Académique Documents

Professionnel Documents

Culture Documents

Targeting Sectors and Markets

Transféré par

Sean M DugganCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Targeting Sectors and Markets

Transféré par

Sean M DugganDroits d'auteur :

Formats disponibles

SESSION 9: TARGETING OF SECTORS AND

MARKETS

Mr. Sean M Duggan Director, ILSA Consulting

25 June 2012

Overview of session 9

1. About targeting 2. Choosing targets Targeting case example 3. Lessons and discussion issues

1. About targeting

What is targeting?

Drivers Increasing competition among locations to attract and benefits from FDI

Purpose

Principles Approach Delivery Outcomes

Generate high quality investment leads and investment prospects

Based on private sector practices and contemporary marketing techniques Well researched and planned approaches to investment decision makers (and advisers) Consistent concentration on targets (sectors, functions, companies and source markets)

Greater benefits from investors and investment in the longer term

3

1. About targeting

Evidence suggests targeting works!

Econometric evidence Targeted sectors receive more than twice as much FDI as nontargeted sectors in developing countries (Harding and Javorcik, 2010) Targeting industries for investment promotion leads to an increase in FDI of 60% (Charlton and Davis, 2006) Location experiences Considered a key part of Irelands success in attracting FDI during the 1980 and 1990s (MacSharry and White, 2000) Restructuring Tunisias FIPA from country to industry targeting a key to success (Mansour, 2005) Contributed to InvestHK's high level of delivery and costeffectiveness (PwC, 2009)

4

1. About targeting

Targeting advantages Focuses effort on the best FDI prospects Increases investors (and intermediaries) awareness of location, its offer and the IPA Investors react more positively to tailoring of information and services Supports locations in the identification, promotion and development of offer

1. About targeting

Which targets?

Sectors/sub-sectors ISIC Sections = 21 ISIC Divisions = 234 ISIC Classes = 413 HQ/RHQ, capital allocation Research and development Source markets = Product design/development 232 Production and fabrication Top 20 markets = Branding, marketing and sales 86% of FDI Storage, distribution and logistics After sales service and support 82,000 TNCs (2008) Different sizes Links between sectors/sub-sectors, functions and business enterprises

6

Functions

Business enterprises Business clusters

1. About targeting

Illustrations of sector targets?

Location (IPA) Targets Selected sectors/sub-sectors

Czech Republic (Czech Invest)

Ireland (IDA) Hong Kong (InvestHK) Singapore (SEDB)

10

11 9 20 9

Nanotechnology, Automotive, Aerospace, Cleantech, Electrical engineering

Business services, Consumer products Cleantech, ICT, Life sciences, Media Business services, Creative industries, Professional services, ICT, Transport Aerospace, Chemicals, Healthcare, Marine engineering, Precision engineering, ICT

Jordan (JIB)

Tunisia (FIPA)

Agro-Industries, Automotive, Chemicals, Mining and processing, Pharmaceuticals

ICT, Electric and electronic, Mechanical, Textiles, Food industry, Leather and shoes

7

2. Choosing targets Targeting case example

Pressure for change (1990s) erosion of FDI

New location economic development policy priorities

Relative decline in offer competitiveness

Negative perceptions of the location offer Negative perceptions of the existing FDI programme Agency divergence from good practices Location FDI programme

Shifting patterns in FDI move to services Rising investor sophistication and expectations

Increasing importance of reinvestment

2. Choosing targets Targeting case example

A new approach (1999/2000)

Opportunities Risks (Net) profitability Awareness Attractiveness Competitiveness Institutions Supporting infrastructure Regulatory environment

Business strategy Investment drivers

Location demand requirements

Location market

Location supply offer

Policy priorities Development needs

Investor response awareness satisfaction

Targets sector/function source Investment Investor generation servicing Marketing and promotion

Offer improvement awareness advocacy Aftercare and Advocacy

Image building

Strategy Resources

Governance and organisation Performance monitoring

9

2. Choosing targets Targeting case example

Identification of targets

Business strategy Investment drivers Location demand requirements Location market Location supply offer Policy priorities Development needs

Sector targets

Assessment of: Assessment of: Business internationalisation trends Successful locations features and lessons Investor location requirements (criteria and weighting) overall and Location competitors targets, sector positioning, value propositions Patterns of location decisions Relative competitiveness as a levels of mobility location overall and sectors Investor (and broker) perceptions Location brand profile Stakeholder testing and opinion Stakeholder testing and opinion

