocation of funds to different deficit sectors. The debt market consists of money market, mortgage market, bond market and derivative market. The debt market of Bangladesh is very small. An efficient bond market is important for managing public debt and bank liquidity and for efficient conduct of the monetary policy. Without a functioning bond market, the monetary transmission processes of policy measures would be circumvented and the desired impact on the real economy can not be fulfilled, which compromises the effectiveness of the monetary policy operations (Jahur, 2009). Bangladeshs bond market represents the smallest in South Asia, accounting for only 12 percent of the countrys gross domestic product (GDP) (World Bank Report). For developing our bond market, Islami Bank Bangladesh Limited has played a pioneering role by issuing Mudaraba Perpetual Bond (MPB) in the corporate level. Conventional bondholders get predetermined rate of interest which is strictly prohibited in Islamic Shariah. Interest or riba (usury) is a kind of social evil. It is contrary to the welfare of people (Islam, 2005). As regards nature of usury Allah SWT says,

42

The Role of Mudaraba Perpetual Bond

Those who devour usury will not stand except as stands one whom the statan by his touch has driven to madness. That is because they say: trade is like usury. But Allah hath permitted trade and forbidden usury. Those who after receiving admonition from their Lord, desist, shall be pardoned for the past. Their case is for Allah (to judge). But those who repeat (the offence) are companions of the fire. They will abide therein (forever). (2:275) When in an Islamic framework of society, interest is prohibited and business is permitted, the banking or financial institutions are permitted to do business under the same injunction. A business institution, be it trade, commerce, industry, transportation, power, or agriculture has to work for profit. If banking institutions are contributing to productivity, they have to share the productivity in the form of profit; and profit can not be pre-determined before the costs are booked against business revenue and the profit and loss account is prepared (Sharif, 1996). IBBL declares the profit of the MPB after completing income statement at the end of an accounting period. 4.1 About the Issuer IBBL was established on March 13, 1983 as a public limited company under the Banking Companies Act, 1913 (amended in 1994). The bank started its operation on March 30, 1983 under the ambit of Banking Company Ordinance, 1962 (amended in 1991) as the first interest free Shariah based Commercial Bank with a mission to establish Islamic Banking through the introduction of welfare oriented banking system. The Bank is enlisted with DSE & CSE. IBBL has been declared as one of the 20 Blue Chip companies in the country by DSE and as one of the 30 best companies by CSE. The bank provides a wide range of Islamic banking services. The major portion of investment portfolio of IBBL is towards corporate business while the rest is towards SME, Specialized Schemes and retail investments. The bank carries out its business activities through 254 branches with the total staff strength of 11,033.

Thoughts on Economics

43

IBBL is holding a diverse shareholding pattern with foreign and domestic sponsor shareholders. IBBL is a first generation private sector bank in the country and is one of the best performing banks of the nation. The management has been taking utmost care maintaining capital adequacy and liquidity management as per requirement of Bangladesh Bank and maintains excellent growth with strategic plan to expand branch network, deposit and investment, develop new products and savings schemes. The bank has been operating profitably since the beginning of its journey keeping the internal capital generation high, following very cautious investment policy to keep the quality of asset strong. Details of the Issue

Description Pre-IPO Placement Public Offering Total Value of Bond after IPO No. of units 1,500,000 1,500,000 3,000,000 Offer in Tk. 1000 1000 1000 Amount Tk. 1,500,000,000 1,500,000,000 3,000,000,000

Basic Information of the Issue

Category Name of the Bank Size of the issue Unit price Market Lot Term Profit Distribution Description Islami Bank Bangladesh Limited Tk. 3000 million (Tk. 1500 million in private placement and Tk. 1500 million in IPO) Tk. 1000 5 Perpetual ( No maturity period) i) MPB carries 1.25 weightage for distribution of profit income generated by

ii) Not less than 65% of the deployment of MPB fund and

iii) An additional rate of profit equivalent to 10% of the rate of dividend declared by the IBBL every year. No portion of dividend will be distributed to the MPB holders. Minimum Subscription Credit Rating Tk. 5000 or Multiple of Tk. 5000 MPB has been rated A+ by the rating agency Credit Rating

44

The Role of Mudaraba Perpetual Bond

Information and Services Limited (CRISL) Trustee Manager to the Issue Investment Corporation of Bangladesh (ICB) ICB Capital Management Limited (A subsidiary company of ICB)

