Académique Documents

Professionnel Documents

Culture Documents

Tutorial 02

Transféré par

MFong ThongCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Tutorial 02

Transféré par

MFong ThongDroits d'auteur :

Formats disponibles

Tutorial 2: Annuities Basic Formulas: Present value interest factor of an annuity, PVIFA(k,n) = [ 1 ( 1 + k )-n ] / k Present value interest factor

r of a perpetuity, PVIFA(k; ) = 1 / k Future value interest factor of an annuity, FVIFA(k,n) = [ ( 1 + k )n 1 ] / k Annuities Due, payments at start of period, PVIFADue(k,n) = PVIFA(k,n) * ( 1 + k ) FVIFADue(k,n) = FVIFA(k,n) * ( 1 + k ) Where: k is the effective discount rate per payment period and n is the number of payments. Note: to use these formulas, the payments must be equal and at regular intervals and k cannot vary. Finding Effective rates: As mentioned in last weeks tutorial, find the future value of $1 over the given period and subtract off that $1 principal to find out how much interest accumulated over the period. Example: Convert 8% with semi-annual compounding to an effective monthly rate. Note that the stated rate really means 4% per six months, so a monthly rate is 1/6 of a period. k1/12 = ( 1 + k1/2 ) 1/6 1 = 0.6558% per month

Tutorial 2: Annuities Quick Derivation, in case you forget your formula sheet. At a fixed interest rate, if you withdraw all of the interest every period leaving the principal untouched, you can withdraw the same amount per period forever. This is perpetuity. Therefore the present value of a perpetuity of $1 per period, is the amount that you must deposit to generate $1 of return per period. PVIFA(k; ) * k = 1 PVIFA(k; ) = 1 / k An annuity can be viewed as gaining a perpetuity and losing it after the end of the annuity payments. PVIFA(k;n) = PVIFA(k; ) PV(n)[ PVIFA(k; )] PVIFA(k;n) = 1 / k [ 1 / k * (1 + k)-n ] PVIFA(k;n) = [ 1 - (1 + k)-n ] / k Note that the PVIFA(k;n) cannot exceed 1 / k To find the future value of an annuity, simply find the present value and future value the result. FVIFA(k;n) = ([ 1 - (1 + k)-n ] / k) * ( 1+ k )n FVIFA(k;n) = [( 1+ k )n 1 ] / k

Tutorial 2: Annuities Sample Problem 1. Bob wants to be a millionaire. If Bob has just turned 35 how much would he have to invest at the end of each year in order to have $1 million on his 65th birthday, assuming that he is able to get a return on investment of 10% per year? How much would he have to invest if he made the investment at the end of each month instead? Future Value = $1,000,000 FV = CF x FVIFA(0.10, 30) CF = FV / FVIFA(0.10, 30) CF = 1,000,000 / 164.5 = $6079.25 Therefore he would have to invest $6,079.25 per year to end up with one million dollars on his 65th birthday. k = .10 n = 30

With monthly investment: Future Value = $1,000,000 k = (1 + .10)1/12 1 = 0.007974 CF = FV / FVIFA(0. 007974, 360) CF = 484.77 Therefore he would have to invest $484.77 at the end of every month to end up with one million dollars on his 65th birthday. n = 30x12 = 360

Tutorial 2: Annuities Sample Problem 2. If Bob gets his $1 million, how much could he afford to withdraw at the end of each month through his 90 th birthday that would leave him with a balance of zero at that time?

Present Value = $1 million k = 0.007974 n = 25x12= 300 CF = PV / PVIFA(0. 007974, 300) CF = $1,000,000 / 113.8 CF = $8.784.96 Therefore Bob could withdraw $8.784.96 at the end of each month through his 90th birthday.

Tutorial 2: Annuities Sample Problem 3. How expensive a house can you afford to purchase if you have $23,000 for a down payment and you can afford to pay $1,800 per month on a mortgage, if the mortgage rate is 9% per annum with semi-annual compounding and a 20 year amortization period? If you can afford $900 every two weeks instead, what is the maximum you can pay for a house? What you can afford = down payment + PVmortgage. CF = 1,800 n = 20x12 = 240 months

k = (1 + 0.045)1/6 1 = 0.0073631 per month PV = CF x PVIFA(0.0073631, 240) PV = $202,432 Therefore you can afford $202,432 + $23,000 (down payment) for a total of $225,432.