10

2. Choosing targets Targeting case example

Sector focused organisation structure

Agency Head Assistant Head Sector Lead Investor Support Team Sectors Investor Support Analysts Sectors Assistant Head Sector Lead Investor Support Team Sectors Investor Support Analysts Sectors Assistant Head Special Projects Investor Support Team Special Projects Investor Support Analysts Special Projects Marketing and Communications

Strategy

Key

Investor Support Research

Corporate Services

Corporate Services and Administration Overseas Offices / Representatives

11

2. Choosing targets Targeting case example

Supporting investment database

Market knowledge Sector description Main sector trends, drivers and features Market/industry issues impacting investors Major investing business enterprises decision makers in the sector Level of expected international mobility of investment Investment project Offer proposition Typical investment Criteria to assess project priority given to process/requirements potential investment Quantifiable aspects of projects a typical investment Identification of the Criteria influencing an most likely regional investors location rivals decision Location offer position of rivals Core proposition arguments for location

12

2. Choosing targets Targeting case example

Virtual organisation networks and partners

Government and Private sector

Industry Department

FDI Steering Group Overseas Trade Offices Trade Development Agency Economic Development Offices

Reflecting target source markets

Brokers, investor bodies, media, Government

Networks Investment Promotion Agency Head Office Overseas Offices Overseas Representatives

Ambassadors

Independent and influential individuals

13

2. Choosing targets Targeting case example

Progressive rollout

Investor identification Target enterprises (by sector and source market) Initial long-list of enterprises Short-list based on response Develop detailed profile information capture on customer relationship database Investor approach Investment assessment General promotion Criteria based to information determine level of Initial e-mail/phone support and type of contact handling response Develop tailored Sector propositions Additionality Follow up presentations Displacement and meetings Net benefit Long term relationship building strategy visits, events, introductions 12-36 months

14

2. Choosing targets Targeting case example

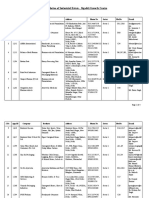

Performance targets (illustrative)

Process step Input context Products, services and activities Investor Outcome Target description Staff Expenditure Projects Leads Perceptions Satisfaction Investment Jobs Target metric Number (X) Budget ($) >X >X > X% very positive > X% very satisfied >X >X

Performance targets clear and transparent and are aligned to strategy Emphasis is placed on targeting investors and outcomes Performance is reported publicly on a yearly basis

15

2. Choosing targets Targeting case example

Targeting refinement (2007/8)

Business strategy Investment drivers Location demand requirements Location market Location supply offer Policy priorities Development needs

Desirable

Sector targets

Attractable

Based on performance characteristics Based on relative sector strengths of sectors using seven measures: (revealed comparative advantage analysis industry performance Wage level relative to OECD industry averages): Employment per enterprise Industry size Value-added per employee Export size Capital invested per enterprise Labor productivity Industry size Export specialisation Industry growth Value-added Technology

16

2. Choosing targets Targeting case example

Revised sector targets (illustrative)

Harder Higher Future goal Attractability

Priority sectors

Easier

Key clusters

Education services Information technology Biotechnology Research & development Pharmaceuticals

Core

Longer-term sectors Key clusters

Financial services/Banking Finance/Investment cos. Business support services

Transport and logistics Telecommunications Hotels, hospitality & tourism Construction services Transport services Supporting services to air transport Food processing Retail trade Rubber & plastics

Desirability

Aircraft manufacturing

Energy extraction Ship building

Wholesale trade

Furniture manufacturing Iron & steel Glass and ceramics Paper products Publishing Motor vehicle sales and repair

Key clusters

Lower

Bad fit

Quick win

17

2. Choosing targets Targeting case example

Revised source markets (illustrative)

Consistency High

Portfolio of secondary markets

Priority markets

Low

18

2. Choosing targets OECD quantitative approach

Sector Attractiveness index

Variable Measure Share of value added of the sector in total value added Value-added Compound Average Growth Rate (CAGR) of value added of the sector over 5 years Share of the sector in total exports Evolution of the Relative Comparative Advantage of the sector over 5 years Labour cost advantage or disadvantage in the sector (benchmark: a cluster of emerging countries) Share of world FDIs inflows of the sector CAGR of world FDIs inflows over a number of years CAGR of FDI stocks of each sector as a percentage of GDP over a number of years 19 Variable

Country benefits index

Measure Share of the sector in total employment Employment CAGR of employment of the sector over a number of years

Innovation

Sector Innovation Performance Index built on 12 OECD countries Value added created per employee of the sector

Exports

Level of complexity

Cost of Labour

World FDIs trends

FDI stocks in

2. Choosing targets OECD quantitative approach

Ukraine, 2010

Rubber and plastics products (beneath real estate) Machinery and equipment Real estate, renting Coke, refined petroleum products and nuclear fuel Electrical and optical equipment Communication