4.2 Purpose of the Issue The main purpose of the bond is to raise fund to meet the capital adequacy ratio of the Bank. Since the raising of Tier-1 Capital has impact on share value dilution and dividend paying capacity of the bank, the IBBL has been looking for alternate sources of Tier-2 Capital as a subordinated investment instrument and identified the issuance of Mudaraba Perpetual Bond to resolve the issue of capital adequacy. 4.3 The Introduction of Islamic Capital Market Instruments in Pakistan and in Malaysia There are no shariah objections to financial markets, only to the interest-based instruments which are traded in the markets. Therefore, the first attempt to develop shariah-compliant debt instruments involved securitizing traditional Islamic financing instruments, as with the mudaraba certificates issued in Pakistan from 1980 onward after a law was passed giving legal recognition to the certificates. Mudaraba involves the establishment of partnership companies with investors, and the company managers share in the profits, but the financiers alone bear the losses. In 2008 the original law was amended to bring the mudaraba companies under the regulatory supervision of the Securities and Exchange Commission of Pakistan, the aim being to ensure better investor protection. In Malaysia, where Islamic banking started in 1983, a natural innovation was to securitize the debt instruments used, mainly murabaha financing, where a bank would purchase a commodity on behalf of a client and resell it to the client for a markup, with settlement through deferred payments. The first instrument was issued by the Shell oil companys Sarawak subsid iary in 1990, with Bank Islam Malaysia as the arranger. By attracting third-party investors interested in benefiting from these deferred payments, the bank could use its capital for further financing rather than having it committed on a long-term basis. This debt trading, known as bai al-dayn, is permitted by the Malaysian interpretation of the Shafii School of Islamic jurisprudence which prevails in Malaysia and Indonesia, but is not permitted in Saudi Arabia or the Gulf.

Thoughts on Economics

45

4.4 The Corporate Bond Market in Malaysia The growth of the Malaysian bond market can be traced back to the 1970s, when the government started issuing bonds to meet the massive funding needs of the countrys development agenda at the time. By the mid-1980s, the private sector assumed a more important role in the strategic development of the Malaysian economy, with the aim of making it the main driver of growth as well as finance. During that period, the corporate sector was heavily reliant on finance from banks, which led the government to pursue the development of the corporate bond market as a key strategic priority. The 1997-98 Asian financial crises brought home the folly of over-reliance on bank loans. Lessons learnt from the crisis led the government to step up its efforts to develop the corporate bond market, in order to offer the private sector alternative sources of finance and reduce funding mismatches. Historically, because of the lack of a well-developed bond market, most of the credit intermediation in the country was done through the banking system. Potential credit withdrawals and the eventual credit squeeze suffered by the corporate sector during the Asian crisis highlighted the importance of risk diversification within the financial system. Consequently, development of the corporate debt market gained greater importance and was accelerated to allow greater diversification of credit risk among economic agents, as well as to provide funding with the appropriate maturity structures. For the past 15 years, efforts to develop the Malaysian bond market have been fruitful. In terms of relative size of the bond market versus domestic bank credit, growth in the former has been quite significant. Another notable achievement is the successful promotion of the Islamic bond market. Islamic bonds, which comply with Shariah principles, have played a major role in Malaysias capital market development, contributing to the significant growth of the countrys Islamic financial system. Through this niche market, Malaysia is poised to play a strategic role in global Islamic finance. The increasing demand from the private sector for innovative forms of finance continues to fuel the development of Malaysias corporate bond market. Growth has also been spurred by the increasing presence of institutional investors, such as pension funds, unit trust funds and insurance companies. The Malaysian corporate debt market has enjoyed enormous growth, rising from MYR 4.1 billion in private debt securities (PDSs) outstanding in 1989 to approximately MYR 188 billion in 2004, an increase of 45 times. In addition, the Malaysian corporate bond market represents 37% of the countrys GDP by this measure, one of the largest in the world (IMF (2005) and Table 1).

46

The Role of Mudaraba Perpetual Bond

Furthermore, the Malaysian bond market accounted for 8% of the total Asian bond market (excluding Japan) in 2004. Table 1: Size of Local Currency Bond Market as a Percentage of GDP End-March 2005 data Government Corporate China Hong Kong SAR Japan Korea Malayasia Singapore Thailand United States 19.5 9.4 146.8 26.1 40.6 40.3 21.9 47.0 0.7 38.1 16.6 122.0 37.3 31.6 13.6 21.5 Financial institutions 10.8 ** 26.1 37.4 16.7 ** 6.5 90.2

Note: ** Hong Kong and Singapore: corporate data include financial institutions. For others, corporate refers to non-financial corporate issuers. Sources: Asian Development Bank; Asian Bonds Online.

At the end of 1986, the PDS market was virtually non-existent in Malaysia. This was in contrast to the equity and government debt markets, both of which had achieved a reasonable level of sophistication and maturity by that time. PDSs outstanding in 1987 amounted to only MYR 395 million (0.5% of GDP), versus the market capitalization of the Kuala Lumpur Stock Exchange (KLSE) of MYR 73.8 billion (91% of GDP) and the outstanding amount of Malaysian Government Securities (MGS) of MYR 48.8 billion (60.2% of GDP). 4.5 Overview of Pakistan's Corporate Bond Market The corporate bond market exists in Pakistan in the form of Term Finance Certificates (TFC). The following sections present some salient features of the TFC market along with an international comparison. Features of the TFC Market The corporate bond market in Pakistan, in the form of TFCs, has experienced robust growth since the first TFC issue of Packages Limited for Rs. 232 million in February of 1995. The total amount of outstanding TFCs as of March 2006 is estimated at Rs. 57.99 billion (US$ dollars 0.97 billion or 1.12