With bi-weekly payments: CF = 900

n = 20 x 26 = 520

k = (1 + 0.045)1/13 1 = 0.0033917 per two weeks Note: 52 weeks in a year = 26 payments per year and 13 payments in 6 months. PV = CF x PVIFA(0.0033917, 520) PV = $219,735 Therefore you can afford $242,735 with bi-weekly payments.

Tutorial 2: Annuities Sample Problem 4. You are buying furniture for your house. The store is offering terms of no payments or interest for one full year (the first payment is due in 365 days) and 2% per month thereafter. What would be the monthly payments on a $5,000 purchase if there were to be 24 equal payments? Would you be better off financing the purchase on a line of credit that charged 18% per annum with no interest free period? Here we have a 2 period model, in the first period there are no payments and the discount rate is different in the first case. The annuity formula gives us the value of the annuity at the start of the annuity, which in this case is the beginning of the second year. The first payment is on the first day of the second year so we have to treat the payments as an annuity due.

PV1 = 5000 = PV2 = CF x PVIFAdue(2%, 24) = CF x 19.292 Therefore the payments are $259.17 per month.

Continued

Tutorial 2: Annuities Either find the present value of the original payments under the 18% interest rate or find the payments (on the same schedule) that would pay off the $5,000. PV2 = 5000 x 1.18 (no interest free period)

k = (1 + 0.18)1/12 1 = 1.38884% PV2 = 5900 = CF x PVIFAdue(1.38884%, 24)

With a known present value of $5900 CF = 5,900 / PVIFAdue(1.38884%, 24) CF = 286.78 Since the monthly payments are higher, we are not better off.

With a known cash flow (the original payments) PV1 = PV2 / 1.18 = 259.17 x PVIFAdue(1.38884%, 24) / 1.18 PV1 = $4,518.64 Since we could afford to buy less furniture we are not better off financing with the 18 % line of credit.

Tutorial 2: Annuities Sample Problem 5. You are paying $1,200 per month on a 25 year mortgage at 12% per annum with monthly compounding. You have just made your 40th payment, how much of that $1,200 was applied to the principal? What was the starting value of the mortgage? We know k = 1% per month, and CF = 1,200 monthly. Originally there were 12 x 25 or 300 months. To find how much you reduced the outstanding balance by with your 40th payment, find out how much you owed after the 39 th payment and also after the 40th payment. The difference is how much of your payment went to reduce the principal. After payment 39, k = 300 39 = 261 PV = 1,200 x PVIFA(1%, 261) = 112, 171 After payment 40, k = 300 40 = 260 PV = 1,200 x PVIFA(1%, 260) = 112,081 Difference = 112, 171 - 112,081 = $90 Therefore of the 1,200 of the 40th payment, $90 went to pay down the principal $1,110 went to pay interest. At that rate its no wonder it takes 25 years to pay off the mortgage.

Before the first payment there are 300 payments left PV = 1,200 x PVIFA(1%, 300) = 115,075 So the original mortgage was for $115,075.

Tutorial 2: Annuities Problem Set 2-10.

Mr. Wilson is 60 years old and is planning his retirement. He owns a house that has a current market value of $275,000 with no outstanding mortgage. He wants to use his equity in this house to generate some extra income for the next 25 years. There are two options that he is considering. Option 1: a reverse mortgage. The trust company will pay him a lump sum at the end of each of the following 25 years. The company will build a mortgage claim against his house that will be worth 80% of its current assessed value. Interest will be accumulated at a rate of 10% compounded annually. No fees are required to set up this reverse mortgage. Option 2: sale and lease back. An investment company has offered to buy the house for $275,000 and lease it back to him at a price of $19,500 per year, fixed for the next 25 years. Mr. Wilson would have to pay the legal fees of $675, and all of the same household expenses that he would have to pay if he owned the house. He would invest the proceeds at a fixed rate of 8% compounded annually and withdraw an equal amount each year until he was left with a balance of zero at the end of the 25 years. a. If Mr. Wilson is only concerned with his before-tax annual income over the next 25 years, which option should he choose. sol2.html - 10 b. What else should he consider before reaching a final decision? sol2.html - 10b

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Staff Settlement Form - NewDocument9 pagesStaff Settlement Form - NewBaban GaigolePas encore d'évaluation

- Philippine Stock ExchangeDocument25 pagesPhilippine Stock ExchangeJessa Raga-as100% (1)

- Credit Transaction: RD RDDocument4 pagesCredit Transaction: RD RDaya5monteroPas encore d'évaluation

- LP in ABMDocument4 pagesLP in ABMGLICER MANGARON100% (1)