25

Country benefits Index

50 70 45 40 35 30

Financial activities

Trade

Chemicals Construction Business services Food Mining

Metals Mean = 25

Transport

20 15 10 5 0 0 10 20

Agri

Electricity, gas and water supply Fishing Wood Textiles Leather Transport equipment Paper Publishing

Mean = 27

The size of the bubble reflects the relative share of FDI stocks

Other non-metallic mineral products Hotels and restaurants

30

40

50

60 70

Sector attractiveness Index

2. Choosing targets OECD quantitative approach

Kazakhstan, 2009

Finance

Country benefits Index

76 72 68

64

60 56

Motor vehicles & transport equipment Coke, petroleum products , nuclear fuels manufacturing Business & IT services

Geological services

Non-metallic mineral products

Basic metals and fabricated metal products Construction Trade & repairs Mining & quarrying

52

48 44 40 36 32 28 24 20 16

Papers

Rubber & Plastic products Communication Chemicals Transport & storage

Machinery Food, beverages & tobaccos

Electrical & electronic equipment

Median = 34

Real estate

Hotels & restaurants

Agriculture, hunting and forestry Electricity, gas & water supply

Leather and leather products Fishing,

The size of the bubble reflects the relative share of FDI stocks

Textile and textile products

12 4 8 12 16 20 24 28 32 36 40 44 48 52 56 60 64 68 72

Sector attractiveness Index

2. Choosing targets OECD quantitative approach

Quantitative analysis of past trends Consultations and Research Stakeholders validation Agreed targets

Oil/gas related sectors and financial services show high past performance

The government priority is to diversify the However, Kazakhstan country and focus on has capabilities and endowments that could tradable and higher value-added products be leveraged in agribusiness, chemicals, The OECD suggests focusing on specific sublogistics or business sectors services However, Ukraine was impacted by the Priorities of the financial crisis and the government include external shock on diversification from demand for metals metals, reducing Ukraine has capabilities dependency on and endowments that imported natural gas, could be leveraged in improving value-added other sectors such as productions agribusiness, aircraft The OECD suggests on manufacturing, focusing on specific subrenewables sectors

Agribusiness beef, grain and dairy valuechains Chemicals fertilizers Logistics focusing on agribusiness Business Services

Kazakhstan, 2009

Financial services and metals show high past performance

Agribusiness grain and dairy value-chains Renewables biomass value-chain Machinery and transport equipment civilian aircraft manufacturing 22

Ukraine, 2010

2. Choosing targets Targeting case example

What not to do

Opportunities Risks (Net) profitability Weak dialogue and feedback Business strategy Investment drivers

Overall programme lacks coherence Awareness Attractiveness Competitiveness 12 sector targets not evidence base Location Location supply market offer

No National investment policy statement Institutions Supporting infrastructure Regulatory environment

Location demand requirements

Policy priorities Development needs

Investor response awareness is satisfaction Information not

available or difficult to access Image building

Offer improvement Targets awareness sector/function advocacy source Little evidence of advocacy and offer Poor improvement Investment Investor Aftercare and direction/support generation servicing Advocacy provided Marketing and promotion Governance and organisation Performance monitoring Lack of targets, measurement and 23 reporting

Strategy Inadequate resources and annual budget cycle Resources

Lack of strategy implementation

3. Lessons and discussion issues

Targeting is about more than targets

Alignment of location supply and demand Focusing on appropriate prospects Promoting the location (and agency) to influence behaviour:

Generate positive investor responses Stimulate location improvements

Location demand requirements Location market Location supply offer

Investor response awareness satisfaction

Targets Offer improvement sector/function awareness enterprise advocacy source Promotion programme

Coherence and consistency of approach

24

3. Lessons and discussion issues

Key lessons from experience of targeting

Build on research and understanding Part of a coherent programme Targeting should use criteria built on market knowledge location demand and supply Combine as part of a wider programme approach with new and existing investors

Tailor to target needs

Include networks Sustained and persistent application Apply learning principles

Preparation and use of proposition based sales and promotional materials for use with targets

Uses a wide range of partners including government brokers and ambassadors Long time engagement with networks to make and sustain relationships a trusted adviser

Monitoring to update market knowledge, assess outcomes and enhance the offer

25

3. Lessons and discussion issues

Key lessons from experience of targeting

Policy priorities Development needs Performance monitoring Objectives

Research / Data

Its an on-going process the world changes

Analysis

Delivery

Tools / materials

Programme design

But ... It doesnt guarantee success

26

3. Lessons and discussion issues

Some key discussion questions

Research What level of research have you undertaken to understand the location market and sectors?