Thoughts on Economics

47

percent of GDP). The TFC issuers include both non-financial and financial institutions as well as TFCs are based on legislation enacted in 1984, which authorized the issuance of redeemable capital securities. As a debt instrument, the TFC is slightly different from the traditional corporate bond because it was specifically designed to comply with Sharia Law. The key difference is that the TFC substitutes the words "expected profit rate" for "interest rate." The amount of TFCs outstanding is estimated using data on the date of issue, size of issue, and the maturity date of the public portion of TFCs. This probably underestimates the amount of TFCs since by law only 25 percent of the issue has to be raised from the public. Further, it is assumed that amortization payments are made in the form of a bullet payment on the maturity date. Although many of the TFCs are amortized through bullet payments some have different amortization structures. The coupon rate on the TFCs display a wide variety with different fixed coupons as well as floating coupons linked to various interest rates including the discount rate, Pakistan Investment Bond (PIB) rates, and the Karachi Interbank Offer Rate (KIBOR). As early as 1960s and 1970s, prior to nationalization of the financial institutions, corporate debentures issued by Pakistani companies were listed on stock exchanges with limited secondary market trading. TFCs were issued by development finance institutions (DFIs) as early as 1985, although these were placed privately. In 1988, Water and Power Development Authority (WAPDA), a government owned statutory organization, issued a five year bond. Over the period 1988 to 1994, WAPDA issued Rs. 22.5 billion of bonds to the public. The market experience of WAPDA bonds was disappointing due to two factors. First, WAPDA had to delay repayments of its maturing bonds due to insufficient funds. Second, the secondary market for the WAPDA bonds did not meet market expectations due to the under capitalization of the market maker resulting in low liquidity of the bonds. Although the first TFC was issued in 1995, the pace of issuance did not take off until 2001 when the number of new issues (17) equaled the total number of issues in the period 1995-2000. The sum of the new issues in 2001 was close to twice the total amount issued in the period 1995-2000. This sudden surge in TFC issues was partially a result of the Government's decision to bar institutional investors from NSS in March 2000. Table2 and Figure 1 show the evolution of the stock of outstanding TFCs.

48

The Role of Mudaraba Perpetual Bond

Table:2

Financial TFC (in Billion Rs) 0.5 2.5 2 3 16 17 Non Financial TFC (in Billion Rs) 0.2 1.5 1.5 2 10 20 Total TFC (in Billion Rs) 0.7 4 3.5 5 26 37

Year 1995 1997 1999 2001 2003 2005

Figure:1- Evolution of the stock of outstanding TFCs

Source: SBP and Authors calculations

4.6 Bahrain Corporate Bond Market The market for listed Islamic bonds (sukuk) is growing significantly in Bahrain, along with other segments of the Islamic finance industry. The value of sukuk listed on the Bahrain Stock Exchange (BSE) has doubled in the past five years to over US$3 billion at Present. The growth in the Islamic funds and capital markets is reflective of the surge sweeping through the regions financial services industry. The Islamic and conventional fund industry in Bahrain is one of the fastest growing segments of the overall financial sector. With over US$16 billion in assets under management, through more than 2,500 funds, the industry has been growing at an annual average of about 20% in recent years. The Bahrain Stock Exchanges (BSEs) sukuk market has grown significantly, with the total size of sukuk listings currently in excess of US$3 billion, double that from five years ago. On its part, the Central Bank of Bahrain (CBB), having pioneered the development of sukuk, remains active in the sovereign sukuk market, with a total of US$2.05 billion medium to long term sukuk issued, complemented by a regular programme of short term issuance. Recently, the

Thoughts on Economics

49

CBB issued its second international sukuk, worth US$350 million, which is listed on the London Stock Exchange, along with a previous issue of US$250 million. As the financial services regulator, the CBB is fully cognizant of the importance of the asset management industry and the capital market in attracting foreign capital and talent, and in facilitating economic development and the creation of high value-added jobs. The new framework includes Bahrains first-ever rules allowing collective investment undertakings (CIUs) to target professional investors, such as hedge funds, derivatives and other alternative investment vehicles. In keeping with Bahrains leadership in Islamic finance, the new CIU rules also provide a solid foundation for the establishment and management of funds that comply with Islamic principles. The CBB is actively supporting a number of Islamic capital market-related development initiatives, being undertaken by the International Islamic Financial Market (IIFM), which the CBB chairs. Another Bahrain-based organization, the Accounting & Auditing Organisation for Islamic Financial Institutions (AAOIFI) has also recently issued a statement on sukuk, providing important guidelines for sukuk issuers. It is the CBBs hope that such initiatives will go a long way in harmonizing market practices and creating a deep and vibrant Islamic capital market, which though growing significantly, remains small. There is a limited number of Islamic issuance in comparison to the conventional fixed income market. The Islamic finance industry should put substantial resources into creating a vibrant secondary market, including risk management products for Islamic investors and developing Sharia compliant hedging mechanisms. 4.7 Bond Market of Bangladesh The Bangladesh Bond Market is at a nascent stage. One of the main functions of a bond market is to provide long term finance by creating alternative source of finance through capital market. The main purpose of Bond market is to provide stable source of income to the investors against volatile equity market. The Bangladesh capital market is yet to develop required ground to create the environment for a congenial bond market. The high rate of interest in the market and government savings instrument, soft infrastructure for Bond market, unrestricted bank finance etc. all are still congenial for a sound Bond market. In addition the investors are more interested in short term gains instead of waiting for higher returns. The mentioned scenario together with the attitude of the Islamic minded investors against interest income is responsible for non development of Bond market in the country. A number of listed companies issued some debentures and listed them with stock exchange but those debentures could not draw the attention of the investors. Some also