- Univ of Brunei-Statement of PurposeDocument2 pagesUniv of Brunei-Statement of Purposeayu abidinPas encore d'évaluation

- 121CLEPLUGDocument236 pages121CLEPLUGHR20169Pas encore d'évaluation

- Account StatementDocument1 pageAccount Statementzeeshan kkrPas encore d'évaluation

- Chapter 9 - NPA PDFDocument98 pagesChapter 9 - NPA PDFSuraj ChauhanPas encore d'évaluation

- From press-to-ATM - How Money Travels - The Indian ExpressDocument14 pagesFrom press-to-ATM - How Money Travels - The Indian ExpressImad ImadPas encore d'évaluation

- PAM-Assgn 1 - Mariam Fatima Burhan-20181-24727Document5 pagesPAM-Assgn 1 - Mariam Fatima Burhan-20181-24727Mariam Fatima BurhanPas encore d'évaluation

- Liability For Dishonor of Cheques ProjectDocument25 pagesLiability For Dishonor of Cheques ProjectAbhijeet TalwarPas encore d'évaluation

- Procurement of Hexagonal Drill Rod 22 M.M. Dia X 1800 M.M. Length As Per NIT Specification.Document28 pagesProcurement of Hexagonal Drill Rod 22 M.M. Dia X 1800 M.M. Length As Per NIT Specification.sharang shankerPas encore d'évaluation

- Letter Writing (Formal) For SBI PO, IBPS PO Mains Exams - Set 1Document62 pagesLetter Writing (Formal) For SBI PO, IBPS PO Mains Exams - Set 1Sakshi BhardwajPas encore d'évaluation

- The Impact of Credit Cards On HDFC Bank Customers in Shimoga - An Evaluative StudyDocument9 pagesThe Impact of Credit Cards On HDFC Bank Customers in Shimoga - An Evaluative StudyankitPas encore d'évaluation

- Fybcon Acc Finance 0001 NEWDocument20 pagesFybcon Acc Finance 0001 NEWnishanthreddy89Pas encore d'évaluation

- SBT AR Eng 2011Document92 pagesSBT AR Eng 2011gmp_07Pas encore d'évaluation

- ACF 103 Tutorial 6 Solns Updated 2015Document18 pagesACF 103 Tutorial 6 Solns Updated 2015Carolina SuPas encore d'évaluation

- Westmont Bank V OngDocument4 pagesWestmont Bank V Ongmodernelizabennet100% (4)

- Caiib - Retail Banking (Numerical)Document24 pagesCaiib - Retail Banking (Numerical)RASHMI KUMARIPas encore d'évaluation

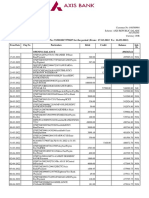

- Statement of Axis Account No:913010017379687 For The Period (From: 17-03-2022 To: 16-09-2022)Document7 pagesStatement of Axis Account No:913010017379687 For The Period (From: 17-03-2022 To: 16-09-2022)Om Namah ShivayPas encore d'évaluation

- Risk and ReturnDocument3 pagesRisk and ReturnrudrakshiPas encore d'évaluation

- 16 Role of SME in Indian Economoy - Ruchika - FINC004Document22 pages16 Role of SME in Indian Economoy - Ruchika - FINC004Ajeet SinghPas encore d'évaluation

- File CH Tila Worksheet 07Document2 pagesFile CH Tila Worksheet 07Helpin HandPas encore d'évaluation

- NISM V A Sample 500 QuestionsDocument36 pagesNISM V A Sample 500 Questionsbenzene4a183% (35)

- PBP II Chapter 14 Installment PurchasesDocument53 pagesPBP II Chapter 14 Installment PurchasesJorge Luna RamirezPas encore d'évaluation

- Phone Bill (PLDT)Document1 pagePhone Bill (PLDT)Jayson C. LagarePas encore d'évaluation

- Topik 1 Rangka Kerja PerundanganDocument28 pagesTopik 1 Rangka Kerja PerundanganBenjamin Goo KWPas encore d'évaluation

- Commercial Bank Management Sem IIIDocument11 pagesCommercial Bank Management Sem IIIJanvi MhatrePas encore d'évaluation

- Chapter 16 - The Payables LedgerDocument31 pagesChapter 16 - The Payables Ledgershemida100% (3)

- MBBcurrent 564548147990 2022-04-30 PDFDocument7 pagesMBBcurrent 564548147990 2022-04-30 PDFAdeela fazlinPas encore d'évaluation