Programme

Resources Networks Application Learning

To what extent do you have all of the programme components in place?

What information do you have available and to what extent is it tailored to targets? What networks are in place and how well are they being used in practice? How long has the targeting approach been operating?

How often is performance assessed and what offer enhancements have been made?

27

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Family Seed Saving BookDocument30 pagesThe Family Seed Saving BookpermaMedia100% (3)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Eternal YouthDocument7 pagesEternal YouthDeepak Naik100% (1)

- National Geographic Traveler Western BalkansDocument25 pagesNational Geographic Traveler Western Balkansg_sarcevich5427100% (4)

- Four Sites in Upland KaneoheDocument357 pagesFour Sites in Upland Kaneohestormwaverider100% (1)

- Bagaipo vs. CA (Original & Digest)Document4 pagesBagaipo vs. CA (Original & Digest)Vince Leido100% (1)

- If I Were The Prime Minister of IndiaDocument3 pagesIf I Were The Prime Minister of IndiaNIKHILPATNI0% (1)

- Curriculum Vitae .Document1 pageCurriculum Vitae .Dumora FatmaPas encore d'évaluation

- Report Text: General ClassificationDocument7 pagesReport Text: General Classificationrisky armala syahraniPas encore d'évaluation

- Indus Valley CivilizationDocument20 pagesIndus Valley CivilizationRAHUL16398Pas encore d'évaluation

- F P L C: ARM Ractice AND LearingDocument3 pagesF P L C: ARM Ractice AND Learingronalit malintadPas encore d'évaluation

- Classical Era of ROMAN EMPIREDocument4 pagesClassical Era of ROMAN EMPIREHamza UsmanPas encore d'évaluation

- Von Beyme Constitutional EngineeringDocument21 pagesVon Beyme Constitutional EngineeringAnn BoPas encore d'évaluation

- Ivory Coast ProjectDocument16 pagesIvory Coast ProjectAuguste ZongoPas encore d'évaluation

- Endosulfan TragedyDocument16 pagesEndosulfan TragedyAbhiroop SenPas encore d'évaluation

- Familia Acanthaceae en PanamáDocument8 pagesFamilia Acanthaceae en PanamáMario Junior Zegarra VásquezPas encore d'évaluation

- Tropical Rainforest Research PaperDocument5 pagesTropical Rainforest Research Papergz8qs4dn100% (1)

- AT Da 9 Classe (Proposta)Document2 pagesAT Da 9 Classe (Proposta)A.C HUMORPas encore d'évaluation

- Azolla Book1984Document4 pagesAzolla Book1984Mariyath Muraleedharan KiranPas encore d'évaluation

- Deforestation in Dhaka CityDocument32 pagesDeforestation in Dhaka CityAshraf Atique0% (1)

- Organic FarmDocument2 pagesOrganic FarmAlexander QuiñonesPas encore d'évaluation

- Porcine BrucellosisDocument35 pagesPorcine BrucellosisCharlotte AcayanPas encore d'évaluation

- Sustainability WorkshopsDocument1 pageSustainability Workshops300rPas encore d'évaluation

- LOA SiggadiGrowthCenterKotdwar1442650109Document4 pagesLOA SiggadiGrowthCenterKotdwar1442650109UDGGAMPas encore d'évaluation

- Characteristics of MetalDocument3 pagesCharacteristics of MetalChari Mae Tamayo PanganibanPas encore d'évaluation

- Contoh Soal TOEFL StructureDocument3 pagesContoh Soal TOEFL StructureRestii DevianingsihPas encore d'évaluation

- Crop-Growing Skyscrapers - Reading 1: Web: Anhngulinhnam - Edu.vn// Fanpage: IeltsthaytuDocument13 pagesCrop-Growing Skyscrapers - Reading 1: Web: Anhngulinhnam - Edu.vn// Fanpage: IeltsthaytuKiệt Đỗ TấnPas encore d'évaluation

- Atlantis Od Spring Tank Mix Sheet 2021 v01Document2 pagesAtlantis Od Spring Tank Mix Sheet 2021 v01weldsaidiPas encore d'évaluation

- Gardening Activity - Fermented Plant JuiceDocument2 pagesGardening Activity - Fermented Plant JuiceJay BinateroPas encore d'évaluation

- French Tarragon For Iha PageDocument11 pagesFrench Tarragon For Iha PageAgatheDumenilPas encore d'évaluation

- Ti Bajssít Ajkáyo NaljjajjegénjDocument8 pagesTi Bajssít Ajkáyo NaljjajjegénjDennis ValdezPas encore d'évaluation