50

The Role of Mudaraba Perpetual Bond

failed to pay the installments. In recent days IBBL issued MPB and ACI Company issued Zero Coupon Bonds with attractive tax incentives. BRAC bank also issued BRAC Bank 25% Subordinated Convertible Bonds to raise Tier-II capital to comply with the regulatory requirement of Bangladesh Bank. Credit Rating Agency of Bangladesh (CRAB) Limited has assigned A3 (Single A three) rating to the proposed issuance of BDT 2,000 million 20% convertible zero coupon bond by Jamuna Bank Limited (hereinafter also referred to as JBL or the Bank). The objective of the proposed BDT 2,000 million (approximately) zero coupon bonds (ZCB) are to increase the Tier II capital and thus increase the overall capital adequacy ratio of the issuer (JBL). The Bank will issue ZCB worth BDT 2,000 million (approximately) having maturity from 3-7 years having BDT 1,000 face value. Some of the multilateral agencies operating in Bangladesh are ready to offer technical and financial assistance to promote Bond market of the country. Bangladesh Bank and SEC with support of the Ministry of Finance have been exploring the feasibility and modus operandi to explore the issue for the interest of the capital market. 4.8 Important Features of Mudaraba Perpetual Bond

The important features of MPB are as under:

a) It is at perpetual nature & will not be redeemed b) It is listed at Stock Exchanges & is traded in the market c) Investor is getting profit by deployment of Mudaraba Fund at the weight 1.25 plus equivalent to 10% of declared dividend d) The bonds are subordinated to the depositors but remain high compared to the shareholders in respect of repayment of dividend & profit e) It is treated as supplementary capital (Tier-2 Capital) up to the maximum 30% of Tier- 1 capital f) It is treated as component of Mudaraba Deposit g) It is governed by the rule and principle of utilization and distribution of profit of Mudaraba Fund. h) It is fully paid up i) Bond holder is not entitled to any investment facility against the bonds

Thoughts on Economics

51

j) Tax on profit of the bonds determined in accordance with the principles of NBR. 4.9 MPB Structure Globally bond is a debt instrument carrying certain declared percentage of interest. Considering advantage of Bond being an instrument offering stable income source for the bond holders, many countries like India, Malaysia, Pakistan, Sudan, Iran have restructured bonds to bring under the Islamic principle of Shariah, wherein the bond s will not offer fixed rate of interest rather making the return as a part of profit distribution to the bond holders, a partner to share profit or loss on the basis of shariah but however, keeping the features of the bond as stable source of income. Considering the above, IBBL decided to go for Mudaraba Perpetual Bond to meet the capital adequacy need. At the first instance, the management of IBBL received the consent of the Shariah Council of the Bank for issuing MPB explaining the features of MPB and its modus operandi of determining profitability. The shariah council approved the above MPB subject to the condition that the bondholders should be informed about the profit distribution with weightage before issuing MPB. IBBL invested the fund received through MPB as general investment of the Bank and it treated as a component of total Mudaraba Fund. MPB holders share the income derived from total investment activities. The MPB holders get minimum 65% of the Investment Income generated from deployment of total Mudaraba Fund with 1.25 weightage. The gross income generated from the investment is distributed to the bondholders as under: Minimum 65% of the income generated by deployment of MPB fund. The MPB will carry 1.25 weightage. An additional amount equivalent to 10% of the rate of dividend declared and payable to the shareholders of IBBL each year.

As the name applies the bond is of perpetual in nature and will not be redeemed at any time. 4.10 Shariah Compliance The MPB is a shariah based product. The fund being collected on mudaraba principles through the MPBs is deployed in business activities under shariah principles. Mudarabah arises where a provider of capital called the rabb almal (or a group of such capital providers) enters into a contract with a manager (called the mudarib) to engage in any specific trade activity with the

52

The Role of Mudaraba Perpetual Bond

objective of sharing the potential profit. At the core of any mudarabah contract there are four basic conditions between the mudarib and the capital provider(s) as follows: Profit, when realized, has to be shared between the two parties in accordance with a profit-sharing ratio pre-stipulated at the time of the contract. Loss, in case it arises, would have to be born entirely by rabb al-mal as the mudarib only loses his or her effort. The rabb al-mal cannot interfere in the day-to-day management of the mudarabah, apart from his or her right to restrict possible fields of economic activity for the mudarabah. This provision, however, has to be made clear within the mudarib contract. The mudarib has a hand of trust (yad amana) in the management of mudarabah capital, which means he would work to his best effort and, therefore, cannot guarantee capital or profit to rabb al-mal. Loss of capital can be guaranteed by the mudarib only when such loss proves to be the result of mismanagement or delinquency of the mudarib; or where such loss results from a breach of the contract, like violating restricted fields of economic activity.

IBBL Shariah board looks into the principles of shar iah compliance from time to time along with other investments of the bank. The investment of the fund being collected against MPB is not ring fenced and is mixed up with the overall asset pool of IBBL. Since the entire banking operation of IBBL is based on shariah compliance, the additional business created out of the MPB fund also remains Shariah compliant. However, the income against overdue charges is to be carefully separated from normal income in order to keep the income absolutely shariah compliant. The MPB will not carry any fixed profit percentage; rather the profit percentage will vary from time to time depending on the overall profitability of the asset pool of the bank. That means the investors of MPB are exposed to certain amount of business risk which is an essential requirement of income of the MPB holders being shariah compliant. 4.11 Legal Status of the Bond Holders Unlike the interest based traditional Bond; MPB is a subordinate instrument. As a mudaraba instrument it gets priority over the shareholders in respect of getting profit and also refund of principal in case of liquidation of the bank. The bondholders will however, stand subordinated to the depositors in respect of the payment of both profit and refund of principal. The MPB has been listed

Thoughts on Economics

53

with both the Bourse of the country and it remains freely transferable depending on the market demand. The Bondholders are not entitled to enjoy any rights and privilege as enjoyed by the shareholders except statutory requirements. 4.12 Role of MPB for Development of Bangladesh Bond Market The basic concept behind issuing MPB, however, is for the holders of the MPB to share in the profits of large enterprises or in their revenues. Through the issuance of MPB, IBBL plays a major role in the development of the Islamic banking business and thereby contribute significantly to the achievement of the noble objectives sought by the Shariah. For meeting the essential requirement for developing a bond market, IBBL issued MPB and enriched the Bangladesh bond market. It is the first corporate bond in our capital market. Thus it is a milestone for Bangladesh bond market.

5. Problems Related to MPB

Though it has very positive role to play to develop a bond market in Bangladesh but there are some problems, which are mentioned below: 1. Lack of awareness of investors about the bonds features and also about the bond market. 2. As there is no fixed interest rate, so investors who want regular interest/profit/dividend/return for their regular income- are not interested to invest in MPB 3. Investors assume a risk that the issuer may fail to satisfy the terms of the obligation with respect to the timely payment of profit due to adverse market condition. 4. Entrance of new competitors adversely affects the bonds price.

6. Problems related with Bangladesh Bond Market

1. Lack of government proper policy regarding development of bond market, it is still far behind than the Asian other countries as China, Korea, Malaysia, Philippine, Singapore, Thailand, India , Pakistan and Srilanka. 2. Shortage of corporate bonds in the market 3. Absence of effective protective laws to ensure the position of investors in bond market (Akter, Nazma and Mohsin, M., 2010).

54

The Role of Mudaraba Perpetual Bond

7. Recommendations

7.1 Recommendations to Overcome the Problems Related to MPB The following recommendations are put forwarded to solve the problems related to MPB: 1. IBBL should arrange seminars and workshops for the investors to increase their awareness about the features (rate of dividend, 1.25 weightage, perpetual etc.) of MPB. 2. IBBL should disclose financial statements to the investors and it will reduce bondholders default risk. 3. Since ACI Company and BRAC Bank offered convertible bonds, IBBL should introduce convertible feature with the existing features of the MPB to attract the investors. 4. IBBL should increase the percentage of declared dividend which will be added with the 1.25 weightage. 5. Other Islamic Banks should come forward to issue their own mudaraba bonds in the Bangladesh bond market. 7.2 Recommendations for the Development of Bond Market The suggested Road Map under the auspices of IFC to develop a bond market in a country like Bangladesh is: i) ii) Rationalization of the Interest Rate Structure whereby the Government borrows at the lowest possible rate to create a level playing field Establish benchmarking and long-term Yield Curve.

iii) Provide a Legal Framework of user friendly Rules & Regulations, conducive to the creation and development of a market. iv) Develop a system of issuance of future Sovereign Papers (Sanchaya Patras etc.) of different maturities as Tradable and Transferable Securities. v) Fund future infrastructure projects through issuance of Government and Private Bonds.

vi) Lower Registration and Issue cost of Bonds and Debentures. vii) Create independent Credit Rating Agencies.

Thoughts on Economics

55

viii) Develop and strengthen market intermediaries like dealers, investment analysts, investment/ merchant bankers etc. ix) Facilitate education process of market participants, including the investors and issuers. x) Unbundled pension and insurance funds and promote flotation of private mutual funds, especially Money Market Mutual Funds.

xi) Allow Investment Grade Corporate Bonds and Debentures to form part of SLR of Banks. xii) Facilitate Securitization and issuance of Asset Backed Securities and Collateralized Loan Obligations with the backing of multilateral agencies and development of Money Market instruments. xiii) Establish Central Depository Registration System. and Electronic Settlement and

xiv) Upgrade Accounting and Disclosure Standards as well as Foreclosure Laws. The authors think that the above road map is sufficient to develop our bond market. Therefore security market authorities should implement the road map properly.

8. Conclusion

The bond market may play a very significant role in developing the economy of Bangladesh. The Mudaraba Perpetual Bond is being traded in the countrys capital market to pave the way to creating an Islamic bond market. Being influenced by IBBL-MPB, ACI Company issued Zero Coupon Bonds with attractive tax incentives. BRAC bank also issued BRAC Bank 25% Subordinated Convertible Bonds to raise Tier-II capital to comply with the regulatory requirement of Bangladesh Bank. Credit Rating Agency of Bangladesh (CRAB) Limited has assigned A3 (Single A three) rating to the proposed issuance of BDT 2,000 million 20% convertible zero coupon bond by Jamuna Bank Limited (hereinafter also referred to as JBL or the Bank). The Bank will issue ZCB worth BDT 2,000 million (approximately) having maturity from 3-7 years having BDT 1,000 face value.Thus IBBL-MPB is playing a role as a catalyst for developing Bangladesh Bond Market.

56

The Role of Mudaraba Perpetual Bond

REFERENCES

1. Akter, Nazma and Mohsin M., (2010), Heterogeneous investors Base in Government Bond Market: A Critical Review of Some Selected south Asian countries, Thoughts on Economics, Vol. 20. No. 02, p-68. Islam, ABM. Mahbubul (2005), Islamic Constitution: Quranic and Sunnatic Perspectives, Professors Publication, Dhaka, p-331. Jahur, M. Saleh (2009), Development of Bond Market in Bangladesh: Issues, Status, and Policies, CSE Portfolio, July-September, 2009, p-49. Jahur M. S. and Quadir N. (2010), Development of Bond Market in Bangladesh: Issues, Status, and Policies, Management Research and Practice, Vol. 2, Issue 3, p:312.

Misir, M. Abu, Mohsin M., and Kamal A., (2010), Contemporary Issues in Bond Market Development in Bangladesh: Experience and Evidence from Asian Countries, The Bangladesh Accountant, January-March 2010, p-27.

2. 3. 4.

5.

6. 7.

Mu, Yibin (2007), South Asia Bond Markets and Bangladesh, World Bank Dhaka Sharif, M. Raihan (1996), Guidelines to Islamic Economics: Nature, Concepts and Principles, Bangladesh Institute of Islamic Thought (BIIT), p-166.

Usmani, M. Taqi,(1998), Sukuk and their Contemporary Applications, AAOIFI Shariah Council, P-2.

8. 9.

Wilson, Rodney (2006), Islamic Capital Markets: The Role of Sukuk, QFINANCE, p-1.

10. Ibrahim, Muhammad bin and Wong Adrian (2005), The Corporate Bond Market in Malaysia, Bank Negara Malaysia publ. Websites:

i) http://www.islamibankbd.com/home.php ii) http://bd-ipo.blogspot.com/2010/01/aci-limited-aci-20-convertible-zero.html iii) http://www.dsebd.org/forthcoming/Brac_Bonds.pdf

Vous aimerez peut-être aussi

- The Role of Mudaraba Perpetual Bond (MPB) of IBBL For Development of Bangladesh Bond MarketDocument19 pagesThe Role of Mudaraba Perpetual Bond (MPB) of IBBL For Development of Bangladesh Bond MarketS M IftekharPas encore d'évaluation

- Functions of Islami BanksDocument4 pagesFunctions of Islami BanksJakir_bnk100% (1)

- Historical Background of IBBLDocument5 pagesHistorical Background of IBBLSISkobirPas encore d'évaluation

- Definition of Investment and Investment MechanismDocument12 pagesDefinition of Investment and Investment MechanismShaheen Mahmud50% (2)

- Promotional Tools of FSIBLDocument54 pagesPromotional Tools of FSIBLMoinuddin Hassan Syeman83% (6)

- Consumer Finance in Context of BangladeshDocument26 pagesConsumer Finance in Context of BangladeshAshis Debnath50% (2)

- EXIM Bank Internship ReportDocument56 pagesEXIM Bank Internship ReportMehadi HasanPas encore d'évaluation

- Banking Vs Non Banking Financial InstitutionsDocument2 pagesBanking Vs Non Banking Financial InstitutionsFarihaFardeen100% (1)

- General Banking Activities (CBS)Document15 pagesGeneral Banking Activities (CBS)Ifrat SnigdhaPas encore d'évaluation

- Overview of Bangladesh BankDocument7 pagesOverview of Bangladesh BankIshtiaque A. SakibPas encore d'évaluation

- The Role of Investment Banks in Facilitating The IPODocument23 pagesThe Role of Investment Banks in Facilitating The IPOFarnaz KarimPas encore d'évaluation

- Tawkir Term PaperDocument18 pagesTawkir Term PaperSoniya ZamanPas encore d'évaluation

- Investment Banking in IndiaDocument6 pagesInvestment Banking in IndiaYadvendra YadavPas encore d'évaluation

- INvestment Alter Native12Document8 pagesINvestment Alter Native12Agonto OdvutPas encore d'évaluation

- Indian Financial MarketDocument114 pagesIndian Financial MarketmilindpreetiPas encore d'évaluation

- WElfare Investment Scheme of IBBLDocument21 pagesWElfare Investment Scheme of IBBLMahibul HasanPas encore d'évaluation

- Scope of Investment BankingDocument7 pagesScope of Investment BankingMehedi HassanPas encore d'évaluation

- BASIC Bank Limited: Serving People For ProgressDocument15 pagesBASIC Bank Limited: Serving People For ProgressMD Shariful IslamPas encore d'évaluation

- Overview of Financial System of BangladeshDocument13 pagesOverview of Financial System of BangladeshMonjurul Hassan50% (2)

- A Case Study of Profitability Analysis of Standard Chartered Bank Nepal LTDDocument16 pagesA Case Study of Profitability Analysis of Standard Chartered Bank Nepal LTDDiwesh Tamrakar100% (1)

- "General Banking in Bangladesh" - A Study Based On First Security Islami Bank Ltd.Document53 pages"General Banking in Bangladesh" - A Study Based On First Security Islami Bank Ltd.SharifMahmudPas encore d'évaluation

- Foreign Exchange Business Performance of IBBLDocument108 pagesForeign Exchange Business Performance of IBBLNoor Ibne Salehin0% (1)

- A Case Study of Profitability Analysis of Standard Chartered Bank Nepal LTDDocument16 pagesA Case Study of Profitability Analysis of Standard Chartered Bank Nepal LTDram binod yadavPas encore d'évaluation

- Ibbl Investment Portfolio ofDocument47 pagesIbbl Investment Portfolio ofঘুমন্ত বালক100% (2)

- BFSI Sector in IndiaDocument3 pagesBFSI Sector in IndiaKenneth GallowayPas encore d'évaluation

- Islami Bank Bangladesh Limited, Sylhet Branch " As My Project ReportDocument63 pagesIslami Bank Bangladesh Limited, Sylhet Branch " As My Project ReportangelPas encore d'évaluation

- BankingDocument8 pagesBankingDivya NathPas encore d'évaluation

- MCB Bank:History: ProfitabilityDocument5 pagesMCB Bank:History: ProfitabilityShaheryar SialPas encore d'évaluation

- DraftDocument15 pagesDraftfaysalsiddique307Pas encore d'évaluation

- Icb Capital Management LTDDocument45 pagesIcb Capital Management LTDazbannaPas encore d'évaluation

- Project ReportDocument55 pagesProject Reportshrestha mobile repringPas encore d'évaluation

- Progress and Prospect of Bangladesh Money Market and Capital Market Security in BangladeshDocument45 pagesProgress and Prospect of Bangladesh Money Market and Capital Market Security in BangladeshN M Baki Billah94% (16)

- BankDocument9 pagesBankakashgulati007Pas encore d'évaluation

- Al BarskhaDocument86 pagesAl BarskhaMian MohsinPas encore d'évaluation

- Contribution of Financial Market in BDDocument8 pagesContribution of Financial Market in BDAmeen IslamPas encore d'évaluation

- Indian Banking IndustryDocument12 pagesIndian Banking Industrysimranarora2007Pas encore d'évaluation

- Credit Rating Report ON Islami Bank Bangladesh LimitedDocument17 pagesCredit Rating Report ON Islami Bank Bangladesh LimitedAL TuhinPas encore d'évaluation

- Islami Bank Bangladesh LimitedDocument82 pagesIslami Bank Bangladesh Limitedrbkshuvo0% (1)

- Chapter - I 1.1 Background of The StudyDocument47 pagesChapter - I 1.1 Background of The StudyAakash AcharyaPas encore d'évaluation

- Internship Report FinalDocument41 pagesInternship Report Finalsohana0% (1)

- Islamic Banking in Pakistan Cooperation With Central Bank and Conventioanl BanksDocument14 pagesIslamic Banking in Pakistan Cooperation With Central Bank and Conventioanl BanksM.Majid ShaikhPas encore d'évaluation

- A Brief Research On Investment Corporation of BangladeshDocument14 pagesA Brief Research On Investment Corporation of BangladeshShakil NaheyanPas encore d'évaluation

- Investment Banks-Final With ChangesDocument14 pagesInvestment Banks-Final With Changesdaanishk87Pas encore d'évaluation

- Financial Statment Analysis of SiblDocument30 pagesFinancial Statment Analysis of SiblShafiur Ratul100% (1)

- BII Final NOTES UNIT1Document26 pagesBII Final NOTES UNIT1SOHAIL makandarPas encore d'évaluation

- Performance Appraisal of Union Bank: Introduction To Banking SectorDocument38 pagesPerformance Appraisal of Union Bank: Introduction To Banking SectorMukesh ManwaniPas encore d'évaluation

- First Security Islami Bank Internship ReportDocument65 pagesFirst Security Islami Bank Internship ReportDurantoDx100% (2)

- Ch-3 Financial Market in BangladeshDocument8 pagesCh-3 Financial Market in Bangladeshlabonno350% (1)

- Vishakha Black Book ProjectDocument48 pagesVishakha Black Book ProjectrohitPas encore d'évaluation

- Ific BankDocument95 pagesIfic BankAl AminPas encore d'évaluation

- Ibbl PDFDocument3 pagesIbbl PDFKanij FatemaPas encore d'évaluation

- Identify & Evaluate Marketing OpportunitiesDocument9 pagesIdentify & Evaluate Marketing Opportunitiesmsohail_2004Pas encore d'évaluation

- Mission of IBBLDocument19 pagesMission of IBBLTayyaba AkramPas encore d'évaluation

- Term Paper Square Pharmacitical LTDDocument84 pagesTerm Paper Square Pharmacitical LTDs.m. nakibul islamPas encore d'évaluation

- An Overview of Indian Banking SectorDocument37 pagesAn Overview of Indian Banking SectorKalyan VsPas encore d'évaluation

- Genesis Institute of Business ManagementPuneDocument22 pagesGenesis Institute of Business ManagementPunemanoj jaiswalPas encore d'évaluation

- History of Banking in IndiaDocument17 pagesHistory of Banking in IndiadharinimehtaPas encore d'évaluation

- Takaful and Islamic Cooperative Finance for Beginners!D'EverandTakaful and Islamic Cooperative Finance for Beginners!Pas encore d'évaluation

- Are Traders Preprogrammed To FailDocument17 pagesAre Traders Preprogrammed To FailRitha Dhama C SPas encore d'évaluation

- ATS TriumphDocument4 pagesATS TriumphsandeeprazzPas encore d'évaluation

- Chapter 15 - Capital BudgetiDocument66 pagesChapter 15 - Capital BudgetiAnonymous qi4PZk0% (1)

- Icici Subsidiaries Ar 2015 16Document492 pagesIcici Subsidiaries Ar 2015 16RAHIM KHANPas encore d'évaluation

- Corporate BankingDocument56 pagesCorporate Bankingsujata_patil11214405Pas encore d'évaluation

- Overview of Property and Casualty ReinsuranceDocument29 pagesOverview of Property and Casualty ReinsuranceAman AroraPas encore d'évaluation

- Financial Reporting Quality Fair ValueDocument13 pagesFinancial Reporting Quality Fair ValueÁgnes SchwarczPas encore d'évaluation

- FAQsDocument34 pagesFAQsFredPahssenPas encore d'évaluation

- Fixed Income, PortfolioDocument15 pagesFixed Income, PortfolioDuyên HànPas encore d'évaluation

- Understanding Accounting and Financial Information: SeventeenDocument41 pagesUnderstanding Accounting and Financial Information: SeventeenLim Cia ChienPas encore d'évaluation

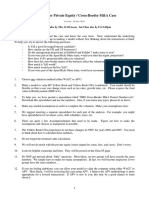

- Questions For Private Equity / Cross-Border M&A Case: Thu Class Due by Thu 12:00 Noon Sat Class Due by Fri 9:00pmDocument2 pagesQuestions For Private Equity / Cross-Border M&A Case: Thu Class Due by Thu 12:00 Noon Sat Class Due by Fri 9:00pmvencentPas encore d'évaluation

- Irma Resume Teaching eDocument5 pagesIrma Resume Teaching eapi-273353364Pas encore d'évaluation

- Financial Management Practices On Growth of Small and Medium Enterprises: A Case of Manufacturing Enterprises in Nairobi County, KenyaDocument13 pagesFinancial Management Practices On Growth of Small and Medium Enterprises: A Case of Manufacturing Enterprises in Nairobi County, KenyaIOSRjournalPas encore d'évaluation

- Pob NotesDocument5 pagesPob Notesanessa AllenPas encore d'évaluation

- HP 17bII+ Financial Calculator ManualDocument309 pagesHP 17bII+ Financial Calculator ManualBrooks KincaidPas encore d'évaluation

- Negotiable Instruments ReviewerDocument18 pagesNegotiable Instruments ReviewerRowena Yang90% (21)

- February 23, 2018 Strathmore TimesDocument23 pagesFebruary 23, 2018 Strathmore TimesStrathmore TimesPas encore d'évaluation

- Cert. of EmploymentDocument21 pagesCert. of EmploymentMark Andrew FernandezPas encore d'évaluation

- SVU Mba Syllabus All SubjectsDocument13 pagesSVU Mba Syllabus All SubjectsMichael WellsPas encore d'évaluation

- 7Document3 pages7Afolabi Eniola AbiolaPas encore d'évaluation

- Book 6. The Shadow GovernmentDocument50 pagesBook 6. The Shadow GovernmentWilliam StylesPas encore d'évaluation

- Family Law Mnemonics - Recoupment ChartDocument4 pagesFamily Law Mnemonics - Recoupment Chartbuenasuerte11100% (1)

- Comparatie IFRS HGB PDFDocument5 pagesComparatie IFRS HGB PDFslisPas encore d'évaluation

- CPT PaperDocument4 pagesCPT Paperpsawant77Pas encore d'évaluation

- PEST Analysis of BankingDocument30 pagesPEST Analysis of BankingRoyal Projects100% (2)

- Ch28 Test Bank 4-5-10Document9 pagesCh28 Test Bank 4-5-10bluephoe100% (1)

- BRS 1Document24 pagesBRS 1JishnuPatilPas encore d'évaluation

- 5 6066385334139093151 PDFDocument24 pages5 6066385334139093151 PDFhvmandaliaPas encore d'évaluation

- Material Adverse Change Clauses: Decoding A Legal EnigmaDocument6 pagesMaterial Adverse Change Clauses: Decoding A Legal Enigmahariom bajpaiPas encore d'évaluation

- Lawnranger Landscaping ServiceDocument47 pagesLawnranger Landscaping ServiceKailash Kumar100% (1)